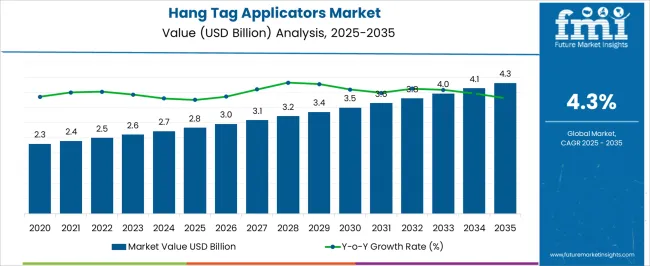

The Hang Tag Applicators Market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

| Metric | Value |

|---|---|

| Hang Tag Applicators Market Estimated Value in (2025E) | USD 2.8 billion |

| Hang Tag Applicators Market Forecast Value in (2035F) | USD 4.3 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The Hang Tag Applicators market is witnessing robust demand across manufacturing and retail ecosystems, driven by the growing emphasis on efficiency, consistency, and traceability in product labeling. As global supply chains become more complex and demand for quality control intensifies, hang tag applicators are being increasingly adopted to automate tagging processes in industries such as textiles, apparel, logistics, and consumer goods.

The ability to reduce manual labor, minimize tagging errors, and enhance operational throughput has positioned these machines as essential tools in fast-paced production environments. Adoption is further bolstered by the need for standardized labeling across global distribution networks and the rising use of barcoded, QR-coded, and RFID-enabled tags.

Government regulations around product identification and tracking are reinforcing the demand for reliable applicator systems, particularly in export-focused industries In the years ahead, innovation in sensor-based positioning, smart interfaces, and material handling systems is expected to further elevate the performance of hang tag applicators, enabling scalable integration across both large enterprises and SMEs.

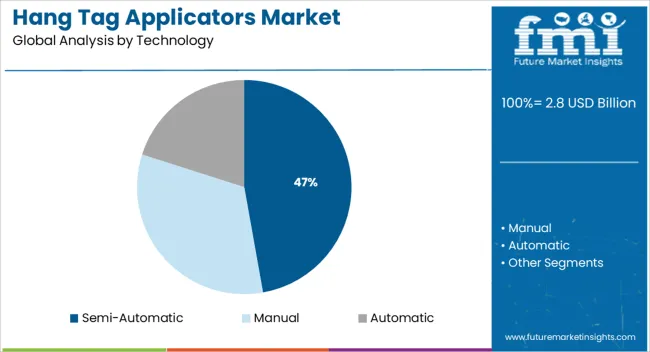

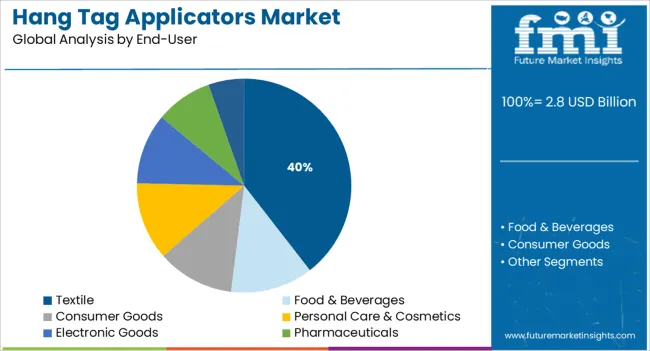

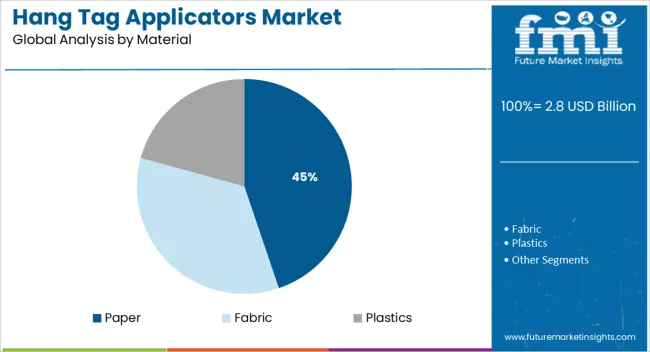

The market is segmented by Technology, End-User, and Material and region. By Technology, the market is divided into Semi-Automatic, Manual, and Automatic. In terms of End-User, the market is classified into Textile, Food & Beverages, Consumer Goods, Personal Care & Cosmetics, Electronic Goods, Pharmaceuticals, and Others. Based on Material, the market is segmented into Paper, Fabric, and Plastics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The semi-automatic technology segment is projected to hold 47.2% of the total revenue share in the Hang Tag Applicators market in 2025, making it the dominant technological configuration. The segment’s leadership is being supported by its balance between operational efficiency and cost-effectiveness, offering partial automation while still allowing manual control for handling variable tag placements. Semi-automatic applicators are widely utilized in production lines where product diversity requires flexibility, but complete automation may not be economically feasible.

Enhanced accuracy and improved speed, compared to manual tagging methods, have been key contributors to the adoption of semi-automatic systems across textile and packaging industries. Additionally, minimal training requirements and compact design have made these machines suitable for mid-sized manufacturers seeking to increase output without heavy capital investment.

The segment's growth has also been encouraged by advancements in optical sensors, touch-screen interfaces, and programmable settings, which have enabled faster changeovers and better error detection These advantages continue to solidify semi-automatic systems as a cost-efficient and scalable solution for dynamic labeling environments.

The textile end-user segment is expected to account for 39.5% of the total revenue share in the Hang Tag Applicators market by 2025, making it the leading industry segment. Growth in this segment is being driven by rising global apparel production volumes and increasing demand for standardized branding and product traceability.

Hang tag applicators are being integrated into textile production lines to streamline the labeling of garments, accessories, and fabric rolls, ensuring uniform presentation and reducing manual errors. Regulatory pressure for fiber content disclosure, pricing clarity, and country-of-origin labeling has also contributed to the demand for precise and consistent hang tag applications in the textile industry.

The growing popularity of fast fashion, e-commerce logistics, and supply chain optimization has further pushed textile companies to invest in semi-automated and automated applicator solutions As global textile hubs seek higher operational efficiency and compliance with international labeling standards, the demand for dedicated tagging systems continues to rise, positioning this segment for sustained dominance.

The paper material segment is projected to represent 44.8% of the total revenue share in the Hang Tag Applicators market in 2025, emerging as the most widely used material type. The widespread use of paper for hang tags is being supported by its cost-effectiveness, ease of printing, and compatibility with a wide range of applicator technologies.

Paper tags offer high print clarity and durability for short-to-medium lifecycle products, which aligns with the requirements of industries such as apparel, retail, and packaging. The ability to integrate barcodes, logos, and QR codes seamlessly on paper substrates has reinforced its utility in enhancing brand identity and product tracking.

Additionally, growing environmental consciousness and regulatory emphasis on sustainable packaging have led manufacturers to prefer recyclable and biodegradable paper tags over plastic or composite alternatives Ongoing innovation in coated and textured paper variants is enhancing visual appeal and performance, enabling paper to remain the preferred choice for brands seeking a balance between functionality, aesthetics, and sustainability.

The tags are the necessity of all the end-use products to keep an identification code that defines the product in detail and also displays the price on it. Hang tags are now getting popular in the market due to its advantage over stick tags that is to provide an ease in removing the tag without damaging the product.

Hanging tags also provide a challenge to apply the tag strong enough that it does not drop off the product and also in removing the tag when required. Hang tag applicators thus plays a crucial role in tagging the products. The market of hang tag applicators can be assumed to last long time until a new way of tagging the produced is introduced.

Presently, hanging tags is the way of tagging the products adopted worldwide and continuously decreasing the market of sticking tags, and thus projecting a bright future for the hang tag applicators market

The hang tag applicators are available in the market with wide variety differentiating on the basis of application and speed. Manual hang tag applicators are suitable for very small or rare requirement of hanging tags while automatic hang tag applicators are capable of tagging around 400 tags per minute or more, suitable for a huge volume of products to be tagged.

This fact has driven the hang tag applicators market. The applicability of hang tags in most of the industries including food and beverage industry where the huge volume of products are produced has driven the hang tag applicators market.

The hang tags are adopted majorly for apparel industry which accounts for around 2% of world’s GDP, which is around three trillion US dollar of industry and further growing fairly high rate globally. Thus, the growth of apparel market and huge market size is one of the prominent drivers of hang tag applicators market.

Hanging tags has an advantage over adhesive tags but still, provides a challenge in the handling of products with hang tags as they are more likely to get stuck with openly ended curves or small poles around the tag. The solution for this challenge might give rise to the introduction of a new way of tagging or describe the product replacing the hang tag tags. This is a probable threat to the hang tag applicators market.

The end use applications of the hang tags define the requirement of hang tags applicators in the region. Apparel and footwear market is largest in Asia Pacific with market size around USD 600 billion, followed by Western Europe and North America with market size around USD 400 billion each.

Also, North America accounts for around half of world’s smart labels market. Thus, North America, Asia Pacific, and Western Europe indicate a potential market for hang tag applicators.

Latin America and Africa are the regions with low apparel and footwear market along with low packaging market size and low GDP, thus packaging firms prefer to invest in labor and time rather than investing on automatic hang tag applicators. Thus, the market for manual hang tag applicators is much brighter in the region as compared to automatic hang tag applicators in terms of volume.

Few of the key players of the hang tag applicators market are Northfield Corporation, Kenco Label & Tag Co., LLC., Graphic Packaging International, Inc., Autotex Italia Srl, Allflex Australia Pty Ltd., etc.

The global hang tag applicators market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the hang tag applicators market is projected to reach USD 4.3 billion by 2035.

The hang tag applicators market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in hang tag applicators market are semi-automatic, manual and automatic.

In terms of end-user, textile segment to command 39.5% share in the hang tag applicators market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hangover Cure Product Market Size and Share Forecast Outlook 2025 to 2035

Hangover Cure Product Industry Analysis in United States Growth, Trends and Forecast from 2025 to 2035

Competitive Overview of Hangover Cure Product Companies

Hanger Market Trends & Forecast 2025 to 2035

Hanging Bags Market

Hang Tags Market Insights – Growth & Trends Forecast 2025 to 2035

Change And Configuration Management Market Size and Share Forecast Outlook 2025 to 2035

Change Management Software Market Size and Share Forecast Outlook 2025 to 2035

Changeover Switch Market Size, Share, and Forecast 2025 to 2035

Change Control Management Software Market

Global Anti-hangover Supplement Market Insights – Trends & Forecast 2023-2033

Baby Changing Station Market Size and Share Forecast Outlook 2025 to 2035

Tire Changing Machines Market Size and Share Forecast Outlook 2025 to 2035

Tire Changers - Market Growth - 2025 to 2035,

Liner Hanger Market

Interchangeable Biosimilars Market

Baby Changing Light Market

Ion Exchange Resins Market Size & Forecast 2025 to 2035

Light-Changing Packaging Inks Market - Growth & Demand 2025 to 2035

Colour Changing Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA