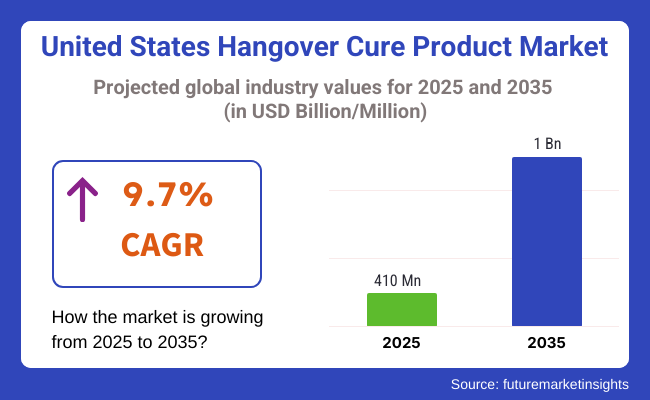

The United States hangover cure product market is USD 410 million in 2025 and is expected to record a 9.7% CAGR from 2025 to 2035. The United States hangover cure product industry is expected to be USD 1 billion in 2035. One of the key growth drivers is the increasing demand for lifestyle-based health solutions that guarantee rapid recovery and energy following alcohol consumption, especially among young adults and urban working professionals.

The American consumer industry is shifting towards a health-conscious direction, yet alcohol remains a part of social life. This inconsistency has opened the door to hangover relief products that balance excess with restraint. Ready-to-drink packaging, dissolvable tablets, and dietary supplements aimed at liver care and dehydration relief are gaining traction in key cities like Los Angeles, New York, and Miami.

Innovation in the USA industry is largely driven by startup agility and influencer-driven branding. With Instagram and TikTok acting as core marketing platforms, brands are leveraging lifestyle aesthetics and wellness narratives to rebrand hangover cures as aspirational wellness products rather than emergency drugs. Prevention and balance, and not cure, are now the priority.

E-commerce has emerged as the leading distribution platform, allowing direct-to-consumer business models to thrive. Subscription products are growing in popularity among repeat buyers, while retail chain coverage at stores such as CVS and Whole Foods is normalizing and mainstreaming the category. Product bundling with vitamin regimens and hydration sets is also fueling growing cart sizes and consumer loyalty.

Regulatory clarity and ingredient disclosure will be drivers in the future. With the growing industry size, they will pay greater attention to health claims and label validity. Companies that abide by FDA guidelines and document scientific rationale will gain a competitive advantage. Continued investment in clinical studies, product authentication, and open sourcing-will define the next decade of sustainable expansion in the United States hangover cure product industry.

In the United States hangover cure product industry(2025), tablets/capsules will lead the industry position with 41.2% of the industry share, and the solution/drinks will be next with 27.8%. Tablets and capsules are favored because they are the most convenient and easy to store while packing a lot of active ingredients.

Amongst others, Cheers Health, Flyby Recovery, and Blowfish are brands that managed to build substantial trust from consumers based on their use in formulations designed to restore B vitamins, zinc, DHM (dihydromyricetin), and milk thistle extract, which provide purported liver protection and antioxidant benefits.

Blowfish, for example, is a well-known hangover cure supplied in tablet form with aspirin, caffeine, and electrolytes for immediate relief of headache and fatigue. The supplements are well-accepted as positioning themselves as medicines through scientific means, synonymous with their rapidly health-conscious consumers post-alcohol consumption.

Meanwhile, hangover drinks and liquid shots have been gaining popularity, occupying 27.8% industry share owing to fast absorption and lifestyle appeal. Morning Recovery from More Labs is the industry leader with a patent-pending formula of DHM, milk thistle, and Vitamin B Complex. The brand addresses the lifestyle acquisitions of a millennial and Gen Z professional consumer who aspires to be productively engaged in life after a social event. Packaging and influencer marketing appeal to the trend.

Likewise, Liquid I.V. and Drinkwel serve hydration and nutrient replenishment, targeting fitness enthusiast consumers and festival-goers. These types of drinks usually perform the function of wellness tonics, leading to cross-category buy-in. They are also new entrants, such as The Plug and ZBiotics, with certain offerings. For example, The Plug is plant-based and caffeine-free, while ZBiotics promotes itself as the world's first genetically engineered probiotic developed to digest acetaldehyde, an important alcoholic toxin.

Also, new entrants, such as The Plug and ZBiotics, have unique propositions. The Plug is plant-based and caffeine-free. ZBiotics is marketed as the world's first genetically engineered probiotic for breaking down acetaldehyde, a major toxin from alcohol. Such novelties further ensure diversification of the industry, with drinks growing swiftly while the most trusted clinically associated format among core consumers will remain tablets/capsules.

In the United States hangover cure product industryfor 2025, hangover remedies will dominate the industry with a 76.7% industry share, while prevention products account for 23.3%. Remedies like tablets, effervescent drinks, and functional beverages attract consumers with their claims of fast symptom relief.

The leaders in this area are companies Flyby, Liquid I.V., and Hydrant, who put science behind their solutions. Flyby offers capsules containing DHM (dihydromyricetin), B vitamins, and milk thistle; all three have clinical associations with liver support and alcohol metabolism.

Liquid I.V. sells its electrolyte drink mix as a means of fast hydration to reduce two primary symptoms of a hangover: fatigue and headache. Approved by registered dietitians, Hydrant offers oral rehydration solutions with magnesium and zinc to replenish hydration balance post-drinking.

While prevention products must be taken before or during drinking, their industry is now slowly becoming populated. ZBiotics is a biotech start-up, a patented probiotic that produces an enzyme to degrade acetaldehyde, a toxic byproduct of alcohol before it builds up.

Practically designed for biohackers and wellness-oriented consumers looking for preventive solutions, ZBiotics has generated word-of-mouth publicity. On a similar note, No Days Wasted markets DHM Detox, a pre-drinking supplement containing green tea extract and prickly pear, which aims to reduce liver stress and fatigue.

The prevention products are newer to the industry but occupy a very low industry share due to poor consumer awareness and the need for premeditated applications. Remedies are still convenient, offer immediate relief, and are available in all traditional and digital retail ecosystems.

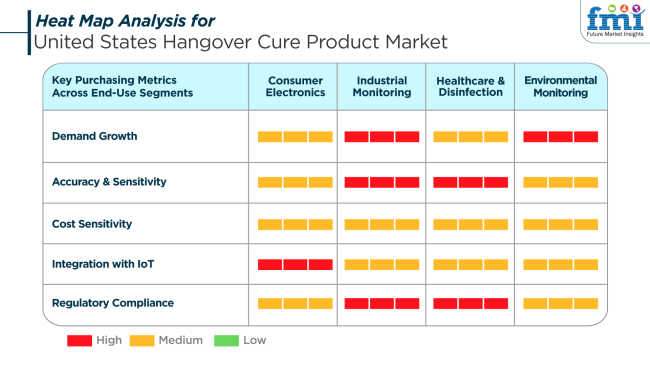

While hangover cure products are not industrial equipment, the purchasing behavior in all health-related categories mirrors several of the same issues. In this sense, USA demand growth for the wellness product industry is robust, particularly among younger adults who value fast-acting, functional solutions that align with their socially active and active lifestyles.

Accuracy here implies perceived efficacy and product speed. With increasing significance, accuracy will compel individuals to buy products providing quantifiable advantages within hours. That heightened sensitivity to performance is pushing firms toward evidence-based formulations, increasing absolute product credibility.

While mass-market consumers remain generally price-conscious, the premium segment is expanding very rapidly. Consumers in this group are most concerned with clean labels, non-synthetic ingredients, and sustainable packaging. Moreover, FDA-permitted claims and home-country-based manufacturing are becoming more and more regarded as good value-adds, a reflection of the shift toward trust-based consumption.

The United States hangover cure product industry has several structural and strategic risks that could hold back its long-term scalability. One of the largest risks is that it has an unclear regulatory environment. While the majority of products are marketed as dietary supplements, there can be uneven regulation that could lead to ambiguous labeling and expose brands to legal risk if the claims are not sufficiently substantiated.

Consumer trust is another significant vulnerability. While most brands are positioned within the wellness ecosystem, product efficacy is very uneven, and the public is aggressively cynical. In the absence of clinical trials or physician-validated efficacy, certain products will likely lose credibility, particularly with a more questioning public.

Market fragmentation and me-too competition represent a growing threat. With low barriers to entry and high margins, the marketplace has been flooded with copycat products. Brands that cannot differentiate through innovation, authenticity, or strategic branding risk commoditization and margin reduction. As a response to this, ongoing investment in product innovation, compliance, and storytelling will be essential to long-term success.

Between 2020 and 2024, the industry saw steady growth as the popularity of products targeting relief from hangover symptoms such as fatigue, dehydration, and nausea continued to grow. This need was most urgently being propelled by younger adults and city residents, who were most likely to buy such products subsequent to social activities.

Thus, there was an increased supply of such hangover cure products at many retail points, especially in online retail, enabling customers convenient access to the solutions. Of importance here was concentration on supplements, effervescent tablets, and ready-to-drink forms.

Looking ahead to 2025 to 2035, the industry will see dramatic changes. Consumers will increasingly require more tailored solutions based on age, health status, and lifestyle. Natural and organic ingredients will reign supreme, as consumers remain focused on wellness and natural healing processes.

Advances in technology, including wearable patches and ingestible smart devices, will transform the hangover recovery process, with real-time tracking and personalized care. Also, hangover cure products will more and more be part of overall wellness regimens, prevention-focused, and holistic health strategies.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Product Focus: Conventional hangover cure products in tablet, capsule, and ready-to-drink (RTD) drink form. | Innovative Solutions: Intelligent hangover cure products with wearable patches and swallow able devices for live monitoring. |

| Consumer Demographics: Primarily young adults and middle-aged consumers requiring occasional hangover relief. | Broader Demographics: Expanded industry covering the health-conscious and cross-age consumer segment demanding personalized, preventive care. |

| Industry Drivers: Increasing alcohol use and hangover misery. | Wellness and Wellness Trends: Emphasis on natural ingredient and holistic well-being solutions spread to daily practices. |

| Key Ingredients: Active compounds like caffeine, electrolytes, and aspirin for rapid relief. | Natural and Organic Ingredients: Emphasis on plant-based ingredients such as milk thistle, ginger, and turmeric, which have detoxification and anti-inflammatory actions. |

| Distribution Channels: E-commerce sites, pharmacies, convenience stores, and health food shops. | Direct-to-Consumer & Wellness Integration: Increased emphasis on direct-to-consumer online sales and incorporation into wellness clinics, spas, and holistic health practices. |

The USA industry will grow at 7.6% CAGR throughout the research period. Increasing awareness of health and wellness, especially among millennials and Gen Z, is significantly contributing to driving demand for hangover cure products. Higher consumption patterns for alcohol, especially in urban areas, coupled with a growing demand for speedy recovery solutions after night outs, have driven consumer demand for hangover cure products.

Over the past two years, product format innovation across categories such as effervescent tablets, hydration powders, and herbal-infused shots has expanded the size of the industry. The assertive nature of health-aware consumers actively looking for effective and easy-to-digest well-being supplements has also extended the growth run. Online and offline channels are driving sales volume in the United States, but digital is particularly impactful.

Online selling, driven by competitive online advertising, influencer marketing, and word-of-mouth endorsement, is structuring path-to-purchase. DTC and subscription models are generating repeat buying and brand loyalty. In addition to this, the expanding availability through pharmacy chains, convenience stores, and airport store chains has propagated access further.

Low regulatory barriers and over-the-counter acceptance also facilitate smooth industry entry and scale-up distribution. Consumer tastes in the USA are trending towards clean-label, non-GMO, and vegan-friendly products, leading brands to reformulate or launch new products to address these needs. The functional ingredients category is gaining popularity, with milk thistle, prickly pear, and vitamins B and C becoming increasingly popular due to their restorative nature.

The increasing interest in preventive health and wellness culture-where consumers are going out of their way to seek remedies to reverse alcohol-induced dehydration and exhaustion-is also likely to drive sales. The intersection of healthy lifestyle practice, health consciousness, and differentiated product offerings makes the USA industry a high-maturity and high-opportunity marketplace for hangover remedy products during the decade ahead.

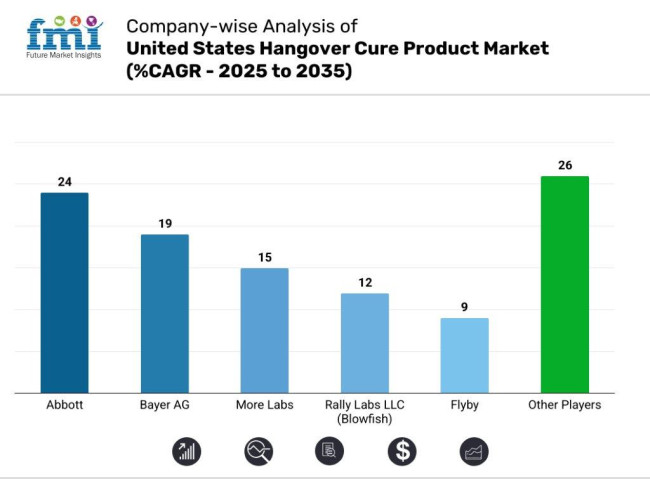

The industry for hangover cure products is growing fast with increased consumer health awareness and the need for speedy recoveries after alcohol intake. Abbott dominates the industry through the use of its pharmaceutical-grade image and pre-existing healthcare trust factor to promote scientifically formulated products that resonate well with health-aware consumers.

Bayer AG is keeping a close watch, following from its established brand recall and OTC background, marketing effective hangover cure supplements that are being positioned within its broader wellness proposition.

Meanwhile, emerging brands like More Labs and Flyby are getting in front of millennial and Gen Z consumers with lifestyle-driven marketing, natural ingredients, and easy-to-use formats like ready-to-drink shots and capsules. Rally Labs LLC (Blowfish) and Cheers Health are creating strong followings with distinctive, science-formulated products optimized for quicker absorption and ease of use.

Companies such as The Himalaya Drug Company and Liquid I.V., Inc. expand the industry further with herbal and hydration-based solutions, meeting the need for plant-based and multifunctional recovery products. Throughout the competitive industry, product effectiveness, natural ingredients, and brand reputation are becoming differentiators.

Market Share Analysis by Company

| Company | Estimated Market Share (%) |

|---|---|

| Abbott | 20-24% |

| Bayer AG | 16-19% |

| More Labs | 12-15% |

| Rally Labs LLC (Blowfish) | 9-12% |

| Flyby | 7-9% |

| Other Players | 21-26% |

Key Company Insights

Abbott leads the United States hangover cure product category with a rough estimate of 20-24% industry share, fueled by its dedication to clinically supported well-being solutions as well as a powerful brand reputation among health-aware shoppers.

Its attention to pharmaceutical-standard formulations gives it a tremendous competitive advantage within a market environment where safety and efficacy are premium concerns. Bayer AG controls between 16% and 16-19% industry share, buoyed by the company's widespread OTC portfolio and established international reputation as a trusted supplier of healthcare remedies, complemented by robust distribution channel penetration.

More Labs take an estimated 12-15% industry share with younger consumers through natural, quick-recovery shots positioned as necessary lifestyle products. Rally Labs LLC (Blowfish) has approximately 9-12% share based on its distinctive, FDA-approved hangover cure that dissolves in water and is convenient, with guaranteed results.

Flyby comprises approximately 7-9%, which is amongst the most favored by millennials and engaged consumers preferring natural, preventive supplements for everyday wellness and recovery, assisting Flyby in gaining an increasing proportion of this new category.

By product, the industry is segmented into solution/drinks, tablets/capsules, powder, and patches.

By type, the industry is segmented into prevention and remedies.

By distribution channel, the industry is segmented into offline and online. The offline segment is further segmented into hypermarkets & supermarkets, convenience stores, pharmacy & drug stores, airport retail stores, and others.

The industry is slated to reach USD 410 million in 2025.

The industry is predicted to reach a size of USD 1 billion by 2035.

Key companies include Abbott, Bayer AG, More Labs, Rally Labs LLC (Blowfish), Flyby, The Himalaya Drug Company, Drinkwel, LLC, Cheers Health, Liquid I.V., Inc., DOTSHOT, and AfterDrink Ltd.

The USA industry itself is the focus, with a CAGR of 9.7% during the forecast period.

Tablets/capsules are being widely used.

Table 1: Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Market Volume (Units Pack) Forecast by Region, 2019 to 2034

Table 3: Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: Market Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 5: Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 6: Market Volume (Units Pack) Forecast by Type, 2019 to 2034

Table 7: Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 8: Market Volume (Units Pack) Forecast by Distribution Channel, 2019 to 2034

Table 9: Southeast Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: Southeast Market Volume (Units Pack) Forecast by Country, 2019 to 2034

Table 11: Southeast Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 12: Southeast Market Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 13: Southeast Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 14: Southeast Market Volume (Units Pack) Forecast by Type, 2019 to 2034

Table 15: Southeast Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 16: Southeast Market Volume (Units Pack) Forecast by Distribution Channel, 2019 to 2034

Table 17: Southwest Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Southwest Market Volume (Units Pack) Forecast by Country, 2019 to 2034

Table 19: Southwest Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 20: Southwest Market Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 21: Southwest Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 22: Southwest Market Volume (Units Pack) Forecast by Type, 2019 to 2034

Table 23: Southwest Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Southwest Market Volume (Units Pack) Forecast by Distribution Channel, 2019 to 2034

Table 25: Northeast Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Northeast Market Volume (Units Pack) Forecast by Country, 2019 to 2034

Table 27: Northeast Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 28: Northeast Market Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 29: Northeast Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 30: Northeast Market Volume (Units Pack) Forecast by Type, 2019 to 2034

Table 31: Northeast Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 32: Northeast Market Volume (Units Pack) Forecast by Distribution Channel, 2019 to 2034

Table 33: West Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: West Market Volume (Units Pack) Forecast by Country, 2019 to 2034

Table 35: West Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 36: West Market Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 37: West Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 38: West Market Volume (Units Pack) Forecast by Type, 2019 to 2034

Table 39: West Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 40: West Market Volume (Units Pack) Forecast by Distribution Channel, 2019 to 2034

Table 41: Midwest Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: Midwest Market Volume (Units Pack) Forecast by Country, 2019 to 2034

Table 43: Midwest Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 44: Midwest Market Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 45: Midwest Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 46: Midwest Market Volume (Units Pack) Forecast by Type, 2019 to 2034

Table 47: Midwest Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: Midwest Market Volume (Units Pack) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Market Value (US$ Million) by Product, 2024 to 2034

Figure 2: Market Value (US$ Million) by Type, 2024 to 2034

Figure 3: Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 4: Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Market Volume (Units Pack) Analysis by Region, 2019 to 2034

Figure 7: Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 10: Market Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 11: Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 12: Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 13: Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 14: Market Volume (Units Pack) Analysis by Type, 2019 to 2034

Figure 15: Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 16: Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 17: Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 18: Market Volume (Units Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 19: Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 20: Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 21: Market Attractiveness by Product, 2024 to 2034

Figure 22: Market Attractiveness by Type, 2024 to 2034

Figure 23: Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 24: Market Attractiveness by Region, 2024 to 2034

Figure 25: Southeast Market Value (US$ Million) by Product, 2024 to 2034

Figure 26: Southeast Market Value (US$ Million) by Type, 2024 to 2034

Figure 27: Southeast Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 28: Southeast Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: Southeast Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: Southeast Market Volume (Units Pack) Analysis by Country, 2019 to 2034

Figure 31: Southeast Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: Southeast Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: Southeast Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 34: Southeast Market Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 35: Southeast Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 36: Southeast Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 37: Southeast Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 38: Southeast Market Volume (Units Pack) Analysis by Type, 2019 to 2034

Figure 39: Southeast Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 40: Southeast Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 41: Southeast Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 42: Southeast Market Volume (Units Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 43: Southeast Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 44: Southeast Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 45: Southeast Market Attractiveness by Product, 2024 to 2034

Figure 46: Southeast Market Attractiveness by Type, 2024 to 2034

Figure 47: Southeast Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 48: Southeast Market Attractiveness by Country, 2024 to 2034

Figure 49: Southwest Market Value (US$ Million) by Product, 2024 to 2034

Figure 50: Southwest Market Value (US$ Million) by Type, 2024 to 2034

Figure 51: Southwest Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 52: Southwest Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Southwest Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Southwest Market Volume (Units Pack) Analysis by Country, 2019 to 2034

Figure 55: Southwest Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Southwest Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Southwest Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 58: Southwest Market Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 59: Southwest Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 60: Southwest Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 61: Southwest Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 62: Southwest Market Volume (Units Pack) Analysis by Type, 2019 to 2034

Figure 63: Southwest Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 64: Southwest Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 65: Southwest Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 66: Southwest Market Volume (Units Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Southwest Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 68: Southwest Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 69: Southwest Market Attractiveness by Product, 2024 to 2034

Figure 70: Southwest Market Attractiveness by Type, 2024 to 2034

Figure 71: Southwest Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Southwest Market Attractiveness by Country, 2024 to 2034

Figure 73: Northeast Market Value (US$ Million) by Product, 2024 to 2034

Figure 74: Northeast Market Value (US$ Million) by Type, 2024 to 2034

Figure 75: Northeast Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 76: Northeast Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Northeast Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Northeast Market Volume (Units Pack) Analysis by Country, 2019 to 2034

Figure 79: Northeast Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Northeast Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Northeast Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 82: Northeast Market Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 83: Northeast Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 84: Northeast Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 85: Northeast Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 86: Northeast Market Volume (Units Pack) Analysis by Type, 2019 to 2034

Figure 87: Northeast Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 88: Northeast Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 89: Northeast Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 90: Northeast Market Volume (Units Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 91: Northeast Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 92: Northeast Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 93: Northeast Market Attractiveness by Product, 2024 to 2034

Figure 94: Northeast Market Attractiveness by Type, 2024 to 2034

Figure 95: Northeast Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 96: Northeast Market Attractiveness by Country, 2024 to 2034

Figure 97: West Market Value (US$ Million) by Product, 2024 to 2034

Figure 98: West Market Value (US$ Million) by Type, 2024 to 2034

Figure 99: West Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 100: West Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: West Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: West Market Volume (Units Pack) Analysis by Country, 2019 to 2034

Figure 103: West Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: West Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: West Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 106: West Market Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 107: West Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 108: West Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 109: West Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 110: West Market Volume (Units Pack) Analysis by Type, 2019 to 2034

Figure 111: West Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 112: West Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 113: West Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 114: West Market Volume (Units Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 115: West Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 116: West Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 117: West Market Attractiveness by Product, 2024 to 2034

Figure 118: West Market Attractiveness by Type, 2024 to 2034

Figure 119: West Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 120: West Market Attractiveness by Country, 2024 to 2034

Figure 121: Midwest Market Value (US$ Million) by Product, 2024 to 2034

Figure 122: Midwest Market Value (US$ Million) by Type, 2024 to 2034

Figure 123: Midwest Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 124: Midwest Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: Midwest Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: Midwest Market Volume (Units Pack) Analysis by Country, 2019 to 2034

Figure 127: Midwest Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: Midwest Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: Midwest Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 130: Midwest Market Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 131: Midwest Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 132: Midwest Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 133: Midwest Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 134: Midwest Market Volume (Units Pack) Analysis by Type, 2019 to 2034

Figure 135: Midwest Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 136: Midwest Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 137: Midwest Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 138: Midwest Market Volume (Units Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 139: Midwest Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 140: Midwest Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 141: Midwest Market Attractiveness by Product, 2024 to 2034

Figure 142: Midwest Market Attractiveness by Type, 2024 to 2034

Figure 143: Midwest Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: Midwest Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hangover Cure Product Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Hangover Cure Product Companies

Global Anti-hangover Supplement Market Insights – Trends & Forecast 2023-2033

Secure Logistics Market Size and Share Forecast Outlook 2025 to 2035

Secure Web Gateway Market Analysis – Growth & Forecast 2019-2029

Procurement Software Market Analysis - Size, Share, and Forecast 2025 to 2035

Procurement Analytics Market Size and Share Forecast Outlook 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

UV Cured Acrylic Foam Tapes Market Insights - Trends & Growth Forecast 2024 to 2034

Procure-to-Pay Solution Market Trends – Growth & Forecast 2024-2034

UV Cured Coatings Market Size and Share Forecast Outlook 2025 to 2035

3D Secure Payment Authentication Market Insights by Components, Application, and Region - 2025 to 2035

Dual-Cure Luting Cements Market Size and Share Forecast Outlook 2025 to 2035

Snap Secure Containers Market

CRISPR Genomic Cure Market

Tracheostomy Securement Tapes Market

Self-Adhesive Dual-Cure Luting Cement Market Size and Share Forecast Outlook 2025 to 2035

Tube and Dressing Securement Products Market

Retail Sourcing And Procurement Market Size and Share Forecast Outlook 2025 to 2035

United States Commercial Refrigeration Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA