The procure-to-pay solution market is experiencing strong growth driven by increasing digitization of procurement functions, the growing emphasis on supply chain transparency, and the need for operational efficiency across enterprises. Current market conditions reflect rising adoption of automated and cloud-based systems that streamline procurement, invoicing, and payment processes. Enterprises are investing in integrated platforms to reduce manual errors, enhance compliance, and improve vendor collaboration.

The future outlook is positive as industries continue to adopt AI-powered analytics, robotic process automation, and blockchain-based verification systems to improve financial accuracy and traceability. Growth rationale is centered on the scalability, cost-effectiveness, and security offered by advanced procure-to-pay platforms.

The expanding focus on centralized procurement operations, compliance management, and global supplier visibility is expected to drive consistent market expansion Ongoing digital transformation initiatives and strong return-on-investment potential are ensuring that procure-to-pay solutions remain a core enabler of enterprise efficiency and strategic sourcing.

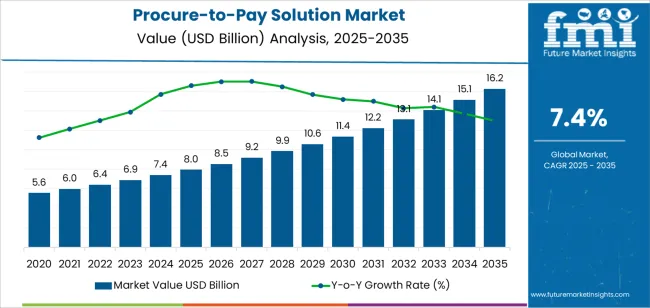

| Metric | Value |

|---|---|

| Procure-to-Pay Solution Market Estimated Value in (2025 E) | USD 8.0 billion |

| Procure-to-Pay Solution Market Forecast Value in (2035 F) | USD 16.2 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The market is segmented by Deployment, Enterprise, and End-Use Industry and region. By Deployment, the market is divided into SaaS and On-Premise. In terms of Enterprise, the market is classified into Large Enterprise and SMB. Based on End-Use Industry, the market is segmented into BFSI, Healthcare, Oil & Gas, Telecommunication, Retail, Automotive, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

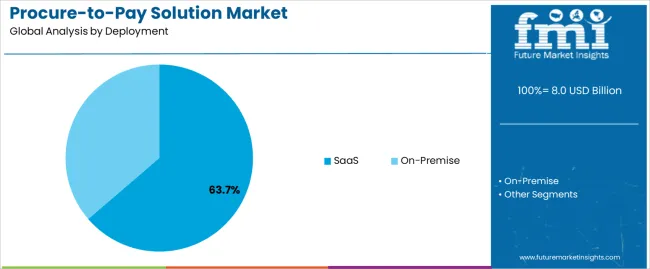

The SaaS segment, holding 63.70% of the deployment category, has been leading the market due to its flexibility, scalability, and lower upfront costs compared to on-premise systems. Cloud deployment has enabled enterprises to streamline operations with real-time access to procurement and payment data across locations.

The segment’s growth is being supported by the increasing integration of AI and automation features that enhance workflow efficiency and compliance monitoring. Continuous updates, subscription-based pricing, and minimal infrastructure requirements have strengthened enterprise adoption.

The growing preference for hybrid and multi-cloud environments has further improved deployment efficiency and data resilience With ongoing investments in cybersecurity and data privacy, SaaS-based procure-to-pay platforms are expected to maintain their dominance and support sustained digital transformation in procurement processes globally.

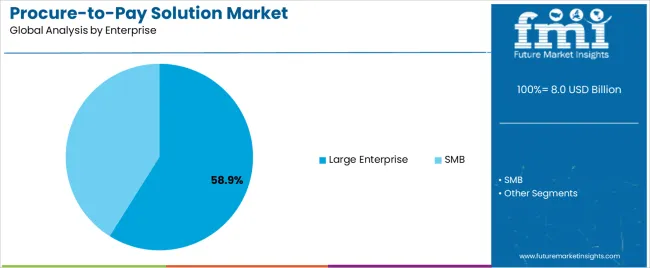

The large enterprise segment, representing 58.90% of the enterprise category, has maintained leadership due to high transaction volumes, complex procurement structures, and extensive supplier networks. These organizations have prioritized procure-to-pay automation to improve cash flow management and enhance process visibility across departments.

Implementation of advanced analytics and compliance dashboards has enabled real-time monitoring of procurement performance. Cost control, contract optimization, and audit readiness have been the primary motivators behind large-scale adoption.

Moreover, large enterprises possess the financial capacity and IT infrastructure necessary to integrate sophisticated solutions across global operations Continued expansion of cross-border trade and supplier diversity programs is expected to reinforce adoption levels, ensuring that large enterprises remain the dominant contributors to overall market growth.

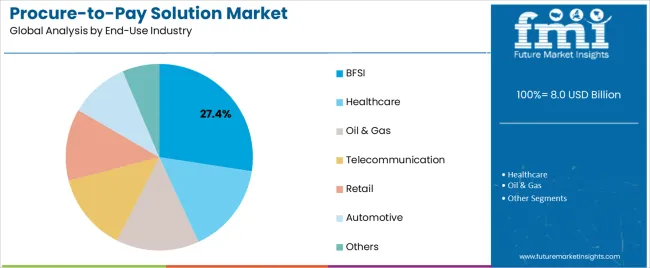

The BFSI segment, accounting for 27.40% of the end-use industry category, has emerged as the leading vertical due to the sector’s emphasis on secure, transparent, and compliant financial operations. High transaction frequency and regulatory oversight have driven banks and financial institutions to adopt robust procure-to-pay solutions that minimize fraud and enhance audit traceability.

Integration with ERP and accounting systems has enabled seamless invoice validation, approval workflows, and supplier payment processing. The segment’s growth is also supported by automation initiatives aimed at improving operational efficiency and reducing processing time.

Enhanced risk management, data integrity, and adherence to financial compliance standards have made procure-to-pay platforms indispensable within BFSI institutions Continued investments in digital finance infrastructure and cloud adoption are expected to strengthen the segment’s position and ensure sustained market leadership.

Development of Mobile Procurement Solutions Presents Opportunities in the Market

In the P2P solutions industry, leveraging the widespread use of mobile devices provides a significant potential. Creating and improving mobile procurement solutions allows consumers to start, authorize, and keep an eye on procurement processes while moving.

The modern worker demands flexibility and response, and this mobile accessibility meets that need. Businesses can accelerate decision-making, improve user engagement, and optimize procurement operations by enabling smooth mobile interactions. This enhances the user experience while simultaneously presenting P2P solution providers as innovative partners that offer solutions that meet the mobile-first demands of modern business professionals.

Ongoing Digitalization of Various Industries Drives Growth and Agility in the Market

Digital transformation is essential to being competitive in the current fast-paced corporate climate. Businesses are using cutting-edge technology, such as purchase-to-pay solutions, to automate and expedite their procurement procedures. Businesses can shorten processing times, eliminate manual mistakes, and improve resource allocation by automating operations like purchase orders, approvals, and invoicing.

This digital revolution drives corporate development and agility in the marketplace by improving operational efficiency and facilitating improved decision-making using real-time data insights.

Robotic Process Automation (RPA) Revolutionizes Procurement Operations in the Market

Robotic Process Automation (RPA) is transforming procurement processes by automating repetitive procedures and workflows throughout procure-to-pay platforms. Organizations can use software robots intended to replicate human activities to expedite procurement procedures such as purchase order creation, invoice processing, and supplier onboarding.

Automation not only shortens cycle times and decreases manual mistakes but also frees up important human resources for strategic initiatives and managing supplier relationships. Businesses that use RPA in procurement can boost their efficiency, reduce costs, and increase agility.

| Attributes | Details |

|---|---|

| Trends |

|

| Opportunities |

|

| Challenges |

|

| Segment | On-premise (Deployment) |

|---|---|

| Value Share (2025) | 54.2% |

Based on deployment, the on-premise segment holds 54.2% of market shares in 2025.

| Segment | Large Enterprises (Enterprise) |

|---|---|

| Value Share (2025) | 57.2% |

Based on enterprise, the large enterprises segment captured 57.2% of market shares in 2025.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 4.2% |

| Germany | 2.8% |

| Japan | 2.1% |

| China | 7.9% |

| Australia | 10.9% |

The demand for procure-to-pay solutions in the United States is projected to rise at a 4.2% CAGR through 2035.

The procure-to-pay solution market growth in Germany is estimated at a 2.8% CAGR through 2035.

The demand for procure-to-pay solutions in Japan is anticipated to amplify at a 2.1% CAGR through 2035.

The sales of procure-to-pay solutions in China are estimated to surge at a 7.9% CAGR through 2035.

Procure-to-pay solution sales in Australia are expected to increase at a 10.9% CAGR through 2035.

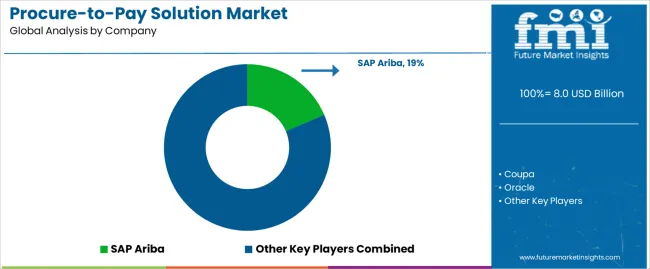

The procure-to-pay (P2P) solution industry is highly competitive, with leading competitors striving for market share and visibility. Leading international corporations like SAP Ariba, Coupa, and Oracle dominate the market, employing their vast resources, worldwide reach, and established brand awareness to provide full P2P suites.

These industry heavyweights have strong skills in automating procurement processes, improving supplier engagement, and offering end-to-end solutions that meet the unique demands of leading businesses.

Recent Developments

The global procure-to-pay solution market is estimated to be valued at USD 8.0 billion in 2025.

The market size for the procure-to-pay solution market is projected to reach USD 16.2 billion by 2035.

The procure-to-pay solution market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in procure-to-pay solution market are saas and on-premise.

In terms of enterprise, large enterprise segment to command 58.9% share in the procure-to-pay solution market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Solution Styrene Butadiene Rubber (S-SBR) Market Size and Share Forecast Outlook 2025 to 2035

NGS Solution for Early Cancer Screening Market Size and Share Forecast Outlook 2025 to 2035

5PL Solutions Market

High-Resolution Anoscopy Market Size and Share Forecast Outlook 2025 to 2035

mHealth Solutions Market Size and Share Forecast Outlook 2025 to 2035

Super Resolution Microscope Market Insights - Size, Share & Forecast 2025 to 2035

G-3 PLC Solution Market – Smart Grids & Connectivity

Docketing Solution Market Size and Share Forecast Outlook 2025 to 2035

Long Haul Solutions Market Size and Share Forecast Outlook 2025 to 2035

eClinical Solutions and Software Market Insights - Trends & Forecast 2025 to 2035

E-tailing Solutions Market Growth – Trends & Forecast 2020-2030

Connected Solutions for Oil & Gas Market Insights – Trends & Forecast 2020-2030

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

WealthTech Solutions Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Solutions Market Size and Share Forecast Outlook 2025 to 2035

Geospatial Solution Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

E-Learning Solution Market by Solution, Deployment, & Region Forecast till 2035

eDiscovery solution Market

Intravenous Solution Compounders Market Size and Share Forecast Outlook 2025 to 2035

Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA