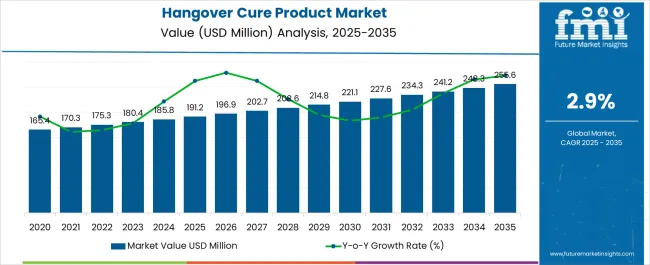

The Hangover Cure Product Market is estimated to be valued at USD 191.2 million in 2025 and is projected to reach USD 255.6 million by 2035, registering a compound annual growth rate (CAGR) of 2.9% over the forecast period.

| Metric | Value |

|---|---|

| Hangover Cure Product Market Estimated Value in (2025 E) | USD 191.2 million |

| Hangover Cure Product Market Forecast Value in (2035 F) | USD 255.6 million |

| Forecast CAGR (2025 to 2035) | 2.9% |

The hangover cure product market is advancing steadily, supported by increasing consumer demand for effective recovery solutions, growing awareness of health management, and expanding product innovation. Current dynamics highlight rising consumption trends in both developed and emerging economies, with growing acceptance of dietary supplements and functional products contributing to adoption.

Regulatory alignment and emphasis on quality assurance have strengthened consumer trust, while investments in research and product formulation are improving efficacy and market positioning. The future outlook is shaped by expansion into new distribution channels, greater penetration in institutional and retail markets, and ongoing product diversification catering to varied consumer preferences.

Growth rationale is underpinned by the intersection of lifestyle trends, urbanization, and the rising willingness to adopt scientifically formulated products for faster recovery With advancements in ingredient science and broader distribution strategies, the market is expected to sustain long-term momentum and capture higher-value opportunities.

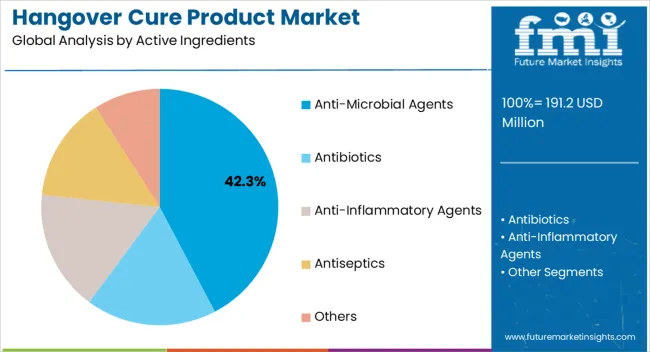

The anti-microbial agents segment, holding 42.30% of the active ingredients category, has emerged as the dominant contributor due to its role in supporting detoxification and physiological balance in post-consumption recovery. Adoption has been reinforced by clinical validation of safety and effectiveness, alongside a growing consumer preference for formulations perceived as reliable and science-backed.

Manufacturers have focused on refining dosages and enhancing bioavailability to improve outcomes. Supply stability and compliance with quality standards have further driven acceptance in both domestic and international markets.

Expansion of premium product lines featuring natural and semi-synthetic anti-microbial compounds has supported differentiation, ensuring sustained demand Over the forecast horizon, continued research into ingredient optimization and integration into multifunctional formulations is expected to reinforce leadership and expand the consumer base.

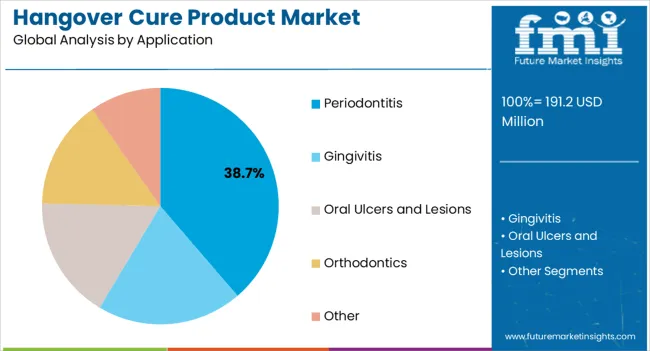

The periodontitis segment, representing 38.70% of the application category, has maintained a strong position due to increasing consumer awareness of oral health and its correlation with overall wellness. Product adoption has been supported by rising prevalence of gum-related issues and the recognition of oral inflammation as a contributing factor to broader health conditions.

Demand growth has been facilitated by integration of functional formulations in dental and preventive care practices. Clinical evidence supporting efficacy has improved acceptance among healthcare professionals, driving trust and repeat usage.

The segment’s expansion has been reinforced by product innovations targeting improved absorption and patient compliance As awareness campaigns and preventive healthcare initiatives increase, the application of hangover cure products within oral health management is expected to remain a significant contributor to overall market share.

The institutional sales segment, accounting for 45.60% of the distribution channel category, has established leadership due to its ability to ensure large-scale product reach and consistent availability. Hospitals, clinics, and wellness centers have been leveraging institutional procurement channels to provide access to hangover cure products as part of broader healthcare services.

Regulatory oversight and standardized procurement practices have enhanced product credibility and compliance. Volume-based purchasing has supported cost efficiency, strengthening the preference for institutional distribution.

Strategic collaborations between manufacturers and healthcare providers have been central to maintaining this channel’s prominence With continued expansion of healthcare infrastructure and rising institutional adoption in emerging markets, the segment is expected to sustain its leading share and drive market penetration over the forecast period.

The global hangover cure product market is very likely to experience exponential growth in the coming future. This rapid surge in demand is attributed to:

All these factors have collectively contributed to the remarkable trajectory of the hangover cure product market.

In the last few years, there has been an increased demand for hangover cure products in the international marketplace. The consumer pool of this market generally comprises:

| Attributes | Key Statistics |

|---|---|

| Hangover Cure Product Market Value (2020) | USD 1,643.3 million |

| Historical Market Value (2025) | USD 2,112.8 million |

| HCAGR (2020 to 2025) | 6.50% |

The hangover cure product relies heavily on consumer drinking habits, socializing patterns, and the overall lifestyle choices of the target demographic, which includes people in all age groups. The market also follows health and wellness trends in the world. As more individuals worldwide adopted the global drinking culture, the demand for these products increased during the historical period. In the last few years, the hangover cure product market has seen a series of ups and downs.

During the pandemic, when the world faced sudden shutdowns, there was a noticeable plunge in demand for hangover cure products. As people stopped socializing in bars and restaurants, there was a decrease in the consumption of alcoholic beverages in the initial phases of the pandemic. Supply chain disruptions also adversely impacted the market. However, as the world adapted to this new normal, people started spending more time in their homes, resulting in more alcohol consumption.

Post-pandemic, the market experienced remarkable growth due to the revival of the hospitality sector. The financial situation of many economies also improved, which meant that people had more disposable income to spend on socializing and partying. This period proved to be very beneficial for the market as consumers all over the world sought effective remedies to alleviate post-celebration effects.

Various factors are responsible for restraining the market growth. Some of them are as follows:

| Attributes | Details |

|---|---|

| Top Product | Tablets and Capsules |

| Market Share in 2025 | 35.60% |

In recent years, it has been observed that there has been a significant surge in demand for hangover tablets and capsules, as they offer a hassle-free alternative to traditional remedies. This growing traction can also be attributed to precise and easily manageable dosages of ingredients in the tablets believed to alleviate hangover symptoms.

The increased demand is also due to the on-the-go compactness of tablets, which suits the preferences of today’s youth. On the basis of product, tablets/capsules dominate the hangover cure product market with a whopping share of 35.60% in 2025.

| Attributes | Details |

|---|---|

| Top Type | Hangover Remedies |

| Market Share in 2025 | 69.40% |

As individuals lead busy lives filled with social engagements and celebrations, the need for effective recovery solutions from the aftermath of alcohol consumption has intensified. The rise of health consciousness is one of the main drivers behind the popularity of hangover remedies.

With an increasing emphasis on overall well-being, consumers are drawn to products formulated with natural and functional ingredients. Based on type, the hangover remedies segment dominates the hangover cure product market, with a share of 69.40%.

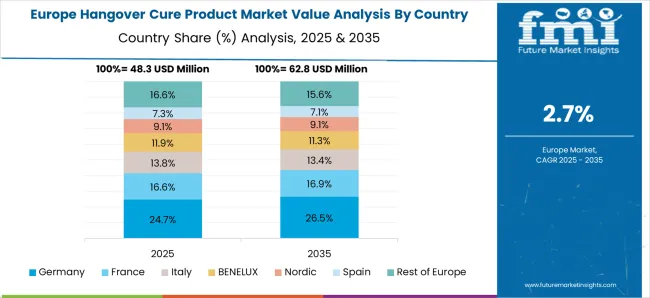

The section provides an analysis of the hangover cure product market by countries, including China, India, Australia, the United States, and Germany. The table presents the CAGR for each country, indicating the expected growth of the market in that country through 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 10.10% |

| India | 9.00% |

| Australia | 8.50% |

| United States | 7.40% |

| Germany | 6.60% |

China is one of the leading countries in Asia for the hangover cure product market. The market in China is anticipated to grow at a CAGR of 10.10% over the forecast period.

China is home to one of the largest populations in the world, with a majority of them in the drinking age. The cultural significance of socializing and celebrations, often accompanied by alcohol consumption, contributes to the demand for effective recovery solutions. The Chinese population is also increasingly accepting the Westernized corporate culture, which involves parties where alcohol consumption is very common. All these factors are collectively contributing to market growth for hangover cure products.

The Indian market is estimated to register a CAGR of 9.00% through 2035. India is known for its cultural diversity, which includes festivals, gatherings, functions, etc. These events contribute to increased instances of alcohol consumption, thus contributing to the overall market for hangover cure products.

The market growth can also be attributed to the rise in disposable incomes of the Indian middle class, inclined to explore and invest in products that enhance their overall drinking experience.

The hangover cure product market has a very bright future in the Australian region. It is anticipated that the market is bound to grow at a remarkable CAGR of 8.5% over the forecast period.

More than 80% of the Australian population resides in the coastal region. These areas are famous for their vibrant beach experience and alcohol consumption. This is one of the main reasons for the market’s significant performance in Australia. Apart from this, millions of tourists visit Australia throughout the year to have a relaxing vacation, further contributing to the market.

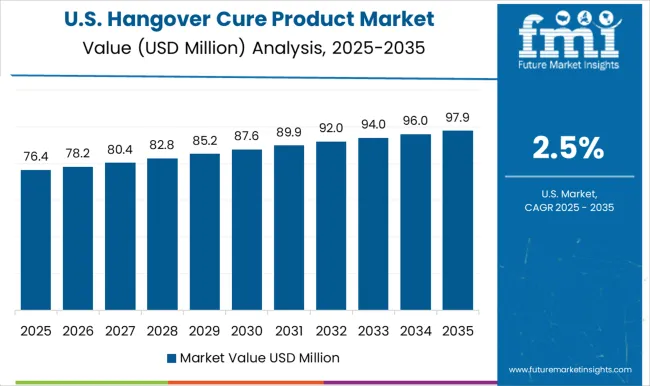

The hangover cure product market in the United States is anticipated to grow at a significant CAGR of 7.40% from 2025 to 2035. The United States market is also accentuated by numerous startups and established brands continuously introducing novel formulations and delivery methods.

The German hangover cure product market is anticipated to exhibit a modest CAGR of 6.60% over the forecast period.

With a rich tradition for beer festivals and social gatherings, Germany offers great opportunities for the market to thrive. Besides this, the German people are concerned about their health and thus seek hangover cure products that not only address the aftereffects of alcohol consumption but are also made up of natural, clean-label ingredients. These factors have led to an exponential expansion of the hangover cure product market in Germany.

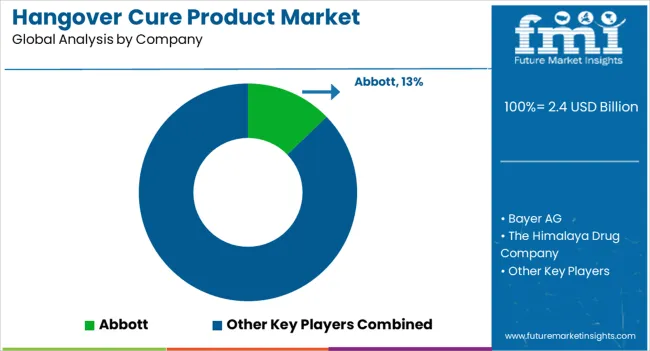

The market for hangover cure products is still in its nascent stages, with a very few companies in the international market. There is no single company that has complete dominance in the international marketplace. This gives a huge opportunity for local small-scale brands to gain a strong foothold in their respective areas.

Key market players are also focusing on producing novel formulations to cater to consumer demand. They are adopting strategies to expand their market reach and increase awareness about hangover cure products.

Recent Developments

The global hangover cure product market is estimated to be valued at USD 191.2 million in 2025.

The market size for the hangover cure product market is projected to reach USD 256.1 million by 2035.

The hangover cure product market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in hangover cure product market are anti-microbial agents, antibiotics, anti-inflammatory agents, antiseptics and others.

In terms of application, periodontitis segment to command 38.7% share in the hangover cure product market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hangover Cure Product Industry Analysis in United States Growth, Trends and Forecast from 2025 to 2035

Competitive Overview of Hangover Cure Product Companies

Global Anti-hangover Supplement Market Insights – Trends & Forecast 2023-2033

Secure Logistics Market Size and Share Forecast Outlook 2025 to 2035

Secure Web Gateway Market Analysis – Growth & Forecast 2019-2029

Procure-to-Pay Solution Market Forecast and Outlook 2025 to 2035

UV Cured Coatings Market Size and Share Forecast Outlook 2025 to 2035

Procurement Software Market Analysis - Size, Share, and Forecast 2025 to 2035

Procurement Analytics Market Size and Share Forecast Outlook 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

UV Cured Acrylic Foam Tapes Market Insights - Trends & Growth Forecast 2024 to 2034

Dual-Cure Luting Cements Market Size and Share Forecast Outlook 2025 to 2035

3D Secure Payment Authentication Market Insights by Components, Application, and Region - 2025 to 2035

Snap Secure Containers Market

CRISPR Genomic Cure Market

Tracheostomy Securement Tapes Market

Self-Adhesive Dual-Cure Luting Cement Market Size and Share Forecast Outlook 2025 to 2035

Tube and Dressing Securement Products Market

Retail Sourcing And Procurement Market Size and Share Forecast Outlook 2025 to 2035

Product Life-Cycle Management (PLM) IT Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA