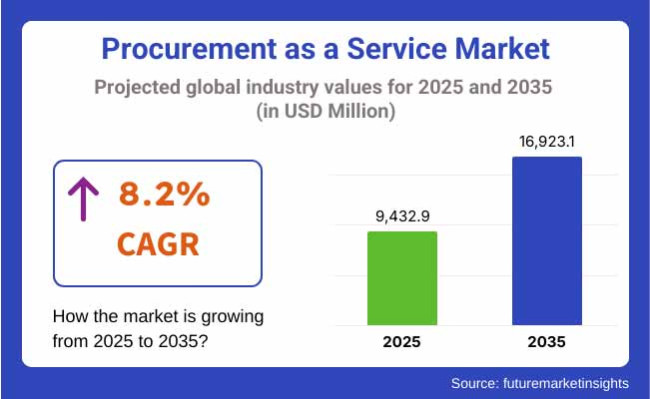

The global Procurement as a Service market is projected to grow significantly, from 9,432.9 Million in 2025 to 16,923.1 Million by 2035 an it is reflecting a strong CAGR of 8.2%.

As organizations become increasingly reliant on everyone else's vendors to execute their procurement function, third-party risk management is becoming a core feature of Procurement as a Service (PaaS). As companies outsource critical procurement roles, ensuring supplier compliance to security and operational standards becomes a must. As a result, the dependency on third party vendors has posed the risks associated with data security, contract compliance, and service quality and has led the enhanced demand for risk management solution.

The increase in market expansion is attributed to the increasing need for the mitigation of risks associated with suppliers, in some of the industries such as BFSI, healthcare, IT, etc. Such industries deal with sensitive data and must have stringent procurement governance in place, as there can be significant disruptions.

Organizations require PaaS solutions with robust and comprehensive risk evaluation framework, ensuring vendor credibility and alignment with procurement policies. Businesses seeking to optimize procurement efficiencies while still fulfilling regulatory obligations only compounds the demand.

Strict international laws like GDPR in Europe and CCPA in California require businesses to perform extensive due diligence before doing business with suppliers. This means that procurement processes need to comply with these legal considerations to avoid repercussions and damage to reputation.

onsequently, PaaS offerings now come with built-in automated compliance management systems, which assist organizations in simplifying audits related to procurement, documentation, and reporting on changing compliance requirements.

Third party procurement service provider adoption is being propelled by digital transformation that is requiring sourcing, spend analysis, and contract management. But a greater reliance on outsourcing raises concerns over supply chain vulnerabilities as well.

Suppliers should not lead to security risks, lack of compliance or operational inefficiencies for organizations. These advanced PaaS solutions feature continuous monitoring and risk assessments in real time enabling the businesses to stay ahead of any supplier-related challenges.

North America holds the largest share in the PaaS market owing to its complex regulatory environment, high due diligence on cybersecurity, and big procurement solution provider companies. High existing levels of digital economy coupled with rising levels of regulatory pressure mean that the region will continue to be a driver of third-party risk management in procurement.

Besides, fast-paced PaaS adoption is observed in emerging markets such as India and Australia as organizations expand operations and look for the best tools to manage supplier risks in dynamic procurement ecosystems.

| Company | IBM Corporation |

|---|---|

| Contract/Development Details |

Secured a contract with a global manufacturing company to provide end-to-end procurement management. |

| Date | 6 years |

| Contract Value (USD Million) | USD 70 |

| Renewal Period | IBM Corporation |

| Company | Accenture plc |

|---|---|

| Contract/Development Details | Partnered with a government department to optimize procurement operations and improve efficiency. |

| Date | 5 years |

| Contract Value (USD Million) | USD 58 |

| Renewal Period | Accenture plc |

Rising adoption of outsourcing procurement functions for cost reduction and efficiency

The vendors are outsourcing the procurement function to third-party service providers at an increasingly regular basis to increase cost optimization and efficiency. Procurement as a Service is ideal for organizations that want to benefit from subject-matter expertise and the latest technologies, as well as economies of scale without having to manage a dedicated in-house procurement function.

Outsourcing can help organizations by allowing them to focus on their core operations while decreasing admin costs through the outsourcing of strategic sourcing, contract management, and spend analysis, among others. Moreover, PaaS providers leverage automation and machine learning-powered tools for improved supplier selection, negotiation, and compliance tracking, which results in faster and cheaper purchasing processes.

Globally, governments are moving towards outsourced procurement models to promote transparency and accountability in public sector spending. A recent initiative from the government has delivered a 15% enterprise wide reduction across several agencies by moving to centralized procurement operations for example. The process of managing vendors is more streamlined and also minimizes the chances of procure fraud.

With tighter regulatory requirements, organizations are leveraging third party procurement providers to navigate complex compliance landscapes efficiently. Amid mounting pressure to optimize procurement expenditure and enhance supplier risk management capabilities, organizations are increasingly adopting PaaS solutions as strategic enabler of cost reduction and operational excellence.

Adoption of blockchain for transparent and secure supplier transactions

The procurement field is being revolutionized by Blockchain. Blockchain could make supplier transactions more transparent, secure, efficient. In traditional procurement processes, there are multiple intermediaries leading to more risk of fraud, delayed payments and contract disputes.

Blockchain can potentially prove beneficial as it is a decentralized and immutable ledger that allows organizations to keep a secure and tamper-proof record of transactions between contractors and suppliers, thereby ensuring supplier authenticity and contract adherence. Blockchain-enabled smart contracts streamline procurement processes by automating workflows, including payments, which are only released after certain predetermined conditions are met, thus minimizing disputes and optimizing cash flow administration.

Also, governments are embracing blockchain-powered procurement platforms to enhance accountability of public sector expenditures. New government-led initiative for blockchain procurement reported 20% bettering of procurement accuracy and fraud prevention in state-level contracts. This technology also ensures that all the stakeholders involved have access to procurement data in real-time, thus reducing the risk of data manipulation or unauthorized changes.

Furthermore, use of blockchain-based digital identity verification for suppliers streamlines the onboarding process and improves regulatory compliance. The demand for secure and effective supplier management systems will lead to increased adoption of blockchain in procurement. Blockchain technology in PaaS solutions is set to revolutionize the process of procurement that will be more transparent, affordable, and resilient against fraud.

Rising demand for procurement automation in SMEs for cost-effective operations

Procurement automation is rapidly becoming a favorite with small and medium-sized enterprises (SMEs) with a view to optimizing their operations and lowering costs. SMEs often are unable to form dedicated procurement teams due to limited resources, making the processes time and labor-intensive, resulting in low efficiency compared to large corporations.

Procurement as a Service (PaaS) themselves offer free cloud-based automation tools which enable small and medium enterprises (SMEs) to automate the negotiation with suppliers, the execution of contracts and spend analysis with minimal manual intervention. SMEs can save operational costs, boost control over supply chains and deploy resources better by automating common procurement tasks.

This means that governments are waking up to how they can help support SME procurement modernization. Data up to October 2023 We have a recently government-backed program that allocated USD 500 million in research funding to promote SMEs in their adoption of digital procurement solutions with the result that businesses who participated were able to increase their procurement process efficiency by 30%.

Clustering of Impactful Projects This emphasizes the critical role of automation to enhance SME competitiveness in the global market. With the increasing availability of affordable procurement automation tools, an ever-increasing number of SMEs are utilizing PaaS solutions for better procurement decision-making process, enhanced supplier collaboration and risk mitigation. This will result to the increase in innovation with digital procurement platforms and facilities, helping further grow the PaaS market, as demand for more cost-effective procurement automation increases, especially with SMEs.

Data security concerns hinder adoption due to the risk of cyber threats in outsourced procurement

The contribution of Procurement as a Service (PaaS) is often delayed due to data security concerns because, when outsourcing procurement functions, organizations must share sensitive business information like finances, intellectual property, and trade secrets with third-party providers.

Contract negotiation: Since procurement processes involve the exchange of sensitive financial data, such as supplier contracts, pricing details, and compliance documents, they form a prime attack vector for cyber threats. Data Breach → Organizations are concerned that outsourcing procurement could leave them vulnerable to a data breach, unauthorized access or hacking attempts that could jeopardize confidential business data and result in financial or reputational loss.

With procurement operations becoming increasingly dependent on digital platforms and cloud-based solutions, the sensitive nature of procurement data makes it a lucrative target for cybercriminals, who exploit vulnerabilities in these systems to gain access to sensitive procurement data. Orchestrated cyber espionage, fraudulent transactions and the impersonation of suppliers are additional risks.

Moreover, procurement consists of various people all over the world at multiple locations, making it more vulnerable to unauthorizedness of data exposure during communication and transactions. These security challenges result in most companies being reluctant to adopt PaaS solutions for their procurement functions, opting to keep the procurement function in-house to retain control of their data.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Procurement regulations required enhanced supplier transparency. |

| AI & Automation Integration | AI-assisted procurement optimized vendor selection. |

| Cloud-Based Procurement Models | Rise in cloud-native procurement solutions for cost efficiency. |

| Risk Management & Compliance | Predictive analytics improved risk mitigation in procurement. |

| Market Growth Drivers | Rising demand for cost reduction and operational agility. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven contract compliance automates procurement governance in real time. |

| AI & Automation Integration | AI-powered self-learning procurement agents enable autonomous supply chain optimization. |

| Cloud-Based Procurement Models | AI-driven decentralized procurement ecosystems enhance supplier collaboration. |

| Risk Management & Compliance | AI-driven risk intelligence autonomously manages supplier disruptions. |

| Market Growth Drivers | AI-powered procurement ecosystems revolutionize strategic sourcing. |

The section highlights the CAGRs of countries experiencing growth in the Procurement as a Service market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 10.9% |

| China | 10.2% |

| Germany | 5.4% |

| Japan | 7.8% |

| United States | 6.7% |

The speedy industrial development of China, the requirements for effective procurement solution have gradually risen. Combining these two strengths means that the myriad of new businesses in China, powered by the booming country and its manufacturing sector, need better ways to manage their complex supply chains. So i also start informing you about the most important change PaaS solution enhanced sourcing efficiency, supplier collaboration, and cost management due to rising demand for raw materials, machinery, and technology. Digital procurement platforms are enabling large enterprises in auto, electronics and heavy industries to enhance their sourcing strategy.

It is a national digital procurement ramp-up by the Chinese government to increase supply chain resilience. China’s Ministry of Industry and Information Technology in 2023 announced a USD 150 billion digital supply chain transformation investment, aimed at improving procurement efficiency across industrial sectors. These subsidies address AI-driven procurement automation that allows enterprises to establish smoother supplier coordination, saving on procurement and boosting efficiency.

In the growing SME sector of India, the need for cost-effective procurement solutions is escalating. Small and medium-sized enterprises (SMEs) account for almost a third of India's GDP and 45% of the country's manufacturing output, highlighting their important role in economic growth. This recognizes that these businesses typically struggle with procurement inefficiencies, supplier management, and cost control.

To reduce overhead costs and negotiate better supplier contracts, SMEs are moving their procurement operations to the Procurement as a Service (PaaS) model as competition in procurement continues to grow. Digital procurement platforms are especially useful for SMEs that lack the internal capacity to implement and sustain traditional procurement best practices, as such platforms provide tools that allow for automated sourcing and supplier evaluation, as well as contract management.

In 2023, the Indian government initiated the MSME Digital Procurement Scheme and this will assist SMEs in moving to cloud-based procurement systems. The initiative is expected to bring more than 100,000 SMEs onto digital procurement networks, enhancing their supplier access and minimizing procurement-related inefficiencies. The program also aims to allow SMEs adopting AI-powered procurement tools to enjoy tax incentives.

Procurement automation is an area of increasing focus for USA firms seeking both cost and efficiency improvements. As labor costs rise, supply chains disrupt, and inflationary fears rise, businesses are increasingly turning to digital procurement solutions to optimize their spend and reduce operational cost. Procurement automation helps organizations simplify purchasing processes, improve supplier negotiations, and remove manual inefficiencies. Healthcare, retail, and IT sectors are especially adopting AI-based procurement solutions to gain real-time spend visibility and better cost-saving opportunities.

In 2023, the USA government launched the Federal Digital Procurement Initiative, investing USD 5 billion to streamline procurement operations for government agencies and private enterprises. This initiative requires implementing AI-enabled procurement platforms to optimize efficiency, guarantee compliance, and decrease procurement cycle time. The program is estimated to reduce procurement costs 15% a year for companies that adopt digital procurement solutions.

The section contains information about the leading segments in the industry. By Component, the Contract Management segment is estimated to grow quickly from the period 2025 to 2035. Additionally, by Enterprise Size, Large Enterprise segment hold dominant share in 2025.

| Component | CAGR (2025 to 2035) |

|---|---|

| Contract Management | 9.8% |

As procurement contracts grow in complexity, along with a need for compliance, contract management solutions have been widely adopted. Digital contract management platforms are being adopted by businesses across industries to expedite negotiations, automate contract approvals, and reduce risks.

Procurement-as-a-service (PaaS) providers are incorporating AI and blockchain in their contract management tools, improving transparency, reducing disputes and allowing seamless collaboration with suppliers. They help enterprises with effective contract lifecycle management, which reduces the intervention of manual actions and makes the entire procurement efficient.

The BFSI, IT, and healthcare sectors are leading the way, with strict compliance regulations and the need for contemporary contract monitoring propelling the adoption of digital contract management systems. The Federal Digital Contracts Initiative was announced by the USA government in 2023 and involved spending USD 3.5 billion on artificial intelligence for public procurement through AI-driven contract management systems.

Such initiative would minimize procurement fraud, speed up contract approvals and help track suppliers more effectively. According to a study, government agencies integrating digital contract management tools witness a 20% decrease in contract processing time which in turn smooths procurement activities.

| Enterprise Size | Value Share (2025) |

|---|---|

| Large Enterprise | 56.3% |

Dominance of Large Enterprises as PaaS is Valued Based on Procurement Volume and Scale in Global Supply Chains. These companies build procure and spend enablement solutions that not only ensure compliance with complex regulatory frameworks but also optimize supplier negotiations and improve spend visibility. Many large enterprises in sectors such as manufacturing, retail, and BFSI demand end-to-end procurement management, making them the major stakeholders of digital procurement solutions.

Large corporations are leveraging intelligence in their spend analysis, automated supplier score-cards, and predictive analytics to achieve procurement efficiency and cost optimization. In 2023, the European Union launched the Corporate Procurement Digitalization Program, which allocated USD 8 billion to assist larger enterprises in adopting AI-powered procurement platforms.

The Programme requires firms that spend over USD 500 million a year on procurement to adopt digital systems to enhance transparency and cost-effectiveness. Early participants in this initiative have seen a 15% reduction in procurement costs and more efficient contract management.

The Procurement as a Service (PaaS) market is growing rapidly as enterprises seek cost efficiency, streamlined supply chain management, and enhanced procurement visibility. The industry is dominated by global consulting and IT firms offering AI-driven, cloud-based procurement solutions. Leading players focus on automation, analytics, and supplier management to deliver end-to-end procurement capabilities.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| GEP | 20-25% |

| Accenture | 15-20% |

| IBM | 12-17% |

| Infosys | 8-12% |

| WNS Global Services | 7-10% |

| Other Companies (combined) | 28-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| GEP | Provides AI-powered procurement solutions and category management. Offers deep analytics, sourcing, and supplier collaboration tools. |

| Accenture | Delivers end-to-end procurement services with a strong focus on digital transformation, cost optimization, and cloud integration. |

| IBM | Specializes in AI-driven procurement analytics, supplier risk management, and automated contract lifecycle solutions. |

| Infosys | Offers procurement consulting, digital procurement automation, and supply chain optimization services. Expanding AI-driven spend analysis. |

| WNS Global Services | Provides customized procurement outsourcing solutions with strong analytics and cost optimization capabilities. Focuses on procurement transformation for enterprises. |

Strategic Outlook

GEP (20-25%)

GEP is the leading provider of Procurement as a Service powered by artificial intelligence, cloud-based technologies and hyper automation to help organizations achieve savings and efficiencies. Its GEP SMART procurement platform combines AI-based insights, contract management, and supplier collaboration in a single solution, resulting in it being a name of choice among global enterprises. GEP's procurement intelligence capabilities have continued to mushroom, and the firm is at the forefront of digital procurement transformation.

Accenture (15-20%)

Accenture is one of the Industry leaders in digital procurement, we offer end-to-end procurement consulting & outsourcing services. Driven by artificial intelligence (AI), blockchain, and cloud-based procurement, Accenture assists organizations in selecting suppliers, managing contracts, and engaging with suppliers. The company keeps growing its AI-enhanced procurement analysis, allowing for cost savings and improved procurement efficiency.

IBM (12-17%)

IBM uses its Watson AI platform to improve procurement processes through comprehensive data analytics, spend optimization, and supplier risk management. Its solutions are quite secure and efficient as the company combines AI-driven insights with blockchain-based contract management. For large enterprises and governments looking for end-to-end procurement automation, IBM has precision procurement solutions.

Infosys (8-12%)

Infosys Information Services also offers digital procurement transformation services, with a focus on AI-led spend analysis, supplier performance management and contract lifecycle management. Business Summary: The company provides cloud-based procurement platforms in a bid to make the procurement function more efficient for enterprises. Infosys continues to create Procurement insights leveraging AI and automation to improve decision-making and drive down operating costs.

WNS Global Services (7-10%)

WNS Global Services provides tailored procurement outsourcing solutions centered on supplier negotiations, cost optimization and risk management. Investing in AI-enabled analytics for improved procurement insights in real time, optimizing sourcing and procurement strategies. Good traction of WNS in the mid-sized enterprises seeking flexible procurement outsourcing models.

Other Key Players (28-38% Combined)

The several other companies Capgemini, Genpact, HCL Technologies, TCS and Corcentric add to diversity in market. These players provide specialized procurement solutions focusing on Automation, Analytics, and supplier management. Many of these companies are also advancing AI-based procurement capabilities to solidify their competitive advantage anyfy.

In terms of Component, the segment is segregated into Strategic Sourcing, Spend Management, Contract Management, Category Management, Process Management and Transactions Management.

In terms of Enterprise Size, the segment is segregated into Small & Medium Enterprise and Large Enterprise.

In terms of Vertical, it is distributed into Manufacturing, Retail and consumer packaged goods, Banking, Financial Services, and Insurance (BFSI), IT and Telecom, Energy and Utilities, Healthcare, Travel and Hospitality and Others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Procurement as a Service Market is projected to witness CAGR of 8.2% between 2025 and 2035.

The Procurement as a Service Market stood at USD 9,432.9 million in 2025.

The Procurement as a Service Market is anticipated to reach USD 16,923.1 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 9.8% in the assessment period.

The key players operating in the Procurement as a Service Market GEP, Accenture, IBM, Infosys, WNS Global Services, Capgemini, Genpact, HCL Technologies, Tata Consultancy Services (TCS), Corcentric.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 17: Global Market Attractiveness by Component, 2023 to 2033

Figure 18: Global Market Attractiveness by Organization Size, 2023 to 2033

Figure 19: Global Market Attractiveness by Vertical, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 37: North America Market Attractiveness by Component, 2023 to 2033

Figure 38: North America Market Attractiveness by Organization Size, 2023 to 2033

Figure 39: North America Market Attractiveness by Vertical, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Organization Size, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Vertical, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Component, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Organization Size, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by Vertical, 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Component, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Organization Size, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by Vertical, 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Million) by Component, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Component, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Organization Size, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by Vertical, 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 137: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Organization Size, 2023 to 2033

Figure 139: East Asia Market Attractiveness by Vertical, 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Component, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Component, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Organization Size, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by Vertical, 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Procurement Analytics Market Size and Share Forecast Outlook 2025 to 2035

Procurement Software Market Analysis - Size, Share, and Forecast 2025 to 2035

Retail Sourcing And Procurement Market Size and Share Forecast Outlook 2025 to 2035

Asthma Treatment Market Forecast and Outlook 2025 to 2035

Asphalt Mixing Plants Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Tomato Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Aspirating System Market Size and Share Forecast Outlook 2025 to 2035

Aseptic Formulation Processing Market Size and Share Forecast Outlook 2025 to 2035

Asphalt Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Astringent Skin Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Aseptic Containment Systems Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Loop-mediated Isothermal Amplification (LAMP) Market Size and Share Forecast Outlook 2025 to 2035

Asset Performance Management Market Size and Share Forecast Outlook 2025 to 2035

Asphalt Mixing Plant Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Asian Sea Bass Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Aspirin Drug Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Stick Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pallets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA