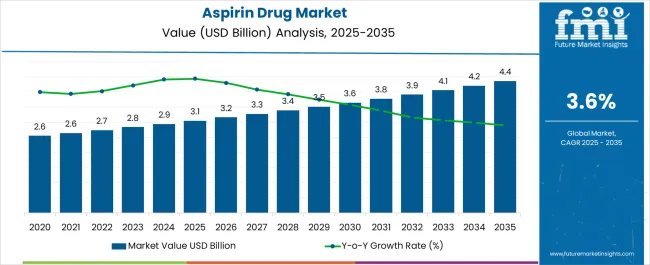

The Aspirin Drug Market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 4.4 billion by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period.

| Metric | Value |

|---|---|

| Aspirin Drug Market Estimated Value in (2025 E) | USD 3.1 billion |

| Aspirin Drug Market Forecast Value in (2035 F) | USD 4.4 billion |

| Forecast CAGR (2025 to 2035) | 3.6% |

The aspirin drug market is experiencing steady expansion as demand continues to be driven by its established role in pain management, cardiovascular health, and preventive care. The current landscape is defined by consistent integration of aspirin into treatment protocols and increasing utilization in chronic disease management. Adoption is supported by cost-effectiveness, broad availability, and well-documented clinical efficacy.

Market players are focusing on reformulations, improved delivery systems, and extended-release variants to address patient compliance and differentiated therapeutic needs. Growth is further influenced by regulatory support for preventive usage in at-risk populations and ongoing clinical research that is strengthening the evidence base for expanded indications.

The future outlook is supported by rising prevalence of cardiovascular disorders, higher healthcare awareness, and penetration into emerging markets where over-the-counter availability is boosting accessibility Collectively, these drivers are expected to underpin stable revenue growth and strengthen aspirin’s position as a core therapeutic agent in the global pharmaceutical landscape.

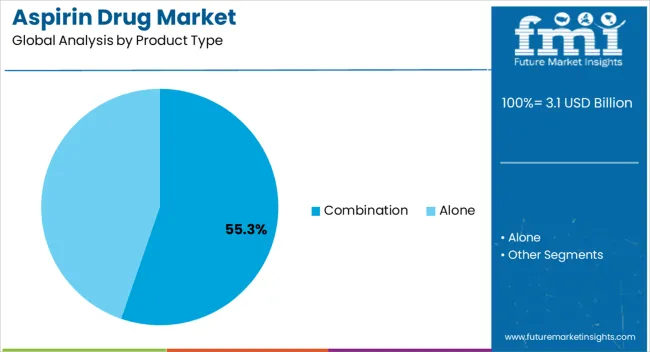

The combination segment, holding 55.30% of the product type category, is leading the market due to its enhanced therapeutic outcomes achieved by synergistic formulations. Combinations with other analgesics or antipyretics have been preferred for broader clinical effectiveness and convenience in multi-symptom relief.

Adoption is reinforced by physician prescribing patterns that favor combination therapies for improved compliance. Manufacturing and regulatory approvals have supported widespread commercialization, while marketing strategies have positioned these products as more comprehensive treatment options.

The segment’s growth is further sustained by availability across both prescription and over-the-counter channels As clinical research continues to validate additional combination benefits, market share is expected to remain strong, supporting the category’s long-term leadership.

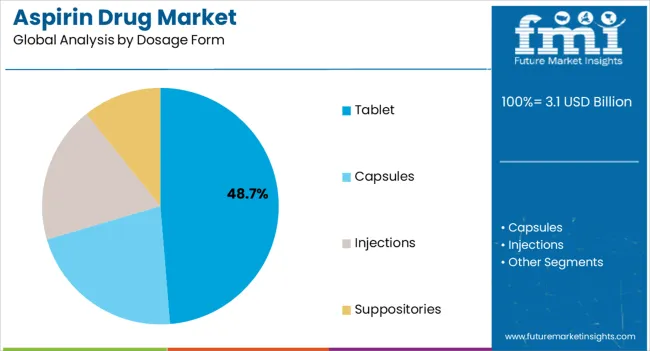

The tablet segment, accounting for 48.70% of the dosage form category, has remained dominant due to its convenience, stability, and cost-effectiveness. High patient preference for tablets, combined with ease of distribution and long shelf life, has strengthened its market position.

Manufacturing scalability and wide acceptance across pharmacies and hospitals have ensured steady demand. Regulatory familiarity with tablet formulations has facilitated faster approvals and reduced barriers for market entry.

Advancements in tablet technology, including enteric coating and extended-release options, are further improving patient adherence and expanding usage in preventive care The segment’s resilience is reinforced by its accessibility in both developed and emerging healthcare systems, ensuring that tablets continue to be the most widely adopted dosage form.

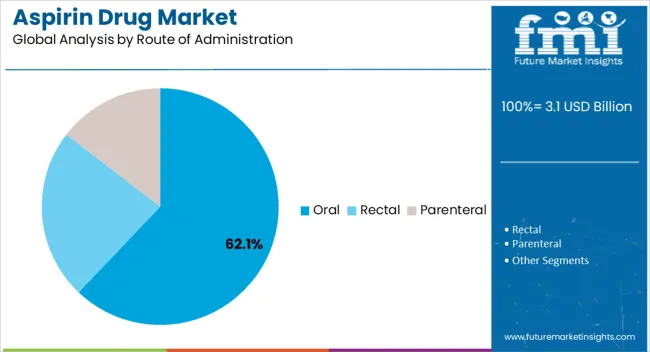

The oral route, holding 62.10% of the route of administration category, has emerged as the preferred choice due to patient convenience, safety, and effectiveness. Oral administration has maintained dominance because of ease of self-administration and widespread availability across retail and hospital pharmacies.

Pharmacokinetic consistency and established clinical outcomes have reinforced physician confidence in oral dosing. The segment has also benefited from cost advantages and strong distribution frameworks that ensure rapid market penetration.

Continuous improvements in formulation technology, such as controlled-release and gastro-resistant preparations, are addressing safety concerns and improving therapeutic compliance The oral route is expected to retain its leadership as the most practical and accessible mode of administration, supporting stable growth across diverse patient populations.

| Attributes | Details |

|---|---|

| Aspirin Drug Market Size (2020) | USD 2,471.6 million |

| Aspirin Drug Market Size (2025) | USD 2,831.8 million |

| Aspirin Drug Market CAGR % (2020 to 2025) | 3.4% |

The market value for aspirin drugs was around 18.6% of the overall USD 3.1 billion of the global non-steroidal anti-inflammatory drugs (NSAIDs) market in 2025.

The sale of aspirin drugs expanded at a CAGR of 3.4% from 2020 to 2025 owing to rising diseases like pain, fever, inflammation, rheumatoid arthritis, and systemic lupus erythematosus. This can be attributed to the consumption of aspirin as a blood-thinning agent in treating chronic diseases. Further, it reduces the risk of blood clot formation and treats minor pain and aches.

The aspirin drug market continues to expand due to new drug research, commercial use, and development breakthroughs. For instance, in July 2020, Dr Reddy's Laboratories launched rosuvastatin, aspirin, and clopidogrel FDC under Rozat Gold.

Over the forecast period, the market is projected to be driven by the pharmaceutical industry's rising efforts in discovering novel treatments to treat chronic diseases. The global aspirin drug market is expected to register a CAGR of 3.8% from 2025 to 2035.

| Historical CAGR % (2020 to 2025) | 3.4% |

|---|---|

| Forecast CAGR % (2025 to 2035) | 3.8% |

| Country | The United States |

|---|---|

| CAGR (2025 to 2035) | 3.9% |

The United States is expected to seize a 25.7% global market share in 2025. Recent market projections indicate continued profitable prospects in North America. The primary driver of the target market is the increasing need for aspirin to manage chronic pain. Chronic pain, especially in adults, is rising in the United States due to sitting for an extended time. Aspirin drug acts as a painkiller for chronic pain. For instance, in a report published by the Centers for Disease Control and Prevention, a prevalence of chronic pain as well as high-impact chronic pain was found among United States adults, with 4% (50.0 million) suffering from chronic pain and 8.0% (19.6 million) from high-impact chronic pain, respectively. These are key driving factors propelling this region's demand for aspirin drugs.

| Country | Germany |

|---|---|

| CAGR (2025 to 2035) | 3.1% |

In Europe, Germany is anticipated to acquire a significant share of 26.5% of the aspirin drug market in 2025. In 2025, the German aspirin drug market is predicted to reach USD 4.4 million, followed by a CAGR of 3.1% through 2035.

| Country | The United Kingdom |

|---|---|

| CAGR (2025 to 2035) | 3.2% |

The aspirin drug market in the United Kingdom is expected to acquire a mere 3.2% global market share in 2025. In Europe, the market share is estimated to be a notable 21.1%. After attaining a market value of USD 3.1 million in 2025, the market is expected to record a CAGR of 3.2% through 2035. The following factors support the regional growth:

| Country | India |

|---|---|

| CAGR (2025 to 2035) | 3.4% |

The aspirin drug market in India is set to exhibit a CAGR of 3.4% in 2035. In India, substantial financing and the launch of several healthcare programs, like Pradhan Mantri Jan Arogya Yojana and Ayushman Bharat, which offer accessible healthcare facilities and reimbursement options to patients receiving healthcare treatment, are boosting the product demand. Other factors leading to product sales are:

| Country | China |

|---|---|

| CAGR (2025 to 2035) | 3.6% |

China holds around 5.4% share in the global market in 2025, owing to the prevalence of increasing cardiovascular diseases like stroke or heart attack. China is one of the leading producers of aspirin drugs. Around two-thirds of aspirin is now produced in China. Drug development of aspirin drugs is significantly increasing in China due to rising research funding. These factors are predicted to drive sales of aspirin drugs in China. Additionally, due to the increase in the production and export of APIs, which accounts for 20% of global output, China is considered one of the top leaders in the region.

| Leading Product Type | Combination |

|---|---|

| CAGR | 4% |

The combination is anticipated to account for 68% value share in 2025. The segment is expected to display a CAGR of 4.0% through 2035. Antiplatelet agents are a class of drugs that include extended-release dipyridamole and a combination of aspirin. A combination of aspirin prevents excessive blood clotting, leading to widespread adoption.

| Leading Dosage Form | Tablets |

|---|---|

| Market Share % (2025) | 3.4% |

The tablets segment is anticipated to hold a market share of 44.8% in 2025. Over the forecast period, the segment is expected to grow gradually, with an estimated CAGR of 3.4% through 2035. Tablets are the easiest and safest way to consume the drug. Further, it helps to alleviate fever and relieve pain from conditions such as toothaches, muscle aches, and the common cold. These factors are increasing the sales of aspirin drugs in tablet form.

| Leading Route of Administration | Oral |

|---|---|

| CAGR | 3.5% |

The oral route of administration usage is more as compared to rectal and parenteral. Topical holds a prominent market share value of 49.8% in 2025, followed by a CAGR of 3.5% through 2035. Owing to its advantages, such as patient compliance, non-invasiveness, and convenience of drug administration, the oral route of administration is the favored method.

| Leading Age Group | Pediatric |

|---|---|

| CAGR | 56.2% |

Pediatrics is projected to hold a market share of 56.2% in 2025. The segment is expected to grow gradually over the forecast period, with an estimated CAGR of 3.8% through 2035. Aspirin drug dosage is quite effective in pediatric populations suffering from diseases like chicken pox and flu-like symptoms. The weak immune system of the pediatric population makes them an easy target for these diseases. Hence, aspirin drug is commonly used in the medicine of the pediatric population.

| Leading Distribution Channel | Retail Pharmacies |

|---|---|

| CAGR | 3.4% |

Retail Pharmacies are anticipated to register a prominent share of 44.0% in the aspirin drug market in 2025, with a CAGR of 3.4% through 2035. The easy availability of drugs in all forms in retail pharmacies supports the increasing purchases of medicines from these pharmacies.

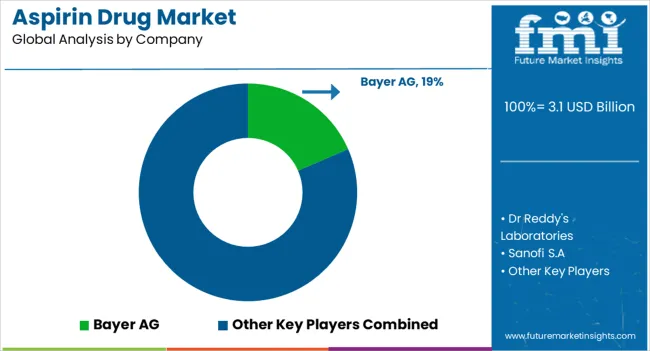

The market for the production of aspirin drugs is fragmented, with several competitors. These businesses are employing strategies including collaborations, partnerships, mergers and acquisitions, and new drug releases to meet consumer demand and amplify their client base. Governments across the globe are also taking initiatives to invest in life-saving drugs like aspirin.

Similarly, the team at Future Market Insights has tracked recent developments related to pharmaceutical companies manufacturing aspirin drugs, which are available in the full report.

The global aspirin drug market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the aspirin drug market is projected to reach USD 4.4 billion by 2035.

The aspirin drug market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in aspirin drug market are combination and alone.

In terms of dosage form, tablet segment to command 48.7% share in the aspirin drug market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aspirin Exacerbated Respiratory Disease Market

Drug-Gene Interaction Panels Market Size and Share Forecast Outlook 2025 to 2035

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Drug Tester Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Drug Integrated Polymer Fibers Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Drug Formulation Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Drug-Induced Dyskinesia Market Size and Share Forecast Outlook 2025 to 2035

Drug Free Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Drug Delivery Technology Market is segmented by route of administration, and end user from 2025 to 2035

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drug Delivery Solutions Market Insights - Growth & Forecast 2025 to 2035

Drug Designing Tools Market Growth – Trends & Forecast 2025 to 2035

Drug of Abuse Testing Market Growth – Trends & Forecast 2025-2035

Drug-Induced Immune Hemolytic Anemia Market - Demand & Forecast 2025 to 2035

Drug Discovery Services Market Insights - Trends & Growth 2025 to 2035

Drug Screening Market Overview - Trends, Demand & Forecast 2025 to 2035

Drug Eruptions Treatment Market - Innovations & Future Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA