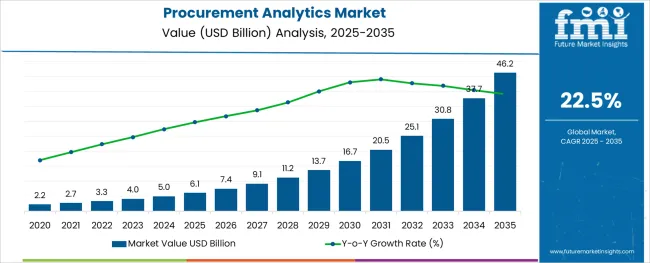

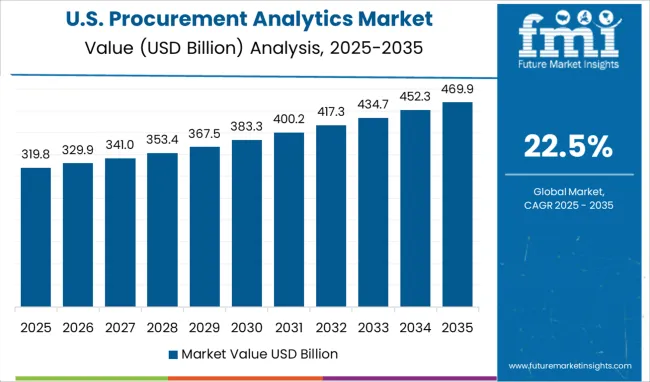

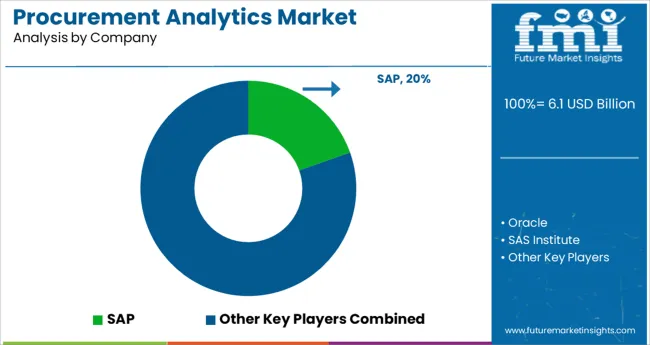

The Procurement Analytics Market is estimated to be valued at USD 6.1 billion in 2025 and is projected to reach USD 46.2 billion by 2035, registering a compound annual growth rate (CAGR) of 22.5% over the forecast period.

The procurement analytics market is expanding rapidly as organizations increasingly prioritize data-driven decision-making to optimize purchasing and supply chain operations. Advances in big data and AI technologies have enabled the development of sophisticated analytics tools that offer real-time insights into procurement spend, supplier performance, and risk management.

Business leaders are leveraging these solutions to gain greater visibility into spending patterns, identify cost-saving opportunities, and enhance supplier collaboration. Additionally, growing complexity in global supply chains has heightened the demand for predictive analytics and automated reporting.

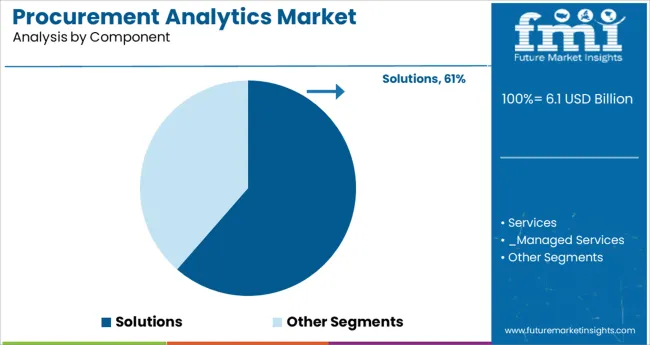

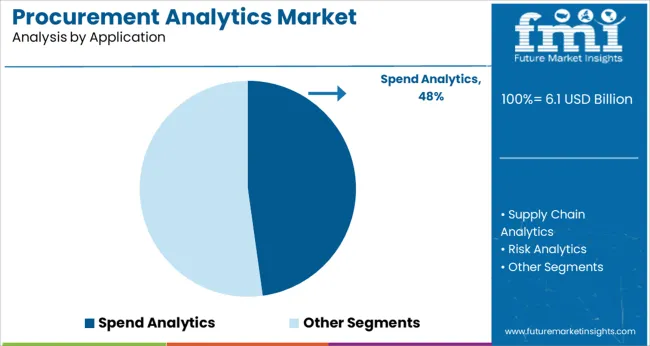

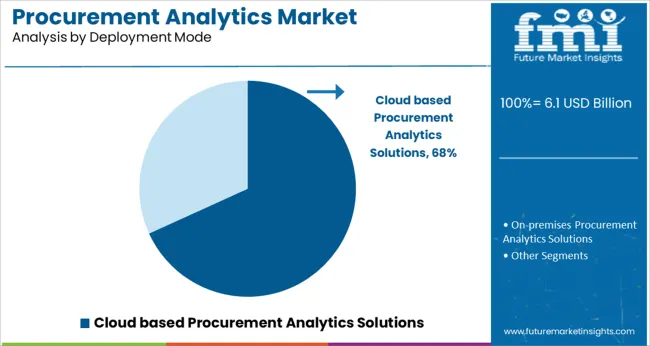

Industry insights indicate that cloud adoption has accelerated market growth by providing scalable, flexible, and cost-effective deployment options. Investments in digital transformation and the drive for operational efficiency are expected to continue fueling market expansion. Segmental growth is anticipated to be led by Solutions as the primary component, Spend Analytics as the key application, and Cloud-based Procurement Analytics Solutions as the preferred deployment mode.

The market is segmented by Component, Application, Deployment Mode, Organization Size, and Industry Vertical and region. By Component, the market is divided into Solutions and Services. In terms of Application, the market is classified into Spend Analytics, Supply Chain Analytics, Risk Analytics, Demand Forecasting, Contract Management, Vendor Management, and Category Management.

Based on Deployment Mode, the market is segmented into Cloud based Procurement Analytics Solutions and On-premises Procurement Analytics Solutions. By Organization Size, the market is divided into Large Enterprises and Small and Medium-sized Enterprises (SMEs). By Industry Vertical, the market is segmented into Manufacturing, BFSI, Retail and e-Commerce, Telecom and IT, Healthcare and Life Sciences, Energy and Utilities, and Government and defence.

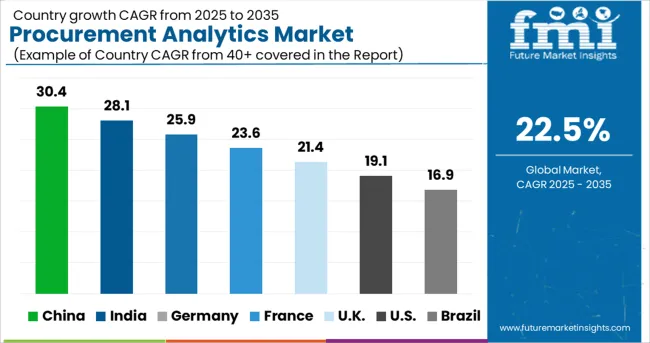

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Solutions segment is projected to hold 61.4% of the procurement analytics market revenue in 2025, reflecting its dominant role in delivering actionable insights across procurement functions. Organizations have increasingly adopted comprehensive analytics solutions that integrate data from multiple sources to provide a holistic view of procurement activities.

These solutions facilitate advanced reporting, trend analysis, and supplier performance monitoring. The growth of this segment is supported by continuous innovation in machine learning algorithms and user-friendly dashboards that improve decision-making speed and accuracy.

As procurement teams seek to move beyond basic data visualization to predictive and prescriptive analytics, the Solutions segment is expected to sustain its leadership in the market.

The Spend Analytics segment is expected to account for 47.8% of the procurement analytics market revenue in 2025, maintaining its position as the leading application. Spend analytics provides organizations with detailed visibility into purchasing patterns and supplier costs, enabling identification of savings opportunities and risk reduction.

Companies across industries have leveraged spend analytics to negotiate better contracts, consolidate suppliers, and improve compliance. The rising complexity of supply chains and the need for transparency have increased reliance on spend analytics tools.

Enhanced data integration capabilities and the ability to analyze unstructured data have further boosted the adoption of this application. The Spend Analytics segment will continue to be a critical component of procurement transformation initiatives.

The Cloud-based Procurement Analytics Solutions segment is projected to contribute 68.2% of the market revenue in 2025, positioning it as the preferred deployment mode. The flexibility and scalability of cloud solutions have made them attractive to organizations of all sizes seeking to implement procurement analytics without heavy upfront investments.

Cloud deployment facilitates faster implementation, easier integration with existing enterprise systems, and remote access to analytics dashboards. Additionally, cloud platforms provide continuous updates and enhanced security features, addressing concerns around data privacy and compliance.

The growing trend toward hybrid work models and digital collaboration has reinforced cloud adoption. As organizations continue to seek agility and cost-efficiency in procurement operations, the Cloud-based segment is expected to lead market growth.

As per the Procurement Analytics Market research by Future Market Insights - market research and competitive intelligence provider, historically, from 2020 to 2024, the market value of the procurement analytics market increased at around 25.4% CAGR.

A variety of factors are expected to encourage the use of procurement analytics technology and services, including rising marketing and promotion expenditures by large businesses and the development of consumer bases.

The growing requirement to predict risks and losses, reduce operating costs, improve efficiency, and execute continual company growth is driving procurement analytics.

Procurement analytics offers companies data-driven insight into how to enhance service levels. The use of analytics tools in procurement processes such as design, planning, delivery, production, and service has expanded.

The transactional elements of procurements can benefit from procurement analytics as well. These analytics may be utilized to identify inefficiencies, purchase order cycle times, and savings opportunities linked with contract conditions. The user may assess payment accuracy, analyze discount opportunities, and monitor duplicate payments or frauds using procurement analytics.

According to a research study conducted by Regina Corso Consulting of US supply chain experts, 90% of the respondents agree procurement analytics has taken on more duties to handle supply chain and sustainability concerns.

With almost half of supply chain professionals stating shortages and interruptions keep them awake at night, it is critical to rely on procurement to help solve these issues. Procurement analytics may be used to split spending across locations, commodities, and entities to uncover potential for value and savings in strategic sourcing.

Procurement analytics is used to detect critical sourcing event triggers which makes it highly useful to the end-users.

Due to factors such as the vast amount of procurement data in every sector, especially in the telecom and IT, the industry is likely to grow rapidly. Greater knowledge of the benefits of this data, such as precise forecasting of future supply chain management, enhanced decision modelling, and reduced costs, are also influencing the growth of the procurement analytics market.

Digitalization has played a vital role in boosting demand for analytics. Data security, integration concerns, and insufficient analytics capabilities, on the other hand, are impeding the market's growth.

Also, the use of procurement analytics in small and medium businesses (SMEs) is projected to provide the industry with several opportunities in the future years.

Data security, integration concerns, and insufficient analytics capabilities, on the other hand, are impeding the market's growth. Despite the hindrance, predictive analytics companies are continuously working to ensure the safety of information to the users of such tools.

Supply chains and data procurement can be transformed by new digital technologies and the big data analytics they deliver. Every quarter, procurement teams are confronted with higher demands. Companies desire lower costs, fewer risks, more efficient processes, and higher profit margins.

Governments also demand firms adhere to defined criteria at every stage of the supply chain. Consumers are also expecting more corporate accountability in terms of ethical sourcing.

There are various advantages to data-driven buying. By integrating real-time information, historical data, and consumer insights, chief procurement officers may take a proactive approach to make informed decisions, optimize the supply chain, and be more prepared for disruptions caused by external factors.

When a firm knows how to use big data to create data-driven procurement strategy, it may have a huge influence on its bottom line. Only about 1/4th of procurement organizations has a long-term digital strategy.

North America is the most lucrative region with procurement analytics market share of over 40%. The rising diffusion of big data in the retail industry is driving procurement analytics market growth.

Businesses are shifting their attention from data collection to engineering approaches to extract insights from data, owing to the extraction of customer data from consumer and retail technology. This information can give merchants a competitive edge and differentiated tools to improve the purchasing experience for their customers.

Furthermore, incorporating procurement data analytics into the purchase system allows businesses to gain greater insights and control over their spending. Some of the primary drivers expected to fuel market growth in North America are the growing Internet of Things (IoT), cloud computing, and the requirement for supply chain and demand intelligence trends.

The United States is expected to account for the highest market share of USD 46.2 Billion by the end of 2035 with a predicted CAGR of 22.3%. To expand market offers, procurement analytics providers have used a variety of development tactics, including new product releases, product upgrades, collaborations and contracts, corporate expansion and acquisitions.

Oracle, SAS Institute, Coupa Software, Microsoft, IBM, Cisco, and others are among the leading suppliers in the USA procurement analytics industry.

Supply Chain Analytics segment is forecasted to grow at the highest CAGR of over 22.1% during 2025 to 2035. The demand for increased operational and supply chain efficiency, as well as the integration of AI and machine learning into supply chain management, will grow as the volume and velocity of data rises.

On the other hand, data security issues and data set flaws are expected to constrain industry growth. Factors such as the swelling utility of supply chain analytics based on the cloud would generate significant opportunities in the forthcoming years.

For enterprises, supply chain analytics may help with cost reduction, transportation network design, inventory optimization, risk assessment, customer interaction, and global integration.

Furthermore, the extensive use of Internet of Things devices in industries such as automotive, medicine, and manufacturing has resulted in large volumes of data being collected, resulting in a surge in the use of such solutions in supply chains.

Market revenue through Telecom and IT segment is forecasted to grow at the highest CAGR of over 22.1% during 2025 to 2035. As per blogs posted by Infosys, the telecom sector has made the initial steps toward commercializing a variety of technologies in 2020, including 5G and the Internet of Things (IoT).

In the telecommunications and information technology industries, the use of the Internet of Things, machine learning, and Blockchain is expected to improve procurement decision-making regarding expenditure and purchasing, supplier portfolios, and contract fulfilment.

Among the leading global Procurement Analytics players market are SAP, Oracle, SAS Institute, Coupa Software, and Genpact. To gain a competitive advantage in the industry, these providers of procurement analytics are engaging in partnerships, mergers and acquisitions, and expansions.

The market for procurement analytics is very competitive. To increase their market presence, players in the market are constantly implementing strategies such as product innovations, collaborations, and mergers and acquisitions.

Similarly, recent Procurement Analytics Market Key Developments related to companies have been tracked by the team at Future Market Insights, which are available in the full report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value |

| Key Regions Covered | North America; Europe; Asia Pacific; Middle East & Africa; Latin America |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, UK, France, Italy, Spain, Russia, China, South Korea, Japan, India, South Africa, UAE |

| Key Market Segments Covered | Component, Application, Deployment Mode, Organization Size, Industry Vertical, Region |

| Key Companies Profiled | Microsoft Corp.; SAP SE; IBM Corp; Oracle Corp.; Cisco Systems Inc.; Amazon Web Service Inc.; SAS Institute Inc.; Coupa Software Inc.; Rosslyn Data Technologies Inc.; Zycus Inc |

| Pricing | Available upon Request |

The global procurement analytics market is estimated to be valued at USD 6.1 billion in 2025.

It is projected to reach USD 46.2 billion by 2035.

The market is expected to grow at a 22.5% CAGR between 2025 and 2035.

The key product types are solutions, services, _managed services and _professional services.

spend analytics segment is expected to dominate with a 47.8% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Procurement Software Market Analysis - Size, Share, and Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Retail Sourcing And Procurement Market Size and Share Forecast Outlook 2025 to 2035

Analytics Of Things Market Size and Share Forecast Outlook 2025 to 2035

Analytics as a Service (AaaS) Market - Growth & Forecast 2025 to 2035

Analytics Sandbox Market

Ad Analytics Market Growth - Trends & Forecast 2025 to 2035

HR Analytics Market

AI-Powered Analytics – Transforming Business Intelligence

NFT Analytics Tools Market Size and Share Forecast Outlook 2025 to 2035

App Analytics Market Trends – Growth & Industry Forecast 2023-2033

Dark Analytics Market Size and Share Forecast Outlook 2025 to 2035

Text Analytics Market Size and Share Forecast Outlook 2025 to 2035

Cloud Analytics Market Size and Share Forecast Outlook 2025 to 2035

Drone Analytics Market Size and Share Forecast Outlook 2025 to 2035

Video Analytics Market Growth - Trends & Forecast 2025 to 2035

Visual Analytics Market Size and Share Forecast Outlook 2025 to 2035

Mobile Analytics Market Size and Share Forecast Outlook 2025 to 2035

Sports Analytics Market Growth - Trends & Forecast 2025 to 2035

Retail Analytics Market Analysis by Solution, Function, Enterprise Size, Deployment Model, Field Crowdsourcing, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA