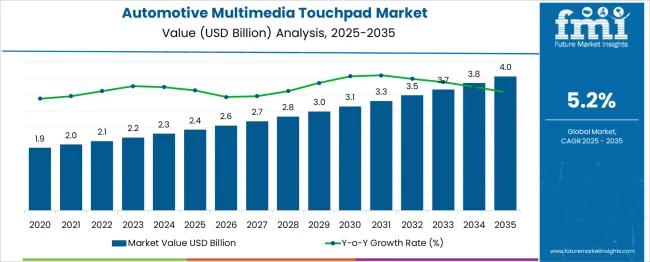

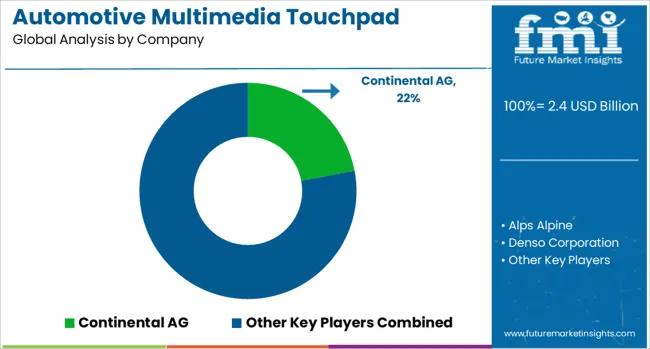

The Automotive Multimedia Touchpad Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 4.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period. The automotive multimedia touchpad market is projected to demonstrate a moderate yet steady elasticity of growth in relation to key macroeconomic indicators. Demand is closely tied to global automotive production volumes, which themselves respond to GDP growth rates in major economies such as China, the USA, Germany, and Japan.

During periods of strong GDP expansion, OEMs increase production of premium and mid-range vehicles, boosting touchpad adoption rates. Disposable income trends also play a critical role, as higher consumer purchasing power correlates with increased demand for technologically advanced infotainment systems. Exchange rate fluctuations can impact component costs, especially given the reliance on semiconductor imports, influencing final pricing and adoption speed.

Interest rate policies indirectly affect the market by shaping auto loan affordability low interest rates encourage new vehicle purchases, accelerating embedded tech upgrades. Additionally, regulatory pushes for safer and more ergonomic HMI (Human-Machine Interface) solutions enhance adoption elasticity, as compliance drives OEM integration.

Periods of strong macroeconomic growth tend to see a slightly higher-than-proportional market expansion, indicating positive elasticity, whereas recessions slow, but do not completely halt, technological adoption due to ongoing premium segment demand resilience.

| Metric | Value |

|---|---|

| Automotive Multimedia Touchpad Market Estimated Value in (2025 E) | USD 2.4 billion |

| Automotive Multimedia Touchpad Market Forecast Value in (2035 F) | USD 4.0 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

Increasing integration of digital cockpit technologies and growing consumer demand for seamless infotainment access are driving the need for advanced human-machine interface systems. Touchpad interfaces are being recognized as a space-efficient and aesthetically integrated solution for mid and high-end vehicles.

With growing connectivity requirements, enhanced safety regulations, and the global shift toward electric and smart vehicles, manufacturers are rapidly adopting software-driven, gesture-enabled touch solutions. Continuous innovation in sensor accuracy, haptic feedback, and adaptive user interfaces is strengthening the future outlook of this market.

Strategic alliances between OEMs and tech firms are further accelerating the development of personalized multimedia systems. As consumers expect smartphone-like responsiveness and connectivity from in-car systems, the demand for multimedia touchpads is projected to remain on a steady upward trajectory across multiple vehicle segments and geographies..

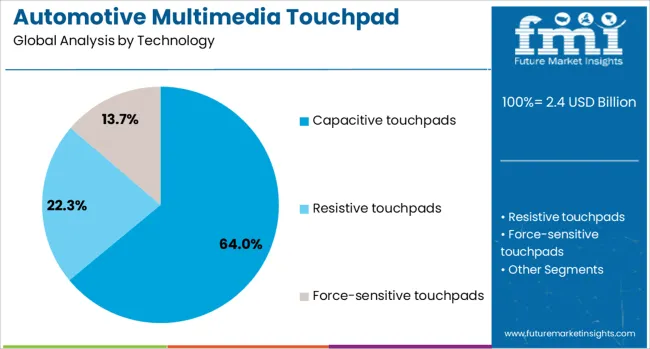

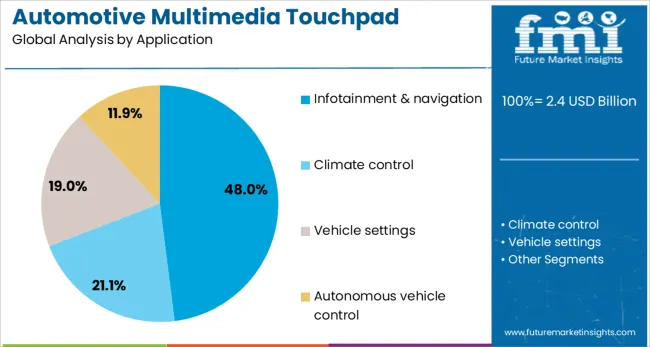

The automotive multimedia touchpad market is segmented by technology, application, vehicle sales channel, and geographic regions. The technology of the automotive multimedia touchpad market is divided into Capacitive touchpads, Resistive touchpads, and Force-sensitive touchpads. In terms of application, the automotive multimedia touchpad market is classified into Infotainment & navigation, Climate control, Vehicle settings, and Autonomous vehicle control.

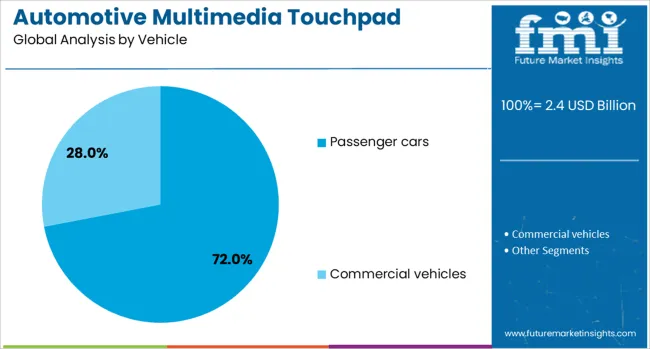

The automotive multimedia touchpad market is segmented into Passenger cars and commercial vehicles. The sales channel of the automotive multimedia touchpad market is segmented into OEM (Original Equipment Manufacturer) and Aftermarket.

Regionally, the automotive multimedia touchpad industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The capacitive touchpads subsegment is projected to hold 64% of the Automotive Multimedia Touchpad market revenue share in 2025, establishing it as the leading technology segment. This dominance has been supported by the superior responsiveness, multi-touch capabilities, and high durability of capacitive touchpads in comparison to mechanical or resistive alternatives.

Automotive manufacturers have favored this technology due to its ability to support gesture recognition, light touch sensitivity, and sleek surface design, which aligns with premium interior aesthetics. The increasing preference for modern infotainment layouts and seamless human machine interaction has created strong demand for touchpads that allow quick, reliable input across a wide range of environmental conditions.

Additionally, capacitive technology has proven adaptable to curved and non-traditional surfaces, enabling greater design flexibility for dashboard and console placements. As OEMs continue to streamline cabin interfaces and eliminate physical buttons, the capacitive touchpad has remained central to delivering intuitive user experiences, reinforcing its position at the forefront of technological adoption in this market..

The infotainment and navigation subsegment is expected to account for 48% of the Automotive Multimedia Touchpad market revenue share in 2025, positioning it as the dominant application segment. This leadership has been driven by the increasing demand for integrated multimedia systems that support real-time information access, entertainment, and vehicle control. Automakers have prioritized touchpad-based systems to provide drivers with non-distractive and ergonomic control of navigation and infotainment functions.

With the rising use of cloud connectivity, voice-enabled services, and in-vehicle personalization, touchpads have become an essential interface for enhancing driver engagement and convenience. Infotainment platforms now require more dynamic and gesture-based inputs, which capacitive touchpads are well suited to support.

As digital cockpit architectures evolve and displays multiply in modern vehicles, touchpads have emerged as a critical solution for managing system complexity while maintaining user focus and driving safety. The continued advancement of automotive UI software and connected technologies has further reinforced the growth of this segment across global vehicle platforms..

The passenger cars subsegment is projected to contribute 72% of the Automotive Multimedia Touchpad market revenue share in 2025, confirming its status as the leading vehicle category. This market dominance has been supported by the rapid adoption of premium in-vehicle infotainment features across sedans, hatchbacks, and SUVs. Passenger vehicles have increasingly served as platforms for introducing user experience innovations, with consumer expectations closely aligned to digital lifestyles.

Automotive brands have integrated touchpad systems into center consoles and armrests to provide refined control over multimedia, navigation, and climate functions. The rising penetration of electric and connected vehicles in the passenger car segment has further accelerated the integration of smart touch interfaces.

Additionally, touchpads allow manufacturers to maintain a minimalist interior design while enabling advanced user interaction through multi-function input control. As competition intensifies within the passenger car segment, the demand for feature-rich, user-friendly cabin environments is expected to sustain the segment’s leadership in touchpad adoption well into the forecast period..

The automotive multimedia touchpad market is gaining traction as vehicle manufacturers integrate more intuitive and connected infotainment systems. Touchpads allow drivers to control navigation, entertainment, and communication features with minimal distraction. Advancements in haptic feedback, gesture recognition, and multi-finger input are enhancing usability. Premium and mid-range vehicle segments are adopting these systems to meet consumer demand for convenience and personalization. While integration complexity and cost considerations remain, suppliers focusing on durability, ergonomic design, and seamless system compatibility are well-positioned for growth.

Consumer expectations for in-car entertainment and control systems are rising rapidly. Automotive multimedia touchpads provide an intuitive way for drivers and passengers to navigate complex infotainment interfaces without over-reliance on physical buttons or touchscreens. The tactile and responsive design improves user interaction while reducing eye movement away from the road, contributing to safer driving. These systems are being increasingly paired with voice commands and gesture controls to create a more seamless and customizable user experience. Automakers in both luxury and mid-tier segments are incorporating touchpads to differentiate their infotainment offerings and attract technology-conscious buyers. Integration into dashboard or center-console layouts allows manufacturers to tailor controls to brand-specific design philosophies. As vehicles evolve into more connected and personalized environments, the touchpad becomes a central feature for user engagement, supporting functions such as navigation scrolling, multimedia selection, and app integration within a unified interface.

Incorporating multimedia touchpads into automotive systems requires careful coordination with existing hardware and software platforms. Compatibility with infotainment operating systems, display resolutions, and control protocols can vary between vehicle models and brands. This diversity creates challenges for suppliers who must develop adaptable designs while ensuring consistent performance. Moreover, achieving accurate and responsive input detection under different temperature ranges, vibration conditions, and lighting scenarios is critical for maintaining user satisfaction. Integration also involves ensuring that touchpad controls do not interfere with other driver-assist functions or safety-critical systems. Automakers must conduct extensive testing to align touchpad responsiveness with haptic feedback settings and user expectations. The process of seamlessly merging touchpad controls with steering wheel buttons, center displays, and head-up displays adds additional complexity. Manufacturers who can provide modular and easily configurable touchpad solutions can reduce development time for automakers and improve adoption rates in various vehicle categories.

Luxury and high-end vehicle segments present strong opportunities for the adoption of advanced multimedia touchpads. In these markets, buyers value refined user interfaces, precision control, and personalized functionality. Touchpads can be integrated with connected features such as real-time navigation, streaming services, and driver profiles. The shift toward larger infotainment displays and multi-display configurations further increases the appeal of touchpads as complementary control devices. Connected vehicles with over-the-air update capabilities can extend the life and relevance of touchpads by adding new functionalities post-purchase. The growing popularity of electric and hybrid vehicles, which often emphasize futuristic interiors, also drives demand for advanced control systems. By offering customizable lighting, gesture sensitivity, and surface materials, suppliers can align products with the aesthetic and functional expectations of premium buyers. Partnerships between automakers and component suppliers can yield tailored solutions that integrate seamlessly with brand-specific infotainment ecosystems.

While the appeal of automotive multimedia touchpads is strong in higher-end segments, cost remains a barrier to widespread adoption in entry-level and budget-conscious vehicles. The inclusion of precision sensors, durable surface materials, and haptic feedback mechanisms adds to manufacturing expenses. Automakers in cost-sensitive markets may prefer simpler control systems, limiting the penetration of touchpads in lower segments. Additionally, competition from alternative input methods such as capacitive touchscreens, rotary controllers, and voice-activated systems exerts pressure on market share. Suppliers must find ways to optimize production processes and source cost-effective components without compromising performance or reliability. Economies of scale can help reduce unit costs, but achieving these efficiencies requires substantial production volumes. As the market grows, companies that can offer a range of touchpad models catering to different price tiers will be better positioned to address both premium and mainstream vehicle demands while maintaining profitability in a competitive environment.

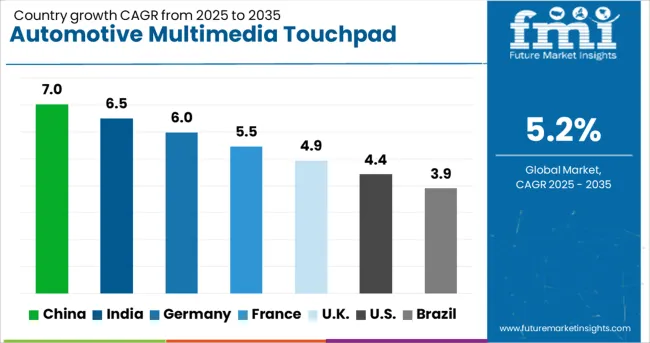

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The global automotive multimedia touchpad market is forecast to grow at a CAGR of 5.2%, driven by increasing adoption of advanced in-car infotainment systems and the push for enhanced driver–vehicle interaction. China leads with a 7.0% growth rate, supported by rapid automotive production and integration of smart cockpit solutions. India follows at 6.5%, fueled by rising vehicle sales and growing demand for connected car technologies. Germany records 6.0% growth, reflecting its strong automotive manufacturing base and focus on premium vehicle features. The United Kingdom grows at 4.9%, supported by niche luxury segments and technology adoption. The United States, a mature market, posts 4.4% growth, shaped by consumer preferences for integrated infotainment and compliance with safety interface standards. These countries are steering market development through innovation, regulatory alignment, and evolving consumer demand. This report includes insights on 40+ countries; the top countries are shown here for reference.

China is leading the automotive multimedia touchpad market with a 7.0% CAGR, driven by the rapid adoption of connected and premium vehicles. Growing consumer preference for advanced infotainment systems is pushing automakers to integrate high-resolution, responsive touchpads with gesture recognition. Local car manufacturers are collaborating with tech firms to develop customized user interfaces that cater to Chinese driving habits and language requirements. Rising demand for electric vehicles, which often feature advanced human-machine interfaces, is also supporting market growth. Government support for smart transportation and vehicle connectivity is accelerating innovation in touchpad design and functionality.

India is recording a 6.5% CAGR in the automotive multimedia touchpad market, supported by rising demand for mid- to high-end vehicles with advanced infotainment features. Increasing consumer awareness of connected car technology and smartphone integration is influencing purchasing decisions. Automakers are introducing models with customizable touchpad controls to improve user experience in congested driving conditions. Growth in ride-hailing and premium taxi services is also creating opportunities for vehicles with advanced infotainment systems. The integration of touchpads with voice assistance is becoming more common, enhancing safety and usability.

Germany is posting a 6.0% CAGR in the automotive multimedia touchpad market, supported by strong luxury and premium vehicle manufacturing. German automakers are at the forefront of integrating advanced touch control systems with haptic feedback, improving driver interaction without distraction. Touchpads are being designed to work seamlessly with augmented reality displays and advanced navigation systems. Increasing regulatory focus on minimizing driver distraction is shaping system architecture and placement within the vehicle. Integration with connected services, over-the-air updates, and multi-language support is also boosting adoption rates.

The United Kingdom is experiencing a 4.9% CAGR in the automotive multimedia touchpad market, driven by demand for connected vehicles and enhanced cabin comfort. Automakers are focusing on ergonomic placement and intuitive control layouts to improve user satisfaction. Touchpads are increasingly integrated with multi-screen infotainment setups and wireless connectivity features. The growth of electric and hybrid vehicles is creating opportunities for touchpad systems that control energy usage displays and climate functions. Consumer preference for minimalistic dashboards with centralized controls is also influencing design trends.

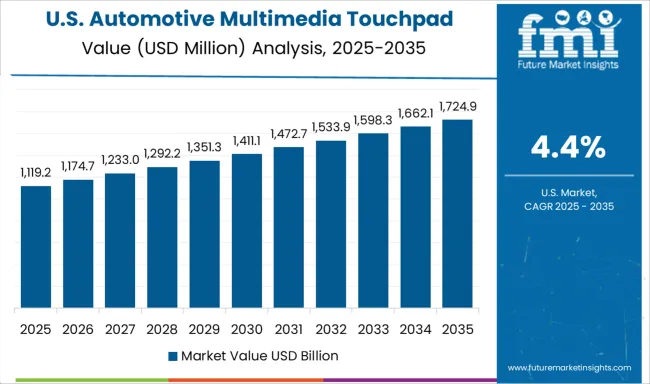

The United States is showing a 4.4% CAGR in the automotive multimedia touchpad market, driven by rising interest in personalized in-car experiences. Automakers are equipping SUVs and sedans with responsive touchpads linked to entertainment, navigation, and climate control. The premium segment, including electric vehicle brands, is leading innovation in gesture-based and customizable control interfaces. Consumer demand for wireless connectivity, streaming services, and smart assistant integration is shaping touchpad functionality. Automakers are also focusing on software upgrades to extend the lifespan and features of existing systems.

The market is gaining momentum as automakers increasingly integrate advanced infotainment and human–machine interface (HMI) technologies into vehicles. These touchpads act as intuitive control devices, allowing drivers and passengers to navigate multimedia systems, adjust settings, and access connected car features with minimal distraction. The push toward connected, semi-autonomous, and premium vehicles is driving the demand for ergonomic, responsive, and high-precision touch input solutions. Key industry players are shaping the market’s evolution.

Continental AG offers innovative automotive control interfaces that combine touchpad functionality with haptic feedback for improved safety and usability. Alps Alpine brings its expertise in electronic components and sensors, delivering compact, durable touchpad solutions optimized for harsh automotive environments.

Denso Corporation, a leading automotive technology supplier, integrates touchpad modules into broader infotainment and connectivity systems, enhancing driver experience. Synaptics Incorporated, known for its expertise in human interface solutions, provides advanced multi-touch and gesture recognition technology tailored for automotive needs.

Preh GmbH specializes in custom control systems, offering touchpad designs that integrate seamlessly into vehicle interiors with a focus on premium quality and tactile feedback. With rising consumer expectations for seamless digital experiences in cars, the market is expected to see continued growth, supported by trends such as voice–touch hybrid controls, AI-enhanced gesture recognition, and the adoption of larger, multi-function infotainment displays.

As mentioned in Synaptics’ official news release and event coverage from Embedded World 2025 (March 11-13, 2025 in Nuremberg, Germany), the company demonstrated its SB7900 SmartBridge™ automotive display processor, integrating touch controllers, display drivers, Knob-on-Display capability, and local dimming for high-contrast infotainment displays.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 Billion |

| Technology | Capacitive touchpads, Resistive touchpads, and Force-sensitive touchpads |

| Application | Infotainment & navigation, Climate control, Vehicle settings, and Autonomous vehicle control |

| Vehicle | Passenger cars and Commercial vehicles |

| Sales Channel | OEM (Original Equipment Manufacturer) and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Continental AG, Alps Alpine, Denso Corporation, Synaptics Incorporated, and Preh GmbH |

| Additional Attributes | Dollar sales vary by touchpad technology, including capacitive, resistive, optical, and emerging gesture-enabled systems; by vehicle segment, such as passenger cars, EVs, commercial, and luxury vehicles; and by region, led by Asia-Pacific, North America, and Europe. Growth is driven by infotainment expansion, OEM integration, and EV adoption under smart vehicle trends. |

The global automotive multimedia touchpad market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the automotive multimedia touchpad market is projected to reach USD 4.0 billion by 2035.

The automotive multimedia touchpad market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in automotive multimedia touchpad market are capacitive touchpads, resistive touchpads and force-sensitive touchpads.

In terms of application, infotainment & navigation segment to command 48.0% share in the automotive multimedia touchpad market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA