The ground mounted solar PV module market is estimated to be valued at USD 121.2 billion in 2025 and is projected to reach USD 197.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

Beyond simple capacity expansion, the growth pattern underscores shifting energy procurement models and infrastructure priorities. In the early phase through 2030, national targets for renewable capacity additions and government-backed auctions will drive large-scale installations, especially in regions with high solar irradiance. This period is likely to emphasize utility-scale deployments, supported by declining module costs and grid integration projects.

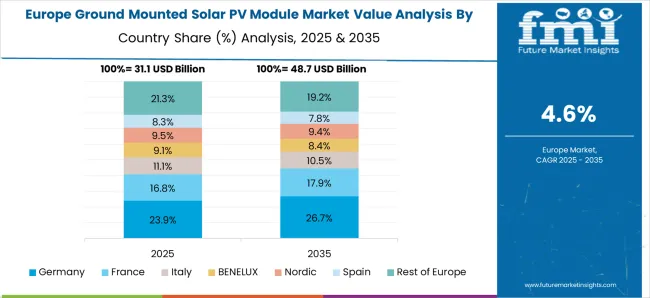

Between 2030 and 2035, the market outlook transitions toward diversification, with more private investment, corporate power purchase agreements, and hybrid projects integrating solar with storage and wind. The incremental value addition of USD 76.2 billion over ten years signals consistent demand, but also rising competition, where developers seek optimized module efficiency, low land-use solutions, and balance-of-system improvements. Regional variation will shape deployment trends, with Asia-Pacific leading installations, while North America and Europe focus on grid stability and repowering older plants.

Construction operations encounter logistical complexity as large-scale installations require coordination between module delivery schedules, foundation installation crews, and electrical installation teams across sites that may span hundreds of acres. Site supervisors work with equipment procurement departments to manage module staging areas and installation sequencing while coordinating with weather monitoring services to optimize construction schedules around seasonal conditions that affect both ground preparation and electrical installation procedures.

Maintenance operations within solar facilities experience unique challenges as ground-mounted systems require vegetation management, drainage maintenance, and access road upkeep alongside traditional electrical system maintenance. Operations teams coordinate with vegetation management contractors and security monitoring services while establishing maintenance schedules that accommodate agricultural leasing arrangements or dual-use land applications that may restrict access during certain seasonal periods.

Cross-functional coordination between project finance teams and engineering departments creates ongoing tension around module selection and installation techniques. Financial analysts evaluate module degradation rates, warranty terms, and long-term performance projections while engineering teams focus on installation efficiency, soil compatibility, and local environmental factors that may affect system performance across project lifespans that often exceed 25 years.

Equipment procurement departments encounter supply chain complexity as module sourcing requires coordination between multiple manufacturing locations, shipping schedules, and quality verification procedures that must align with project construction milestones. Procurement managers work with logistics coordinators to manage container shipping schedules, customs clearance procedures, and on-site delivery timing while coordinating with quality assurance teams about module testing and certification verification processes.

| Metric | Value |

|---|---|

| Ground Mounted Solar PV Module Market Estimated Value in (2025 E) | USD 121.2 billion |

| Ground Mounted Solar PV Module Market Forecast Value in (2035 F) | USD 197.4 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The ground mounted solar PV module market is advancing steadily due to rising investments in renewable energy infrastructure, increasing demand for utility scale solar installations, and supportive government policies aimed at reducing carbon emissions. Ground based systems offer superior scalability, ease of maintenance, and optimal sun tracking capabilities compared to rooftop alternatives, making them ideal for large scale deployment.

Technological improvements in module efficiency, material durability, and installation techniques are enabling enhanced power output and reduced operational costs. Additionally, expanding energy access in emerging economies and power grid modernization efforts are reinforcing the adoption of these modules.

The outlook for the market remains strong as energy security, environmental sustainability, and cost competitiveness continue to drive the transition from conventional power sources to solar based alternatives.

The ground mounted solar PV module market is segmented by technology, product, onnectivity, end use, and geographic regions. By technology, the ground mounted solar PV module market is divided into Thin Film and Crystalline solar. In terms of the product of the ground-mounted solar PV module market, it is classified into Monocrystalline, Polycrystalline, Cadmium Telluride, Amorphous Silicon, and Copper Indium Gallium Diselenide. Based on connectivity, the ground-mounted solar PV module market is segmented into on-grid and off-grid.

By end use, the ground mounted solar PV module market is segmented into Residential, Commercial & Industrial, and Utility. Regionally, the ground mounted solar PV module industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The thin film segment is projected to account for 45.60 percent of the total revenue in the technology category by 2025, establishing itself as a key contributor to market growth. This segment has been favored due to its lightweight structure, lower material costs, and better performance in low-light and high-temperature conditions.

Its flexibility and ease of integration into various land types, including uneven terrain and non-traditional landscapes, make it well-suited for diverse ground-mounted applications. The use of less energy-intensive manufacturing processes and reduced silicon dependency further enhances its environmental appeal.

As developers prioritize cost efficiency, land adaptability, and sustainable sourcing, the thin film technology segment continues to expand its footprint within large scale solar deployments.

The monocrystalline segment is anticipated to contribute 48.90 percent of the total market revenue by 2025 in the product category, making it the leading product type. This dominance is attributed to the superior energy conversion efficiency, longer operational life, and compact form factor of monocrystalline modules.

Their high power output per square meter makes them ideal for maximizing energy generation in land-constrained or high-demand regions. Enhanced cell architecture and recent reductions in production costs have also made these modules more accessible to utility-scale developers.

With continued innovation in bifacial and passivated emitter rear cell technologies, monocrystalline modules are increasingly viewed as the most reliable and performance optimized solution for long term energy projects.

The on grid segment is expected to account for 58.30 percent of the total revenue in the connectivity category by 2025, positioning it as the most dominant configuration in the market. This growth is supported by widespread utility investments, favorable net metering policies, and demand for centralized energy distribution models.

On grid systems enable direct power delivery to the electricity grid, reducing reliance on fossil fuel sources while improving grid stability. Their scalability, combined with lower storage requirements and ease of integration into existing energy infrastructure, makes them highly attractive for governments and independent power producers.

As global energy policies prioritize decarbonization and grid expansion, the on-grid connectivity model continues to lead adoption in the ground-mounted solar PV module market.

The ground-mounted solar PV module market is driven by supportive policies, cost reduction, and large-scale adoption for solar farms. Environmental consciousness and technological advancements continue to fuel its growth.

The expansion of the ground-mounted solar PV module market is largely influenced by favorable government policies and incentives. As governments around the world continue to set ambitious renewable energy targets, they are offering subsidies, tax breaks, and other financial mechanisms to promote the adoption of solar energy. This policy support is essential for the scaling of large-scale solar projects, which require significant initial investment. Countries with abundant land space are prioritizing ground-mounted solar installations due to their cost-effectiveness and scalability. The regulatory frameworks in place are ensuring that projects receive the necessary approvals and financing, thus creating a conducive environment for the market’s growth.

The market dynamics for ground-mounted solar PV modules have also been driven by a consistent reduction in the cost of solar panel production. Over the past few years, advancements in manufacturing processes and economies of scale have led to lower production costs, making solar installations more affordable. The efficiency of solar modules has improved, allowing for higher energy generation from the same area of land. These advancements have made ground-mounted solar systems an increasingly attractive option for large-scale installations. As the cost of installation continues to fall, the financial feasibility of ground-mounted solar energy systems is expected to remain a key driver for market growth.

Ground-mounted solar PV modules are highly suited for large-scale installations, such as utility-scale solar farms. These installations are an essential component of the energy infrastructure in countries aiming to increase their renewable energy generation capacity. The ability to deploy ground-mounted systems on vast stretches of land enables the production of significant amounts of electricity. This is especially relevant in regions with abundant sunlight and available land for development. The growing adoption of solar farms for utility-scale power generation is expected to contribute to the market’s expansion as more countries prioritize renewable energy to meet growing energy demands.

Growing environmental awareness among consumers, corporations, and governments is playing a significant role in shaping the demand for ground-mounted solar PV modules. As public concern over climate change intensifies, industries are increasingly adopting renewable energy sources to reduce their carbon footprint. Ground-mounted solar modules, as a mature and reliable technology, offer an effective solution for generating clean energy. Additionally, the pressure to comply with stricter environmental regulations has motivated many industries to invest in renewable energy projects. This trend is expected to continue, reinforcing the demand for ground-mounted solar systems and further supporting market growth.

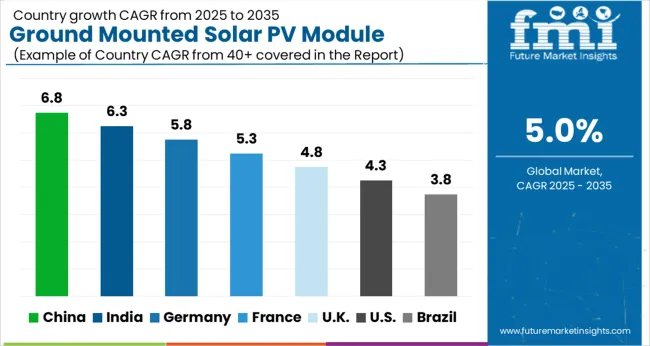

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The Ground Mounted Solar PV Module market is projected to grow globally at a CAGR of 5.0% from 2025 to 2035. China leads the market with a CAGR of 6.8%, supported by its strong commitment to expanding renewable energy capacity and large-scale solar projects. India follows closely with a CAGR of 6.3%, driven by its growing demand for clean energy solutions and supportive government policies encouraging solar energy adoption. France records a CAGR of 5.3%, fueled by its renewable energy ambitions and ongoing efforts to decarbonize the energy sector. The UK grows at 4.8%, supported by a shift toward renewable energy sources and government subsidies for solar installations. The USA follows with a CAGR of 4.3%, as increasing investment in solar infrastructure and favorable regulatory policies continue to stimulate growth in solar energy production. This analysis shows that while Asia-Pacific leads in market growth, Europe and North America remain strong contenders in advancing solar energy adoption through policy support and investment in infrastructure.

The Ground Mounted Solar PV Module market in the UK is forecasted to achieve a CAGR of 4.8% during 2025–2035, rising from approximately 4.3% in 2020–2024, surpassing the global average of 5.0%. This increase is primarily driven by stronger government policies supporting renewable energy infrastructure development and ongoing efforts to decarbonize sectors like transportation and energy. The UK's commitment to solar energy as a key solution for future energy needs is accelerating the development of ground-mounted solar installations, particularly in areas with significant land availability. The adoption of advanced solar technologies, along with collaborations between energy firms and governmental agencies, is further boosting the demand for solar power infrastructure.

The Ground Mounted Solar PV Module market in China is forecasted to achieve a CAGR of 6.8% during 2025–2035, rising from approximately 6.1% in 2020–2024, surpassing the global average of 5.0%. This increase is driven by China's ambitious clean energy targets, government incentives, and large-scale solar infrastructure projects. China's government has set aggressive renewable energy goals, and solar energy plays a central role in achieving these objectives. The demand for ground-mounted solar PV systems is growing rapidly, driven by the country's need for clean and cost-effective energy sources. The further development of solar farms and continued advancements in solar technology are expected to continue propelling the market's growth.

The Ground Mounted Solar PV Module market in India is forecasted to achieve a CAGR of 6.3% during 2025–2035, rising from approximately 5.9% in 2020–2024, surpassing the global average of 5.0%. India’s commitment to renewable energy, including a dedicated focus on solar power, drives substantial growth in the ground-mounted solar PV market. Government policies, such as the National Solar Mission, continue to encourage solar power adoption across the country. Large-scale ground-mounted solar farms are gaining traction due to available land, strong demand for electricity, and the need for energy independence. The rapid adoption of solar technology and lowering installation costs further boosts the market's expansion.

The Ground Mounted Solar PV Module market in France is forecasted to achieve a CAGR of 5.3% during 2025–2035, rising from approximately 4.9% in 2020–2024, surpassing the global average of 5.0%. France’s strong commitment to renewable energy has positioned it as a leader in the European solar market. As the country aims to meet its renewable energy targets, the adoption of ground-mounted solar PV systems continues to grow. Policies supporting energy independence, combined with a push to decarbonize the economy, have led to a surge in solar farm development. The continued drop in solar panel costs and rising demand for clean energy solutions are further fueling the market.

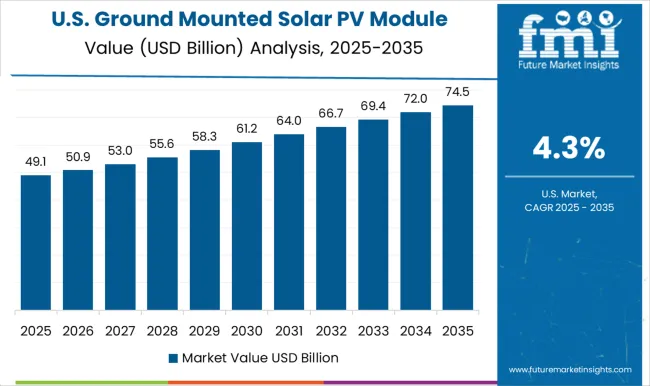

The Ground Mounted Solar PV Module market in the USA is forecasted to achieve a CAGR of 4.3% during 2025–2035, rising from approximately 3.7% in 2020–2024, below the global average of 5.0%. Despite the slower growth, the USA remains a key player in the solar energy sector, driven by strong policy support, tax incentives, and increasing state-level commitments to renewable energy. Solar farms continue to expand, particularly in sun-rich regions like California and Nevada. Advancements in technology, along with significant government incentives, are making ground-mounted solar PV systems more cost-competitive, ensuring continued demand in the coming years.

The ground-mounted solar PV module market is highly competitive, driven by leading global manufacturers and system integrators such as Arctech Solar Holding Co., Ltd., Canadian Solar Inc., CSUN Solar Tech Co., Ltd., First Solar, Inc., Jinko Solar Co., Ltd., JA Solar Technology Co., Ltd., Soltec Power Holdings, S.A., SunPower Corporation, Trina Solar Co., Ltd., and Yingli Energy Co., Ltd. (Yingli Solar). These companies compete intensively by advancing photovoltaic technology, improving module efficiency, reducing system costs, and deploying large-scale solar projects across global markets.

Arctech Solar Holding Co., Ltd. is recognized as a key player in solar tracking and racking systems, enhancing the energy yield and operational reliability of ground-mounted solar installations. Canadian Solar Inc. continues to lead in the development of high-performance crystalline silicon modules, serving both residential and commercial applications while expanding its footprint in utility-scale projects. First Solar, Inc. distinguishes itself through thin-film cadmium telluride (CdTe) technology, achieving high energy output and lower lifecycle emissions, making it a dominant force in large-scale solar farms. Jinko Solar Co., Ltd. and JA Solar Technology Co., Ltd. are among the world’s largest producers of high-efficiency mono PERC and TOPCon photovoltaic modules, commanding substantial global market shares.

Soltec Power Holdings, S.A. specializes in single-axis solar tracking systems that maximize ground-mounted system performance through advanced automation and real-time alignment technology. SunPower Corporation is well known for its premium, high-efficiency solar panels, particularly suited to commercial and residential markets in North America. Trina Solar Co., Ltd. plays a pivotal role with its integrated module, tracker, and storage solutions, supported by the TrinaTracker and TrinaStorage brands, while Yingli Energy Co., Ltd. (Yingli Solar) continues to provide cost-effective, durable panels optimized for utility-scale applications.

Competitive strategies in this market revolve around strategic partnerships for large-scale installations, R&D investments to enhance module efficiency and reliability, and expansions of global manufacturing capacity to meet surging demand for renewable energy. Supported by strong policy incentives, government-backed solar targets, and the continued decline in levelized cost of energy (LCOE), these leading players are driving the global transition toward sustainable, grid-scale solar power generation through technological excellence and scalable deployment models.

| Item | Value |

|---|---|

| Quantitative Units | USD 121.2 Billion |

| Technology | Thin Film and Crystalline solar |

| Product | Monocrystalline, Polycrystalline, Cadmium Telluride, Amorphous Silicon, and Copper Indium Gallium Diselenide |

| onnectivity | On Grid and Off Grid |

| End Use | Residential, Commercial & Industrial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Arctech Solar Holding Co., Ltd.; Canadian Solar Inc.; CSUN Solar Tech Co., Ltd.; First Solar, Inc.; Jinko Solar Co., Ltd.; JA Solar Technology Co., Ltd.; Soltec Power Holdings, S.A.; SunPower Corporation; Trina Solar Co., Ltd.; Yingli Energy Co., Ltd. (Yingli Solar). |

| Additional Attributes | Dollar sales by segment, and market share of leading players, insights on technology trends, pricing dynamics, and government policies influencing adoption are also critical. |

The global ground mounted solar PV module market is estimated to be valued at USD 121.2 billion in 2025.

The market size for the ground mounted solar PV module market is projected to reach USD 197.4 billion by 2035.

The ground mounted solar PV module market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in ground mounted solar PV module market are thin film and crystalline solar.

In terms of product, monocrystalline segment to command 48.9% share in the ground mounted solar PV module market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Solar PV Module Market Size and Share Forecast Outlook 2025 to 2035

Ground Mounted Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Rooftop Solar PV Module Market Size and Share Forecast Outlook 2025 to 2035

PV Module Encapsulant Film Market Analysis by Material Type, Application, Thickness, Weight, End-Use, and Region Forecast through 2035

Solar Module Recycling Service Market Size and Share Forecast Outlook 2025 to 2035

Solar PV Recycling Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracking Module Market Size and Share Forecast Outlook 2025 to 2035

Solar Cells and Module Market Report - Trends & Forecast 2025 to 2035

Solar Photovoltaic (PV) Market Size and Share Forecast Outlook 2025 to 2035

On Grid Solar PV Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar PV EPC Market Size and Share Forecast Outlook 2025 to 2035

Bifacial Solar Module Market Size and Share Forecast Outlook 2025 to 2035

Floating Solar PV Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Solar PV Backsheet Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Underground Rainwater Collection Modules Market Size and Share Forecast Outlook 2025 to 2035

Encapsulant Material for PV Module Market Growth – Trends & Forecast 2024-2034

Semiconductors in Solar PV Power Systems Market Growth - Trends & Forecast 2025 to 2035

Silicone Sealants for Solar Photovoltaic Modules Market Size and Share Forecast Outlook 2025 to 2035

PV Power Forecasting System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA