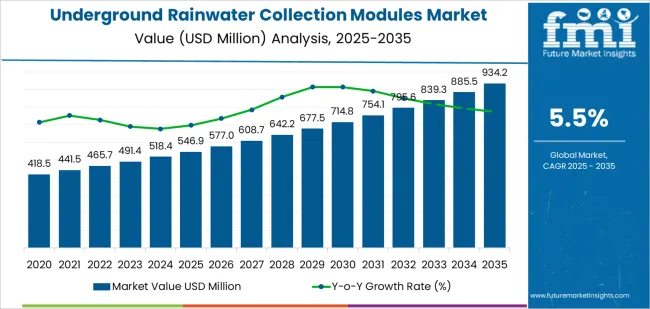

The global underground rainwater collection modules market is valued at USD 546.9 million in 2025 and is projected to reach USD 934.2 million by 2035, reflecting a CAGR of 5.5%. Growth in the early years is driven by expanding adoption of subsurface storage systems in residential developments, commercial facilities, and municipal infrastructure projects. These modules support onsite rainwater capture for irrigation, flushing, and groundwater recharge, reducing strain on centralized supply networks. Manufacturers refine structural integrity, load-bearing performance, and connection interfaces to ensure compatibility with varied soil profiles and site layouts. As urban planning pivots toward water-efficient development models, installation rates increase across regions implementing long-term resource-management strategies.

Toward 2035, demand remains steady as replacement cycles begin to emerge in mature markets and new construction projects integrate modular storage units into drainage and stormwater systems. Growth becomes more uniform as infrastructure authorities incorporate underground modules into resilience planning, particularly in areas experiencing heavier rainfall patterns and stricter runoff regulations. Product development continues to emphasize improved chamber strength, easier onsite assembly, and enhanced filtration compatibility. Even as growth aligns with stable construction and infrastructure schedules, ongoing upgrades in design efficiency and regulatory-driven adoption maintain a positive trajectory for underground rainwater collection modules.

Between 2025 and 2030, the Underground Rainwater Collection Modules Market increases from USD 546.9 million to USD 714.8 million, adding USD 167.9 million over five years. Annual growth moves from USD 28.5 million in the early phase to USD 37.3 million by 2030, indicating a strengthening mid-cycle trend. This period is shaped by rapid expansion of stormwater-management mandates, increased installation of modular storage systems in residential and commercial projects, and wider adoption of decentralized water-recovery infrastructure. Demand rises as municipalities impose runoff-reduction targets and developers deploy high-capacity underground tanks to meet compliance, driving consistent volume and value expansion.

From 2030 to 2035, the market grows from USD 714.8 million to USD 934.2 million, adding USD 219.4 million outperforming the earlier period. Annual increases range from USD 39.3 million to USD 48.7 million, reflecting sustained momentum as large industrial complexes, logistics hubs, and smart-city programs integrate multi-module rainwater systems into water-reuse frameworks. Late-cycle growth is reinforced by hydrological risk assessments, flood-mitigation initiatives, and replacement of aging underground storage assets. By 2035, the decade’s total growth reaches USD 387.3 million, supported by continuous expansion of regulatory requirements, infrastructure upgrades, and broader uptake of scalable rainwater-harvesting technologies.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 546.9 million |

| Market Forecast Value (2035) | USD 934.2 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

Demand for underground rainwater collection modules is rising as property owners and developers look for resilient water-management solutions that reduce reliance on municipal supply and mitigate stormwater runoff. These modules store filtered rainwater below grade, protecting usable space while providing a stable supply for irrigation, flushing, and landscape management. Municipal regulations increasingly require on-site retention systems to control peak runoff and prevent flooding, prompting builders to adopt modular tanks that meet strict volume and loading requirements. Manufacturers improve structural strength, installation flexibility, and soil-interface stability through advanced polymer designs and load-bearing rib structures. As drought-prone regions expand conservation measures, underground systems offer long service life with minimal visual impact, supporting consistent adoption across new urban and suburban projects.

Market expansion is also supported by broader investment in sustainable construction and green-infrastructure programs. Facility managers and architects specify modules compatible with filtration units, recharge wells, and pump systems to support integrated water-reuse networks. Producers refine access ports, sediment traps, and overflow controls to simplify maintenance and ensure compliance with local water-quality standards. Lightweight, modular components shorten installation time and reduce excavation costs, enabling deployment in tight or irregular plots. Growth in commercial developments, schools, logistics facilities, and industrial parks strengthens demand for large-capacity configurations. Although upfront installation costs remain a barrier for small residential projects, long-term savings in water bills and increasing regulatory pressure on runoff management continue to reinforce global adoption of underground rainwater collection modules.

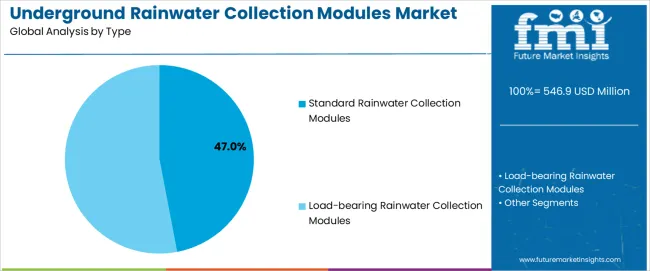

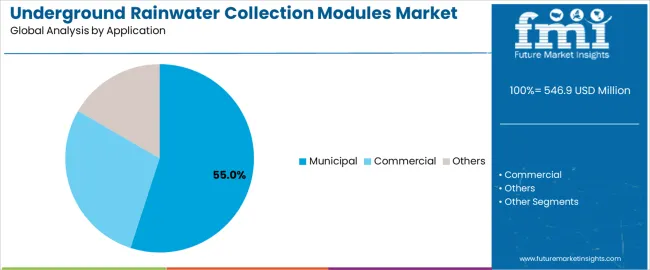

The underground rainwater collection modules market is segmented by type, application, and region. By type, the market is divided into standard rainwater collection modules and load-bearing rainwater collection modules. Based on application, it is categorized into municipal, commercial, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions reflect variations in urban-infrastructure planning, storage requirements, and regulatory emphasis on decentralized water-management systems.

The standard rainwater collection modules segment accounts for approximately 47.0% of the global underground rainwater collection modules market in 2025, making it the leading type category. Its position reflects the widespread use of standard-load modular tanks in residential districts, public spaces, and low-traffic locations that do not require structural reinforcement. These modules are typically used for stormwater attenuation, infiltration systems, and basic storage applications supporting irrigation or non-potable water distribution. Their design allows stable hydraulic performance while maintaining installation flexibility in areas with modest surface loads.

Manufacturers supply standard modules with lightweight polymer structures, open-cell designs, and configurable interlocking features suited to varied site layouts. Adoption is strong in East Asia and Europe, where municipal authorities incorporate modular storage into broader urban drainage frameworks. The segment also fits regions where decentralized rainwater systems support local water-use reduction goals or mitigate runoff during high-intensity rainfall. Standard modules maintain their lead because they offer reliable storage capacity, predictable installation procedures, and compatibility with most excavation conditions without the structural requirements associated with heavy-load environments.

The municipal segment represents about 55.0% of the total underground rainwater collection modules market in 2025, making it the dominant application category. This position is linked to the growing use of rainwater modules in urban drainage networks, stormwater-management systems, and flood-mitigation projects. Municipal authorities deploy underground modules to increase temporary storage capacity, reduce surface runoff, and support recharge efforts in dense city settings that lack open infiltration areas. These installations are often integrated into parks, roadways, plazas, and public-facility grounds.

Manufacturers provide modular systems sized for large-scale installations, offering adaptable configurations that meet municipal design specifications related to flow control and long-term durability. Adoption is high in Europe and East Asia, where regulatory frameworks encourage sustainable drainage systems, and in North America, where municipalities address aging stormwater networks through retrofits. Installation programs often form part of broader resilience strategies aimed at managing extreme rainfall events and reducing stress on existing sewer infrastructure. The municipal category retains its leading share because public agencies require scalable, underground solutions that support long-term water-management planning across varied urban environments.

The underground rainwater collection modules market is growing as households, commercial properties and municipal projects adopt systems that store runoff for irrigation, flushing and landscape use. These buried modules help reduce stormwater load, support water-saving goals and preserve usable ground space. Growth is supported by rising interest in sustainable water management, stricter drainage regulations and expansion of green-building practices. Adoption is limited by installation cost, excavation requirements and soil-site constraints. Manufacturers are improving module strength, filtration compatibility and modularity to support varied project scales.

Demand increases as communities face water-scarcity concerns and seek alternatives to relying solely on municipal supply. Underground modules offer discreet storage without affecting landscaping or building layouts. Commercial sites use these systems to meet sustainability targets and reduce stormwater fees. Residential users adopt them for garden irrigation and household non-potable applications. As planners promote decentralised water management, underground systems gain traction in new developments, parks and schools where space-efficient solutions are needed.

Adoption is moderated by high installation cost, including excavation, soil preparation and integration with drainage networks. Sites with poor soil stability, high groundwater levels or limited access face engineering challenges. Maintenance needs such as sediment removal and filter servicing add operational burden for some users. Budget-constrained projects may opt for above-ground tanks despite space limitations. These constraints reduce uptake in retrofits or locations where civil-work costs outweigh long-term water-saving benefits.

Key trends include development of stronger load-bearing designs suitable for placement under driveways and parking areas, modular units that scale from small homes to large commercial installations, and improved pre-filtration systems to extend service life. Manufacturers are incorporating easier inspection ports, geocellular structures with higher void ratios and materials compatible with varied soil conditions. Interest is rising in systems linked to smart pumps and water-level sensors for automated reuse. As resilience planning grows, underground modules increasingly support stormwater attenuation alongside water harvesting.

| Country | CAGR (%) |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| Brazil | 5.8% |

| USA | 5.2% |

| UK | 4.7% |

| Japan | 4.1% |

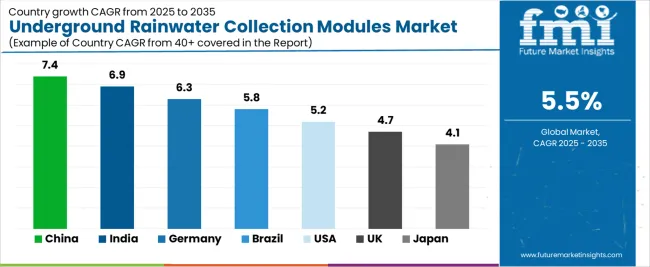

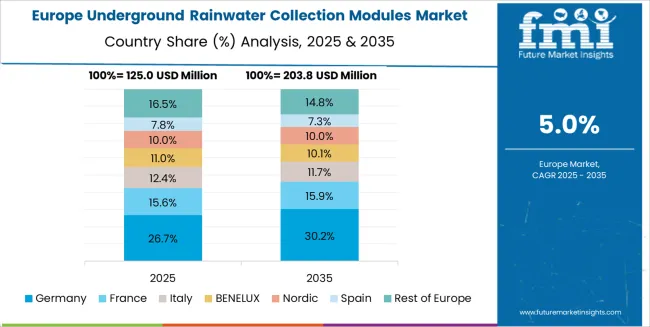

The Underground Rainwater Collection Modules Market is growing steadily worldwide, with China leading at a 7.4% CAGR through 2035, driven by rapid urban development, increasing water scarcity concerns, and large-scale adoption of sustainable water management systems. India follows at 6.9%, supported by government initiatives promoting rainwater harvesting, rising urban infrastructure needs, and escalating demand for groundwater recharge solutions. Germany records 6.3%, reflecting advanced environmental regulations, strong engineering standards, and widespread integration of rainwater systems in green building projects.

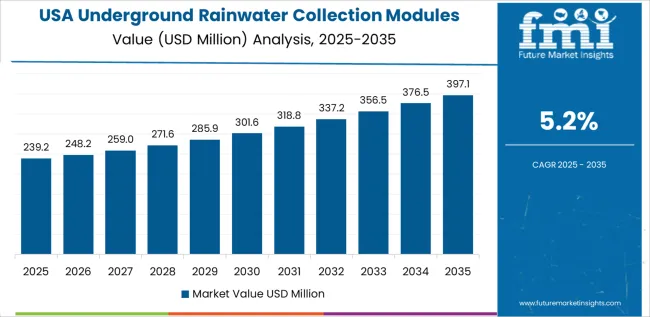

Brazil grows at 5.8%, benefiting from expanding urban populations and heightened demand for decentralized water storage solutions. The USA, at 5.2%, emphasizes resilient infrastructure, stormwater management, and long-term sustainability, while the UK (4.7%) and Japan (4.1%) prioritize compact, durable, and high-efficiency rainwater collection technologies suited for dense urban landscapes.

China is projected to grow at a CAGR of 7.4% through 2035 in the underground rainwater collection modules market. Municipal water planners deploy modular subsurface tanks and infiltration systems to capture runoff, reduce urban flooding, and augment nonpotable supplies for irrigation and cleaning. Developers integrate storage modules with drainage networks and stormwater controls to meet permit thresholds. Vendors supply corrosion-resistant modules, joint seals, and access chambers for routine inspection. Service providers offer design validation, hydraulic modelling, and maintenance schedules supporting lifecycle performance. Investment in green infrastructure and phased retrofit programmes increases procurement across metropolitan and new-development zones.

India is projected to grow at a CAGR of 6.9% through 2035 in the underground rainwater collection modules market. Rising urbanisation, periodic monsoon surges, and municipal stormwater management programmes encourage deployment of subsurface harvesting modules. Local suppliers adapt modules with sediment traps, accessible sumps, and simple filtration suited to heavy debris loads. Integration with community recharge wells and irrigation networks increases local water resilience. Contractors provide training for installation crews and commissioning tests to confirm seepage rates. Governments include subsurface storage in urban resilience budgets and pilot neighbourhood retrofits to validate performance prior to wider rollouts.

Germany is projected to grow at a CAGR of 6.3% through 2035 in the underground rainwater collection modules market. Strict stormwater regulations and sustainable drainage planning drive engineered subsurface systems for retention and reuse. Manufacturers provide certified modules with documented load ratings, hydraulic capacity, and recyclable materials specifications. Planning authorities require validated attenuation modelling and maintenance plans for long-term operation. Integrators coordinate with green-roof, permeable paving, and public-space designs to maximise local retention. Service contracts emphasise scheduled emptying, inspection, and compliance reporting to support asset stewardship in municipal and commercial developments across federal regions.

Brazil is projected to grow at a CAGR of 5.8% through 2035 in the underground rainwater collection modules market. Heavy seasonal rains and coastal development drive need for large-capacity subsurface storage to manage runoff and protect urban drainage. Suppliers adapt modules with high-capacity outlets, corrosion-resistant finishes, and insect-protecting screens suited to humid climates. Municipal projects integrate subsurface storage with floodplain management and community water reuse schemes. Contractors plan staged installations to match wet-season cycles and ensure rapid deployment where runoff peaks. Local authorities include collection modules in resilience planning and public works contracting.

USA is projected to grow at a CAGR of 5.2% through 2035 in the underground rainwater collection modules market. Cities and campuses deploy subsurface modules to meet stormwater control permits and reduce combined-sewer overflow events. Manufacturers supply modules rated for H-25 vehicular loads and integrated sensor options for telemetry. Design-build contractors coordinate trench safety, backfill compaction, and access-port planning to meet code. Systems connect to reuse networks for irrigation, toilet flushing, and cooling towers at commercial sites. Long-term service agreements include sensor calibration, sediment removal, and seasonal maintenance planning for uninterrupted performance.

UK is projected to grow at a CAGR of 4.7% through 2035 in the underground rainwater collection modules market. Urban retrofit programmes and planning guidance for surface water management encourage subsurface harvesting systems in new and refurbished developments. Suppliers offer compact modules tailored to constrained footprints and certified access hatches for inspection under pavement. Specification often requires third-party hydraulic assessment and agreed maintenance schedules under planning conditions. Contractors provide camera inspection and desludging services as part of long-term maintenance packages. Local authorities include subsurface modules within drainage approval conditions and developer contribution frameworks.

Japan is projected to grow at a CAGR of 4.1% through 2035 in the underground rainwater collection modules market. Complex terrain, high groundwater tables, and seismic considerations influence module selection and installation methods. Manufacturers supply buoyancy mitigation features, reinforced lids, and secure anchoring options to prevent floatation and meet seismic standards. Engineers model groundwater interaction to set safe excavation depths and inflow rates. Systems integrate with rain gardens and detention basins to balance infiltration and controlled release. Maintenance contracts emphasise periodic sediment removal and anchor inspections to maintain structural stability and hydraulic performance across varied site conditions.

The global underground rainwater collection modules market shows moderate fragmentation, led by manufacturers supplying structural storage units for stormwater retention, infiltration, and onsite reuse. Pipelife International, ACO Group, and Advanced Drainage Systems maintain strong positions with high-strength, injection-molded modules engineered for long service life and compliance with regional drainage standards.

Doctor Rain, ParkUSA, Oldcastle Infrastructure, StormTank, and Xerxes support mid-to-upper tier demand through systems designed for commercial sites, transportation corridors, and municipal water-management programs. Their modules emphasize load-bearing reliability, hydraulic stability, and installation efficiency across diverse soil conditions. GRAF and FRÄNKISCHE reinforce European availability with lightweight, stackable designs optimized for rapid assembly and adaptable site layouts.

Jiangsu Hippo Plastics, REHAU, Jiangsu Bluewater, Beijing Tidelion, Cirtex Industries, Jensen Precast, and Baozhen broaden regional supply with systems tailored for varying precipitation patterns, soil profiles, and local infiltration requirements. These manufacturers compete on structural performance, flow capacity, and compatibility with filtration or pre-treatment components. Market dynamics are shaped by the need for modular flexibility, certified load ratings for vehicular or landscaped areas, and long-term resistance to ground pressure and sediment accumulation. Strategic differentiation depends on assembly speed, integration with stormwater controls, and support for sustainable water-harvesting programs as urban developments increase focus on decentralized water management and regulatory compliance.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Standard Rainwater Collection Modules, Load-bearing Rainwater Collection Modules |

| Application | Municipal, Commercial, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | Pipelife International, ACO Group, Advanced Drainage Systems, Doctor Rain, ParkUSA, Oldcastle Infrastructure, StormTank, Xerxes, GRAF, FRÄNKISCHE, Jiangsu Hippo Plastics, REHAU, Jiangsu Bluewater, Beijing Tidelion, Cirtex Industries, Jensen Precast, Baozhen |

| Additional Attributes | Dollar sales by type and application categories, regional adoption trends across East Asia, Europe, and North America, competitive landscape with module manufacturers and infrastructure-solution providers, installation requirements and site-engineering specifications, integration with filtration systems and groundwater recharge frameworks. |

East Asia

Europe

North America

South Asia

Latin America

Middle East & Africa

Eastern Europe

The global underground rainwater collection modules market is estimated to be valued at USD 546.9 million in 2025.

The market size for the underground rainwater collection modules market is projected to reach USD 934.2 million by 2035.

The underground rainwater collection modules market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in underground rainwater collection modules market are standard rainwater collection modules and load-bearing rainwater collection modules.

In terms of application, municipal segment to command 55.0% share in the underground rainwater collection modules market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Underground Mining Equipment Market Size and Share Forecast Outlook 2025 to 2035

Underground Hydrogen Storage Market Size and Share Forecast Outlook 2025 to 2035

Underground Coal Gasification Industry Analysis in Asia Pacific Size and Share Forecast Outlook 2025 to 2035

Underground Cabling EPC Market Size and Share Forecast Outlook 2025 to 2035

Underground Mining Automation Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Underground Mining Equipment Market Share

Underground Storage Tanks Market

Underground Service Locator Market

North America Underground Mining Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Sponge City Rainwater Management Systems Market Size and Share Forecast Outlook 2025 to 2035

LED Modules and Light Engines Market Size and Share Forecast Outlook 2025 to 2035

Train Ceiling Modules Market

Thermoelectric Modules Market Size and Share Forecast Outlook 2025 to 2035

Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Power Amplifier Modules Market

Micro-Scale VFFS Modules Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Power Integrated Modules Market Trends – Growth & Forecast through 2034

Power Discrete and Modules Market Size and Share Forecast Outlook 2025 to 2035

Signal Conditioning Modules Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Corrugator Modules Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA