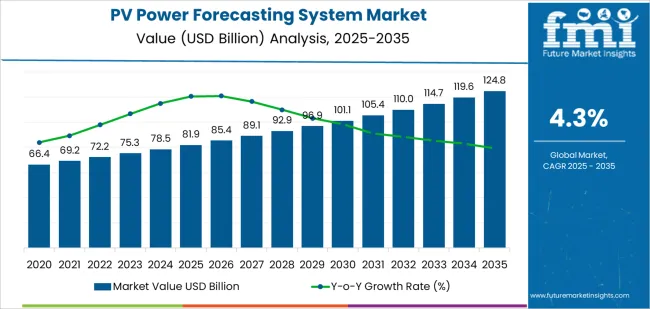

The global PV power forecasting system market is valued at USD 81.9 billion in 2025 and is projected to reach USD 124.9 billion by 2035, registering a CAGR of 4.3%. A compound absolute growth analysis shows a consistent accumulation of annual gains driven by expanding solar capacity additions, rising grid-integration needs, and increased reliance on high-precision forecasting tools to manage variable generation. From the 2025 baseline, cumulative absolute growth rises steadily each year as utilities, grid operators, and large solar asset owners incorporate forecasting solutions to support scheduling accuracy and reduce balancing costs.

Over the forecast period, the compound absolute increase totals USD 43.0 billion, reflecting stable year-over-year additions rather than sharp jumps. Each subsequent year builds on the previous year's installed forecasting infrastructure, creating a layered growth effect where new deployments combine with ongoing upgrades in modeling accuracy, data ingestion, and cloud-based analytics. By 2035, the accumulated gains indicate a market that expands through continuous system enhancement and broader adoption across distributed and utility-scale solar portfolios, producing a sustained upward growth trajectory.

Between 2025 and 2030, the PV Power Forecasting System Market expands from USD 81.9 billion to USD 101.1 billion, generating USD 19.2 billion in total growth. During this period, volume expansion contributes approximately 65 to 70 % of the increase as utility-scale solar installations rise and grid operators adopt forecasting platforms to meet day-ahead and intra-day accuracy requirements. Deployment of forecasting-enabled PV capacity grows steadily across major markets. Price growth represents the remaining 30-35 %, driven by the transition toward high-resolution irradiance models, machine-learning-enhanced forecasting tools, and advanced satellite/cloud-mapping technologies that carry higher integration and licensing values.

From 2030 to 2035, the market grows from USD 101.1 billion to USD 124.9 billion, adding USD 23.8 billion. In this period, volume growth contributes around 55-60%, supported by continued expansion of large solar parks and broader mandatory use of forecasting platforms by developers, independent power producers, and grid-balancing authorities. Installed capacity growth moderates slightly but remains substantial enough to drive strong volume contribution. Price-driven growth accounts for 40-45%, reflecting increasing reliance on next-generation forecasting engines featuring real-time performance analytics, cloud-motion vector modeling, and enhanced grid-stability integration requirements.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 81.9 billion |

| Market Forecast Value (2035) | USD 124.9 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

Demand for PV power forecasting systems is increasing as grid operators and solar asset owners require accurate short-term and day-ahead generation predictions to maintain system stability. Forecasting platforms integrate satellite imagery, sky-camera data, numerical weather models, and plant-level telemetry to estimate irradiance and plant output under changing cloud conditions. Utilities depend on these tools to balance dispatch schedules, manage reserve requirements, and reduce curtailment risk during periods of rapid PV fluctuation. Solar developers and independent power producers adopt forecasting systems to optimize bidding strategies, comply with grid-code obligations, and protect revenue in markets where penalties apply for schedule deviations. As solar penetration rises across Asia-Pacific, North America, and Europe, accurate forecasting becomes essential for integrating large volumes of variable generation.

Market growth is also reinforced by advances in machine-learning models and high-resolution weather datasets that improve accuracy for complex terrains and large-scale solar farms. Forecasting providers enhance error-correction algorithms, ramp-rate detection, and probabilistic outputs to support operational planning for transmission and distribution operators. Asset managers integrate forecasting with SCADA, inverter controls, and energy-storage dispatch systems to reduce imbalance costs and improve plant availability. Growth in hybrid plants combining PV, batteries, and wind increases the value of forecasting tools capable of multi-asset coordination. Although data-quality gaps and variable meteorological infrastructure remain challenges in developing regions, ongoing investment in remote-sensing networks and utility-scale digitalization ensures steady global demand for PV power forecasting solutions.

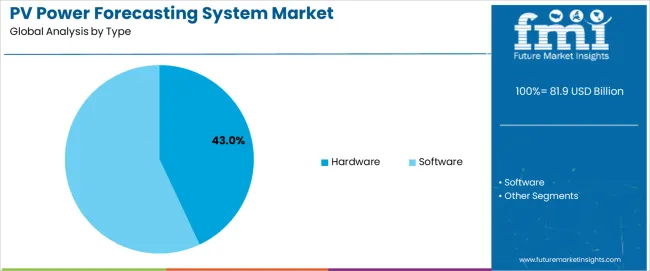

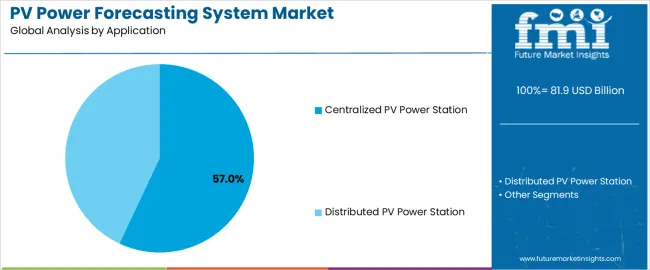

The PV power forecasting system market is segmented by type, application, and region. By type, the market is divided into hardware and software. Based on application, it is categorized into centralized PV power stations and distributed PV power stations. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions reflect differing forecasting requirements, plant sizes, and regional grid-integration patterns that influence forecasting-system deployment.

The hardware segment accounts for approximately 43.0% of the global PV power forecasting system market in 2025, making it the leading type category. This position reflects the essential role of meteorological sensors, irradiance measurement devices, sky imagers, and communication units that collect real-time data required for accurate forecasting. Hardware components serve as the foundation for predictive models because they capture environmental variables that influence short-term and intra-day solar output. Utilities and plant operators rely on precise on-site measurements to reduce forecasting errors that affect grid scheduling and dispatch planning.

Manufacturers supply hardware systems designed to withstand outdoor operating conditions and deliver long-term measurement stability. These systems include radiation sensors, temperature probes, wind-speed instruments, and cloud-movement cameras that support localized forecasting. Adoption is strong in East Asia and North America, where large-scale PV installations require detailed environmental monitoring to manage grid interactions. Hardware demand is also supported by integration with supervisory control systems and requirements set by grid operators for real-time data reporting. The hardware segment maintains its lead because accurate forecasting depends on the reliability and continuity of direct field measurements that feed prediction algorithms across a range of plant sizes.

The centralized PV power station segment represents about 57.0% of the total PV power forecasting system market in 2025, making it the dominant application category. This position results from the scale of utility-level installations, which require structured forecasting to support grid balancing, energy-market participation, and operational planning. Centralized plants generate large, variable output that must be predicted with sufficient accuracy to meet dispatch obligations and reduce curtailment risk. Operators depend on forecasting systems to manage ramp rates, anticipate cloud-transit effects, and align output expectations with grid-management protocols.

These plants frequently incorporate on-site meteorological stations and camera-based cloud tracking systems that enhance short-term forecasting. Adoption is strong in East Asia, North America, and Europe, where centralized PV capacity forms a significant share of renewable-power portfolios. Forecasting systems assist grid operators in planning reserve levels and scheduling ancillary services, creating ongoing demand for improved prediction accuracy. Centralized PV stations maintain their leading position because their operational scale requires continuous forecasting support that stabilizes grid integration and improves output predictability across both clear-sky and variable atmospheric conditions.

The photovoltaic (PV) power forecasting system market is growing as solar energy integration expands and grid operators, independent power producers and utility-scale projects require accurate predictions of solar generation. These systems use weather data, irradiance models, machine learning and real-time monitoring to forecast PV output and manage variability. Growth is supported by rising solar deployment, more stringent grid-integration requirements and the need to optimise energy storage and trading strategies. Adoption is moderated by data-quality challenges, high implementation cost and complexity of modelling local conditions. Providers are advancing AI-driven forecasting engines, higher-resolution weather feeds and cloud-native delivery platforms to improve accuracy and usability.

Demand rises as more PV capacity is connected to grids and operators need to manage intermittent generation. Forecasting systems help schedule dispatch, balance supply and demand, and reduce curtailment of solar output. As storage systems and grid services become more prevalent, accurate day-ahead and intra-day forecasts enable better planning and profitability for solar asset owners. The need for forecast data across large distributed solar fleets, micro-grid systems and utility portfolios further strengthens demand for high-resolution and scalable forecasting solutions.

Adoption is constrained by several key issues including the quality and availability of local weather and irradiance data, the complexity of calibrating models for many site-specific variables (such as shading, module ageing, orientation) and the cost of implementing robust forecasting platforms. Smaller solar operations may lack the budget or personnel to integrate advanced forecasting tools. Uncertainty in forecast accuracy especially in volatile weather conditions reduces confidence among some users. These barriers slow use of sophisticated systems particularly in emerging solar markets.

Key trends include refinement of machine-learning and deep-learning models that incorporate multiple data sources (weather, satellite imagery, sensor data) to improve forecast accuracy. Providers are offering flexible APIs and cloud-based platforms to deliver forecasts from minutes ahead (nowcasting) to days ahead (day-ahead planning). Modular, tiered service models allow users to select levels of accuracy and support based on asset size and budget. Growth in energy-storage coupled PV systems and virtual power plants is increasing demand for integrated forecasting and dispatch optimisation. As solar deployment becomes more distributed, forecasting systems shift toward scalable, edge-compatible, data-driven architectures.

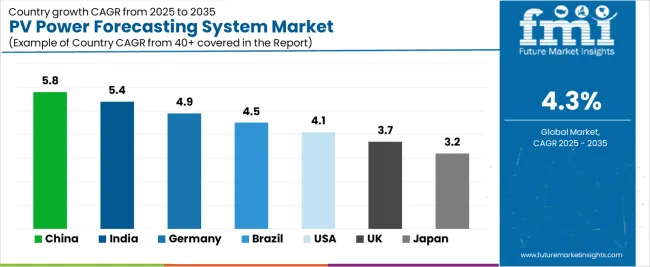

| Country | CAGR (%) |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| Brazil | 4.5% |

| USA | 4.1% |

| UK | 3.7% |

| Japan | 3.2% |

The PV Power Forecasting System Market is expanding steadily across global renewable energy regions, with China leading at a 5.8% CAGR through 2035, driven by rapid solar capacity additions, grid digitization, and rising adoption of AI-based forecasting models. India follows at 5.4%, supported by national solar expansion goals, increasing grid integration needs, and modernization of forecasting mandates for utility-scale PV plants.

Germany records 4.9%, reflecting advanced renewable grid management, strong regulatory frameworks, and widespread deployment of high-precision forecasting tools. Brazil grows at 4.5%, benefiting from expanding solar farms and the need to optimize intermittency management. The USA, at 4.1%, remains a mature market focused on advanced analytics, weather-model innovation, and grid stability solutions, while the UK (3.7%) and Japan (3.2%) emphasize accurate short-term forecasting, cloud-model integrations, and enhanced grid planning for expanding solar fleets.

China is projected to grow at a CAGR of 5.8% through 2035 in the PV power forecasting system market. Expanding solar installations, grid modernisation, and rising renewable integration increase demand for accurate short-term and long-term power predictions. Forecasting vendors supply irradiance modelling, cloud tracking, and real-time performance deviation analysis. Grid operators request improved ramp rate estimates and enhanced scheduling tools. Power producers rely on forecasting models to optimise dispatch planning, maintain output stability, and reduce imbalance charges. Growth aligns with rapid deployment of utility-scale and distributed solar assets requiring reliable forecasting support for operational continuity and grid performance.

India is projected to expand at a CAGR of 5.4% through 2035 in the PV power forecasting system market. Rising grid-connected solar capacity, variable generation patterns, and regional climate diversity increase reliance on forecasting tools. Developers request models that support scheduling, curtailment planning, and system optimisation. Vendors integrate satellite imagery, ground sensors, and probabilistic algorithms to support high-frequency forecasts. Discoms and grid operators depend on improved accuracy to manage procurement plans and reduce short-term imbalances. Demand strengthens as commercial and industrial consumers adopt forecasting-enabled energy management for distributed generation systems.

Germany is expected to rise at a CAGR of 4.9% through 2035 in the PV power forecasting system market. Mature solar adoption, advanced grid frameworks, and strict balancing requirements encourage the use of high-resolution forecasting models. Utilities request near-term forecasts incorporating cloud motion vectors and dynamic system modelling. Developers rely on tools that refine performance baselines and detect abnormal generation behaviour. Grid operators integrate multiple forecasting layers to maintain stability under variable conditions. Increased rooftop solar penetration strengthens the need for predictive systems ensuring operational reliability across distributed assets.

Brazil is projected to grow at a CAGR of 4.5% through 2035 in the PV power forecasting system market. Expanding solar installations, diverse weather patterns, and regional transmission constraints heighten demand for refined forecasting capabilities. Vendors provide solutions integrating satellite datasets, local sensor networks, and irradiance simulations. Utilities rely on forecasts to manage dispatch schedules and reduce balancing penalties across interconnected regions. Small and large producers use predictive modelling to maintain consistent operational planning. Forecasting platforms strengthen coordination between solar assets and grid operators across varying climatic zones.

USA is projected to grow at a CAGR of 4.1% through 2035 in the PV power forecasting system market. Variable climate zones, high renewable diversity, and advanced wholesale markets drive sustained reliance on forecasting tools. Utilities require probabilistic forecasts, ramp event identification, and weather-linked generation modelling. Commercial producers adopt forecasting systems to optimise bidding strategies and reduce imbalance costs. Operators integrate advanced analytics that support regional grid coordination. Growth reflects broader reliance on predictive systems as large-scale solar and distributed PV continue expanding across different regional markets.

UK is projected to expand at a CAGR of 3.7% through 2035 in the PV power forecasting system market. Increasing rooftop solar adoption, evolving market rules, and fluctuating irradiance conditions strengthen demand for precise modelling tools. Vendors support utilities with short-term and day-ahead forecasts integrating cloud analytics and irradiance mapping. Commercial solar operators rely on forecasting to manage grid exports and scheduling requirements. Distributed asset growth requires models capable of harmonising diverse system inputs. Market development reflects the importance of reliable predictions for efficient grid participation.

Japan is projected to grow at a CAGR of 3.2% through 2035 in the PV power forecasting system market. High rooftop solar penetration, varying terrain, and frequent cloud movement heighten reliance on accurate forecasting tools. Utilities adopt near-term prediction models that incorporate sky imaging and high-frequency weather data. Developers use forecasting outputs to plan operations under constrained grid conditions. Forecasts support load balancing and stability across regions with mixed solar density. Vendors expand offerings tailored to compact urban installations and dispersed rural systems.

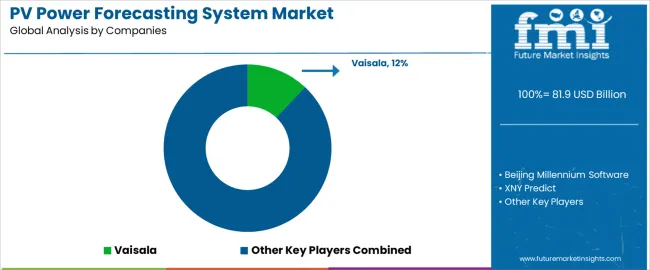

The global PV power forecasting system market shows moderate concentration, led by firms providing forecasting tools that support grid integration, dispatch planning, and performance monitoring for solar assets. Vaisala holds a strong position through advanced irradiance modeling that combines satellite data, numerical weather prediction, and site-specific calibration. Beijing Millennium Software and XNY Predict strengthen China’s domestic forecasting capability with platforms designed for utility-scale PV plants that require rapid-update intervals and localized meteorological inputs. State Power Rixin Tech. supports regional grid operators by supplying forecast models aligned with dispatch requirements and curtailment management frameworks. Across this tier, competition is shaped by model transparency, data-assimilation quality, and the ability to deliver stable forecasts under variable cloud patterns.

emsys contributes specialized expertise for operators managing mixed renewable portfolios, emphasizing real-time forecasting and integration with SCADA and energy-trading platforms. Market competition is influenced by forecast accuracy across multiple horizons, ease of deployment within existing grid systems, and compatibility with digital monitoring tools. Strategic differentiation relies on the precision of weather-model inputs, machine-learning refinement, and long-term system reliability. As PV penetration increases and grids require tighter balancing, suppliers offering high-resolution forecasts, robust validation methods, and dependable operational support are positioned to strengthen their role in global solar forecasting markets.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Hardware, Software |

| Application | Centralized PV power stations, Distributed PV power stations |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | Vaisala, Beijing Millennium Software, XNY Predict, State Power Rixin Tech., emsys |

| Additional Attributes | Dollar sales by type and application, hardware vs software install base, accuracy improvements (ML and satellite inputs), short-term vs day-ahead forecast segmentation, grid-integration and curtailment impact, data-assimilation & sensor-network penetration, pricing/licensing models, edge vs cloud delivery, regional regulatory drivers and grid-code requirements, integration with SCADA/energy-storage/market systems |

East Asia

Europe

North America

South Asia

Latin America

Middle East & Africa

Eastern Europe

The global pv power forecasting system market is estimated to be valued at USD 81.9 billion in 2025.

The market size for the pv power forecasting system market is projected to reach USD 124.8 billion by 2035.

The pv power forecasting system market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in pv power forecasting system market are hardware and software.

In terms of application, centralized pv power station segment to command 57.0% share in the pv power forecasting system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PVPP Beer Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

PVC-M High Impact Resistant Water Supply Pipe Market Size and Share Forecast Outlook 2025 to 2035

PVC UV Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

PVT Collectors Market Size and Share Forecast Outlook 2025 to 2035

PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

PVC Cling Film Market Size and Share Forecast Outlook 2025 to 2035

PV Combiner Box Market Size and Share Forecast Outlook 2025 to 2035

PVC Tapes Market Size and Share Forecast Outlook 2025 to 2035

PVC Footwear Market Analysis by Growth, Trends and Forecast from 2025 to 2035

PVC Packing Straps Market Report – Key Trends & Forecast 2025 to 2035

PV Micro Inverters Market Trends & Forecast 2025 to 2035

PV Inverter Market Analysis by Product, Phase, Connectivity, Nominal Power Output, Nominal Output Voltage, Application, and Region through 2035

PV Module Encapsulant Film Market Analysis by Material Type, Application, Thickness, Weight, End-Use, and Region Forecast through 2035

Market Share Insights of PVC-Free Cap Liner Manufacturers

Leading Providers & Market Share in PVC Tapes Industry

PVDC Coated Film Market Growth and Outlook 2025 to 2035

PVC Cling Wrap Market Trends & Growth Forecast 2024-2034

PVC Blister Packs Market

PVC Container Market

PVC-Free Packaging Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA