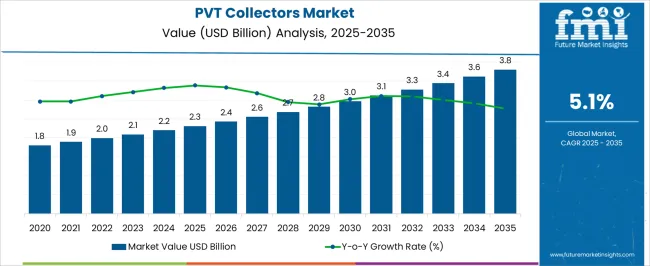

The PVT collectors sector is projected to rise from USD 2.3 billion in 2025 to USD 3.8 billion in 2035, registering a CAGR of 5.1%. The market growth curve shape illustrates a gradual but steady climb, with values moving from 2.3 billion in 2025 to 2.7 billion in 2028 and 3.0 billion by 2030. This consistent trajectory highlights the integration of photovoltaic and thermal energy capture systems, which are increasingly applied in commercial buildings and industrial facilities.

The market growth curve demonstrates measured adoption, where performance efficiency and dual-output capabilities strengthen their role as long-term energy assets in diversified applications. By 2031, the sector is expected to reach 3.1 billion, progressing to 3.4 billion in 2033 and closing at 3.8 billion in 2035. The shape of the curve suggests stable momentum rather than aggressive acceleration, reflecting steady uptake supported by cost competitiveness and operational reliability. This curve as a sign that PVT collectors will continue to gain traction where hybrid energy solutions are preferred. The growth pattern indicates incremental but dependable value creation, positioning these systems as important contributors to energy planning strategies and reinforcing their place in the evolving landscape of renewable-based infrastructure.

| Metric | Value |

|---|---|

| PVT Collectors Market Estimated Value in (2025 E) | USD 2.3 billion |

| PVT Collectors Market Forecast Value in (2035 F) | USD 3.8 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The PVT collectors segment is estimated to contribute nearly 12% of the solar thermal market, about 10% of the photovoltaic market, close to 14% of the renewable heating technologies market, nearly 9% of the building integrated energy systems market, and around 11% of the hybrid renewable energy systems market. Collectively, this equates to an aggregated share of approximately 56% across its parent categories. This proportion highlights the strategic role PVT collectors hold by merging photovoltaic power generation with thermal energy capture, thereby enhancing system efficiency and space utilization. Their significance has been reinforced in residential, commercial, and industrial projects where combined energy output provides both electricity and heat for diverse applications.

Analysts consider PVT collectors not just as hybrid devices but as enablers of energy optimization that influence design choices in integrated renewable installations. Demand has been driven by the need for higher yield per unit area, making them particularly valuable in regions with limited installation space or high combined energy requirements.

Their contribution is seen as shaping long-term investment patterns in building energy systems, where dual-function solutions are increasingly favored for lifecycle value. As a result, PVT collectors are regarded as a transformative component in the renewable energy mix, ensuring their lasting presence across parent markets and reinforcing their importance as a competitive lever for project developers and technology providers alike.

The PVT collectors market is experiencing strong momentum driven by the increasing global focus on renewable energy integration and the demand for high-efficiency solar technologies. The current market scenario reflects the rising adoption of hybrid systems that combine photovoltaic electricity generation with thermal energy capture, offering higher energy output per unit area.

This dual-function capability meets the needs of both residential and commercial users seeking to maximize energy efficiency while reducing carbon emissions. Advancements in system design, improved thermal storage solutions, and the integration of smart control technologies are further enhancing performance and driving adoption.

Supportive policy frameworks, government incentives, and growing environmental awareness are acting as strong catalysts for market expansion. As urban infrastructure continues to modernize and energy transition goals intensify, the PVT Collectors market is expected to witness sustained growth, supported by innovation in materials, improved installation practices, and long-term operational cost benefits.

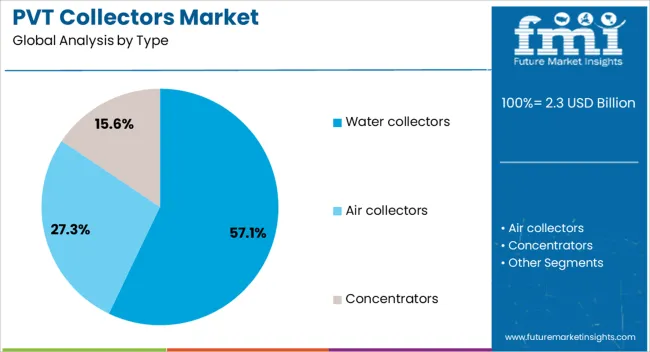

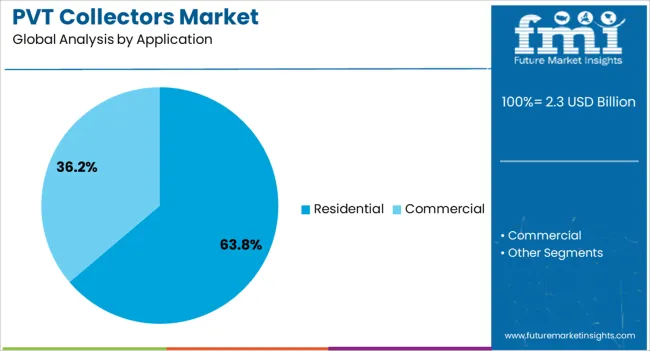

The pvt collectors market is segmented by type, application, and geographic regions. By type, pvt collectors market is divided into Water collectors, Air collectors, and Concentrators. In terms of application, pvt collectors market is classified into Residential and Commercial. Regionally, the pvt collectors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The water collectors segment is projected to account for 57.1% of the overall PVT Collectors market revenue in 2025, making it the dominant type. This leading position is being driven by the high thermal efficiency achieved through water-based heat transfer, which allows for more effective energy capture and utilization in hybrid systems.

Water collectors have been widely preferred in applications where consistent and higher temperature outputs are required, particularly in climates with stable sunlight conditions. The ability of these systems to integrate seamlessly with existing heating and hot water infrastructure has further supported their adoption.

Operational reliability, long lifespan, and lower maintenance costs compared to alternative designs have strengthened their market position The increasing shift toward sustainable heating solutions and the demand for systems capable of delivering both electricity and hot water efficiently have contributed to the continued dominance of the water collectors segment.

The residential application segment is anticipated to hold 63.8% of the PVT Collectors market revenue in 2025, making it the largest end-use category. Growth in this segment is being supported by the rising adoption of renewable energy solutions in households seeking to reduce utility costs and carbon footprints. The ability of PVT collectors to meet both electricity and hot water needs within a single installation has positioned them as a cost-effective and space-efficient choice for residential users.

Government incentives, subsidies, and net-metering policies are further driving uptake in this segment. Additionally, the increasing prevalence of rooftop installations in urban and suburban areas has created favorable conditions for market growth.

The integration of PVT systems with home energy management solutions and storage technologies is enhancing value for homeowners, ensuring sustained demand. As residential consumers continue to prioritize energy independence and efficiency, this segment is expected to retain its leadership position in the market.

The PVT collectors market is anticipated to expand steadily, supported by the growing integration of hybrid systems that combine photovoltaic power generation with thermal energy capture. Demand is reinforced by the dual benefits of electricity and heat production from a single unit.

Opportunities are unfolding in commercial buildings, industrial facilities, and residential complexes seeking efficiency-driven energy solutions. Trends highlight compact designs, improved heat transfer technologies, and modular installation formats. However, challenges, including high upfront costs, efficiency trade-offs, and limited consumer awareness, continue to influence adoption across multiple regions.

Demand for PVT collectors has been reinforced by their ability to simultaneously generate electricity and capture thermal energy, offering greater efficiency than standalone PV or solar thermal systems. Commercial facilities and residential complexes are adopting these systems to reduce energy costs and improve space utilization. Industrial users have also leaned on PVT collectors for low-temperature heating applications alongside power generation. Demand is strongest where land and roof space are limited, making combined systems more practical.

Supportive policies and building energy codes have further accelerated adoption in developed markets. With energy efficiency becoming a priority for households and businesses alike, PVT collectors are being positioned as a practical solution that balances space, performance, and cost efficiency while meeting long-term operational needs.

Opportunities in the PVT collectors market are being shaped by rising adoption in commercial buildings, industrial facilities, and residential projects. Large-scale commercial structures such as hospitals, hotels, and office complexes present opportunities for PVT integration due to their combined electricity and hot water requirements. Opinions highlight that industrial applications such as food processing and chemical production represent another avenue, as these sectors require both electricity and process heat. Opportunities are also unfolding in retrofitting older solar installations with hybrid systems, enabling improved energy output. Emerging economies investing in decentralized power solutions are also opening growth avenues. Partnerships between system integrators, EPC contractors, and equipment suppliers provide further opportunities for expansion. Collectively, these developments indicate that PVT collectors have a clear pathway to adoption across sectors where efficiency and dual output are prioritized.

Trends in the PVT collectors market emphasize system efficiency, compact design, and modular integration. Improved heat transfer technologies and selective coatings are trending, as they enhance thermal efficiency while maintaining high electrical output. Compact and modular systems are gaining traction as installers and end-users prefer solutions that optimize roof space.

Integration with smart energy management platforms is trending, allowing real-time optimization of both thermal and electrical outputs. The use of PVT in district heating projects is also visible, signaling an expansion into community-scale applications. Customizable designs for residential and industrial sectors have further strengthened adoption. These trends highlight a shift toward PVT collectors being perceived not just as hybrid products but as integral components of smart energy infrastructure that offer long-term operational flexibility.

Challenges in the PVT collectors market revolve around high upfront costs, efficiency trade-offs, and low consumer awareness. The complexity of integrating both photovoltaic and thermal components raises production costs, making PVT systems less attractive in price-sensitive regions. Opinions emphasize that efficiency losses occur when systems are not optimized, creating skepticism among end-users. Limited awareness among consumers and installers about the benefits of PVT technology has slowed adoption outside niche markets. Standardization issues and lack of established testing protocols across regions further restrict widespread deployment. Smaller suppliers often struggle with scaling and competing against established PV and solar thermal providers. These structural challenges underscore that despite strong potential, PVT collectors require better cost management, stronger market education, and clearer certification frameworks to achieve broader acceptance across global energy markets.

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

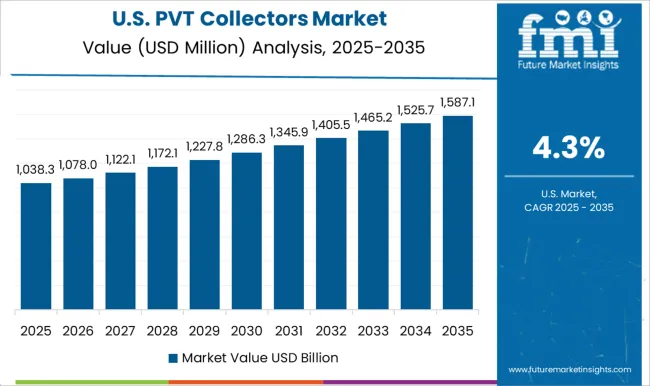

| USA | 4.3% |

| Brazil | 3.8% |

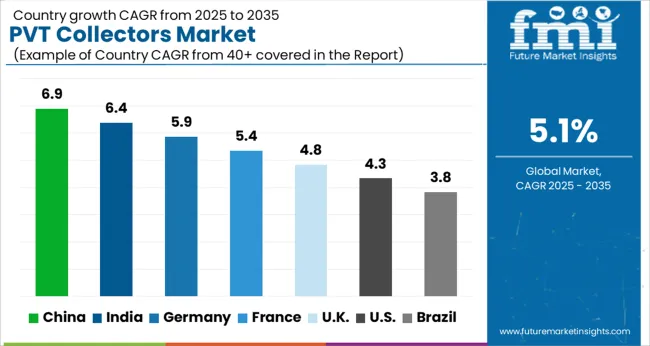

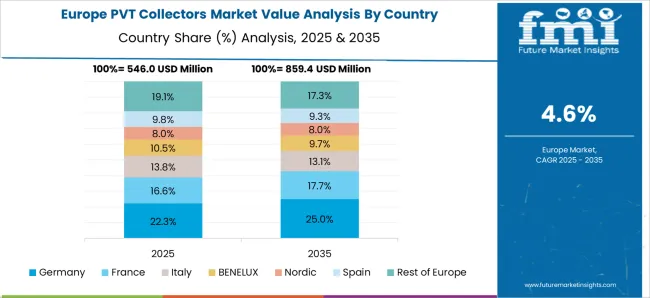

The global PVT (photovoltaic thermal) collectors market is projected to expand at a CAGR of 5.1% between 2025 and 2035. China leads with 6.9%, followed by India at 6.4% and France at 5.4%. The United Kingdom is forecast at 4.8%, while the United States trails at 4.3%. Growth is driven by rising adoption of hybrid solar solutions that simultaneously generate electricity and capture thermal energy. Asian markets achieve faster growth through large scale solar infrastructure programs and domestic manufacturing. European countries emphasize efficiency, regulatory compliance, and integration into residential and commercial projects. The USA shows slower but steady adoption, supported by pilot projects, clean energy incentives, and interest in high efficiency building systems. This report includes insights on 40+ countries; the top markets are shown here for reference.

The PVT collectors market in China is expected to grow at a CAGR of 6.9%. Expansion is fueled by strong solar capacity targets, rising demand for hybrid systems, and cost competitive local manufacturing. PVT systems are being deployed in industrial parks, residential complexes, and large commercial facilities where both electricity and heat are required. Government programs encourage adoption by subsidizing hybrid solar technologies. With strong domestic supply chains and large scale project execution, China positions itself as both a major consumer and global exporter of PVT collectors.

The PVT collectors market in India is forecast to expand at a CAGR of 6.4%. Growth is supported by government backed renewable energy initiatives, rising urban energy demand, and preference for cost efficient hybrid systems. Adoption is strong in institutional facilities, commercial complexes, and industrial clusters where dual output systems improve efficiency. Domestic manufacturers expand capacity to serve local demand, supported by financial incentives for renewable deployment. India’s focus on expanding rooftop solar also creates opportunities for integrating PVT systems in residential segments. Steady policy support and demand for energy efficient solutions make India a key growth market.

The PVT collectors market in France is expected to grow at a CAGR of 5.4%. Expansion is anchored by EU renewable directives, emphasis on hybrid energy efficiency, and retrofitting of older buildings. French adoption is driven by high energy costs and consumer interest in combined heat and power solutions. Local manufacturers focus on high quality, certified collectors that meet strict efficiency and safety standards. Deployment in residential buildings, hotels, and commercial establishments reinforces demand. France remains one of the most important European markets, with innovation in hybrid integration helping to sustain growth momentum.

The PVT collectors market in the UK is projected to expand at a CAGR of 4.8%. Growth is influenced by retrofitting projects, commercial energy efficiency programs, and adoption in residential complexes. Government initiatives provide funding for hybrid energy solutions, but market expansion is slower due to higher system costs compared to conventional solar. Demand is concentrated in commercial properties, institutional buildings, and pilot projects testing efficiency in varying climates. Import dependence plays a role in shaping supply, with European and Asian producers meeting part of the UK demand.

The PVT collectors market in the US is forecast to grow at a CAGR of 4.3%. Expansion is steady but slower compared to other regions due to reliance on conventional solar PV systems. Growth is driven by pilot projects, corporate sustainability initiatives, and demand from high efficiency residential and commercial buildings. USA firms focus on innovation in thermal storage integration and system design to improve performance. Federal and state level incentives for clean energy continue to support niche adoption. Though smaller in scale, the USA remains significant for R&D driven innovations in hybrid solar systems.

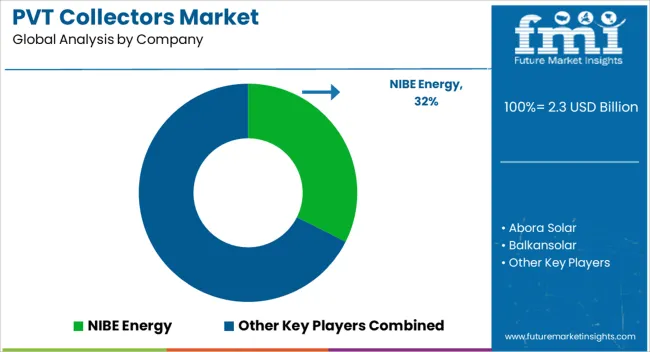

Competition in PVT collectors has been framed around how brochures highlight dual output—thermal and electrical—while convincing buyers of efficiency and compact design. Dualsun and Naked Energy lead with brochures that emphasize high thermal yields paired with photovoltaic performance, presenting case studies that show space savings on rooftops. Abora Solar positions its brochures around record efficiency percentages, displaying side-by-side charts of kWh/m² output against conventional PV.

NIBE Energy and Solimpeks publish brochures stressing system integration, hydronic compatibility, and seasonal performance in colder climates. Sunmaxx and SunEarth use catalogues to highlight installation kits, mounting options, and field-tested durability, aiming at installers seeking turnkey solutions. PowerPanel and Balkansolar distribute brochures underlining modularity, water heating applications, and reliability in commercial deployments. SolarPower competes with literature emphasizing cost efficiency and easy scalability.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Type | Water collectors, Air collectors, and Concentrators |

| Application | Residential and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | NIBE Energy, Abora Solar, Balkansolar, Dualsun, Naked Energy, PowerPanel, SolarPower, Solimpeks, SunEarth, and Sunmaxx |

| Additional Attributes | Dollar sales by collector type (flat plate, hybrid, concentrating, uncovered), Dollar sales by application (residential, commercial buildings, industrial facilities, utility-scale projects), Trends in hybrid solar systems combining photovoltaic and thermal outputs, Role of PVT collectors in improving energy efficiency and reducing reliance on separate systems, Growth in demand for space heating, cooling, and hot water generation, Regional installation patterns across Europe, Asia Pacific, and North America. |

The global PVT collectors market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the PVT collectors market is projected to reach USD 3.8 billion by 2035.

The PVT collectors market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in PVT collectors market are water collectors, air collectors and concentrators.

In terms of application, residential segment to command 63.8% share in the PVT collectors market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mining Collectors Market Size & Demand 2022 to 2032

Fume and Smoke Collectors Market Analysis by Type, End-Use Industry, and Region through 2035

Non-Concentrating Solar Collectors Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA