The non-concentrating solar collectors market will expand rapidly during 2025 to 2035 growing renewable energy uptake and heating requirements for water and space combined with favourable government incentives for clean power.

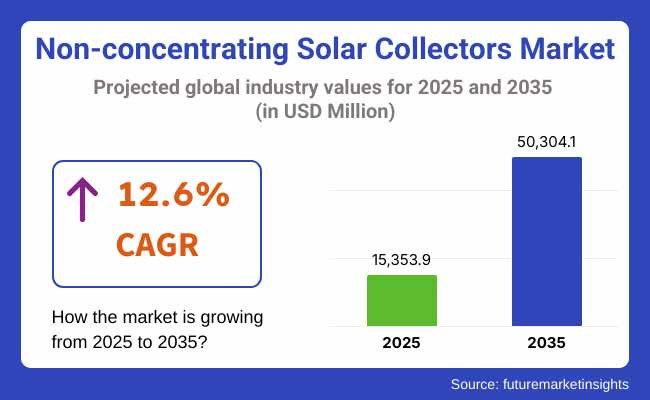

The solar heat absorption system works with unsophisticated flat plate and evacuated tube collectors which create a low-cost solution that is easy to set up. The solar heating segment will experience expansion from USD 15,353.9 million in 2025 until it reaches USD 50,304.1 million in 2035 at a compound annual growth rate (CAGR) of 12.6% throughout the forecast period.

The expansion of the market depends on power consumption needs across residential, commercial and industrial sectors which aim to minimize their dependence on fossil fuels. Better collector technology combined with thermal storage devices and anti-reflective surface upgrades leads to higher system performance.

Driving factors for slow solar collector adoption include dependency on weather conditions and technical difficulties regarding space needs and expensive operational costs. Manufacturers implement modular collector units while providing incentives based on performance and work together with solar integration businesses to ease system deployment.

KThe non-concentrating solar collectors market distributes itself based on collector type and end-user application and experiences increasing demand from residential and commercial sectors.

The major kinds of solar collectors available are flat plate collectors alongside evacuated tube collectors. Flat plate collectors command the market because they are inexpensive and ubiquitous in home water heating yet evacuated tube collectors find success in areas with harsh weather conditions.

Solar panel collectors find primary application in residential properties to supply heat for home water ceremonies and space heating demands. Hotel and hospital and school facilities join the commercial sector to implement solar systems that save energy while minimizing carbon footprints.

Such heating systems have found adoption within industrial processes at facilities due to their use in pre-heating operations especially within food manufacturing and textile manufacturing and pharmaceutical manufacturing facilities. Energy efficiency standards becoming more rigid makes hybrid solar-thermal systems more attractive for adoption.

Rising renewable energy targets, favourable subsidies and public awareness are driving the North America non-concentrating solar collectors market. Solar water heating systems are rarely used in commercial buildings in the United States and Canada but are more common in residential and institutional buildings with aid from state and federal incentives.

The Europe market is driven by ambitious carbon neutrality goals, a growing demand for zero-energy buildings and favourable policy frameworks. Germany, France, and the UK dominate adoption, with new solar thermal systems integrated into district heating and retrofitting initiatives to adhere to energy performance standards.

The non-concentrating solar collectors market in the Asia-Pacific region is expected to grow at the fastest pace due to rapid urbanization, increase in energy prices, and supportive government initiatives for solar energy.

China, India, Japan, and Australia develop large implementation-scale residential and commercial systems, and with adequate incentive policies and mandatory building energy codes, quick market penetration follows.

Challenge: Low Thermal Efficiency and Space Requirements

The non-concentrating solar collectors industry is challenged by relatively low thermal efficiency and also space requirements when compared to concentrating solar technologies. The low-temperature systems include flat plate collectors and evacuated tube collectors and have applications for residential water heating, space heating, and pool heating.

But they need large surface areas and optimal solar orientation to function effectively, which makes them unsuitable for dense urban areas or sites with inadequate sunlight. Moreover, heat losses in cold or cloudy climates, as well as performance limitations in winter months, reduce year-round utility and thus commercial attractiveness.

Opportunity: Demand for Cost-Effective and Sustainable Thermal Energy Solutions

Non-concentrating solar collectors are a good opportunity from the point of view of low cost and low maintenance for domestic and institutional water trapping. This makes them a very convincing choice for residential buildings, hotels, hospitals and schools in sun-rich developing countries due to their simple design, easy installation and low operating costs.

Increasing focus on energy independence, reduction of greenhouse gases, and access to affordable clean energy are stimulating governments worldwide to promote solar thermal systems through incentives, rebates, and green building codes.

Improvements in collector insulation, anti-reflective coatings, and modular mounting systems are all boosting performance levels, while integration into hybrid heating systems and thermal storage units are increasing their area of operation.

The market growth from 2020 to 2024 was primarily supported by renewable energy mandates, adoption of residential solar and government subsidies in emerging regions (such as India and China) and well-established southern Europe region.

Manufacturers concentrated on enhancing collector durability, anti-corrosion coatings and thermal insulation while reducing costs to compete with electric and gas-powered water heating systems. But poor efficiency in colder climates and a lack of awareness in untapped markets hindered uptake in many areas.

In forecast period of 2025 to 2035, solar thermal integrated systems will dominate the market and will comprise smart sensors, thermal storage tanks; AI based energy optimization will enhance their ability. Other characteristics of future designs will include compact form factors, weather-resistant materials, and automated controls to regulate temperature and integrate with the grid.

Meanwhile, growth will be spurred by community-scale solar heating projects and upgrades of existing buildings and the push for sustainability targets and decentralized energy planning in advanced as well as developing economies.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Supportive incentives for residential and institutional solar thermal installations. |

| Technological Advancements | Improvements in collector coatings, frame materials, and insulation. |

| Sustainability Trends | Focus on reducing fossil fuel use in domestic heating applications. |

| Market Competition | Led by regional manufacturers and solar water heating providers. |

| Industry Adoption | Widely used in residences, hospitals, and small hotels in sun-rich regions. |

| Consumer Preferences | Demand for affordable, maintenance-free, and off-grid heating solutions. |

| Market Growth Drivers | Growth driven by solar adoption policies and rising electricity prices. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Expansion of building code mandates and zero-emission heating requirements. |

| Technological Advancements | Development of smart control systems, thermal storage integration, and modular collector arrays. |

| Sustainability Trends | Shift toward decarbonized heating infrastructure and solar-driven thermal grids. |

| Market Competition | Entry of energy-as-a-service companies and hybrid renewable system integrators. |

| Industry Adoption | Expanded use in public buildings, industrial preheating, and energy-efficient retrofits. |

| Consumer Preferences | Preference for automated, high-efficiency systems with digital monitoring and energy savings insights. |

| Market Growth Drivers | Expansion fuelled by net-zero energy goals, thermal storage innovation, and decentralized energy systems. |

The United States non-concentrating solar collectors market has been witnessing steady growth due to numerous factors, such as government incentives to adopt renewable energy sources, rising demand for sustainable heating technologies, and integration of solar thermal systems in residential and commercial buildings.

Low-to-medium temperature applications, such as water heating, space heating, and pool heating, are experiencing growing interest in non-concentrating collectors such as flat plate and evacuated tube types.

Decarbonisation goals, along with federal and state-level tax credits, are further enabling widespread deployment in both the public and private sectors. Other developments impacting collector performance include improvements in collector’s materials, mounting systems and hybrid thermal solutions that are improving energy efficiency and market penetration in Sunbelt states.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 12.8% |

The UK non-concentrating solar collectors market is driven by the UK government's commitment to achieving net-zero carbon emissions and increasing demand for renewable thermal energy in housing, healthcare, and hospitality sectors. Hot water generation and compliance to building energy efficiency have become widespread applications for solar thermal systems.

In the UK, where solar irradiance levels are moderate, the non-concentrating type is more popular, as they are simple, reliable, and perform well on diffused light. Energy efficiency schemes focusing on increased support for green retrofitting projects and solar thermal grants are also contributing to market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 12.5% |

The European Union solar collectors market is heavily expanding due to climate targets, building efficiency regulations and solar thermal aid in district heating systems. Key adopters are countries like Germany, Spain and Italy investing a significant number of flat plate and vacuum tube collectors in residential, industrial and institutional domains.

The EU’s focus on carbon neutrality, fossil fuel offsetting, and circular economy principles are driving up demand for long-lifespan and low-maintenance thermal systems. Member states are also increasingly benefiting from public-private partnerships and funding under the REPowerEU initiative to foster large-scale solar thermal installations.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 12.6% |

In Japan, the non-concentrating solar collectors market is experiencing steady growth, largely due to the country’s efforts to diversify its energy supply, along with aging building infrastructure and the need for low-emission heating systems in residential and public facilities. Evacuated tube collectors are especially effective in smaller spaces and colder areas.

The Japanese government drives solar integration into smart homes and zero-energy buildings (ZEBs) to promote the dissemination of non-concentrating collectors such as FPCs for water and space heating. To suit consumer demands, space restrictions, and the aesthetics of the products within the refrigerator, domestic producers have also adapted them with anti-freeze, modular, and aesthetic designs.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 12.6% |

While the market for solar power continues to expand in South Korea, non-concentrating solar collectors are seeing particularly rapid growth, fuelled by renewable energy mandates, urban sustainability programs, and rising demand for solar heating in both residential and commercial sectors. Government subsidies under the “Green New Deal” have initiated a rapid deployment of flat plate and evacuated tube systems in schools, apartments and industrial origin.

New vacuum insulation, corrosion resistant materials and intelligent solar controllers are enabling efficient operation all year another example of local innovation helping to drive unique solutions. As carbon reduction and energy independence two existing priorities for South Korea gain greater national attention, solar thermal systems are emerging as a core component of the country's clean energy roadmap.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 12.6% |

The non-concentrating solar collectors market is gradually growing, as global energy consumers move toward solar-based heating systems, mainly because of the high investment cost in centralized solutions, which are not only expensive but also maintenance heavy.

These direct absorber collectors, which operate without the aid of mirrors or lenses, generate steady thermal energy for water heating, space heating, and industrial preheating applications.

With increasing focus on decarbonisation and energy self-sufficiency, two segments copper absorber plates for solar collectors and the residential market obviously are contributing to the growing uptake of solar thermal systems. These segments were reflective of a shift in the market toward high-efficiency materials and growing demand for clean energy solutions at the household level.

Non-concentrating collectors usually operate at low to moderate temperatures, so they are particularly applicable in domestic and commercial water heating systems. Materials used for absorber plates significantly influence the thermal performance and longevity of the system, and domestic applications still represent a major end-use sector where energy efficiency and environmental accountability meet.

As energy prices continue to rise and regulatory frameworks encourage the installation of household non-concentrating collectors, they are rapidly adopted in order to balance and off-load reliance on grid electricity and fossil fuels. Such trends influence not just product innovation, but market strategies for manufacturers and energy providers.

Due to their excellent thermal conductivity, corrosive environments resist and structural strength, copper absorber plates are accepted as the gold standard in non-cover solar collector systems. These plates gather solar radiation and remarkably transfer heat to the working fluid, leading to high system output even under variable weather conditions.

Copper’s outstanding electrical conductivity among all commercial metals allows fast and uniform heat transfer over the collector surface, reducing thermal losses and increasing efficiency in average energy conversion.

Used to construct flat-plate and evacuated tube collectors by manufacturers, copper is ideal for applications that require the reliability of consistent heat delivery. This property of the material makes it especially ideal for open-loop and closed-loop solar water heating systems, where the liquid will face not only corrosive attack but also oxidation and degradation at the elevated operating temperatures.

Copper absorber plates are also nice to have in areas with hard water or chemical treatment systems, which could pose problems for less robust metals in the long run as they come into contact with minerals or antifreeze (as long as they're not abusive). Consequently, copper collectors preserve their thermal performance even over long operational lifetimes of 20 years or more, with only minor maintenance.

Beyond its practical luxuries, the pliability of copper enables the meticulous sculpting of absorber plates to maximize surface areas for sunlight absorption.

Selective coatings are deposited on the copper plates by manufacturers, increasing solar absorption and reducing re-radiation rates to yield absorption rates greater than 90% copper-based collectors are therefore best for residential systems where supply of consistent hot water and thermal comfort is essential.

The recyclability of copper also adds to its attractiveness for sustainability-related projects, helping to promote the circular economy and mitigate the environmental impact of solar collector systems.

While they tend to be more expensive initially than aluminium or steel collectors, copper-based systems provide better energy efficiency and long lasting performance, which means that over time they prove to be more cost-effective.

Copper absorber plates are attractive for homeowners and institutions investing in copper absorber plates as they lower operating costs, increase the energy yield and reduce the need for repairs or replacement. These benefits help copper stand out as a high end material option for non-concentrating solar collector systems around the world and particularly in regions demanding high performance.

Copper absorber plates are widely being used in residential rooftops, housing cooperatives, educational institutions, and hospitals where hot water is required consistently and quality is important. These plates allow for heat to be captured and used on a daily basis, environmentally friendly energy is produced in a decentralized fashion, and they can help earn points toward green building certifications.

For cold climates, copper’s rapid heat transfer properties ensure steady system output even during low ambient temperatures, so copper heat pumps continue to perform highly throughout the year.

In addition, as smart energy optimizers and digital monitoring systems are integrated with solar collectors, the copper absorber plates form a solid basis for optimally capturing and maximizing system efficiency. For this reason, they are valued as a high performance option for precision-oriented residential energy management along with their compatibility with automated flow controls and variable circulation systems.

Residential installations remain at the forefront of the non-concentrating solar collectors market, with many homeowners looking to reduce their utility bills, enhance their energy self-sufficiency, or implement sustainable home solutions.

Homeowners are increasingly installing solar water heaters, rooftop collectors, and integrated heating systems for daily domestic hot water needs using clean, renewable energy. These systems reduce electricity or gas consumption, lower monthly bills, and shield homeowners from the uncertainty of energy prices.

Many governments in different regions provide incentives for residential solar collector installation through subsidies, tax breaks, and low-interest loans, making these installations more financially reachable.

Residential solar collectors also contribute towards meeting energy efficiency goals as per green building certifications like LEED, BREEAM, and IGBC etc. Incorporating non-concentrating collectors into the architectural designs (and vice-versa) can empower homeowners to increase their home’s value while reducing carbon footprint.

Environmental regulations have mandated builders and developers to incorporate solar water heating systems into new housing projects, ensuring that eco-conscious buyers are offered sustainable housing options.

Besides environmental and economic advantages, residential solar collectors ensure energy resilience in times of outages or peak demand. Standalone or hybrid systems with thermal storage can be used independently from the grid and provide hot water during emergencies.

These climate-related disruptions are becoming more common as the climate changes, making residential solar thermal systems a simple, reliable solution going forward for indispensable domestic energy needs.

Non-concentrating solar collectors come in various forms, enabling manufacturers to target different residential segments including urban flats, suburban homes, rural dwellings and off-grid accommodation.

Depending on space availability and orientation, flat-plate and evacuated tube collectors can be fitted on rooftops, façades, or open ground. Modular system designs enable homeowners to adjust installations based on family size, usage patterns or budget constraints.

Solar thermal technologies are providing affordable access to hot water in resource-poor areas in emerging economies where grid access is still limited. Collector systems are used by NGOs and government agencies in off-grid villages and low income communities to improve hygiene and reduce indoor air pollution from traditional fuels, as a public health intervention. Such approaches decrease reliance on firewood or kerosene to heat water, resulting in lower environmental impact and improved living standards.

The global non-concentrating solar collectors market is a steadily growing and competitive segment within the larger solar thermal industry. These technologically simpler designs of non-concentrating solar collectors, such as flat-plate collectors and evacuated tube collectors, are prized for their simplicity in being able to move direct and diffused sunlight without using tracking systems, which are ideal for residential, commercial as well as institutional applications.

Top players emphasize high-efficiency absorber coatings, modular installations, freeze protection technologies, and affordable advanced thermal storage integration. It includes manufacturers of solar thermal systems, clean energy equipment companies and renewable heating technology developers.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Bosch Thermo technology | 18-22% |

| Green one tec Solar industries GmbH | 15-19% |

| Viessmann Group | 12-16% |

| Solimpeks Solar Energy Corp. | 8-12% |

| Sunrain Group | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Bosch Thermotechnology | Produces flat-plate solar collectors for domestic hot water and space heating, with high thermal efficiency and durable absorber coatings. |

| Green-one-tec Solarindustrie GmbH | Offers high-output flat-plate collectors, integrating selective coatings, anti-reflective glass, and Euro-certified performance. |

| Viessmann Group | Manufactures evacuated tube and flat-plate collectors, known for frost-resistant systems and seamless boiler integration. |

| Solimpeks Solar Energy Corp. | Develops hybrid PV-T and solar thermal collectors, combining thermal and electric output for residential and commercial rooftops. |

| Sunrain Group | Specializes in large-scale solar thermal systems, providing evacuated tube collectors for residential, industrial, and public installations. |

Key Company Insights

Bosch Thermotechnology

Bosch leads in solar thermal integration, offering reliable flat-plate collector systems with corrosion-resistant materials and compatibility with existing heating infrastructure.

Green one tec Solar industries GmbH

Greenonetec is a major European supplier of certified flat-plate collectors, focusing on efficiency optimization, lightweight construction, and modular installations.

Viessmann Group

Viessmann provides premium solar collector systems, combining modern thermal storage solutions and robust all-weather performance for cold climates.

Solimpeks Solar Energy Corp.

Solimpeks specializes in hybrid and solar thermal solutions, delivering compact systems that generate both hot water and electricity from a single surface.

Sunrain Group

Sunrain offers vacuum tube collector systems, tailored for multi-residential and industrial heating projects, with high efficiency under low solar irradiation.

Other Key Players (30-40% Combined)

Several other companies contribute to the non-concentrating solar collectors market, focusing on regional energy needs, cost-effective thermal storage, and decentralized solar heating solutions:

The overall market size for the non-concentrating solar collectors market was USD 15,353.9 million in 2025.

The non-concentrating solar collectors market is expected to reach USD 50,304.1 million in 2035.

The increasing focus on renewable energy adoption, rising investments in residential solar energy systems, and growing use of copper absorber plates for efficient thermal performance fuel the non-concentrating solar collectors market during the forecast period.

The top 5 countries driving the development of the non-concentrating solar collectors market are the USA, UK, European Union, Japan, and South Korea.

Copper absorber plates and residential installations lead market growth to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Absorber Plates, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Absorber Plates, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Absorber Plates, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Absorber Plates, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Absorber Plates, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Absorber Plates, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Absorber Plates, 2018 to 2033

Table 22: Europe Market Volume (Units) Forecast by Absorber Plates, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Absorber Plates, 2018 to 2033

Table 28: Asia Pacific Market Volume (Units) Forecast by Absorber Plates, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Asia Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Absorber Plates, 2018 to 2033

Table 34: MEA Market Volume (Units) Forecast by Absorber Plates, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: MEA Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Absorber Plates, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Absorber Plates, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Absorber Plates, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Absorber Plates, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Absorber Plates, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Absorber Plates, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Absorber Plates, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Absorber Plates, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Absorber Plates, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Absorber Plates, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Absorber Plates, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Absorber Plates, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Absorber Plates, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Absorber Plates, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Absorber Plates, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Absorber Plates, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Absorber Plates, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Absorber Plates, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Absorber Plates, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Absorber Plates, 2018 to 2033

Figure 63: Europe Market Volume (Units) Analysis by Absorber Plates, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Absorber Plates, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Absorber Plates, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Absorber Plates, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Absorber Plates, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Absorber Plates, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Units) Analysis by Absorber Plates, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Absorber Plates, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Absorber Plates, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Absorber Plates, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Absorber Plates, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Absorber Plates, 2018 to 2033

Figure 99: MEA Market Volume (Units) Analysis by Absorber Plates, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Absorber Plates, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Absorber Plates, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: MEA Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: MEA Market Attractiveness by Absorber Plates, 2023 to 2033

Figure 107: MEA Market Attractiveness by Application, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Solar Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Solar Aluminum Alloy Frame Market Size and Share Forecast Outlook 2025 to 2035

Solar Grade Monocrystalline Silicon Rods Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Solar PV Module Market Size and Share Forecast Outlook 2025 to 2035

Solar Encapsulation Market Size and Share Forecast Outlook 2025 to 2035

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Solar PV Recycling Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracker for Power Generation Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered Active Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Panel Recycling Management Market Size and Share Forecast Outlook 2025 to 2035

Solar Photovoltaic (PV) Market Size and Share Forecast Outlook 2025 to 2035

Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered UAV Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Solar Salt Market Size and Share Forecast Outlook 2025 to 2035

Solar Control Window Films Market Size and Share Forecast Outlook 2025 to 2035

Solar Street Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA