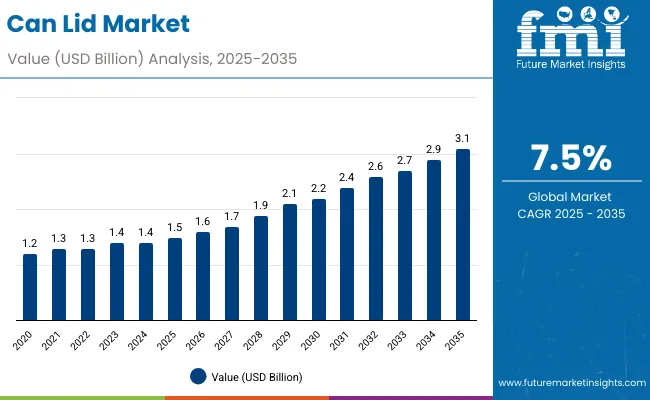

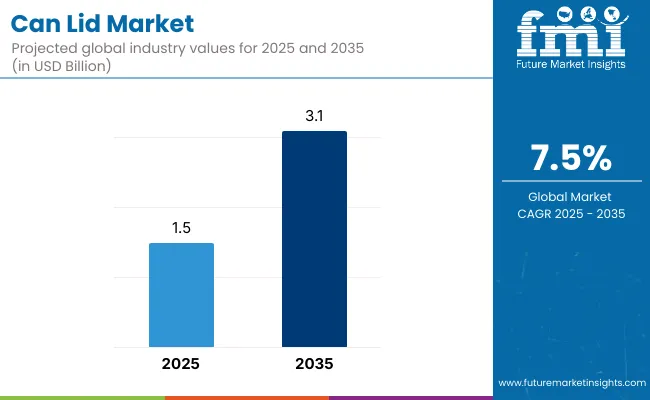

The can lid market is expected to grow from USD 1.5 billion in 2025 to USD 3.1 billion by 2035, resulting in a total increase of USD 1.6 billion over the forecast decade. This represents a 106.7% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 7.5%. Over ten years, the market grows by a 2.1 multiple.

| Metric | Value |

|---|---|

| Can Lid Market Estimated Value in (2025 E) | USD 1.5 billion |

| Can Lid Market Forecast Value in (2035 F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

In the first five years (2025 to 2030), the market progresses from USD 1.5 billion to USD 2.1 billion, contributing USD 0.6 billion, or 37.5% of total decade growth. This phase is shaped by strong demand from beverage manufacturers adopting easy-open lids to improve consumer convenience. Growth is reinforced by aluminum lid usage due to light weight and recyclability.

In the second half (2030 to 2035), the market grows from USD 2.1 billion to USD 3.1 billion, adding USD 1.0 billion, or 62.5% of the total growth. This acceleration is supported by innovations in resealable and peel-off lids, along with bio-coated metal usage. Rising adoption across pet food, nutraceutical, and specialty cans ensures further market penetration, strengthening can lids as an integral packaging component.

From 2020 to 2024, the can lid market expanded from USD 1.1 billion to USD 1.4 billion, supported by rising consumption of carbonated beverages, canned food, and ready-to-drink products. Nearly 70% of revenue came from global packaging giants emphasizing durability, tamper resistance, and easy-open functionality.

Leading companies such as Crown Holdings, Ball Corporation, and Silgan Holdings advanced lightweight aluminum lids, high-seal integrity, and convenient pull-ring systems. Differentiation focused on resealability, printability, and high-speed line compatibility, while smart QR-enabled lids remained secondary. Service-based design customization contributed under 15% of revenues, with most beverage and food manufacturers opting for mass-scale procurement of standardized lids.

By 2035, the can lid market will reach USD 3.1 billion, growing at a CAGR of 7.50%, with eco-friendly lids and digitally interactive solutions expected to account for over 40% of value. Competitive pressure will intensify as providers introduce bio-coated metals, recyclable composites, and AR-enabled engagement tools.

Established leaders are transitioning toward hybrid models combining lightweight material innovations with track-and-trace digital integration. Emerging players such as GZ Industries, Orora Packaging, and EasyOpenLidTech are gaining share through resealable lid formats, sustainable coatings, and region-specific customization, catering to growing demand across beverages, pet food, and industrial packaging sectors.

The increasing consumption of canned beverages and processed foods is driving growth in the can lid market. These lids ensure product safety, freshness, and convenient accessibility, making them essential for soft drinks, energy drinks, and packaged food applications. Rising demand for lightweight, tamper-evident, and recyclable solutions is further boosting adoption.

Innovations such as easy-open ends, resealable features, and bio-coated metal lids are gaining popularity for enhancing consumer convenience and sustainability. High-strength aluminum and composite laminates improve durability while reducing weight. Compatibility with modern canning lines and growing emphasis on circular economy practices are accelerating market expansion across both food and beverage industries.

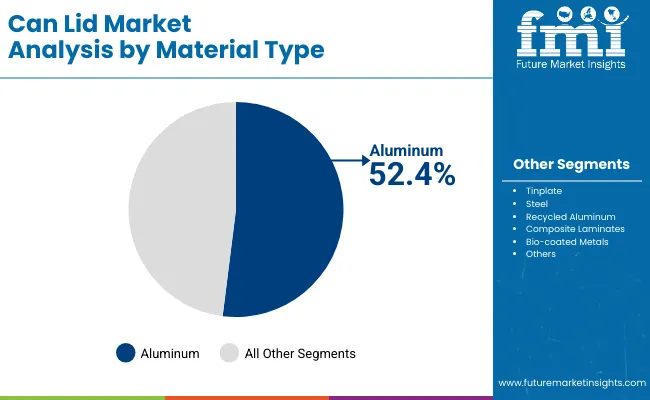

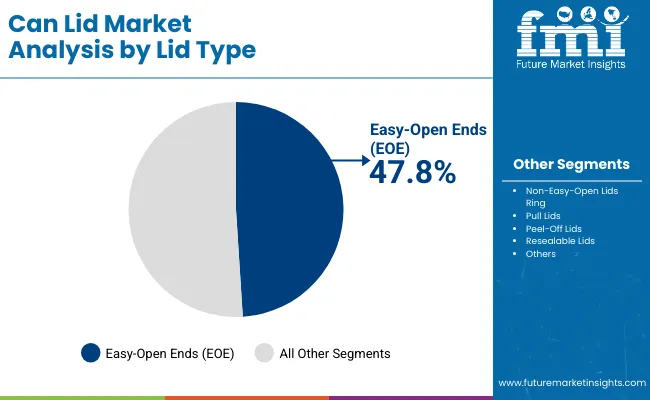

The market is segmented by material, lid type, can type, application, end-use industry, and region. Material segmentation includes aluminum, tinplate, steel, recycled aluminum, composite laminates, and bio-coated metals, offering lightweight, durable, and eco-friendly solutions for can closures. Lid type covers easy-open ends (EOE), non-easy-open lids, ring pull lids, peel-off lids, and resealable lids, ensuring varied convenience features for consumers. Can type segmentation includes beverage cans, food cans, aerosol cans, paint & industrial cans, and specialty cans, meeting requirements across multiple industries.

Applications span carbonated soft drinks, energy drinks, alcoholic beverages, processed & canned food, dairy & nutritional products, pet food, and paints, chemicals & industrial goods. End-use industries include food & beverage manufacturers, breweries & distilleries, nutraceutical & dairy producers, pet food companies, and industrial packaging firms. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Aluminum is projected to account for 52.4% of the can lid market in 2025, driven by its lightweight nature, corrosion resistance, and strong recyclability. Its high barrier properties protect beverages and foods from oxygen and light, preserving freshness and extending shelf life. Brands also value aluminum for premium aesthetics and consumer preference toward sustainable packaging.

Demand is reinforced by global sustainability initiatives promoting circular economies. Recycling infrastructure for aluminum is well established, enabling near-infinite reuse with minimal quality loss. Technological advances in coating and forming processes also enhance performance, ensuring aluminum remains the preferred lid material across industries.

Easy-open ends (EOE) are expected to represent 47.8% of the market in 2025, as they provide consumer-friendly opening mechanisms without requiring additional tools. Their reliability and ease of use make them standard for beverage, food, and pet food cans worldwide.

Adoption is supported by the rise of on-the-go consumption, where convenience drives purchasing decisions. Innovations such as improved scoring techniques and ergonomic tab designs improve safety and functionality. EOE lids also allow for branding and embossing opportunities, enhancing shelf presence.

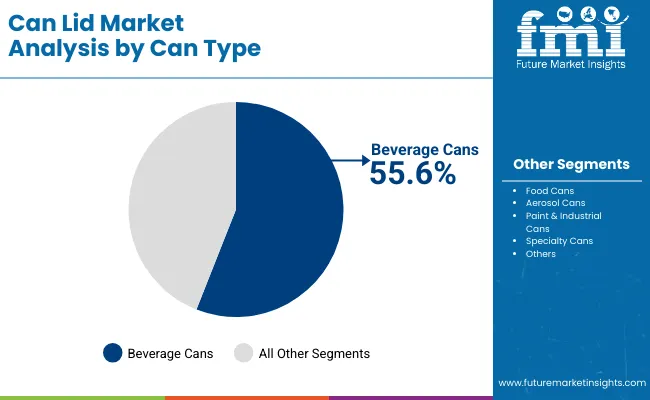

Beverage cans are projected to hold 55.6% of the market in 2025, reflecting their widespread use across carbonated soft drinks, energy drinks, and alcoholic beverages. Can lids for this segment must balance performance with cost-efficiency while ensuring consistent quality at scale.

Global beverage consumption trends reinforce this dominance, with sleek and slim can formats further increasing demand for specialized lids. The ability of beverage can lids to withstand high carbonation pressures highlights their engineering precision. Partnerships with global beverage brands ensure consistent volume growth in this category.

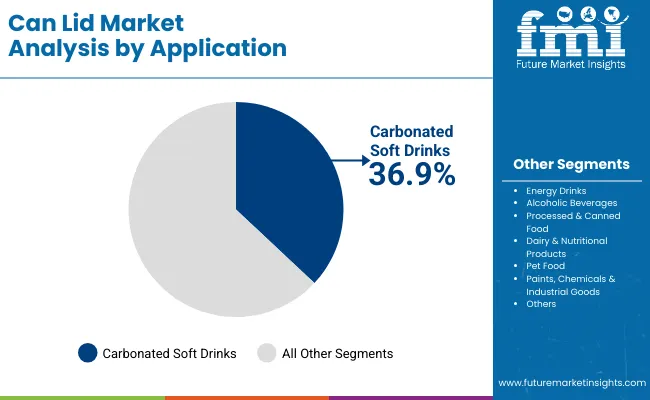

Carbonated soft drinks are forecast to account for 36.9% of the market in 2025, as they represent the largest beverage category worldwide. Can lids used here must provide superior sealing to maintain carbonation, flavor, and freshness throughout distribution.

Rising demand in emerging markets, coupled with product diversification into sugar-free and functional variants, strengthens growth. Manufacturers continue to innovate with lightweight lid designs to reduce material costs while maintaining integrity. Carbonated soft drinks remain the anchor application driving lid production volumes globally.

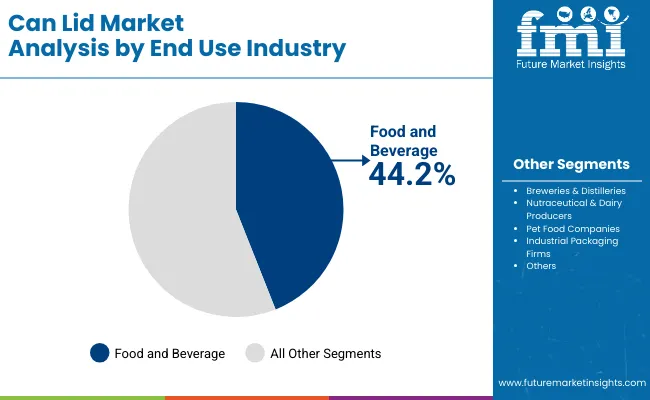

Food and beverage manufacturers are projected to account for 44.2% of the market in 2025, supported by their massive production volumes across canned foods, soft drinks, and energy beverages. Can lids are integral to ensuring product safety, hygiene, and convenience in large-scale manufacturing lines.

Adoption is further reinforced by the need for cost efficiency, high-speed sealing, and consistent supply. Partnerships between manufacturers and packaging firms drive innovation in lightweight materials and sustainable solutions. As global beverage and food demand expands, this end-use category remains the backbone of can lid consumption.

The can lid market is expanding as beverage and food industries demand durable, tamper-resistant, and convenient closures. Growth in carbonated soft drinks, energy drinks, and canned food consumption supports adoption. However, fluctuations in raw material prices and recycling challenges act as restraints. Innovations in lightweight aluminum lids, resealable formats, and sustainable coatings are emerging as key market trends.

Convenience, Safety, and Expanding Beverage Consumption Driving Adoption

Can lids play a critical role in preserving freshness, carbonation, and product safety, making them essential across beverage and food sectors. Easy-open ends (EOEs) are increasingly popular for their consumer-friendly design, especially in carbonated soft drinks and beer. Growth in energy drinks and RTD beverages further drives lid demand. Additionally, lightweight lids support logistics efficiency, while their tamper-evident design enhances consumer trust. These attributes make can lids indispensable in modern packaging.

Raw Material Volatility, Recycling Issues, and High Manufacturing Costs Restraining Growth

Market growth is restrained by the volatility of raw material prices, particularly aluminum and tinplate, which directly impact production costs. Recycling challenges, such as multi-material coatings on lids, complicate material recovery and sustainability goals. Manufacturing can be capital-intensive, requiring precision machinery for sealing integrity. Smaller producers face difficulties balancing cost efficiency with compliance standards. These factors limit accessibility and slow expansion in cost-sensitive markets.

Resealable Lids, Lightweight Aluminum, and Sustainable Coatings Trends Emerging

Key trends include the development of resealable lids that enhance consumer convenience and reduce product waste. Lightweight aluminum innovations are lowering production costs and supporting environmental sustainability by reducing raw material usage. BPA-free and eco-friendly coatings are being introduced to meet regulatory standards. Customizable printing and embossing are improving branding opportunities for beverage manufacturers. These innovations are transforming can lids from basic closures into high-value packaging components aligned with consumer and sustainability demands.

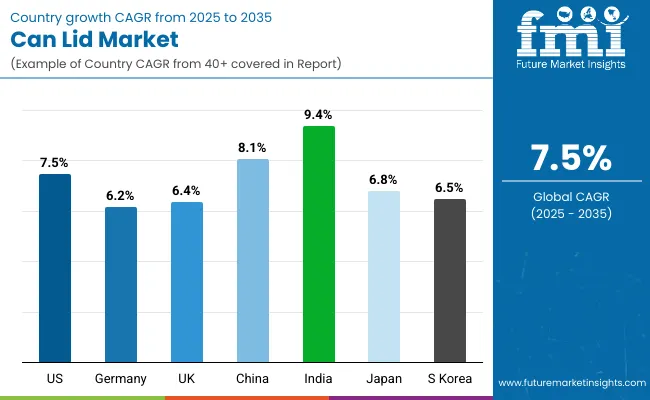

The global can lid market is expanding strongly, driven by growth in beverage consumption, processed food demand, and sustainability-driven packaging trends. Asia-Pacific is emerging as the fastest-growing region, with India and China leading adoption due to surging demand for carbonated drinks, beer, and canned foods. Developed economies such as the USA, Germany, and Japan are emphasizing recyclable aluminum lids, lightweight formats, and advanced sealing solutions, ensuring compliance with stringent safety regulations while catering to shifting consumer preferences for convenience and eco-friendliness.

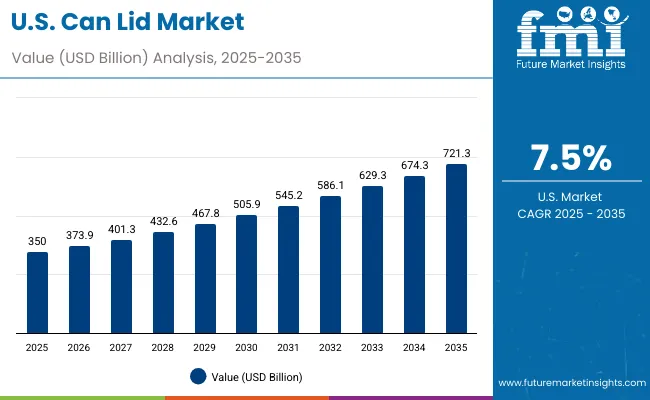

The USA market is projected to grow at a CAGR of 7.5% from 2025 to 2035, driven by rising consumption of energy drinks, craft beer, and ready-to-drink beverages. Manufacturers are innovating with lightweight aluminum lids, resealable options, and advanced coatings for product preservation. Sustainability remains a core focus, with brands shifting to fully recyclable formats. Increasing demand for convenience and premium beverages is reinforcing can lids as an integral part of USA packaging innovations.

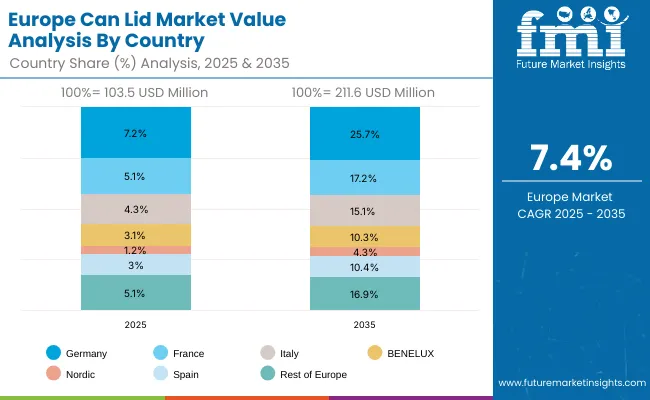

Germany’s market is expected to grow at a CAGR of 6.2%, supported by high demand in beer, carbonated beverages, and processed food packaging. EU sustainability mandates are driving adoption of recyclable aluminum lids and eco-friendly coatings. German OEMs are introducing precision-engineered lids with tamper-evidence and extended durability features. Export-oriented beverage producers are also supporting market expansion through demand for high-quality, compliant packaging components aligned with EU safety and green standards.

The UK market is projected to grow at a CAGR of 6.4%, supported by rising demand for premium RTD cocktails, craft beers, and sparkling waters. Smaller producers and startups are adopting customizable lids for branding opportunities. Growing consumer preference for sustainable packaging is accelerating demand for recyclable aluminum lids. OEMs are focusing on flexible, resealable solutions and value-added coatings to extend product quality while complying with packaging waste reduction regulations.

China’s market is forecast to grow at a CAGR of 8.1%, fueled by rising demand for energy drinks, soft drinks, and canned foods. Expanding urbanization and cold-chain logistics are driving can lid adoption. Domestic OEMs are scaling cost-effective aluminum lids with tamper-proof and resealable features. Sustainability regulations and export-focused beverage brands are also reinforcing demand for compliant, recyclable can lids that cater to both domestic and international consumers in fast-expanding urban and rural markets.

India is forecast to record the fastest growth at a CAGR of 9.4%, supported by surging consumption of carbonated drinks, canned foods, and premium RTD beverages. Growing urbanization and lifestyle shifts are accelerating demand for sustainable, recyclable aluminum lids. Local producers are scaling output to cater to expanding domestic consumption and export demand. Innovations in resealable formats, convenience-focused designs, and regulatory compliance are reinforcing India’s position as a key growth hub for global can lid adoption.

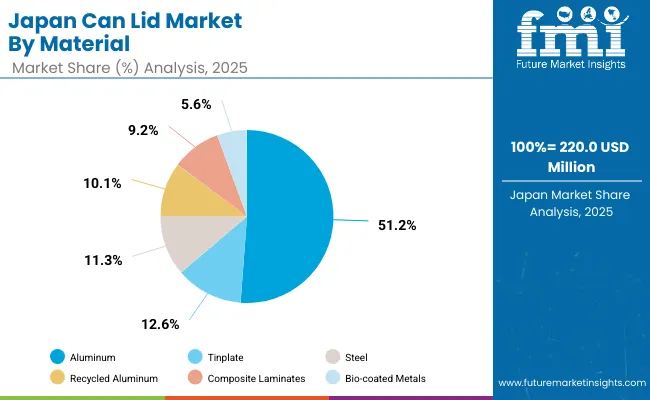

Japan’s market is expected to grow at a CAGR of 6.8%, supported by strong demand in premium teas, energy drinks, and functional beverages. Sleek, lightweight aluminum lids are preferred for convenience and portability. Japanese OEMs are innovating with precision-engineered, moisture-resistant formats to preserve delicate flavors. Seasonal product launches and cultural design customizations are also contributing to demand, reinforcing can lids as an essential element of Japan’s premium beverage and food packaging sector.

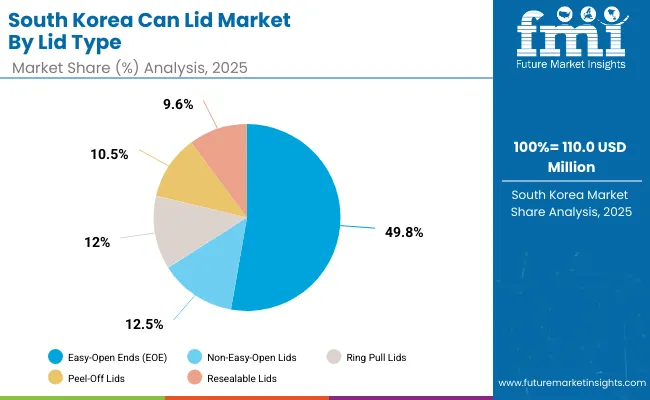

South Korea’s market is projected to grow at a CAGR of 6.5%, driven by demand for RTD teas, ginseng beverages, and energy drinks. Can lids are increasingly integrated into export-oriented K-drinks, emphasizing portability and premium branding. Local OEMs are investing in automation-ready, recyclable formats with resealable features. With rising exports and consumer preference for eco-conscious packaging, sleek and sustainable can lid innovations are seeing higher adoption across beverage and processed food sectors.

Japan’s can lid market in 2025, valued at USD 220 million, is led by aluminum, which holds a 53.6% share due to its light weight, recyclability, and durability. Tinplate accounts for 11.6%, while steel represents 10.7%, highlighting traditional use in beverage and food applications. Recycled aluminum captures 10.4%, reinforcing sustainability trends, while composite laminates hold 8.6%. Bio-coated metals contribute 5.1%, reflecting niche adoption. The continued dominance of aluminum underscores its superior performance but rising interest in recycled and coated alternatives signals a shift toward greener, innovative packaging materials to address both environmental concerns and evolving consumer expectations.

South Korea’s can lid market in 2025, worth USD 110 million, is dominated by easy-open ends (EOE), which capture 49.8% of the market share. Non-easy-open lids follow at 12.4%, while ring pull lids account for 11.8%. Peel-off lids represent 11.1% and resealable lids stand at 9.2%. The dominance of easy-open ends reflects strong consumer preference for convenience and quick access, especially in beverages. Peel-off and resealable options are gaining traction as innovative features enhance functionality and differentiation. This evolving landscape reflects South Korea’s packaging sector adapting to consumer demand for both practicality and premium convenience-driven solutions.

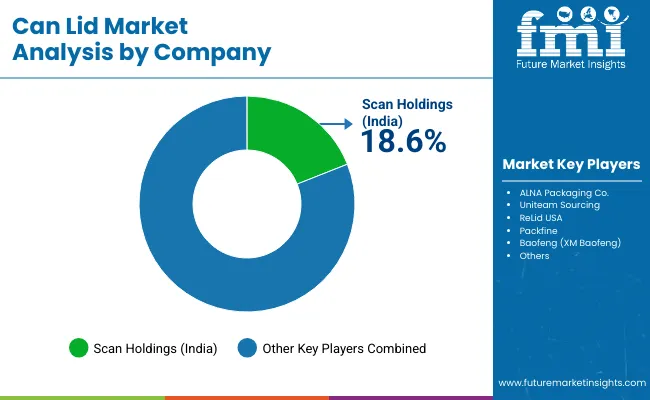

The can lid market is moderately fragmented, with global packaging suppliers, regional manufacturers, and niche innovators competing across beverage, food, and industrial canning applications. Global leaders such as Scan Holdings (India), ALNA Packaging Co., and Uniteam Sourcing hold notable market share, driven by easy-open end (EOE) technologies, lightweight aluminum solutions, and compliance with FDA and EU packaging regulations. Their strategies increasingly emphasize recyclability, tamper evidence, and compatibility with high-speed filling lines.

Established mid-sized players including ReLid USA and Packfine are supporting adoption of advanced can lid formats featuring resealable mechanisms, enhanced barrier coatings, and ergonomic pull tabs. These companies are especially active in premium beverages and processed food sectors, offering solutions that improve consumer convenience, product freshness, and differentiation through design innovation and branding flexibility.

Specialized regional providers such as Baofeng (XM Baofeng) focus on tailored can lid solutions for local beverage companies and food processors. Their strengths lie in cost-efficient production, rapid delivery capabilities, and customization for niche requirements, while also investing in eco-friendly materials and smart packaging features to align with evolving sustainability and traceability standards in global packaging.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| By Material | Aluminum, Tinplate, Steel, Recycled Aluminum, Composite Laminates, Bio-coated Metals |

| By Lid Type | Easy-Open Ends (EOE), Non-Easy-Open Lids, Ring Pull Lids, Peel-Off Lids, Resealable Lids |

| By Can Type | Beverage Cans, Food Cans, Aerosol Cans, Paint & Industrial Cans, Specialty Cans |

| By Application | Carbonated Soft Drinks, Energy Drinks, Alcoholic Beverages, Processed & Canned Food, Dairy & Nutritional Products, Pet Food, Paints, Chemicals & Industrial Goods |

| By End-Use Industry | Food & Beverage Manufacturers, Breweries & Distilleries, Nutraceutical & Dairy Producers, Pet Food Companies, Industrial Packaging Firms |

| Key Companies Profiled | Scan Holdings (India), ALNA Packaging Co., Uniteam Sourcing, ReLid USA, Packfine, Baofeng (XM Baofeng) |

| Additional Attributes | Increasing adoption of aluminum lids for recyclability and lightweight benefits, growing demand for easy-open ends in beverage packaging, rise of resealable lid innovations enhancing consumer convenience, expanding applications in dairy and nutraceutical products, strong uptake by pet food companies for portioned packaging, and heightened focus on bio-coated and composite lids to meet sustainability targets and stricter global packaging regulations. |

The global can lid market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the can lid market is projected to reach USD 3.1 billion by 2035.

The can lid market is expected to grow at a CAGR of 7.5% between 2025 and 2035.

The key materials in the can lid market include aluminum, tinplate, steel, recycled aluminum, composite laminates, and bio-coated metals.

The aluminum segment is expected to account for the highest share of 52.4% in the can lid market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vulcanised Solid Rubber Market Size and Share Forecast Outlook 2025 to 2035

Slip Lid Can Market Size and Share Forecast Outlook 2025 to 2035

Lever Lid Cans Market Size and Share Forecast Outlook 2025 to 2035

Mobile LiDAR Scanner Market Size and Share Forecast Outlook 2025 to 2035

Canine Arthritis Treatment Market Forecast and Outlook 2025 to 2035

Can Stack Stepper Motors Market Forecast and Outlook 2025 to 2035

Canned Wet Cat Food Market Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Canada Compact Wheel Loader Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Cancer Biological Therapy Market Size and Share Forecast Outlook 2025 to 2035

Canned Wine Market Size and Share Forecast Outlook 2025 to 2035

Canned Pet Food Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Canada Straws Market Size and Share Forecast Outlook 2025 to 2035

Canthaxanthin Market Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Industry Analysis in the United Kingdom Size and Share Forecast Outlook 2025 to 2035

Canada Executive Education Program Market Size and Share Forecast Outlook 2025 to 2035

Can Packaging Market Size and Share Forecast Outlook 2025 to 2035

Candidiasis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Canada Eyeshadow Stick & Blush Stick Market Size and Share Forecast Outlook 2025 to 2035

Cancer Diagnostics Market Analysis - Size, Share and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA