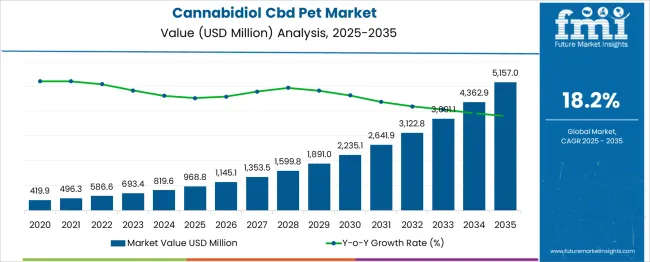

The cannabidiol (CBD) pet market is projected to experience rapid growth from USD 419.9 million in 2020 to USD 5,157.0 million by 2035, driven by a robust CAGR of 18.2%. This dramatic increase highlights the expanding acceptance and adoption of CBD products for pets as pet owners increasingly seek natural alternatives for pet wellness and health management. The Absolute Dollar Opportunity, which is the incremental market value over the forecast period, totals approximately USD 4.7 billion, illustrating a massive growth potential.

Starting from the 2020 baseline, the market is expected to multiply more than twelvefold by 2035, signaling significant revenue prospects for manufacturers, distributors, and retailers involved in the CBD pet product supply chain. This substantial opportunity is underpinned by rising pet ownership globally and increasing consumer awareness of the benefits associated with CBD-based pet products.

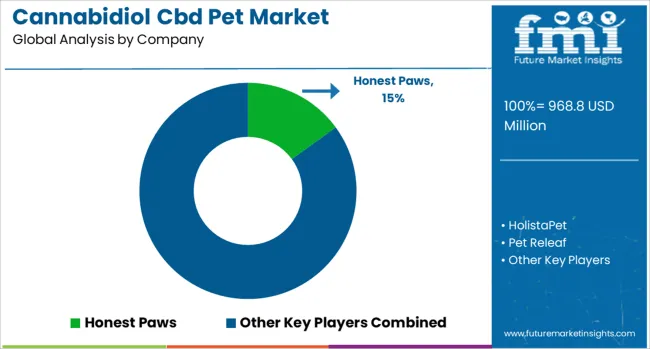

The years between 2025 and 2035 show particularly strong gains, with the market more than quintupling from USD 968.8 million to over USD 5.1 billion. This growth presents key entry points for companies to expand product offerings and capitalize on emerging market segments. Overall, the Cannabidiol CBD Pet Market presents one of the fastest-growing sectors, offering lucrative avenues for investment and business development over the next decade and beyond.

| Metric | Value |

|---|---|

| Cannabidiol CBD Pet Market Estimated Value in (2025 E) | USD 968.8 million |

| Cannabidiol CBD Pet Market Forecast Value in (2035 F) | USD 5157.0 million |

| Forecast CAGR (2025 to 2035) | 18.2% |

Rising prevalence of age-related and chronic conditions in pets, coupled with a growing shift toward alternative therapies, is driving demand for CBD-based formulations. Consumer awareness about the therapeutic benefits of cannabidiol in managing anxiety, pain, inflammation, and mobility issues in animals has contributed to its rapid adoption.

Regulatory clarity in several regions and increasing veterinary endorsement have also supported market penetration, especially in countries with progressive cannabis laws. Investment in product innovation, such as flavored tinctures, chewables, and topical applications, is expanding the product base and improving pet compliance.

As pet humanization trends deepen and pet expenditure continues to rise globally, the market is expected to see sustained momentum, with therapeutic, preventive, and lifestyle-driven applications gaining significant traction. The ability of CBD to address both physical and behavioral health in pets is further reinforcing its role in modern veterinary care..

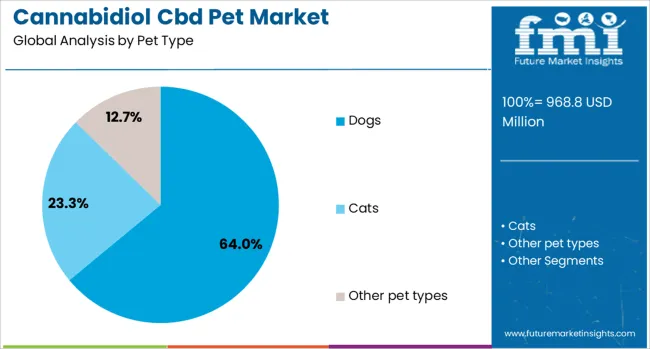

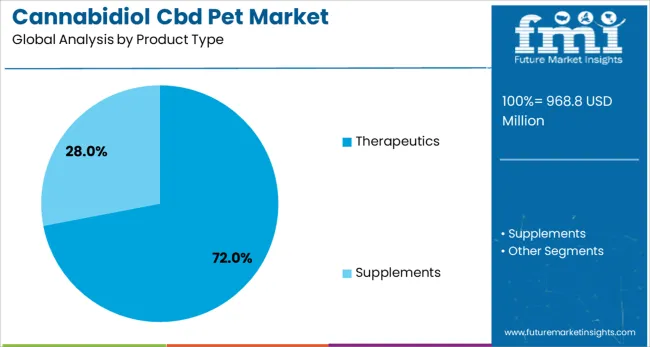

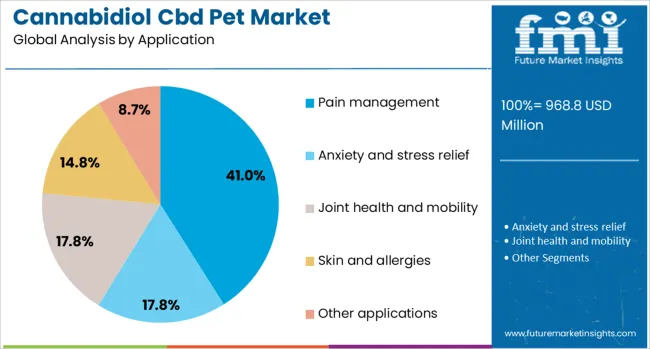

The cannabidiol CBD pet market is segmented by pet type, product type, application, distribution channel, and geographic regions. By pet type, the cannabidiol CBD pet market is divided into Dogs, Cats, and other pet types. In terms of product type, the cannabidiol CBD pet market is classified into Therapeutics and Supplements. Based on application, the cannabidiol CBD pet market is segmented into Pain management, Anxiety and stress relief, Joint health and mobility, Skin and allergies, and other applications.

By distribution channel, the cannabidiol CBD pet market is segmented into E-commerce, Pet specialty stores, CBD stores, and other distribution channels. Regionally, the cannabidiol CBD pet industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dogs segment is projected to hold 64% of the Cannabidiol CBD Pet market revenue share in 2025, making it the most dominant pet type. This growth has been driven by the high adoption rate of dogs globally and their susceptibility to conditions such as arthritis, anxiety, and seizures that can be effectively managed with CBD products.

Veterinary professionals and pet owners have increasingly recognized the therapeutic potential of cannabidiol for enhancing the quality of life in dogs, especially senior ones. The segment has also benefited from a wider variety of dog-specific CBD formulations available in the market, ranging from treats to oils, which offer convenient and targeted administration.

Regulatory permissions for pet CBD products in key markets have enabled product availability through retail and online channels, further supporting demand. Additionally, rising pet healthcare spending and greater inclination toward preventive wellness approaches have positioned the dogs segment as the primary driver of CBD adoption within the pet type category..

The therapeutics segment is expected to account for 72% of the Cannabidiol CBD Pet market revenue share in 2025, emerging as the leading product type. This segment has experienced growth due to the increasing reliance on CBD-based formulations for treating chronic conditions in pets, including pain, inflammation, anxiety, and neurological disorders. Therapeutic CBD products have gained trust among veterinarians and pet owners alike for their ability to deliver clinical benefits with minimal side effects.

Formulations targeted toward medical use are subject to higher standards of testing and quality control, which has enhanced consumer confidence and reinforced segment dominance. Moreover, advancements in formulation science have led to the development of highly bioavailable and condition-specific products.

As the demand for evidence-based and integrative veterinary medicine increases, therapeutic applications of cannabidiol continue to lead the market. The growing number of product launches focusing on joint support, behavioral health, and immune function in pets has further validated the role of CBD as a reliable therapeutic agent..

The pain management segment is projected to represent 41% of the Cannabidiol CBD Pet market revenue share in 2025, leading the application category. Growth in this segment has been supported by the high prevalence of pain-related conditions among aging pets, including osteoarthritis, injuries, and postoperative discomfort. Cannabidiol has been widely studied and utilized for its anti-inflammatory and analgesic properties, offering a natural alternative to conventional pharmaceuticals.

The non-psychoactive nature of CBD, coupled with its tolerability and minimal side effect profile, has made it a preferred option for long-term pain relief. Increasing pet owner interest in improving mobility and comfort, especially for senior pets, has contributed to the rising adoption of CBD-based pain management solutions.

Products formulated specifically for joint pain and inflammation are now commonly integrated into daily pet care routines. Additionally, as veterinary professionals advocate for multimodal pain management approaches, the inclusion of cannabidiol as a supportive therapy continues to strengthen its role in this leading application segment..

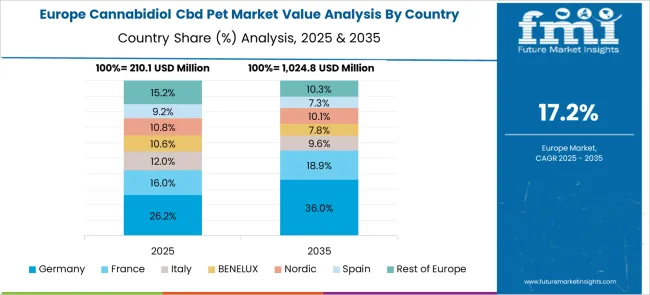

The cannabidiol (CBD) pet market is growing steadily as pet owners seek natural remedies to support animal health, addressing anxiety, joint pain, and inflammation. CBD products for pets include oils, treats, capsules, and topicals formulated to meet the unique physiology of dogs, cats, and other animals. Increased awareness of CBD benefits, paired with expanding e-commerce platforms and specialty pet retailers, fuels adoption. Regulatory clarity remains evolving, particularly regarding product claims and safety standards. North America dominates the market, while Europe and Asia-Pacific are emerging regions with rising consumer interest.

CBD pet products differ widely in cannabinoid concentration, extraction methods, and ingredient sourcing, impacting effectiveness and safety. Lack of standardized testing protocols leads to inconsistent potency and occasional presence of contaminants such as pesticides or heavy metals. Brands with transparent sourcing, third-party lab certifications, and species-appropriate dosing guidelines gain consumer trust. Variability in carrier oils, flavor additives, and bioavailability technologies further influences product performance. Manufacturers face the challenge of balancing palatability with efficacy to encourage pet compliance. Ensuring traceability and reliable quality controls is vital to meet growing regulatory scrutiny and protect animal health.

The market has seen diversification in product types designed to simplify dosing and enhance absorption for pets. Soft chews, flavored treats, tinctures with droppers, and transdermal patches cater to different pet sizes and owner preferences. Microemulsion and liposomal formulations improve CBD bioavailability, allowing for lower doses with consistent effects. Novel delivery systems that combine CBD with supportive ingredients such as glucosamine or omega-3 fatty acids address multiple health concerns simultaneously. Packaging innovations like child-proof and tamper-evident containers enhance safety. These developments improve ease of use and foster repeat purchases among pet owners seeking convenient, effective solutions for chronic conditions.

Demand for CBD pet products is broadening beyond dogs to include cats, horses, and small mammals. Increased pet ownership, especially in urban areas, supports market growth. Rising expenditure on pet wellness and humanization trends motivate owners to explore holistic health products. Regions with clearer regulatory frameworks and wider legal acceptance of hemp-derived ingredients show faster adoption. Online marketplaces and veterinary endorsements help educate consumers and expand reach. Emerging markets in Asia-Pacific and Latin America are showing early signs of interest, supported by expanding middle-class pet populations. As product variety and accessibility increase, market penetration is expected to deepen across multiple pet segments and regions.

The legal framework for CBD pet products remains complex and varies widely by country and region. Regulations govern permissible THC levels, product labeling, manufacturing standards, and health claims. In many areas, CBD products fall into a grey zone between supplements and pharmaceuticals, creating uncertainty for manufacturers and retailers. Lack of formal approval pathways restricts marketing claims, and ongoing safety data requirements can delay new product launches. Additionally, concerns about inconsistent product quality and dosing complicate consumer confidence. Companies that proactively engage with regulatory bodies, invest in robust safety testing, and educate consumers on responsible use are better positioned to navigate evolving compliance landscapes and build sustainable market presence.

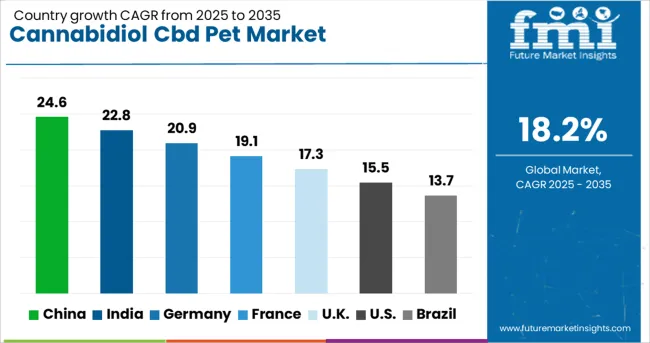

| Country | CAGR |

|---|---|

| China | 24.6% |

| India | 22.8% |

| Germany | 20.9% |

| France | 19.1% |

| UK | 17.3% |

| USA | 15.5% |

| Brazil | 13.7% |

The global cannabidiol (CBD) pet market is expanding rapidly at an 18.2% CAGR, driven by increasing pet health awareness and demand for natural supplements. Among BRICS nations, China leads with 24.6% growth, supported by growing manufacturing capacity and exports. India follows at 22.8%, fueled by rising pet ownership and alternative health trends. In the OECD region, Germany records 20.9% growth, reflecting regulatory support and consumer acceptance. France shows 19.1% growth, driven by expanding pet wellness markets. The United Kingdom grows at 17.3%, supported by increasing product availability and consumer interest. The United States, a mature market, shows 15.5% growth, shaped by established regulatory frameworks and strong market demand. These countries collectively drive market expansion through production scale, regulatory policies, and consumer trends. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the cannabidiol (CBD) pet market with an impressive 24.6% growth rate, driven by increasing consumer interest in natural health solutions for pets. Rising awareness of CBD benefits among pet owners, especially in major cities, supports this rapid expansion. Compared to India, China benefits from better-established supply chains and stronger regulatory frameworks that facilitate product availability and trust. The market is witnessing growth in CBD-infused treats, oils, and supplements targeting anxiety, pain relief, and inflammation in pets. Local manufacturers are investing in research to meet quality standards while international brands expand their footprint. E-commerce platforms also play a significant role in reaching pet owners nationwide, offering subscription services and fast delivery. China’s focus on product safety and innovation further strengthens its position as a leading CBD pet market in Asia.

Cannabidiol pet market in India is growing at 22.8%, reflecting growing interest in alternative pet care options across urban centers. Pet owners are gradually adopting CBD products for their pets, primarily to manage stress, joint pain, and skin conditions. India trails slightly behind China in regulatory clarity, yet progress in legal frameworks encourages market expansion. Local companies are partnering with international CBD suppliers to improve product offerings and educate veterinarians on usage. Compared to Germany, India’s market is emerging but rapidly gaining momentum through online retail channels. Rising pet ownership, particularly in tier-1 and tier-2 cities, supports demand. Awareness campaigns and social media influence also contribute to educating consumers about the benefits of CBD for pets.

Cannabidiol pet market in Germany grows steadily at 20.9%, supported by high consumer confidence in product safety and veterinary endorsements. The market benefits from strong regulations ensuring quality and accurate labeling, setting it apart from emerging markets like India. German pet owners show strong preference for CBD oils and supplements aimed at treating chronic pain, anxiety, and inflammation. Retail pharmacies and specialty pet stores stock certified products, reflecting a cautious but growing acceptance. Compared to the UK, Germany experiences slightly faster adoption due to more developed veterinary education programs. Continuous innovation in product formulations and quality testing ensures steady market expansion. Environmental concerns also drive demand for responsibly sourced CBD products.

The United Kingdom cannabidiol pet market expands at 17.3%, driven by increasing interest in holistic pet health and wellness. UK consumers favor natural remedies, with topical CBD products and treats gaining popularity for managing pet anxiety and pain. Compared to Germany, regulatory clarity is less stringent but improving, encouraging more brands to enter the market. Veterinary clinics increasingly recommend CBD as a complementary treatment. Online sales dominate distribution, supported by pet wellness influencers promoting benefits. The market is also shaped by growing demand for products with transparent ingredient sourcing and minimal additives. While growth is slower than China and India, UK consumers show steady enthusiasm for CBD pet care products.

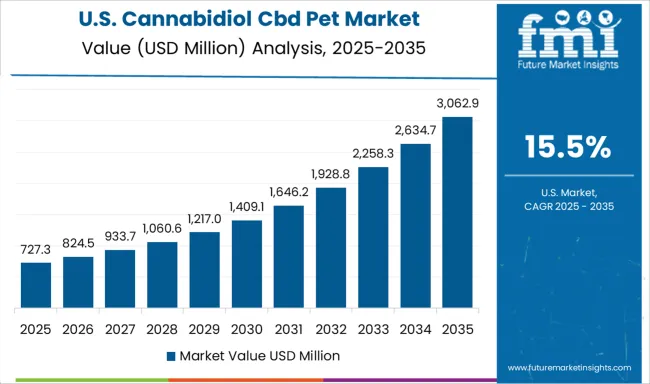

The United States cannabidiol pet market grows steadily at 15.5%, reflecting a mature but expanding landscape. USA pet owners increasingly turn to CBD for pain management, anxiety relief, and overall wellness. Compared to China’s rapid growth, the USA market faces more regulatory scrutiny but benefits from well-established product standards and large-scale distribution networks. Retail giants and specialty pet stores stock a wide range of CBD products, while online platforms support subscription models and fast delivery. Educational campaigns by veterinarians and industry groups increase acceptance. The focus on product transparency and testing helps build consumer trust. Although growth is slower than in Asian markets, the USA market shows stable long-term potential.

The CBD pet market is rapidly expanding as pet owners increasingly seek natural wellness solutions for anxiety, pain, and overall health in their animals. Honest Paws leads with a strong brand reputation, offering a diverse product range specifically formulated for pets, including tinctures, treats, and topical applications backed by third-party lab testing. HolistaPet emphasizes veterinary partnerships and science-driven formulations, ensuring product safety and efficacy that appeal to health-conscious pet owners. Pet Releaf focuses on organic, full-spectrum hemp extracts designed to address chronic conditions in pets, positioning itself as a premium option in the market. CBDfx differentiates by offering a broad portfolio that includes pet-specific CBD products alongside its human wellness line, targeting consumers seeking trusted multi-use brands.

Charlotte’s Web Holdings Inc. is a pioneer in the broader CBD industry, leveraging its extensive hemp cultivation expertise and quality control to provide reliable pet CBD products that benefit from the company’s widespread consumer recognition. Together, these companies drive innovation through transparent sourcing, rigorous testing, and targeted marketing, responding to growing consumer demand for effective, natural, and trusted CBD pet wellness solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 968.8 Million |

| Pet Type | Dogs, Cats, and Other pet types |

| Product Type | Therapeutics and Supplements |

| Application | Pain management, Anxiety and stress relief, Joint health and mobility, Skin and allergies, and Other applications |

| Distribution Channel | E-commerce, Pet specialty stores, CBD stores, and Other distribution channels |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honest Paws, HolistaPet, Pet Releaf, CBDfx, and Charlotte’s Web Holdings Inc. |

| Additional Attributes | Dollar sales in the Cannabidiol (CBD) Pet Market vary by product type (oils, treats, capsules), pet type (dogs, cats, others), distribution channel (online, retail, veterinary), and region (North America, Europe, Asia-Pacific). Growth is driven by increasing pet health awareness, rising CBD adoption, and demand for natural wellness products for pets. |

The global cannabidiol CBD pet market is estimated to be valued at USD 968.8 million in 2025.

The market size for the cannabidiol CBD pet market is projected to reach USD 5,157.0 million by 2035.

The cannabidiol CBD pet market is expected to grow at a 18.2% CAGR between 2025 and 2035.

The key product types in cannabidiol CBD pet market are dogs, cats and other pet types.

In terms of product type, therapeutics segment to command 72.0% share in the cannabidiol CBD pet market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

CBD-Infused Skincare Market Size and Share Forecast Outlook 2025 to 2035

CBD Skin Care Market Size and Share Forecast Outlook 2025 to 2035

CBD Oil Market Size and Share Forecast Outlook 2025 to 2035

CBD Snacks Market Size and Share Forecast Outlook 2025 to 2035

CBD Gummies Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

CBD Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of CBD Product Packaging Market Share

USA CBD Gummies Market Trends – Growth, Demand & Innovations 2025-2035

Pet CBD Market

ASEAN CBD Gummies Market Growth – Trends, Demand & Innovations 2025-2035

Europe CBD Gummies Market Insights – Size, Share & Industry Trends 2025-2035

Flavored CBD Powder Market Growth - Innovations & Consumer Trends 2025 to 2035

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA