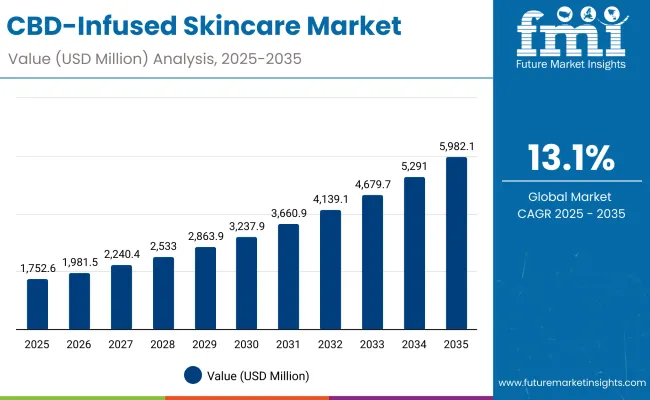

The Global CBD-Infused Skincare Market is expected to record a valuation of USD 1,752.6 million in 2025 and USD 5,982.1 million in 2035, with an increase of USD 4,229.5 million, which equals a growth of more than 240% over the decade. The overall expansion represents a CAGR of 13.1% and more than a 3X increase in market size.

Global CBD-Infused Skincare Market Key Takeaways

| Metric | Value |

|---|---|

| Global CBD-Infused Skincare Market Estimated Value in (2025E) | USD 1,752.6 million |

| Global CBD-Infused Skincare Market Forecast Value in (2035F) | USD 5,982.1 million |

| Forecast CAGR (2025 to 2035) | 13.1% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,752.6 million to USD 3,237.9 million, adding USD 1,485.3 million, which accounts for about 35% of the total decade growth. This phase records steady adoption across anti-inflammatory and acne/blemish care products, driven by growing consumer awareness of CBD’s natural soothing properties, its effectiveness in reducing redness and irritation, and its increasing presence in dermatologist-tested formulations. Anti-inflammatory products dominate this period as they cater to more than half of consumer demand, positioning CBD as a go-to solution for inflammation-prone skin.

The second half from 2030 to 2035 contributes USD 2,744.2 million, equal to 65% of total growth, as the market jumps from USD 3,237.9 million to USD 5,982.1 million. This acceleration is powered by widespread consumer acceptance of CBD-infused skincare as a mainstream beauty category, with expanding claims such as vegan, natural/organic, and clean-label creating differentiation in the premium skincare segment.

E-commerce channels expand rapidly during this period, supported by D2C models and social media-led beauty communities. Regional growth is most pronounced in Asia-Pacific, with China and India recording CAGR above 20%, while Japan significantly increases its global share by 2035.

From 2020 to 2024, the Global CBD-Infused Skincare Market grew steadily from niche adoption to broader awareness, with much of the growth concentrated in early-stage launches across North America and Western Europe.

During this period, the competitive landscape was dominated by emerging specialist brands controlling over 80% of revenue, while legacy cosmetic companies were still experimenting with limited CBD-infused product lines. Differentiation relied heavily on positioning around purity, plant-based sourcing, and boutique distribution channels, while large-scale retail presence remained limited.

Demand for CBD-Infused Skincare will expand to USD 1,752.6 million in 2025, and the revenue mix will shift as mainstream brands scale up offerings, and consumer preferences increasingly emphasize natural/organic and vegan claims. Traditional beauty giants such as The Body Shop and Kiehl’s face rising competition from digital-first CBD brands such as CBDfx, Cannuka, and Vertly, which leverage influencer marketing, e-commerce exclusivity, and community-based engagement.

Larger hemp-based companies like Charlotte’s Web and Medterra are entering the skincare category as a natural adjacency to supplements, highlighting cross-category synergies. Competitive advantage is moving away from niche branding alone to credibility, dermatologist endorsements, and multi-channel distribution.

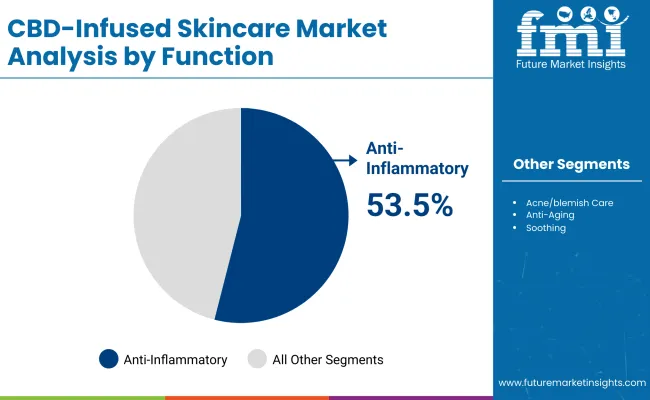

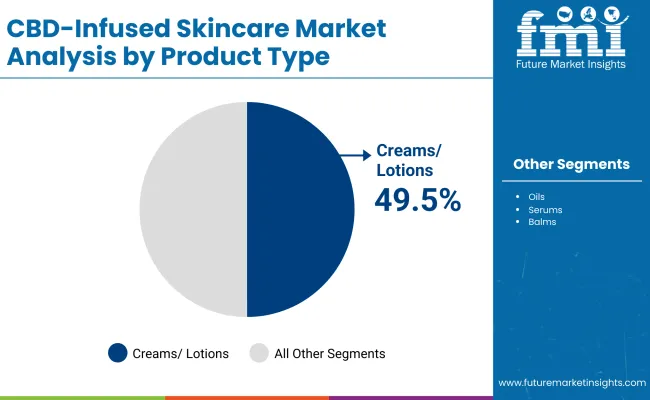

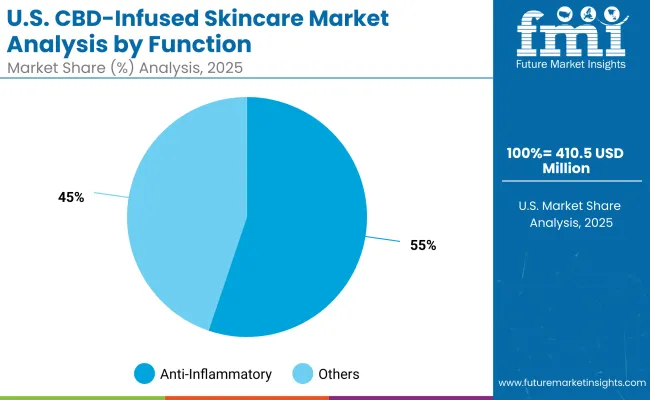

Advances in plant-based ingredient extraction and formulation science have improved the quality, stability, and safety of CBD-infused products, allowing them to compete directly with mainstream skincare. Anti-inflammatory properties of CBD make it particularly appealing to consumers with sensitive, acne-prone, or redness-prone skin, explaining why the anti-inflammatory segment alone accounts for 53.5% of market share in 2025. The rise of creams and lotions (49.5% share in 2025) reflects CBD’s integration into daily-use products, ensuring wider penetration across diverse consumer groups.

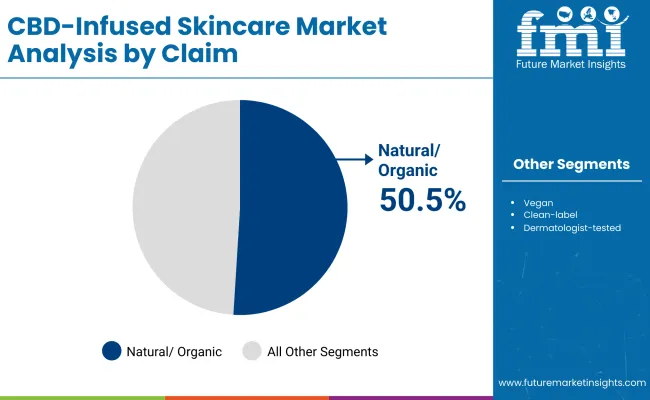

The expansion of natural/organic claims (50.5% share in 2025) highlights growing alignment with the global clean beauty movement. Consumers increasingly reject artificial additives, parabens, and harsh chemicals, opting instead for CBD-infused products marketed as vegan, organic, and eco-friendly. This trend is particularly strong in China and India, where middle-class consumers are actively trading up to premium natural formulations.

Global growth is also fueled by increasing mainstream accessibility. E-commerce platforms, pharmacy chains, and specialty beauty stores are amplifying CBD brand visibility, while mass retail is beginning to stock CBD-infused lines alongside traditional skincare. In the USA, regulatory clarity has encouraged new launches, while in Asia-Pacific, progressive acceptance of CBD cosmetics is creating a demand surge, especially in China, India, and Japan.

The market is segmented by function, product type, channel, and claim, reflecting consumer-driven adoption dynamics. Functions include anti-inflammatory, acne/blemish care, anti-aging, and soothing, highlighting CBD’s versatility in addressing multiple skin concerns.

Product types cover creams/lotions, oils, serums, and balms, offering formats ranging from everyday use to specialized treatments. Channels include e-commerce, pharmacies, mass retail, and specialty beauty stores, underscoring CBD’s shift from niche to mainstream. Claims include natural/organic, vegan, clean-label, and dermatologist-tested, signifying how consumer trust is built in this emerging category.

| Function | Value Share % 2025 |

|---|---|

| Anti-inflammatory | 53.5% |

| Others | 46.5% |

The anti-inflammatory segment is projected to contribute over half of the Global CBD-Infused Skincare Market revenue in 2025, maintaining its lead as the dominant function category. This is driven by CBD’s proven efficacy in calming redness, reducing swelling, and managing irritation, which resonates strongly with consumers facing sensitive skin conditions.

The segment’s growth is also supported by rising demand from younger consumers seeking acne solutions, and older demographics valuing anti-aging benefits linked to reduced inflammation. As clinical research progresses and consumer trust deepens, anti-inflammatory formulations are expected to remain the cornerstone of CBD skincare adoption worldwide.

| Product Type | Value Share % 2025 |

|---|---|

| Creams/lotions | 49.5% |

| Others | 50.5% |

The creams and lotions segment is forecasted to hold the largest share of the market in 2025, led by their role as daily-use skincare essentials. These products are favored for their versatility and compatibility with multiple skin types, making them ideal for mass adoption. Their wide retail availability in pharmacies, e-commerce, and specialty beauty stores enhances accessibility, fueling their dominant position.

Oils, serums, and balms are witnessing rapid uptake in premium and niche categories, with consumers associating them with concentrated benefits and luxury experiences. As CBD-infused product innovation evolves, these categories will continue expanding, but creams and lotions are expected to remain the most commercially significant format throughout the forecast period.

| Claim | Value Share % 2025 |

|---|---|

| Natural/organic | 50.5% |

| Others | 49.5% |

The natural/organic claim segment is projected to account for the largest share of the Global CBD-Infused Skincare Market in 2025. This leadership reflects a strong consumer shift toward clean beauty, where sustainability, plant-derived actives, and ethical sourcing are prioritized. CBD-infused products marketed under natural/organic and vegan positioning enjoy higher consumer trust and premium acceptance, particularly in APAC and Europe.

As regulatory frameworks evolve and consumer awareness grows, dermatologist-tested claims will gain more relevance, bridging the gap between niche CBD brands and mainstream cosmetic giants. By 2035, clean-label and organic CBD formulations are expected to command premium pricing and higher loyalty rates, cementing their role in driving market expansion.

Rising Scientific Validation and Dermatologist Endorsements

One of the strongest drivers in the Global CBD-Infused Skincare Market is the increasing clinical validation of CBD’s anti-inflammatory and antioxidant properties, paired with a growing number of dermatologist endorsements. Consumers no longer perceive CBD skincare as just a wellness fad; instead, they see it as a functional, scientifically-backed ingredient.

This shift is crucial because 53.5% of the market value in 2025 is concentrated in anti-inflammatory products, which are especially relevant to conditions like acne, eczema, and rosacea. Major dermatology associations in the USA and Europe have started acknowledging CBD’s potential benefits for topical use, improving trust among both medical professionals and consumers.

As a result, dermatologist-tested product claims are gaining traction, and mainstream retail chains are more willing to dedicate shelf space to CBD skincare. This convergence of clinical credibility and retail availability is fueling consumer adoption at scale.

Mainstream Beauty Retail Integration Across Channels

Another critical driver is the integration of CBD skincare into mainstream beauty retail channels, especially in pharmacies, mass retail, and specialty beauty stores. Initially, CBD products were confined to niche e-commerce stores and wellness boutiques, but regulatory clarity in the USA and progressive acceptance in Europe and Asia-Pacific are changing this dynamic.

Brands like The Body Shop and Kiehl’s are already using their established retail presence to normalize CBD skincare, and e-commerce platforms are amplifying the trend with global accessibility. This retail integration matters because it helps CBD products shed the stigma of being “alternative” or “underground.”

It also exposes a broader demographic of consumers particularly older buyers in Europe and Asia who prefer pharmacy-backed trust to CBD-based products. This mainstreaming effect is a long-term growth driver, ensuring that CBD skincare is positioned not just as a niche segment but as a legitimate category within the global beauty market.

Regulatory Fragmentation and Cross-Border Barriers

Despite growing acceptance, the market is still restrained by fragmented regulatory frameworks across regions. While the USA and parts of Europe allow topical CBD use, many countries in Asia-Pacific and the Middle East still impose restrictions or maintain legal ambiguity. For instance, China shows the highest CAGR of 22.2%, yet only CBD isolate (THC-free) has regulatory clearance for cosmetics, creating barriers for full-spectrum formulations that dominate in North America.

This inconsistent policy landscape forces brands to maintain separate formulations and packaging for different markets, which increases costs and complicates global expansion. It also limits the ability of smaller brands like Vertly or Cannuka to scale internationally, as compliance costs eat into profitability.

Consumer Perception Challenges and Stigma

Another major restraint is the lingering consumer stigma surrounding cannabis-derived ingredients. Even though CBD is non-psychoactive, many consumers especially in conservative markets such as India and Germany still associate it with recreational marijuana use.

This perception limits adoption in mass retail and pharmacy channels where consumer trust is critical. In fact, despite India recording the fastest CAGR at 23.7%, mainstream buyers remain hesitant, and early adoption is concentrated among urban millennials and premium e-commerce shoppers.

Overcoming stigma requires heavy investment in education campaigns, transparent labeling (vegan, clean-label, THC-free), and dermatologist-tested claims. Until perception gaps are fully bridged, CBD skincare adoption will remain skewed toward younger and more progressive consumers.

Rise of Hybrid Claims: Clean-Label, Vegan, and CBD-Infused

A notable trend is the emergence of hybrid product claims, where CBD is positioned alongside vegan, clean-label, natural/organic, and dermatologist-tested attributes. In 2025, natural/organic claims already command 50.5% of the market value (USD 858.6 million), and this figure is expected to rise sharply as consumers demand multi-layered trust signals.

Brands are responding by blending CBD with other trending actives such as hyaluronic acid, retinol alternatives, and niacinamide, while marketing them under vegan and cruelty-free banners. This not only widens the appeal of CBD products but also allows brands to compete in the broader premium skincare and clean beauty categories, moving beyond the CBD niche.

Asia-Pacific as the Growth Powerhouse for CBD Skincare

The second defining trend is the regional growth shift toward Asia-Pacific, led by China, India, and Japan. Together, these markets are projected to record CAGR levels of 22.2%, 23.7%, and 18.8%, respectively, far above the global average of 13.1%. This surge is driven by rising middle-class incomes, digital-first shopping behavior, and increasing openness to plant-based beauty solutions.

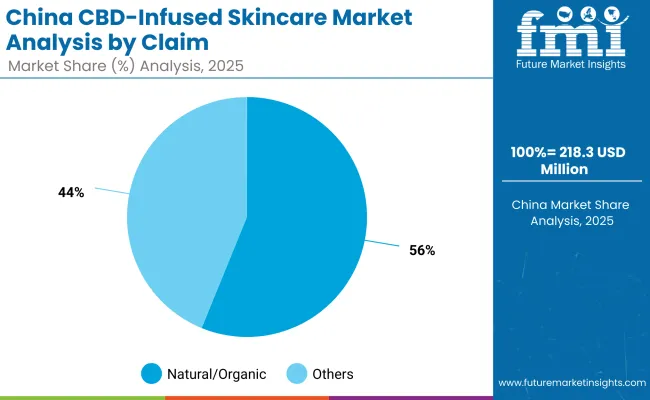

China, in particular, is witnessing rapid adoption in e-commerce-led beauty sales, with 56.2% of demand in 2025 linked to natural/organic claims. Japan is moving CBD skincare into premium channels, while India’s rapid CAGR reflects a demographic shift where young consumers are embracing CBD products as part of modern wellness.

By 2035, Asia-Pacific will be the epicenter of CBD skincare growth, with local regulations gradually evolving to accommodate this demand surge.

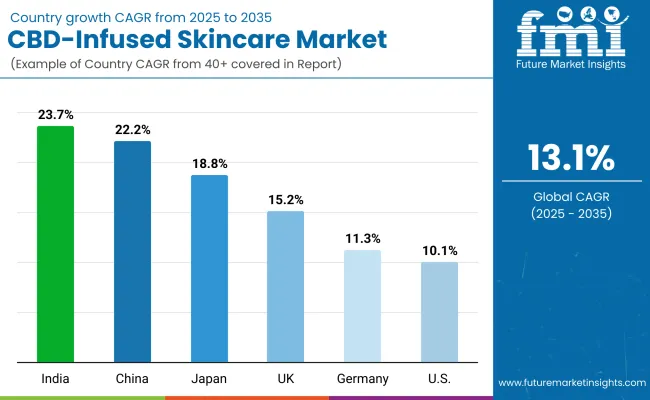

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 22.2% |

| USA | 10.1% |

| India | 23.7% |

| UK | 15.2% |

| Germany | 11.3% |

| Japan | 18.8% |

The Global CBD-Infused Skincare Market shows distinct country-level growth trajectories, with India (23.7%) and China (22.2%) leading as the fastest-growing markets from 2025 to 2035. In India, rapid adoption is being fueled by urban millennial consumers who favor natural/organic and vegan beauty products, alongside rising disposable incomes and digital-first purchasing behaviors.

The wellness-driven perception of CBD, aligned with Ayurveda-inspired plant-based preferences, is enabling faster acceptance compared to Western markets. Similarly, China is positioned as a growth powerhouse due to regulatory acceptance of CBD isolate in cosmetics, a surge in clean beauty claims (56.2% share in 2025), and strong e-commerce-led retail ecosystems that amplify consumer reach. Both countries reflect how Asia-Pacific is transforming into the central hub for CBD skincare innovation and expansion, outpacing more mature Western markets.

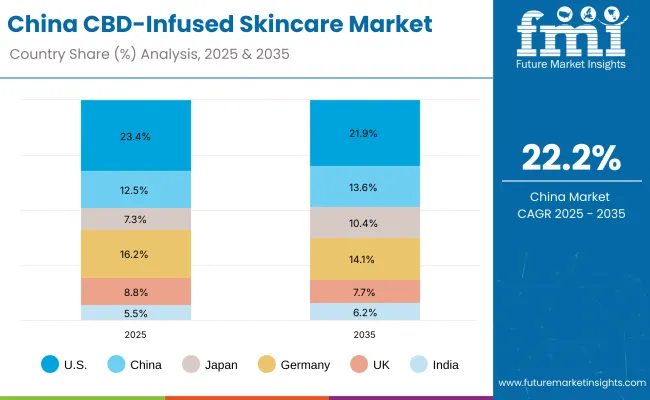

In contrast, developed markets like the USA (10.1%) and Germany (11.3%) are growing at a slower pace due to market maturity, regulatory complexities, and lingering consumer skepticism around cannabis-derived products. The USA, while still the largest single market contributor in 2025 with a 23.4% share, will see its relative share decline to 21.9% by 2035, as Asia-Pacific markets accelerate.

The UK (15.2%) and Japan (18.8%) reflect moderate-to-strong growth driven by premium skincare adoption and expanding retail acceptance of CBD-infused beauty lines. Japan’s shift is particularly notable, with its CAGR indicating a strong consumer pivot toward anti-aging and dermatologist-tested CBD skincare, while the UK benefits from an established clean beauty movement.

Collectively, these differences highlight how regional adoption patterns are diverging, with Asia-Pacific markets setting the pace for global CBD skincare expansion while Western countries consolidate and refine existing demand.

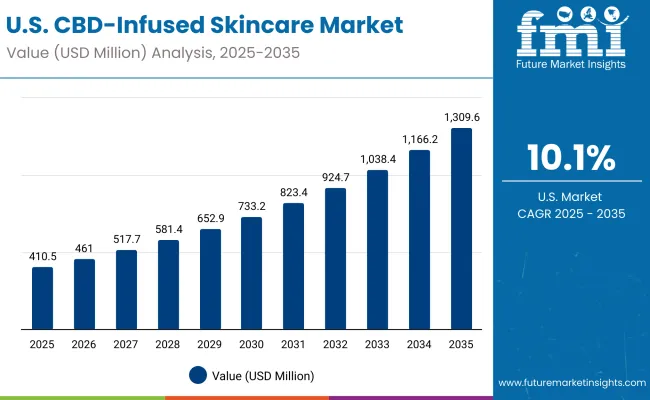

| Year | USA CBD-Infused Skincare Market (USD Million) |

|---|---|

| 2025 | 410.5 |

| 2026 | 461.0 |

| 2027 | 517.7 |

| 2028 | 581.4 |

| 2029 | 652.9 |

| 2030 | 733.2 |

| 2031 | 823.4 |

| 2032 | 924.7 |

| 2033 | 1,038.5 |

| 2034 | 1,166.2 |

| 2035 | 1,309.7 |

The Global CBD-Infused Skincare Market in the United States is projected to grow at a CAGR of 10.1%, supported by rising demand for anti-inflammatory and dermatologist-tested skincare solutions. Reverse migration from niche cannabis dispensaries into mainstream pharmacies and mass retail chains is expanding accessibility.

Product positioning around acne/blemish care and soothing formulations is gaining traction among younger consumers, while older demographics are increasingly adopting CBD-based anti-aging solutions. Digital-native brands are building strong momentum in e-commerce, but partnerships with dermatologists and established retailers are accelerating category legitimacy.

The Global CBD-Infused Skincare Market in the United Kingdom is expected to grow at a CAGR of 15.2%, supported by the country’s mature clean beauty movement and openness to natural/organic formulations. Premium skincare brands and high-street retailers have introduced CBD-infused lines, often positioned as vegan and cruelty-free.

Demand from urban consumers is rising, particularly in London and Manchester, where younger demographics are quick adopters of plant-based beauty. Institutional support through regulatory clarity on topical CBD use, combined with established specialty beauty retail chains, continues to accelerate expansion.

India is witnessing the fastest growth in the Global CBD-Infused Skincare Market, with a forecast CAGR of 23.7% through 2035. Rising awareness in tier-1 and tier-2 cities is being fueled by younger consumers who associate CBD with plant-based wellness and Ayurvedic traditions.

Premium e-commerce platforms are playing a crucial role in category introduction, with international brands piloting CBD skincare lines for Indian consumers. Local start-ups are also exploring blends of CBD with traditional botanicals like turmeric and neem, appealing to the growing middle-class interest in hybrid wellness-beauty products. Regulatory barriers remain, but demand is expected to expand rapidly once clarity increases.

The Global CBD-Infused Skincare Market in China is expected to grow at a CAGR of 22.2%, the second-highest among leading economies. Growth is driven by regulatory acceptance of CBD isolate in cosmetics, a surge in demand for natural/organic claims (56.2% share in 2025), and the country’s massive e-commerce infrastructure.

Domestic beauty brands are collaborating with online marketplaces like Tmall and JD.com to accelerate distribution, while global brands are targeting premium consumer segments. Municipal acceptance of CBD in skincare has enabled wider marketing campaigns, creating momentum for mass adoption.

| Country | 2025 Share (%) |

|---|---|

| USA | 23.4% |

| China | 12.5% |

| Japan | 7.3% |

| Germany | 16.2% |

| UK | 8.8% |

| India | 5.5% |

| Country | 2035 Share (%) |

|---|---|

| USA | 21.9% |

| China | 13.6% |

| Japan | 10.4% |

| Germany | 14.1% |

| UK | 7.7% |

| India | 6.2% |

| USA by Function | Value Share % 2025 |

|---|---|

| Anti-inflammatory | 55.2% |

| Others | 44.8% |

The Global CBD-Infused Skincare Market in the United States is projected at USD 410.51 million in 2025, expanding to over USD 1,309.69 million by 2035, growing at a CAGR of 10.1%. Anti-inflammatory skincare dominates with a 55.2% share, reflecting CBD’s strong positioning as a solution for redness, irritation, and acne/blemish management.

This category resonates with both younger consumers seeking acne treatments and older demographics focused on inflammation-linked aging. The USA market shows balanced adoption across product formats, with creams and lotions leading everyday use, while oils and serums are positioned in premium e-commerce channels.

Growth is further supported by dermatologist endorsements, pharmacy-led distribution, and increased presence in mainstream retail. Partnerships between CBD-native brands and major pharmacy chains provide credibility, while direct-to-consumer players drive education and awareness. With strong e-commerce infrastructure and growing social media advocacy, the USA is expected to remain a cornerstone of global demand, though its share is gradually declining as Asia-Pacific accelerates.

| China by Claim | Value Share % 2025 |

|---|---|

| Natural/organic | 56.2% |

| Others | 43.8% |

The Global CBD-Infused Skincare Market in China is expected to grow at a CAGR of 22.2%, making it one of the fastest-growing regions globally. Valued at USD 218.3 million in 2025 (12.5% global share), the market will expand rapidly as natural/organic CBD skincare claims dominate with a 56.2% share.

Regulatory acceptance of CBD isolate for cosmetics has accelerated new product launches, particularly through digital-first platforms like Tmall and JD.com. Consumers in tier-1 cities are driving demand for clean beauty and eco-friendly skincare, where CBD is positioned as both premium and functional.

China’s opportunity lies in the convergence of e-commerce scale, clean-label beauty adoption, and premiumization. Domestic brands are leveraging competitive pricing to expand reach, while international brands are using organic and vegan positioning to capture higher-end consumers. By 2035, China is projected to surpass traditional European markets in share, reshaping the global competitive order.

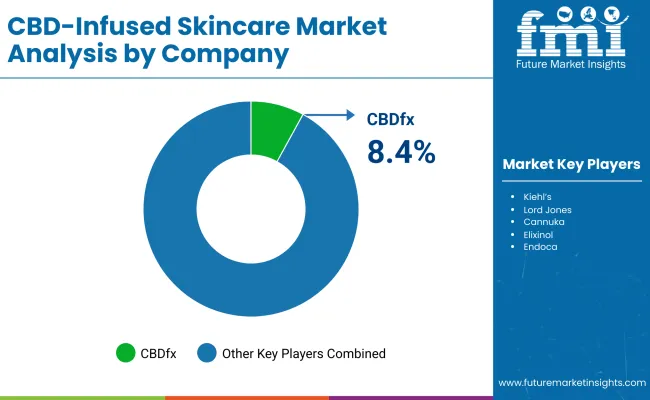

| Company | Global Value Share 2025 |

|---|---|

| CBDfx | 8.4% |

| Others | 91.6% |

The Global CBD-Infused Skincare Market is moderately fragmented, with specialist CBD brands, mainstream beauty giants, and wellness companies competing across different consumer segments. CBDfx, holding an 8.4% share, leads globally due to its extensive e-commerce reach, diversified CBD skincare portfolio, and aggressive social media-driven marketing. Its first-mover advantage and consumer education campaigns have positioned it as the benchmark for CBD skincare globally.

Mainstream players such as Kiehl’s and The Body Shop leverage strong retail footprints to normalize CBD skincare, appealing to consumers seeking trusted legacy beauty names. Premium CBD-first brands such as Lord Jones, Cannuka, and Vertly cater to niche markets with high-end positioning and curated retail strategies. Larger hemp companies like Charlotte’s Web, Endoca, and Medterra have extended into skincare, leveraging their credibility in supplements and wellness.

Competitive differentiation is shifting away from “CBD novelty” toward multi-claim positioning (vegan, clean-label, dermatologist-tested) and integrated brand ecosystems that emphasize transparency, safety, and premium quality. Digital-first CBD skincare brands are scaling through subscription models and influencer marketing, while mainstream beauty players emphasize dermatologist-backed claims and multi-channel distribution. Over the forecast period, success will depend on balancing CBD authenticity with broad clean beauty credentials to appeal to both niche and mass consumer bases.

Key Developments in Global CBD-Infused Skincare Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,752.6 Million |

| Function | Anti-inflammatory, Acne/blemish care, Anti-aging, and Soothing |

| Product Type | Creams/lotions, Oils, Serums, and Balms |

| Channel | E-commerce, Pharmacies, Mass retail, and Specialty beauty stores |

| Claim | Natural/organic, Vegan, Clean-label, and Dermatologist-tested |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CBDfx , Kiehl’s , Lord Jones, Cannuka , Elixinol , Endoca , Charlotte’s Web, Medterra , Vertly , and The Body Shop |

| Additional Attributes | Dollar sales by function, product type, channel, and claim; consumer adoption trends in natural/organic and dermatologist-tested categories; rising demand for anti-inflammatory CBD skincare; premiumization driven by serums and oils; growth of e-commerce and pharmacy distribution; hybrid claims combining vegan, clean-label, and CBD formulations; regional market acceleration in Asia-Pacific, especially China, India, and Japan; USA market maturity supported by retail mainstreaming; competitive landscape marked by digital-first brands and legacy beauty retailers. |

The Global CBD-Infused Skincare Market is estimated to be valued at USD 1,752.6 million in 2025.

The market size for the Global CBD-Infused Skincare Market is projected to reach USD 5,982.1 million by 2035.

The Global CBD-Infused Skincare Market is expected to grow at a 13.1% CAGR between 2025 and 2035.

The key product types in the Global CBD-Infused Skincare Market are creams/lotions, oils, serums, and balms.

In terms of function, the anti-inflammatory segment is projected to command 53.5% share in the Global CBD-Infused Skincare Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Global PDRN Skincare Market Size and Share Forecast Outlook 2025 to 2035

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Global Smart Skincare Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Ormedic Skincare Market Demand & Insights 2024-2034

Ceramide Skincare Market Size and Share Forecast Outlook 2025 to 2035

BPA-Free Skincare Market Trends – Demand & Forecast 2024-2034

Camellia Skincare & Cosmetics Market

Buffering Skincare Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Menopause Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA