The global self-healing materials market is projected to grow from USD 2,529.7 million in 2025 to USD 2,355.9 million by 2035, advancing at a CAGR of 25.0% during the forecast period. Market growth is being driven by advancements in polymer science, increased demand for durable and low-maintenance materials, and expanding adoption across automotive, construction, aerospace, and electronics sectors.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 2,529.7 million |

| Market Value (2035F) | USD 2,355.9 million |

| CAGR (2025 to 2035) | 25.0% |

Self-healing materials are being engineered to automatically repair microcracks, scratches, and structural defects without external intervention, extending component life, improving safety, and reducing long-term maintenance costs. These materials are being integrated into smart coatings, composites, concrete, electronic circuits, and consumer products, supporting use cases where durability and reliability are paramount.

Polymeric self-healing systems, such as microencapsulated agents and reversible chemical bonds, are being applied in structural adhesives and coatings. Vascular healing systems and shape-memory polymers are being developed for high-performance applications in transportation, energy, and consumer electronics. These innovations are improving the effectiveness of material restoration while preserving mechanical integrity under stress.

In automotive and aerospace applications, self-healing composites are being incorporated into exterior panels, structural joints, and electrical components to enhance crash resistance and operational safety. In the construction industry, smart cement and concrete formulations with self-healing additives are being deployed to support long-life infrastructure with reduced maintenance needs, aligning with public sector goals on resilience and sustainability.

In electronics, self-healing circuits and stretchable materials are being explored to support flexible displays, wearable devices, and printed circuit boards. These developments are addressing key challenges in the miniaturization and durability of electronic components, particularly for emerging technologies in consumer electronics and IoT systems.

Supportive government policies promoting sustainable infrastructure and advanced materials innovation are further accelerating market adoption. Research funding and pilot-scale projects are being implemented to commercialize self-healing solutions in civil, automotive, and defense applications.

The self-healing materials market is expected to sustain rapid growth through 2035, supported by smart material innovations, environmental compliance goals, and increasing emphasis on lifecycle efficiency and material resilience.

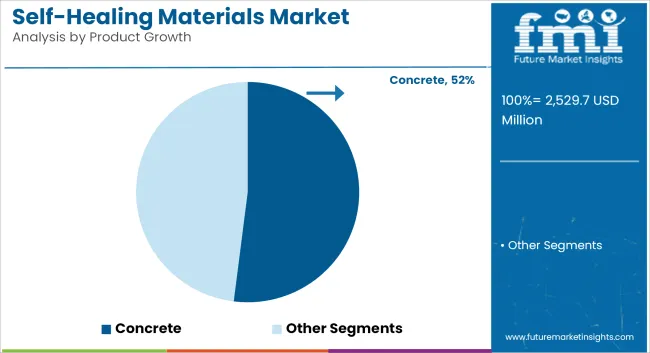

Concrete is projected to be the dominant product in the self-healing materials market, accounting for approximately 52% of total demand in 2025, with a projected CAGR of 18.5% through 2035. The segment's growth is underpinned by increasing applications in transportation infrastructure, water management systems, and sustainable urban development. Self-healing concrete is being deployed in bridges, tunnels, dams, and high-performance buildings due to its ability to seal microcracks, resist chemical ingress, and extend structural life.

Public infrastructure authorities in the EU and USA are incorporating self-healing specifications in road and bridge rehabilitation projects, supported by smart city and resilience initiatives. In developing regions like Southeast Asia and Latin America, rapid urbanization and high maintenance costs are pushing governments to adopt long-lasting construction materials. Additionally, the integration of bacterial and polymer-based self-healing technologies is gaining commercial traction, with companies such as Basilisk, AkzoNobel, and Acciona pioneering large-scale deployments.

Ongoing research and pilot deployments in university-led public infrastructure programs are validating long-term performance and cost-saving benefits, positioning self-healing concrete as a transformative material in future-ready infrastructure projects.

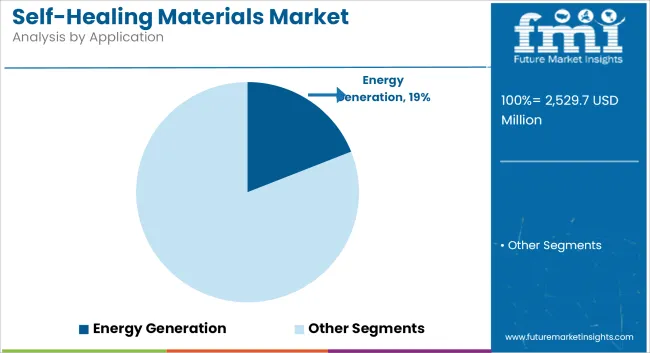

The energy generation sector is expected to become a major application area for self-healing materials, representing over 19% of global demand by 2025 and projected to grow at a CAGR of 16.8% through 2035. The integration of self-healing coatings, composites, and concrete in renewable energy installations-particularly wind turbines, hydroelectric dams, and solar power structures-is gaining traction due to the need for uninterrupted operations and reduced maintenance cycles.

Wind energy installations, both onshore and offshore, are deploying self-healing composites in turbine blades to address erosion, cracking, and fatigue. In the hydropower sector, self-healing concrete and coatings help prevent leakage and structural weakening in spillways, canals, and pressure conduits. Additionally, solar farms are utilizing self-repairing polymers to reduce damage from UV exposure, temperature cycling, and environmental stressors.

Utility companies and EPC contractors are increasingly adopting performance-based material selection criteria, making self-healing materials attractive for long-term returns. Energy policy frameworks in the U.S., EU, and China are incentivizing infrastructure durability and resilience, which is prompting a surge in R&D collaborations and pilot-scale rollouts in this segment. As renewable energy infrastructure scales globally, the energy sector is expected to play a key role in accelerating the commercial maturity of self-healing technologies.

High Production Costs and Commercialization Barriers

Engineers have developed a new way to create an organic self-healing material with potentially very low production costs, but the routine use of materials that can self-repair and regenerate their own performance is still a long way off. Indeed, the majority of self-healing technologies are still at the developmental or early commercialization stage, limiting their use for mass-market applications. Moreover, the introduction of a self-healing mechanism that does not compromise mechanical strength or thermal stability is still a materials engineering challenge.

Integration in Smart Infrastructure and Consumer Electronics

In self-healing materials is expected to boom, with the increasing focus on smart cities and smart infrastructure as a potential market, particularly in roads, tunnels and utility networks, the researchers said. However, generating various types of materials with the aforementioned properties promotes significant durability, safety, and maintenance cost reduction.

At the same time, the increasing growth of flexible electronics, wearable devices, and foldable smart phones brings forth fresh demand for self-healing polymers and conductive coatings. Businesses that concentrate on scalable, cost-efficient production and application-specific breakthroughs will be able to take advantage of these high-growth sectors.

Self-Healing Materials market is at a CAGR of 26.2% during the forecast period. Bottom line, in critical verticals such as construction, aerospace, automotive, defence sectors, where material lifecycle times and autonomous repair are major vectors of performance and cost savings, demand is scaling exponentially.

Large numbers of world-class R&D institutes, considerable federal funding for smart materials, and high penetration of advanced technologies in both commercial and residential sectors support growth. Self-healing polymers, composites and coatings are being increasingly considered for infrastructure repair and electronics applications as the lifecycle cost and system resilience are the primary motivators.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 26.2% |

The self-healing materials market in the UK is anticipated to grow at a CAGR of over 24.3% through 2035. Considerable academic-industry partnerships and investments in research particularly in nanomaterials, self-healing concrete, and bio-inspired polymerase facilitating in the shift towards autonomous repair technologies.

Nations’ strong sustainability mandates, and low-carbon construction targets, are driving builders and developers to install smart materials that slash long-term maintenance and environmental impact. Applications are growing beyond just construction to aerospace and renewable energy systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 24.3% |

Europe will grow at 25.1% CAGR, with Germany, France, and the Netherlands leading the way. In the public infrastructure, automotive, and packaging sectors, the regulatory pressure to adhere to circular economy goals is driving an increase in the adoption of durable and repairable materials.

In the East, public and private companies are investing heavily in bio-based and thermoplastic self-healing compounds and EU cofounded projects keep promoting collaboration between industrial and academia. Multifunctional composites in aerospace and EV manufacturing also significantly contribute to market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| Europe | 25.1% |

Japan is expected to be the second largest market for self-healing materials with a CAGR of 24.7% between 2025 and 2035. Its leadership in areas such as materials science, robotics, and high-performance coatings are generating demand across sectors including electronics, semiconductors, and infrastructure.

In a civil context, self-healing materials are making their way into not just consumer electronics and automotive components, but also in cities in the midst of an inner-city makeover. Japanese spaces any to reversible and dynamic polymer networks that fusion make for heat customer imagination and long stable control, particularly in all energy and construction hospitable.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 24.7% |

South Korea is expected to witness a CAGR of 25.0% from 2023 to 2035, driven by national investments in Smart Infrastructure and materials Innovation. With its strengths in semiconductor and display manufacturing, the country is finding new uses for self-healing films, coatings and substrates.

Building companies are testing within their public works and smart city projects self-healing concrete. From academia to tech-forward government initiatives, efforts to scale up new material systems make South Korea another major innovator on the global map for self-healing materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 25.0% |

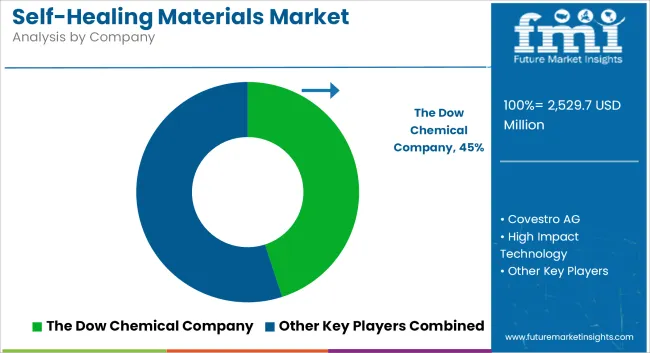

The self-healing materials market is characterized by intense innovation-led competition, with companies investing heavily in R&D to commercialize multifunctional, cost-effective, and environmentally friendly solutions. Key market players are focusing on patent-protected technologies, including microencapsulation, vascular networks, and bacteria-based healing mechanisms to gain first-mover advantage.

Strategic partnerships between material science firms and infrastructure developers are increasingly common, enabling co-development of field-tested solutions tailored for real-world performance. Expansion of pilot plants and demonstration projects is aiding in technology validation and regulatory approvals, particularly in Europe and North America. Several players are targeting vertical integration, from microbial culture development to final formulation, to secure supply chain control and optimize performance.

The overall market size for the Self-Healing Materials Market was approximately USD 2,529.7 million in 2025.

The Self-Healing Materials Market is expected to reach around USD 2,355.9 million by 2035.

The demand is driven by increasing applications in construction for durable infrastructure, automotive sector for enhanced vehicle longevity, and electronics industry for damage-resistant components.

The top 5 countries driving market growth are the USA, UK, Europe, Japan, and South Korea.

The Microencapsulation is expected to command a significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nanomaterials Market Insights - Size, Share & Industry Growth 2025 to 2035

Tire Materials Market Insights – Size, Trends & Forecast 2025–2035

Facade Materials Market Size and Share Forecast Outlook 2025 to 2035

Solder Materials Market Size and Share Forecast Outlook 2025 to 2035

Sheath Materials Market Size and Share Forecast Outlook 2025 to 2035

Cathode Materials for Solid State Battery Market Size and Share Forecast Outlook 2025 to 2035

Exosuit Materials Market Size and Share Forecast Outlook 2025 to 2035

Stealth Materials and Coatings Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Recycling Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Market: Growth, Trends, and Future Opportunities

Optical Materials Market - Trends & Forecast 2025 to 2035

Circuit Materials Market Analysis based on Substrate, Conducting Material, Outer Layer, Application, and Region: Forecast for 2025 and 2035

Graphite Materials Market Size and Share Forecast Outlook 2025 to 2035

Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Recycled Materials Packaging Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Materials Market Growth - Trends & Forecast 2025 to 2035

Fluoride Materials Market

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Strapping Materials Market Size and Share Forecast Outlook 2025 to 2035

Smart Card Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA