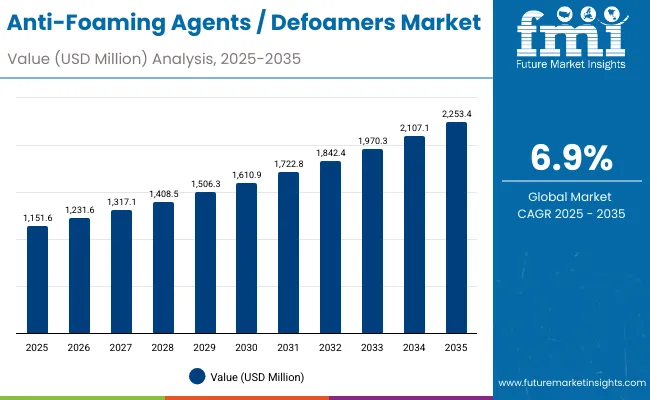

The Anti-Foaming Agents / Defoamers Market is expected to record a valuation of USD 1,151.6 million in 2025 and USD 2,253.4 million in 2035, with an increase of USD 1,101.8 million, which equals a growth of 95.6% over the decade. The overall expansion represents a CAGR of 6.9% and nearly a 2X increase in market size.

Anti-Foaming Agents / Defoamers Market Key Takeaways

| Metric | Value |

|---|---|

| Anti-Foaming Agents / Defoamers Market Estimated Value in (2025E) | USD 1,151.6 million |

| Anti-Foaming Agents / Defoamers Market Forecast Value in (2035F) | USD 2,253.4 million |

| Forecast CAGR (2025 to 2035) | 6.9% |

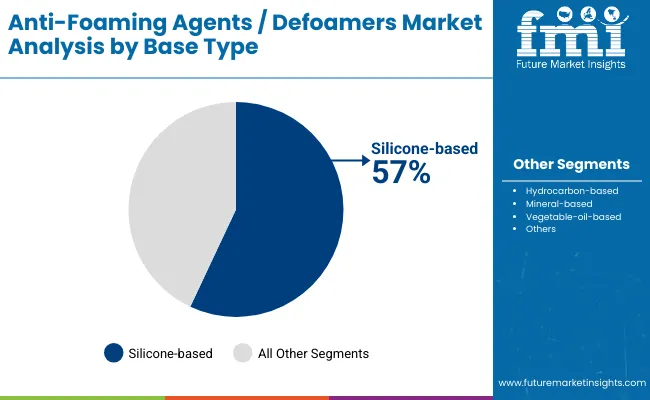

During the first five-year period from 2025 to 2030, the market increases from USD 1,151.6 million to USD 1,610.9 million, adding USD 459.3 million, which accounts for 41.7% of the total decade growth. This phase records steady adoption in skincare, haircare, and oral care processing, driven by the need for efficient foam suppression in both cold and hot processing conditions. Silicone-based defoamers dominate this period as they cater to over 57% of industrial and cosmetic applications requiring reliable and high-performance foam control.

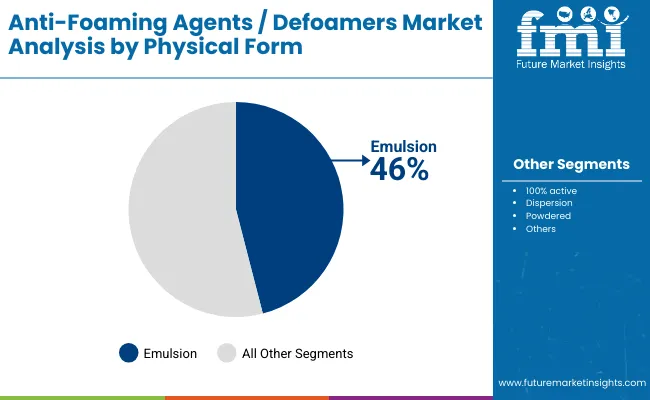

The second half from 2030 to 2035 contributes USD 642.5 million, equal to 58.3% of total growth, as the market jumps from USD 1,610.9 million to USD 2,253.4 million. This acceleration is powered by widespread deployment of high-shear stable and broad-pH formulations that can sustain under diverse processing environments. Innovations in vegetable-oil-based and mineral-based defoamers gain traction due to clean-label positioning, sustainability focus, and consumer preference for naturally derived ingredients. Emulsion-based formats continue to be dominant, but dispersions and powdered forms capture additional share as manufacturers look for versatile and cost-efficient solutions.

From 2020 to 2024, the Anti-Foaming Agents / Defoamers Market grew from USD 945.2 million to USD 1,100.0 million, driven by silicone and hydrocarbon-based formulations dominating industrial processing. During this period, the competitive landscape was led by multinational chemical companies controlling nearly 65% of revenue, with leaders such as Dow, Wacker, and BASF focusing on tailored silicone-based systems for high-volume manufacturing. Competitive differentiation relied on thermal stability, efficacy under shear stress, and cost competitiveness, while mineral and vegetable-oil-based solutions were often limited to niche applications with minimal traction.

Demand for defoamers expands to USD 1,151.6 million in 2025, and the revenue mix begins to shift as natural-origin and high-performance stable formulations grow to over 45% share by the end of the forecast period. Traditional silicone leaders face rising competition from players offering biodegradable, low-VOC, and sustainable alternatives. Major companies are pivoting to hybrid portfolios, combining silicone efficacy with plant-based versatility, to retain relevance in highly regulated personal care markets. Emerging entrants specializing in multifunctional defoamers compatible with microbiome-balancing and pH-sensitive formulations are gaining share. The competitive advantage is moving away from price competitiveness alone to sustainability, regulatory compliance, and adaptability across diverse formulations.

Advances in formulation chemistry have improved stability and efficiency, allowing for broader adoption across personal care and industrial applications. Silicone-based defoamers remain popular due to their superior performance in high-shear and broad pH conditions, which are common in skincare, haircare, and bath & shower processing. The rise of emulsion technology has contributed to enhanced dispersion, easier incorporation into formulations, and reduced dosage requirements, making them the preferred format for both cost-sensitive and performance-driven markets.

Expansion of oral care and leave-on cosmetic formulations has further fueled market growth. Increasing focus on sustainability and clean-label solutions has opened opportunities for vegetable-oil-based defoamers, which align with consumer expectations for natural ingredients. Segment growth is expected to be led by silicone-based solutions in base type, emulsion in physical form, and high-shear stable defoamers in process compatibility due to their adaptability and effectiveness. Emerging markets such as India and Japan are set to outpace global averages due to premiumization and strong consumer adoption of advanced dermocosmetic and biotech-driven formulations.

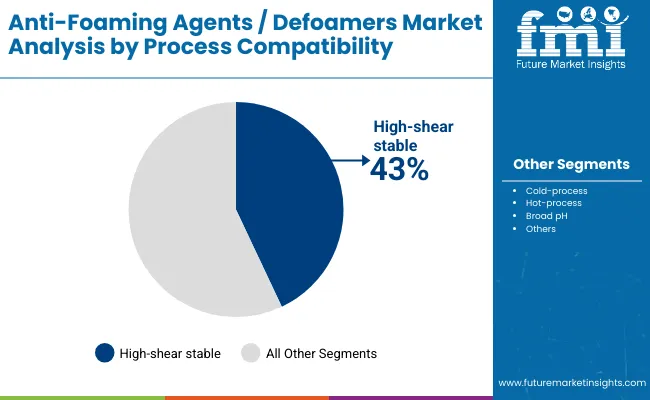

The market is segmented by base type, physical form, process compatibility, application role, end use, and geography. By base type, categories include silicone-based, hydrocarbon-based, mineral-based, and vegetable-oil-based solutions, highlighting the dominance of silicone but growing interest in natural oils. Physical form classification covers 100% active, emulsion, dispersion, and powdered forms to cater to diverse formulation needs. Based on process compatibility, segmentation includes cold-process, hot-process, high-shear stable, and broad-pH solutions, reflecting demand for versatility in manufacturing.

In terms of application role, categories encompass manufacturing process aid, rinse-off finished formulas, and leave-on finished formulas, capturing the value across both upstream and downstream product development. End uses include skincare processing, haircare processing, bath & shower processing, and oral care processing, representing the breadth of personal care applications. Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

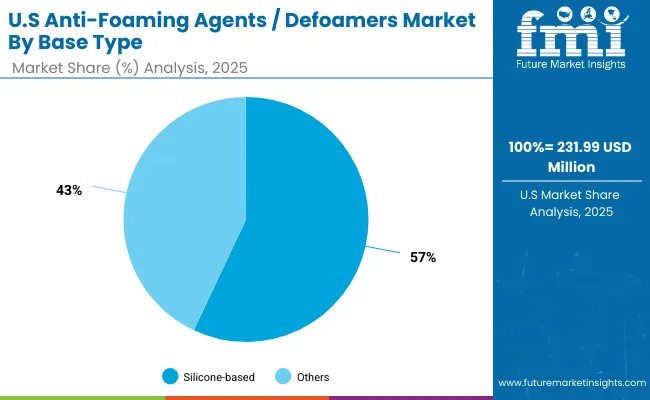

| Base Type | Value Share% 2025 |

|---|---|

| Silicone-based | 57% |

| Others | 43.0% |

The silicone-based segment is projected to contribute 57% of the Anti-Foaming Agents / Defoamers Market revenue in 2025, maintaining its lead as the dominant base type category. This is driven by ongoing demand for highly effective foam control agents that provide stability under high shear and diverse pH conditions. Silicone-based formulations have been prioritized by manufacturers seeking reliable, consistent performance in both personal care and industrial applications.

The segment’s growth is also supported by the development of advanced silicone emulsions and dispersions that improve compatibility with water-based systems. As sustainability and regulatory compliance become increasingly critical, silicone-based defoamers are being reformulated to balance performance with eco-friendly requirements. The silicone-based segment is expected to retain its position as the backbone of defoamer solutions, particularly in skincare, haircare, and bath & shower processing.

| Physical Form | Value Share% 2025 |

|---|---|

| Emulsion | 46% |

| Others | 54.0% |

The emulsion segment is forecasted to hold 46% of the Anti-Foaming Agents / Defoamers Market share in 2025, led by its application in water-based formulations where easy dispersion and uniform performance are critical. Emulsion defoamers are favored for their ability to deliver consistent results at lower dosages, making them highly cost-efficient across large-scale manufacturing processes.

Their ease of incorporation into finished formulations and versatility across rinse-off and leave-on products have facilitated widespread adoption in the personal care industry. The segment’s growth is bolstered by technological advancements that improve stability, extend shelf life, and reduce separation issues in challenging environments. As manufacturers increasingly require multifunctional and ready-to-use solutions, emulsion formats are expected to continue their dominance in the market.

| Process Compatibility | Value Share% 2025 |

|---|---|

| High-shear stable | 43% |

| Others | 57.0% |

The high-shear stable segment is projected to account for 43% of the Anti-Foaming Agents / Defoamers Market revenue in 2025, establishing it as the leading process compatibility type. These defoamers are preferred for their ability to withstand demanding processing conditions, where intense mixing and mechanical forces often degrade conventional formulations.

Their suitability for high-speed manufacturing of skincare, haircare, and oral care products has made them a popular choice across both mass and premium brands. Developments in silicone chemistry and additive blends have enhanced stability, ensuring longer-lasting foam suppression without compromising product aesthetics. Given their balance of robustness and versatility, high-shear stable defoamers are expected to maintain their leading role in the global market.

Rising Demand for Stable Processing in High-Shear Personal Care Manufacturing

A major driver is the increasing complexity of formulations in skincare, haircare, and oral care products, which rely on high-shear manufacturing processes such as homogenization and high-speed mixing. These processes generate persistent foam that reduces efficiency and compromises product uniformity. The demand for high-shear stable defoamers already accounting for 43% of the market in 2025 is expanding rapidly because they ensure smoother processing, shorter production cycles, and lower rework costs. In markets like the USA and Europe, where premium dermocosmetics and microbiome-friendly formulations are booming, the ability to maintain foam control without destabilizing active ingredients has positioned high-shear stable silicone defoamers as indispensable.

Shift Toward Sustainable and Natural-Origin Ingredients in Formulation Aid

Consumer and regulatory pressures are driving personal care manufacturers to adopt vegetable-oil-based and mineral-based defoamers as alternatives to traditional silicone and hydrocarbon systems. Emerging markets like India and Japan, where natural beauty and clean-label products dominate, are witnessing a surge in adoption of vegetable-oil-based defoamers. These align with the sustainability goals of global brands and help differentiate products in competitive retail environments. Companies such as BASF and Evonik are investing in hybrid solutions that combine the efficiency of silicones with bio-based carriers, offering formulators both sustainability compliance and high performance.

Regulatory and Labeling Challenges for Silicone-Based Formulations

While silicone-based defoamers hold 57% market share in 2025, their long-term dominance is being challenged by increasingly strict regulatory and labeling requirements. In Europe, restrictions on certain silicones in rinse-off applications due to environmental persistence are forcing manufacturers to reformulate or phase out certain grades. This creates additional costs for producers and can limit market access in regions where eco-certification (e.g., COSMOS, ECOCERT) is critical for brand positioning. As a result, manufacturers that rely heavily on silicones face hurdles in aligning with sustainability-driven markets.

Cost Sensitivity in Emerging Markets Affecting Premium Formulations

In regions like South Asia & Pacific and parts of Latin America, cost-sensitive consumer markets often prioritize affordability over advanced formulation performance. Premium defoamers, particularly high-shear stable silicones, are sometimes too costly for local manufacturers, leading them to adopt cheaper, less effective alternatives. This slows penetration of advanced defoaming solutions in mass-market product lines, especially in bath & shower and oral care categories where price competition is intense. This cost barrier restrains growth, even though demand for basic foam suppression remains high.

Integration of Defoamers with Multi-Functional Cosmetic Additives

A significant trend is the shift toward multifunctional defoamers that combine foam suppression with added benefits such as emulsification, texture enhancement, or skin-feel improvement. Brands are seeking to minimize ingredient lists for clean-label positioning, so suppliers are innovating with defoamers that serve dual roles in formulations. For example, emulsion-based defoamers are being tailored not only to suppress foam but also to contribute to viscosity control in haircare and skincare creams. This trend is particularly evident in Japan, where biotech-driven multifunctional ingredients are accelerating adoption in premium cosmetic segments.

Growth of Emulsion-Based Formats for Ease of Incorporation

Emulsions, holding 46% share in 2025, are rapidly becoming the industry standard due to their ease of handling, dispersion, and compatibility with water-based formulations. Their growth is tied to increasing demand for rinse-off and leave-on personal care products, where uniform distribution of defoamers is critical for performance. Innovations in low-VOC and preservative-free emulsions are also aligning with clean-beauty standards, especially in Europe and North America. This trend is reinforced by global suppliers like Wacker and Momentive, who are investing in next-generation emulsions that improve stability and reduce dosage needs.

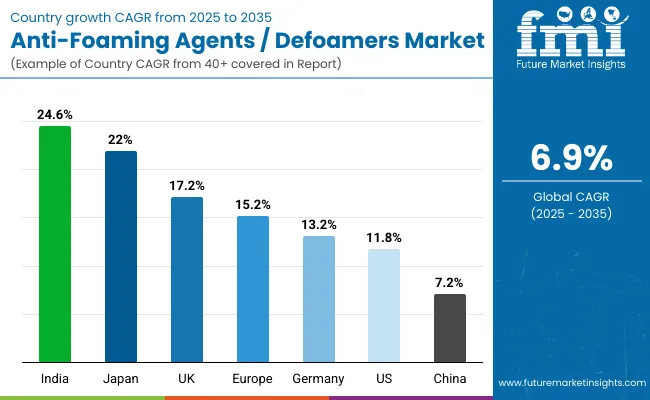

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 7.2% |

| USA | 11.8% |

| India | 24.6% |

| UK | 17.2% |

| Germany | 13.2% |

| Japan | 22.0% |

| Europe | 15.2% |

The Anti-Foaming Agents / Defoamers Market shows strong regional contrasts in growth trajectories between 2025 and 2035. India is expected to record the fastest CAGR at 24.6%, driven by a combination of rapid industrial expansion in personal care manufacturing and consumer preference for affordable yet effective skincare and haircare products. Local manufacturers are increasingly integrating vegetable-oil-based defoamers to align with clean-label and herbal beauty trends, while multinational suppliers target India as a volume-led growth hub.

Japan follows closely with a CAGR of 22.0%, reflecting premiumization in dermocosmetics and a rising demand for multifunctional, biotech-derived defoamers compatible with advanced formulations. The USA at 11.8% CAGR highlights its position as a stable yet innovation-driven market, where silicone-based and high-shear stable defoamers remain dominant, but sustainability pressures are pushing companies toward hybrid systems that balance performance with eco-friendly attributes.

In Europe, overall growth stands at 15.2% CAGR, though individual countries such as the UK (17.2%) and Germany (13.2%) display distinct patterns. The UK is accelerating adoption of eco-certified emulsions and powdered defoamers, supported by strong consumer demand for clean-label bath and shower products. Germany’s growth is influenced by the country’s stringent regulatory environment, encouraging manufacturers to pivot from traditional silicone-based formulations toward mineral and vegetable-oil-based alternatives.

China, with a moderate 7.2% CAGR, is expanding steadily as a large-scale producer of personal care products, emphasizing cost-efficient emulsion and dispersion formats to serve domestic and export markets. Together, these country-level growth rates underscore how both affordability-driven adoption in emerging economies and innovation-led premiumization in developed markets are shaping the global trajectory of the defoamers industry.

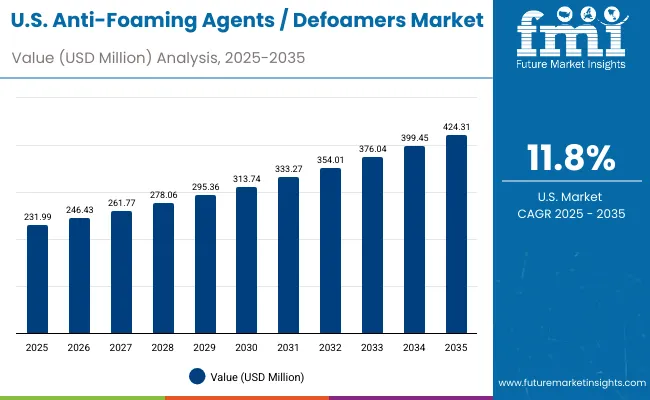

| Year | USA Anti-Foaming Agents / Defoamers Market (USD Million) |

|---|---|

| 2025 | 231.99 |

| 2026 | 246.43 |

| 2027 | 261.77 |

| 2028 | 278.06 |

| 2029 | 295.36 |

| 2030 | 313.74 |

| 2031 | 333.27 |

| 2032 | 354.01 |

| 2033 | 376.04 |

| 2034 | 399.45 |

| 2035 | 424.31 |

The Anti-Foaming Agents / Defoamers Market in the United States is projected to grow at a CAGR of 11.8%, led by strong adoption across skincare, haircare, and bath & shower processing industries. Premium cosmetic manufacturers are increasingly using high-shear stable silicone-based defoamers, which accounted for over 57% of the market in 2025, to maintain consistent performance in fast production lines. Emulsion formats are also gaining momentum, particularly in rinse-off and leave-on applications where uniform distribution is critical. Sustainability pressures are driving innovation toward hybrid silicone-vegetable blends that meet eco-labeling standards while retaining performance.

The Anti-Foaming Agents / Defoamers Market in the United Kingdom is expected to grow at a CAGR of 17.2%, supported by demand in premium haircare and bath & shower categories. UK formulators are prioritizing eco-certified emulsions and mineral-oil alternatives to replace conventional silicones in rinse-off applications. Niche growth is also observed in oral care, where microfoam suppression is critical for product stability and user experience. Regulatory compliance with EU and UK standards has encouraged suppliers to reformulate toward clean-label and biodegradable options, creating opportunities for vegetable-oil-based defoamers.

India is witnessing rapid growth in the Anti-Foaming Agents / Defoamers Market, which is forecast to expand at a CAGR of 24.6% through 2035, the fastest globally. A sharp increase in demand from mass-market skincare and haircare brands is driven by affordability and rising awareness among consumers in tier-2 and tier-3 cities. Local manufacturers are adopting vegetable-oil-based and mineral-based defoamers to align with herbal and ayurvedic beauty trends, while multinational players are positioning silicone emulsions for premium categories. Oral care processing is also gaining importance, with Indian brands focusing on low-cost defoamer solutions to scale production volumes.

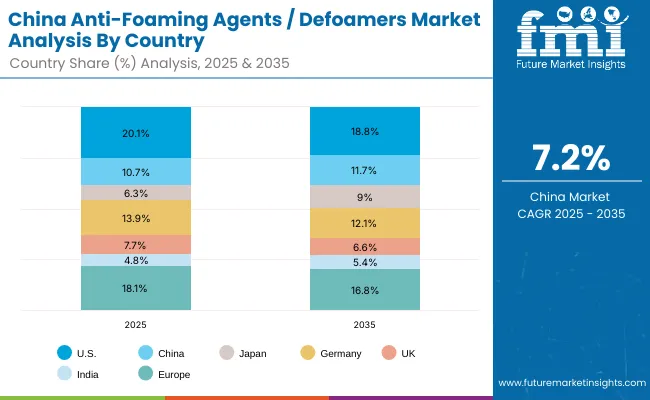

| Countries | 2025 Share (%) |

|---|---|

| USA | 20.1% |

| China | 10.7% |

| Japan | 6.3% |

| Germany | 13.9% |

| UK | 7.7% |

| India | 4.8% |

| Europe | 18.1% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 18.8% |

| China | 11.7% |

| Japan | 9.0% |

| Germany | 12.1% |

| UK | 6.6% |

| India | 5.4% |

| Europe | 16.8% |

The Anti-Foaming Agents / Defoamers Market in China is expected to grow at a CAGR of 7.2%, reflecting steady but competitive expansion. Growth is primarily driven by large-scale skincare and bath & shower manufacturing hubs that emphasize cost-efficient emulsion and dispersion defoamers. Domestic producers are scaling affordable, high-volume emulsions to meet export requirements, particularly for Southeast Asian markets. Multinational players are investing in silicone-based high-shear stable systems for premium brands, but adoption remains limited to urban consumer segments. The government’s focus on green chemistry is encouraging suppliers to experiment with hybrid and mineral-based solutions.

| USA by base type | Value Share% 2025 |

|---|---|

| Silicone-based | 57% |

| Others | 43.0% |

The Anti-Foaming Agents / Defoamers Market in the United States is projected at USD 231.99 million in 2025, expanding at a CAGR of 11.8% through 2035. Silicone-based defoamers contribute 57%, while other types (hydrocarbon, mineral, vegetable-oil-based) collectively account for 43%, highlighting the continued dominance of silicone solutions in the USA processing landscape. This leadership stems from their superior efficiency in high-shear and broad pH manufacturing environments, making them indispensable in skincare, haircare, and bath & shower processing.

Growing reliance on high-speed manufacturing lines and stringent product consistency requirements is a key catalyst, as foam control is critical to batch quality and throughput. USA manufacturers are also prioritizing emulsions within silicone systems, which disperse easily in aqueous formulations and improve cost efficiency. At the same time, pressure from sustainability-conscious consumers is nudging suppliers to explore hybrid silicone-vegetable blends, aligning with regulatory and eco-label standards. These dynamics ensure silicone’s strong position while opening pathways for natural alternatives to expand steadily.

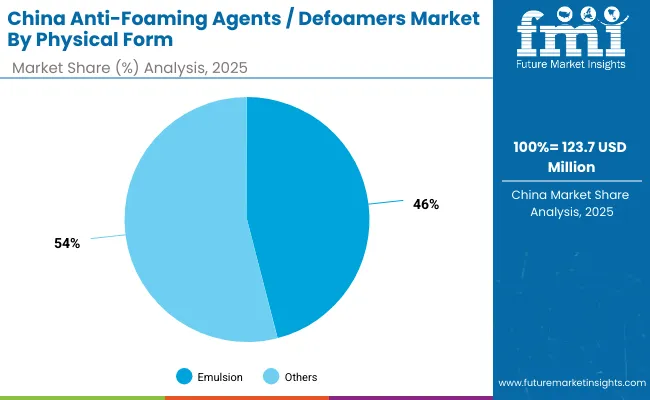

| China by Physical Form | Value Share% 2025 |

|---|---|

| Emulsion | 46% |

| Others | 54.0% |

The Anti-Foaming Agents / Defoamers Market in China is valued at USD 123.7 million in 2025, growing at a CAGR of 7.2% through 2035. Emulsion formats lead at 46%, followed by other physical forms (100% active, dispersions, powdered) at 54%. The dominance of emulsions reflects the large-scale adoption of water-based skincare and bath & shower formulations across Chinese manufacturing hubs, where cost efficiency and ease of incorporation are essential.

This advantage positions emulsions as a preferred choice for both domestic and export-oriented producers. Affordable emulsions supplied by local firms cater to mass-market brands, while multinationals invest in premium, high-shear stable emulsions for dermocosmetic applications in tier-1 cities. Broader process compatibility and scalability make emulsions indispensable to China’s rapidly growing personal care sector. As regulatory emphasis on green chemistry expands, hybrid emulsions combining silicone and vegetable-oil bases are expected to rise, balancing cost and compliance.

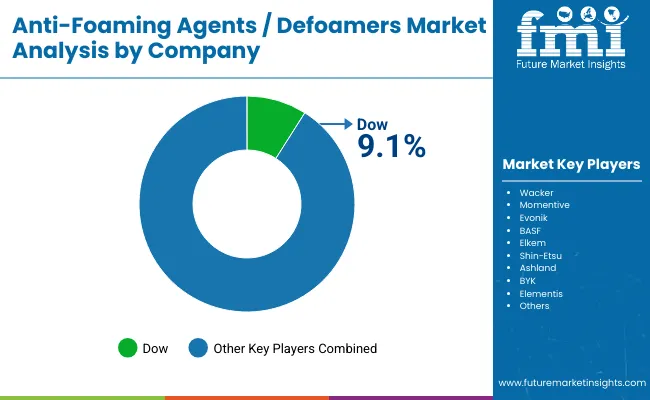

The Anti-Foaming Agents / Defoamers Market is moderately consolidated, with chemical giants, mid-tier specialty players, and regional suppliers competing across personal care, industrial processing, and oral care formulations. Global leaders such as Dow, Wacker, BASF, Evonik, and Momentive hold significant share, driven by extensive silicone-based portfolios, advanced high-shear stable systems, and strong penetration in premium skincare and haircare markets. Their strategies increasingly emphasize eco-compliant emulsions, hybrid formulations, and integrated solutions that align with sustainability commitments.

Established mid-sized players like Elkem, Shin-Etsu, Ashland, BYK, and Elementis serve demand for versatile dispersions, emulsions, and powdered formats that balance cost and performance. These companies are accelerating adoption in oral care and bath & shower segments, where ease of use and regulatory compliance are critical.

Niche-focused providers are responding with natural-origin and mineral-based alternatives, catering to herbal and ayurvedic personal care in markets like India, as well as clean-label certified products in the UK and Europe. Competitive differentiation is shifting away from cost-driven formulations toward sustainability, regulatory adaptability, and innovation in multifunctional defoamers that deliver both foam suppression and texture enhancement.

Key Developments in Anti-Foaming Agents / Defoamers Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Base Type | Silicone-based, Hydrocarbon-based, Mineral-based, Vegetable-oil-based |

| Physical Form | 100% active, Emulsion, Dispersion, Powdered |

| Process Compatibility | Cold-process, Hot-process, High-shear stable, Broad pH |

| Application Role | Manufacturing process aid, Rinse-off finished formulas, Leave-on finished formulas |

| End Use | Skincare processing, Haircare processing, Bath & shower processing, Oral care processing |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Dow, Wacker, Momentive, Evonik, BASF, Elkem, Shin-Etsu, Ashland, BYK, Elementis |

| Additional Attributes | Dollar sales by base type and physical form, adoption trends in skincare and haircare formulations, rising demand for high-shear stable and broad-pH defoamers, sector-specific growth in bath & shower and oral care, hybrid silicone-vegetable innovations, regional growth influenced by clean-label and sustainability initiatives, and advancements in emulsion and dispersion formats. |

The Anti-Foaming Agents / Defoamers Market is estimated to be valued at USD 1,151.6 million in 2025.

The market size for the Anti-Foaming Agents / Defoamers Market is projected to reach USD 2,253.4 million by 2035.

The Anti-Foaming Agents / Defoamers Market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in the Anti-Foaming Agents / Defoamers Market are silicone-based, hydrocarbon-based, mineral-based, and vegetable-oil-based defoamers.

In terms of physical form, the emulsion segment is set to command 46% share in the Anti-Foaming Agents / Defoamers Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anti-Foaming Personal Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Anti-Foaming Agents Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Leavening Agents Market Analysis - Size, Growth, and Forecast 2025 to 2035

Market Share Breakdown of Anti-Slip Agents Manufacturers

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA