The aerial firefighting market is projected to grow from USD 1.4 billion in 2025 to USD 2.3 billion by 2035, delivering an absolute gain of USD 0.9 billion and a growth multiplier of 1.64x over the decade. This growth, supported by a steady CAGR of 5%, is driven by increasing demand for aerial firefighting solutions due to more frequent and severe wildfires. In the first five years (2025–2030), the market will grow from USD 1.4 billion to USD 1.8 billion, adding USD 0.4 billion, which accounts for 45.5% of the total incremental growth, with a 5-year multiplier of 1.29x.

The early phase of growth is driven by rising climate change concerns and increasing investments in aerial firefighting infrastructure. The second phase (2030–2035) will contribute USD 0.5 billion, representing 54.5% of the total growth, reflecting stronger momentum as governments and private companies continue to invest in advanced firefighting technologies and increase the use of drones and autonomous aerial vehicles. Annual increments rise from USD 0.1 billion in early years to USD 0.2 billion by 2035, signaling a faster pace of growth. Manufacturers focusing on improving efficiency, fire suppression systems, and cost-effective solutions will capture the largest share of this USD 0.9 billion opportunity.

| Metric | Value |

|---|---|

| Aerial Firefighting Market Estimated Value in (2025 E) | USD 1.4 billion |

| Aerial Firefighting Market Forecast Value in (2035 F) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The aerial firefighting market is gaining significant traction due to the rising frequency and severity of wildfires driven by climate change, deforestation, and expanding urban–wildland interfaces. Governments and emergency response agencies are prioritizing the development and deployment of fast response systems that can combat large-scale fires efficiently.

Aerial assets, including fixed-wing aircraft and helicopters, are increasingly favored for their reach, speed, and ability to access difficult terrains. Innovations in water and retardant dispersal systems, improved avionics, and integration with satellite-based fire monitoring technologies are further enhancing operational effectiveness.

Budget allocations for disaster preparedness and emergency management are also increasing across multiple geographies. With rising public safety concerns and the intensification of wildfire events, the market is expected to grow steadily as countries invest in modernizing their aerial firefighting fleets and supporting infrastructure.

The aerial firefighting market is segmented by type, service end-user, and geographic regions. The aerial firefighting market is divided into Aircraft, Helicopter, Fixed-wing aircraft, and Unmanned Aerial Vehicles. In terms of service, the aerial firefighting market is classified into Firefighting operations, Aerial surveillance and monitoring, and Aerial logistics and support.

The end-users of the aerial firefighting market are segmented into the Government, Private firefighting contractors, and Industrial companies. Regionally, the aerial firefighting industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The aircraft segment is projected to hold 48.60% of the total market revenue by 2025 within the type category, making it the leading segment. This is due to the high payload capacity, extended range, and speed advantages offered by fixed wing aircraft in suppressing large scale wildfires.

These aircraft can cover wider geographical areas in a shorter time and are equipped with advanced dispersal systems that enable efficient deployment of fire retardants and water. Their utility in both direct attack and support missions has reinforced their operational value.

Additionally, ongoing modernization of aerial fleets and increasing contracts for large airtankers are contributing to the segment's dominance. The ability to perform long-duration missions and support coordinated firefighting strategies has further strengthened the aircraft segment’s leadership position.

The firefighting operations segment is expected to contribute 53.20% of overall market revenue by 2025 within the service category. This dominance is attributed to the growing reliance on aerial firefighting as a primary response method to manage and suppress increasingly destructive wildfires.

The segment benefits from the rising need for rapid response systems that can operate under diverse and extreme environmental conditions. Investment in aerial firefighting services is also driven by their strategic importance in protecting human life, infrastructure, and ecosystems.

Moreover, governments and agencies are contracting specialized service providers to augment their in house capabilities, expanding the reach and impact of this segment. As demand for integrated fire management solutions rises, firefighting operations remain the most critical and resource intensive service, securing their top position in the market.

The government segment is anticipated to hold 46.70% of the total market share by 2025 within the end user category. This leadership is driven by public sector responsibility in managing natural disasters and safeguarding national forests and residential communities.

Governments are the primary buyers and operators of aerial firefighting fleets, often through defense, interior, and disaster management departments. Funding for firefighting programs has increased significantly in response to high profile wildfire events and mounting pressure to enhance disaster preparedness.

Additionally, collaboration between federal, state, and municipal agencies has improved coordination and resource sharing, further boosting government investment. With a mandate to ensure public safety and environmental protection, the government segment continues to lead in aerial firefighting deployments and fleet expansion initiatives.

The aerial firefighting market is driven by the increasing frequency of wildfires and significant opportunities in government investments for firefighting modernization. Emerging trends such as hybrid aircraft and improved firefighting equipment are shaping the market. However, challenges like high operational costs and limited fleet capacity remain significant obstacles. By 2025, overcoming these challenges through cost-efficient solutions and better fleet management will be critical to ensuring the continued expansion of the aerial firefighting market, enabling faster and more effective responses to wildfires.

The aerial firefighting market is experiencing growth due to the increasing frequency and intensity of wildfires across the globe. Climate change, coupled with drought conditions, has made wildfires more prevalent, especially in regions such as North America, Australia, and Europe. Aerial firefighting, which includes aircrafts like helicopters and fixed-wing planes equipped with fire retardants, offers a fast and effective method for combating large-scale fires. By 2025, the demand for aerial firefighting services will continue to grow as the need for rapid, effective wildfire suppression increases.

Opportunities in the aerial firefighting market are growing as governments globally invest in improving firefighting capabilities. With the rising threat of wildfires, public and private sectors are committing to modernizing their firefighting fleets and adopting more advanced aircraft and equipment. Additionally, partnerships between governments and private contractors to improve firefighting infrastructure provide avenues for expansion. By 2025, these investments will drive the market as modernized fleets are deployed to combat increasingly destructive wildfires in vulnerable regions.

Emerging trends in the aerial firefighting market include the adoption of hybrid aircraft and more efficient firefighting equipment. Hybrid aircraft, combining electric and traditional fuel technologies, are being developed to reduce operational costs and environmental impact. Moreover, innovations in fire retardant systems, such as more effective and faster-dispensing technologies, are improving firefighting efficiency. By 2025, these trends will play a major role in reshaping the market, offering more sustainable and efficient options for aerial firefighting operations.

Despite growth, challenges such as high operational costs and limited fleet capacity persist in the aerial firefighting market. Operating aircraft for firefighting is expensive, requiring maintenance, fuel, and specialized crew training, which can be a significant financial burden for agencies, especially in countries with budget constraints. Additionally, the limited availability of aerial firefighting units in regions prone to wildfires can delay response times.

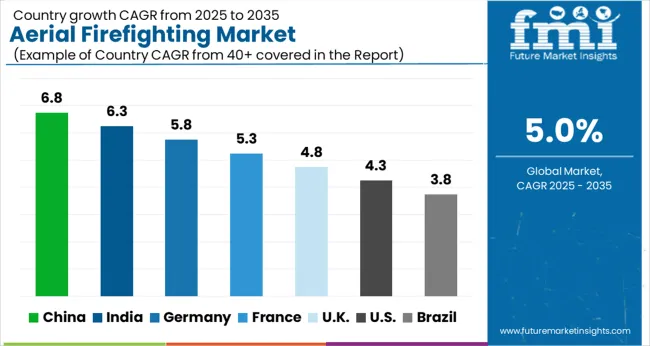

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global aerial firefighting market is projected to grow at a 5% CAGR from 2025 to 2035. China leads with a growth rate of 6.8%, followed by India at 6.3%, and France at 5.3%. The United Kingdom records a growth rate of 4.8%, while the United States shows the slowest growth at 4.3%. These varying growth rates are driven by increasing fire risks, the rising need for faster response times in firefighting operations, and growing investments in aerial firefighting technologies. Emerging markets like China and India are experiencing higher growth due to rapid urbanization, industrial expansion, and increasing wildfire threats, while more mature markets like the USA and the UK see steady growth driven by technological advancements, increased government funding, and the need for more efficient firefighting solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The aerial firefighting market in China is growing rapidly, with a projected CAGR of 6.8%. China’s increasing frequency of wildfires, combined with the country’s focus on improving disaster management and emergency response systems, is driving the demand for aerial firefighting solutions. The government’s investments in firefighting infrastructure, along with expanding forest protection programs, are further contributing to the adoption of aerial firefighting technologies. Additionally, China’s focus on urbanization and industrial expansion is leading to an increased risk of fire hazards, further accelerating the need for efficient aerial firefighting capabilities to protect both urban and rural areas.

The aerial firefighting market in India is projected to grow at a CAGR of 6.3%. India’s rapidly growing infrastructure, coupled with the increasing frequency of forest fires and urban fires, is driving the demand for advanced aerial firefighting technologies. The country’s rising focus on improving firefighting capabilities and disaster management systems, along with growing government investments in firefighting infrastructure, continues to support market expansion. Additionally, India’s increasing risk of wildfires, exacerbated by climate change, along with the rising population in urban areas, further accelerates the adoption of aerial firefighting solutions.

The aerial firefighting market in France is projected to grow at a CAGR of 5.3%. France’s rising wildfire risks, particularly in rural areas, combined with the country’s strong focus on protecting natural resources, is driving steady demand for aerial firefighting technologies. The government’s investments in firefighting equipment, along with rising support for forest management and fire protection programs, continue to fuel market growth. Additionally, France’s focus on improving its disaster response capabilities and the growing need for more efficient firefighting solutions are further contributing to the market expansion.

The aerial firefighting market in the United Kingdom is projected to grow at a CAGR of 4.8%. The UK’s growing need for efficient firefighting solutions, driven by increasing fire risks in rural and urban areas, is supporting steady market growth. The country’s regulatory focus on improving fire safety standards and emergency response systems continues to boost demand for advanced aerial firefighting technologies. Additionally, the UK’s ongoing investments in firefighting infrastructure and its commitment to improving climate resilience contribute to the adoption of more efficient and effective firefighting solutions.

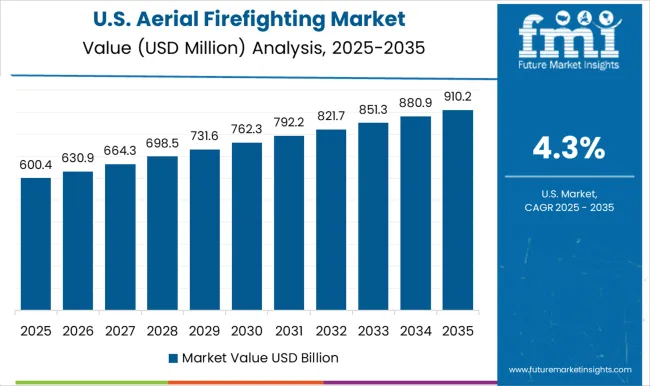

The aerial firefighting market in the United States is expected to grow at a CAGR of 4.3%. The USA market remains steady, driven by increasing fire risks, particularly in the western regions, and the growing demand for faster and more efficient firefighting technologies. The country’s focus on improving disaster response capabilities, combined with rising government investments in firefighting infrastructure and equipment, supports market growth. Additionally, the increasing frequency of wildfires due to climate change, along with the USA government’s commitment to reducing fire-related damages, further accelerates the demand for aerial firefighting technologies.

The aerial firefighting market is dominated by Aero Empresa Brasileira de Aeronáutica S.A. (Embraer), which leads with its specialized firefighting aircraft solutions designed to combat wildfires effectively and efficiently. Embraer’s dominance is supported by its innovative aircraft designs, global presence, and strong track record in providing high-performance aerial firefighting systems. Key players such as Air Tractor, Inc., Bombardier Inc., and Boeing Company maintain significant market shares by offering versatile, reliable aircraft tailored for fire suppression, providing robust performance in challenging environments. These companies focus on enhancing aircraft capabilities, improving water or retardant delivery systems, and integrating advanced technologies for better operational efficiency and safety. Emerging players like Coulson Aviation, Dauntless Air, Inc., and Bridger Aerospace Group Holdings, LLC are expanding their market presence by offering specialized aerial firefighting services and equipment, focusing on innovation, reliability, and cost-effectiveness. Their strategies include providing customizable solutions, leveraging modern firefighting aircraft, and enhancing the speed and accuracy of fire suppression operations. Market growth is driven by the increasing frequency of wildfires, government support for firefighting solutions, and the growing need for advanced technologies in emergency response. Innovations in drone-assisted firefighting, autonomous aircraft systems, and multi-role aerial platforms are expected to continue shaping competitive dynamics and fuel further growth in the global aerial firefighting market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Type | Aircraft, Helicopter, Fixed wing aircraft, and Unmanned aerial vehicles |

| Service | Firefighting operations, Aerial surveillance and monitoring, and Aerial logistics and support |

| End-user | Government, Private firefighting contractors, and Industrial companies |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aero Empresa Brasileira de Aeronáutica S.A., Aerovironment, Inc., Air Tractor, Inc., Airbus Defence and Space, Boeing Company, Bombardier Inc., Bridger Aerospace Group Holdings, LLC, Canadair Regional Jet, Conair Group Inc., Coulson Aviation, Dauntless Air, Inc., and Erickson Incorporated |

| Additional Attributes | Dollar sales by aircraft type and application, demand dynamics across wildfire control, government, and private sectors, regional trends in aerial firefighting adoption, innovation in firefighting technology and payload capacity, impact of regulatory standards on safety and environmental concerns, and emerging use cases in urban firefighting and disaster management systems. |

The global aerial firefighting market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the aerial firefighting market is projected to reach USD 2.3 billion by 2035.

The aerial firefighting market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in aerial firefighting market are aircraft, helicopter, _type 1, _type 2, _type 3, fixed wing aircraft and unmanned aerial vehicles.

In terms of service, firefighting operations segment to command 53.2% share in the aerial firefighting market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Aerial Ladder Trucks Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Aerial Imaging Market Share

Aerial Imaging Market Growth - Trends & Forecast 2025 to 2035

UK Aerial Imaging Market Trends – Demand, Innovations & Forecast 2025-2035

UK Aerial Work Platform Market Analysis – Size & Growth Forecast 2025-2035

USA Aerial Work Platform Market Insights – Demand, Size & Industry Trends 2025-2035

USA Aerial Imaging Market Analysis – Size & Industry Trends 2025-2035

BRICS Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Korea Aerial Work Platform MarketGrowth - Trends & Forecast 2025 to 2035

Japan Aerial Work Platform Market Growth – Innovations & Therapies 2025 to 2035

Japan Aerial Imaging Market Report – Trends & Innovations 2025-2035

ASEAN Aerial Work Platform Market Insights – Size, Trends & Forecast 2025-2035

Germany Aerial Imaging Market Analysis – Growth, Applications & Outlook 2025-2035

Germany Aerial Work Platform Market Trends – Demand & Outlook 2025-2035

Unmanned Aerial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Aerial Vehicles (UAV) Commercial Drone Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Aerial Robot Market Size and Share Forecast Outlook 2025 to 2035

GCC Countries Aerial Imaging Market Growth – Trends, Demand & Innovations 2025-2035

Western Europe aerial work platform market Analysis & Forecast by Product Type, End-use, Fuel Type, Platform Height, Sales Channel, and Region Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA