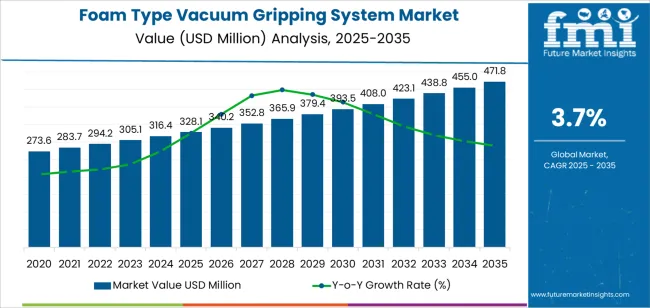

The foam type vacuum gripping system market is expected to grow from USD 328.1 million in 2025 to USD 471.9 million by 2035, supported by increasing automation in manufacturing, processing, and logistics environments. During the first phase of the forecast period (2025–2030), the market is expected to reach approximately USD 393.5 million, adding USD 65.4 million, which accounts for 45 percent of total decade growth. This phase is shaped by strong adoption of integrated vacuum generation units, where foam grippers are configured to handle variable shapes, uneven surfaces, and multi-part picking tasks without frequent tool changes. Facilities engaged in wood processing, panel handling, sheet metal fabrication, and packaging operations are prioritizing foam-based systems to increase throughput, reduce manual handling, and maintain process continuity in high-cycle environments.

In the latter phase (2030–2035), market expansion adds USD 78.4 million, reflecting broader deployment of external vacuum generation platforms integrated into robotic cells and automated handling lines. Growth will be driven by improved foam durability, optimized pore structures for consistent suction distribution, and gripper plate designs that enable quick replacement and layout flexibility. As manufacturers pursue higher operational efficiency and adaptive material handling capability, foam vacuum gripping systems will continue to expand across industries requiring reliable lifting, alignment, sorting, and transfer of large or irregular products.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | New system sales (integrated, external) | 54% | Automation-led, efficiency-driven purchases |

| Replacement foam pads & consumables | 26% | Wear parts, specialized foam materials | |

| Service & maintenance contracts | 12% | System diagnostics, vacuum optimization | |

| Custom solutions & integration | 8% | Application-specific designs, retrofits | |

| Future (3-5 yrs) | Smart vacuum systems | 46-50% | IoT connectivity, adaptive gripping control |

| Foam consumables & parts | 20-24% | Advanced foam materials, replacement pads | |

| Service-as-a-subscription | 14-17% | Performance monitoring, predictive maintenance | |

| Integration & commissioning | 10-13% | Robotic integration, system optimization | |

| Digital monitoring services | 6-9% | Vacuum analytics, efficiency tracking | |

| Training & consulting | 3-5% | Operator training, application development |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 328.1 million |

| Market Forecast (2035) | USD 471.9 million |

| Growth Rate | 3.7% CAGR |

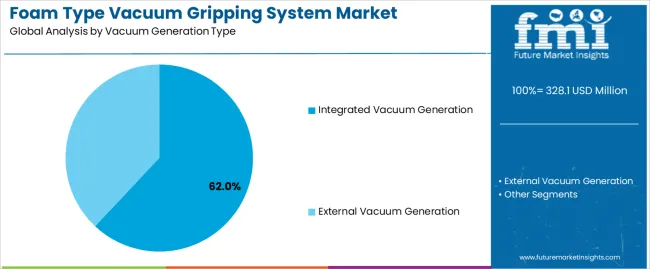

| Leading Technology | Integrated Vacuum Generation |

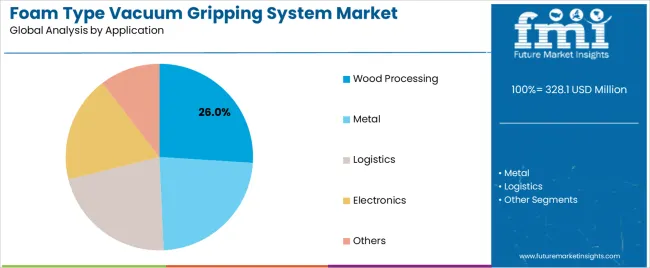

| Primary Application | Wood Processing Segment |

The market demonstrates strong fundamentals with integrated vacuum generation systems capturing a dominant share through advanced automation capabilities and material handling optimization. Wood processing applications drive primary demand, supported by increasing automation requirements and operational efficiency needs. Geographic expansion remains concentrated in developed markets with established manufacturing infrastructure, while emerging economies show accelerating adoption rates driven by industrial automation initiatives and rising productivity standards.

Primary Classification: The market segments by vacuum generation type into integrated vacuum generation and external vacuum generation, representing the evolution from basic gripping equipment to sophisticated handling solutions for comprehensive material processing optimization.

Secondary Classification: Application segmentation divides the market into wood processing, metal, logistics, electronics, and others, reflecting distinct requirements for handling capacity, operational efficiency, and material compatibility standards.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by automation expansion programs.

The segmentation structure reveals technology progression from standard vacuum equipment toward sophisticated gripping systems with enhanced control and automation capabilities, while application diversity spans from wood processing facilities to electronics manufacturing operations requiring precise material handling solutions.

Market Position: Integrated Vacuum Generation systems command the leading position in the foam type vacuum gripping system market with 62% market share through advanced compact features, including superior space efficiency, operational simplicity, and material handling optimization that enable manufacturing facilities to achieve optimal gripping consistency across diverse wood processing and logistics environments.

Value Drivers: The segment benefits from manufacturing facility preference for streamlined gripping systems that provide consistent handling performance, reduced installation complexity, and operational efficiency optimization without requiring significant infrastructure modifications. Advanced design features enable automated vacuum control, pressure monitoring, and integration with existing robotic equipment, where operational performance and space constraints represent critical facility requirements.

Competitive Advantages: Integrated Vacuum Generation systems differentiate through proven operational reliability, compact installation characteristics, and integration with automated manufacturing systems that enhance facility effectiveness while maintaining optimal handling standards suitable for diverse material processing applications.

Key market characteristics:

External Vacuum Generation systems maintain a 38% market position in the foam type vacuum gripping system market due to their centralized vacuum properties and high-capacity advantages. These systems appeal to facilities requiring multiple gripping points with competitive pricing for large-scale manufacturing applications. Market growth is driven by industrial expansion, emphasizing reliable vacuum distribution solutions and operational efficiency through optimized system designs.

Market Context: Wood Processing applications accounts 26% market share and demonstrate the highest growth rate in the foam type vacuum gripping system market with 4.5% CAGR due to widespread adoption of automation systems and increasing focus on material handling optimization, production efficiency enhancement, and quality applications that maximize output while maintaining handling standards.

Appeal Factors: Wood processing facility operators prioritize system versatility, material compatibility, and integration with existing manufacturing infrastructure that enables coordinated handling operations across multiple production stages. The segment benefits from substantial industrial investment and automation programs that emphasize the acquisition of vacuum gripping systems for productivity optimization and material handling applications.

Growth Drivers: Manufacturing expansion programs incorporate vacuum gripping systems as standard equipment for wood handling operations, while furniture industry growth increases demand for flexible handling capabilities that comply with quality standards and minimize operational complexity.

Market Challenges: Varying material characteristics and surface texture requirements may limit system standardization across different facilities or product scenarios.

Application dynamics include:

Metal applications capture significant market share through intensive handling requirements in sheet metal processing, stamping operations, and fabrication facilities. These applications demand robust gripping systems capable of operating with heavy loads while providing effective material control and operational reliability capabilities.

Logistics applications account for substantial market share, including warehouse operations, distribution centers, and fulfillment facilities requiring efficient handling capabilities for operational optimization and throughput efficiency.

Market Position: Electronics applications command notable market position with 4.2% CAGR through delicate component handling requirements that demand gentle gripping systems.

Value Drivers: Electronics manufacturing requires careful material handling meeting requirements for component protection, surface integrity, and operational precision without damage risks.

Growth Characteristics: The segment benefits from electronics industry expansion, automation advancement, and established quality programs that support widespread adoption and operational efficiency.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Industrial automation & robotics adoption (Industry 4.0, smart manufacturing) | ★★★★★ | Manufacturers invest in automated handling; robotic integration creates consistent demand for vacuum gripping systems with advanced control capabilities. |

| Driver | Labor shortage & productivity enhancement needs | ★★★★★ | Automation addresses workforce gaps; vacuum systems enable unmanned operations and increase throughput in manufacturing environments. |

| Driver | E-commerce growth & logistics automation expansion | ★★★★☆ | Warehouses need flexible handling solutions; distribution center automation drives demand for versatile gripping systems and material handling equipment. |

| Restraint | High initial investment & integration costs | ★★★★☆ | Small manufacturers defer automation; increases price sensitivity and slows vacuum system adoption in cost-conscious segments. |

| Restraint | Material compatibility & surface limitations | ★★★☆☆ | Porous or uneven surfaces challenge vacuum gripping; limits application scope and requires specialized solutions for difficult materials. |

| Trend | Lightweight materials & energy efficiency focus | ★★★★★ | Advanced foam compositions reduce energy consumption; efficient vacuum generation and optimized designs differentiate market offerings and operational costs. |

| Trend | Customization & application-specific solutions | ★★★★☆ | Industry-specific requirements drive tailored systems; modular designs and custom foam patterns enable differentiation and market segmentation. |

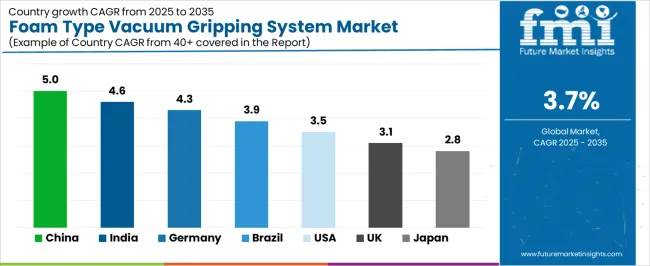

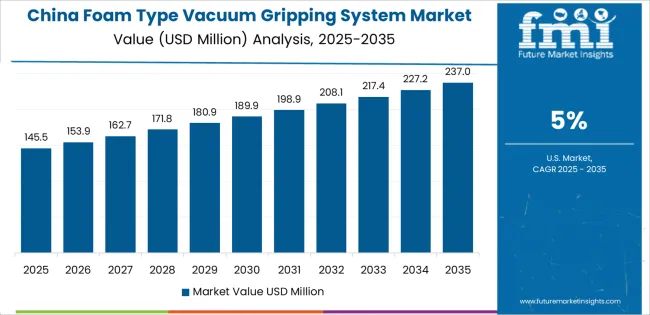

The foam type vacuum gripping system market demonstrates varied regional dynamics with Growth Leaders including China (5.0% growth rate) and India (4.6% growth rate) driving expansion through manufacturing automation initiatives and industrial development. Steady Performers encompass Germany (4.3% growth rate), Brazil (3.9% growth rate), and developed regions, benefiting from established manufacturing sectors and advanced automation adoption. Emerging Markets feature United States (3.5% growth rate) and United Kingdom (3.1% growth rate), where manufacturing modernization and automation initiatives support consistent growth patterns.

Regional synthesis reveals East Asian markets leading adoption through manufacturing expansion and automation development, while North American countries maintain steady expansion supported by industrial technology advancement and productivity standardization requirements. European markets show moderate growth driven by manufacturing applications and automation integration trends.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 5.0% | Lead with cost-effective automation | Price competition; IP protection |

| India | 4.6% | Focus on wood and metal sectors | Infrastructure gaps; technical support |

| Germany | 4.3% | Provide premium engineering | Over-specification; lengthy approval |

| Brazil | 3.9% | Value-oriented solutions | Import duties; economic volatility |

| United States | 3.5% | Emphasize reliability and service | Market maturity; competition intensity |

| United Kingdom | 3.1% | Push smart manufacturing | Brexit logistics; investment uncertainty |

| Japan | 2.8% | Advanced precision systems | Aging workforce; conservative adoption |

China establishes fastest market growth through aggressive manufacturing automation programs and comprehensive industrial development, integrating advanced foam type vacuum gripping systems as standard components in furniture manufacturing, electronics assembly, and logistics installations. The country's 5.0% growth rate reflects government initiatives promoting industrial automation and manufacturing efficiency capabilities that mandate the use of advanced handling systems in manufacturing and logistics facilities. Growth concentrates in major industrial hubs, including Guangdong, Zhejiang, and Jiangsu, where automation technology development showcases integrated vacuum gripping systems that appeal to manufacturing operators seeking advanced productivity optimization capabilities and material handling applications.

Chinese manufacturers are developing cost-effective vacuum gripping solutions that combine domestic production advantages with advanced operational features, including automated control systems and enhanced foam technology. Distribution channels through automation equipment suppliers and manufacturing service distributors expand market access, while government support for industrial modernization supports adoption across diverse manufacturing and logistics segments.

Strategic Market Indicators:

In Mumbai, Bengaluru, and Chennai, manufacturing facilities and logistics operations are implementing advanced foam type vacuum gripping systems as standard equipment for material handling and automation applications, driven by increasing government industrial investment and manufacturing modernization programs that emphasize the importance of automation capabilities. The market holds a 4.6% growth rate, supported by government manufacturing initiatives and industrial infrastructure development programs that promote advanced handling systems for manufacturing and logistics facilities. Indian operators are adopting vacuum gripping systems that provide consistent operational performance and reliability features, particularly appealing in urban regions where productivity efficiency and automation represent critical operational requirements.

Market expansion benefits from growing manufacturing capabilities and international technology partnerships that enable domestic production of advanced vacuum gripping systems for industrial and logistics applications. Technology adoption follows patterns established in industrial automation, where reliability and performance drive procurement decisions and operational deployment.

Market Intelligence Brief:

Germany establishes market leadership through comprehensive automation programs and advanced manufacturing infrastructure development, integrating foam type vacuum gripping systems across automotive, wood processing, and logistics applications. The country's 4.3% growth rate reflects established industrial relationships and mature automation technology adoption that supports widespread use of vacuum handling systems in manufacturing and distribution facilities. Growth concentrates in major industrial centers, including Baden-Württemberg, Bavaria, and North Rhine-Westphalia, where manufacturing technology showcases mature vacuum gripping deployment that appeals to industrial operators seeking proven material handling capabilities and operational efficiency applications.

German equipment providers leverage established distribution networks and comprehensive service capabilities, including integration programs and maintenance support that create customer relationships and operational advantages. The market benefits from mature automation standards and manufacturing requirements that mandate vacuum gripping system use while supporting technology advancement and operational optimization.

Market Intelligence Brief:

Brazil's market expansion benefits from diverse industrial demand, including manufacturing modernization in São Paulo and Curitiba, logistics facility upgrades, and government industrial programs that increasingly incorporate vacuum gripping solutions for automation applications. The country maintains a 3.9% growth rate, driven by rising manufacturing activity and increasing recognition of automation technology benefits, including improved material handling and enhanced operational efficiency.

Market dynamics focus on cost-effective vacuum gripping solutions that balance advanced operational performance with affordability considerations important to Brazilian manufacturing operators. Growing industrial modernization creates continued demand for automation systems in new facility infrastructure and manufacturing upgrade projects.

Strategic Market Considerations:

United States establishes steady growth through comprehensive manufacturing programs and advanced automation infrastructure development, integrating foam type vacuum gripping systems across manufacturing, logistics, and distribution applications. The country's 3.5% growth rate reflects established industrial relationships and mature automation technology adoption that supports widespread use of vacuum handling systems in manufacturing and warehouse facilities. Growth concentrates in major industrial centers, including Michigan, California, and Texas, where automation technology showcases established vacuum gripping deployment that appeals to operators seeking proven material handling capabilities and productivity applications.

American equipment providers leverage established distribution networks and comprehensive service capabilities, including technical support programs and maintenance services that create customer relationships and operational advantages. The market benefits from mature automation standards and manufacturing requirements that mandate vacuum gripping system use while supporting technology advancement and operational optimization.

Market Intelligence Brief:

United Kingdom's industrial technology market demonstrates sophisticated foam type vacuum gripping system deployment with documented operational effectiveness in manufacturing applications and logistics facilities through integration with existing automation systems and industrial infrastructure. The country leverages engineering expertise in automation technology and robotic systems integration to maintain a 3.1% growth rate. Industrial centers, including Midlands, London, and Scotland, showcase advanced installations where vacuum gripping systems integrate with comprehensive manufacturing platforms and facility automation systems to optimize material handling operations and production effectiveness.

British manufacturers prioritize system reliability and automation compatibility in vacuum gripping equipment development, creating demand for advanced systems with enhanced features, including robotic integration and automated control systems. The market benefits from established industrial technology infrastructure and a willingness to invest in advanced automation technologies that provide long-term operational benefits and compliance with international manufacturing standards.

Market Intelligence Brief:

Japan's market growth is driven by advanced robotics integration and manufacturing excellence, with foam type vacuum gripping systems deployed across automotive plants, electronics facilities, and logistics operations. The country maintains a 2.8% growth rate through established automation infrastructure and technology leadership in advanced manufacturing systems. Japanese manufacturers emphasize precision engineering and operational reliability, creating demand for high-quality vacuum gripping solutions with advanced features.

South Korea's foam type vacuum gripping system market expansion benefits from comprehensive manufacturing modernization and technology adoption in electronics manufacturing, automotive production, and logistics operations. The country's growth trajectory reflects government support for advanced automation technologies and industrial innovation initiatives that promote vacuum gripping adoption for productivity enhancement and material handling optimization.

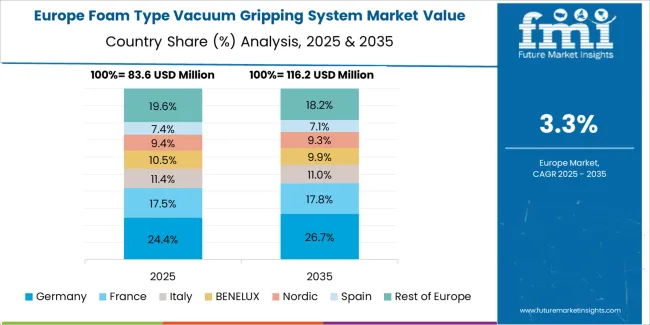

The foam type vacuum gripping system market in Europe is projected to grow from USD 117.4 million in 2025 to USD 179.5 million by 2035, registering a CAGR of 4.3% over the forecast period. Germany is expected to maintain its leadership position with a 42.6% market share in 2025, supported by its advanced automation infrastructure and major manufacturing centers including Stuttgart and Munich.

France follows with a 18.9% share in 2025, driven by comprehensive manufacturing modernization programs in automotive and logistics applications. The United Kingdom holds a 14.7% share through specialized manufacturing applications and automation requirements. Italy commands a 11.8% share, while Spain accounts for 8.4% in 2025. The rest of Europe region is anticipated to gain momentum, expanding its collective share from 3.6% to 4.9% by 2035, attributed to increasing vacuum gripping adoption in Nordic countries and emerging Eastern European manufacturing facilities implementing automation programs.

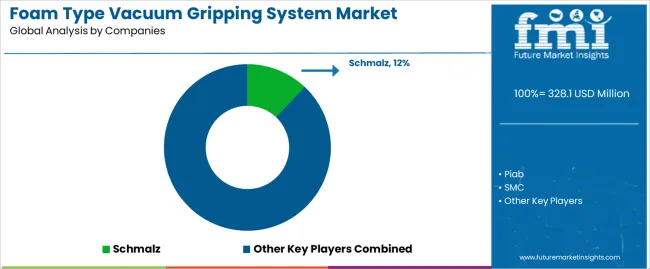

The competitive structure encompasses 15-20 credible players, with the top 5 holding approximately 56-62% by revenue. Leadership is maintained through distribution networks, technical support, and technology innovation combining vacuum efficiency, foam material quality, and control system integration capabilities. Basic vacuum generation mechanisms and standard foam pad designs are commoditizing, while margin opportunities exist in application engineering, custom solutions, and integration into customer workflows including robotic systems and automated production lines.

Global platforms control distribution reach and comprehensive product portfolios with service networks, providing broad availability and proven reliability across multi-region support. Their typical blind spots include specialized application requirements and highly customized solutions that may limit penetration in niche segments. Technology innovators maintain R&D capabilities with advanced vacuum systems and smart control interfaces, offering latest features first with attractive ROI on automation enhancement, though they face service density challenges outside core regions and price competition from established players.

Regional specialists control local technical support, fast delivery, and application expertise, providing proximity support with pragmatic pricing and local manufacturing knowledge. However, they encounter technology gaps and international expansion limitations in service operations. Application-focused specialists maintain custom foam design, material expertise, and specialized integration support, achieving differentiation through tailored solutions and industry-specific knowledge, though standardization challenges and limited scalability represent typical constraints.

System integrators focus on turnkey automation including robotic integration, control programming, and complete material handling solutions, winning complex projects with comprehensive implementation capabilities and project management expertise. Their business model dependencies and resource intensity represent operational challenges. The competitive environment emphasizes application expertise, technical support, and system integration as key differentiators, with successful players combining product innovation with comprehensive service capabilities and industry-specific knowledge that addresses diverse operational requirements across manufacturing, logistics, and processing sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD million |

| Vacuum Generation Type | Integrated Vacuum Generation, External Vacuum Generation |

| Application | Wood Processing, Metal, Logistics, Electronics, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, China, Germany, India, United Kingdom, Japan, Brazil, France, South Korea, Australia, and 25+ additional countries |

| Key Companies Profiled | Schmalz, Piab, SMC, Joulin, UniGripper, Millibar Robotics, Vacuforce, EuroTECH, AIRBEST |

| Additional Attributes | Dollar sales by vacuum generation type and application categories, regional adoption trends across East Asia, North America, and Western Europe, competitive landscape with automation equipment manufacturers and material handling suppliers, manufacturing operator preferences for gripping control and system reliability, integration with robotic platforms and automation systems, innovations in vacuum technology and foam material enhancement, and development of automated gripping solutions with enhanced performance and material handling optimization capabilities. |

The global foam type vacuum gripping system market is estimated to be valued at USD 328.1 million in 2025.

The market size for the foam type vacuum gripping system market is projected to reach USD 471.8 million by 2035.

The foam type vacuum gripping system market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in foam type vacuum gripping system market are integrated vacuum generation and external vacuum generation.

In terms of application, wood processing segment to command 26.0% share in the foam type vacuum gripping system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foam Mixing Machine Market Size and Share Forecast Outlook 2025 to 2035

Foam Market Size and Share Forecast Outlook 2025 to 2035

Foam-Free Pad Formers Market Size and Share Forecast Outlook 2025 to 2035

Foam Cups Market Size and Share Forecast Outlook 2025 to 2035

Foam Bottle Technology Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Granulate Market Size and Share Forecast Outlook 2025 to 2035

Foam Plastics Market Size and Share Forecast Outlook 2025 to 2035

Foaming Creamer Market Size and Share Forecast Outlook 2025 to 2035

Foam Tape Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Market Size and Share Forecast Outlook 2025 to 2035

Foamer Pump Market Size, Share & Forecast 2025 to 2035

Foam Food Container Market Size and Share Forecast Outlook 2025 to 2035

Foam Mesh Sleeves Market Growth - Demand & Forecast 2025 to 2035

Foam Edge Protectors Market Size and Share Forecast Outlook 2025 to 2035

Foamer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Foam Cap Liners Market Size and Share Forecast Outlook 2025 to 2035

Foam Pouch Market Analysis - Demand, Size & Industry Outlook 2025 to 2035

Foam Cooler Box Market Analysis - Growth & Trends 2025 to 2035

Foam Packaging Inserts Market Analysis, Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA