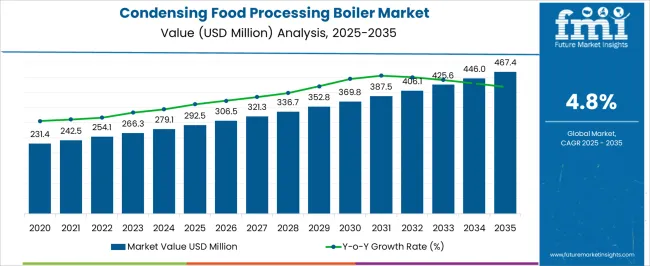

The Condensing Food Processing Boiler Market is estimated to be valued at USD 292.5 million in 2025 and is projected to reach USD 467.4 million by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period. The growth curve depicted in the chart indicates a steady and consistent upward trajectory, reflecting gradual but reliable adoption of high-efficiency boilers in food and beverage facilities. Early years, from 2020 to 2025, show incremental growth from USD 231.4 million to nearly USD 293 million, highlighting the impact of energy efficiency regulations and the replacement of outdated systems.

From 2026 to 2030, the market advances more sharply, with values surpassing USD 350 million by 2029. This mid-term acceleration corresponds to heightened demand for optimized thermal efficiency, reduced fuel costs, and compliance with stricter environmental standards. Post-2030, the curve demonstrates moderate but sustained growth, crossing USD 400 million by 2032 and stabilizing toward USD 467.4 million by 2035. The YoY growth rate line reflects this trend, peaking around 2029–2031 before gradually declining as the market enters a maturity phase.

| Metric | Value |

|---|---|

| Condensing Food Processing Boiler Market Estimated Value in (2025 E) | USD 292.5 million |

| Condensing Food Processing Boiler Market Forecast Value in (2035 F) | USD 467.4 million |

| Forecast CAGR (2025 to 2035) | 4.8% |

The drive toward reducing carbon footprints and improving operational efficiency has encouraged food processing facilities to adopt advanced boiler technologies. These boilers provide higher thermal efficiency by recovering latent heat from exhaust gases, leading to significant fuel savings and reduced emissions.

Regulatory pressures related to environmental compliance and rising energy costs have further accelerated this adoption. Additionally, the expansion of the global food processing sector, fueled by urbanization and changing consumer food preferences, has boosted demand for reliable steam generation equipment. Technological enhancements in boiler design and control systems have enhanced performance and ease of integration.

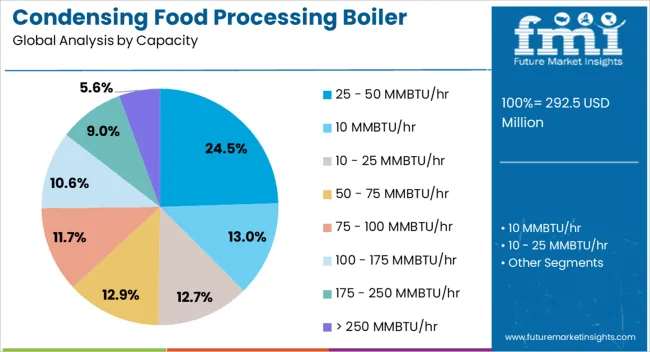

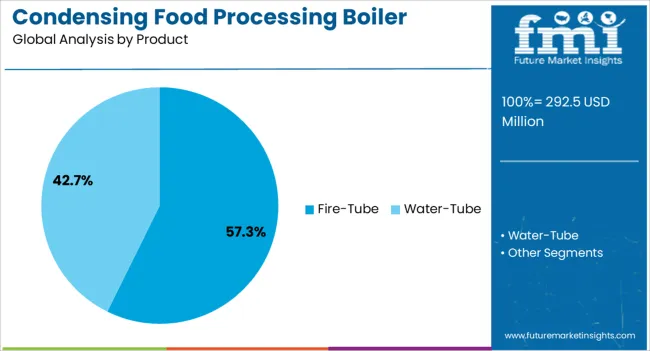

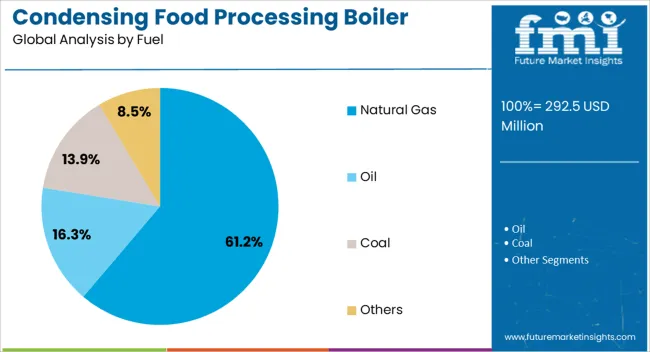

Segmental growth is expected to be driven by the 25 to 50 MMBTU/hr capacity range, fire-tube boilers due to their efficiency and compact design, and natural gas fuel preference for its cleaner combustion properties.

The condensing food processing boiler market is segmented by capacity, product, fuel, and geographic regions. By capacity, the condensing food processing boiler market is divided into 25 - 50 MMBTU/hr, 10 MMBTU/hr, 10 - 25 MMBTU/hr, 50 - 75 MMBTU/hr, 75 - 100 MMBTU/hr, 100 - 175 MMBTU/hr, 175 - 250 MMBTU/hr, and > 250 MMBTU/hr. In terms of product, the condensing food processing boiler market is classified into Fire-Tube and Water-Tube. Based on fuel, the condensing food processing boiler market is segmented into Natural Gas, Oil, Coal, and Others. Regionally, the condensing food processing boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 25 to 50 MMBTU/hr capacity segment is projected to hold 24.5% of the condensing food processing boiler market revenue in 2025, establishing itself as a preferred capacity range. This segment is favored by medium-sized food processing plants requiring efficient steam generation to support various cooking and sterilization processes. The capacity suits facilities balancing production scale and energy consumption optimally.

Boilers in this range provide flexibility to handle variable load demands while maintaining fuel efficiency. As food processing companies seek to optimize energy use without compromising output, this capacity segment is becoming a common choice.

Its ability to integrate with existing systems and offer scalability supports its market leadership.

The fire-tube boiler segment is expected to contribute 57.3% of the market revenue in 2025, maintaining its dominance among product types. Fire-tube boilers are preferred for their simpler construction, lower initial cost, and ease of maintenance compared to other boiler types. Their design enables efficient heat transfer and reliable operation suited for the steady steam demands of food processing operations.

The robustness and proven technology of fire-tube boilers have made them a reliable choice in food plants where operational uptime is critical. Additionally, improvements in materials and insulation have enhanced their efficiency and lifespan.

These advantages make fire-tube boilers a leading product segment in the market.

The natural gas fuel segment is projected to hold 61.2% of the condensing food processing boiler market revenue in 2025, establishing it as the dominant fuel choice. Natural gas is favored due to its clean combustion characteristics which produce lower emissions compared to other fossil fuels. It offers consistent energy supply and easy integration with modern condensing boiler designs that optimize thermal efficiency.

Food processing companies have increasingly adopted natural gas to meet stringent environmental regulations and corporate sustainability goals. Moreover, the relative cost-effectiveness and availability of natural gas in many regions support its preference.

As the industry moves toward cleaner energy sources, natural gas is expected to remain the preferred fuel for condensing boilers in food processing applications.

Condensing food processing boilers are gaining ground through efficiency, regulatory support, and wide applicability. Manufacturers are advancing modular designs and partnerships, strengthening their role in food industry modernization.

Adoption of condensing food processing boilers has been strongly influenced by their ability to deliver higher energy efficiency compared to conventional steam systems. Food manufacturers across bakery, dairy, and beverage industries are shifting toward condensing technology to reduce operational fuel consumption and improve overall thermal performance. These boilers recover latent heat from flue gases, which translates into lower energy bills and better return on investment. Their appeal lies not only in cost savings but also in operational reliability, which is critical for continuous production cycles. This dynamic is expected to keep condensing boilers a preferred choice for companies seeking predictable output with lower operating expenditures in competitive food processing environments.

Governmental and regional mandates requiring energy-efficient equipment in industrial plants have accelerated adoption of condensing food processing boilers. Regulations emphasize emission reduction and energy savings, creating a strong case for manufacturers to replace older boiler systems. Compliance with standards related to steam quality, safety, and efficiency is also a factor driving change. Food processors operating under strict hygiene and process safety requirements view condensing boilers as a suitable match for regulatory compliance. Penalties and higher energy taxes for inefficient systems push the industry further toward modern boiler technologies. This regulatory backdrop ensures consistent demand while encouraging manufacturers to strengthen certifications and testing capabilities to meet evolving requirements.

The application scope of condensing food processing boilers is widening across multiple segments, including frozen foods, confectionery, and ready-to-drink beverages. Their ability to generate steady steam at controlled temperatures makes them suitable for processes requiring precision. Condensing boilers also offer adaptability for both small-scale and large-scale plants, appealing to a wide spectrum of food producers. Demand from packaged food categories has contributed significantly to their growing market penetration, as companies emphasize efficient heating and reduced energy wastage. With expanding global demand for processed food, these boilers are being positioned as versatile solutions that ensure operational continuity while minimizing overhead costs in production environments.

Manufacturers of condensing food processing boilers are focusing on product innovation, regional expansion, and collaborative agreements with food processors to drive market presence. The introduction of modular and compact designs has helped cater to space-constrained plants. Service support programs and predictive maintenance initiatives are being promoted to strengthen customer loyalty. Partnerships with food manufacturers for turnkey boiler solutions have also increased, with integrated offerings combining boilers, heat recovery, and monitoring systems. Competition revolves around price competitiveness, fuel efficiency, and long-term reliability. Strategic collaborations and expansion of service hubs across high-demand regions will be essential in capturing larger market share while building trust among food processors.

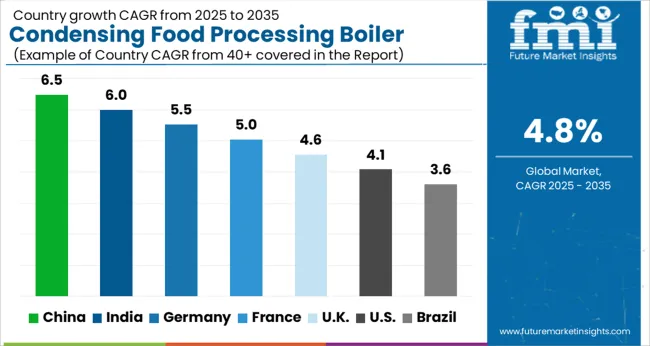

The condensing food processing boiler market is projected to expand at a global CAGR of 4.8% from 2025 to 2035, supported by energy efficiency mandates, stricter emission controls, and rising investments in food production facilities. China leads with a CAGR of 6.5%, fueled by rapid modernization of food processing plants, government-backed energy savings programs, and higher adoption of condensing systems in large-scale dairy and beverage facilities. India follows at 6.0%, driven by rapid expansion of packaged food industries, demand for efficient heating systems, and supportive industrial energy policies. France achieves 5.0% growth, supported by adoption in frozen food plants, dairy cooperatives, and institutional kitchens requiring consistent steam supply. The United Kingdom posts 4.6% growth, with applications expanding in ready-meal production and commercial food chains, though adoption is steady due to mature infrastructure. The United States lags slightly at 4.1%, reflecting slower replacement cycles in established plants, reliance on traditional boiler systems, and selective adoption in high-energy-use facilities. This analysis highlights condensing boiler adoption across major food-producing regions, offering a benchmark for efficiency-driven investments, energy compliance, and competitive positioning in global food manufacturing.

China registered a CAGR of about 5.4% during 2020–2024, which is projected to rise further to 6.5% between 2025–2035 as large-scale modernization of food processing facilities accelerates. Early momentum was shaped by rapid demand in beverage, dairy, and frozen food plants, where reliable steam generation and efficiency improvements were prioritized. In the upcoming decade, government-backed efficiency programs, stricter emission codes, and replacement of older boiler fleets will continue to strengthen adoption. Local manufacturers expanding production and service support have reduced dependency on imported systems. These advancements, combined with integrated waste-heat recovery applications, are expected to reinforce the leadership position of China in this space.

India posted an estimated CAGR of 5.0% from 2020–2024, moving upward to 6.0% for 2025–2035 as packaged food production and institutional kitchen projects expanded. Early growth was influenced by rising adoption of efficient steam systems in bakeries, dairy cooperatives, and beverage units. The climb in CAGR for the next phase is explained by large-scale food export opportunities, government incentives for efficient energy usage, and private sector expansion into ready-to-eat foods. Affordable local manufacturing has made condensing boilers more accessible for mid-sized processors. Service partnerships and regional assembly units further supported adoption by lowering downtime and maintenance costs across key industrial regions.

France recorded a CAGR of 4.2% during 2020–2024, which is expected to climb to 5.0% between 2025–2035 as modernization of food plants and stricter heating efficiency rules gain traction. Early progress came from dairy cooperatives and frozen food manufacturers adopting compact boilers for consistency in thermal operations. In the upcoming decade, rising investment in bakery and confectionery units, along with incentives for low-energy equipment, is boosting adoption. Suppliers offering modular condensing boilers with advanced safety features are gaining ground. Retrofit opportunities in older processing plants and institutional kitchens are also shaping steady demand, ensuring a reliable base of installations moving forward.

The United Kingdom posted a CAGR of 3.8% from 2020–2024, which is projected to increase to 4.6% between 2025–2035, slightly below the global average of 4.8%. The modest improvement comes from wider awareness of lifecycle energy savings, regulatory nudges on heating efficiency, and selective adoption in ready-meal production plants. Earlier momentum was relatively limited, as traditional boiler systems continued to dominate commercial food operations. The rise in CAGR for the next decade is explained by an expanding processed food market, improved cost competitiveness of condensing boilers, and institutional adoption across schools and hospitals. This signals a steady transition, though at a slower pace compared to emerging economies.

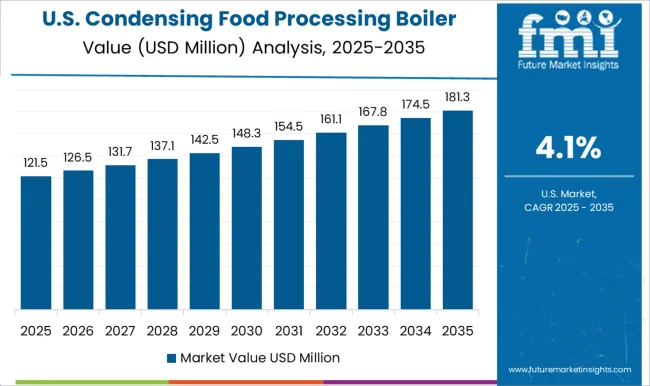

The United States registered a CAGR of 3.5% during 2020–2024, which is projected to reach 4.1% between 2025–2035, reflecting gradual but steady adoption trends. Early adoption was limited to hurricane-prone and energy-intensive regions where operational savings were emphasized. The increase in CAGR is supported by greater demand for energy-efficient equipment in large meat processing plants, beverage facilities, and frozen food production hubs. Replacement of outdated boiler systems has begun in high-capacity plants, improving the appeal of condensing boilers. Although reliance on conventional systems persists, regional distribution hubs and service networks are making condensing options more viable for operators across multiple states.

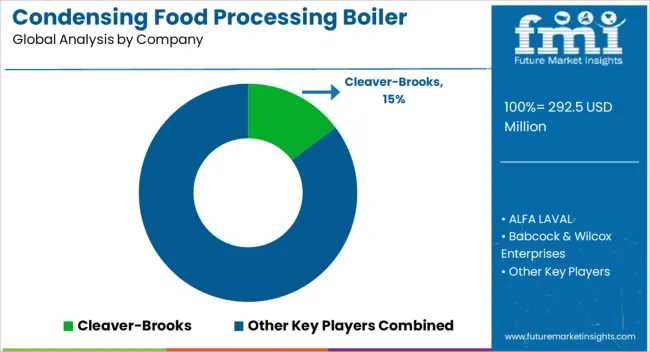

The condensing food processing boiler market is marked by strong competition between global engineering leaders, regional manufacturers, and specialized boiler system providers. Cleaver-Brooks plays a leading role in North America, offering high-efficiency condensing boiler systems and integrated steam solutions for food processing plants. ALFA LAVAL leverages its expertise in heat transfer and thermal technologies to supply compact boiler units that improve energy recovery in food and beverage operations. Babcock & Wilcox Enterprises emphasizes advanced boiler designs tailored for industrial-scale food facilities, with a focus on reducing fuel costs and emissions. Babcock Wanson remains prominent in Europe, known for turnkey boiler solutions and long-standing partnerships with food manufacturers. BM GreenTech is emerging with energy-efficient condensing systems aimed at eco-conscious processors. Bosch Industriekessel is widely recognized for its industrial boiler systems, offering high-performance condensing units that meet stringent European efficiency and safety regulations. C

layton Industries specializes in small footprint, rapid start-up steam generators, making them attractive for food processors needing flexibility and continuous operation. Cochran provides reliable steam boilers, with increasing emphasis on condensing technology for food and beverage producers in the UK and abroad. Forbes Marshall maintains a strong presence in Asia, focusing on energy efficiency, process automation, and customized boiler systems for food plants. Hurst Boiler offers durable condensing boiler solutions in the USA., with strong distribution and service support networks. Miura America differentiates itself through modular, on-demand steam boilers, making them highly suitable for food industries requiring scalable production capacity. Rentech Boiler Systems supplies custom-engineered solutions, catering to large food processing facilities in North America. Thermax has a significant footprint in Asia and the Middle East, offering condensing boiler systems with integrated energy solutions. Thermodyne Boilers strengthens its presence in India with compact and affordable condensing units tailored for small and mid-sized processors. Viessmann maintains a premium position in Europe, delivering high-efficiency condensing boiler technologies with a strong focus on innovation and compliance with energy efficiency standards

| Item | Value |

|---|---|

| Quantitative Units | USD 292.5 Million |

| Capacity | 25 - 50 MMBTU/hr, 10 MMBTU/hr, 10 - 25 MMBTU/hr, 50 - 75 MMBTU/hr, 75 - 100 MMBTU/hr, 100 - 175 MMBTU/hr, 175 - 250 MMBTU/hr, and > 250 MMBTU/hr |

| Product | Fire-Tube and Water-Tube |

| Fuel | Natural Gas, Oil, Coal, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cleaver-Brooks, ALFA LAVAL, Babcock & Wilcox Enterprises, Babcock Wanson, BM GreenTech, Bosch Industriekessel, Clayton Industries, Cochran, Forbes Marshall, Hurst Boiler, Miura America, Rentech Boiler Systems, Thermax, Thermodyne Boilers, and Viessmann |

| Additional Attributes | Dollar sales, share, competitive landscape, regional demand trends, regulatory drivers, end-use adoption, pricing benchmarks, and emerging growth opportunities. |

The global condensing food processing boiler market is estimated to be valued at USD 292.5 million in 2025.

The market size for the condensing food processing boiler market is projected to reach USD 467.4 million by 2035.

The condensing food processing boiler market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in condensing food processing boiler market are 25 - 50 mmbtu/hr, 10 mmbtu/hr, 10 - 25 mmbtu/hr, 50 - 75 mmbtu/hr, 75 - 100 mmbtu/hr, 100 - 175 mmbtu/hr, 175 - 250 mmbtu/hr and > 250 mmbtu/hr.

In terms of product, fire-tube segment to command 57.3% share in the condensing food processing boiler market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Condensing Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Non-Condensing Fire Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Condensing Unit Market Trends-Growth, Demand & Forecast 2025 to 2035

Condensing Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Condensing Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Non-Condensing Fire Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Non-Condensing Water Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Condensing Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Industrial Condensing Units Market Size and Share Forecast Outlook 2025 to 2035

Evaporative Condensing Units Market Trend Analysis Based on Type, Operation, Application, and Region 2025 to 2035

Transportation Condensing Units Market Growth – Trends & Forecast 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA