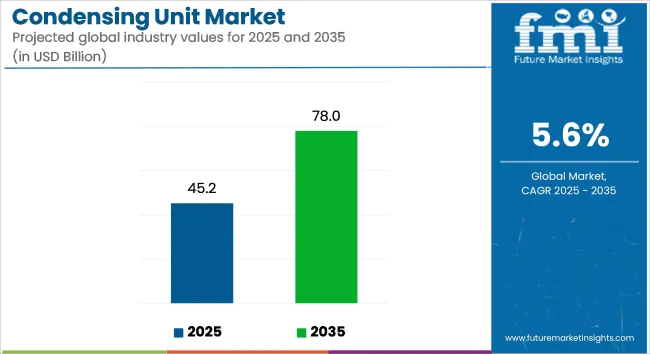

The global condensing unit market is estimated to be valued at USD 45.2 billion in 2025 and is forecast to grow to USD 78.0 billion by 2035, advancing at a CAGR of 5.6% during the forecast period. Growth is largely driven by rising demand for efficient climate control systems in residential, commercial, and industrial sectors, supported by urbanization, infrastructure development, and stringent energy efficiency regulations.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 45.2 billion |

| Industry Value (2035F) | USD 78.0 billion |

| CAGR (2025 to 2035) | 5.6% |

The condensing unit market is being propelled by swift urbanization and expansion in commercial real estate, resulting in higher demand for effective and energy-efficient HVACR systems. Stricter building codes and government incentives for green buildings have also accelerated the transition to high-efficiency condensing units that meet standards such as ASHRAE 90.1 and EU Eco-design. In industrial sectors such as food & beverage, pharmaceuticals, and chemicals condensing units are critical for temperature-sensitive processes, cold storage, and cleanroom environments.

Simultaneously, advancements in refrigerants and compressor technologies are enhancing system efficiency, reducing greenhouse gas emissions, and increasing reliability. Additionally, the global push towards HVACR electrification and smart monitoring systems is driving demand for intelligent, IoT-enabled condensing units that offer real-time performance optimization and predictive maintenance capabilities. The Asia-Pacific region is expected to remain the largest and fastest-growing market, bolstered by robust infrastructure initiatives, factory modernization, and rapid growth in commercial buildings.

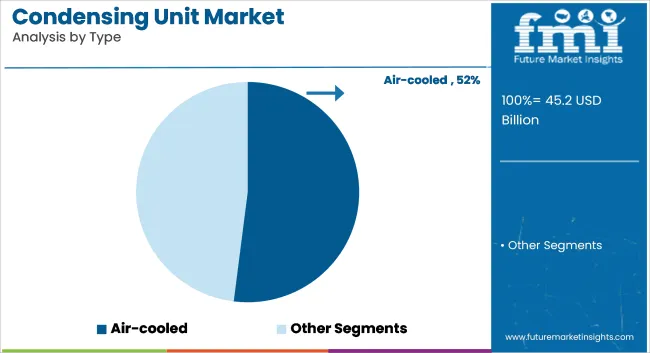

Air-cooled condensing units are projected to account for 52% of the overall market in 2025, growing at a CAGR of 5.5% through 2035. These units are widely used due to their simplicity, lower upfront costs, and compatibility with rooftop and modular HVAC systems. Their design enables easy retrofitting and maintenance, making them popular across commercial spaces, residential buildings, and light industrial facilities.

Newer designs incorporate electronic expansion valves, variable-speed fans, and microchannel coils boosting energy efficiency and noise reduction. Regulators and industry standards like Energy Star and Eurovent further drive adoption through rebates and certification incentives. As building owners and developers aim to reduce operational expenses and environmental footprint, air-cooled units continue to be the go-to solution across most end-use segments.

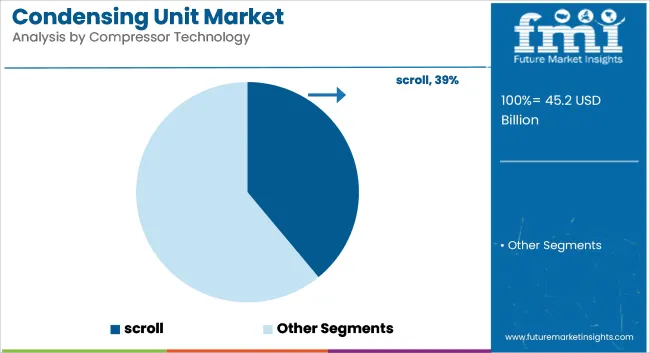

Scroll compressors are projected to dominate the condensing unit market, holding approximately 39% of the global share in 2025 and growing at a CAGR of 5.8% through 2035. Their widespread usage is primarily attributed to superior energy efficiency, quiet operation, and minimal maintenance requirements. These compressors are especially favored in HVACR systems used across supermarkets, cold storage facilities, commercial buildings, and residential environments.

Their compact size and compatibility with low-GWP refrigerants make them highly suitable for modern, environmentally compliant cooling solutions. As global building codes tighten and sustainability initiatives intensify, scroll compressors are becoming the preferred choice for replacing legacy systems.

In addition, their scalability across both small and large-scale applications further enhances their appeal in infrastructure and retail expansion projects. Ongoing technological advancements in variable speed and inverter-compatible scroll compressors are also improving system responsiveness and efficiency, making this segment a critical contributor to long-term condensing unit market growth.

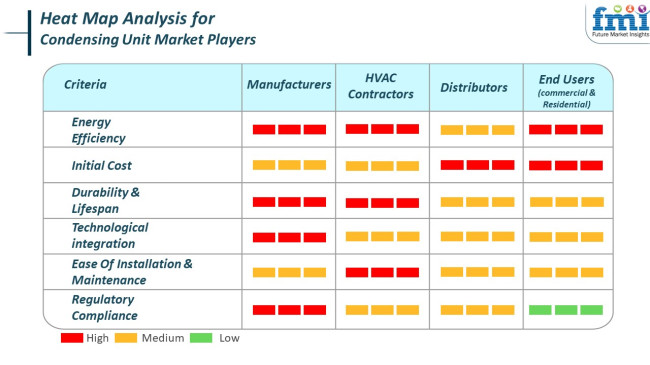

The industry caters to various stakeholders such as manufacturers, HVAC contractors, distributors, and end users, each having varied criteria as priorities. The manufacturer considers energy efficiency, longevity, and regulatory compliance to make sure their product complies with industry requirements and sustainability demands.

HVAC installers and service technicians, who perform the installation and maintenance, appreciate ease of installation, ease of maintenance, and cooling operation reliability in order to facilitate simple operation and customer satisfaction. Distributors are concerned with initial cost and availability and seek to acquire low-cost, hot-selling units that can be readily shipped from industry to industry.

End users, residential and commercial, value energy efficiency, performance, and cost because these directly affect the operating cost and comfort. As the demand for smart cooling solutions and energy-efficient solutions is on the rise, technology innovation is rapid. Urbanization, growth of commercial infrastructure, and environment legislations in the GCC region keep the industry going, forcing all the stakeholders to keep pace with evolving customer demands and sustainability needs.

The industry is witnessing tremendous growth based on the growing demand for effective cooling solutions in multiple industries, such as food and beverage, pharmaceutical, and commercial buildings.

Even with this favorable trend, the industry is exposed to a number of risks that may affect its growth. Among the key issues is the regulatory environment of refrigerants. There is growing environmental regulation that forces producers to move towards environmentally friendly refrigerants. This change calls for a huge investment in research and development to design compliant products, and in case of non-compliance, industry share erosion or legal actions may ensue.

Supply chain interruption is also a major risk. Manufacturing is dependent on an advanced web of suppliers for components like compressors, heat exchangers, and controls. Geopolitical tensions, tariffs, or pandemics can derail this supply chain, hindering production and increasing costs. Companies must develop robust supply chain strategies to mitigate these threats.

Economic conditions can also affect industry conditions. The demand is greatly influenced by building and industrial activity, which is extremely cyclical. In times of recession, low investment in new buildings can lead to reduced demand for HVAC equipment such as condensing units. The manufacturers must diversify their product base and venture into new industries to act as a buffer against such downturns.

Technological innovation and changing customer tastes also bring challenges. Increasing focus on smart technologies and energy efficiency in HVAC solutions is something that doesn't go unnoticed. Companies that are not innovating and incorporating these elements into their offerings risk losing competitive advantage and failing to meet customer needs. Adapting to technology expenditure and staying informed on industry trends are essential to maintaining industry share.

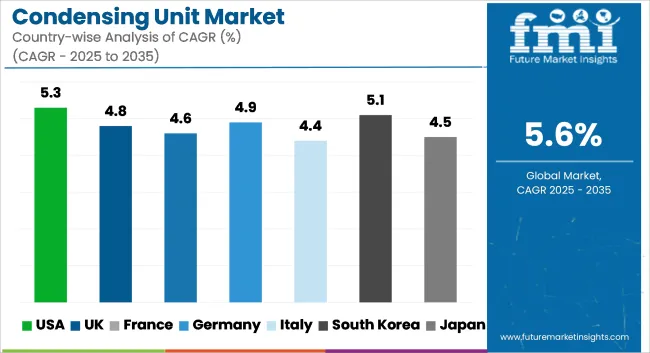

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.3% |

| UK | 4.8% |

| France | 4.6% |

| Germany | 4.9% |

| Italy | 4.4% |

| South Korea | 5.1% |

| Japan | 4.5% |

| China | 6.2% |

| Australia | 4.7% |

| New Zealand | 4.3% |

The USA industry is anticipated to record a 5.3% CAGR between 2025 to 2035. The growth is led mainly by aggressive investments in commercial HVAC systems, food processing units, and retail refrigeration systems. Demand is also supported by growing stringent environmental regulations promoting energy-efficient and low-emission units. Deep penetration of grocery stores and quick-service restaurants in the industry also fuels the demand for high-end refrigeration solutions.

Major industry participants in the USA are Emerson Electric Co., Heatcraft Refrigeration Products LLC, and Lennox International Inc., which remain focused on innovation in modular and scroll condensing units. The movement toward natural refrigerants such as hydrocarbons and CO₂ is influencing product enhancement and buying behaviors. The development of digital monitoring and intelligent control technologies is also shaping competition.

The UK industry is forecast to expand at a CAGR of 4.8% over the forecast period. Increased installation of HVAC and refrigeration equipment in urban development projects and healthcare properties is propelling the demand for high-performance options. Additionally, adherence to regulations under F-Gas regulations is compelling the replacement of high-GWP refrigerants with low-GWP refrigerants in commercial refrigeration applications.

With the adoption of compact, air-cooled condensing units, organizations such as Johnson Controls, Daikin Applied UK Ltd., and GEA Group are leaders in system efficiencies and environmental adaptability. The adoption trend of compact, air-cooled condensing units continues to extend to smaller- and medium-sized retail and hospitality sectors. Decarbonization and sustainability will continue to drive more innovation and adoption of technology across the industry.

The French industry is projected to grow at a CAGR of 4.6% between 2025 and 2035. The growth is driven by growth in the food retail industry, expansion in cold storage logistics, and retrofitting of commercial refrigeration equipment. Compliance with European directives on energy efficiency and climate objectives continues to drive the product mix.

Industry players such as Schneider Electric, Danfoss, and Panasonic are engaged in unit design optimization for reduced energy consumption and environmental footprints. Air-cooled products continue to have a strong industry presence due to commercial applications in urban industries. Integration of digital building blocks for performance monitoring and pre-emptive maintenance is fueling adoption across varied end-use segments.

Germany is anticipated to achieve growth at a CAGR of 4.9% during the forecast period, led by a well-established industrial base and rising environmental consciousness. Industrial and commercial refrigeration industries are shifting towards high-efficiency heat recovery systems and natural refrigerants. Efficient supermarket and logistics hub construction also aids in the growth of the industry.

Industry participants such as Bitzer, Güntner GmbH, and Emerson are putting money into R&D to develop low-noise, high-efficiency condensing units with robust environmental features. Growing demand for decentralized cold chain networks and retail infrastructure energy optimization is boosting sales of electronic, intelligent condensing units. Government policies supporting the adoption of green technology will also fuel industry growth.

Italy's industry is likely to grow at a CAGR of 4.4% through 2035, driven by increasing demand in the hospitality, food service, and pharmaceutical sectors. The replacement of aging infrastructure with energy-efficient alternatives and adherence to EU-wide refrigerant phase-down regulations are key drivers.

Industry pioneers such as LU-VE Group, Dorin, and Embraco are responding by offering tiny, environmentally friendly boxes. The units that can be placed remotely are on the rise within inner-city business applications where space available as much as sound level is a main concern. Technical advances permitting wider thermal control and refrigerant management of the kind outlined will be responsible for longer-term trends in take.

South Korea is anticipated to grow at a CAGR of 5.1% during the forecast period, based on expansion in deployment in electronics manufacturing, biotech facilities, and high-end retail refrigeration. Local, new companies are concentrating on miniaturization and green performance, which is in line with nationwide energy-saving initiatives.

These key players - LG Electronics, Samsung HVAC, and Carrier Korea - dominate the technology developments of inverter-based condensing systems. IoT-based platform integration and focus on refrigerant leakage control and detection are increasing industry attractiveness. Government incentives for energy-efficient technology are also increasing investments towards developing new products.

The Japanese industry is expected to record a CAGR of 4.5% between 2025 and 2035. Industry leadership is dominated by technological advancement, space-saving system demand, and energy-driven commitment. Drivers are shifting refrigeration needs of the food processing, pharmaceutical, and convenience store sectors.

Industry leaders such as Daikin Industries, Panasonic Corporation, and Mitsubishi Electric continue to launch variable speed and CO₂-based solutions. Super-silent, compact units are being spurred by consumer demand in high-density urban areas, influencing product design. Advanced sensor technology and automation features are improving operating efficiency and cost savings in installations.

China is expected to lead global growth in the industry at a CAGR of 6.2% over the forecast period. Rapid industrialization, expansion in cold chain logistics, and high government focus on food safety and urban infrastructure development are major growth drivers. The commercial refrigeration industry is benefiting from the surge in the development of supermarkets and hypermarkets.

Domestic players such as Haier, Midea, and Highly Refrigeration are going up against global players in terms of economic and scalable condensing solutions. Green technology focus and a move towards R290 and CO₂ refrigerants are pushing new products into the marketplace. Cloud monitoring and compatibility for smart grids is increasingly applied at a mass scale in commercial uses.

Australia's industry will grow at a CAGR of 4.7% until 2035. Industry growth is stimulated by increasing demand in agriculture-based cold storage, food retail chains, and infrastructure development. Policy regulations on energy use and emissions are impacting system design and refrigerant selection.

Key industry players such as Kirby HVAC&R, Heatcraft Australia, and Actrol are marketing sustainable, modular units appropriate for varied climatic conditions. There is a strong demand for outdoor air-cooled systems with durable and corrosion-resistant materials. Solar-compatible and hybrid energy models will grow in accordance with national decarbonization policy.

New Zealand is projected to grow at a CAGR of 4.3% over the forecast period, driven primarily by investment in low-GWP alternatives for sustainable agriculture, food export logistics, and commercial energy-efficient buildings. The refrigeration sector is responding to government policies mandating the transition to low-GWP alternatives.

Industry leaders such as Patton Refrigeration, Realcold, and Emerson are prioritizing reliable system performance for seashore and rural use. Climate-proof, remote-monitoring-capable units are the prime driver of buying intentions. The increasing focus on operating sustainability and life-cycle efficiency is set to drive product innovation and uptake.

The condensing unit market is highly competitive, with leading industry players Carrier, Daikin, Johnson Controls, Emerson, Mitsubishi Electric, Panasonic, and Ingersoll Rand investing heavily in R&D, sustainable refrigerants, and smart HVACR solutions.

Trends include partnerships with HVAC OEMs, contractor training programs, and deployments of digital platforms for remote monitoring and predictive service. Manufacturers are launching high-efficiency, low-GWP condensing units compliant with international standards.

Expansion strategies in emerging markets across Asia-Pacific, Latin America, and the Middle East are underway to capitalize on urban development and retail infrastructure growth. The competitive edge is determined by product performance, refrigerant compliance, digital connectivity, and an efficient service ecosystem supporting installers and end users.

By type, the industry is segmented into air-cooled, water cooled, and fan cooled.

By refrigerant type, the industry is segmented into R404A, R134a, R407A/R407C/R407F, R507A or R22, and green refrigerants.

By compressor technology, the industry is segmented into reciprocating, hermetic, semi-hermetic, open, rotary, scroll, rotary vane, screw, and centrifugal.

By application, the industry is segmented into high-temperature, medium temperature, and low temperature.

By end use, the industry is segmented into residential, commercial, and industrial.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

The industry is estimated to be USD 45.2 billion in 2025.

By 2035, the industry is expected to grow to approximately USD 78.0 billion.

China is projected to witness a 6.2% CAGR, supported by rapid industrialization, urbanization, and the growth of cold chain logistics.

Air-cooled condensing units are the leading segment, favored for their lower installation costs and ease of maintenance.

Key players include Emerson Electric Co., Danfoss, Daikin Applied, Tecumseh Products Company, BITZER KÜHLMASCHINENBAU GMBH, Hussmann Corporation, Voltas Limited, Patton Ltd, GEA Group, Heatcraft Worldwide Refrigeration, Rivacold UK Ltd, and JINAN RETEK INDUSTRIES INC.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Condensing Units Market Size and Share Forecast Outlook 2025 to 2035

Evaporative Condensing Units Market Trend Analysis Based on Type, Operation, Application, and Region 2025 to 2035

Transportation Condensing Units Market Growth – Trends & Forecast 2025 to 2035

United States Hand Holes Market Size and Share Forecast Outlook 2025 to 2035

United States Walk-in Cooler and Freezer Market Size and Share Forecast Outlook 2025 to 2035

United States Commercial Refrigeration Equipment Market Forecast and Outlook 2025 to 2035

United States Dog Toys Market Size and Share Forecast Outlook 2025 to 2035

United States Biodegradable Cups and Lids Market Size and Share Forecast Outlook 2025 to 2035

United States Green Tea Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Hispanic Novelties Market Size and Share Forecast Outlook 2025 to 2035

United States Scented Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

United States Label Release Liner Market Size and Share Forecast Outlook 2025 to 2035

United States Beetroot Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States Digital Ovulation Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States of America Digital Pregnancy Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Collision Repair Parts Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Pest Control Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA