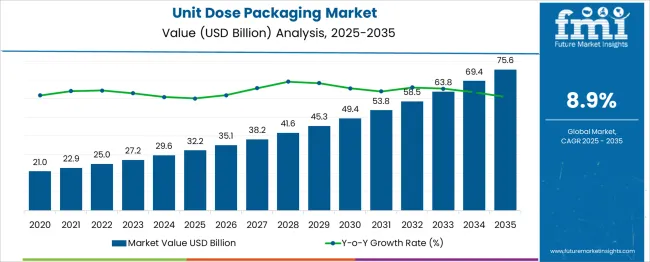

The Unit Dose Packaging Market is estimated to be valued at USD 32.2 billion in 2025 and is projected to reach USD 75.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.9% over the forecast period.

Between 2025 and 2030, the market is expected to rise from USD 32.2 billion to USD 49.4 billion, driven by increasing demand for accurate dosing solutions in pharmaceuticals, nutraceuticals, and personal care products. Year-on-year analysis shows consistent growth, with values reaching USD 35.1 billion in 2026 and USD 38.2 billion in 2027, supported by enhanced patient compliance and safety-focused packaging regulations. By 2028, the market is projected to reach USD 41.6 billion, advancing to USD 45.3 billion in 2029 and USD 49.4 billion by 2030. Growth will be further fueled by rising adoption of blister packs, strip packs, and pre-measured sachets across healthcare and food sectors. Increasing integration of smart labeling and serialization technologies to meet traceability requirements will also boost market adoption. These dynamics position unit dose packaging as a vital component in modern healthcare supply chains, ensuring precision, convenience, and regulatory compliance across global markets while supporting sustainable packaging innovations.

| Metric | Value |

|---|---|

| Unit Dose Packaging Market Estimated Value in (2025 E) | USD 32.2 billion |

| Unit Dose Packaging Market Forecast Value in (2035 F) | USD 75.6 billion |

| Forecast CAGR (2025 to 2035) | 8.9% |

The unit dose packaging market occupies an important niche across multiple packaging-related sectors. Within the Pharmaceutical Packaging Market, it accounts for about 18%, as unit dose formats dominate in oral solid doses and liquid medications for patient safety and dosage accuracy. In the Healthcare Packaging Market, its share is approximately 14%, considering its critical role in hospitals, clinics, and home care for improved medication adherence. For the Consumer Goods Packaging Market, the share is around 4%, mainly in products like detergents and single-use household items. In the Food and Beverage Packaging Market, it contributes nearly 6%, driven by portion-controlled servings, ready-to-eat meals, and beverage concentrates.

Within the Personal Care Packaging Market, its share is about 3%, as single-use skincare and cosmetic products gain popularity in travel and sample segments. Growth is propelled by rising demand for convenience, hygiene assurance, and compliance with strict pharmaceutical regulations. Advanced materials, smart labels, and tamper-evident features are enhancing usability and safety standards. Additionally, the trend toward sustainable single-dose formats using recyclable films and eco-friendly laminates is influencing product development. Unit dose packaging continues to strengthen its position as a functional, patient-centric, and user-friendly solution across industries, ensuring precision and reducing the risks of medication and product misuse.

The unit dose packaging market is experiencing notable growth, fueled by the rising demand for precise, safe, and tamper-evident pharmaceutical delivery formats. Healthcare providers and patients increasingly prefer single-use dosages to reduce medication errors, ensure hygiene, and comply with regulatory standards.

The growing aging population and expansion of chronic disease treatments are driving pharmaceutical companies to adopt scalable, cost-efficient packaging formats that also support compliance. Additionally, the trend toward self-administration of medication has prompted innovation in convenient, easy-to-use packaging solutions.

Sustainability concerns are also shaping the market, with manufacturers shifting toward recyclable materials and compact designs that reduce environmental impact. Global pharmaceutical supply chain modernization and serialization mandates are further accelerating the adoption of unit dose formats across both developed and emerging markets.

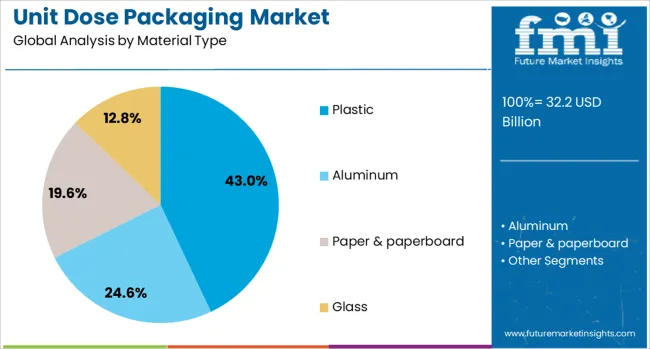

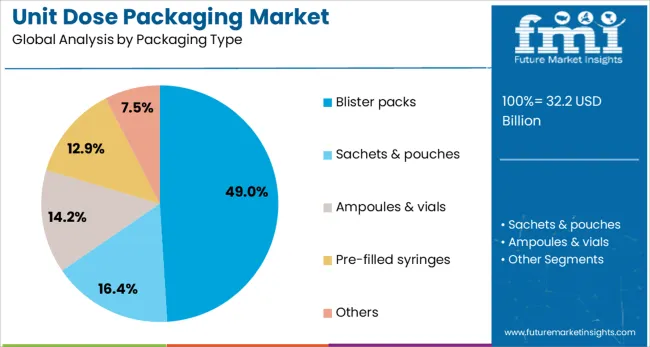

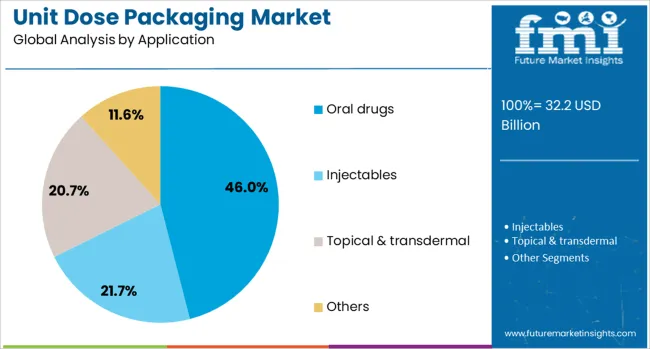

The unit dose packaging market is segmented by material type, packaging type, application, and end use and geographic regions. By material type of the unit dose packaging market is divided into Plastic, Aluminum, Paper & paperboard, and Glass. In terms of packaging type of the unit dose packaging market is classified into Blister packs, Sachets & pouches, Ampoules & vials, Pre-filled syringes, and Others. Based on application of the unit dose packaging market is segmented into Oral drugs, Injectables, Topical & transdermal, and Others. By end use of the unit dose packaging market is segmented into Pharmaceutical, Cosmetics & personal care, Nutraceuticals, and Others. Regionally, the unit dose packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Plastic is projected to lead the material segment in the unit dose packaging market with a 43.0% revenue share in 2025. Its dominance is supported by the material’s flexibility, lightweight nature, and compatibility with automated high-speed filling lines.

Plastic offers excellent barrier properties against moisture and contaminants, making it suitable for sensitive pharmaceutical formulations. Its adaptability in thermoforming and injection molding processes also facilitates the creation of precise, secure unit-dose compartments.

Furthermore, advancements in recyclable plastics and bioplastics are enhancing its appeal amid rising sustainability demands in healthcare packaging.

Blister packs are expected to account for 49.0% of the market share by 2025, making them the most preferred packaging type. Their widespread use is driven by their ability to deliver unit doses in a tamper-evident, child-resistant, and portable format.

Blister packaging enables easy visual identification of individual doses, helping to improve patient compliance and inventory management. It also supports high-speed production, making it cost-effective for mass-market pharmaceutical and OTC products.

The format’s compatibility with both solid and semi-solid dosage forms further broadens its application in unit dose packaging.

The oral drugs segment is anticipated to hold a 46.0% market share in 2025, dominating the application category. This is largely due to the prevalence of oral drug administration as the most common and convenient route for patients.

Unit dose packaging of oral drugs helps improve dosage accuracy, reduce contamination risks, and enhance medication adherence—critical factors in chronic care and elderly patient management.

With rising prescription volumes globally, especially in cardiovascular, diabetes, and antibiotic categories, oral drug packaging in unit doses continues to be prioritized by healthcare providers and manufacturers alike.

The unit dose packaging market is expanding due to rising demand in pharmaceuticals, personal care, and homecare products. Growth during 2024 and 2025 was driven by precision dosing requirements, patient safety initiatives, and convenience in drug administration. Opportunities are emerging in pre-filled syringes, single-use blister packs, and portion-controlled liquid packaging for OTC medicines. Key trends include smart labeling for compliance monitoring, tamper-evident solutions, and eco-conscious material innovations. However, restraints such as high production costs, packaging complexity, and stringent regulatory standards remain significant. The outlook signals steady growth, supported by healthcare digitization and single-dose delivery systems.

The primary growth driver is the need for safe, controlled medication delivery in clinical and home settings. In 2024 and 2025, hospitals adopted unit dose packaging extensively for reducing medication errors and improving patient adherence. Pharmaceutical companies expanded usage for antibiotics, injectables, and pediatric formulations to ensure accurate dosing. Convenience in managing chronic therapies encouraged retail pharmacies to offer single-dose blister packs. These developments confirm that safety-driven packaging formats will remain vital for improving therapeutic outcomes and reducing healthcare risks, cementing their relevance in modern medical supply chains.

Significant opportunities exist in the development of unit dose packaging for injectables and single-use liquid products. In 2025, pre-filled syringes and pens gained traction for vaccines and biologics, simplifying administration in outpatient care. Single-dose liquid sachets for OTC cough syrups and nutraceutical supplements became popular for portability and hygiene. Growth prospects also emerged in ophthalmic and dermatological product packaging using sterile single-use formats. These factors indicate that manufacturers focusing on application-specific designs and expanding capacity for small-volume, high-precision packaging solutions are positioned to lead market growth globally.

Emerging trends emphasize the adoption of digital compliance tools and safety-driven packaging enhancements. In 2024, pharmaceutical companies implemented smart labels with QR codes for dose verification and patient education, improving adherence monitoring. Tamper-evident blister packs became standard in regulated markets to enhance product security during distribution. Lightweight, recyclable barrier films gained popularity in response to demand for cost efficiency without compromising product stability. These innovations indicate a clear shift toward intelligent packaging systems offering safety, convenience, and functional value, aligning with evolving consumer and regulatory expectations worldwide.

Market restraints stem from elevated production costs, complex machinery requirements, and strict compliance obligations. In 2024 and 2025, small-scale drug manufacturers faced challenges adopting unit dose packaging due to expensive high-speed equipment and material waste concerns. Regulatory frameworks mandating child-resistant and tamper-proof designs further increased cost burdens and prolonged development cycles. Limited flexibility in reconfiguring lines for diverse drug formats restricted scalability. These factors highlight the need for cost-optimized machinery, modular packaging solutions, and streamlined certification processes to enable broader market penetration across pharmaceutical and healthcare sectors.

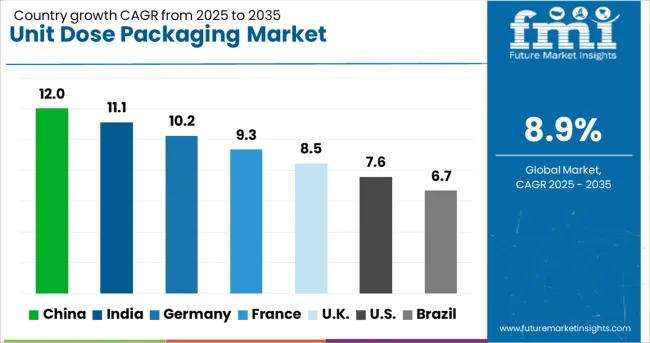

| Country | CAGR |

|---|---|

| China | 12.0% |

| India | 11.1% |

| Germany | 10.2% |

| France | 9.3% |

| UK | 8.5% |

| USA | 7.6% |

| Brazil | 6.7% |

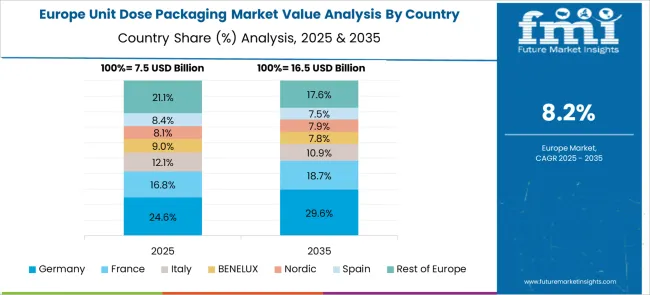

The global unit dose packaging market is projected to grow at 8.9% CAGR during 2025–2035. China leads with 12% CAGR, driven by pharmaceutical expansion and stringent dosage accuracy regulations. India follows at 11.1%, supported by cost-efficient healthcare delivery and demand for patient-compliant formats. Germany posts 10.2% CAGR, focusing on high-quality, sustainable packaging for healthcare and personal care sectors. The United Kingdom records 8.5%, while the United States grows at 7.6%, reflecting steady demand in mature markets emphasizing smart compliance tools and eco-friendly packaging. Asia-Pacific dominates overall growth due to manufacturing scale and export-oriented production, while Europe and North America prioritize safety, automation, and connected packaging technologies.

The unit dose packaging market in China is forecasted to grow at 12.0% CAGR, supported by rising pharmaceutical production and strict regulatory frameworks for medication adherence. Growing adoption of blister packs and pre-filled syringes strengthens demand across hospitals and retail pharmacies. Domestic players expand automated packaging lines to meet GMP standards, while global firms introduce innovative solutions with child-resistant and tamper-evident features. Increasing emphasis on connected healthcare accelerates integration of QR-enabled tracking and smart labeling in packaging systems. Expansion of e-pharmacy networks adds momentum to small-dose packaging adoption.

The unit dose packaging market in India is projected to grow at 11.1% CAGR, driven by increasing focus on affordable healthcare and medication safety. Unit dose blister packs for solid oral dosage forms dominate demand in hospitals and clinics, while liquid unit doses gain traction in pediatric and geriatric care. Government healthcare programs and expansion of generic medicine networks further promote low-cost, standardized packaging. Manufacturers adopt eco-friendly films and high-barrier laminates to meet both cost and compliance needs. Integration of track-and-trace systems under government ePharma guidelines is accelerating adoption in organized retail.

The unit dose packaging market in Germany is expected to expand at 10.2% CAGR, driven by advanced healthcare systems and stringent EU pharmaceutical regulations. High adoption of pre-filled injectables and single-use syringes boosts demand in specialty drug delivery. Sustainability trends promote use of recyclable blister materials and mono-material packs, aligning with EU circular economy objectives. Technological innovations like RFID tagging and smart sensors embedded in packaging enhance patient compliance and inventory management. Automation and robotics in packaging facilities improve efficiency and ensure precision for complex dosage forms.

The unit dose packaging market in the United Kingdom is forecasted to grow at 8.5% CAGR, supported by rising healthcare digitalization and demand for connected drug delivery systems. Expansion of home healthcare and e-prescriptions increases the need for secure unit dose formats that ensure correct administration. Packaging manufacturers introduce innovative tamper-proof and child-resistant solutions, integrated with QR codes for remote prescription verification. Regulatory emphasis on serialization strengthens adoption of digital-ready packaging technologies, particularly in the generic and specialty drug segments.

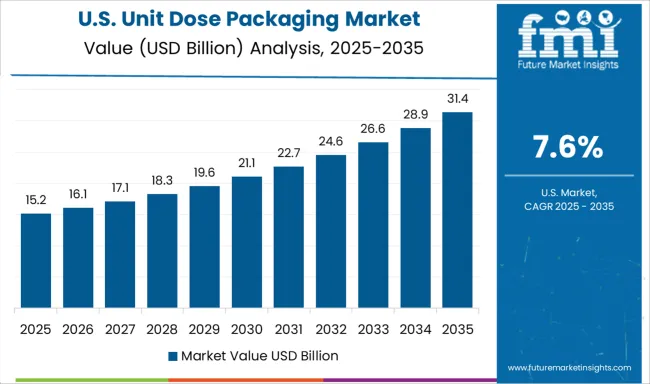

The unit dose packaging market in the United States is projected to grow at 7.6% CAGR, reflecting strong adoption in a mature pharmaceutical ecosystem emphasizing patient safety and compliance. Demand for unit dose formats in hospitals and nursing care facilities remains high due to medication error reduction protocols. Growth in personalized medicine drives adoption of smart blister packs with embedded sensors for adherence tracking. Manufacturers invest in recyclable barrier films and connected packaging systems that integrate with electronic health records (EHRs) to enhance treatment accuracy. Automation trends in pharmaceutical manufacturing accelerate robotic packaging adoption.

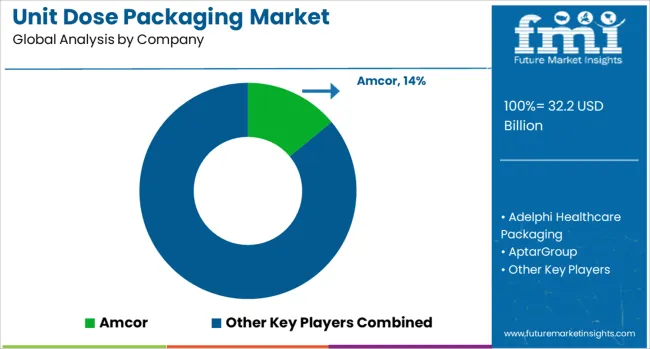

The unit dose packaging market is dominated by Amcor, which secures its leadership through a diverse portfolio of high-barrier blister packs, single-use sachets, and strip packs tailored for pharmaceuticals, nutraceuticals, and personal care products. Amcor reinforces its dominant position by leveraging advanced material science, global manufacturing facilities, and strong partnerships with healthcare companies to ensure regulatory compliance and extended shelf life for sensitive formulations. Key players such as West Pharmaceutical Services, Catalent, Gerresheimer, AptarGroup, Constantia Flexibles, and Stevanato Group hold significant market shares by providing innovative unit dose solutions like prefilled syringes, nasal sprays, and sterile packaging formats. These companies emphasize precision dosing, patient convenience, and safety features to meet rising demand in healthcare and wellness sectors. Emerging players including Adelphi Healthcare Packaging, Berry Global, Borosil, Corning, DWK Life Sciences, Glenroy, Lameplast, Nipro, Schott, SGD Pharma, Shiotani Glass, Unit Pack Company, and Valmatic are increasing competitiveness through specialized unit dose designs for ophthalmic, respiratory, and topical applications. Their strategies focus on cost-effective production, customization for small-batch pharmaceuticals, and sustainable packaging options to cater to both large-scale manufacturers and niche players. Market growth is being driven by the rising need for accurate dosing, regulatory emphasis on patient safety, and expansion of home healthcare solutions. Continuous innovation in barrier materials, sterilization processes, and convenient dispensing formats will remain key drivers shaping competitive dynamics across global markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 32.2 Billion |

| Material Type | Plastic, Aluminum, Paper & paperboard, and Glass |

| Packaging Type | Blister packs, Sachets & pouches, Ampoules & vials, Pre-filled syringes, and Others |

| Application | Oral drugs, Injectables, Topical & transdermal, and Others |

| End Use | Pharmaceutical, Cosmetics & personal care, Nutraceuticals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor, Adelphi Healthcare Packaging, AptarGroup, Berry Global, Borosil, Catalent, Constantia Flexibles, Corning, DWK Life Sciences, Gerresheimer, Glenroy, Lameplast, Nipro, Schott, SGD Pharma, Shiotani Glass, Stevanato Group, Unit Pack Company, Valmatic, and West Pharmaceutical Services |

| Additional Attributes | Dollar sales segmented by blister, sachet, strip, and pouch formats, distributed through pharmacies, hospital procurement, and e‑commerce. Pharmaceuticals dominate, with food and cosmetics rising. Asia-Pacific drives fastest growth. Demand centers on child-resistant, tamper-evident, and recyclable packaging. Smart unit-dose labeling with IoT tracking, QR authentication, and compliance-friendly designs shapes future innovations. |

The global unit dose packaging market is estimated to be valued at USD 32.2 billion in 2025.

The market size for the unit dose packaging market is projected to reach USD 75.6 billion by 2035.

The unit dose packaging market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in unit dose packaging market are plastic, aluminum, paper & paperboard and glass.

In terms of packaging type, blister packs segment to command 49.0% share in the unit dose packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pharmaceutical Unit Dose Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Pharmaceutical Unit Dose Packaging Providers

United States Commercial Refrigeration Equipment Market Size and Share Forecast Outlook 2025 to 2035

United States Dog Toys Market Size and Share Forecast Outlook 2025 to 2035

United States Biodegradable Cups and Lids Market Size and Share Forecast Outlook 2025 to 2035

United States Green Tea Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Hispanic Novelties Market Size and Share Forecast Outlook 2025 to 2035

United States Scented Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

United States Label Release Liner Market Size and Share Forecast Outlook 2025 to 2035

United States Beetroot Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States Digital Ovulation Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States of America Digital Pregnancy Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Collision Repair Parts Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Pest Control Services Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Collation Shrink Films Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Aluminum Tubes Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Child Resistant Bottles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA