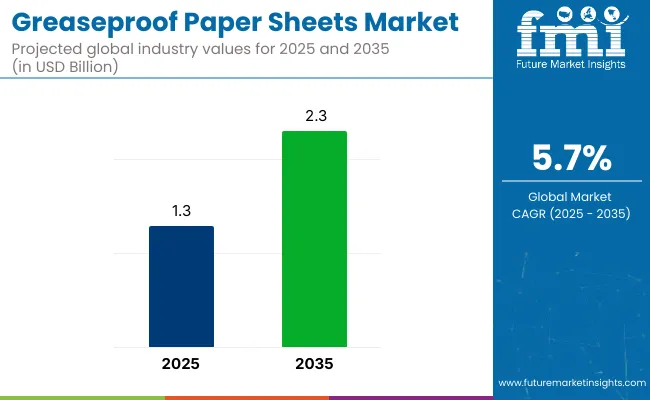

The greaseproof paper sheets market is projected to reach USD 1.3 billion in 2025 and expand to USD 2.3 billion by 2035, registering a CAGR of 5.7%. Sales in 2024 were recorded at USD 1.2 billion. Growth has been driven by increasing adoption of hygienic and grease-resistant wraps in foodservice and bakery segments.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 1.3 billion |

| Projected Market Value (2035F) | USD 2.3 billion |

| Value-based CAGR (2025 to 2035) | 5.7% |

Greater consumption of takeaway meals and artisanal baked products has been supported by widespread use of non-stick, aesthetic packaging formats.

In 2023, a facility expansion was announced by Nordic Paper to address rising demand for greaseproof paper in the food industry. “Our expansion is a direct response to strong market signals and will strengthen our position as a leading supplier in sustainable food packaging,” was stated by Anita Paulsson, EVP of Sales and Marketing at Nordic Paper.Converting lines and technological upgrades were included to improve product consistency. The move was aligned with market trends observed across global quick-service restaurants and regional food distributors.

Technical upgrades in coating and fiber engineering have been introduced to improve tensile strength, heat resistance, and non-stick performance. Product designs have been adjusted to enable compatibility with auto-wrap systems and folding applications.

Enhanced digital printing and precision cutting have been developed to improve brand visibility and handling efficiency. Innovation efforts have been concentrated on optimizing cost-efficiency and end-use versatility for bakery and fast-food packaging.

Growth opportunities are expected to emerge through the adoption of customized, multilayer greaseproof solutions in foodservice operations. Industry players are anticipated to prioritize compatibility with automated converters and differentiated product formats.

Demand across Southeast Asia and Latin America is forecasted to rise due to urbanization and quick-service retail penetration. Strategic focus is likely to remain on regional expansion, acquisition of paper converters, and food-grade paper innovation.

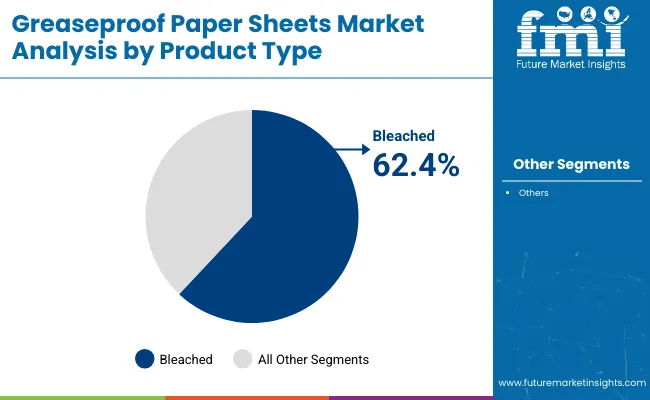

The market has been segmented based on product type, product offering, weight, application, end-use industry, and region. By product type, bleached and unbleached greaseproof paper have been included to address varied visual and functional preferences. Fluro-carbon based and fluro-carbon free variants have been offered under product offerings to meet diverse regulatory and environmental requirements.

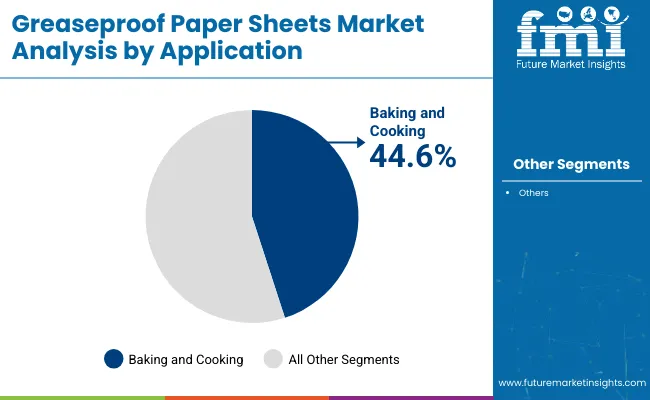

By weight, segments have been defined as <40 GSM, 40-80 GSM, and 80 GSM to serve distinct barrier and durability needs. Applications have been categorized into baking/cooking and food packaging, with the latter further segmented into paper bags, wrapping paper, laminating base paper, microflute paper, clamshells, and others.

Confectionery, poultry, fresh produce, fast foods, and others have been identified as the major end-use industries. Regional coverage has been provided for North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Bleached paper is projected to account for 62.4% of the temperature logger packaging market in 2025 due to its hygienic finish, smooth printability, and adherence to food and pharma standards. These grades have been widely utilized for primary and secondary packaging in sterile and regulatory-driven environments.

Compatibility with sealing systems and barrier coatings has been leveraged for use in cold chain packaging. Enhanced brand visibility has been enabled while maintaining clean-room acceptance across foodservice and diagnostics supply chains.

Superior adaptability to printing and variable labeling has been demonstrated by bleached grades, especially for traceable shipping of temperature-sensitive cargo. Their adoption has been supported by minimal odor, high brightness, and chemical inertness, suitable for high-purity use cases. FSC-certified variants have been increasingly selected in alignment with sustainability mandates. Demand has been anticipated to rise due to increased pharma volumes and standardized meal kit logistics.

Baking and cooking applications are anticipated to contribute 44.6% of the temperature logger packaging market in 2025, as demand for meal kits, frozen doughs, and cook-ready items has surged. Food-grade thermal packaging has been required to preserve freshness, inhibit contamination, and withstand direct appliance integration.

Embedded loggers have been increasingly used to monitor safety thresholds across last-mile delivery networks. Compliance and product integrity have been ensured for frozen, parbaked, and semi-prepped goods.

Logger integration has been adopted for real-time thermal validation throughout manufacturing and fulfillment stages. Assurance of cold chain protection has been emphasized by e-commerce and grocery distributors offering perishable meal products. Allergy-conscious segments and freshness verification claims have driven usage among premium culinary brands. Continued demand has been expected for logger-ready packaging in cooking-specific logistics flows.

Growing Food Industry

The food industry is expanding rapidly, leading to a higher demand for packaging solutions. Greaseproof paper sheets are essential for restaurants, cafes, and food delivery services.

They help keep food fresh and prevent leaks, which is important for maintaining quality. As more people eat out or order food online, the need for reliable packaging increases. This trend drives the growth of the greaseproof paper sheets market.

Focus on Sustainability

Environmental concerns are on the rise, and many buyers favour eco-friendly goods. Sheets of greaseproof paper manufactured from eco-friendly materials are growing in popularity. These sheets are a better option for the environment because they are frequently reusable and biodegradable.

Businesses are providing more environmentally friendly solutions in response to this demand. As more companies look to lessen their environmental effect, this emphasis on sustainability is driving the market ahead.

Convenience in Food Preparation

People are searching for methods to simplify the process of preparing and serving meals. Sheets of greaseproof paper offer an easy way to bake, cook, and package food. They save time and labour by preventing stickiness and simplifying cleanup.

Convenient cooking options are in greater demand as busy lifestyles become increasingly prevalent. Greaseproof paper sheets are becoming more and more popular in both household and commercial kitchens as a result of this trend.

Competition from Alternative Products

Other packaging materials compete in the market for greaseproof paper sheets. Commonly used and maybe less expensive products are aluminium foil and plastic wrapping.

For convenience, some customers might select these substitutes. The market expansion for greaseproof paper sheets may be constrained by this rivalry since businesses need to figure out how to set their products apart and emphasise their advantages.

Price Sensitivity

Many consumers are sensitive to price changes, especially in the food industry. If the cost of greaseproof paper sheets rises, some businesses may look for cheaper options. This price sensitivity can affect sales and limit market growth. Companies need to find ways to keep prices competitive while maintaining quality to attract and retain customers.

Consumers are increasingly aware of the importance of food safety and quality. Many people prefer packaging that keeps their food fresh and safe from contamination. Greaseproof paper sheets are ideal for this purpose since they stop oil and grease from leaking through. Cooking at home is also becoming more popular.

As a result of this trend, more individuals use greaseproof paper sheets for meal preparation. Additionally, consumers value environmentally friendly items, which encourages them to select sustainable solutions. Overall, as people look for quality, convenience, and environmental responsibility in their food choices, the need for greaseproof paper sheets is growing.

The greaseproof paper sheets market is witnessing several key trends. First, there is a noticeable shift toward eco-friendly materials. Many manufacturers are now producing sheets from recycled paper or sustainable sources, responding to consumer demand for greener options.

Customization is becoming popular. Businesses are looking for specific sizes and designs to meet their unique needs. This trend allows companies to stand out in a competitive market. Third, the rise of online food delivery services is driving demand. As more people order food online, the need for reliable packaging solutions such as greaseproof paper sheets increases. These trends highlight the evolving landscape of the market, focusing on sustainability, customization, and convenience.

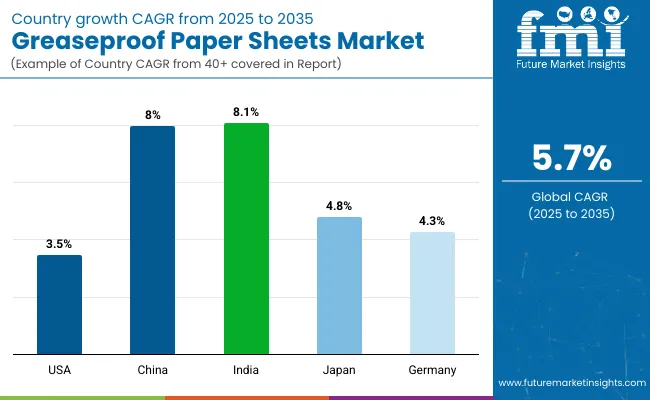

| Countries | CAGR |

|---|---|

| USA | 3.5% |

| China | 8.0% |

| India | 8.1% |

| Japan | 4.8% |

| Germany | 4.3% |

The rising demand for food delivery is projected to fuel growth in the USA greaseproof paper market. As more individuals place food orders online, eateries must use trusted packaging to maintain the freshness of their food. Sustainability is also given a lot of attention, and many customers choose eco-friendly goods. Demand is increased by the rise in preference for home cooking, as more people use these sheets for meal preparation.

In China, the greaseproof paper industry is expected to expand rapidly due to the booming food delivery industry. As urbanization increases, more people are living busy lives and relying on ready-to-eat meals. Restaurants and food vendors need effective packaging to maintain food quality during transport.

Additionally, as people become more aware of health, this makes consumers to seek safer, non-toxic packaging options. The government's push for sustainable practices also encourages the use of eco-friendly materials. These factors contribute to a positive outlook for the greaseproof paper market in China.

The rising food service sector is fuelling the growth of the greaseproof paper market in India. As more cafés and restaurants operate, there is a greater demand for high-quality packaging. Convenience meals are becoming more popular among Indian customers, and this frequently calls for efficient packaging solutions.

As families search for quick and simple ways to make meals, home cooking is also becoming popular. Additionally, there is a growing market for environmentally friendly items, and many buyers choose natural packaging materials. India has a high need for greaseproof paper sheets as a result of these trends.

Japan's greaseproof paper market is likely to grow due to the country’s unique food culture. Many traditional Japanese dishes require careful packaging to maintain freshness and presentation. The increasing popularity of bento boxes and ready-to-eat meals boosts the demand for greaseproof paper.

Additionally, Japanese consumers value quality and safety in food packaging, leading to a preference for non-toxic materials. With a growing focus on sustainability, there is also a shift towards eco-friendly packaging options. These factors support the expansion of the greaseproof paper market in Japan.

In Germany, the greaseproof paper market is expected to grow as sustainability becomes a key concern for consumers. Many Germans prefer eco-friendly packaging solutions, and greaseproof paper made from recycled materials fits this demand. The rise of the food delivery sector also contributes to market growth, as restaurants need effective packaging for takeout meals.

Additionally, the trend of healthy eating is driving demand for safe and natural food packaging. As more people focus on convenience and quality, the greaseproof paper market in Germany is well-positioned for growth.

The greaseproof paper market is competitive in terms of having many well-established players along with new competitors vying for share of the market. Brand experience and reputation enable the old brands to deliver quality products that cater to consumer requirement of safety and sustainability in high numbers. There is a clear trend towards eco materials, and many companies are answering with green packaging solutions.

Collaborations and partnerships between manufacturers, distributors as well food service providers are rampant which tends to strengthen distribution networks and extended market penetration. In general, the competitive picture is fluid with trends in consumer preferences and sustainable packaging requirements of the food industry as some core forces.

Businesses are concentrating on a few crucial tactics in order to expand in the greaseproof paper market. First, a lot of companies are focussing on sustainability by creating environmentally friendly goods. Customers that value the environment and favour eco-friendly packaging solutions are drawn in by this strategy. Businesses may reach a rising market of environmentally conscious consumers by utilising recycled materials and cutting waste.

Innovation is a significant strategy. Businesses are spending high on research to make their greaseproof paper goods better and stronger enabling the longevity of food freshness. Partnerships also play a crucial role in growth. By collaborating with food service providers and distributors, companies are expanding their reach and connecting with more customers. These partnerships help ensure that products are available where consumers want them.

Customization is gaining importance as well. Businesses are providing customised solutions to satisfy the unique requirements of many industries, including bakeries, restaurants, and food delivery services. Their products are attractive and practical because of this adaptability.

The market was valued at USD 1.3 billion in 2025.

The market is predicted to reach a size of USD 2.3 billion by 2035.

Some of the key companies manufacturing greaseproof paper include Nordic Paper AS, Georgia-Pacific Corp., Ahlstrom Munksjo Oyj, and McNarin Packaging, and others.

China is likely to be a prominent hub for greaseproof paper manufacturers.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Greaseproof Sheets Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Greaseproof Sheets Providers

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Paper Recycling Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA