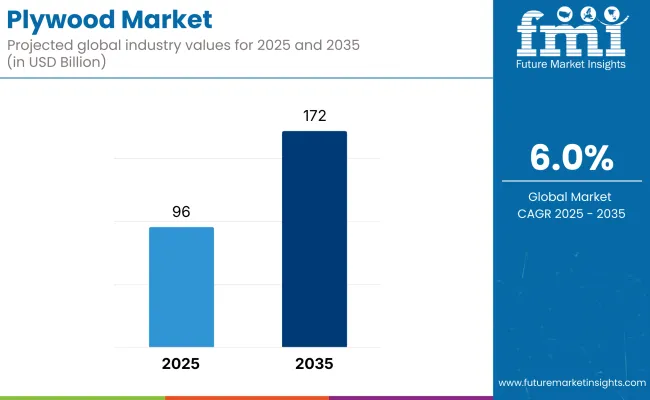

The plywood market is likely to grow continuously with an approximate size of around USD 96 billion in the year 2025 and may rise to around USD 172 billion by 2035 with a CAGR of around 6%. It is rising because of increasing construction activities, increasing demand for eco-friendly products, and increasing applications in the field of furniture and packaging.

The leading industry growth driver is the thriving construction and infrastructure industry, particularly in Asia-Pacific, the Middle East, and parts of Africa. It is widely applied in roof coverings, flooring, paneling, and wall sheathing for residential and commercial building owing to its affordability and durability.

The furniture and interior designing industry is also a major contributor. It is widely used in making cabinets, wardrobes, office furniture, and decorative panels. Its imitation potential, processability, and resistance to shrinkage or swelling make it an ideal material for modern interiors and modular furniture systems.

Technological developments in veneering, adhesive bonding, and fire retardancy have improved the performance of the products. Advances in moisture-proof and termite-proof types are expanding the use of the material to outdoor and high-humidity conditions, such as marine, agricultural, and commercial purposes.

The industry is challenged by raw material supply, deforestation issues, and unstable timber prices. Governmental logging restrictions and rising demand for wood certified sources can drive costs up, compelling manufacturers to embrace plantation-based and sustainable forestry methods.

Increased availability of engineered wood alternatives, including MDF and particleboard, also creates competition in some applications. However, it still has an advantage in load-bearing construction and long-term durability, particularly where strength-to-weight ratio is highly important in the application.

The industry is flourishing and growing at a fast speed due to the construction and furniture manufacturers' needs. Most of these applications include residential and commercial constructions to furniture making and packaging. The hardness, versatility, and affordability are the main reasons it is a much-demanded product for so many applications. The industry is dominated by a range of product types specific to a particular application, ranging from softwood, hardwood, to marine plywood.

Technological advancements have led to the development of fire-resistant and water-proof option, satisfying evolving end-user needs. The Asia-Pacific region, particularly China and India, has most of the industry share due to urbanization and rapid industrial development.

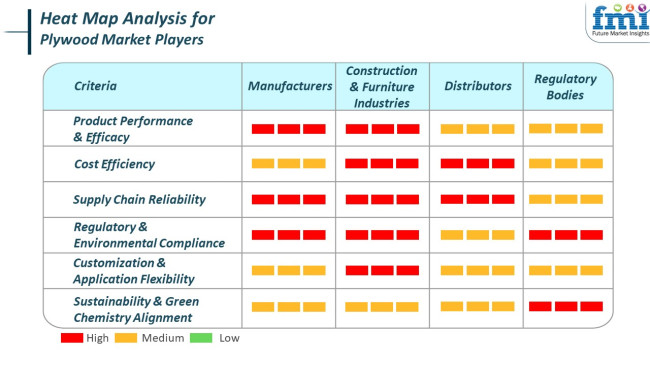

Moreover, the trend towards sustainable and environmentally friendly products has encouraged manufacturers to follow environmentally sound practices, thus affecting industry dynamics. Manufacturers stress producing high-quality plywood according to the stringent requirements of the construction and furniture industries. They invest in green production methods and desire to achieve a stable supply chain to serve the growing demand from around the world.

Construction and furniture industries require cost-efficient and reliable solutions that deliver top-class performance for various applications. They seek out materials that are extremely effective, sustainable, and can be engineered to meet certain operational needs.

From 2020 to 2024, there was moderate growth in the industry, as a result of the consistent demand from the construction, furniture, and interior design industries. The pandemic initially slowed down demand as a result of delayed construction and supply chain disruption.

But the housing construction industry also saw an uptick, especially as work on home improvements picked up pace as individuals remained indoors more than ever before. Joining the demand too were plywood products created with renewable wood material and forestry conducted sustainably.

Prior to 2025 to 2035, the industry is going to experience significant changes with the increasing focus on green building materials and sustainability. There will be a sudden surge in demand for green substitutes, including FSC-certified wood or low-emission adhesive-based plywood.

Also, the increased focus by the construction sector on energy-efficient and green construction practices will fuel demand for these products too. In addition, technological innovation in production will result in more durable, lightweight, and cheaper products that will make them more attractive for use in many areas, including the production of furniture, cabinetry, and interior design.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing demand from residential construction and renovation projects. | Sustainability trend-driven growth and environmentally friendly building materials in the construction industry. |

| Limited innovation, with a focus on cost-effective, long-lasting products. | Manufacturing technology advances resulting in lighter, stronger, and more versatile products. |

| Increased demand for FSC-certified plywood, with some regulatory pressure on sourcing. | Increased regulations driving sustainability, resulting in the growth of environmentally friendly alternatives. |

| Construction, furniture, and home improvement project focus. | Growth into green building endeavors, where there is a higher application in sustainable interior design and green homes. |

| Pandemic-induced supply chain disruptions, coupled with difficulties in raw material sourcing. | Enhanced supply chain resilience and sustainable sourcing from certified forests, fueled by worldwide efforts towards sustainability. |

| More consumer demand for sustainable. | Heavy focus on lowering the environmental impact of production and taking up green certifications. |

The sector is witnessing strong growth, fueled by growing demand from the construction, furniture, and packaging sectors. Yet, some of the existing and anticipated risks could affect its course.

One of the major ongoing threats is the price volatility of raw materials, i.e., timber and adhesives. Volatility in these materials can potentially affect manufacturers' costs of production and profit margins. Besides this, there is also environmental control tightening, with increased emphasis on deforestation and carbon emissions.

Compliance with such regulations can be extremely costly in terms of investment in sustainable manufacturing and sourcing practices. In addition, the industry is confronted by the presence of cheap imports, which may contribute to price rivalry and affect local manufacturers.

In the future, the industry might face risks related to technological progress and shifting consumer trends. With the emergence of new materials and building techniques, conventional products can be challenged by others with improved performance or reduced environmental impact. Moreover, geopolitical conflicts and trade policies can disrupt global supply chains, affecting the supply of raw materials and finished goods. The industry's reliance on specific regions for production is a factor contributing to this vulnerability.

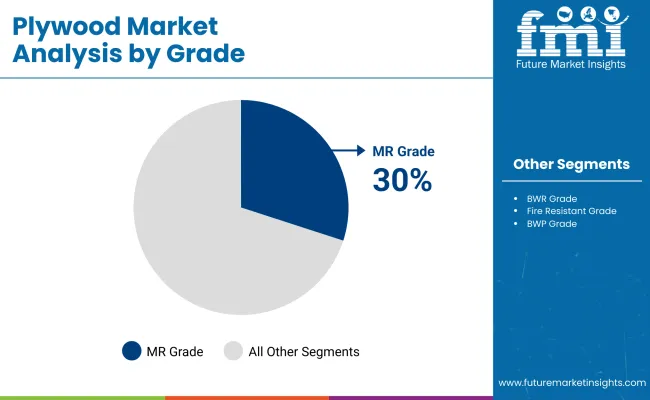

The industry is being segmented on a grade basis, thereby making MR Grade and BWR Grade the two most prominent classes. As per forecasting, in 2025, the MR Grade will comprise 30% of the total shares, whereas the BWR Grade will comprise 25%.

MR grade moisture resistant plywood has the highest industry share as it is the most affordable and versatile for use in interior projects. It can generally be seen that the extensive application of MR-grade in furniture making, paneling, and cabinetry in regions is often addressed in residential construction.

Plywood is treated to contain moisture resistance, allowing its use in room conditions characterized by moderate humidity, like in living rooms, bedrooms, or office furniture. With Greenply Industries and Century Plyboards India providing MR-grade for all possible applications due to its incredible cost justification of durability and strength, its suitable application in affordable housing and residential interiors in emerging industries becomes an important parameter of growth for MR-grade plywood.

On the flip side, the BWR grade would make up 25% of the industry in 2025. Plywood of this sort is resistant to higher levels of moisture and is normally meant for water and humidity-exposed areas such as kitchens, bathrooms, and commercial spaces. BWR-grade can endure a much harsher environment and gives higher strength and durability.

Kajaria Plywood and Sarda Plywood, the manufacturers of BWR-grade plywood, guarantee high performance and dependability for uses in housing and commercial applications. Exponentially growing demand for BWR-grade can easily be justified with increasing construction in cases where moisture resistance is much needed, especially in the commercial sector, for use in cabinetry and wall paneling in places drenched with moisture.

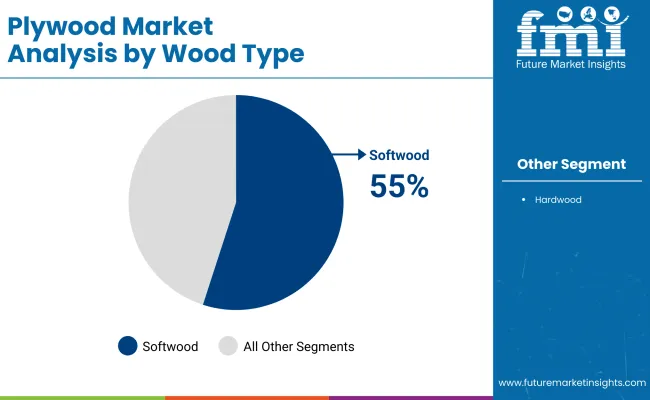

In the industry, the segmentation by wood type shows that softwood has a much stronger edge over hardwood. Softwood is expected to hold a industry share of 55% in 2025, while 45% will be held by hardwood.

Softwood is mostly appreciated for its cheap cost, availability, and flexibility. Its application is mostly in construction for frame, subfloor, and general applications in residential and commercial buildings. Softwood is very lightweight and durable, making it fit to be used in applications where handling is easy and cost-effective. Producers of softwood like Georgia-Pacific and Weyerhaeuser have diversified users from wall and ceiling construction to furniture manufacturing.

The consequent extensive use of softwoods in industries and residential construction makes it a viable option in the industry. On further note, the demand for softwood is also supported by its usage where strength-to-weight ratio is crucial, for example, in automotive and marine applications.

Hardwood, being denser and stronger than its softwood counterpart, will only acquire a 45% industry share by the year 2025. Potential industries include high-end furniture, cabinetry, and flooring, mainly where everything is defined by semblance, which would require extra strength and durability.

Typically, hardwood is used in applications that need a subtle finish and high durability, such as high-end furniture and ornamental woodworking. On the production side, key manufacturers like Arauco and PotlatchDeltic manufacture hardwood for industries where long-lasting applications require superior quality. Hardwood in high-end and custom-designed applications ensures that there will always be a steady demand for this wood, especially in the sub-sector of furniture, interior works, and luxury construction.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 2.8% |

| UK | 2.5% |

| France | 2.6% |

| Germany | 2.7% |

| Italy | 2.5% |

| South Korea | 2.8% |

| Japan | 2.6% |

| China | 3 % |

| Australia | 2.6% |

| New Zealand | 2.5% |

The USA industry is expected to grow at a CAGR of 2.8% during 2025 to 2035. Demand is expected to be driven by increased activity in non-residential construction and residential renovation. Plywood's toughness, affordability, and versatility in structural applications make it a key component in flooring systems, roofing, and formwork in infrastructure construction.

Large domestic manufacturers such as Boise Cascade Company, Roseburg Forest Products, and Georgia-Pacific LLC have been developing moisture-resistant and fire-retardant varieties. Government spending on infrastructure under multi-year capital programs will drive consistent material use.

The British industry is anticipated to grow at a CAGR of 2.5%. Though the post-Brexit construction sector has witnessed modest growth, the demand remains significantly correlated with sustainable housing and modular construction patterns. The recyclability and durability of it have sustained its popularity despite increasing awareness of the environmental impact of construction materials.

Companies like Hanson Plywood and James Latham Ltd. have seen sales rise in certified sustainable and specialty industries. EU timber regulation compliance and UK Conformity Assessed (UKCA) marking standard have influenced buying patterns, with certified imports being favored.

France is expected to reach a CAGR of 2.6% between 2025 and 2035. The rising adoption of energy-efficient building designs and eco-certified refurbishments drives the demand in France. The use in prefab buildings and light commercial interiors has become more popular, driving industry strength during economic swings.

Companies such as GroupeRougier and Thebault Plywood are using local timber resources and sophisticated veneer technology to match low-emission building practices. Green construction and circular construction regulatory systems are the key drivers of long-term industry demand.

Germany's industry also is anticipated to register growth at a CAGR of 2.7% over the forecast period. Continuous development in residential construction and the use of engineered wood products in energy-efficient buildings are robust growth drivers. The government's emphasis on low-carbon building materials has favored plywood over metal and concrete in certain applications.

Manufacturers like PollmeierMassivholz GmbH and Koskisen GmbH are experts in the production of laminated and cross-laminated panels tailored to German building codes. Rising fire resistance and thermal performance of engineered plywood are compelling its growing application in mid-rise construction.

Italy is also anticipated to grow by a CAGR of 2.5%. The industry relies on constant demand for interior renovation, marine, and furniture making. Value-added usage is supported by Italian craftsmanship, its design culture in decorative finishing, and light panel utilization.

Major manufacturers such as SAIB and FantoniSpA are investing in environmentally labeled goods and increasing manufacturing capacity to meet evolving export requirements. Regulatory measures favoring biomass-based products also create opportunities for the use of plywood beyond conventional buildings.

South Korea will grow at 2.8% CAGR. Rising demand for modular construction, small-volume housing, and high-rise interiors is propelling the use. Lightweight and strong plywood gives functional advantages for space-saving, flexible solutions in urban centers.

Companies like Dongwha Enterprise and Hanwha L&C are creating high-quality varieties with exceptional warping and weathering performance. Dependence on imports remains strong, particularly for hardwood veneers, with a focus on sources from certified Southeast Asian and Oceania forests.

Japan is anticipated to expand at a CAGR of 2.6%. The industry remains firm due to the high demand for earthquake-resistant buildings, conventional dwelling tendencies, and advanced wood building structures. Seismic performance and heat insulation provided by plywood have augmented its value proposition compared to national building codes.

Key industry players such as Sumitomo Forestry Co., Daiken Corporation, and Nissin Plywood Co. are investing in plywood used in structure-grade forms as cross-laminated and laminated veneer lumber. The government's pro-wood-based architecture policies have further deepened plywood's role in future residential building.

China stands to lead regional industry expansion with an estimated CAGR of 3%. Large-scale urbanization, infrastructure expansion, and high export output drive high demand. The material's application in concrete formwork, packaging, and furniture production guarantees broad industry-wide demand.

Leading companies such as China National Building Material Company and Luli Group are also expanding capacity and enhancing production processes to be in tune with international quality levels. Increased adoption of automated veneer technologies and emission-trapping adhesives is increasing export competitiveness and environmental compliance.

Australia is forecast to grow at a CAGR of 2.6%. Demand is sustained by residential construction in suburban industries, renovation of existing housing stock, and social infrastructure projects financed by the government. Plywood is increasingly being utilized in weather-resistant sheathing and framing for energy-efficient homes.

Regional producers such as Austral Plywoods and Big River Group deal in plantation timber that is sustainably sourced as well as marine-grade plywood grades. Fire protection and performance-based material standards in national building codes have contributed to the industry position.

The industry in New Zealand is expected to increase at a CAGR of 2.5%. The demand is supported by domestic construction of earthquake-resistant buildings and urban as well as rural area infrastructure development. Raw material inputs for the local production of plywood are domestic supplies made secure owing to abundant domestic timber resources.

Companies like Nelson Pine Industries and Juken New Zealand Ltd. have plantation-based production and formaldehyde-free resins to address both health and environmental concerns. Green building certification programs have contributed positively towards the use in public and private sector developments.

The industry presents fierce competition for multinationals, national players, and niche companies, all fighting for their respective small share of the industry. Weyerhaeuser Company and Georgia-Pacific LLC are the chief players, enjoying the advantages of vertically integrated supply chains, vast timberland resources, and advanced manufacturing techniques, with their focus on high-performance engineered wood products solidifying their dominance in the construction, furniture, and industrial spaces.

While Boise Cascade Company and UPM seek to capitalize on their investments in sustainability efforts using certified wood sources and eco-adhesive technologies, they continue to align with green building initiatives. Their investment in moisture- and fire-resistant plywood has also helped boost their profile in the infrastructure and residential construction industries.

In the niche of decorative and high-end plywood applications, Greenply Industries Limited and Uniply Industries Ltd cater to clients in the interior design, modular furniture, and commercial fit-out industries. Their brands are well entrenched in the industry and backed up by a strong retail distribution network across Asia and Europe.

In low-cost, high-volume exporting, Asian producers, including Jaya Tiasa Holdings Berhad and Subur Tiasa Holdings Berhad, hold significant industry shares due to their cost-effective manufacturing in Malaysia and Indonesia. Conversely, SVEZA is the top player in the Russian European industry, recognized for its high-strength birch plywood for industrial as well as structural applications.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Weyerhaeuser Company | 18-22% |

| Georgia-Pacific LLC | 15-19% |

| Boise Cascade Company | 12-16% |

| Greenply Industries Limited | 10-14% |

| UPM | 8-12% |

| Combined Market Share (Other Players) | 20-30% |

| Company Name | Key Offerings |

|---|---|

| Weyerhaeuser Company | Structural-grade for residential and commercial construction applications. |

| Georgia-Pacific LLC | Pressure-treated and moisture-resistant optimized for industrial and marine applications. |

| Boise Cascade Company | Eco-certified and fire-retardant panels for sustainable construction projects. |

| Greenply Industries Limited | Decorative plywood and veneer products with premium wood finishes. |

| UPM | Lightweight yet high-strength solutions for transportation and furniture applications. |

Key Company Insights

Weyerhaeuser Company (18-22%)

A structural and engineered wood industry leader, Weyerhaeuser's vertically integrated timberlands and high-capacity mills provide supply chain control and cost-effectiveness.

Georgia-Pacific LLC (15-19%)

Georgia-Pacific is an industrial-grade specialist that invests in pressure-treated and fire-resistant paneling for marine, infrastructure, and high-humidity applications.

Boise Cascade Company (12-16%)

Boise Cascade is committed to sustainability, providing eco-friendly solutions as well as collaborating with LEED-certified projects and green builders.

Greenply Industries Limited (10-14%)

Greenply leads the decorative category with the fusion of superior aesthetics and robust, termite-proof characteristics for superior furniture and interior uses.

UPM (8-12%)

UPM is a major European entity that focuses on lightweight, high-strength solutions for the automotive, marine, and construction industries.

Other Key Players

By size, the industry is segmented into 4’x8’, 4’x6’, 4’x10’, 3’x6’, and others.

By thickness, the industry is categorized into <8mm, 8mm-18mm, and >18mm.

By grade, the industry is divided into MR grade, BWR grade, fire resistant grade, BWP grade, and structural grade.

By wood type, the industry is classified into softwood and hardwood.

By number of ply, the industry is segmented into 3 ply, 5 ply, 7 ply, and more.

By sales channel, the industry is categorized into direct sales and distributors/retailers.

By application, the industry finds applications in furniture, flooring & construction, automotive interiors, packaging, marine, and others.

By region, the industry spans North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

The industry is estimated to reach USD 96 billion by 2025.

The industry is projected to grow to USD 172 billion by 2035.

China is expected to grow at a rate of 3%.

MR grade plywood is the leading product segment.

Key players in this industry include Weyerhaeuser Company, Georgia-Pacific LLC, Boise Cascade Company, Greenply Industries Limited, UPM, Uniply Industries Ltd, Jaya Tiasa Holdings Berhad, Subur Tiasa Holdings Berhad, and SVEZA.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plywood Boxes Market Size and Share Forecast Outlook 2025 to 2035

Wooden & Plywood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Softwood Veneer and Plywood Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA