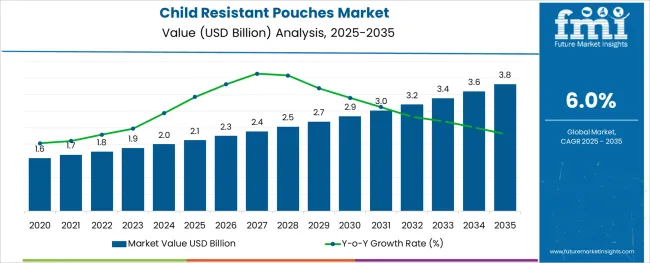

The Child Resistant Pouches Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 3.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

The child resistant pouches market is witnessing steady growth, driven by rising safety concerns and evolving regulatory standards surrounding the packaging of hazardous and controlled substances. With increased incidents of accidental ingestion, especially among children, governments and health organizations have reinforced mandates requiring tamper-proof and child-safe packaging across industries including pharmaceuticals, cannabis, and household chemicals.

As a result, manufacturers are innovating with multi-layered barrier films, heat-sealable materials, and advanced locking mechanisms that comply with child-resistance protocols while maintaining ease of use for adults. Additionally, the surge in direct-to-consumer sales of medications and supplements has boosted demand for secure yet lightweight packaging formats that meet e-commerce and sustainability standards.

Future growth is expected to be supported by continued regulatory scrutiny, growing awareness around at-home safety, and the expansion of child-safe design applications beyond traditional pharma use-cases into personal care and nutraceuticals.

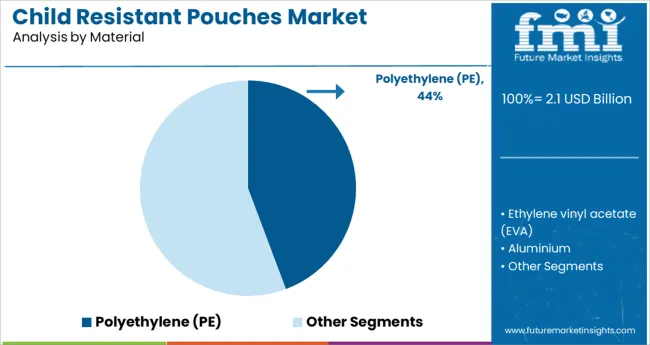

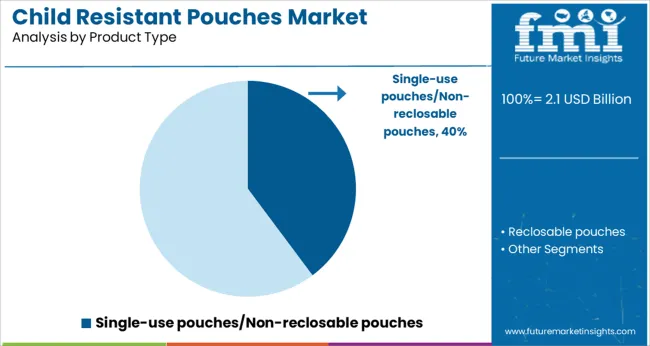

The market is segmented by Material, Product Type, Filling method, and End Use and region. By Material, the market is divided into Polyethylene (PE), Ethylene vinyl acetate (EVA), Aluminium, and Others. In terms of Product Type, the market is classified into Single-use pouches/Non-reclosable pouches and Reclosable pouches.

Based on Filling method, the market is segmented into Fill through top and Fill through bottom. By End Use, the market is divided into Pharmaceutical products, Household Chemicals, Detergent Pods, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

It is estimated that polyethylene (PE) accounts for 44.30% of the overall revenue in the material segment, positioning it as the most widely used substrate in child resistant pouch manufacturing. This dominance is attributed to PE’s excellent flexibility, seal integrity, and puncture resistance, which are critical for maintaining product safety and preventing unauthorized access.

Its compatibility with various lamination structures allows manufacturers to meet both regulatory and barrier property requirements. Moreover, PE’s lightweight profile contributes to cost-efficiency in production and distribution, while also aligning with sustainability efforts through recyclability.

Its widespread availability and adaptability for high-speed pouching equipment have further entrenched its use. These functional and economic advantages have solidified PE’s position as the preferred material in the development of child resistant packaging solutions.

The single-use or non-reclosable pouches segment is projected to hold 39.80% of the product type market by 2025, reflecting a strong preference for disposable safety formats. This leadership is driven by regulatory compliance needs in pharmaceutical and cannabis applications, where controlled dosage and tamper evidence are critical.

Single-use designs reduce the risk of accidental reuse, enhancing product integrity and user safety. The format has also gained traction in sectors where once-opened contents are intended for immediate or one-time use, simplifying safety standards and reducing liability risks for manufacturers.

Additionally, non-reclosable pouches require fewer mechanical components, lowering production complexity and improving cost efficiency. As consumer and regulatory emphasis on secure, tamper-evident packaging grows, this segment remains at the forefront due to its simplicity, effectiveness, and widespread applicability.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Companies with revenues generated from selling child resistant pouches exceeding USD 5 Million, have been considered Tier I companies. Those with segment revenues between USD 1 Million & USD 5 Million, have been considered as Tier II companies. Finally, companies with segment revenue below USD 1 Million have been considered as Tier III companies.

Annually, a significant number of accidental drug ingestion cases are reported, of which, nearly 45% of the cases comprise of children below 52 months, as the subject. To curb the risk of accidental ingestion by children, yet, ensure a convenient opening system for adults, child resistant packaging, and by extension, pouches, are manufactured.

Child resistant pouches are mostly used in the pharmaceutical, and medicinal marijuana industry, due to high demand for specific packaging, and packaging solutions which are compliant with government regulations.

The child resistant pouches market share is subject to significant influence from government regulations and design level innovation among key manufacturers.

Globally, manufacturers of child resistant pouches are emphasizing on innovative designs, such as that of ‘Thumb-Pocket’ zipper bags. These have thumb tab zippers, which are easy for adults to open.

The design includes a sophisticated press-to-close zipper, instead of a bulky pull-tab closure. Also, a significant number of single dose child resistant pouches feature micro tear slits for opening.

The micro perforation near the corner enables adults to tear the package open, without efforts.

In addition, child resistant pouches are designed to be opaque, to eliminate product visibility. The ‘PharmaLoc’ External latch pouches feature a tab, which can only be opened with two-handed dexterity, which is impossible to achieve by children aged below 52 months.

Another feature which is seen in child resistant pouches is a ‘Push-pin’ child guard features, wherein, a special pin needs to be inserted to the zipper to access the contents.

The road ahead

The advancement in pharmaceutical drug formulation processes, coupled with the ever expanding variety of drugs will continue to create absolute need for special packaging, to ensure total reduction of accidental ingestion cases.

The global child resistant pouches market will be influenced by further amendment in existing regulations, in accordance with advancement in drug formulations.

Therefore, the global child resistant pouches market is expected to have a positive outlook over the forecast period.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data.

It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

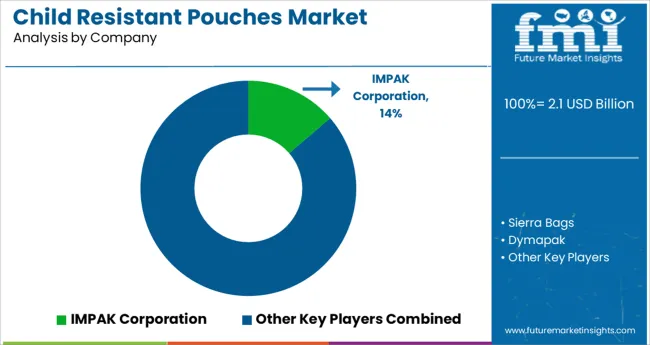

Some of the key players operating in the global child resistant pouches market are IMPAK Corporation, Sierra Bags, Dymapak, Stink Sack, Bemis Company, Inc., Mondi Plc, Amcor Ltd., Sealed Air Corporation, Constantia Flexibles Group GmbH, and Sonoco Products Company, among others.

The raw material suppliers include E.I. du Pont de Nemours and Company, China Hongqiao Group Limited, and United Company RUSAL Plc, among others.

The global child resistant pouches market has been segmented as follows -

The global child resistant pouches market is estimated to be valued at USD 2.1 billion in 2025.

It is projected to reach USD 3.8 billion by 2035.

The market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types are polyethylene (pe), ethylene vinyl acetate (eva), aluminium and others.

single-use pouches/non-reclosable pouches segment is expected to dominate with a 39.8% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Distribution Among Child-Resistant Pouches Manufacturers

Child Resistant Locking Pouches Market from 2025 to 2035

Child Resistant Single Dose Pouches Market Size and Share Forecast Outlook 2025 to 2035

Children Enteral Nutrition Market Size and Share Forecast Outlook 2025 to 2035

Child Safety Seats Market Growth - Trends & Forecast 2025 to 2035

Children’s Health Supplement Market Analysis by Product Type, Application and Age Group Through 2025 to 2035.

Children Mattress Market Product Type, Ingredient Type, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Child resistant Zipper Market Size and Share Forecast Outlook 2025 to 2035

Child-Resistant Pumps Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Re-Closable Edible Bags Market Size and Share Forecast Outlook 2025 to 2035

Child-Resistant Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Pipette Closures Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Dropper Caps Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Bottles Market Size and Forecast

Child-Resistant Containers Market Trends & Demand 2025 to 2035

Competitive Landscape of Child Resistant Re-Closable Edible Bags Providers

Leading Providers & Market Share in Child-Resistant Foil Packaging

Market Share Insights for Child Resistant Dropper Caps Manufacturers

Market Share Distribution Among Child Resistant Pipette Closures Manufacturers

Child Resistant Bags Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA