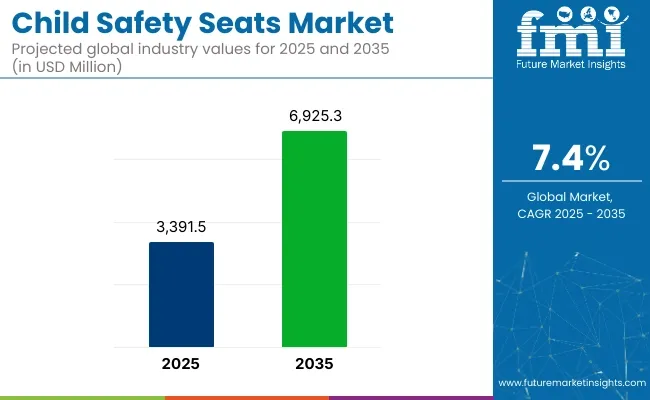

The global child safety seats market is projected to reach USD 3,391.5 million in 2025 and expand to USD 6,925.3 million by 2035, registering a compound annual growth rate (CAGR) of 7.4% during the forecast period. Growth is being supported by regulatory enforcement, product innovation, and rising consumer emphasis on child passenger safety.

In 2024, new car seat safety regulations were introduced by the National Highway Traffic Safety Administration (NHTSA). As reported by What to Expect, updates to federal safety standards now require improved side-impact protection and stricter installation compliance testing. These changes were implemented to align with real-world crash data and child restraint effectiveness studies. Manufacturers have been required to update their testing procedures and product designs to meet these criteria by the compliance deadline.

Recaro announced a strategic partnership with Avova in 2024 to expand its portfolio of child safety seating systems. According to the official press release, the collaboration was formed to combine Recaro’s design and engineering capabilities with Avova’s compliance knowledge within European safety regulations.

Recaro confirmed that the initiative will include the development of new booster and convertible seat models for the ECE R129 (i-Size) regulation category. Production has been planned for facilities in Germany to ensure quality consistency and supply chain efficiency.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3,391.5 million |

| Industry Value (2035F) | USD 6,925.3 million |

| CAGR (2025 to 2035) | 7.4% |

In the USA market, Chicco USA introduced a new rotating convertible car seat in early 2024. As per the company’s statement, the product was designed to allow 360-degree rotation, easing in-car installation and everyday use. The seat complies with both rear- and forward-facing configurations for multiple age groups and incorporates energy-absorbing materials for impact protection.

According to the announcement, “Chicco’s design addresses caregiver convenience while maintaining adherence to federal safety benchmarks”.As countries introduce stricter crash-test requirements and public campaigns continue to educate caregivers on proper restraint use, demand for certified, modular, and long-life child safety seats is expected to increase steadily through 2035.

Convertible car seats accounted for 34% of the global market share in 2025 and are projected to grow at a CAGR of 7.6% through 2035. Their appeal was driven by the ability to transition from rear-facing to forward-facing configurations, offering prolonged usage and cost efficiency for parents.

In 2025, regulatory guidelines in North America and Europe encouraged extended rear-facing usage up to 2 years of age, reinforcing demand for convertible seats. These seats were widely adopted for their adaptability across child weight and height ranges, making them a preferred choice for families with growing children.

Manufacturers enhanced safety features such as side-impact protection, energy-absorbing foam, and multi-position recline mechanisms. Product development focused on latch system improvements, easier installation indicators, and vehicle compatibility to meet evolving safety standards like FMVSS 213 and ECE R44/129.

Rear-facing seats held 47% of the global market share by seat orientation in 2025 and are expected to grow at a CAGR of 7.7% through 2035. These seats were mandated for use in early childhood due to their superior head, neck, and spine protection during frontal collisions.

In 2025, adoption was reinforced by pediatric health guidelines and updated road safety regulations in countries such as the United States, Germany, Sweden, and Australia. Rear-facing configurations were integrated across infant, convertible, and all-in-one seat categories, offering flexibility and compliance for children up to 18 kg or 105 cm in height.

Manufacturers prioritized load leg features, anti-rebound bars, and improved base anchoring systems to enhance crash performance. Awareness campaigns and government-backed car seat inspection programs also contributed to increasing rear-facing seat usage across both new and existing child safety installations.

Lack of Awareness and Low Adoption in Emerging Markets

Despite the stringent safety regulations in developed regions, many emerging economies still lack strong child passenger safety laws and enforcement mechanisms. In countries where vehicle ownership is rising, the adoption of child safety seats remains low due to a lack of awareness and cultural perceptions regarding child transportation.

Additionally, economic constraints and affordability concerns prevent widespread adoption of high-end child safety seats in price-sensitive markets. Governments and safety organizations need to implement educational campaigns, incentives, and stricter enforcement policies to promote the use of child car seats in developing regions.

Counterfeit and Non-Certified Products

The market faces a significant problem due to the massive influx of counterfeit and substandard child safety seats. Many of the inexpensive, unapproved car seats found in the market do not meet safety standards and could seriously endanger children in case of an accident. Mismanagement of the regulatory framework, as well as poor quality surveillance cantors, allows for the unsafe sale of child restraint systems, to the detriment of consumers.

In order to tackle the challenge, the regulatory bodies, and the producers have to improve the standards for product certification, as well as the steps for compliance, and have to train the consumers on the drawbacks related to the child safety seats that did not receive certification.

Advancements in Smart and AI-Powered Child Safety Seats

The increased use of smart technology in child safety seats is contributing to the rise of market growth. Sensors that measure temperature or change, crash alerts, AI-engineered impact absorption systems, and child positioning monitoring systems that operate in real-time are the types of devices being integrated by the crew of researchers and engineers. Car seat manufacturers are creating smart child car seats with Bluetooth technology, GPS locator, and IoT safety features that parents can activate.

The advantages of these smart child car seats are real-time notifications about the safety of the kid and the automatic transmission of emergency alert in case of an accident. The integration of IoT in the automotive industry and the development of AI-based safety features are expected to lead the transition to newer models of child safety seats.

Growing Demand for Sustainable and Ergonomic Designs

The growing interest in products that are environmentally safe and have long life span is resulting in new market opportunities. Specifically, companies are making child car seats that are done with recyclable plastic, organic fabric, and naturally flame-retardant materials that no harmful toxins are involved to fulfill the demand of the customers looking for products that are environmentally friendly.

Furthermore, the ergonomic and multi-functional car seats, which can be used from infancy to childhood are now the most sought product by the budget-oriented as well as the convenience-seeking parents. The development of compact, foldable, and ultra-lightweight child car seats, which could be carried on trips has benefited the market in both advanced and developing countries.

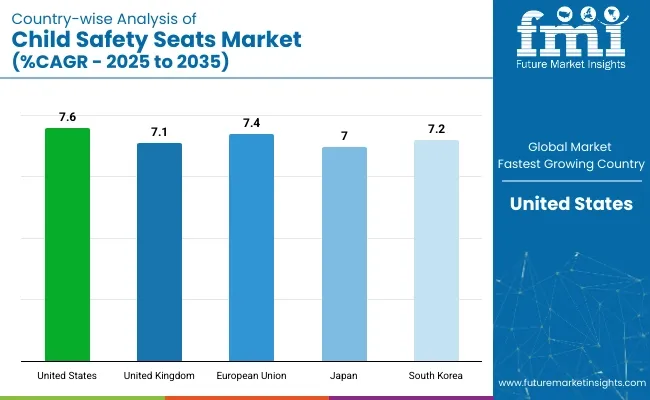

The United States child safety seats market is widening as a result of governmental initiative, parents become more concerned about the safety of the children, and automobile ownership is on the rise. The National Highway Traffic Safety Administration (NHTSA) has stringent rules for the use of a car seat for children, namely those that are appropriate for age and weight.

This is because of the fact that parents tend to ignore directives and always put the child's seat in the front. Be it as it may, the latest technology such as smart sensors on the child safety seat for knock, temperature control, and monitoring by the phone app, is making such seating more attractive for hi-tech lovers. Beside this, the e-commerce sector is the other strong factor that supports the expansion of the market. It is thanks to the rise of online shops that families have the opportunity to choose and purchase various types and features of car seats for their children with no difficulty.

An additional increase in the number of ridesharing services, which specifically appeal to families, is becoming an important factor in the demand for portable and foldable car seats. Moreover, state laws compelling the use of booster seats up to the age of 8 or older are further underpinning the market development.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.6% |

The United Kingdom child safety seats market is on the rise, thanks to the adherence to stringent legal mandates, people opting for high-end goods, and greater cognizance about road safety for children. The Road Traffic Act in the UK requires all children under 12 years or 135 cm in height to use child car seats, subsequently increasing sales of such age-appropriate car seats.

Furthermore, the market shows a growing trend in the ISOFIX-compatible child seat sales as the manufacturers prioritize both the hassle-free installation and the increased safety. An additional example is the emergence of the eco-friendly and sustainable car seat materials, which are made of recycled fabrics and non-toxic plastics, that are certainly very attractive to the parents who care about the environment.

Moreover, the insurance benefits provided to parents that use the certified child safety seats are the other efficient driving factors for the adoption. The advent of online-shopping platforms that are offering safety-rated child seats is also adding to the market access success.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.1% |

The European Union child safety seats market is developing rapidly owing to the establishment of the safety regulations, an increase in the education of child safety in transport, and the broadened government involvement. To a considerable extent, the demand for quality child seats that comply with the new regulations is facilitated by the ECE R129 (i-Size) regulation, which requires the use of rear-facing car seats for at least 15 months and longer in some cases.

In addition, the market expansion is clearly influenced by the preeminently high use of premium and luxury car seats in countries such as Germany, France, and the Netherlands. Environmental concerns and the EU's directive on safety innovation are also the reasons for this shift, the development of recyclable car seats and the use of smart monitoring systems.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.4% |

The child safety seats market in Japan is experiencing a continuous expansion, mainly due to the implementation of stringent traffic safety regulations, the birth rate increase, and the development of child-friendly mobility solutions. According to the Japanese Road Traffic Act, children below 6 years must use child safety seats which has resulted in the wide acceptance of them.

With the technological edge, Japan is witnessing more and more innovations in children's safety seats, such as fabric that can regulate temperature, suspension designs for impact resistance, and AI-integrated safety monitoring. Furthermore, as compact vehicles and an urban driving environment are predominant in Japan, the need for lightweight and space-saving car seats is being effective.

The surge of nuclear families and the need for premium baby products are also the factors that drive the sales of convertible and all-in-one car seats which provide long-term value and adaptability.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.0% |

The expansion of the South Korea child safety seats market is due to the government-supported road safety initiatives, increase in disposable income, and urbanization. The government of South Korea directs the mandatory use of a child safety seat for kids under 6 years which is a factor that causes the demand for high-quality and budget-friendly car seats to increase.

The robust e-commerce sector of the country is also an important factor driving the online sales of child safety seats. As a result, premium and internationally certified seats are accessible to the customers. Besides, intelligent security features, such as temperature control and motion sensors, are becoming trendy with tech-savvy parents.

Manufacturers are also responding to the growing interest in sustainability by producing car seats made of non-toxic, BPA-free, and recycled materials, which are sought after by eco-friendly consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.2% |

The international child safety car seats market is experiencing a steady climb as it is propelled by increased awareness of child safety in cars, tougher government rules, and the ever-growing number of vehicles worldwide. Child car seats are the ones that offer the most protection, as they facilitate the diminishing of injury possibility, as well as the adherence to road safety laws; hence they have to be used for infants and toddlers to sit in a car safely.

The sector is influenced by the breakthroughs in the production of materials that are resistant to impact, the adoption of smart safety features, and the requirement for lightweight, portable, and ergonomic car seats. Major producers are putting the spotlight on customizable seating solutions, the addition of comfort, and simple installation systems and targeting automotive safety regulations and the dynamic consumer preferences.

Convertible, Booster, Infant, Combination Seat, All in One

Rear Facing, Forward Facing

Plastic, Steel, Composite

Online, Specialty Stores, Mega Retail Stores

North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Middle East & Africa

The global child safety seats market is projected to reach USD 3,391.5 million by the end of 2025.

The market is anticipated to grow at a CAGR of 7.4% over the forecast period.

By 2035, the child safety seats market is expected to reach USD 6,925.3 million.

The specialty stores segment is expected to dominate due to the availability of certified child safety seats, expert recommendations, and growing consumer preference for in-store testing and demonstrations before purchasing.

Key players in the child safety seats market include Britax, Graco, Chicco, Maxi-Cosi, and Evenflo.

Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

Table 2: Global Market Volume (Units) Forecast by Region, 2020 to 2035

Table 3: Global Market Value (USD Million) Forecast by Product, 2020 to 2035

Table 4: Global Market Volume (Units) Forecast by Product, 2020 to 2035

Table 5: Global Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 6: Global Market Volume (Units) Forecast by Type, 2020 to 2035

Table 7: Global Market Value (USD Million) Forecast by Functionality, 2020 to 2035

Table 8: Global Market Volume (Units) Forecast by Functionality, 2020 to 2035

Table 9: Global Market Value (USD Million) Forecast by Material, 2020 to 2035

Table 10: Global Market Volume (Units) Forecast by Material, 2020 to 2035

Table 11: Global Market Value (USD Million) Forecast by Age Group, 2020 to 2035

Table 12: Global Market Volume (Units) Forecast by Age Group, 2020 to 2035

Table 13: Global Market Value (USD Million) Forecast by Distribution Channel, 2020 to 2035

Table 14: Global Market Volume (Units) Forecast by Distribution Channel, 2020 to 2035

Table 15: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 16: North America Market Volume (Units) Forecast by Country, 2020 to 2035

Table 17: North America Market Value (USD Million) Forecast by Product, 2020 to 2035

Table 18: North America Market Volume (Units) Forecast by Product, 2020 to 2035

Table 19: North America Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 20: North America Market Volume (Units) Forecast by Type, 2020 to 2035

Table 21: North America Market Value (USD Million) Forecast by Functionality, 2020 to 2035

Table 22: North America Market Volume (Units) Forecast by Functionality, 2020 to 2035

Table 23: North America Market Value (USD Million) Forecast by Material, 2020 to 2035

Table 24: North America Market Volume (Units) Forecast by Material, 2020 to 2035

Table 25: North America Market Value (USD Million) Forecast by Age Group, 2020 to 2035

Table 26: North America Market Volume (Units) Forecast by Age Group, 2020 to 2035

Table 27: North America Market Value (USD Million) Forecast by Distribution Channel, 2020 to 2035

Table 28: North America Market Volume (Units) Forecast by Distribution Channel, 2020 to 2035

Table 29: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 30: Latin America Market Volume (Units) Forecast by Country, 2020 to 2035

Table 31: Latin America Market Value (USD Million) Forecast by Product, 2020 to 2035

Table 32: Latin America Market Volume (Units) Forecast by Product, 2020 to 2035

Table 33: Latin America Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 34: Latin America Market Volume (Units) Forecast by Type, 2020 to 2035

Table 35: Latin America Market Value (USD Million) Forecast by Functionality, 2020 to 2035

Table 36: Latin America Market Volume (Units) Forecast by Functionality, 2020 to 2035

Table 37: Latin America Market Value (USD Million) Forecast by Material, 2020 to 2035

Table 38: Latin America Market Volume (Units) Forecast by Material, 2020 to 2035

Table 39: Latin America Market Value (USD Million) Forecast by Age Group, 2020 to 2035

Table 40: Latin America Market Volume (Units) Forecast by Age Group, 2020 to 2035

Table 41: Latin America Market Value (USD Million) Forecast by Distribution Channel, 2020 to 2035

Table 42: Latin America Market Volume (Units) Forecast by Distribution Channel, 2020 to 2035

Table 43: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 44: Western Europe Market Volume (Units) Forecast by Country, 2020 to 2035

Table 45: Western Europe Market Value (USD Million) Forecast by Product, 2020 to 2035

Table 46: Western Europe Market Volume (Units) Forecast by Product, 2020 to 2035

Table 47: Western Europe Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 48: Western Europe Market Volume (Units) Forecast by Type, 2020 to 2035

Table 49: Western Europe Market Value (USD Million) Forecast by Functionality, 2020 to 2035

Table 50: Western Europe Market Volume (Units) Forecast by Functionality, 2020 to 2035

Table 51: Western Europe Market Value (USD Million) Forecast by Material, 2020 to 2035

Table 52: Western Europe Market Volume (Units) Forecast by Material, 2020 to 2035

Table 53: Western Europe Market Value (USD Million) Forecast by Age Group, 2020 to 2035

Table 54: Western Europe Market Volume (Units) Forecast by Age Group, 2020 to 2035

Table 55: Western Europe Market Value (USD Million) Forecast by Distribution Channel, 2020 to 2035

Table 56: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2020 to 2035

Table 57: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 58: Eastern Europe Market Volume (Units) Forecast by Country, 2020 to 2035

Table 59: Eastern Europe Market Value (USD Million) Forecast by Product, 2020 to 2035

Table 60: Eastern Europe Market Volume (Units) Forecast by Product, 2020 to 2035

Table 61: Eastern Europe Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 62: Eastern Europe Market Volume (Units) Forecast by Type, 2020 to 2035

Table 63: Eastern Europe Market Value (USD Million) Forecast by Functionality, 2020 to 2035

Table 64: Eastern Europe Market Volume (Units) Forecast by Functionality, 2020 to 2035

Table 65: Eastern Europe Market Value (USD Million) Forecast by Material, 2020 to 2035

Table 66: Eastern Europe Market Volume (Units) Forecast by Material, 2020 to 2035

Table 67: Eastern Europe Market Value (USD Million) Forecast by Age Group, 2020 to 2035

Table 68: Eastern Europe Market Volume (Units) Forecast by Age Group, 2020 to 2035

Table 69: Eastern Europe Market Value (USD Million) Forecast by Distribution Channel, 2020 to 2035

Table 70: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2020 to 2035

Table 71: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 72: South Asia and Pacific Market Volume (Units) Forecast by Country, 2020 to 2035

Table 73: South Asia and Pacific Market Value (USD Million) Forecast by Product, 2020 to 2035

Table 74: South Asia and Pacific Market Volume (Units) Forecast by Product, 2020 to 2035

Table 75: South Asia and Pacific Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 76: South Asia and Pacific Market Volume (Units) Forecast by Type, 2020 to 2035

Table 77: South Asia and Pacific Market Value (USD Million) Forecast by Functionality, 2020 to 2035

Table 78: South Asia and Pacific Market Volume (Units) Forecast by Functionality, 2020 to 2035

Table 79: South Asia and Pacific Market Value (USD Million) Forecast by Material, 2020 to 2035

Table 80: South Asia and Pacific Market Volume (Units) Forecast by Material, 2020 to 2035

Table 81: South Asia and Pacific Market Value (USD Million) Forecast by Age Group, 2020 to 2035

Table 82: South Asia and Pacific Market Volume (Units) Forecast by Age Group, 2020 to 2035

Table 83: South Asia and Pacific Market Value (USD Million) Forecast by Distribution Channel, 2020 to 2035

Table 84: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2020 to 2035

Table 85: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 86: East Asia Market Volume (Units) Forecast by Country, 2020 to 2035

Table 87: East Asia Market Value (USD Million) Forecast by Product, 2020 to 2035

Table 88: East Asia Market Volume (Units) Forecast by Product, 2020 to 2035

Table 89: East Asia Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 90: East Asia Market Volume (Units) Forecast by Type, 2020 to 2035

Table 91: East Asia Market Value (USD Million) Forecast by Functionality, 2020 to 2035

Table 92: East Asia Market Volume (Units) Forecast by Functionality, 2020 to 2035

Table 93: East Asia Market Value (USD Million) Forecast by Material, 2020 to 2035

Table 94: East Asia Market Volume (Units) Forecast by Material, 2020 to 2035

Table 95: East Asia Market Value (USD Million) Forecast by Age Group, 2020 to 2035

Table 96: East Asia Market Volume (Units) Forecast by Age Group, 2020 to 2035

Table 97: East Asia Market Value (USD Million) Forecast by Distribution Channel, 2020 to 2035

Table 98: East Asia Market Volume (Units) Forecast by Distribution Channel, 2020 to 2035

Table 99: Middle East and Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 100: Middle East and Africa Market Volume (Units) Forecast by Country, 2020 to 2035

Table 101: Middle East and Africa Market Value (USD Million) Forecast by Product, 2020 to 2035

Table 102: Middle East and Africa Market Volume (Units) Forecast by Product, 2020 to 2035

Table 103: Middle East and Africa Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 104: Middle East and Africa Market Volume (Units) Forecast by Type, 2020 to 2035

Table 105: Middle East and Africa Market Value (USD Million) Forecast by Functionality, 2020 to 2035

Table 106: Middle East and Africa Market Volume (Units) Forecast by Functionality, 2020 to 2035

Table 107: Middle East and Africa Market Value (USD Million) Forecast by Material, 2020 to 2035

Table 108: Middle East and Africa Market Volume (Units) Forecast by Material, 2020 to 2035

Table 109: Middle East and Africa Market Value (USD Million) Forecast by Age Group, 2020 to 2035

Table 110: Middle East and Africa Market Volume (Units) Forecast by Age Group, 2020 to 2035

Table 111: Middle East and Africa Market Value (USD Million) Forecast by Distribution Channel, 2020 to 2035

Table 112: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2020 to 2035

Figure 1: Global Market Value (USD Million) by Product, 2025 to 2035

Figure 2: Global Market Value (USD Million) by Type, 2025 to 2035

Figure 3: Global Market Value (USD Million) by Functionality, 2025 to 2035

Figure 4: Global Market Value (USD Million) by Material, 2025 to 2035

Figure 5: Global Market Value (USD Million) by Age Group, 2025 to 2035

Figure 6: Global Market Value (USD Million) by Distribution Channel, 2025 to 2035

Figure 7: Global Market Value (USD Million) by Region, 2025 to 2035

Figure 8: Global Market Value (USD Million) Analysis by Region, 2020 to 2035

Figure 9: Global Market Volume (Units) Analysis by Region, 2020 to 2035

Figure 10: Global Market Value Share (%) and BPS Analysis by Region, 2025 to 2035

Figure 11: Global Market Y-o-Y Growth (%) Projections by Region, 2025 to 2035

Figure 12: Global Market Value (USD Million) Analysis by Product, 2020 to 2035

Figure 13: Global Market Volume (Units) Analysis by Product, 2020 to 2035

Figure 14: Global Market Value Share (%) and BPS Analysis by Product, 2025 to 2035

Figure 15: Global Market Y-o-Y Growth (%) Projections by Product, 2025 to 2035

Figure 16: Global Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 17: Global Market Volume (Units) Analysis by Type, 2020 to 2035

Figure 18: Global Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 19: Global Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 20: Global Market Value (USD Million) Analysis by Functionality, 2020 to 2035

Figure 21: Global Market Volume (Units) Analysis by Functionality, 2020 to 2035

Figure 22: Global Market Value Share (%) and BPS Analysis by Functionality, 2025 to 2035

Figure 23: Global Market Y-o-Y Growth (%) Projections by Functionality, 2025 to 2035

Figure 24: Global Market Value (USD Million) Analysis by Material, 2020 to 2035

Figure 25: Global Market Volume (Units) Analysis by Material, 2020 to 2035

Figure 26: Global Market Value Share (%) and BPS Analysis by Material, 2025 to 2035

Figure 27: Global Market Y-o-Y Growth (%) Projections by Material, 2025 to 2035

Figure 28: Global Market Value (USD Million) Analysis by Age Group, 2020 to 2035

Figure 29: Global Market Volume (Units) Analysis by Age Group, 2020 to 2035

Figure 30: Global Market Value Share (%) and BPS Analysis by Age Group, 2025 to 2035

Figure 31: Global Market Y-o-Y Growth (%) Projections by Age Group, 2025 to 2035

Figure 32: Global Market Value (USD Million) Analysis by Distribution Channel, 2020 to 2035

Figure 33: Global Market Volume (Units) Analysis by Distribution Channel, 2020 to 2035

Figure 34: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2025 to 2035

Figure 35: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2025 to 2035

Figure 36: Global Market Attractiveness by Product, 2025 to 2035

Figure 37: Global Market Attractiveness by Type, 2025 to 2035

Figure 38: Global Market Attractiveness by Functionality, 2025 to 2035

Figure 39: Global Market Attractiveness by Material, 2025 to 2035

Figure 40: Global Market Attractiveness by Age Group, 2025 to 2035

Figure 41: Global Market Attractiveness by Distribution Channel, 2025 to 2035

Figure 42: Global Market Attractiveness by Region, 2025 to 2035

Figure 43: North America Market Value (USD Million) by Product, 2025 to 2035

Figure 44: North America Market Value (USD Million) by Type, 2025 to 2035

Figure 45: North America Market Value (USD Million) by Functionality, 2025 to 2035

Figure 46: North America Market Value (USD Million) by Material, 2025 to 2035

Figure 47: North America Market Value (USD Million) by Age Group, 2025 to 2035

Figure 48: North America Market Value (USD Million) by Distribution Channel, 2025 to 2035

Figure 49: North America Market Value (USD Million) by Country, 2025 to 2035

Figure 50: North America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 51: North America Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 52: North America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 53: North America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 54: North America Market Value (USD Million) Analysis by Product, 2020 to 2035

Figure 55: North America Market Volume (Units) Analysis by Product, 2020 to 2035

Figure 56: North America Market Value Share (%) and BPS Analysis by Product, 2025 to 2035

Figure 57: North America Market Y-o-Y Growth (%) Projections by Product, 2025 to 2035

Figure 58: North America Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 59: North America Market Volume (Units) Analysis by Type, 2020 to 2035

Figure 60: North America Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 61: North America Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 62: North America Market Value (USD Million) Analysis by Functionality, 2020 to 2035

Figure 63: North America Market Volume (Units) Analysis by Functionality, 2020 to 2035

Figure 64: North America Market Value Share (%) and BPS Analysis by Functionality, 2025 to 2035

Figure 65: North America Market Y-o-Y Growth (%) Projections by Functionality, 2025 to 2035

Figure 66: North America Market Value (USD Million) Analysis by Material, 2020 to 2035

Figure 67: North America Market Volume (Units) Analysis by Material, 2020 to 2035

Figure 68: North America Market Value Share (%) and BPS Analysis by Material, 2025 to 2035

Figure 69: North America Market Y-o-Y Growth (%) Projections by Material, 2025 to 2035

Figure 70: North America Market Value (USD Million) Analysis by Age Group, 2020 to 2035

Figure 71: North America Market Volume (Units) Analysis by Age Group, 2020 to 2035

Figure 72: North America Market Value Share (%) and BPS Analysis by Age Group, 2025 to 2035

Figure 73: North America Market Y-o-Y Growth (%) Projections by Age Group, 2025 to 2035

Figure 74: North America Market Value (USD Million) Analysis by Distribution Channel, 2020 to 2035

Figure 75: North America Market Volume (Units) Analysis by Distribution Channel, 2020 to 2035

Figure 76: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2025 to 2035

Figure 77: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2025 to 2035

Figure 78: North America Market Attractiveness by Product, 2025 to 2035

Figure 79: North America Market Attractiveness by Type, 2025 to 2035

Figure 80: North America Market Attractiveness by Functionality, 2025 to 2035

Figure 81: North America Market Attractiveness by Material, 2025 to 2035

Figure 82: North America Market Attractiveness by Age Group, 2025 to 2035

Figure 83: North America Market Attractiveness by Distribution Channel, 2025 to 2035

Figure 84: North America Market Attractiveness by Country, 2025 to 2035

Figure 85: Latin America Market Value (USD Million) by Product, 2025 to 2035

Figure 86: Latin America Market Value (USD Million) by Type, 2025 to 2035

Figure 87: Latin America Market Value (USD Million) by Functionality, 2025 to 2035

Figure 88: Latin America Market Value (USD Million) by Material, 2025 to 2035

Figure 89: Latin America Market Value (USD Million) by Age Group, 2025 to 2035

Figure 90: Latin America Market Value (USD Million) by Distribution Channel, 2025 to 2035

Figure 91: Latin America Market Value (USD Million) by Country, 2025 to 2035

Figure 92: Latin America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 93: Latin America Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 94: Latin America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 95: Latin America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 96: Latin America Market Value (USD Million) Analysis by Product, 2020 to 2035

Figure 97: Latin America Market Volume (Units) Analysis by Product, 2020 to 2035

Figure 98: Latin America Market Value Share (%) and BPS Analysis by Product, 2025 to 2035

Figure 99: Latin America Market Y-o-Y Growth (%) Projections by Product, 2025 to 2035

Figure 100: Latin America Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 101: Latin America Market Volume (Units) Analysis by Type, 2020 to 2035

Figure 102: Latin America Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 103: Latin America Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 104: Latin America Market Value (USD Million) Analysis by Functionality, 2020 to 2035

Figure 105: Latin America Market Volume (Units) Analysis by Functionality, 2020 to 2035

Figure 106: Latin America Market Value Share (%) and BPS Analysis by Functionality, 2025 to 2035

Figure 107: Latin America Market Y-o-Y Growth (%) Projections by Functionality, 2025 to 2035

Figure 108: Latin America Market Value (USD Million) Analysis by Material, 2020 to 2035

Figure 109: Latin America Market Volume (Units) Analysis by Material, 2020 to 2035

Figure 110: Latin America Market Value Share (%) and BPS Analysis by Material, 2025 to 2035

Figure 111: Latin America Market Y-o-Y Growth (%) Projections by Material, 2025 to 2035

Figure 112: Latin America Market Value (USD Million) Analysis by Age Group, 2020 to 2035

Figure 113: Latin America Market Volume (Units) Analysis by Age Group, 2020 to 2035

Figure 114: Latin America Market Value Share (%) and BPS Analysis by Age Group, 2025 to 2035

Figure 115: Latin America Market Y-o-Y Growth (%) Projections by Age Group, 2025 to 2035

Figure 116: Latin America Market Value (USD Million) Analysis by Distribution Channel, 2020 to 2035

Figure 117: Latin America Market Volume (Units) Analysis by Distribution Channel, 2020 to 2035

Figure 118: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2025 to 2035

Figure 119: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2025 to 2035

Figure 120: Latin America Market Attractiveness by Product, 2025 to 2035

Figure 121: Latin America Market Attractiveness by Type, 2025 to 2035

Figure 122: Latin America Market Attractiveness by Functionality, 2025 to 2035

Figure 123: Latin America Market Attractiveness by Material, 2025 to 2035

Figure 124: Latin America Market Attractiveness by Age Group, 2025 to 2035

Figure 125: Latin America Market Attractiveness by Distribution Channel, 2025 to 2035

Figure 126: Latin America Market Attractiveness by Country, 2025 to 2035

Figure 127: Western Europe Market Value (USD Million) by Product, 2025 to 2035

Figure 128: Western Europe Market Value (USD Million) by Type, 2025 to 2035

Figure 129: Western Europe Market Value (USD Million) by Functionality, 2025 to 2035

Figure 130: Western Europe Market Value (USD Million) by Material, 2025 to 2035

Figure 131: Western Europe Market Value (USD Million) by Age Group, 2025 to 2035

Figure 132: Western Europe Market Value (USD Million) by Distribution Channel, 2025 to 2035

Figure 133: Western Europe Market Value (USD Million) by Country, 2025 to 2035

Figure 134: Western Europe Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 135: Western Europe Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 136: Western Europe Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 137: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 138: Western Europe Market Value (USD Million) Analysis by Product, 2020 to 2035

Figure 139: Western Europe Market Volume (Units) Analysis by Product, 2020 to 2035

Figure 140: Western Europe Market Value Share (%) and BPS Analysis by Product, 2025 to 2035

Figure 141: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2025 to 2035

Figure 142: Western Europe Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 143: Western Europe Market Volume (Units) Analysis by Type, 2020 to 2035

Figure 144: Western Europe Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 145: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 146: Western Europe Market Value (USD Million) Analysis by Functionality, 2020 to 2035

Figure 147: Western Europe Market Volume (Units) Analysis by Functionality, 2020 to 2035

Figure 148: Western Europe Market Value Share (%) and BPS Analysis by Functionality, 2025 to 2035

Figure 149: Western Europe Market Y-o-Y Growth (%) Projections by Functionality, 2025 to 2035

Figure 150: Western Europe Market Value (USD Million) Analysis by Material, 2020 to 2035

Figure 151: Western Europe Market Volume (Units) Analysis by Material, 2020 to 2035

Figure 152: Western Europe Market Value Share (%) and BPS Analysis by Material, 2025 to 2035

Figure 153: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2025 to 2035

Figure 154: Western Europe Market Value (USD Million) Analysis by Age Group, 2020 to 2035

Figure 155: Western Europe Market Volume (Units) Analysis by Age Group, 2020 to 2035

Figure 156: Western Europe Market Value Share (%) and BPS Analysis by Age Group, 2025 to 2035

Figure 157: Western Europe Market Y-o-Y Growth (%) Projections by Age Group, 2025 to 2035

Figure 158: Western Europe Market Value (USD Million) Analysis by Distribution Channel, 2020 to 2035

Figure 159: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2020 to 2035

Figure 160: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2025 to 2035

Figure 161: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2025 to 2035

Figure 162: Western Europe Market Attractiveness by Product, 2025 to 2035

Figure 163: Western Europe Market Attractiveness by Type, 2025 to 2035

Figure 164: Western Europe Market Attractiveness by Functionality, 2025 to 2035

Figure 165: Western Europe Market Attractiveness by Material, 2025 to 2035

Figure 166: Western Europe Market Attractiveness by Age Group, 2025 to 2035

Figure 167: Western Europe Market Attractiveness by Distribution Channel, 2025 to 2035

Figure 168: Western Europe Market Attractiveness by Country, 2025 to 2035

Figure 169: Eastern Europe Market Value (USD Million) by Product, 2025 to 2035

Figure 170: Eastern Europe Market Value (USD Million) by Type, 2025 to 2035

Figure 171: Eastern Europe Market Value (USD Million) by Functionality, 2025 to 2035

Figure 172: Eastern Europe Market Value (USD Million) by Material, 2025 to 2035

Figure 173: Eastern Europe Market Value (USD Million) by Age Group, 2025 to 2035

Figure 174: Eastern Europe Market Value (USD Million) by Distribution Channel, 2025 to 2035

Figure 175: Eastern Europe Market Value (USD Million) by Country, 2025 to 2035

Figure 176: Eastern Europe Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 177: Eastern Europe Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 178: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 179: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 180: Eastern Europe Market Value (USD Million) Analysis by Product, 2020 to 2035

Figure 181: Eastern Europe Market Volume (Units) Analysis by Product, 2020 to 2035

Figure 182: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2025 to 2035

Figure 183: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2025 to 2035

Figure 184: Eastern Europe Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 185: Eastern Europe Market Volume (Units) Analysis by Type, 2020 to 2035

Figure 186: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 187: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 188: Eastern Europe Market Value (USD Million) Analysis by Functionality, 2020 to 2035

Figure 189: Eastern Europe Market Volume (Units) Analysis by Functionality, 2020 to 2035

Figure 190: Eastern Europe Market Value Share (%) and BPS Analysis by Functionality, 2025 to 2035

Figure 191: Eastern Europe Market Y-o-Y Growth (%) Projections by Functionality, 2025 to 2035

Figure 192: Eastern Europe Market Value (USD Million) Analysis by Material, 2020 to 2035

Figure 193: Eastern Europe Market Volume (Units) Analysis by Material, 2020 to 2035

Figure 194: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2025 to 2035

Figure 195: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2025 to 2035

Figure 196: Eastern Europe Market Value (USD Million) Analysis by Age Group, 2020 to 2035

Figure 197: Eastern Europe Market Volume (Units) Analysis by Age Group, 2020 to 2035

Figure 198: Eastern Europe Market Value Share (%) and BPS Analysis by Age Group, 2025 to 2035

Figure 199: Eastern Europe Market Y-o-Y Growth (%) Projections by Age Group, 2025 to 2035

Figure 200: Eastern Europe Market Value (USD Million) Analysis by Distribution Channel, 2020 to 2035

Figure 201: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2020 to 2035

Figure 202: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2025 to 2035

Figure 203: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2025 to 2035

Figure 204: Eastern Europe Market Attractiveness by Product, 2025 to 2035

Figure 205: Eastern Europe Market Attractiveness by Type, 2025 to 2035

Figure 206: Eastern Europe Market Attractiveness by Functionality, 2025 to 2035

Figure 207: Eastern Europe Market Attractiveness by Material, 2025 to 2035

Figure 208: Eastern Europe Market Attractiveness by Age Group, 2025 to 2035

Figure 209: Eastern Europe Market Attractiveness by Distribution Channel, 2025 to 2035

Figure 210: Eastern Europe Market Attractiveness by Country, 2025 to 2035

Figure 211: South Asia and Pacific Market Value (USD Million) by Product, 2025 to 2035

Figure 212: South Asia and Pacific Market Value (USD Million) by Type, 2025 to 2035

Figure 213: South Asia and Pacific Market Value (USD Million) by Functionality, 2025 to 2035

Figure 214: South Asia and Pacific Market Value (USD Million) by Material, 2025 to 2035

Figure 215: South Asia and Pacific Market Value (USD Million) by Age Group, 2025 to 2035

Figure 216: South Asia and Pacific Market Value (USD Million) by Distribution Channel, 2025 to 2035

Figure 217: South Asia and Pacific Market Value (USD Million) by Country, 2025 to 2035

Figure 218: South Asia and Pacific Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 219: South Asia and Pacific Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 220: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 221: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 222: South Asia and Pacific Market Value (USD Million) Analysis by Product, 2020 to 2035

Figure 223: South Asia and Pacific Market Volume (Units) Analysis by Product, 2020 to 2035

Figure 224: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2025 to 2035

Figure 225: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2025 to 2035

Figure 226: South Asia and Pacific Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 227: South Asia and Pacific Market Volume (Units) Analysis by Type, 2020 to 2035

Figure 228: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 229: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 230: South Asia and Pacific Market Value (USD Million) Analysis by Functionality, 2020 to 2035

Figure 231: South Asia and Pacific Market Volume (Units) Analysis by Functionality, 2020 to 2035

Figure 232: South Asia and Pacific Market Value Share (%) and BPS Analysis by Functionality, 2025 to 2035

Figure 233: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Functionality, 2025 to 2035

Figure 234: South Asia and Pacific Market Value (USD Million) Analysis by Material, 2020 to 2035

Figure 235: South Asia and Pacific Market Volume (Units) Analysis by Material, 2020 to 2035

Figure 236: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2025 to 2035

Figure 237: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2025 to 2035

Figure 238: South Asia and Pacific Market Value (USD Million) Analysis by Age Group, 2020 to 2035

Figure 239: South Asia and Pacific Market Volume (Units) Analysis by Age Group, 2020 to 2035

Figure 240: South Asia and Pacific Market Value Share (%) and BPS Analysis by Age Group, 2025 to 2035

Figure 241: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Age Group, 2025 to 2035

Figure 242: South Asia and Pacific Market Value (USD Million) Analysis by Distribution Channel, 2020 to 2035

Figure 243: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2020 to 2035

Figure 244: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2025 to 2035

Figure 245: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2025 to 2035

Figure 246: South Asia and Pacific Market Attractiveness by Product, 2025 to 2035

Figure 247: South Asia and Pacific Market Attractiveness by Type, 2025 to 2035

Figure 248: South Asia and Pacific Market Attractiveness by Functionality, 2025 to 2035

Figure 249: South Asia and Pacific Market Attractiveness by Material, 2025 to 2035

Figure 250: South Asia and Pacific Market Attractiveness by Age Group, 2025 to 2035

Figure 251: South Asia and Pacific Market Attractiveness by Distribution Channel, 2025 to 2035

Figure 252: South Asia and Pacific Market Attractiveness by Country, 2025 to 2035

Figure 253: East Asia Market Value (USD Million) by Product, 2025 to 2035

Figure 254: East Asia Market Value (USD Million) by Type, 2025 to 2035

Figure 255: East Asia Market Value (USD Million) by Functionality, 2025 to 2035

Figure 256: East Asia Market Value (USD Million) by Material, 2025 to 2035

Figure 257: East Asia Market Value (USD Million) by Age Group, 2025 to 2035

Figure 258: East Asia Market Value (USD Million) by Distribution Channel, 2025 to 2035

Figure 259: East Asia Market Value (USD Million) by Country, 2025 to 2035

Figure 260: East Asia Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 261: East Asia Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 262: East Asia Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 263: East Asia Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 264: East Asia Market Value (USD Million) Analysis by Product, 2020 to 2035

Figure 265: East Asia Market Volume (Units) Analysis by Product, 2020 to 2035

Figure 266: East Asia Market Value Share (%) and BPS Analysis by Product, 2025 to 2035

Figure 267: East Asia Market Y-o-Y Growth (%) Projections by Product, 2025 to 2035

Figure 268: East Asia Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 269: East Asia Market Volume (Units) Analysis by Type, 2020 to 2035

Figure 270: East Asia Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 271: East Asia Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 272: East Asia Market Value (USD Million) Analysis by Functionality, 2020 to 2035

Figure 273: East Asia Market Volume (Units) Analysis by Functionality, 2020 to 2035

Figure 274: East Asia Market Value Share (%) and BPS Analysis by Functionality, 2025 to 2035

Figure 275: East Asia Market Y-o-Y Growth (%) Projections by Functionality, 2025 to 2035

Figure 276: East Asia Market Value (USD Million) Analysis by Material, 2020 to 2035

Figure 277: East Asia Market Volume (Units) Analysis by Material, 2020 to 2035

Figure 278: East Asia Market Value Share (%) and BPS Analysis by Material, 2025 to 2035

Figure 279: East Asia Market Y-o-Y Growth (%) Projections by Material, 2025 to 2035

Figure 280: East Asia Market Value (USD Million) Analysis by Age Group, 2020 to 2035

Figure 281: East Asia Market Volume (Units) Analysis by Age Group, 2020 to 2035

Figure 282: East Asia Market Value Share (%) and BPS Analysis by Age Group, 2025 to 2035

Figure 283: East Asia Market Y-o-Y Growth (%) Projections by Age Group, 2025 to 2035

Figure 284: East Asia Market Value (USD Million) Analysis by Distribution Channel, 2020 to 2035

Figure 285: East Asia Market Volume (Units) Analysis by Distribution Channel, 2020 to 2035

Figure 286: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2025 to 2035

Figure 287: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2025 to 2035

Figure 288: East Asia Market Attractiveness by Product, 2025 to 2035

Figure 289: East Asia Market Attractiveness by Type, 2025 to 2035

Figure 290: East Asia Market Attractiveness by Functionality, 2025 to 2035

Figure 291: East Asia Market Attractiveness by Material, 2025 to 2035

Figure 292: East Asia Market Attractiveness by Age Group, 2025 to 2035

Figure 293: East Asia Market Attractiveness by Distribution Channel, 2025 to 2035

Figure 294: East Asia Market Attractiveness by Country, 2025 to 2035

Figure 295: Middle East and Africa Market Value (USD Million) by Product, 2025 to 2035

Figure 296: Middle East and Africa Market Value (USD Million) by Type, 2025 to 2035

Figure 297: Middle East and Africa Market Value (USD Million) by Functionality, 2025 to 2035

Figure 298: Middle East and Africa Market Value (USD Million) by Material, 2025 to 2035

Figure 299: Middle East and Africa Market Value (USD Million) by Age Group, 2025 to 2035

Figure 300: Middle East and Africa Market Value (USD Million) by Distribution Channel, 2025 to 2035

Figure 301: Middle East and Africa Market Value (USD Million) by Country, 2025 to 2035

Figure 302: Middle East and Africa Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 303: Middle East and Africa Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 304: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 305: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 306: Middle East and Africa Market Value (USD Million) Analysis by Product, 2020 to 2035

Figure 307: Middle East and Africa Market Volume (Units) Analysis by Product, 2020 to 2035

Figure 308: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2025 to 2035

Figure 309: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2025 to 2035

Figure 310: Middle East and Africa Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 311: Middle East and Africa Market Volume (Units) Analysis by Type, 2020 to 2035

Figure 312: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 313: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 314: Middle East and Africa Market Value (USD Million) Analysis by Functionality, 2020 to 2035

Figure 315: Middle East and Africa Market Volume (Units) Analysis by Functionality, 2020 to 2035

Figure 316: Middle East and Africa Market Value Share (%) and BPS Analysis by Functionality, 2025 to 2035

Figure 317: Middle East and Africa Market Y-o-Y Growth (%) Projections by Functionality, 2025 to 2035

Figure 318: Middle East and Africa Market Value (USD Million) Analysis by Material, 2020 to 2035

Figure 319: Middle East and Africa Market Volume (Units) Analysis by Material, 2020 to 2035

Figure 320: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2025 to 2035

Figure 321: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2025 to 2035

Figure 322: Middle East and Africa Market Value (USD Million) Analysis by Age Group, 2020 to 2035

Figure 323: Middle East and Africa Market Volume (Units) Analysis by Age Group, 2020 to 2035

Figure 324: Middle East and Africa Market Value Share (%) and BPS Analysis by Age Group, 2025 to 2035

Figure 325: Middle East and Africa Market Y-o-Y Growth (%) Projections by Age Group, 2025 to 2035

Figure 326: Middle East and Africa Market Value (USD Million) Analysis by Distribution Channel, 2020 to 2035

Figure 327: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2020 to 2035

Figure 328: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2025 to 2035

Figure 329: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2025 to 2035

Figure 330: Middle East and Africa Market Attractiveness by Product, 2025 to 2035

Figure 331: Middle East and Africa Market Attractiveness by Type, 2025 to 2035

Figure 332: Middle East and Africa Market Attractiveness by Functionality, 2025 to 2035

Figure 333: Middle East and Africa Market Attractiveness by Material, 2025 to 2035

Figure 334: Middle East and Africa Market Attractiveness by Age Group, 2025 to 2035

Figure 335: Middle East and Africa Market Attractiveness by Distribution Channel, 2025 to 2035

Figure 336: Middle East and Africa Market Attractiveness by Country, 2025 to 2035

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Children Enteral Nutrition Market Size and Share Forecast Outlook 2025 to 2035

Child resistant Zipper Market Size and Share Forecast Outlook 2025 to 2035

Child-Resistant Pumps Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Re-Closable Edible Bags Market Size and Share Forecast Outlook 2025 to 2035

Child-Resistant Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Pouches Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Single Dose Pouches Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Pipette Closures Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Dropper Caps Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Bottles Market Size and Forecast

Children’s Health Supplement Market Analysis by Product Type, Application and Age Group Through 2025 to 2035.

Child Resistant Locking Pouches Market from 2025 to 2035

Child-Resistant Containers Market Trends & Demand 2025 to 2035

Children Mattress Market Product Type, Ingredient Type, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Competitive Landscape of Child Resistant Re-Closable Edible Bags Providers

Market Share Distribution Among Child-Resistant Pouches Manufacturers

Leading Providers & Market Share in Child-Resistant Foil Packaging

Market Share Insights for Child Resistant Dropper Caps Manufacturers

Market Share Distribution Among Child Resistant Pipette Closures Manufacturers

Child Resistant Bags Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA