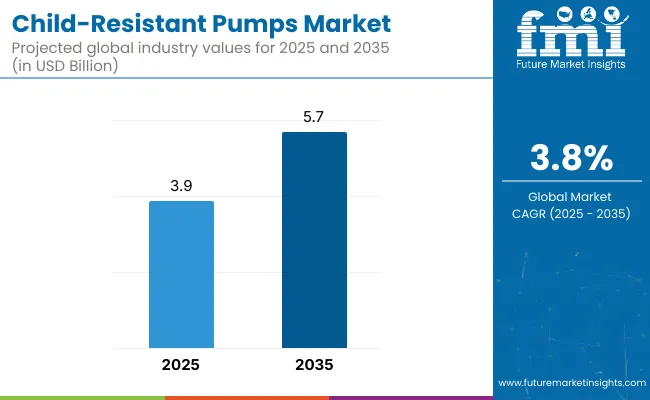

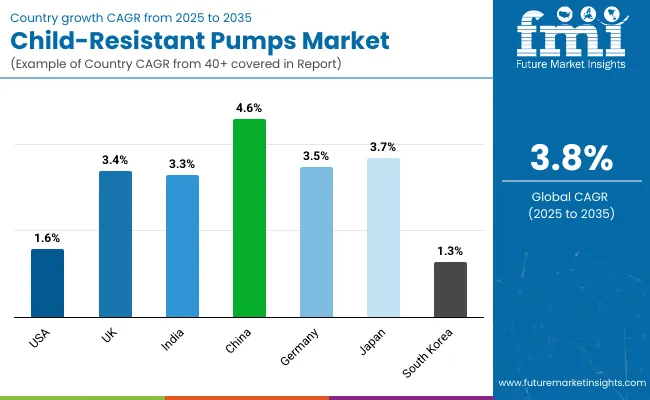

The child-resistant pumps market is estimated to be valued at USD 3.9 billion in 2025, growing to USD 5.7 billion by 2035, indicating a total increase of USD 1.8 billion over the ten-year period. This reflects an overall market growth of 46.2%, with a compound annual growth rate (CAGR) of 3.8%. The market is set to expand by a 1.4 multiple between 2025 and 2035.

In the first half of the decade (2025 to 2030), the market grows from USD 3.9 billion to USD 4.6 billion, contributing USD 0.7 billion, or 38.9% of total decadal growth. This stage sees rising demand from pharmaceutical, cosmeceutical, and household chemical packaging segments, with manufacturers complying with stringent child safety regulations especially in North America and Europe. Innovations focus on single-handed operation while preventing accidental dispensing by children.

During the second half from 2030 to 2035, the market increases from USD 4.6 billion to USD 5.7 billion, contributing USD 1.1 billion, or 61.1% of total growth. This period is marked by expanding usage in CBD, nutraceutical, and OTC liquid products, with regulatory bodies mandating CR-compliant packaging for high-risk or concentrated products. Multi-layered lock mechanisms and recyclable CR-certified materials become standard, as both brand owners and consumers prioritize safety and environmental compliance.

From 2020 to 2024, the child-resistant pumps market grew from USD 520 million to USD 860 million, driven by hardware-centric adoption in regulated pharmaceutical, nutraceutical, and household chemical packaging. During this period, the competitive landscape was dominated by pump manufacturers controlling nearly 70% of revenue, with leaders such as Aptar, Nemera, and Aero Pump focusing on precision-locking mechanisms and dosage control systems tailored for safety-critical use cases.

Competitive differentiation relied on certified child-resistance standards, ease of adult use, and compatibility with a wide range of liquid viscosities, while digital adherence tools were often bundled as auxiliary offerings rather than primary revenue drivers. Service-based models had limited presence, contributing less than 10% of the total market value, as brand owners prioritized tamper-resistance and regulatory compliance in pump design.

Demand for child-resistant pumps will expand to USD 4.6 billion in 2030, and the revenue mix will shift as smart safety features and design services grow to over 40% share. Traditional pump manufacturers face rising competition from digital-forward players offering embedded tracking, safety-trigger sensors, and refillable compliant systems. Major vendors are pivoting to hybrid models, integrating user-feedback-based locking, sustainable material frameworks, and serialization options to retain relevance.

Emerging entrants such as Origin Pharma, Feldman Industries, C.L. Smith, O. Berk, and Qiming Packaging are gaining share by specializing in patent-backed closure innovation, region-specific compliance formats, and customizable CR solutions for high-margin therapeutic applications. The competitive advantage is moving away from passive safety engineering to holistic user-centric protection, digital readiness, and recurring revenue through compliance-driven customization.

Stringent regulatory frameworks and heightened consumer safety awareness are driving the growth of the child-resistant pumps market. These pumps are designed to prevent accidental ingestion or misuse of potentially hazardous products such as pharmaceuticals, nutraceuticals, household chemicals, and personal care formulations. Rising global concern over unintentional poisoning incidents among children has compelled manufacturers to integrate certified child-resistant mechanisms into pump packaging systems.

Push-and-turn and twist-lock pump formats have gained popularity due to their effectiveness in securing contents while maintaining adult usability. These designs comply with standards such as the USA Poison Prevention Packaging Act (PPPA) and EU child-resistance guidelines, ensuring broad market acceptance. Innovations in closure technology and ergonomic design have made child-resistant pumps suitable for both OTC and prescription product lines.

Industries such as healthcare, cosmetics, and homecare are driving demand for child-safe dispensing systems that offer controlled dosing, tamper evidence, and reusability. These pumps align with brand commitments to consumer safety and regulatory compliance, while also enhancing trust among caregivers and end users.

Segment growth is expected to be led by pump dispensers with certified safety locks, pharmaceutical and nutraceutical applications in end-use segments, and polypropylene-based components due to their mechanical strength, customization flexibility, and compatibility with viscous formulations.

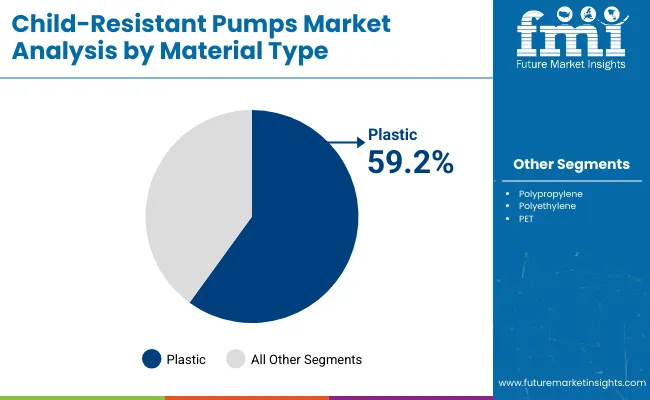

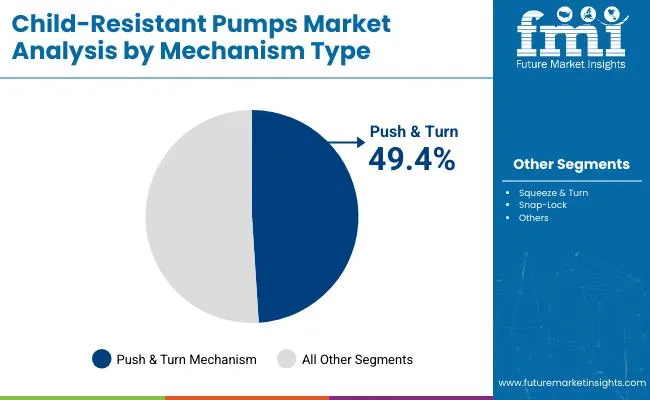

The market is segmented by material type, mechanism type, pump type, end-use industry, and region. Material type includes plastic (polypropylene, polyethylene, PET) and metal, offering varying levels of durability, cost-effectiveness, and compatibility with active ingredients. Mechanism type segmentation features push & turn, squeeze & turn, and snap-lock configurations, each designed to prevent unintentional access by children while maintaining user convenience.

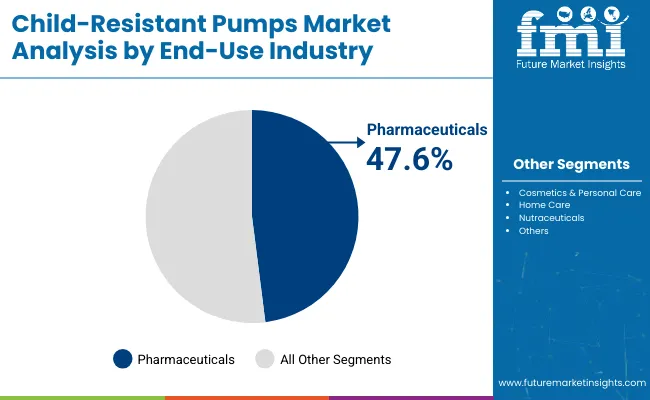

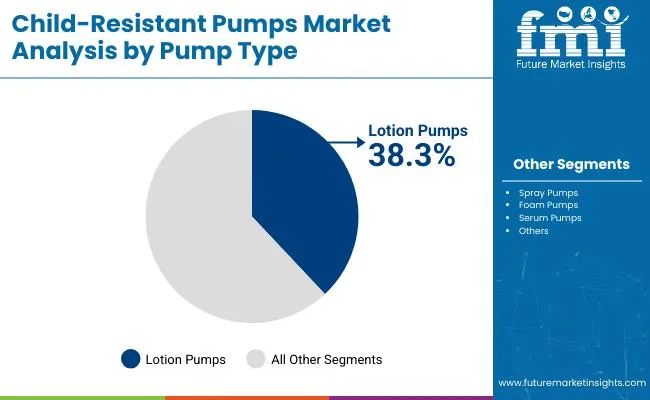

Based on pump type, the market includes lotion pumps, spray pumps, foam pumps, and serum pumps, reflecting versatility in dispensing across liquid, gel, and foaming formulations. End-use industries include pharmaceuticals, cosmetics & personal care, home care, and nutraceuticals, where child safety, dosing control, and regulatory compliance are critical packaging considerations. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The plastic segment is expected to dominate the child-resistant pumps market with a projected share of 59.2% in 2025. This leadership stems from the material’s adaptability, ease of manufacturing, and compatibility with tamper-evident and locking mechanisms. Plastics such as polypropylene (PP) and polyethylene (PE) are widely used due to their robustness, ability to form precise parts, and chemical resistance, which is essential for pharmaceutical and household chemical applications.

Plastic allows manufacturers to integrate multiple child-resistant features, including push-and-turn and squeeze-and-twist designs, at a competitive cost. The material's lightweight nature also supports efficient shipping and packaging. As sustainability becomes a market driver, bio-based and recyclable plastic variants are gaining traction, further reinforcing the segment’s dominance. Plastic remains the preferred choice due to its balance between safety, affordability, and innovative flexibility across diverse dispensing formats.

The pharmaceuticals segment is projected to lead the end-use industry category in the child-resistant pumps market, accounting for 47.6% of total share in 2025. Regulatory bodies such as the USA Consumer Product Safety Commission (CPSC) and the European Medicines Agency (EMA) mandate child-resistant packaging for many prescription and over-the-counter (OTC) drugs, especially liquid medications and topical applications.

This has led to a strong adoption of child-resistant pump formats that prevent accidental ingestion or misuse by children. These pumps are increasingly integrated with metered dosing, anti-counterfeit features, and tamper-evident seals to align with pharmacovigilance protocols. Moreover, as the pharmaceutical industry expands its topical drug delivery portfolios, especially in pain relief, dermatology, and hormone therapy, demand for secure and compliant dispensing systems continues to surge. The sector’s focus on patient safety, compliance, and controlled dosing keeps it at the forefront of child-resistant pump adoption.

The Push & Turn mechanism segment is expected to hold the highest share of 49.4% in 2025 in the child-resistant pumps market. This mechanism has gained widespread acceptance across pharmaceutical and personal care packaging due to its proven efficacy in preventing accidental access by children while remaining intuitive for adults. The dual-action feature requiring both downward pressure and rotation meets international safety standards, including USA Poison Prevention Packaging Act (PPPA) and European EN ISO regulations.

Its simplicity and effectiveness have made it the default choice among over-the-counter liquid medication bottles, topical formulations, and even some household chemicals. In addition, it allows manufacturers to retain ergonomic pump designs without compromising safety, ensuring consistency across product lines.

The lotion pump segment is projected to command a 38.3% market share in 2025 in the child-resistant pumps market. This is attributed to their adaptable dispensing design that suits viscous and semi-viscous formulations, ranging from pharmaceuticals to skincare and cosmeceuticals. These pumps combine safety and usability, providing precise dosage control while ensuring child-resistance through integrated locking mechanisms or dual-step actuation.

Lotion pumps are increasingly adopted in product formats like medicated creams, therapeutic balms, anti-acne solutions, and nutraceutical topical. Their compatibility with various bottle sizes and neck finishes allows easy incorporation into existing packaging lines without significant retooling.

Design compliance, ergonomic challenges, and added manufacturing costs slow down adoption, even as demand rises across pharmaceuticals, household chemicals, and cannabis-infused topicals for secure dispensing solutions that prevent accidental exposure in child-accessible environments.

Safety Regulations and Risk Mitigation Across Sensitive Applications

Child-resistant pumps are gaining widespread attention in industries where product safety and regulatory compliance are paramount. In the pharmaceutical sector, especially for over-the-counter (OTC) liquids, topical medications, and controlled substances, these pumps help prevent unintentional ingestion or misuse by children.

Similar demand is observed in household chemicals, personal care, and cannabis-infused formulations. Legislation such as the Poison Prevention Packaging Act (PPPA) and ISO 8317 standards are pushing manufacturers to integrate child-resistant features into pump designs. These pumps combine controlled dosage delivery with safety locking mechanisms, reducing liability risks while ensuring accessibility for adults and caregivers. As awareness of child safety grows, regulatory authorities continue tightening mandates for packaging compliance across sectors.

Ergonomic Limitations and Cost-intensive Design Engineering

Despite growing regulatory requirements, child-resistant pumps face barriers rooted in design complexity and usability concerns. Creating pumps that are both child-resistant and user-friendly especially for elderly or physically impaired adults poses significant engineering challenges. Achieving dual-action mechanisms, tamper-resistance, and leak-proof sealing within compact designs often leads to higher tooling and material costs.

Moreover, validating compliance through drop tests, torque resistance, and child panel protocols adds to certification lead time and costs. Smaller companies may find it difficult to invest in proprietary CR mechanisms, relying instead on licensed designs or third-party components. These constraints limit widespread availability and delay time-to-market for newer product formats.

Multi-purpose Dispensing Innovation and Material Simplification Trends

A key trend in the child-resistant pumps market is the evolution toward intuitive, multi-functional dispensers that blend safety with convenience. Manufacturers are developing twist-lock, push-and-turn, and squeeze-release pump heads that meet compliance without compromising aesthetics or ease of use. Simultaneously, efforts are underway to reduce environmental impact by designing CR pumps using mono-material constructions and recyclable components, replacing metal springs and complex multi-resin systems.

These innovations serve both regulated pharmaceuticals and premium personal care products, where safety, sustainability, and brand differentiation converge. As child-resistant packaging becomes a standard expectation, especially in sensitive product categories, demand for compliant yet consumer-friendly pumps is set to grow.

The global child-resistant pumps market is gaining steady momentum across pharmaceutical, personal care, and household chemical segments. Stricter safety regulations, rise in self-medication, and increased at-home storage of potentially hazardous products are key growth drivers. Asia-Pacific is leading the expansion with China, Japan, and India witnessing policy-driven adoption across both OTC drug and chemical packaging.

Europe remains ahead in safety packaging compliance, led by Germany and the UK In North America, the USA reflects consistent regulatory enforcement through the Poison Prevention Packaging Act (PPPA), but adoption remains limited to regulated therapeutic and chemical categories. South Korea is growing slowly, reflecting less demand in non-pharma segments and higher reliance on blister and foil-sealed alternatives.

The child-resistant pumps market in the United States is expected to grow at a CAGR of 1.6% from 2025 to 2035. The market is shaped by mandatory child-resistant closures for certain drug classes, cleaning products, and adult-use cannabis applications. While demand is largely confined to regulatory-enforced categories, innovation in pump-lock mechanisms and tamper-evident collars is gradually expanding use in cosmetics and nutraceuticals.

The child-resistant pumps market in the United Kingdom is projected to grow at a CAGR of 3.4%, driven by MHRA mandates and EU-derived safety packaging frameworks. Drug safety standards for pediatric ingestion prevention have encouraged widespread use of lockable pump mechanisms in OTC analgesics, liquid vitamins, and allergy medications. Increased focus on accidental poisoning prevention in home care products is further accelerating adoption.

India is expected to register a CAGR of 3.3% in the child-resistant pumps market through 2035. Rising incidents of pediatric exposure to over-the-counter drugs, household cleaners, and chemical agents have raised regulatory interest in child-proof packaging. Premium pharmaceutical and personal care brands are increasingly adopting CR-certified pumps for urban markets, especially in syrup-based medication and topical formulations.

The child-resistant pumps market in China is forecast to grow at a CAGR of 4.6%, the highest among leading economies. Regulatory shifts in pharmaceuticals, chemicals, and disinfectant products are reinforcing adoption of safety-locked pump packaging. Additionally, the rise in dual-parent working households and increased home storage of disinfectants and medications is driving demand for child-proof dispensers. Domestic pump manufacturers are expanding CR-certified SKUs for both export and domestic use.

Germany is projected to grow at a CAGR of 3.5% in the child-resistant pumps market, backed by stringent consumer safety laws and widespread awareness of accidental ingestion risks. Child-proof packaging is now standard across most OTC medicines, household chemicals, and even food supplements. German packaging companies are developing ergonomic, senior-friendly yet child-resistant closures that comply with both EU and national safety directives.

Japan’s child-resistant pumps market is forecast to grow at a CAGR of 3.7%, fueled by pharmaceutical precision dosing systems and high consumer demand for safety-first packaging. Though traditionally conservative in adopting CR formats, Japanese brands are now integrating child-safety features in both health and hygiene product lines. The increasing presence of imported safety-compliant products is also influencing domestic standards.

The child-resistant pumps market in South Korea is expected to grow at a modest CAGR of 1.3%, reflecting slower regulatory momentum and a preference for foil seals or blister packaging over pump-based closures. While the market for CR closures is emerging in OTC health and wellness categories, widespread adoption remains limited. Cultural packaging preferences and product format trends in Korea favor simpler tamper-evident seals over mechanical locking pumps.

The child-resistant pumps market is moderately fragmented, with global dispensing leaders, regulatory-compliant innovators, and regionally embedded suppliers competing across pharmaceutical, nutraceutical, and household chemical sectors. Global leaders such as Aptar and Nemera hold significant market share, driven by patented child-lock mechanisms, compliance with ISO 8317 and CFR Title 16, and integration with therapeutic and controlled substance packaging. Their strategies increasingly emphasize tamper-resistance, senior-friendly usability, and platform-based modular pumps for regulated drug delivery and home care.

Established mid-sized players, including Origin Pharma, Feldman Industries, and C.L. Smith, offer high-volume, compliant dispensing solutions for CBD, OTC drugs, and chemical products. These companies are accelerating adoption through CR-certified closures, metered dose outputs, and pre-validated packaging formats tailored for contract packagers, wellness brands, and pharma distributors.

Specialized providers such as O. Berk, Aero Pump, and Qiming Packaging focus on cost-effective, application-specific child-resistant pumps for nutraceuticals, essential oils, and personal care. Their strength lies in regional manufacturing proximity, flexibility in neck sizes and dosage control, and fast turnaround for small-batch or private-label clients.

Competitive differentiation is shifting away from basic closure systems toward integrated CR pump ecosystems that combine safety certifications, ergonomic design, customization flexibility, and compatibility with a growing range of therapeutic liquids and viscous formulations.

Key Development of Child-Resistant Pumps Market

The global child-resistant pumps market is estimated to be valued at USD 3.9 billion in 2025.

The market size for the child-resistant pumps market is projected to reach USD 5.7 billion by 2035.

The child-resistant pumps market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in the child-resistant pumps market include locking pumps, push-and-turn pumps, squeeze-and-turn pumps, and twist-lock pumps.

In terms of material, the plastic segment is expected to command the highest share of 59.2% in the child-resistant pumps market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Children Enteral Nutrition Market Size and Share Forecast Outlook 2025 to 2035

Child Safety Seats Market Growth - Trends & Forecast 2025 to 2035

Children’s Health Supplement Market Analysis by Product Type, Application and Age Group Through 2025 to 2035.

Children Mattress Market Product Type, Ingredient Type, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Child resistant Zipper Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Re-Closable Edible Bags Market Size and Share Forecast Outlook 2025 to 2035

Child-Resistant Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Pouches Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Single Dose Pouches Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Pipette Closures Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Dropper Caps Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Bottles Market Size and Forecast

Child Resistant Locking Pouches Market from 2025 to 2035

Child-Resistant Containers Market Trends & Demand 2025 to 2035

Competitive Landscape of Child Resistant Re-Closable Edible Bags Providers

Market Share Distribution Among Child-Resistant Pouches Manufacturers

Leading Providers & Market Share in Child-Resistant Foil Packaging

Market Share Insights for Child Resistant Dropper Caps Manufacturers

Market Share Distribution Among Child Resistant Pipette Closures Manufacturers

Child Resistant Bags Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA