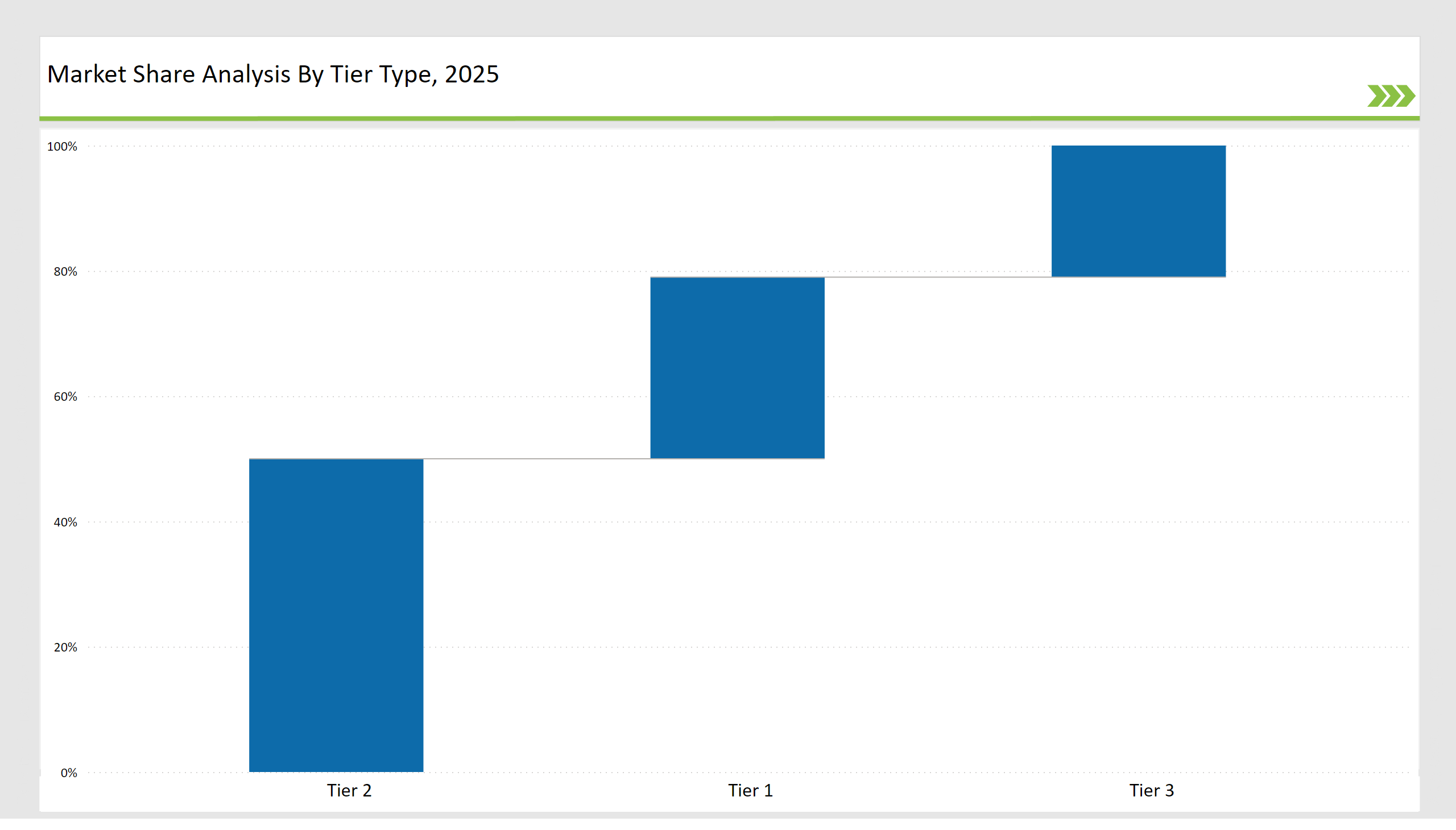

The Diagnostic Vials Market is highly competitive globally in terms of market presence and strategies, which are divided into Tier 1, Tier 2, and Tier 3. Major companies are Thermo Fisher Scientific, Corning Incorporated, and DWK Life Sciences, who together share the market; they account for 58% of the total market.

These Tier 1 players leverage economies of scale, advanced R&D, and strong global distribution networks. Their strategic focus includes sustainability initiatives, precision manufacturing, and regulatory-compliant designs catering to pharmaceutical, clinical, and life sciences applications.

Tier 2 players, such as Greiner Bio-One and Cole-Parmer, represent 28% of the global market share. They target mid-sized enterprises and regional markets, offering cost-effective, customizable diagnostic vials. With enhanced operational efficiencies and personalized solutions, Tier 2 players solidify their positions in emerging economies.

Tier 3 players, including smaller regional manufacturers, startups, and private labels, account for 14% of the global market share. These players target specialized and localized demands where eco-friendliness is the forefront and niche products cater to their needs. Using meagre resources as a response against these companies, Tier 3 companies also achieve the competitive advantage due to agility, innovation, and bespoke solutions.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Thermo Fisher Scientific, Corning Incorporated, DWK Life Sciences) | 15% |

| Rest of Top 5 (Greiner Bio-One, Cole-Parmer) | 5% |

| Next 5 of Top 10 (Eppendorf AG, Globe Scientific, Heathrow Scientific, Mettler Toledo, BrandTech Scientific) | 9% |

The market remains consolidated at the top, with Tier 1 players leveraging global expansion, while Tier 3 players drive innovation and niche specialization.

Type of Player & Industry Share (%), 2025

| Player Tier | Industry Share (%) |

|---|---|

| Top 10 Players | 29% |

| Next 20 Players | 50% |

| Remaining Players | 21% |

The Diagnostic Vials Market is segmented based on primary end-use industries, including:

To cater to diverse industry needs, vendors offer customized and innovative solutions, including:

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Thermo Fisher Scientific, Corning Incorporated, DWK Life Sciences |

| Tier 2 | Greiner Bio-One, Cole-Parmer |

| Tier 3 | Eppendorf AG, Globe Scientific, niche startups, Heathrow Scientific, BrandTech Scientific |

| Manufacturer | Latest Developments |

|---|---|

| Thermo Fisher Scientific | Launched biodegradable diagnostic vials in January 2024. |

| Corning Incorporated | Introduced smart-labeled tracking vials in February 2024. |

| DWK Life Sciences | Focused on precision-manufactured vials in March 2024. |

| Greiner Bio-One | Developed medical-grade tamper-proof vials in April 2024. |

| Cole-Parmer | Expanded cost-effective and customizable vial options in May 2024. |

| Eppendorf AG | Advanced high-precision vials with RFID tracking in June 2024. |

The Diagnostic Vials Market is expected to evolve with automation and IoT technologies, improving efficiency and customization. Sustainability is a key priority, with manufacturers shifting towards eco-friendly materials. AI-driven production workflows, RFID-enabled monitoring, and regulatory compliance will define the future landscape.

Real-time data analytics will enhance supply chain management and quality control, enabling market players to stay competitive. In addition, the growth of smart packaging solutions will improve traceability and compliance with regulations. Companies are also optimizing vial durability to extend shelf life and minimize waste.

Future growth for the industry will be boosted by expansion into emerging markets and strategic alliances, making the industry much more resilient and flexible in its response to the latest changes in consumer demand.

The key players in the market are Thermo Fisher Scientific, Corning Incorporated, DWK Life Sciences, Greiner Bio-One, and Cole-Parmer.

The top 10 players collectively hold 29% of the global market.

The market is in a fragmented concentration, with 29% from Tier 1 players, but Tier 2 and Tier 3 players lead the majority in share, who drive innovation and cost-effective solutions.

Tier-3 companies focus on niche, eco-friendly, and high-precision solutions, contributing 21% of the market.

Automation, sustainability, AI integration, and real-time data analytics drive market growth.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diagnostic Shipper Market Size and Share Forecast Outlook 2025 to 2035

Diagnostic Imaging Markers Market Size and Share Forecast Outlook 2025 to 2035

Diagnostic Imaging Services Market Size and Share Forecast Outlook 2025 to 2035

Diagnostic Exosome Biomarkers Market Trends – Growth & Forecast 2025 to 2035

Diagnostic X-Ray System Market – Trends & Forecast 2025 to 2035

Diagnostic Tools for EVs Market Growth - Trends & Forecast 2025 to 2035

Diagnostic Stopper Market

Diagnostic Vials Market Size and Share Forecast Outlook 2025 to 2035

HIV Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

DNA Diagnostics Market Growth - Trends & Forecast 2024 to 2034

Food Diagnostics Services Market Size, Growth, and Forecast for 2025–2035

Rabies Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Cancer Diagnostics Market Analysis - Size, Share and Forecast 2025 to 2035

Tissue Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Sepsis Diagnostics Market Growth - Trends & Forecast 2025 to 2035

Dental Diagnostic and Surgical Equipment Market Analysis - Trends & Forecast 2024 to 2034

Allergy Diagnostic Market Forecast and Outlook 2025 to 2035

Poultry Diagnostic Testing Market Size and Share Forecast Outlook 2025 to 2035

Poultry Diagnostics Market - Demand, Growth & Forecast 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA