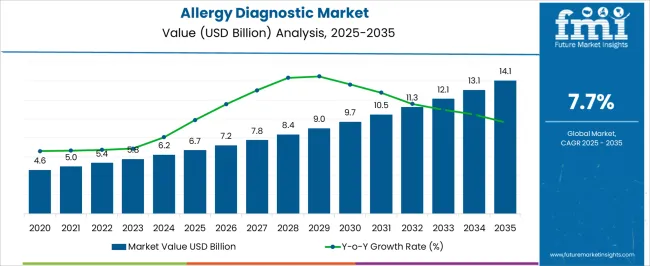

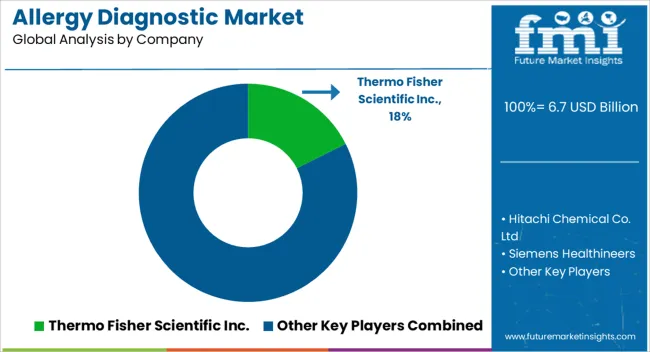

The allergy diagnostic market is expected to grow from USD 6.7 billion in 2025 to USD 14.1 billion by 2035, advancing at a CAGR of 7.7% over the forecast period. The growth dynamics of this market are shaped by the interplay of rising allergy prevalence, technological innovation in diagnostics, and broader healthcare infrastructure developments. These factors are collectively reshaping the diagnostic landscape, enabling faster, more accurate detection and creating new opportunities for both established and emerging players.

One of the strongest dynamics driving growth is the global rise in allergy cases, particularly respiratory and food-related allergies. Urban environments, changing dietary patterns, and increased exposure to pollutants are key contributors. This has led to greater awareness among patients and healthcare providers of the importance of early diagnosis and proper treatment planning. Increased screening rates, combined with improved healthcare access in both developed and developing countries, are accelerating test volumes and expanding the patient base for diagnostic providers.

Technological progress is another important market-shaping dynamic. Allergy diagnostics are shifting from conventional methods, such as skin prick and intradermal testing, to more advanced techniques like molecular diagnostics and component-resolved diagnostics (CRD). These technologies allow for precise identification of allergen components rather than broad categories, reducing false positives and enabling personalized treatment strategies. Laboratories and hospitals are increasingly investing in automated analyzers and multiplex testing platforms that allow simultaneous screening of multiple allergens, improving efficiency and scalability. This technological integration is also supported by digital health platforms that enable electronic reporting, better data management, and predictive analytics.

The regulatory and reimbursement environment also significantly influences market dynamics. Favorable insurance coverage in North America and parts of Europe has boosted access to diagnostic tests, while emerging economies are beginning to recognize the economic burden of untreated allergies, prompting policy support. However, disparities remain, as limited reimbursement in some regions continues to restrict adoption. At the same time, ongoing government initiatives promoting allergy awareness, combined with investments in healthcare infrastructure, are creating a more supportive environment for market expansion.

Competitive intensity in the allergy diagnostic sector is shaping innovation and service models. Established diagnostic companies are focusing on expanding their test portfolios and entering into partnerships with healthcare providers and research organizations. Start-ups and niche players are contributing through innovations in home-based allergy testing kits and portable diagnostic devices. The increasing role of telemedicine in allergy consultations further enhances accessibility, making diagnostics more patient-centric and driving adoption across varied healthcare delivery models.

| Metric | Value |

|---|---|

| Allergy Diagnostic Market Estimated Value in (2025 E) | USD 6.7 billion |

| Allergy Diagnostic Market Forecast Value in (2035 F) | USD 14.1 billion |

| Forecast CAGR (2025 to 2035) | 7.7% |

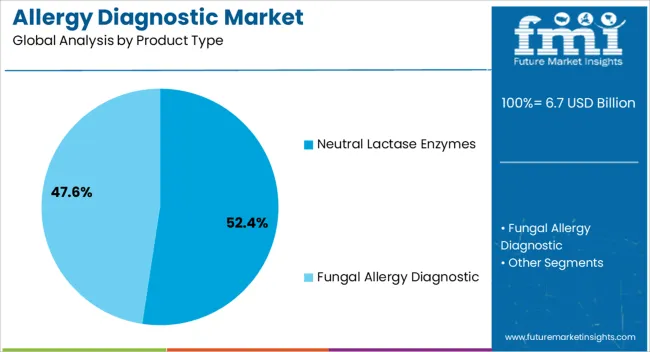

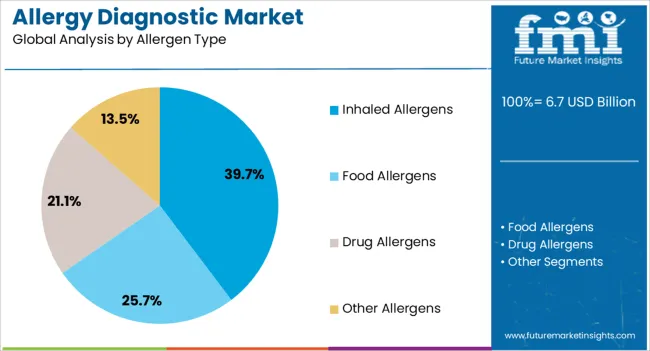

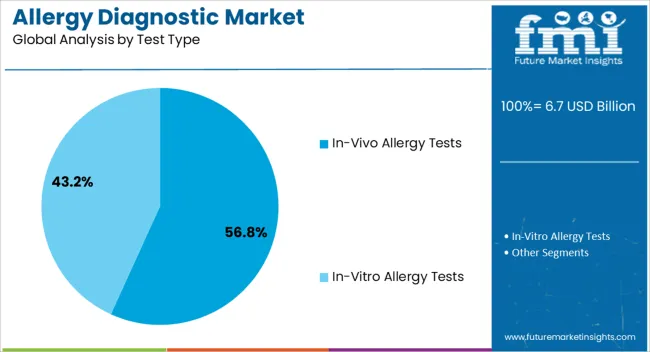

The allergy diagnostic market is segmented by Product Type, Allergen Type, Test Type, and End User and region. By Product Type, the market is divided into Neutral Lactase Enzymes and Fungal Allergy Diagnostic. In terms of Allergen Type, the market is classified into Inhaled Allergens, Food Allergens, Drug Allergens, and Other Allergens. Based on Test Type, the market is segmented into In-Vivo Allergy Tests and In-Vitro Allergy Tests. By End User, the market is divided into Diagnostic Laboratories, Hospitals, Academic Research Institutes, and Other End Users. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Neutral Lactase Enzymes segment is projected to account for 52.4% of the allergy diagnostic market revenue in 2025, establishing itself as the leading product category. Growth of this segment has been supported by rising lactose intolerance diagnoses and its frequent overlap with allergic gastrointestinal symptoms.

Clinicians have increasingly used neutral lactase enzyme-based tests to differentiate between true lactose allergies and intolerances, aiding in more targeted treatment pathways. These enzymes offer broad diagnostic utility and are valued for their stability under neutral pH conditions, making them suitable for a wide range of test kits.

Pharmaceutical manufacturers have expanded their product lines to include enzyme-based testing components that are compatible with multiple sample types, contributing to market growth. The segment’s dominance is further reinforced by its role in supporting confirmatory diagnostics, especially in combination with breath tests and in vivo evaluations. With gastrointestinal symptoms remaining a common manifestation of food-related allergies, Neutral Lactase Enzymes are expected to sustain demand across diverse clinical environments.

The Inhaled Allergens segment is forecasted to contribute 39.7% of the allergy diagnostic market revenue in 2025, maintaining its position as the dominant allergen type tested. This segment’s growth has been driven by the increasing incidence of respiratory allergies linked to environmental exposures, including pollen, dust mites, pet dander, and mold spores.

Urbanization, climate change, and industrial emissions have elevated airborne allergen loads, resulting in a higher frequency of allergic rhinitis, asthma, and other respiratory conditions. Public health data has confirmed the surge in inhaled allergen sensitivity, particularly in densely populated and temperate regions.

Allergy specialists and pulmonologists have prioritized inhaled allergen testing in both pediatric and adult populations to guide immunotherapy and preventive strategies. Technological advancements in microarray-based allergen panels have also allowed multiplex testing for multiple inhalants simultaneously, improving diagnostic efficiency. Given their widespread clinical relevance and growing burden of airborne allergies, Inhaled Allergens are expected to remain a core focus within allergy diagnostics.

The In-Vivo Allergy Tests segment is projected to represent 56.8% of the allergy diagnostic market revenue in 2025, retaining its leading role in clinical testing approaches. This growth has been driven by the high sensitivity, reproducibility, and immediate response visibility offered by in-vivo methods, such as skin prick tests and intradermal testing.

These tests have been widely adopted due to their cost-effectiveness, real-time results, and applicability across a broad spectrum of allergens. Healthcare practitioners have continued to prefer in-vivo testing as a first-line diagnostic tool, particularly in outpatient allergy clinics and general practice settings.

Medical literature has consistently supported the reliability of in-vivo tests for diagnosing common allergic conditions, making them a staple in allergy workups. Training programs and clinical guidelines have also standardized in-vivo testing protocols, improving practitioner confidence and diagnostic accuracy. As allergic diseases continue to impact diverse age groups and geographies, the In-Vivo Allergy Tests segment is expected to retain its market leadership through ongoing clinical endorsement and widespread procedural familiarity.

The dramatic change towards customized medicine concentrates on the demand for accurate and customized diagnostic approaches, ramping up the demand for allergy screening procedures. Allergy diagnostic providers should align their product portfolios with the evolving ecosystem of specialized healthcare to meet the specific needs of patients and healthcare providers.

The focus on patient-centered care models underscores the importance of timely diagnosis, visionary leadership, and advances in patient outcomes in allergic reactions. To meet demand, providers prioritize developing user-friendly, patient-centric testing solutions. This improves availability and compliance with allergy examinations, prospectively leading to better patient outcomes and widening market share.

The continued growth in healthcare expenditure, particularly in developing economies, supports the expansion of the allergy diagnostic device market. The allergy diagnostic providers customize their market campaigns to cash on developing healthcare expenses and developing potential in the untrodden regions.

Restraints Adversely Influencing the Allergy Diagnostics Industry

The significant price of research and development, along with extended innovation cycles, inhibits the profitability and competition in the allergy diagnostic industry. The vendors contend with rising innovation costs, budgetary constraints, and volatile regulatory timelines, which constrain development and market penetration. This factor impedes the sales growth of allergy diagnostics between 2025 and 2035.

The dearth of qualified experts and expertise in allergy diagnostics creates operational hurdles for allergy diagnostic providers, hindering service quality, innovation, and expansion initiatives. Hiring and preserving qualified professionals, such as those in precision medicine and cutting-edge allergy testing, inhibits the growth of the allergy diagnostic device market.

The global allergy diagnostic equipment market was valued at around USD 4.6 million in 2020. The allergy diagnostic sales are projected to increase at a healthy CAGR of 10.2% attaining a market value of USD 6.7 million by 2025.

Between 2020 and 2025, the allergic diagnostic industry saw considerable growth, catapulted by the occurrence of allergies, diagnostic technology innovations, and escalating consciousness about allergic issues. During this period, the allergy diagnostic device sector witnessed an intensification in demand for allergy testing equipment, immunoassay analyzers, and other diagnostic devices, with rising investments in research and development by vendors.

From 2025 to 2035, the revenue forecast for the market is slated to grow. Factors like the rising geriatric population, towering pollution issues, and broadening medical infrastructure in developing countries spur allergy diagnostic industry expansion. The evolution in precision medicine and tailored diagnostics transform allergy diagnostics, presenting customized solutions.

The strengthening focus on preventive medicine and timely identification of disease, along with favorable government schemes encouraging allergy diagnostics, augment allergy diagnostic market growth. The market sees steady demand and innovation, proffering profitable opportunities to cash on the shifting healthcare ecosystem and fulfill the diagnostic requirements of allergy patients globally.

The section below covers the forecast for the allergy diagnostic market in terms of countries. Information on key countries in several parts globally, including North America, Asia Pacific, Europe, and others, is mentioned.

The United States is the torchbearer of the allergy diagnostic industry in North America, with a CAGR of 7.1% between 2025 and 2035. In the Asia Pacific allergy diagnostic sector, China exhibits a CAGR of 7.2% through 2035, leaving behind Japan at 6.8%.

| Countries | CAGR 2025 to 2035 |

|---|---|

| China | 7.2% |

| United States | 7.1% |

| United Kingdom | 6.7% |

The allergy diagnostic sector in China observes swift growth because of catalysts like soaring healthcare expenses, amplifying allergy awareness, and innovations in diagnostic tools. The expanding population and urbanization shifts aid the proliferating allergy diagnostic sales.

Obstacles like constrained access to medical care in remote areas and regulatory intricacies inhibit the allergic diagnostics market growth. The partnership between regional and foreign vendors presents ample potential for the expansion of the allergic diagnostic industry.

The allergic diagnostics market in the United States is attributed to the rising incidence of allergies, stimulating demand for diagnostic testing. Technological innovation like the adoption of customized medicine approaches and molecular diagnostics, catapults the growth of the allergy diagnostic device industry.

The presence of deep-rooted healthcare infrastructure and favorable reimbursement rules assist the market expansion of allergy diagnostics. The pricing stress and health care improvements are an obstacle to providers, warranting advanced methods to stay competitive.

The allergy diagnostics industry in the United Kingdom encountered rapid growth because of spurring allergy incidence, amplifying healthcare expenses, and government schemes to enhance allergy management.

The adoption of POC testing and e-medicine solutions ramp up the availability of diagnostic services. The alliance between healthcare providers and diagnostic firms to produce consolidated allergy management solutions augments the growth of the allergy diagnostic industry.

The section contains information about the leading segments in the allergy diagnostic industry. In terms of product type category, the fungal allergy diagnostic segment accounts for a share of 68.8% by 2035. By allergen type category, the inhaled allergens segment is projected to prevail by garnering a share of 46.8% in 2035.

| Segment | Fungal Allergy Diagnostic |

|---|---|

| Value Share (2035) | 68.8% |

Rising cases of mold and yeast allergies in adults, and an evident surge in demand for fungal allergy diagnostics. This trend is escalated by the soaring cases of allergy-prompted asthma. To satisfy the fungal allergy diagnostics demand, providers are positioning themselves to present economical allergy testing solutions in rural areas. Identifying the perspective of the market, vendors are slated to cash on the elevating need for accessible allergy testing equipment.

| Segment | Inhaled Allergens |

|---|---|

| Value Share (2035) | 46.8% |

The inhaled allergens stimulate widespread allergic symptoms, comprising respiratory disorders such as asthma and rhinitis, which are predominant and consistently diagnosed disorders. This segment's ascendance in allergy diagnostics sales is characterized by the augmenting prevalence of respiratory allergies.

The ease of exposure to inhaled allergens intensifies the demand for diagnostic tools to recognize triggers rapidly. The provider cashs on this trend by strengthening innovative diagnostic solutions personalized to proficiently detect inhaled allergens, serving the widening market requirements.

Owing to the presence of reputed allergy diagnostic vendors the market is very competitive. To expand their global reach, allergy diagnostics device producers employ various promotional campaigns. The allergy diagnostics providers focus on using organic and inorganic strategies to solidify the global footprint.

Setting up a partnership with local suppliers to augment their supply chain and engaging in mergers and acquisitions are classic instances of inorganic approaches. Faster product innovations, patenting, and licensing procedures are emphasized.

Prominent allergy diagnostic equipment vendors stress providing attractive discounts and better prices to possess a greater market share in emerging economies.

Industry Updates

| Company | Astria Therapeutics, Inc. |

|---|---|

| Headquarter | United States |

| Recent Advancement |

Astria Therapeutics, Inc declared an agreement with Inchon’s Sciences in October 2025. This agreement envelops the OX40 portfolio, especially emphasizing on advancement of STAR-0310 for potential treatment of atopic dermatitis and other allergies and immune disorders. |

| Company | ALK, Inc. |

|---|---|

| Headquarter | Denmark |

| Recent Advancement |

ALK received FDA approval in January 2025 for widespread application of ODACTRA, a percutaneous immunotherapy tablet in the medication of house pollen-induced allergic rhinitis for people of age between 12 and 17. |

The market is bifurcated into fungal allergy diagnostic, and neutral lactase enzymes.

Key allergen type present in the industry include inhaled allergens, food allergens, drug allergens, and other allergens.

The report consists of key test types like in-vivo allergy tests and in-vitro allergy tests.

Key end users present in the industry include diagnostic laboratories, hospitals, academic research institutes, and other end users.

Analysis of the market has been carried out in key countries of North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and the Middle East and Africa.

The global allergy diagnostic market is estimated to be valued at USD 6.7 billion in 2025.

The market size for the allergy diagnostic market is projected to reach USD 14.1 billion by 2035.

The allergy diagnostic market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in allergy diagnostic market are neutral lactase enzymes and fungal allergy diagnostic.

In terms of allergen type, inhaled allergens segment to command 39.7% share in the allergy diagnostic market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ocular Allergy Diagnostic System Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Allergy Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Allergy Tester Market Size and Share Forecast Outlook 2025 to 2035

Allergy Immunotherapy Market Analysis - Size, Share & Forecast 2025 to 2035

Market Share Breakdown of Allergy Immunotherapy Providers

Allergy Treatment Market Analysis - Demand & Forecast 2024 to 2034

IgE Allergy Blood Tests Market Size, Growth, and Forecast 2025 to 2035

Food Allergy Market Size and Share Forecast Outlook 2025 to 2035

Food Allergy Immunotherapy Market Analysis Size and Share Forecast Outlook 2025 to 2035

Nasal Allergy Treatment Market Size and Share Forecast Outlook 2025 to 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Pollen Allergy Market Size and Share Forecast Outlook 2025 to 2035

Seasonal Allergy Market Size and Share Forecast Outlook 2025 to 2035

Needle Free Allergy Therapy Market Size and Share Forecast Outlook 2025 to 2035

Diagnostic Shipper Market Size and Share Forecast Outlook 2025 to 2035

Diagnostic Imaging Markers Market Size and Share Forecast Outlook 2025 to 2035

Diagnostic Imaging Services Market Size and Share Forecast Outlook 2025 to 2035

Diagnostic Vials Market Size and Share Forecast Outlook 2025 to 2035

Diagnostic Exosome Biomarkers Market Trends – Growth & Forecast 2025 to 2035

Diagnostic X-Ray System Market – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA