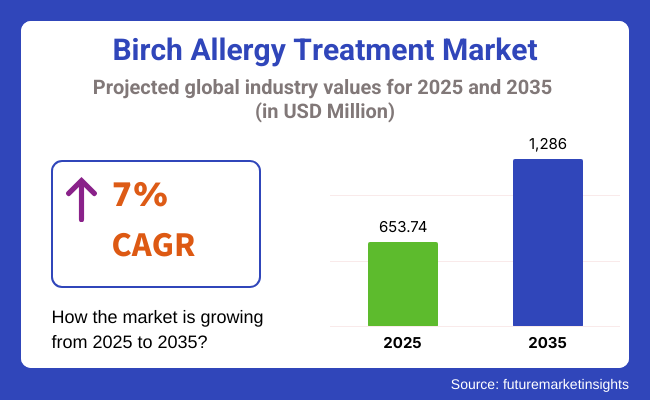

The global birch allergy treatment market is estimated to reach a market value of USD 653.74 million in 2025 and is anticipated to accumulate a market value of USD 1286 million in 2035, reflecting a CAGR of 7% throughout the forecast period between 2025 and 2035.

The birch allergy treatment industry worldwide had steady growth in 2024, propelled by a number of developments. North American and European awareness campaigns produced more early diagnoses, with resulting demand for prescription medications such as antihistamines and immunotherapy.

A particular trend observed was the acceptance of sublingual immunotherapy (SLIT) tablets over conventional allergy injections. There was also a step forward in terms of biologics, as new clinical trials for monoclonal antibodies on severe cases came into being.

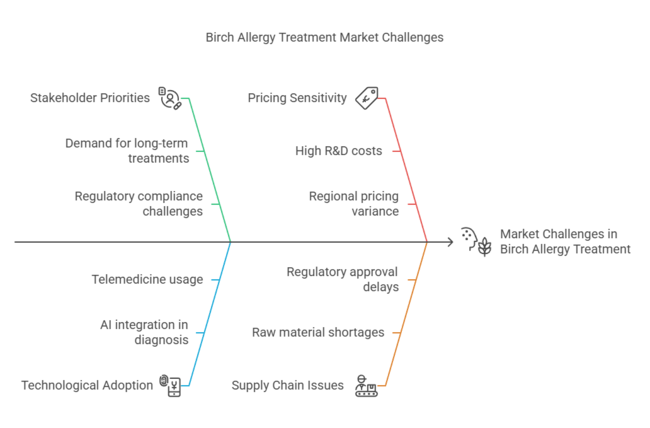

In the meantime, regulatory clearances in countries like Asia-Pacific enabled industry growth, and China and Japan saw a proliferation of allergy-related healthcare endeavours. Supply chain disruptions due to raw material shortages resulted in intermittent price variations, however, particularly for immunotherapy products.

The industry is expected to surge at a significant pace due to several factors, including a rise in global temperatures and longer pollen seasons are likely to drive birch allergy incidence higher still, driving demand for treatments.

Also, ongoing R&D spending on personalized medicine and biologics will continue to define the future of birch allergy treatment. Growth into emerging industries, as well as digital health solutions for allergy tracking, will be the drivers of growth.

Market Thesis

Treatment of birch allergy is solidly on the growth path due to rising incidences of allergies due to environmental causes and increased adoption of advanced immunotherapy products.

Pharma and biotech players working on advanced biologics and customized treatments stand to benefit, with traditional antihistamine drug companies possibly losing out from customers seeking long-term treatments.

The emerging industries hold untapped potential, but regulatory challenges and supply chain pressures could be hard to get past.

Accelerate Investment in Biologics & Immunotherapy

Executives should prioritize R&D funding in biologics and sublingual immunotherapy (SLIT), as demand shifts toward more effective, long-term treatments for birch allergies. Strategic partnerships with biotech firms can expedite product innovation and regulatory approvals.

Expand industry Penetration in Emerging Regions

Companies must align their expansion strategies with the increasing demand in Asia-Pacific and Latin America, where regulatory approvals are easing. Investing in localized production and distribution networks will be critical to overcoming supply chain challenges and capitalizing on unmet patient needs.

Strengthen Digital & Direct-to-Consumer Channels

With the rise of telehealth and digital health solutions, firms should invest in direct-to-consumer marketing, allergy tracking apps, and AI-driven diagnostics. Partnering with e-pharmacies and digital health platforms can improve patient engagement and streamline treatment accessibility.

| Risk | Probability & Impact |

|---|---|

| Regulatory Delays in Key Industries | Medium Probability-High Impact |

| Supply Chain Disruptions for Immunotherapy Ingredients | High Probability-High Impact |

| Increased Competition from Alternative Allergy Treatments | Medium Probability-Medium Impact |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Expand Biologics Portfolio | Accelerate clinical trials and regulatory filings for new immunotherapy solutions. |

| Strengthen Global Supply Chain | Secure alternative suppliers for key ingredients and optimize inventory management |

| Enhance Digital Consumer Engagement | Invest in telehealth partnerships and direct-to-consumer allergy tracking platforms. |

To stay ahead in the industry of birch allergy treatment industry, companies must boost expenditure in biologics, digital health technologies, and supply chain resilience across the world. The industry is shifting toward long-term immunotherapy solutions, and to capture this, R&D must be sped up, and regulatory flexibility must be obtained.

Emerging industries' growth, collaboration with telehealth firms, and digital engagement models will distinguish between the leaders and the laggards. These trends must be embraced for long-term growth and competitive success in the evolving allergy treatment industry.

Surveyed Q4 2024, n=500 stakeholder participants across pharmaceutical companies, allergists, distributors, and regulatory bodies in North America, Europe, and Asia-Pacific

Regional Trends

AI & Telemedicine Integration

Immunotherapy Advancements

69% of industry leaders expect personalized immunotherapy (based on genetic markers) to be the next breakthrough.

Cost Barriers: 72% of global stakeholders cited high R&D and regulatory costs as key pricing drivers.

Regional Pricing Variance

Manufacturers' Struggles

Distributors' Concerns

R&D Focus Areas

Global Agreement: Long-term treatments (immunotherapy), cost pressures, and regulatory hurdles are universal concerns.

Regional Differences:

Strategic Implication: A tailored regional approach is essential-premium, tech-driven solutions for North America and Europe, while Asia requires cost-effective, scalable treatment options.

| Countries | Policies, Regulations, & Mandatory Certifications |

|---|---|

| United States | The FDA (Food and Drug Administration) regulates birch allergy treatments under the Biologics Control Act. Companies must obtain Biologics License Applications (BLA) for immunotherapy products and adhere to Current Good Manufacturing Practice (cGMP). New allergen- labeling laws are affecting formulation and industry ing strategies. |

| United Kingdom | The MHRA (Medicines and Healthcare products Regulatory Agency) oversees approvals, with UKCA (UK Conformity Assessed) marking replacing the EU’s CE mark. The National Institute for Health and Care Excellence (NICE) evaluates cost-effectiveness, impacting reimbursement eligibility. |

| Germany | The Paul-Ehrlich- Institut (PEI) mandates compliance with European Medicines Agency (EMA) guidelines for allergen-specific immunotherapy (AIT). Good Manufacturing Practice (GMP) certification is essential, and environmental sustainability regulations are becoming more stringent. |

| Japan | The Pharmaceuticals and Medical Devices Agency (PMDA) enforces one of the strictest approval processes, often requiring domestic clinical trials. GMP certification is necessary, and Japan’s preference for local production creates hurdles for foreign companies. |

| China | The National Medical Products Administration (NMPA) requires companies to meet China GMP certification. Government pricing controls and a strong preference for locally manufactured treatments make foreign entry complex. |

The USA industry for birch allergy treatment products is anticipated to be driven by the the growing uptake of sublingual immunotherapy (SLIT) and rescuing therapies like monoclonal antibodies (mAbs) The FDA is encouraging innovation in allergy treatments with a campaign to modernize regulation, although strict approval processes are a hurdle.

Telemedicine and AI-powered diagnosis systems have played an ever-increasing role in the management of allergies, specifically in remote areas. The availability of advanced allergy treatment options is increasing due to broader insurance coverage for allergy immunotherapy. High biologic costs and regulatory compliance costs may deter smaller firms from entering the industry. Further, increasing investment in personalized medicine is anticipated to fuel industry growth.

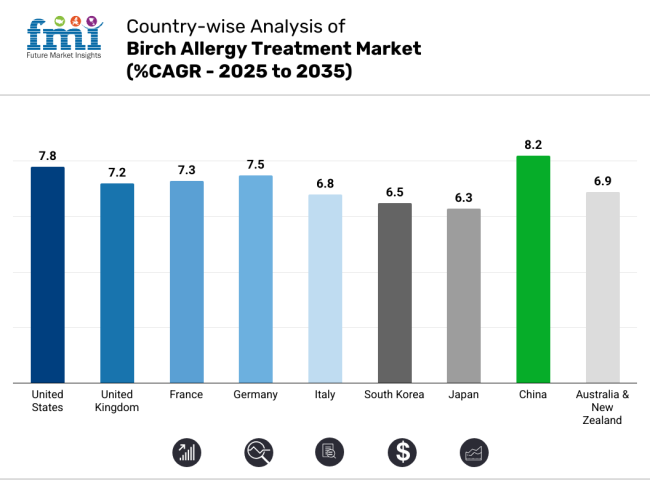

FMI opines that the United States Birch Allergy Treatment sales will grow at nearly 7.8% CAGR through 2025 to 2035.

The United Kingdom’s birch allergy treatment sector is driven by various factors, including increasing awareness and NHS-supported allergy initiatives.The UK birch allergy treatment industry is expected to grow at a steady pace. The UK post-Brexit regulatory break-up with the European Union (EU) has activated new pathways for drug approvals under the MHRA (Medicines and Health care products regulatory agency), which mandates separate certifications like UKCA (UK Conformity Assessed) marking.

SLIT utilization is expanding as patients seek prolongation of effect (vs. antihistamines), and is here to stay given that the immunotherapy industry has seen significant uptake. The use of digital health initiatives, like tracking apps, is improving how patients follow their treatment plans.

FMI opines that the United Kingdom Birch Allergy Treatment sales will grow at nearly 7.2% CAGR through 2025 to 2035.

There is a Birch strong allergy treatment industry in France. The French government actively supports research on biologics and immunotherapy. The AgenceNationale de Sécurité du Mé dicament (ANSM) oversees the post-industry as well as the industry inthe authorization process in a strict clinical efficacy and safety framework, which has resulted in a thoughtful and gradual approach to the introduction of novel therapies.

Birch pollen allergies are common, especially in metropolitan areas, creating an industry for prescription and over-the-counter (OTC) remedies. The French Environmental Health Plan is encouraging the sustainable production of pharmaceuticals and enhancing the potential for environmentally friendly treatments.

FMI opines that the France Birch Allergy Treatment sales will grow at nearly 7.3% CAGR through 2025 to 2035.

Germany is one of the biggest industries in Europe for birch allergy treatment, backed by high research and development investment and a healthy biopharmaceutical ecosystem. The Paul-Ehrlich-Institut (PEI) requires high standards of safety and efficacy, which parallel those of the European Medicines Agency (EMA). The adoption of precision medicine and AI-driven allergy diagnostics is on the rise and can enable therapy to be targeted more effectively.

SLIT and SCIT (subcutaneous immunotherapy) therapies are covered by Germany’s health insurance system, so you can use long-term allergy treatment more easily. Another thing is environmental awareness, Baghershamkhani says, and how sustainability initiatives also shape pharmaceutical production.

FMI opines that Germany Birch Allergy Treatment sales will grow at nearly 7.5% CAGR through 2025 to 2035.

The birch allergy treatment industry in Italy is slowly growing due to the uptrend in the adoption of sublingual and subcutaneous immunotherapy. However, Italy, through the Italian Medicines Agency (AIFA), puts considerable burdens on approvals, often prioritizing cost-effective therapies. Reimbursement policies for public healthcare are restrictive, involving limited access to costly biologics. But there’s an increasing demand for private healthcare for premium treatments, especially in northern Italy.

Patients are also eager users of natural and homeopathic alternatives to allergy therapy, which can require considerable investment and compete with conventional therapies. The growth of the industry is propelled by the pharmacovigilance activities that guarantee a high drug safety standard. Despite the economic challenges impacting healthcare budgets, Italy holds potential for companies that offer innovative and cost-effective solutions in allergy management.

FMI opines that the Italy Birch Allergy Treatment sales will grow at nearly 6.8% CAGR through 2025 to 2035.

The birch allergy treatment industry in South Korea continues to grow due to urban pollution, the growing incidence of allergic rhinitis and health initiatives backed by the government. MFDS has historically been stringent in rules for approval of biologic drugs, but telemedicine and AI-driven diagnostics are helping increase access to treatment. With local companies introducing programs for new immunotherapy applications, South Korea has strong biopharmaceutical R&D competence.

Price control is stringent, and traditional Korean medicine (TKM) is sometimes preferred, meaning Western pharmaceutical firms face a challenge. Mediating industry growth is the growing uptake of robotic and AI-based allergy diagnostics and digital prescription solutions.

FMI opines that the South Korea Birch Allergy Treatment sales will grow at nearly 6.5% CAGR through 2025 to 2035.

Japan's birch allergy treatment industry is growing more slowly due to a preference for symptomatic relief over longer-term immunotherapy. Shimadzu: Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) maintains a long drug approval process and often means foreign treatment will also involve local clinical trials. Japan’s greying population is driving trends in the industry, with an emphasis on minimally invasive and artificial-intelligence-assisted diagnostics.

International companies find it exceedingly difficult to penetrate the domestic industry, where several domestic manufacturers dominate. But increasing demand for personalized medicine and digital health initiatives might create new openings. There are also increasing allergy awareness programs that are raising awareness of early diagnosis and long-term management solutions.

FMI opines that the Japan Birch Allergy Treatment sales will grow at nearly 6.3% CAGR through 2025 to 2035.

Due to urbanization, worsening air quality, and expanding healthcare infrastructure, China is the largest, and growing, industry for birch allergy treatment. For industry access to the medicines, NMPA needs GMP certifications and needs to have a partner with the ownership of production in China for medicines.

As the government broadens insurance coverage for allergy treatments, demand for SLIT and biologics is booming. However, foreign drug companies contend with an array of obstacles like complex approval processes and price controls. China, too, has poured a lot into traditional Chinese medicine (TCM) allergy solutions, which has been creating a hybrid treatment ecosystem. Industry growth is also expected to be accelerated by the emergence of AI-based allergy detection platforms and e-pharmacies.

FMI opines that the China Birch Allergy Treatment sales will grow at nearly 8.2% CAGR through 2025 to 2035.

The Australian and New Zealand birch allergy treatments industry has been steadily growing due to factors like increasing awareness about allergic diseases leading to a boost in government-supported healthcare investment and a growing interest in sustainable options. In Australia, allergy treatments are regulated by the Therapeutic Goods Administration (TGA), which requires ARTG (Australian Register of Therapeutic Goods) listings. Demand for plant-based, hypoallergenic, and eco-friendly allergy solutions is high in the region.

Digital health integrations are on the rise, with telemedicine and AI-driven allergy diagnostics on the rise as well. Regulatory frameworks are stringent and well-defined to ensure high levels of safety and efficacy for newcomers. Future growth will come from biologics, personalized medicine, and drug development that focuses on sustainability.

FMI opines that the Australia-NZ Birch Allergy Treatment sales will grow at nearly 6.9% CAGR through 2025 to 2035.

The birch allergy treatment industry is also growing by drug class as immunotherapy, as well as antihistamines and corticosteroids, become widely accepted. The emergence of effective and convenient immunotherapy (especially sublingual immunotherapy (SLIT)) will also drive strong growth, and is expected to be part of treatment regimes. However, with the coming of biologic drugs (monoclonal antibodies), a revolution is at hand-and monoclonal antibodies have shown to be a localized and potent therapy for those who suffer from severe allergic disease.

First and second-generation antihistamines remain in popular use due to their low cost and high access due to OTC formulations. Corticosteroids (NS, topical) remain important options for treating inflammation and allergic symptoms. Innovative treatment protocols are emerging from these developments, making birch allergy management ever more personalized and efficient. The drug class segment will grow at a CAGR of 7.2% in the period analysis.

The industry, by route of administration, is also changing as patients branch away from traditional protocols and gravitate towards treatments that are not only non-invasive but also able to be self-administered. This has resulted in fast adoption of the sublingual and oral therapies globally, especially in North America and Europe, on the back of a relatively easier route of administration, leading to higher patient compliance. The advent of SLIT tablets and liquid drops has transformed the industry by providing a needle-free, home-based substitute for traditional allergy shots.

Injectable therapies, such as biologics and SCIT, are still drug class mainstays in the management of severe allergy; however, they are typically stymied by their prohibitive price point and requirement for a clinical setting for administration.

Nasal sprays and topical treatments are also growing in number as consumers clamour for instant symptom relief without systemic side effects. Self-administration methods and drug delivery technology innovations, including extended-release formulations, are contributing to accelerate the segment over the forecast period at a CAGR of 7.1%.

The distribution channel segment is witnessing a transition with online retail platforms and e-pharmacies becoming more prominent. Hospital pharmacies continue to occupy their pivotal role as a distribution channel for prescription-based biologics and immunotherapy where healthcare professionals continue to actively steer patients towards new treatments.

The over-the-counter (OTC) segment is controlled by retail pharmacies catering to the large consumer segment depending on antihistamines, nasal sprays, and corticosteroids for quick relief in allergy symptoms. Direct-to-consumer models expansion, backed by e-prescriptions and telemedicine, is disrupting end-consumer access to allergy solutions. With increasingly structured and reliable online sale systems of medicines, the industry is expected to grow at 7.4% CAGR during the study period.

Birch Allergy Therapy Industry: Overview The birch allergy therapy industry is moderately consolidated, with several large- and small-scale players with significant shares in the global industry. Dominant companies are warring on the frontiers of price, innovation, alliances, and geography.

They also dedicate substantial resources to research and development of innovative immunotherapeutic and biologics to increase the effectiveness and convenience of treatment. Competitive pricing strategies are implemented to secure larger market shares, while strategic partnerships and collaborations enable access to new industries and technologies. Geographic expansion- especially in emerging industries- continues to be a priority as companies look to tap a growing patient population.

Staller genes Greer acquired HAL Allergy for USD 1.6 billion in March 2023 to expand its portfolio of sublingual immunotherapy products and better position itself in the European allergy immunotherapy industry. Avalon noted that the same trend applied to Teva's acquisition of Nurtec in April 2023, when the pharmaceutical company paid USD 2.2 billion for the allergy drugs to bolster its allergy portfolio and solidify itself as a leading provider in the allergic rhinitis therapeutics industry. Indexed, 1 new deal will make it even more relevant to the industry.

Industry Share Analysis

Antihistamines, Cetirizine, Diphenhydramine, Decongestants, Pseudoephedrine and Oxymetazoline

Oral and Intranasal

Hospital Pharmacy, Online Pharmacy, Retail Pharmacy

North America, Latin America, Europe, South Asia, East Asia, Oceania and Middle East & Africa

The rising prevalence of birch pollen allergies, increased awareness, and advancements in immunotherapy are key drivers.

Sublingual immunotherapy (SLIT), antihistamines, and corticosteroids are widely used for managing symptoms and long-term relief.

Companies are developing biologics, enhancing immunotherapy options, and investing in drug delivery advancements for better efficacy and convenience.

North America and Europe lead due to high pollen exposure, advanced healthcare systems, and widespread adoption of immunotherapy.

E-pharmacies and telemedicine services are making treatments more accessible, offering convenience and competitive pricing for consumers.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 17: Global Market Attractiveness by Drug Class, 2023 to 2033

Figure 18: Global Market Attractiveness by Route of Administration, 2023 to 2033

Figure 19: Global Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 37: North America Market Attractiveness by Drug Class, 2023 to 2033

Figure 38: North America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 39: North America Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Drug Class, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 77: Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 78: Europe Market Attractiveness by Route of Administration, 2023 to 2033

Figure 79: Europe Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 97: South Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 117: East Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 137: Oceania Market Attractiveness by Drug Class, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Route of Administration, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 157: MEA Market Attractiveness by Drug Class, 2023 to 2033

Figure 158: MEA Market Attractiveness by Route of Administration, 2023 to 2033

Figure 159: MEA Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Evaluating Birch Sap Market Share & Provider Insights

Allergy Diagnostic Market Forecast and Outlook 2025 to 2035

Allergy Tester Market Size and Share Forecast Outlook 2025 to 2035

Allergy Immunotherapy Market Analysis - Size, Share & Forecast 2025 to 2035

Market Share Breakdown of Allergy Immunotherapy Providers

Allergy Treatment Market Analysis - Demand & Forecast 2024 to 2034

IgE Allergy Blood Tests Market Size, Growth, and Forecast 2025 to 2035

Food Allergy Market Size and Share Forecast Outlook 2025 to 2035

Food Allergy Immunotherapy Market Analysis Size and Share Forecast Outlook 2025 to 2035

Nasal Allergy Treatment Market Size and Share Forecast Outlook 2025 to 2035

Ocular Allergy Diagnostic System Market Size and Share Forecast Outlook 2025 to 2035

Pollen Allergy Market Size and Share Forecast Outlook 2025 to 2035

Seasonal Allergy Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Allergy Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Needle Free Allergy Therapy Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA