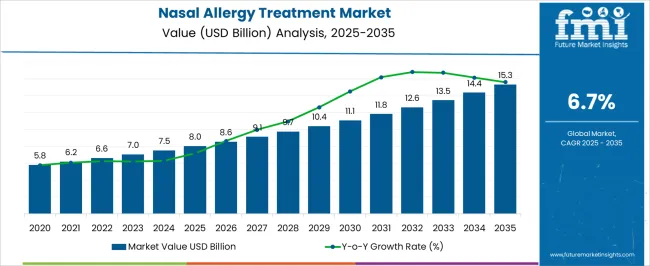

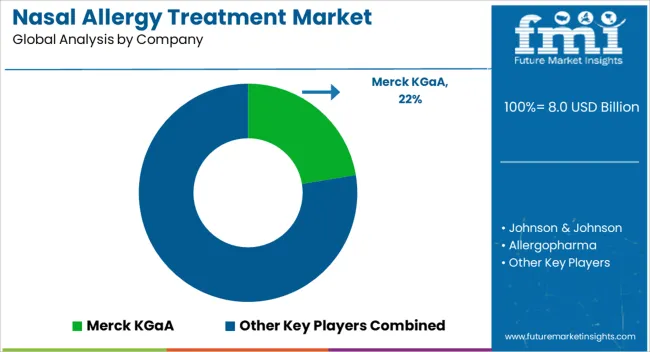

The Nasal Allergy Treatment Market is estimated to be valued at USD 8.0 billion in 2025 and is projected to reach USD 15.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

| Metric | Value |

|---|---|

| Nasal Allergy Treatment Market Estimated Value in (2025 E) | USD 8.0 billion |

| Nasal Allergy Treatment Market Forecast Value in (2035 F) | USD 15.3 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The nasal allergy treatment market is experiencing steady growth supported by increasing prevalence of allergic disorders, rising awareness about early diagnosis, and greater availability of advanced therapeutic options. The burden of environmental triggers such as pollution, pollen, and climate change related allergens has significantly elevated demand for effective treatments.

Advancements in formulation technology including fast acting antihistamines, combination therapies, and extended release tablets have improved patient adherence and treatment outcomes. The market is also benefitting from wider accessibility through over the counter channels, which cater to the growing self medication trend.

Regulatory support for safer formulations and the emphasis on non invasive treatment methods are shaping future opportunities. The outlook remains positive as patient centric innovations and expansion in both developed and emerging healthcare markets continue to drive adoption.

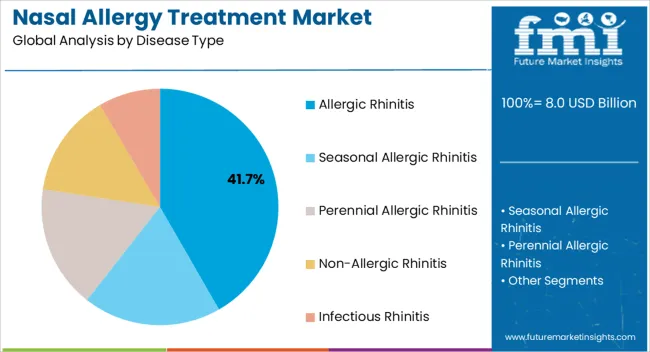

The allergic rhinitis segment is projected to account for 41.70% of total market revenue by 2025, making it the most prominent disease type. This growth is being driven by the rising global incidence of seasonal and perennial allergies, influenced by urbanization and higher exposure to environmental allergens.

Increased demand for effective treatment options that provide quick relief from nasal congestion, sneezing, and irritation has reinforced the adoption of targeted therapies. The segment has also gained traction due to improved awareness, early diagnosis initiatives, and expanded therapeutic coverage under healthcare systems.

The combination of high prevalence and treatment availability has established allergic rhinitis as the leading disease type in the market.

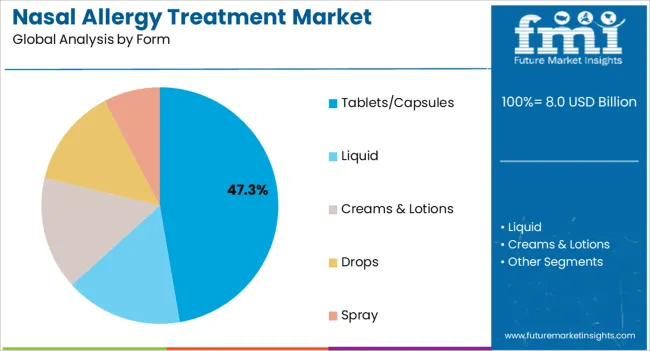

The tablets and capsules segment is expected to hold 47.30% of market revenue by 2025 within the form category, positioning it as the leading treatment format. Convenience of oral administration, ease of dosing, and wide availability across both prescription and over the counter channels have contributed to its dominance.

Tablets and capsules are widely preferred by patients due to portability, longer shelf life, and lower cost compared to alternative forms such as sprays. Continuous advancements in drug formulations, including extended release and combination therapies, have further strengthened adoption.

As patient preference aligns with simplicity and effectiveness, this form continues to maintain a leadership position in the nasal allergy treatment market.

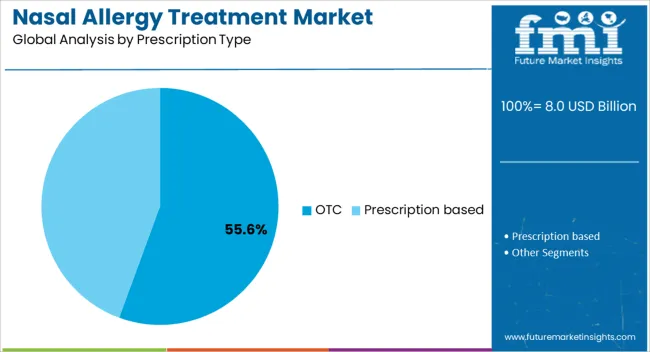

The over the counter segment is estimated to capture 55.60% of total revenue by 2025 within the prescription type category, positioning it as the dominant channel. Growth has been supported by the rising trend of self medication, easy accessibility through retail pharmacies, and increasing consumer trust in non prescription antihistamines and decongestants.

Healthcare systems have promoted OTC availability to reduce pressure on clinical services while enabling patients to manage mild to moderate allergy symptoms independently. Expanded distribution through e commerce platforms and enhanced brand visibility have also reinforced the preference for OTC products.

This segment continues to lead due to affordability, convenience, and strong consumer adoption in both developed and emerging markets.

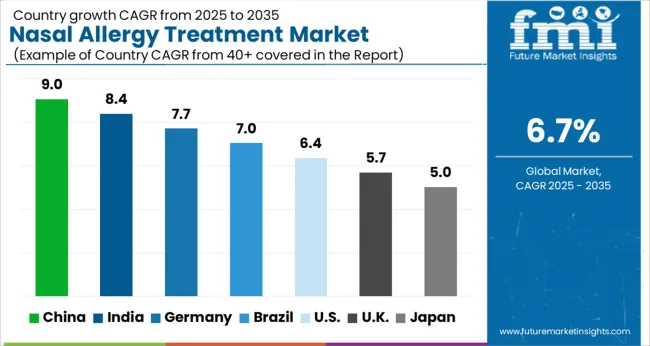

The global sales of the market are anticipated to rise at a CAGR of 6.7% between 2025 and 2035, owing to the rising prevalence of allergic diseases.

The global market holds around 32.6% share of the overall global allergy treatment market with a value of around USD 8 Billion, in 2025.

The market is expanding as a result increase in the patient pool suffering from allergies. In fact, it is anticipated that the need for nasal allergy treatments would rise in the coming years due to the patient’s comfort and ease as it reduces inflammation, and remove congestion. The incidence rate and prevalence rate of allergic rhinitis are growing rapidly owing to which the demand for available treatments is expected to increase over the forecast period.

Some of the most popular therapies for nasal allergies are antihistamines, decongestants, nasal corticosteroids, allergen immunotherapy, and leukotriene receptor antagonists. Antihistamines rule the market, as it is one of the highly prescribed and adopted drugs for the treatment of allergies with or without prescription.

Owing to the above-mentioned factors, the global market is expected to grow at a prominent pace, and reach a valuation of around USD 15.3 billion during the year 2035.

Globally, the prevalence of hay fever/allergic rhinitis was registered at ~35%, which is gaining the attraction of manufacturers to develop a specific treatment for this indication. This creates an enormous opportunity for the manufacturer to explore the nasal allergy treatment market. The life science industry has set foot into the pharmaceutical industry giving rise to multiple biopharma companies that have proven technology and advanced treatment options that are exclusive and received approval, this gives healthcare specialists to rely upon these new treatment options.

For instance, the main method for treating people with sensitivities to aeroallergens is subcutaneous immunotherapy (SCIT). Subcutaneous immunotherapy (SCIT), a revolutionary treatment for allergic illnesses, reduces discomfort while modifying allergic disease by concentrating on the underlying immunological mechanism. In numerous well-controlled clinical trials, its effectiveness and safety have been proven in the treatment of allergies, allergic rhinitis/rhinoconjunctivitis, asthma, and hypersensitivity to stinging insects.

Overall, it is anticipated that the market for nasal allergy treatments will rise over the coming years as more research and development are put into creating fresh, efficient treatment choices.

The market is experiencing a decline due to the adverse effects associated with allergy shots and tablets.

Along with that, patients can experience minor effects such as redness or swelling at the injection site or effects on the entire body or particular body system. Along with that, rarely, a serious systemic reaction called anaphylaxis can develop.

In a few cases, people can experience systematic reactions such as hives, nasal congestion, watery eyes, and sneezing. More severe reactions may include wheezing or chest tightness and throat swelling. Rarely, allergy treatments can cause anaphylaxis, a potentially fatal reaction. It may result in low blood pressure and respiratory difficulties. An allergy shot can sometimes cause a significant reaction in a person. The majority of these can happen within 30 minutes of the injection.

The side effects associated with the treatment may hinder the market growth.

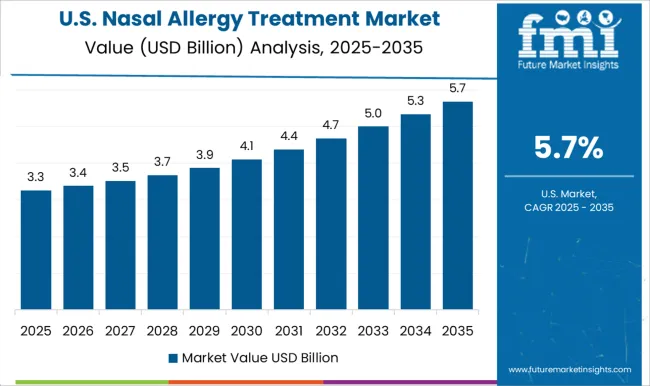

The USA dominates the North American region with a total market share of around 92.4% in 2025 and is expected to continue to maintain consistent growth over the entire projected period with a CAGR of 5.8%. The main drivers of nasal allergy prevalence in the United States include environmental factors such as air pollution, climate change, and exposure to allergens such as pollen and dust mites.

Allergies are the sixth most common chronic ailment in the United States, according to the American College of Allergy, Asthma & Immunology, with a cost of more than USD 8 billion annually. Each year, more than 50 million Americans experience allergic reactions. The frequency of AR was 19.9%, according to a recent large retrospective cohort study by Frontiers Media S.A. in the year 2025. According to the National Health Interview Survey done by the Centers for Disease Control and Prevention in 208, 5.8 million adults in the US had hay fever (allergic rhinitis) in the previous 12 months.

Since the prevalence is high the manufacturer finds it lucrative to regulate in such a market, therefore this factor influences the nasal allergy treatment market in the most favorable manner in the USA market.

China has a market share of 65.8% in the East Asia nasal allergy treatment market in 2025. Disease progression can be retarded by taking precautions such as diagnostic tests which include the provocation test, specific IgG4 test, tIgE test, and multiple other specific tests that can lead to successful treatment outcomes. China is focusing on improving its diagnosis to pace up into the global market.

For the prevention and treatment of allergic disorders, allergen detection is essential. Although China's technology is now lacking, many of the diagnostic gaps will soon be filled thanks to the development of new microparticle- and array-based methods.

To assist allergists and laboratory personnel in improving the diagnostic standard and directing the treatment of allergic illnesses for the benefit of patients and the market as a whole, this consensus summarizes the existing in vivo and in vitro diagnostic procedures for allergens.

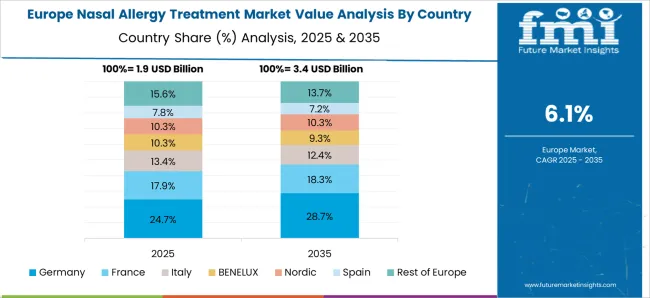

Germany holds a market share of 29.8% in 2025 in the European nasal allergy treatment market, owing to the presence of many established players in European countries.

Bencard Allergie, the German division of Allergy Therapeutics in the United Kingdom, which creates allergy vaccinations, was referenced by Labiotech UG in June 2025. The first allergoids for allergen-specific immunotherapies were marketed by a German business. With the use of virus-like particles, Allergy Therapeutics, and its affiliates are developing a novel method for allergy immunotherapy. Bencard appears to be in a strong position despite its opponents. According to a recent report from Allergy Therapeutics, Bencard contributes 60% of the company's revenues in Germany, which is where sales are growing the fastest.

Germany is strengthening its manufacturing and development of novel drugs which will positively grow the market in the future.

India holds a share of around 48.6% in the South Asia market in 2025.

India has one of the highest levels of pollution, which is largely brought on by the use of mosquito coils and incense sticks indoors, and by outdoor, biomass, fossil fuels, and vehicle exhausts. According to Elsevier Inc., there are an estimated 7.5 million instances of asthma in India, and recent studies have indicated that the frequency of allergic rhinitis and asthma would rise in 2024.

Although India's prevalence rates are generally lower than those of high-income nations, there are still several million instances of the disease overall, according to various estimates. Indian manufacturers must therefore increase their supply of treatment drugs in order to handle such a sizable patient population.

Allergic rhinitis is expected to give high growth at a CAGR of 6.4% between 2025 and 2035. As per American Academy of Allergy Asthma and Immunology, 2025, allergic rhinitis affects almost 10-30% of the population worldwide. Additionally, sensitization to foreign proteins present in the environment affects upto 40% of the global population. In the geriatric population, rhinitis is less commonly allergic in nature. Hence the prevalence contributes to the global shares.

Tablets/Capsules are mostly favored by patients suffering from allergies. It has a market share of 37.1% in the global market in 2025.

The most popular sort of pill is a tablet. They encourage market growth since they are an affordable, secure, and efficient method of delivering oral medications. Tablets and capsules are frequently used by makers and formulators of drug products as a dosage form that is affordable.

OTC has a market share of 76.3% in the global market in 2025. OTC medications are easier for customers to obtain because they are readily available and may be bought without a prescription. People aren't obliged to wait for medications to be filled or schedule appointments with doctors, which saves time and money. Because OTC drugs are typically less expensive than prescription drugs, more people can afford them.

Oral route of administration is mostly preferred by patients. It has a market share of 36.6% in the global market in 2025.

Patients can take oral medications at home without the need for medical supervision because they are simple to administer. Patients who need long-term treatment for chronic diseases would especially benefit from this. Drugs used orally are frequently less expensive than medications taken orally or intravenously, which require more specialized equipment and medical supervision.

Antihistamines have a market share of 46.0% in the global market in 2025. Since histamine, a substance secreted by the body in response to an allergen is blocked by antihistamines, they are frequently given for allergies. Sneezing, itching, and runny nose are examples of common allergic reaction symptoms that are brought on by histamine. A variety of allergic reactions, including as hay fever, allergic rhinitis, and hives, can be successfully treated with them.

Hospital pharmacies hold a market share of 35.9% during the year 2025. The main locations where easily accessible licensed and approved medicine is found are hospitals. Hospital pharmacies may greatly enhance patient care by working together with doctors, nurses, and pharmacy teams to supply the appropriate medications and supplies in accordance with treatment procedures. The assurance of better patient outcomes aids hospitals in exceeding patient satisfaction targets. The segment is anticipated to grow at a profitable pace over the forecast period because of the comprehensive care provided in hospital settings.

Increase in number of pipeline products and approval by the regulatory bodies, along with merger and acquisition by key players in different regions, are key differentiating strategies that nasal allergy treatment manufacturers are adopting.

Similarly, recent developments related to companies manufacturing nasal allergy treatment drugs have been tracked by the team at Future Market Insights. These are available in the full report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; and the Middle East & Africa |

| Key Countries Covered | The USA, Canada, Brazil, Mexico, Argentina, the United kingdom, Germany, Italy, Russia, Spain, France, Benelux, India, Thailand, Indonesia, Malaysia, Japan, China, South Korea, Australia, New Zealand, Türkiye, GCC Countries, North Africa and South Africa |

| Key Market Segments Covered | Disease Type, Form, Prescription Type, Route of Administration, Treatment, Distribution Channel and Region |

| Key Companies Profiled | Merck KGaA; Johnson & Johnson; Allergopharma; Sanofi SA; McNeil Consumer Healthcare,; Genentech Inc.; GlaxoSmithKline PLC; Leti Pharma,; Alerpharma S.A; Allergan, Inc.; Meda Pharmaceuticals, Inc; Novartis International AG; Bausch Health Companies Inc.; Allergopharma; ALK Abello; Stallergenes Greer; Allergy Therapeutics; Aimmune Therapeutics; Biomay AG; HAL Allergy Group; Bayer; AstraZeneca |

| Report Coverage | Market Forecast, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Pricing | Available upon Request |

The global nasal allergy treatment market is estimated to be valued at USD 8.0 billion in 2025.

The market size for the nasal allergy treatment market is projected to reach USD 15.3 billion by 2035.

The nasal allergy treatment market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in nasal allergy treatment market are allergic rhinitis, seasonal allergic rhinitis, perennial allergic rhinitis, non-allergic rhinitis and infectious rhinitis.

In terms of form, tablets/capsules segment to command 47.3% share in the nasal allergy treatment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nasal Implant Market Size and Share Forecast Outlook 2025 to 2035

Nasal Sprays Market Analysis - Size, Share, and Forecast 2025 to 2035

Nasal Packing Devices Market Size and Share Forecast Outlook 2025 to 2035

Nasal Antihistamines Market – Growth & Forecast 2025 to 2035

Nasal vaccines Market

Nasal Sampling Lines Market

Nasal Oxygen Cannula Market

Nasal Polyposis Treatment Market - Drug Innovations & Demand 2025 to 2035

Nasal Congestion Treatment Devices Market Analysis Size and Share Forecast Outlook 2025 to 2035

Intranasal Corticosteroids Market Analysis – Growth & Demand Forecast 2025 to 2035

Migraine Nasal Spray Market Outlook – Trends, Growth & Forecast 2025 to 2035

High Flow Nasal Cannula Market – Innovations & Forecast 2024-2034

Pediatric Nasal Cannula Market

Electronic Nasal Spray Devices Market Size and Share Forecast Outlook 2025 to 2035

Fragmentable Nasal and Ear Dressing Market Size and Share Forecast Outlook 2025 to 2035

Steroid-Free Nasal Sprays Market Insights - Trends & Forecast 2025 to 2035

Inhalation And Nasal Spray Generic Drugs Market Size and Share Forecast Outlook 2025 to 2035

Allergy Tester Market Size and Share Forecast Outlook 2025 to 2035

Allergy Immunotherapy Market Analysis - Size, Share & Forecast 2025 to 2035

Market Share Breakdown of Allergy Immunotherapy Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA