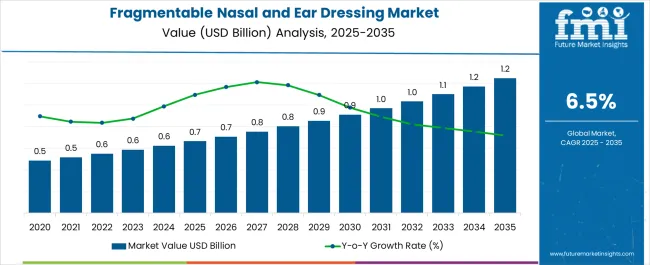

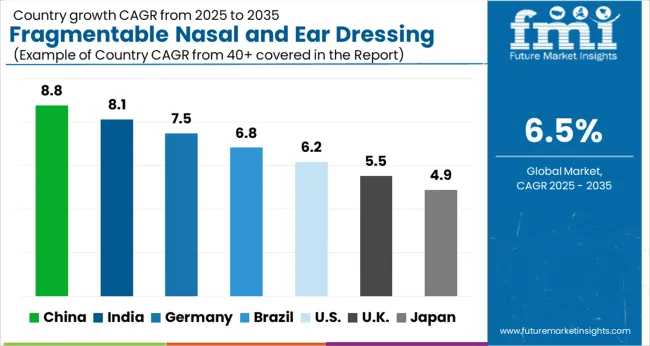

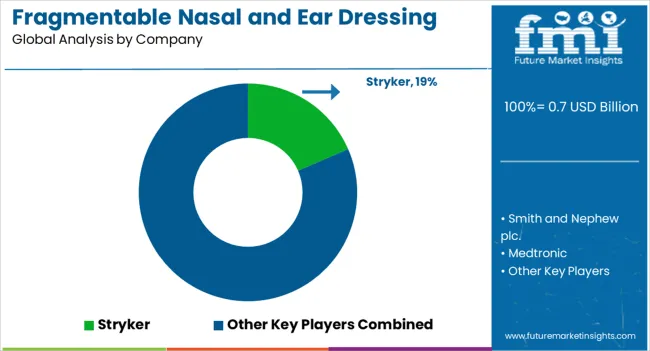

The Fragmentable Nasal and Ear Dressing Market is estimated to be valued at USD 0.7 billion in 2025 and is projected to reach USD 1.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Fragmentable Nasal and Ear Dressing Market Estimated Value in (2025 E) | USD 0.7 billion |

| Fragmentable Nasal and Ear Dressing Market Forecast Value in (2035 F) | USD 1.2 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The fragmentable nasal and ear dressing market is expanding steadily, fueled by increasing adoption of minimally invasive ENT procedures and growing emphasis on patient comfort during post-surgical recovery. Industry publications and clinical reports have noted rising use of advanced dressings in nasal and ear surgeries to reduce bleeding, minimize infection risk, and promote faster healing. Healthcare providers are prioritizing absorbent and biocompatible materials that can fragment naturally, eliminating the need for painful removal and thereby improving patient outcomes.

Surgeons are increasingly adopting these dressings in both hospital and outpatient settings, supported by favorable clinical trial outcomes and new product approvals. Moreover, heightened awareness of ENT disorders and the rising number of rhinoplasty, sinus surgeries, and ear canal procedures have accelerated market growth.

Technological improvements in design, particularly with tailored sizes and shapes, have increased usage across diverse patient groups. Looking ahead, continued innovation in bioresorbable materials and expansion of ENT surgical infrastructure globally are expected to further strengthen market demand.

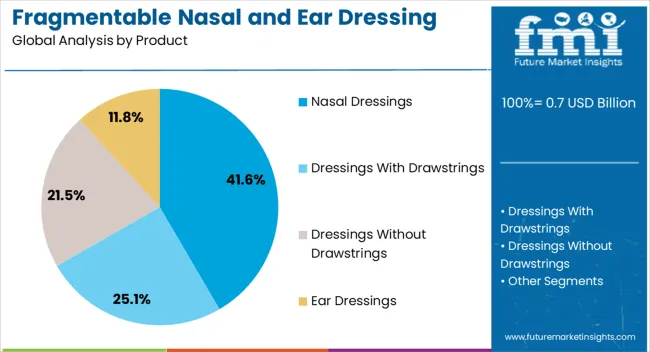

The Nasal Dressings segment is projected to contribute 41.6% of the fragmentable nasal and ear dressing market revenue in 2025, maintaining its position as the leading product category. Growth in this segment has been driven by the rising number of nasal surgeries, including those for sinusitis, septoplasty, and nasal polyps, which require effective postoperative hemostasis.

Clinical evidence has highlighted that fragmentable nasal dressings reduce patient discomfort by dissolving naturally, thereby improving compliance and reducing the need for secondary interventions. Healthcare institutions have increasingly adopted these dressings due to their efficiency in minimizing bleeding and infection risks.

The nasal cavity’s higher surgical frequency compared to ear-related procedures has further reinforced this segment’s leadership. As innovation in resorbable materials and controlled drug-release nasal dressings progresses, the Nasal Dressings segment is expected to sustain strong adoption levels.

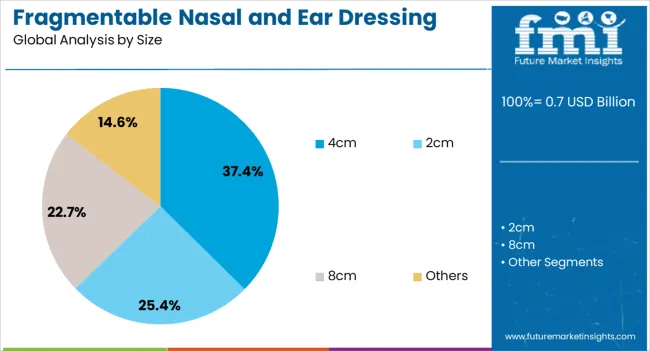

The 4 cm size segment is projected to account for 37.4% of the fragmentable nasal and ear dressing market revenue in 2025, making it the most utilized size category. This preference has been shaped by its suitability for a broad range of ENT surgical procedures, where compact dressings are required for effective wound coverage and ease of placement.

Surgeons have favored the 4 cm size due to its adaptability across patient demographics, including both adult and pediatric cases. Clinical usage data has indicated that this size balances sufficient absorbency with patient comfort, reducing pressure in sensitive nasal and ear cavities.

Manufacturers have optimized production of the 4 cm size, ensuring consistent availability and widespread distribution. With surgical protocols increasingly emphasizing minimally invasive and patient-friendly post-operative care, the 4 cm size segment is expected to retain its dominance in clinical practice.

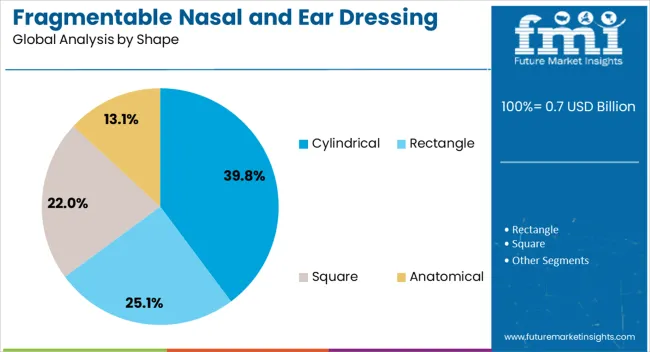

The Cylindrical segment is projected to hold 39.8% of the fragmentable nasal and ear dressing market revenue in 2025, establishing itself as the leading shape category. Growth of this segment has been attributed to its anatomical compatibility with nasal and ear cavities, ensuring secure placement and effective wound coverage.

ENT specialists have preferred cylindrical shapes as they provide consistent pressure distribution, supporting hemostasis and patient comfort. Clinical feedback has emphasized that cylindrical dressings fragment evenly, reducing the risk of obstruction or uneven dissolution during recovery.

This design has been widely adopted across hospitals and outpatient clinics due to its versatility and ease of use. Furthermore, manufacturers have standardized cylindrical dressings for mass production, enabling broad adoption across diverse healthcare systems. As ENT surgery volumes continue to rise, the Cylindrical segment is expected to maintain its leadership by aligning with clinical efficacy and patient-centered care needs.

The market value for fragmentable nasal and ear dressing was around 4.8% of the overall USD 0.7 Billion of the global wound care dressings market in 2025. The market for fragmentable nasal and ear dressing expanded at a CAGR of 5.7% from 2020 to 2025, due to the increasing cases of ear and nasal surgeries.

Fragmentable nasal and ear dressings have indeed emerged as a distinct field within the broader domain of wound care and medical dressings. While traditional dressings have been used for various types of wounds, the specific needs and challenges associated with nasal and ear wounds have led to the development of specialized dressings.

The emergence of fragmentable nasal and ear dressings can be attributed to advancements in material science, medical technology, and a better understanding of the unique characteristics of nasal and ear wounds.

These dressings are designed to address the anatomical and physiological considerations of the nasal and ear regions, providing tailored solutions for wound healing and management.

Fragmentable dressings are typically made from materials that can fragment or absorb over time, promoting wound healing and minimizing the need for dressing removal.

These materials may include bioabsorbable substances such as collagen, gelatin, or synthetic polymers that gradually degrade and integrate with the body's tissues. This points to the increase adoption of these types of dressing which boosts the market growth.

There is ample of opportunity for manufacturers to innovate and develop new fragmentable nasal and ear dressing products. This can involve the exploration of new materials, improved designs, and enhanced functionalities.

By introducing innovative products that address specific needs, manufacturers can differentiate themselves and capture market share.

Apart from this, collaborations with healthcare professionals, such as ENT specialists, surgeons, and wound care specialists, can lead to valuable partnerships.

By understanding the specific requirements and challenges faced by healthcare professionals in nasal and ear wound care, manufacturers can develop tailored solutions and gain insights for product improvements.

Adhering to regulatory requirements and obtaining necessary certifications is crucial for fragmentable nasal and ear dressing manufacturers. Ensuring compliance with quality standards and regulations can enhance trust and credibility among healthcare professionals and regulatory authorities, facilitating market entry and acceptance.

This can create opportunities for the manufacturers in the fragmentable nasal and ear dressing market.

Higher costs associated with fragmentable ear and nasal dressings compared to traditional dressings may result in limited adoption by healthcare providers and patients.

If the pricing of these specialized dressings is perceived as too high, healthcare facilities or individuals with budget constraints may opt for more affordable alternatives, thereby reducing the demand for fragmentable dressings.

Also, insurance coverage and reimbursement policies can significantly influence the affordability of medical products. If fragmentable ear and nasal dressings are not adequately covered by insurance plans or if reimbursement rates are low, patients may face out-of-pocket expenses that they may find difficult to afford.

This can discourage patients from opting for fragmentable dressings, leading to lower market demand.

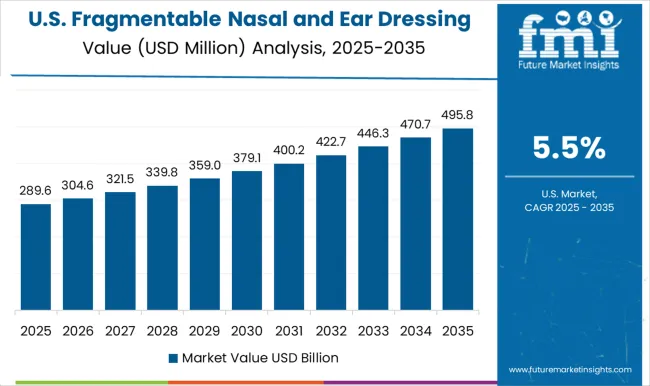

The USA occupies leading share in North America market contributing around USD 0.7 Million in 2025. The United States has one of the most significant and advanced healthcare markets globally.

With a vast network of healthcare facilities, hospitals, and clinics, there is a significant demand for various medical products, including dressings for nasal and ear injuries or surgical procedures.

Also, this country is known for its cutting-edge medical research and technological advancements. This environment fosters innovation, leading to the development of new and advanced medical products, including novel dressings for nasal and ear applications.

China’s revenue generation on fragmentable nasal and ear dressing market in 2025 was USD 47.2 Million. The high population density, environmental factors, and lifestyle changes in China contribute to the prevalence of ear, nose, and throat (ENT) conditions.

The increased prevalence can lead to a considerable demand for medical products catering to these health issues.

Even, China has been investing heavily in its healthcare infrastructure, building new hospitals, clinics, and medical centers. The expansion of healthcare facilities further boosts the demand for medical products across the country.

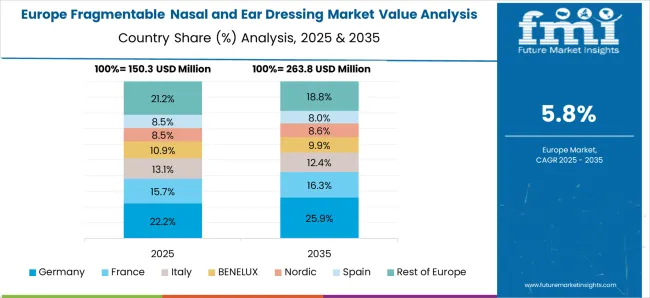

In 2025, Germany held a dominant share in the Europe market and contributed around USD 33.7 Million. Germany is a leader in medical research and technology. The country is home to several innovative medical device manufacturers, and it is known for producing high-quality and advanced medical products.

Germany has a well-established and robust healthcare system, known for its high-quality medical care and accessibility. This creates a significant demand for various medical products, including dressings for nasal and ear injuries or surgical procedures.

The market value of nasal dressings was around USD 0.7 Million in 2025, representing a sizable 95.5% global market share in 2025. Nasal injuries, such as nosebleeds or nasal fractures, are relatively common compared to ear injuries.

Also, there are numerous nasal surgical procedures, including functional endoscopic sinus surgery (FESS) and nasal septoplasty. The higher incidence of nasal issues and procedures results in a higher demand for nasal dressings.

Others segment of fragmentable nasal and ear dressing market contributed about 38.8% market share in 2025 and is expected to grow with a CAGR of 8.7%.

The others segment includes the dressings that are more than 8 cm and less than 2 cm in size. Smaller sizes may be suitable for certain injuries or surgical sites, while larger sizes may be required for more extensive procedures.

The type and extent of the surgical procedure can influence the size of the dressing needed. Complex surgeries or larger wounds may necessitate larger dressings for adequate coverage and protection. This is why others segment dominate the market.

By shape, anatomical segment accounted for a predominant share of the global market, which was around 36.4% in 2025. Anatomically shaped dressings are designed to fit the contours of the nasal and ear areas more accurately. This results in enhanced comfort for patients, as the dressings are less likely to shift or cause discomfort during use.

Also, the pre-shaped design of these dressings can simplify the application process for healthcare providers, saving time and effort during the dressing change procedures.

Sinus surgery segment of fragmentable nasal and ear dressing market contributed 50.3% of the market share in 2025. As the number of sinus surgeries increases, it rises the demand for postoperative dressings that aid in wound healing, reduce inflammation, and prevent infections.

Sinus surgery can involve delicate and sensitive areas in the nasal and ear regions. Hence, there might be a growing need for specialized dressings designed to address the specific requirements of these surgical sites.

The hospitals have a considerable presence in the fragmentable nasal and ear dressing market, accounted for 32.0% of the global market. Hospitals are significant consumers of medical products, including dressings for nasal and ear injuries. As the number of patients and medical procedures increases, the demand for such dressings also rises.

The medical procedures and surgeries that require specialized dressings for postoperative care is quite high in the hospitals therefore hospitals are a dominant segment. This can drive the need for more advanced and specific nasal and ear dressings.

Major manufacturers work to expand the market for both their flagship products and the consumer solutions that they provide. For example, today's leading manufacturers frequently provide tailored solutions based on the requirements of various end users.

Due to the intense competition in the market, many leading competitors are putting a lot of effort into various market consolidation operations such merger, acquisition, supply distribution alliances, and the launch of new products.

Instances of important developmental strategies used among market participants in the fragmentable nasal and ear dressing market are presented below:

Similarly, recent developments related to the company’s active within the fragmentable nasal and ear dressing market space have been tracked by the team at Future Market Insights, which are available in the full report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value, Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East and Africa (MEA) |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, Germany, Italy, France, UK, Spain, BENELUX, Russia, India, Thailand, Indonesia, Malaysia, China, Japan, South Korea, Australia, New Zealand, GCC countries, Türkiye, Northern Africa and South Africa. |

| Key Market Segments Covered | Product, Size, Shape, Application, End User and Region |

| Key Companies Profiled | Stryker; Smith and Nephew plc; Medtronic; Pfizer Inc.; MP MEDITECH; Datt Mediproducts Private Limited; First Aid Bandage Company (FABCO); Summit Medical LLC (Innovia Medical); Olympus Corporation; Lohmann & Rauscher GmbH & Co. KG |

| Report Coverage | Market Forecast, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Pricing | Available upon Request |

The global fragmentable nasal and ear dressing market is estimated to be valued at USD 0.7 billion in 2025.

The market size for the fragmentable nasal and ear dressing market is projected to reach USD 1.2 billion by 2035.

The fragmentable nasal and ear dressing market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in fragmentable nasal and ear dressing market are nasal dressings, dressings with drawstrings, dressings without drawstrings and ear dressings.

In terms of size, 4cm segment to command 37.4% share in the fragmentable nasal and ear dressing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nasal Implant Market Size and Share Forecast Outlook 2025 to 2035

Nasal Allergy Treatment Market Size and Share Forecast Outlook 2025 to 2035

Nasal Congestion Treatment Devices Market Analysis Size and Share Forecast Outlook 2025 to 2035

Nasal Sprays Market Analysis - Size, Share, and Forecast 2025 to 2035

Nasal Packing Devices Market Size and Share Forecast Outlook 2025 to 2035

Nasal Polyposis Treatment Market - Drug Innovations & Demand 2025 to 2035

Nasal Antihistamines Market – Growth & Forecast 2025 to 2035

Nasal vaccines Market

Nasal Sampling Lines Market

Nasal Oxygen Cannula Market

Intranasal Corticosteroids Market Analysis – Growth & Demand Forecast 2025 to 2035

Migraine Nasal Spray Market Outlook – Trends, Growth & Forecast 2025 to 2035

High Flow Nasal Cannula Market – Innovations & Forecast 2024-2034

Pediatric Nasal Cannula Market

Electronic Nasal Spray Devices Market Size and Share Forecast Outlook 2025 to 2035

Steroid-Free Nasal Sprays Market Insights - Trends & Forecast 2025 to 2035

Inhalation And Nasal Spray Generic Drugs Market Size and Share Forecast Outlook 2025 to 2035

Sour Dressings Market

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Combat Dressing Market Trends – Growth & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA