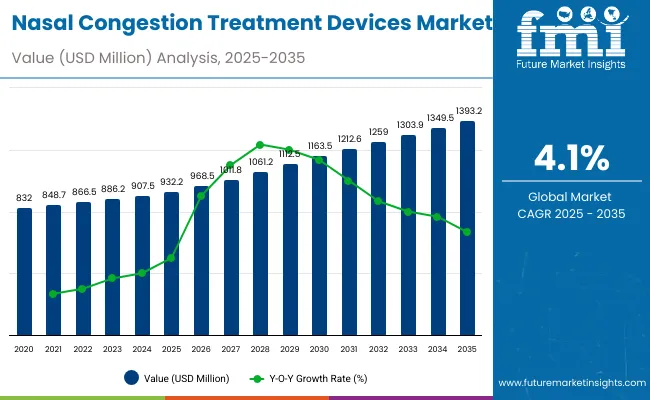

The global nasal congestion treatment devices market is projected to reach a valuation of USD 932.2 million by 2025 and USD 1,393.2 million by 2035. This indicates a decade-long increase of USD 461.0 million between 2025 and 2035. The market is expected to expand at a compound annual growth rate (CAGR) of 4.1%, representing a 1.49X increase over the ten-year period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 932.2 million |

| Industry Value (2035F) | USD 1,393.2 million |

| CAGR (2025 to 2035) | 4.1% |

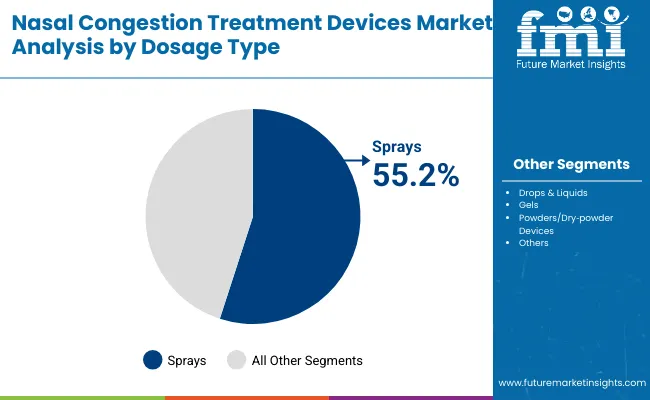

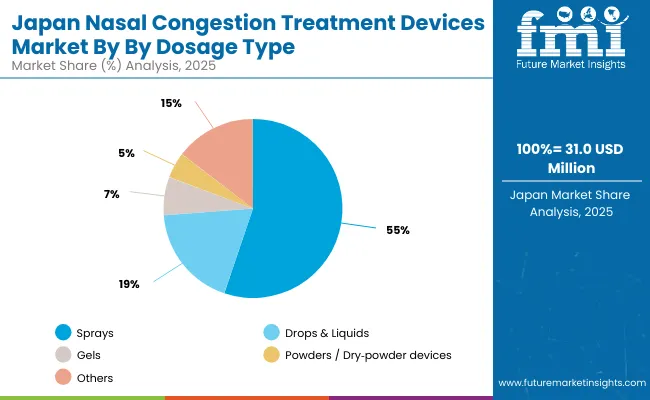

During the first five-year period from 2025 to 2030, the total market value is projected to expand from USD 932.2 million to USD 1,163.5 million, adding USD 231.3million which contributes50.2% of the total decade growth. Sprays segment will remain dominant holding around 55.0% share of the category by 2030 due to strong consumer preference for multi-dose OTC formulations and ease of retail access. Drops & Liquids will account for nearly 18.0% share by 2030, while powders and dry-powder devices will remain niche.

The second half from 2030 to 2035 contributes USD 229.7million, equal to 49.8% of the total growth, as the market jumps from USD 1,163.5 million to USD 1,393.2 million. This acceleration is powered by rising digital distribution and stronger adoption in emerging markets such as China and India.

Sprays and Drops & Liquids together capture a large share of above 72% by the end of the decade. Powders and dry-powder devices are likely to expand steadily to around 6.5% share, reflecting consumer openness to alternative delivery formats.

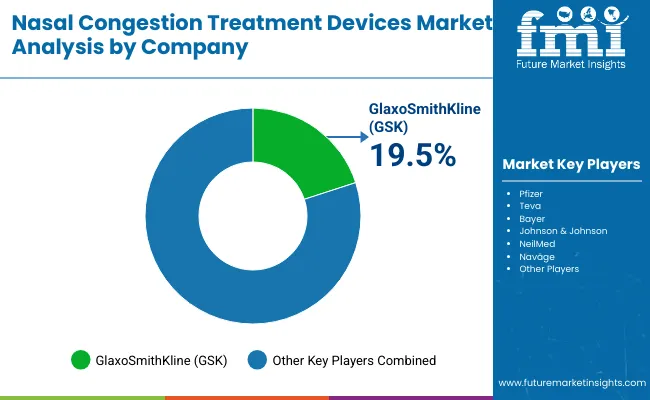

From 2020 to 2024, the overall Nasal Congestion Treatment Devices Market grew from USD 832.0 million to USD 905.7 million. Leading players such as GlaxoSmithKline (GSK), Pfizer, Teva, Bayer, Johnson & Johnson, NeilMed, and Naväge together account for a significant share of global revenues, with GSK alone holding 19.5% market share in 2024. Key strategies deployed by these companies include expanding OTC spray portfolios, introducing consumer-friendly nasal irrigation systems, and leveraging direct-to-consumer distribution channels, including online pharmacies and retail partnerships.

In 2025, the Nasal Congestion Treatment Devices Market is expected to reach a value of approximately USD 932.2 million, driven by sustained dominance of spray-based formulations and the rising adoption of multi-dose systems.

Growth will be propelled by consumer demand for quick-acting, non-prescription solutions for allergic rhinitis and chronic sinusitis, alongside the growing role of e-commerce channels, which are projected to account for over 20% of distribution share by 2025. Manufacturers are increasingly investing in ergonomically designed applicators, advanced powder-delivery devices, and refillable multi-dose sprays to enhance usability and compliance. In addition, heightened awareness of drug-free options such as irrigation devices and powered aspirators is creating incremental opportunities, especially in pediatric and home-care segments.

The Nasal Congestion Treatment Devices Market is seeing strong growth because consumers worldwide face rising prevalence of allergic rhinitis, sinusitis, and upper respiratory infections. Major drivers include the growing demand for quick-relief, non-prescription therapies, wider awareness of self-care, and expansion of e-commerce channels that make devices easily accessible. Innovations such as multi-dose spray systems with ergonomic nozzles, advanced dry-powder devices, and powered nasal irrigation kits are enhancing compliance, reducing symptom recurrence, and providing measurable improvement in patient quality of life.

The pandemic amplified the need for drug-free, at-home respiratory relief solutions, accelerating adoption of nasal irrigation systems and OTC sprays. As household budgets prioritize affordable and convenient healthcare, manufacturers who deliver user-friendly formats, hygienic delivery mechanisms, and digitally enabled distribution are achieving robust sales. In countries with expanding middle-class populations particularly in Asia Pacific markets such as China and India rising consumer health awareness and modern retail infrastructure are further boosting demand.

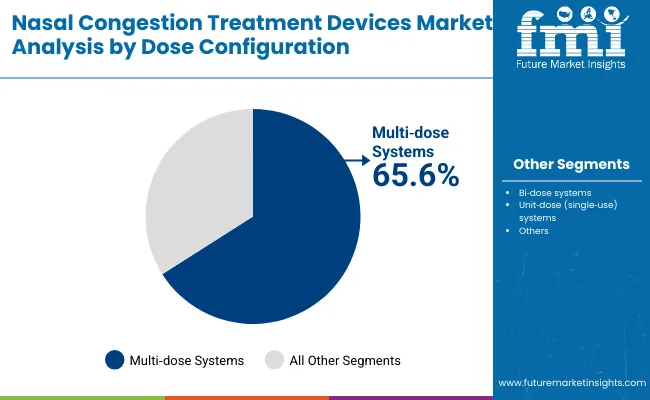

The market is segmented by dosage type, dose configuration, distribution channel, and region. Dosage type includes Sprays, Drops & Liquids, Gels, Powders/Dry-powder devices, and Others, highlighting the primary formats preferred by patients for nasal congestion relief. Based on dose configuration, the segmentation covers Multi-dose systems, Bi-dose systems, and Unit-dose (single-use) systems, reflecting consumer choice between refillable, dual, and single-use delivery mechanisms.

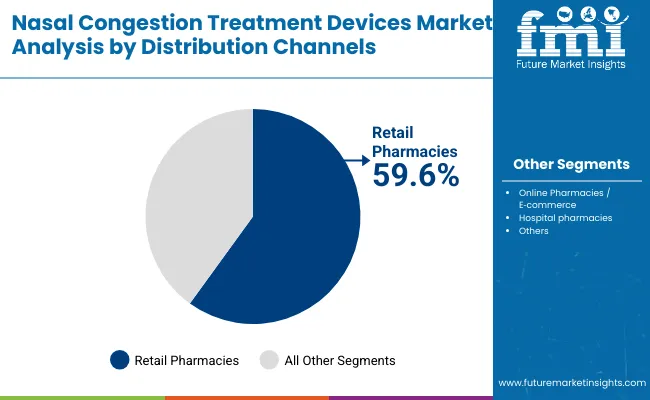

Distribution channels encompass Retail Pharmacies, Online Pharmacies/E-commerce, Hospital Pharmacies, and Others, representing the mix of traditional and digital pathways through which devices reach end users. Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

| By Dosage Type | Market Share (%) |

|---|---|

| Sprays | 55.2% |

| Drops & Liquids | 18.6% |

| Gels | 6.9% |

| Powders / Dry powder devices | 4.7% |

| Others | 14.6% |

Sprays are expected to retain a dominant position, contributing 55.2% in 2025, owing to their convenience, rapid action, and widespread availability across retail and online channels. Their adoption has been driven by the rising global incidence of allergic rhinitis and sinusitis, coupled with consumer preference for non-invasive, easy-to-use formulations.

Preference has been increasingly shown for multi-dose spray systems due to their cost-effectiveness, portability, and ability to provide consistent dosing across extended use. Market penetration has also been supported by leading pharmaceutical companies expanding OTC nasal spray portfolios under trusted brand names. These factors have collectively contributed to the sustained demand for sprays over alternative dosage formats such as gels and powders in both mature and emerging healthcare markets.

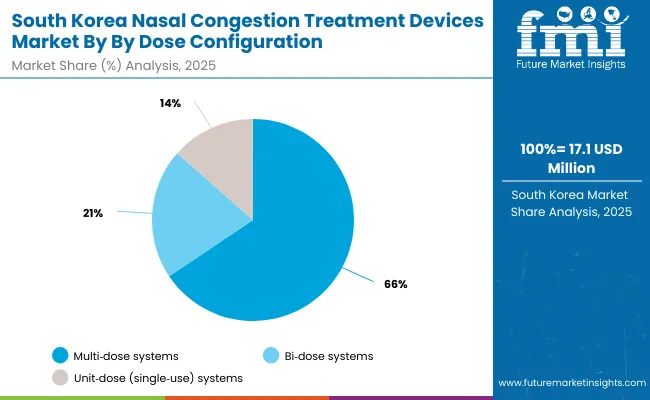

| By Dose Configuration | Market Share (%) |

|---|---|

| Multi dose systems | 65.6% |

| Bi dose systems | 20.9% |

| Unit dose (single use) systems | 13.5% |

Multi-dose systems have emerged as the leading configuration and are projected to hold around 65.6% share in 2025, driven by strong consumer preference for reusable and cost-effective nasal spray formats. Their dominance is supported by the widespread use of OTC decongestant sprays for allergic rhinitis and sinusitis, where patients require multiple doses over extended treatment durations. Regulatory agencies have allowed multi-dose packaging with built-in preservatives and metered pumps, ensuring product safety while extending shelf life, further cementing their adoption.

Additionally, the convenience of multi-dose formats aligns well with retail and e-commerce distribution, where patients prioritize affordability and longevity of use. In contrast, bi-dose systems at 20.9% and unit-dose systems at 13.5% serve niche needs particularly in sensitive populations such as pediatrics or patients requiring preservative-free formulations. Collectively, these dynamics have established multi-dose systems as the preferred configuration across both developed and emerging markets.

| Distribution channels | Market Share (%) |

|---|---|

| Retail pharmacies | 59.6% |

| Online pharmacies / e commerce | 20.1% |

| Hospital pharmacies | 15.3% |

| Others | 5.0% |

Retail pharmacies are expected to remain the largest distribution channel, contributing around 59.6% of sales in 2025, due to their ability to provide immediate access to OTC nasal sprays, drops, and gels. Consumers continue to prefer pharmacies for congestion relief products because of convenience, professional guidance from pharmacists, and the presence of well-recognized brands. This channel has also benefited from strong foot traffic and in-store promotions, reinforcing its role as the primary point of purchase.

Online pharmacies and e-commerce platforms, holding 20.1% share in 2025, are rapidly expanding as patients increasingly shift toward digital health solutions and home delivery services. Subscription models, bundled offerings, and discounts are making this channel especially appealing to chronic allergy sufferers. Hospital pharmacies, accounting for 15.3% of the market, remain relevant for prescription-based nasal treatments and specialized post-operative congestion relief, while the “Others” category at 5.0% includes smaller outlets and alternative sales channels. Overall, this distribution mix highlights the dominance of retail access while underscoring the accelerating role of digital commerce in shaping consumer buying behavior.

Rising Prevalence of Allergic Rhinitis and Sinus Disorders

The most significant growth driver in the Nasal Congestion Treatment Devices Market is the rising global prevalence of allergic rhinitis, chronic sinusitis, and upper respiratory infections. Increasing exposure to pollution, climate variability, and lifestyle triggers has led to a sustained rise in nasal congestion cases across both developed and emerging economies. Consumers are increasingly seeking immediate relief through user-friendly and non-prescription solutions such as sprays and nasal irrigation devices.

Retail pharmacies, which contribute nearly 60.0% of sales, remain the primary access point, while the rapid growth of online channels is expanding the market’s reach. Manufacturers are responding with innovations in spray formulations, preservative-free multi-dose systems, and ergonomically designed applicators that improve dosing accuracy and compliance. Collectively, these factors are reinforcing the demand trajectory of nasal congestion devices as a staple of self-care and household medicine cabinets.

Cost Sensitivities and Safety Concerns in Device Use

Despite rising demand, cost sensitivity and safety concerns remain significant restraints. Frequent use of decongestant sprays can lead to rebound congestion (rhinitis medicamentosa), which has made regulators and healthcare providers more cautious about long-term consumer dependence. Additionally, device misuse, particularly in pediatric populations, raises concerns around dosing consistency and product safety.

While nasal irrigation systems and powered aspirators offer drug-free alternatives, they often require higher upfront costs and careful cleaning, which can discourage adoption among cost-sensitive consumers in developing markets. Hospital pharmacies and prescribers still tend to favor conventional drug-based treatment in many cases, creating hurdles for broader device adoption. Moreover, in low-resource settings, limited awareness and distribution infrastructure restrict penetration, especially for advanced dry-powder or powered irrigation devices.

Digital Commerce and Consumerization of Nasal Care

A key trend shaping the market is the rapid consumerization of nasal care, driven by the convergence of device innovation and digital sales platforms. Online pharmacies and e-commerce channels are projected to increase their share from 20.1% in 2025 to 22.0% by 2035, as subscription models, bundled seasonal allergy kits, and doorstep delivery resonate with chronic users. At the same time, device manufacturers are aligning nasal congestion products with broader digital health ecosystems.

Emerging models include mobile app-linked smart sprays or acoustic therapy devices that allow usage tracking and symptom monitoring. Furthermore, the integration of drug-free alternatives such as saline sprays, phototherapy aids, and oscillation devices into mainstream retail channels reflects a consumer shift toward holistic and preventive care. In mature markets like the USA and Europe, demand is increasingly tied to brand trust and clinical validation, while in Asia Pacific, rapid urbanization and digital retail adoption are opening up new growth opportunities.

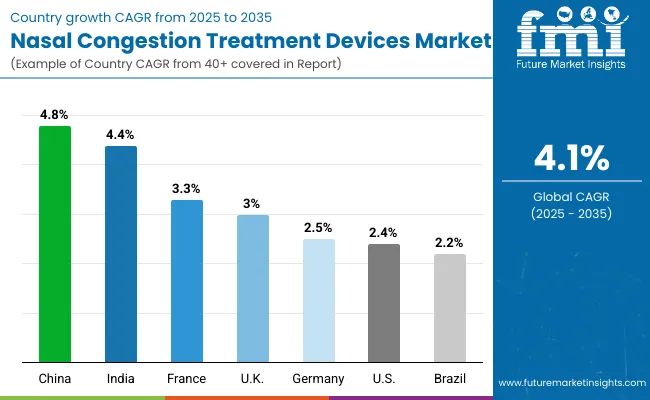

| Countries | CAGR |

|---|---|

| USA | 2.4% |

| Brazil | 2.2% |

| China | 4.8% |

| India | 4.4% |

| Europe | 2.8% |

| Germany | 2.5% |

| France | 3.3% |

| UK | 3.0% |

Asia Pacific is emerging as the fastest-growing region in the Nasal Congestion Treatment Devices Market, projected to grow at a CAGR of 4.4% in India and 4.8% in China between 2025 and 2035. Growth in these countries is being driven by rising prevalence of allergic rhinitis, increasing pollution levels, and higher adoption of OTC sprays and nasal irrigation devices.

China benefits from large-scale e-commerce penetration and expanding retail pharmacy networks, while India is witnessing rapid uptake of cost-effective multi-dose sprays and saline solutions as consumer health spending rises. The region’s momentum also stems from expanding middle-class populations in Tier 1 and Tier 2 cities, increased awareness of self-care products, and government-backed healthcare infrastructure modernization that indirectly supports OTC device adoption.

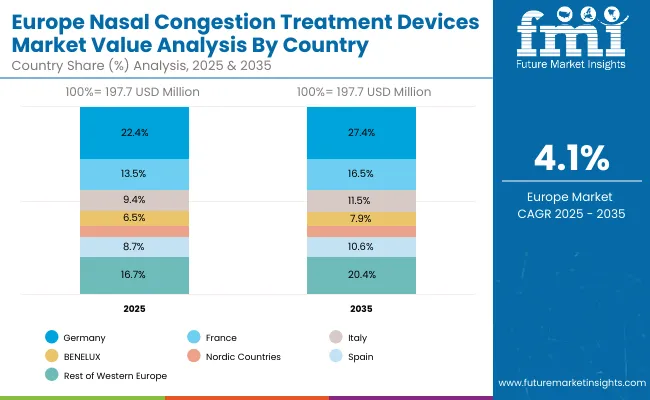

Europe is expected to grow steadily at a CAGR of 2.8% through 2035. Germany, holding a 22.4% share in 2025, is projected to moderate slightly by 2035, while the UK is expected to rise from 18.1% in 2025 to 19.4% in 2035, supported by NHS-backed digital health expansion and consumer preference for preservative-free sprays. France, forecasted at a CAGR of 3.3%, will see demand tempered by pricing pressures in the public health system.

Italy and Spain show stable but moderate growth, while the Rest of Western Europe is expected to increase its collective share to 21.1% by 2035, reflecting broader market adoption across mid-sized countries. Europe’s growth is supported by harmonized regulatory standards for OTC nasal devices, rising preference for natural saline-based formulations, and expansion of online pharmacies.

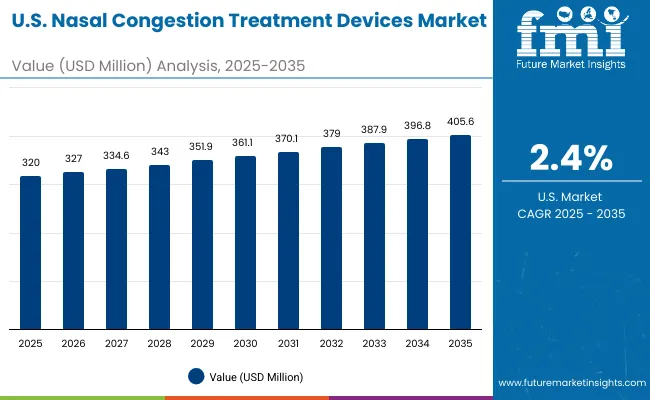

North America remains a mature but innovation-led market, with the USA projected to grow at a CAGR of 2.4% between 2025 and 2035. Growth is driven by continuous consumer reliance on OTC nasal sprays and the gradual uptake of alternative options such as dry-powder devices and powered irrigation systems.

Replacement of legacy decongestant sprays with preservative-free, multi-dose variants is a key trend. Furthermore, digital distribution channels are expanding rapidly, with online sales contributing over 20% by 2025 and set to rise further by 2035. Federal awareness campaigns around allergy management and the widespread use of nasal devices for pediatric congestion also reinforce steady adoption.

The nasal congestion treatment devices market in the USA is forecasted to grow at a 2.4% CAGR, primarily driven by the rising prevalence of allergic rhinitis and chronic sinusitis, which affects a large portion of the population. Consumers are increasingly turning to OTC sprays and multi-dose delivery systems for rapid relief, supported by strong availability across retail pharmacies that capture nearly 60.0% of sales. Growth is being further fueled by digital distribution, with online pharmacies holding over 20.0% share in 2025 and expanding steadily through 2035. Manufacturers are responding with preservative-free spray innovations and ergonomic applicator designs to meet consumer safety and compliance needs.

The Nasal Congestion Treatment Devices Market in the UK is projected to grow at a 3.0% CAGR through 2035, supported by NHS modernization projects that emphasize accessible and preventive respiratory care. The UK market share is forecasted to increase from 18.1% in 2025 to 19.4% by 2035, highlighting steady adoption. Demand is being driven by widespread seasonal allergies and growing consumer preference for preservative-free sprays and saline-based formulations. A strong digital health ecosystem, along with NHS-backed e-pharmacy services, is accelerating online distribution, making products more accessible to both urban and rural populations.

The Nasal Congestion Treatment Devices Market in Germany is forecast to grow at a 2.5% CAGR, supported by strong consumer adoption of multi-dose sprays and a shift toward saline-based and preservative-free formulations. Germany held 22.4% of the European market in 2025 but is expected to moderate slightly to 21.6% by 2035 due to competitive pricing pressures and growing adoption in the rest of Western Europe. German consumers show a strong inclination for clinically validated and pharmacy-recommended nasal devices, reinforcing the dominance of branded OTC sprays. Additionally, the integration of e-commerce platforms and digital pharmacies is helping manufacturers reach chronic users more effectively.

| Europe Countries | 2025 |

|---|---|

| Germany | 22.4% |

| France | 13.5% |

| Italy | 9.4% |

| BENELUX | 6.5% |

| Nordic Countries | 4.7% |

| Spain | 8.7% |

| Rest of Western Europe | 16.7% |

| Europe Countries | 2035 |

|---|---|

| Germany | 24.0% |

| France | 16.3% |

| Italy | 12.5% |

| BENELUX | 9.3% |

| Nordic Countries | 6.8% |

| Spain | 11.0% |

| Rest of Western Europe | 20.1% |

The Nasal Congestion Treatment Devices Market in India is expected to grow at a CAGR of 4.4%, making it one of the fastest-growing markets globally. Growth is fueled by rising prevalence of allergic rhinitis and pollution-related sinus conditions, combined with increasing consumer spending on OTC healthcare. Expanding urban populations in Tier 1 and Tier 2 cities are boosting sales of sprays and saline-based drops through retail and e-commerce platforms. Local and multinational companies are offering cost-effective multi-dose sprays and nasal irrigation kits, tailored for Indian price sensitivity and distribution infrastructure.

The Nasal Congestion Treatment Devices Market in China is projected to grow at a CAGR of 4.8% through 2035, supported by aggressive expansion of retail and digital healthcare channels. Rising seasonal allergy incidence in densely populated cities, coupled with increasing consumer preference for saline sprays and dry-powder devices, is driving demand. Under the “Healthy China 2030” initiative, awareness campaigns are promoting safe OTC solutions, accelerating adoption. Domestic manufacturers are scaling production of cost-effective sprays, while premium brands are gaining traction in Tier 1 markets through online pharmacies.

The Nasal Congestion Treatment Devices Market in Japan is projected to reach USD 31.0 million by 2035, growing at a CAGR of 3.0%. In dosage types, Sprays holds around 55.3% in 2025. Growth is driven by Japan’s aging population, where chronic sinusitis and rhinitis incidence is rising. Consumers show high preference for preservative-free, ergonomically designed sprays that align with strict quality and safety standards. Hospital pharmacies play a key role in driving adoption of unit-dose and bi-dose systems, particularly for elderly patients.

The Nasal Congestion Treatment Devices Market in South Korea is estimated at USD 17.1 million in 2025. Multi‑dose Systems to contribute a revenue share of 62.6% in 2025. Strong consumer awareness of respiratory health, coupled with widespread use of e-commerce platforms, is fueling sales of sprays and nasal irrigation systems. The younger population segment is adopting powered nasal aspirators and advanced saline delivery devices, while hospital pharmacies contribute to demand through prescription-based congestion relief.

The Nasal Congestion Treatment Devices Market is moderately consolidated, with global pharmaceutical leaders, established OTC healthcare brands, and specialized device manufacturers competing across sprays, drops, irrigation systems, and powered delivery devices. GlaxoSmithKline (GSK) holds the largest share at 19.5% in 2024, driven by its strong OTC nasal spray portfolio under widely recognized brands. GSK continues to leverage its global retail and e-commerce presence, emphasizing preservative-free sprays, consumer education, and multi-dose system dominance.

Established healthcare companies such as Pfizer, Bayer, Johnson & Johnson, and Teva maintain competitive positions through diversified respiratory portfolios that include nasal sprays and drops integrated into broader allergy and cold-relief product lines. These players focus on leveraging distribution scale, pharmacist engagement, and digital marketing to capture consumer trust. Johnson & Johnson and Bayer are particularly active in promoting saline-based and natural formulations, aligning with the growing consumer preference for non-drug congestion relief.

Specialized device players such as NeilMed and Naväge cater to niche but expanding categories. NeilMed dominates the saline irrigation market with a wide range of neti pots, squeeze bottles, and powered rinse systems, supported by strong physician recommendations. Naväge has differentiated itself by introducing powered nasal irrigation devices with proprietary saline pods, gaining traction in North America and increasingly in Asia Pacific. Their strategies revolve around convenience, patented delivery mechanisms, and premium product positioning in online and specialty retail channels.

Emerging regional players and private-label brands are strengthening competition by offering cost-effective sprays, gels, and drops tailored for local markets. These entrants often compete on affordability, portability, and availability through fast-growing e-commerce platforms.

As the market evolves, competitive differentiation is shifting from basic OTC decongestants toward ergonomic spray applicators, drug-free alternatives, powered irrigation devices, and integration with digital retail ecosystems. Players that successfully align innovation with consumer trust, safety, and accessibility are expected to lead growth through 2035.

Key Development

| Item | Value |

|---|---|

| Mar ket Value | USD 932.2 million |

| Dosage type | Sprays, Drops & Liquids, Gels, Powders/Dry-powder devices, and Others |

| dose configuration | Multi-dose systems, Bi-dose systems, and Unit-dose (single-use) systems, reflecting consumer choice between refillable, dual, and single-use delivery systems |

| Distribution channels | Retail Pharmacies, Online Pharmacies/E-commerce, Hospital Pharmacies, and Others |

| Regions Covered | North America, Latin America, Western & Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Germany, France, UK etc. |

| Key Companies Profiled | GlaxoSmithKline (GSK), Pfizer, Teva, Bayer, Johnson & Johnson, NeilMed, Naväge, Others |

| Additional Attributes | Dollar sales by application and regions, adoption trends of Nasal Irrigation Devices and Decongestant Delivery Systems, Rising demand in Homecare Settings, Growing demand across Pharmacies and Retail Clinics, and Increasing adoption in Hospitals & Specialty ENT Clinics |

The global Nasal Congestion Treatment Devices Market is estimated to be valued at USD 932.2 million in 2025.

The market size for Nasal Congestion Treatment Devices is projected to reach USD 1,393.2million by 2035.

The Nasal Congestion Treatment Devices Market is expected to grow at a CAGR of 4.1% during this period.

Key product types include Sprays, Drops & Liquids, Gels, Powders / Dry-powder devices, and Others.

Retail pharmacies are projected to command 59.6% of the market in 2025, followed by online pharmacies / e-commerce at 20.1%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nasal Allergy Treatment Market Size and Share Forecast Outlook 2025 to 2035

Nasal Packing Devices Market Size and Share Forecast Outlook 2025 to 2035

Nasal Polyposis Treatment Market - Drug Innovations & Demand 2025 to 2035

Electronic Nasal Spray Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Nasal Implant Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Nasal Sprays Market Analysis - Size, Share, and Forecast 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Nasal Antihistamines Market – Growth & Forecast 2025 to 2035

Nasal vaccines Market

Nasal Sampling Lines Market

Nasal Oxygen Cannula Market

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA