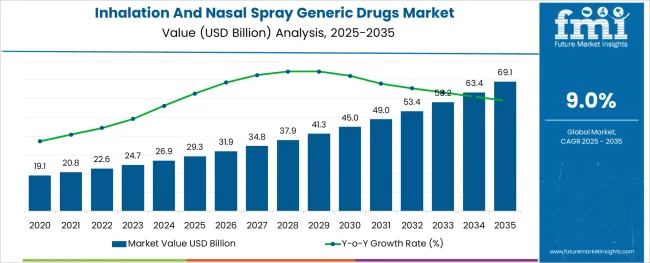

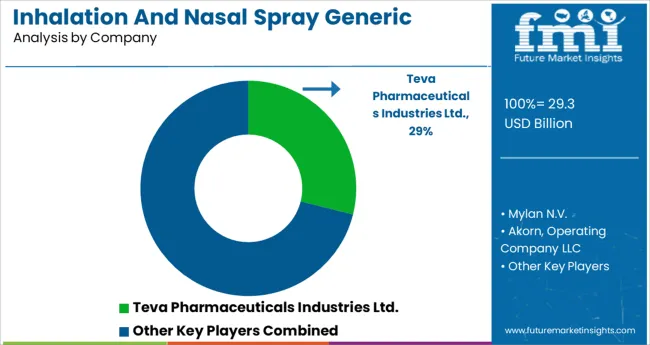

The Inhalation And Nasal Spray Generic Drugs Market is estimated to be valued at USD 29.3 billion in 2025 and is projected to reach USD 69.1 billion by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period.

The inhalation and nasal spray generic drugs market is experiencing steady growth, supported by the increasing prevalence of chronic respiratory conditions and rising demand for cost effective therapeutics. The shift toward generic formulations has been encouraged by regulatory support, patent expiries, and healthcare systems aiming to reduce treatment costs.

Improved patient adherence due to the non-invasive nature of inhalation and nasal delivery has further expanded usage across chronic care management. Developments in drug-device combinations and inhaler technologies are also enhancing therapeutic outcomes while meeting regulatory requirements for bioequivalence and safety.

The market is expected to witness robust growth as manufacturers continue to innovate on device design, reduce particle size for deeper lung penetration, and expand access in developing economies. Cost-conscious procurement policies and rising healthcare awareness are anticipated to sustain demand over the coming years, particularly among elderly and chronic respiratory patient groups.

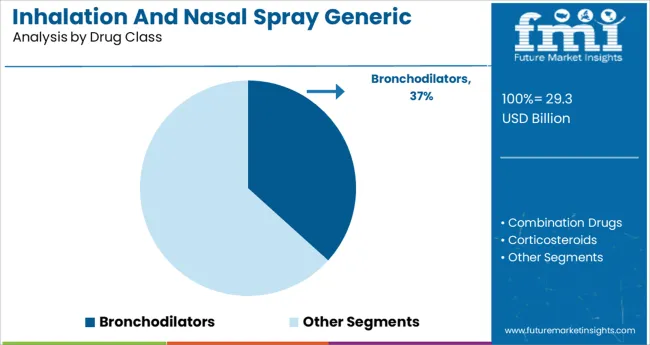

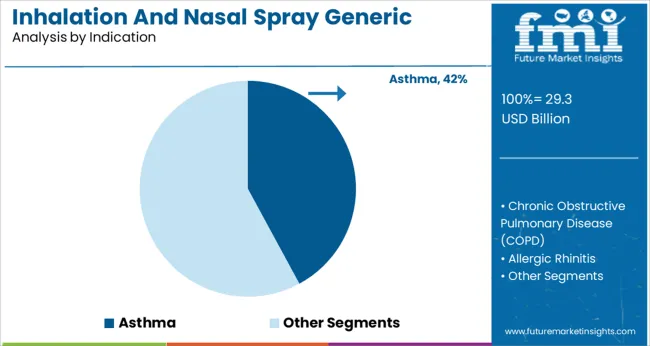

The market is segmented by Drug Class, Indication, Patient Demographics, End-user, and Distribution Channel and region. By Drug Class, the market is divided into Bronchodilators, Combination Drugs, Corticosteroids, Decongestant Sprays, Antihistamines, and Others. In terms of Indication, the market is classified into Asthma, Chronic Obstructive Pulmonary Disease (COPD), Allergic Rhinitis, and Others. Based on Patient Demographics, the market is segmented into Geriatric Patient, Adult Patient, and Paediatric Patient. By End-user, the market is divided into Hospitals, Homecare, and Others. By Distribution Channel, the market is segmented into Hospitals Pharmacy, Retail Pharmacy, and Online Pharmacies. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

It is observed that bronchodilators account for 36.70% of the total market under the drug class segment. This leadership position is attributed to their critical role in managing obstructive airway diseases including asthma and chronic obstructive pulmonary disease.

The segment has gained traction due to its fast acting relief properties and broad prescription coverage across age groups. Generic bronchodilator options have proven essential in reducing the financial burden on healthcare systems while maintaining clinical effectiveness.

Their high adoption has been further supported by streamlined regulatory pathways and widespread formulary inclusion. As the need for long term respiratory management continues to rise bronchodilators are expected to remain the dominant drug class in this therapeutic category.

Asthma holds the highest share within the indication category at 42.10%. This is due to the sustained increase in asthma prevalence particularly among aging populations and in urbanized regions with high pollution levels.

The condition’s chronic nature necessitates ongoing medication where inhalation and nasal spray formulations offer targeted delivery with fewer systemic side effects. The segment has been further supported by favorable clinical guidelines advocating inhaled therapies as the first line of treatment.

Growth has also been driven by educational programs promoting early diagnosis and consistent management especially in school aged and elderly populations. This consistent demand and therapeutic importance have reinforced asthma as the leading indication in the market.

Due to the rising incidence of asthma attacks in both children and adults, the asthma subsegment is projected to account for over 40.0% of total revenues in 2024.

Approximately 26.9 million US residents, including children and adults under the age of 18, experienced asthma attacks in 2024, accounting for 41% of all incidents, as reported by the CDC's National Health Interview Survey.

Additionally, the number of asthma-related visits to emergency rooms rose by approximately 57% in 2020.

New product introductions and increasing demand for generics in the treatment of chronic obstructive pulmonary disease (COPD) should drive growth in the inhalation and nasal spray generic drugs market sector over the forecast period.

One such example is the generic version of Advair Diskus, WixelaInhub, which was approved by the FDA in January 2020 (manufactured by Mylan N.V.). It is used to treat chronic obstructive pulmonary disease and asthma. The expansion of the demand for inhalation and nasal spray generic drugs is anticipated to be boosted by these kinds of approvals.

| Attributes | Details |

|---|---|

| Market Value (2025) | USD 20.78 Billion |

| Market Value (2035) | USD 49.01 Billion |

| CAGR (2025 to 2035) | 8.96% |

Rising Prevalence of Asthma and Chronic Obstructive Pulmonary Disease

Health issues like asthma and COPD are taken very seriously. A sizable fraction of the world's population is impacted by them. Asthma and chronic obstructive pulmonary disease (COPD) share several risk factors, including smoking, cigarette use, and environmental pollution.

The American Lung Association reports that smoking is the leading cause of COPD and accounts for around 80% of COPD-related fatalities.

Over 360 and 19.1 million individuals suffered from asthma and COPD in 2020, respectively, according to the Global Burden of Disease Study. Asthma and chronic obstructive pulmonary disease are becoming more common as a result of the improved living standards seen in industrialized nations.

But in poorer nations, where air pollution and smoking are more common, these diseases are more common among the population.

Market growth for generic inhalers and nasal sprays is anticipated to be bolstered by an aging population with chronic respiratory diseases, including COPD and asthma.

Market Growth of Generic Drugs May Be Stifled by Strict Regulations

As more and more low-price generic inhalation and nasal spray medications become available around the world, different regulatory authorities have opted for stringent criteria to focus on quality.

Brazil, Mexico, and Russia are just a few of the emerging countries whose regulatory bodies have recently revised their policies on the sale of generic pharmaceuticals.

The sales of inhalation and nasal spray generic drugs in the global market have been significantly slowed as a result of the new regulatory standards.

Additionally, several pharmaceutical businesses operating in Russia are facing challenges due to the country's new regulatory legislation, which requires clinical trials for generic drugs. Similarly, the Drugs Controller General of India, the country's domestic drug regulatory organization, established several new drug advisory groups to monitor clinical studies, approve new drugs, etc.

Therefore, the demand for inhalation and nasal spray generic drugs is expected to grow slowly as a result of the tough and strict rules imposed by various developing countries.

With widespread use for the treatment of respiratory illnesses like asthma and COPD, bronchodilators are expected to represent over 25.0% of the market by 2024. Asthma and chronic obstructive pulmonary disease (COPD) are on the rise, which is also fueling.

According to the World Health Organization (WHO), in 2020, there were over 26.9 million individuals living with asthma worldwide. The Asthma and Allergy Foundation of America estimates that by 2024, over 25 million people in the United States are likely to have asthma.

As a result, the market is likely to be driven by the increasing demand for bronchodilators.

For the duration of the forecast, the market for combination pharmaceuticals is anticipated to grow at a compound annual rate of 9.85%. Combination medicine launched by major companies like Apotex Inc. and Teva Pharmaceutical Industries Ltd. is responsible for most of this expansion.

When it comes to treating allergic rhinitis, for instance, Apotex Inc. introduced a generic version of Dymista (azelastine and fluticasone) nasal spray, originally developed by Meda Pharmaceuticals, in March 2024.

In 2024, retail pharmacies' share of total revenue was over 55.0% due to rising healthcare costs and robust sales of generic drugs. In the United States, for instance, generic medications accounted for almost 90% of prescriptions filled in 2020.

Further, the average profit margin of generics in pharmacies is around 43%, indicating high income. The cost of pharmaceuticals has also risen steadily over time. Examples include a 4.9% increase in pharmaceutical spending in the United States between 2020 and 2024.

The sales of inhalation and nasal spray generic drugs by online pharmacies are projected to expand over the coming years. Patients can benefit greatly from the availability and convenience of online pharmacies.

The number of people who buy drugs from online pharmacies is rising quickly alongside the expansion of internet access. For example, in 2024, there was a 45 percent rise from the year before in the number of products sold through internet pharmacies in Great Britain.

In terms of revenue, North America accounted for more than 35.0% of the demand for inhalation and nasal spray generic drugs in 2024. The key elements fueling the regional expansion are the introduction of new goods, acquisitions, collaborations, and the rising incidence of chronic respiratory disorders.

Statistics from the Centers for Disease Control and Prevention (CDC) show that 57 males per 100,000 and 40.5 women per 100,000 had COPD in the United States.

The introduction of low-cost generic nasal sprays is anticipated to boost the industry. In the United States, for instance, Sandoz introduced a generic version of Narcan (naloxone HCl) Nasal Spray in December 2024. This spray is used to reverse the effects of an opioid overdose.

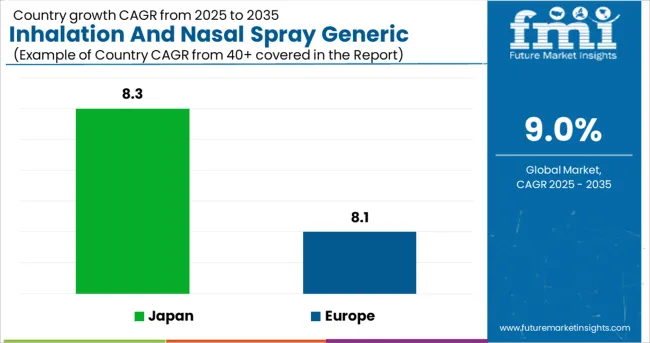

Over the course of the forecast period, the Europe inhalation and nasal spray generic drugs market is expected to expand at a CAGR of 8.1%.

In the countries of the region, cigarette consumption is incredibly high. Tobacco consumption is highest in the WHO European Region, with an estimated 209 million individuals smoking (or 29%).

Furthermore, Europe has the highest smoking rate among women, with 74 million of them lighting up every day. The prevalence of smoking varies considerably between geographic regions. Tobacco use is a major contributor to health inequalities and a leading cause of preventable death and disability in the area.

In 2024, Germany market-led Europe's inhalation and nasal spray generic drugs market by country, and it's expected to maintain its dominance through 2035 when it's expected to be worth USD 1,998.9 million. A compound annual growth rate (CAGR) of 7.2% was predicted for the UK market. In addition, the market in France is growing at a CAGR of 8.9%.

Non-communicable diseases (NCDs) are rapidly becoming more of a problem in India than communicable diseases, including tuberculosis (TB), HIV, and water- and vector-borne illnesses. Cancer, chronic respiratory problems, and cardiovascular disease are just a few of the non-communicable diseases that account for nearly 60% of deaths in the country, as reported by the Ministry of Health and Family Welfare.

The years of potential productivity lost due to NCDs are substantial. Deaths from preventable causes, such as heart disease, stroke, and respiratory illness, are also projected to increase over time, leading to greater financial losses.

In 2025, Japan was the largest country inhalation and nasal spray generic drugs market in the Asia Pacific region, and this trend is projected to continue through 2035. A compound annual growth rate (CAGR) of 8.3% is expected in the Japanese market. The market in India, meanwhile, is growing at a CAGR of 9.6 percent throughout the forecast period.

The growth of the region is attributed to the strategic partnerships to manufacture generic products in the region. For instance, in August 2024, CDMO Bora Pharmaceuticals Laboratories Inc. partnered with Kyowa Pharmaceuticals Industry Co. Ltd. to manufacture generic products, including nasal sprays, in Japan.

This contract strengthens and increases the visibility of the country's pharmaceutical capabilities.

New Entrants to Foster Innovation in the Global Market

The startups in the inhalation and nasal spray generic drugs market are adding a new edge to the properties of excavators by curating innovations beyond the imagination.

They are continually upgrading the Inhalation and Nasal Spray Generic Drugs with advanced technology, and manufacturers and sellers are continuously attempting to reduce costs for greater accessibility to the market share. Startup firms are triggering the expansion of the inhalation and nasal spray generic drugs market with their unique attempts.

Top startups operating in the inhalation and nasal spray generic drugs market are:

| Name | Description |

|---|---|

| QNASL | For those suffering from seasonal allergies, QNASL has created a nasal spray to help. A waterless mist (nasal aerosol), QNASL (beclomethasone dipropionate) is used once daily to treat nasal allergy symptoms such as congestion, sneezing, and an itchy, runny nose. |

| Trillium Health Care Products | Drug creator with a wide range of therapeutic targets. Over-the-counter (OTC) and prescription (RX) gastrointestinal treatments, cough, cold, and flu medication, antiseptic ointments, suppositories, nasal sprays, and allergy relief, analgesics, sleep aids, and other life science products are developed by the company. |

Major companies like Cipla Inc., Teva Pharmaceuticals, and Viatris Inc. are investing heavily in research and development, as well as product launches of brand-new products.

There has been a rise in the number of generic inhalers and nasal sprays approved for the treatment of respiratory illnesses such as asthma, COPD, and allergic rhinitis, and this is expected to continue driving demand in the market. To give just one example, in March 2025, the FDA approved the ANDA for inhalation aerosol Breyna, a generic form of Symbicort intended for patients with asthma and COPD.

This product is manufactured by Mylan Pharmaceuticals, a subsidiary of Viatris Inc. With this green light, the business can move on with plans to introduce Breyna in 2025.

Market leaders in Inhalation and Nasal Spray Generic Drugs worldwide include:

The global inhalation and nasal spray generic drugs market is estimated to be valued at USD 29.3 billion in 2025.

It is projected to reach USD 69.1 billion by 2035.

The market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types are bronchodilators, combination drugs, corticosteroids, decongestant sprays, antihistamines and others.

asthma segment is expected to dominate with a 42.1% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inhalation CDMO Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Global Inhalation Formulation Market Analysis – Size, Share & Forecast 2024-2034

Inhalational Anaesthesia Drugs Market

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA