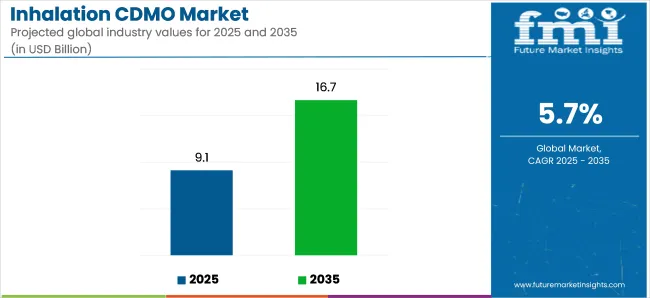

The global inhalation contract development and manufacturing organization (CDMO) market is projected to grow from USD 9.13 billion in 2025 to USD 16.68 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.7% during the forecast period. This growth is driven by the increasing prevalence of respiratory diseases, advancements in inhalation drug delivery technologies, and the rising demand for outsourced manufacturing services in the pharmaceutical industry.

Recent developments in the inhalation CDMO market highlight significant advancements in drug delivery systems and manufacturing processes. Companies are focusing on enhancing the efficiency and performance of inhalation products, aiming to meet the growing requirements of modern therapies. Innovations in dry powder inhalers (DPIs), metered-dose inhalers (MDIs), and nebulizers are improving drug delivery to the lungs, offering better patient compliance and therapeutic outcomes.

A notable trend in the market is the integration of digital technologies in inhalation devices. The incorporation of sensors and connectivity features in inhalers is enabling real-time monitoring of medication usage, providing valuable data for healthcare providers to optimize treatment plans. This digital transformation is enhancing the overall patient experience and contributing to the growth of the inhalation CDMO market.

| Attributes | Key Insights |

|---|---|

| Estimated Market Size (2025E) | USD 9.13 billion |

| Forecast Market Value (2035F) | USD 16.68 billion |

| Value-based CAGR (2025 to 2035) | 5.7% |

On July 24, 2024, Catalent expanded its collaboration with De Motu Cordis (DMC) to support the development of DMC‑IH1, an inhaled dry powder epinephrine (DPI) designed for emergency anaphylaxis treatment-as per Catalent’s announcement via Contract Pharma . The extended deal builds on an existing relationship initiated in November 2022, now encompassing large-scale drug product manufacturing and DPI assembly through Catalent’s Boston, Morrisville, and San Diego sites.

DMC CEO Peter O’Neill stated, “We are excited to build on our partnership…to further advance DMC‑IH1,” highlighting Catalent’s role in commercial preparation. This collaboration marks a significant step in inhalation CDMO services, supporting life-saving DPI development through end-to-end capabilities.

The market's growth is also supported by favorable regulatory environments and increasing investments in research and development. Governments and regulatory agencies are providing support for the development of inhalation therapies, recognizing their potential in treating respiratory conditions. Additionally, pharmaceutical companies are investing in the development of new inhalation products, further driving the demand for specialized manufacturing services offered by inhalation CDMOs.

As the inhalation CDMO market continues to evolve, ongoing research and development efforts are expected to lead to the introduction of more specialized and efficient products. These advancements will cater to the diverse needs of healthcare providers and patients, further driving the market's growth and enhancing the quality of care for individuals with respiratory diseases.

The global inhalation CDMO (Contract Development and Manufacturing Organization) market is set for significant growth from 2025 to 2035. Key segments contributing to this growth include the commercial scale of operation and formulation development services. These segments are driven by the increasing demand for inhalation therapies. Leading companies like Lonza Group, Catalent, and Recipharm are expanding their capabilities to provide high-quality, scalable inhalation production and development services.

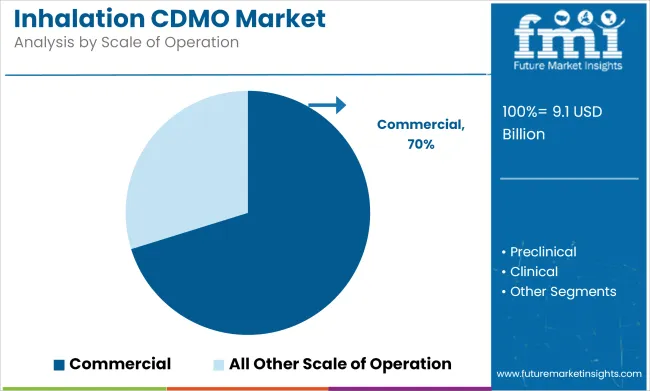

The commercial segment is expected to account for 70.2% of the inhalation CDMO market share in 2025. This growth is driven by the rising demand for large-scale production of inhalation products, which include dry powder inhalers (DPIs), metered dose inhalers (MDIs), and nebulized solutions. As the number of patients with respiratory diseases continues to rise globally, pharmaceutical companies are increasingly turning to CDMOs for efficient, cost-effective, and scalable manufacturing solutions to meet market demand.

Key players such as Lonza Group and WuXi AppTec are leading the charge by offering integrated solutions that cover the entire product lifecycle, from drug development to commercial production.

As inhalation therapies, particularly those for chronic diseases, continue to expand in the global healthcare market, the demand for large-scale manufacturing capabilities will drive the commercial segment's growth. Furthermore, regulatory advancements and the increasing adoption of biologics and biosimilars in inhalation products are expected to further support the expansion of this segment.

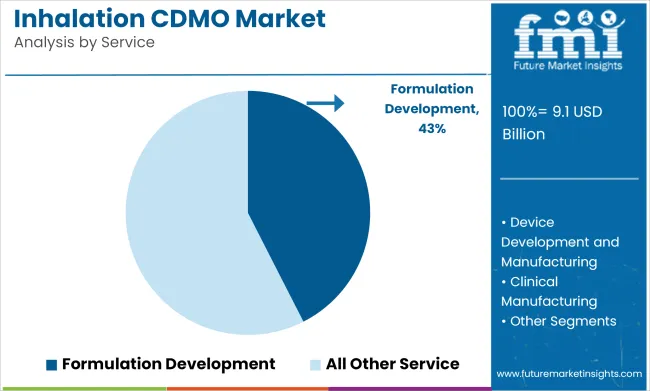

Formulation development is projected to hold 42.5% of the services market share in 2025. This segment is gaining traction as more pharmaceutical companies seek expertise in developing specialized inhalation formulations tailored to the unique delivery requirements of respiratory drugs. Formulation development services encompass the design, testing, and optimization of inhalation drug products, ensuring that they are both effective and deliver the desired therapeutic effects when administered through inhalation devices.

The demand for formulation development is driven by the growing complexity of respiratory treatments, particularly for biologics and novel therapies targeting conditions like asthma, COPD, and cystic fibrosis. Companies like Catalent and Recipharm are at the forefront of offering advanced formulation development services that ensure proper drug delivery and patient compliance.

As the inhalation drug market expands and the need for specialized, high-performance formulations increases, the formulation development segment is expected to see continued growth. This trend is particularly evident in the development of complex inhalable biologics and personalized inhalation therapies.

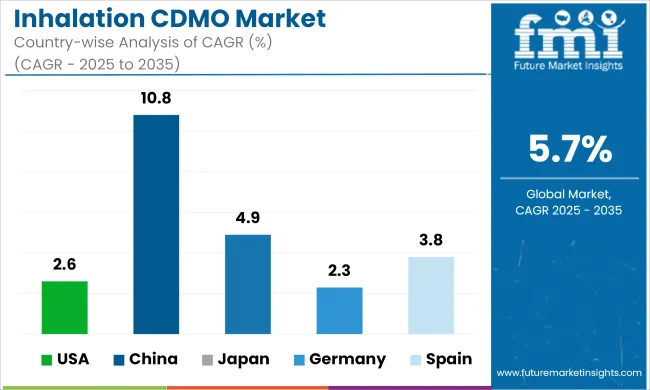

The table below shows the estimated growth rates of the top five countries. China, Japan, and Spain are set to record higher CAGRs of 10.8%, 4.9%, and 3.8%, respectively, through 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 2.6% |

| China | 10.8% |

| Japan | 4.9% |

| Germany | 2.3% |

| Spain | 3.8% |

The United States dominated the global market and held a 33.1% market share in 2024. The United States is expected to exhibit a CAGR of 2.6% throughout the forecast period, driven by factors like:

The high prevalence of respiratory disorders such as asthma and COPD in the United States is a significant driver for the inhalation CDMO market. The demand for innovative inhalation therapies is surging, ultimately driving the growth of CDMOs in the United States.

In 2024, China held a dominant share of 7.7% in East Asia’s market. The market is expected to surge with a CAGR of 10.8% from 2025 to 2035. Some of the key drivers/trends include:

China faces a rising prevalence of respiratory disorders, including air pollution-related issues and an increasing number of smokers. This creates a substantial demand for advanced inhalation therapies, presenting an opportunity for CDMOs to cater to the growing healthcare needs in China.

China's pharmaceutical market is rapidly expanding, driven by a rising aging population, increased healthcare awareness, and high disposable income. This growth creates opportunities for CDMOs to collaborate with local and international pharmaceutical companies seeking inhalation drug development services.

Germany is expected to surge at a CAGR of 2.3% during the forecast period. This can be attributed to factors like:

Germany is a pharmaceutical hub with a strong emphasis on research and development activities. The country's well-established pharmaceutical industry demands specialized CDMOs, particularly those offering inhalation drug development expertise.

Germany's central location in Europe is a strategic base for companies that serve Europe’s pharmaceutical market. Inhalation CDMOs can leverage this location to establish a presence and cater to the diverse needs of the pharmaceutical industry.

Japan is set to surge at a CAGR of 4.9% between 2025 and 2035. Factors driving the market growth include:

In Japan, there is a high frequency of respiratory conditions such as asthma and chronic obstructive pulmonary disease (COPD), which drives up demand for inhalation treatments. As a result, inhalation CDMOs now have the chance to work with pharmaceutical firms to develop and produce respiratory medicinal products.

Japan has a solid pharmaceutical regulation system in place. Operating in Japan, inhalation CDMOs must navigate and abide by the rules established by the Pharmaceuticals and Medical Devices Agency (PMDA). Comprehending and obeying these rules is essential to developing and effectively launching new products in the market.

Japan is renowned for its technological breakthroughs. The country’s inventive research and development in inhalation medication delivery methods and technologies can benefit inhalation CDMOs operating nationwide. Being at the forefront of these developments enables companies to provide their clients with state-of-the-art solutions.

Over the forecast period, demand for inhalation CDMO in Spain is expected to rise at a CAGR of 3.8%. This growth projection can be attributed to several key factors:

Spain is a vital country in the global pharmaceuticals market. Spain-based inhalation CDMOs can expand their offerings to serve clients abroad or collaborate with multinational pharmaceutical firms. Incorporating this integration with the global market can yield supplementary growth prospects.

The aging population of Spain is driving up demand for healthcare services and pushing the inhalation CDMO market. The elderly are more likely to suffer from respiratory disorders, which makes effective inhalation therapy necessary. By creating specialized respiratory therapies, inhalation CDMOs can help satisfy these healthcare demands.

For inhalation CDMOs, it is crucial to consider Spain’s market trends and cultural preferences. Inhalable medicine products can succeed more in Spain’s market if their formulations and delivery methods are customized to suit regional tastes and medical standards.

Collaborations and acquisitions are common growth strategies that leading companies employ in the inhalation CDMO market. They aim to enhance their capabilities, expand their service offerings, and stay competitive in the dynamic landscape.

For instance

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 9.13 billion |

| Projected Market Size (2035) | USD 16.68 billion |

| CAGR (2025 to 2035) | 5.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for dollar sales |

| Services Analyzed (Segment 1) | Formulation Development, Device Development and Manufacturing, Clinical Manufacturing, Scale-up and Tech Transfer, Quality Control and Quality Assurance, Technology and Innovation, Regulatory Assistance, Analytical Services |

| Products Analyzed (Segment 2) | API, API Substrate, Large Molecule, Small Molecule, Inhalation Platform (Dry Powder Inhaler (DPIs), Metered Dose Inhaler (MDIs), Soft Mist Inhaler) |

| Company Sizes Analyzed (Segment 3) | Large, Medium, Small |

| Scales of Operation Analyzed (Segment 4) | Preclinical, Clinical, Commercial |

| Regions Covered | North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

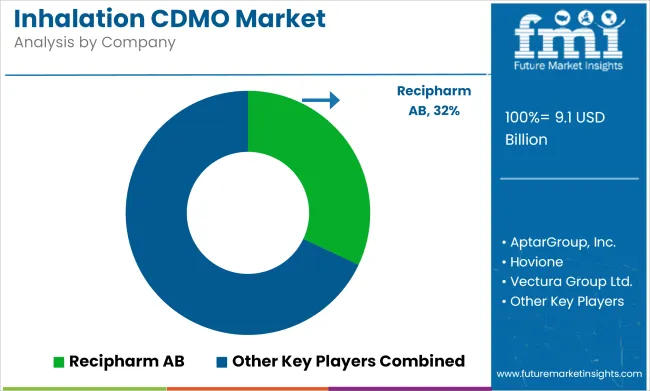

| Key Players influencing the Inhalation CDMO Market | Recipharm AB, AptarGroup, Inc., Hovione, Vectura Group Ltd., Nemera, Kindeva, H&T Presspart, Sanner GmbH, Stevanato Group, Medspray, ICONOVO AB, Lonza, Gerresheimer AG, Catalent, Patheon N.V. (Thermo Fisher Scientific, Inc.), Lubrizol Life Science, Enteris BioPharma, Cambrex Corporation, INKE, Piramal Pharma Limited, Lupin |

| Additional Attributes | dollar sales, CAGR trends, service segmentation, product type demand, company size distribution, scale of operation trends, competitor dollar sales & market share, regional growth patterns |

The global market was valued at USD 8.90 billion in 2024.

The market is set to reach a valuation of USD 16.68 billion by 2035.

Demand for inhalation CDMO increased at a 5.7% CAGR from 2020 to 2024.

The global market is projected to reach USD 9.13 billion by 2025.

The United States accounted for a 33.1% share of the global market in 2024.

Germany held around 2.3% market share in 2024.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inhalation And Nasal Spray Generic Drugs Market Size and Share Forecast Outlook 2025 to 2035

Global Inhalation Formulation Market Analysis – Size, Share & Forecast 2024-2034

Inhalational Anaesthesia Drugs Market

CMO/CDMO Industry Analysis in Brazil Size and Share Forecast Outlook 2025 to 2035

CMO/CDMO Market Analysis - Size, Share, and Forecast 2025 to 2035

Global Cosmetic CDMO Market Analysis – Size, Share & Forecast 2024-2034

Immunoassay CDMO Market Analysis – Size, Trends & Industry Outlook 2025-2035

Nutraceutical CDMO Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule CMO/CDMO Market Size and Share Forecast Outlook 2025 to 2035

Global Sterile Injectable CDMO Market Analysis – Size, Share & Forecast 2024-2034

Demand for Immunoassay CDMO in USA Size and Share Forecast Outlook 2025 to 2035

Investigational New Drug CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule Innovator CDMO Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA