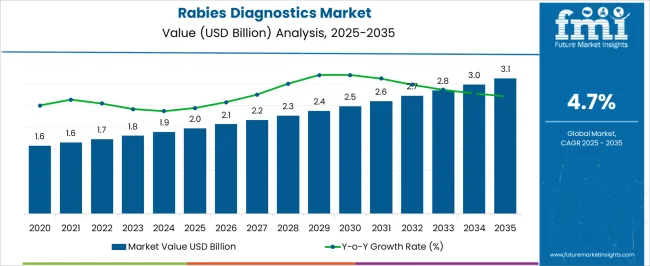

The Rabies Diagnostics Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

| Metric | Value |

|---|---|

| Rabies Diagnostics Market Estimated Value in (2025 E) | USD 2.0 billion |

| Rabies Diagnostics Market Forecast Value in (2035 F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The Rabies Diagnostics market is experiencing steady growth, driven by the increasing focus on early detection and prevention of rabies infections across healthcare systems globally. The market is being shaped by the growing awareness of rabies as a critical public health issue and the need for timely and accurate diagnostic solutions. Advancements in molecular diagnostic techniques, point-of-care testing, and rapid immunoassays are enabling faster detection, thereby improving patient outcomes.

Rising investments in healthcare infrastructure, particularly in emerging economies, are facilitating broader access to diagnostic solutions. Additionally, initiatives to strengthen surveillance programs for zoonotic diseases are contributing to market expansion.

The demand for highly sensitive and specific diagnostic tests is expected to increase, as regulatory agencies and healthcare providers emphasize compliance with international health standards With the global burden of rabies remaining significant in certain regions, the market is poised for continued growth, supported by innovations in diagnostic platforms and integration of automated laboratory workflows to enhance efficiency and reduce turnaround times.

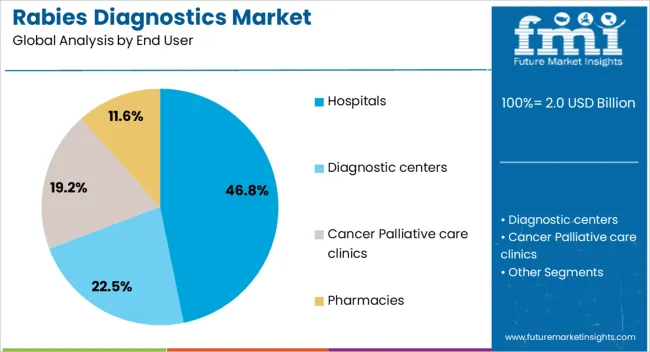

The rabies diagnostics market is segmented by end user, and geographic regions. By end user, rabies diagnostics market is divided into Hospitals, Diagnostic centers, Cancer Palliative care clinics, and Pharmacies. Regionally, the rabies diagnostics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Hospitals end-use segment is projected to hold 46.8% of the Rabies Diagnostics market revenue share in 2025, making it the leading segment. This dominance is being attributed to the critical role hospitals play in managing suspected rabies cases and the reliance on rapid and accurate diagnostic testing in clinical decision-making. Hospitals are increasingly adopting advanced diagnostic platforms that allow early detection of rabies infections, facilitating timely administration of post-exposure prophylaxis.

The growth of this segment has been reinforced by the high patient volume in hospital settings and the need for centralized diagnostic facilities capable of handling complex testing procedures. Investments in laboratory infrastructure, coupled with training of healthcare professionals in modern diagnostic techniques, have further supported adoption.

The hospitals segment also benefits from structured patient care pathways that require confirmatory testing before treatment, ensuring consistent demand for diagnostics The ability to integrate automated testing workflows and maintain compliance with regulatory standards has made hospitals a key driver for market growth, positioning this segment as a cornerstone for revenue generation in the Rabies Diagnostics market.

The World Health Organization (WHO), in April 2025, published a fresh set of rabies guidelines and recommendations covering key facets including rabies elimination, control, and prevention. As per WHO, despite being a preventable disease, rabies kills nearly 59,000 people, annually.

The new set of guidelines are anticipated to provide regions struggling with high number of rabies cases, with hands-on guide to eliminate rabies. Key updates focused at rabies elimination, includes, robust surveillance strategies and suitable rabies diagnostics, recommendations on immunization—human and animal, palliative care in developing, low-income economies.

Moreover, in its recent paper position of 2025, the international public health regulatory body, takes a tough call on rabies vaccines, replacing its 2010 position paper. The position paper elaborates in the novel advancements in the field of rabies diagnostics, with a focus on programmatic viabilities, simplified vaccination programs, and cost-effectiveness of rabies diagnostics. WHO recommends pre-exposure prophylaxis (PrEP) and post-exposure prophylaxis (PEP) as the two new immunization strategies.

Apart from such programs, other key growth drivers include:

Of the 59,000 reported rabies-related deaths, globally, most of them are reported from the low-income settings—with India reporting the highest number of such deaths. As per Association for the Prevention and Control of Rabies in India's (APCRI) 2025 journal, India accounts for nearly 36 percent of worldwide rabies deaths, with the nation reporting nearly 20,000 deaths, annually.

The country is also said to have the maximum number of stray dogs, compared to any other country, further driving the demand for rabies diagnostics. Moreover, Kenya's efforts to eliminate rabies by 2035, includes, mass dog vaccinations, provision of post-exposure prophylaxis (PEP), public awareness, improved surveillance, and quick response to rabies outbreak.

Several Asian countries have adopted Intradermal regimes. Such instances has prompted companies and global health regulatory bodies to invest in the research and development of effective rabies diagnostic tools. However, high cost of PEP to governments is anticipated to disrupt the supply chain and challenge its availability, thereby translating into increased risks and higher out-of-pocket payments.

The Center for Disease Control and Prevention (CDC) recently launched a new rabies test, for a more superior diagnoses of rabies. The newly launched LN34 pan-lyssavirus real-time polymerase chain reaction (PCR) assay (LN34) showcased a higher diagnostic capability compared to the current standard direct fluorescent antibody (DFA) test.

The LN34 is said to be much more robust and reliable versus the standard rabies diagnostics tests, and also replace DFA to become the most preferred test for rabies diagnosis. Moreover, the new LN34 does not require any specialized training or lab set-ups and can be used in a variety of settings.

Additionally, LN34 has said to take-off the economic burden and lessen the treatment regime. Development of such advancement rabies diagnostic tools could result in a shift the epidemiology of rabies—resulting in a more superior rabies identification and treatment protocol, thereby, reducing further rabies-related mortality rates.

Additionally, Nacimbio and Lomonosov MSU are planning to together conduct research programs to develop innovative immunobiological drugs for rabies. Other key players, making advancements in the rabies diagnostics market include, Merck KGaA, Bio-Rad Laboratories, Inc, Aviva Systems Biology Corporation, and Abbexa Ltd among others.

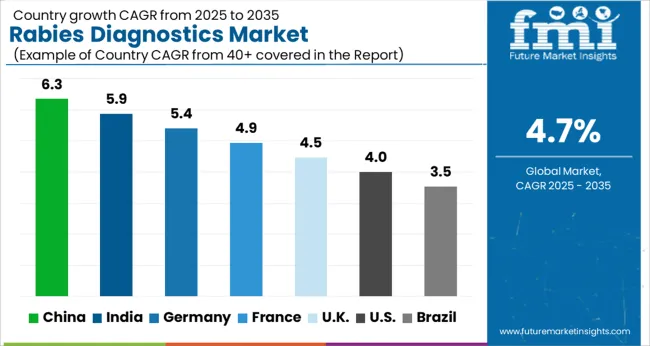

| Countries | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

The Rabies Diagnostics Market is expected to register a CAGR of 4.7% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.3%, followed by India at 5.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.5%, yet still underscores a broadly positive trajectory for the global Rabies Diagnostics Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.4%.

The USA Rabies Diagnostics Market is estimated to be valued at USD 686.5 million in 2025 and is anticipated to reach a valuation of USD 1.0 billion by 2035. Sales are projected to rise at a CAGR of 4.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 90.7 million and USD 54.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.0 Billion |

| End User | Hospitals, Diagnostic centers, Cancer Palliative care clinics, and Pharmacies |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

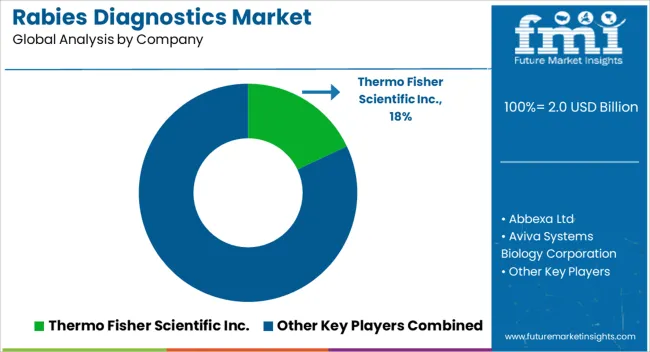

| Key Companies Profiled | Thermo Fisher Scientific Inc., Abbexa Ltd, Aviva Systems Biology Corporation, BIONOTE Co., LTD, Bio-Rad Laboratories, Inc., Creative Diagnostics, Demeditec Diagnostics GmbH, Merck KGaA, MyBioSource, Inc., and Norgen Biotek Corp. |

The global rabies diagnostics market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the rabies diagnostics market is projected to reach USD 3.1 billion by 2035.

The rabies diagnostics market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in rabies diagnostics market are hospitals, diagnostic centers, cancer palliative care clinics and pharmacies.

In terms of , segment to command 0.0% share in the rabies diagnostics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DNA Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

HIV Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Food Diagnostics Services Market Size, Growth, and Forecast for 2025–2035

Cancer Diagnostics Market Analysis - Size, Share and Forecast 2025 to 2035

Tissue Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Sepsis Diagnostics Market Growth - Trends & Forecast 2025 to 2035

Poultry Diagnostics Market - Demand, Growth & Forecast 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

In-vitro Diagnostics Kit Market Size and Share Forecast Outlook 2025 to 2035

In Vitro Diagnostics Market Insights - Trends & Forecast 2025 to 2035

Clinical Diagnostics Market Insights – Size, Share & Forecast 2025 to 2035

Covid-19 Diagnostics Market – Demand, Growth & Forecast 2022-2032

In-Vitro Diagnostics Packaging Market

Connected Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Molecular Diagnostics In Pharmacogenomics Market Size and Share Forecast Outlook 2025 to 2035

Psychosis Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Pneumonia Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

The Companion Diagnostics Market is segmented by product, technology, application and end user from 2025 to 2035

Bacterial Diagnostics in Aquaculture Market Insights - Growth & Forecast 2025 to 2035

Cognitive Diagnostics Market Analysis & Forecast by Diagnosis, Indication, End User and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA