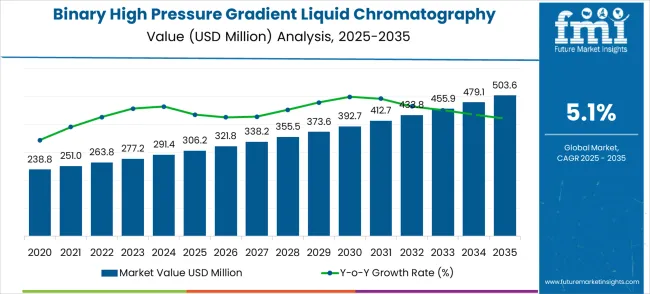

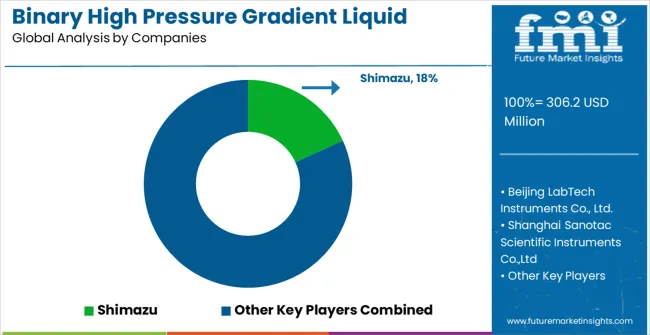

The global binary high pressure gradient liquid chromatography system market is forecast to grow from USD 306.2 million in 2025 to USD 503.6 million by 2035, at a CAGR of 5.1%. From 2025 to 2030, the market is expected to add nearly USD 80 million in value, marking the initial adoption phase. Demand in this block will be influenced by rising pharmaceutical research needs, expanding food safety testing, and environmental monitoring. Manufacturers are likely to prioritize innovations that improve throughput, precision, and system compatibility with modern laboratory requirements, laying the groundwork for sustained expansion.

From 2030 to 2035, the market is projected to gain around USD 117 million, reflecting a sharper adoption curve. This block is expected to benefit from technological enhancements such as advanced automation, higher sensitivity detectors, and integration with biotechnology and clinical diagnostic workflows. Stakeholders viewing growth in 5-year segments can better identify when momentum shifts, allowing resource optimization and targeted investments. By aligning strategies with these phased patterns, companies can enhance product portfolios, strengthen distribution networks, and secure leadership in high-demand applications. This structured progression illustrates how the market will steadily build long-term value across the forecast horizon.

The binary high-pressure gradient liquid chromatography system market is expanding as laboratories and pharmaceutical companies increase their reliance on advanced analytical technologies for complex compound separation and precise quantification. Key usage distribution can be observed across pharmaceutical drug development and quality control (32%), biotechnology and proteomics research (26%), food and beverage safety testing (19%), environmental monitoring (13%), and academic research institutions (10%).

Adoption is being driven by the ability of binary HPLC systems to deliver consistent flow rates and gradient accuracy for high-resolution separation of multi-component samples. Manufacturers are investing in systems with faster run times, improved pump stability, and reduced solvent consumption to enhance laboratory efficiency. Integration with automation platforms and AI-driven data interpretation is reshaping workflows, particularly in high-throughput pharmaceutical testing. The compatibility of binary HPLC with advanced detectors, including mass spectrometry, strengthens its role in precision medicine and biomarker discovery. Growing regulatory requirements for trace analysis in food and environmental sectors are also encouraging deployment. With rising focus on data integrity, digital connectivity, and modular system design, binary gradient HPLC is emerging as a critical tool across analytical industries.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 306.2 million |

| Market Forecast Value (2035) | USD 503.6 million |

| Forecast CAGR (2025-2035) | 5.1% |

Market expansion enables analytical laboratories to achieve superior chromatographic separation through precise gradient programming that enhances resolution and reduces analysis time compared to isocratic methods. Pharmaceutical companies require sophisticated analytical methods for drug development and quality control applications where complex mixture separation demands gradient elution capabilities that deliver consistent, reproducible results. Binary gradient systems provide operational flexibility for method development and routine analysis across diverse compound classes requiring optimized separation conditions. Pharmaceutical analysis drives primary demand through regulatory compliance requirements for impurity testing and stability studies, while environmental laboratories adopt binary gradient systems for complex sample matrices including water contamination analysis and pesticide residue detection. Chemical industry applications expand through quality control requirements for complex formulations and reaction monitoring. High system costs and gradient programming complexity may restrict adoption among price-sensitive analytical laboratories.

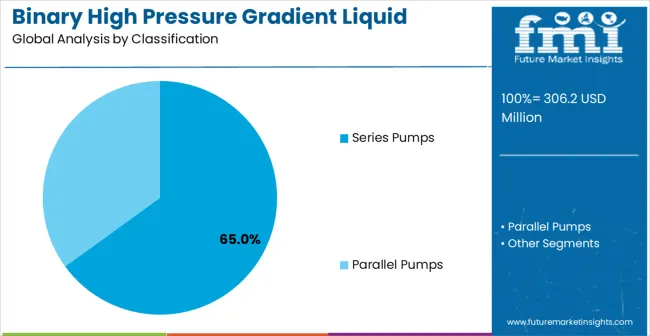

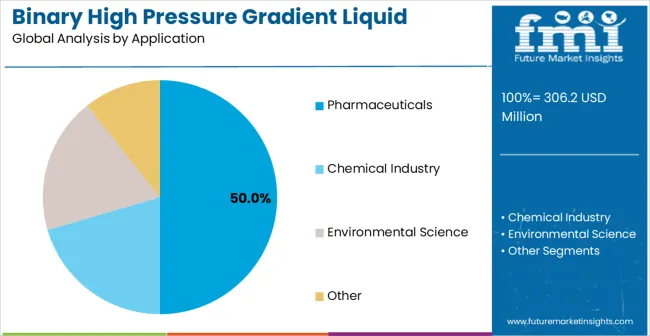

The market is segmented by product type, application, and region. By product type, the market is divided into series pumps, parallel pumps, and integrated systems. By application, the market is categorized into chemical industry, pharmaceuticals, environmental science, and others. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

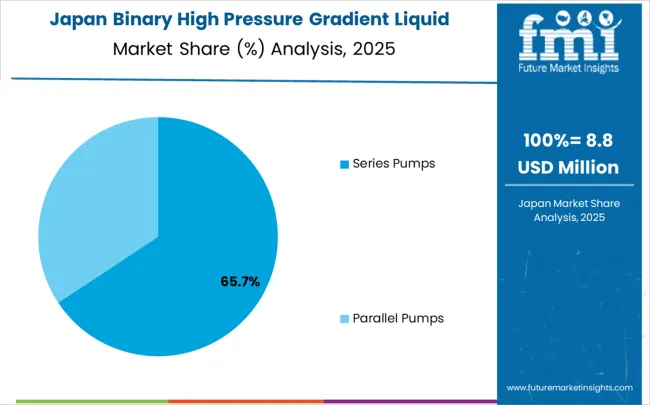

Series pumps are projected to account for 65% of the binary high pressure gradient liquid chromatography system market in 2025. This share is supported by superior gradient mixing precision and flow stability characteristics that series pump configurations provide for demanding analytical applications requiring consistent mobile phase delivery. These systems offer enhanced gradient reproducibility through sequential pump operation that minimizes composition variations and maintains stable flow rates throughout gradient programs. The segment benefits from widespread adoption by pharmaceutical laboratories requiring validated analytical methods and consistent chromatographic performance. Modern series pump designs incorporate advanced flow control algorithms and pressure compensation mechanisms that ensure optimal gradient formation across varying analytical conditions. These systems support complex gradient programs with precise timing and composition control that enable method development for challenging analytical separations. Series pump configurations provide essential capabilities for laboratories requiring certified analytical methods and regulatory compliance documentation supporting pharmaceutical and environmental applications.

Pharmaceuticals are expected to represent 50% of binary high pressure gradient liquid chromatography system demand in 2025. This dominant share reflects the critical role of sophisticated analytical methods in pharmaceutical development and quality control applications requiring precise separation of drug substances and related impurities. Modern pharmaceutical laboratories require binary gradient systems for stability testing, impurity profiling, and method validation applications that support regulatory submission and compliance requirements. The segment provides essential analytical infrastructure for drug development programs including formulation analysis, dissolution testing, and pharmacokinetic studies requiring sensitive detection and quantification capabilities. Pharmaceutical applications drive demand for high-performance systems that maintain gradient precision throughout extended analytical runs while providing documentation necessary for regulatory validation. The segment supports comprehensive pharmaceutical analysis programs including raw material testing, in-process monitoring, and finished product release testing across diverse drug product categories requiring specialized analytical approaches.

Market growth is driven by pharmaceutical industry expansion requiring sophisticated analytical methods for drug development and quality control applications, increasing regulatory compliance requirements demanding validated analytical methods with enhanced separation capabilities, and growing biopharmaceutical development creating demand for specialized analytical techniques capable of characterizing complex biological molecules. Environmental monitoring programs drive adoption of binary gradient systems for analyzing complex sample matrices including water contamination and soil extracts requiring advanced separation capabilities. Chemical industry quality control applications expand through regulatory requirements for product characterization and impurity testing demanding precise analytical methods. Academic research institutions invest in advanced analytical capabilities for pharmaceutical and environmental research programs requiring sophisticated separation technologies.

Market growth faces restraints from high capital equipment costs affecting analytical laboratory budget allocation and procurement decisions, technical complexity requiring specialized training for gradient method development and system optimization that may not be readily available through standard training programs, and maintenance requirements demanding technical expertise for pump calibration and gradient validation procedures. Competition from alternative chromatographic techniques including ultra-high-performance liquid chromatography may reduce binary gradient system adoption in applications where enhanced speed and resolution provide operational advantages. Supply chain limitations can affect component availability while specialized manufacturing requirements create pricing volatility affecting procurement decisions.

Key trends include integration of artificial intelligence for automated method optimization and gradient program development that reduces method development time and technical expertise requirements, development of miniaturized systems supporting reduced solvent consumption and enhanced analytical sensitivity for trace analysis applications, and advancement in pump technology enabling ultra-low pulsation operation that improves gradient precision and chromatographic reproducibility. Connectivity enhancement enables remote monitoring and diagnostic capabilities that improve system uptime while supporting comprehensive maintenance scheduling and performance optimization. Environmental compliance initiatives promote development of solvent-efficient systems that reduce environmental impact while maintaining analytical performance necessary for regulatory compliance. Quality improvement programs focus on enhancing gradient reproducibility and system reliability through advanced control algorithms and predictive maintenance capabilities that support demanding analytical applications requiring consistent long-term performance.

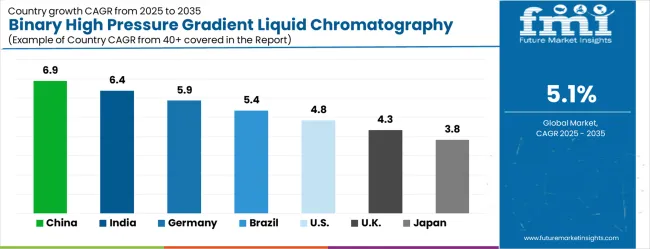

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| Brazil | 5.4% |

| United States | 4.8% |

| United Kingdom | 4.3% |

| Japan | 3.8% |

The binary high pressure gradient liquid chromatography system market is gathering pace worldwide, with China taking the lead thanks to expanding pharmaceutical manufacturing and growing analytical laboratory infrastructure. Close behind, India benefits from increasing pharmaceutical research and development activities and growing environmental monitoring requirements, positioning itself as a strategic growth hub. Germany shows steady advancement, where precision analytical technology development and pharmaceutical industry presence strengthen its role in the regional supply chain. Brazil is sharpening focus on pharmaceutical quality control and environmental compliance, signaling an ambition to capture niche opportunities. Meanwhile, the United States stands out for its established pharmaceutical industry and advanced analytical capabilities, and the United Kingdom and Japan continue to record consistent progress. Together, China and India anchor the global expansion story, while the rest build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

The binary high pressure gradient liquid chromatography system market in China is experiencing robust growth, driven by rapid expansion of pharmaceutical manufacturing and comprehensive analytical laboratory infrastructure. The country’s CAGR of 6.9% through 2035 is fueled by government investment in pharmaceutical quality control systems and stringent regulatory compliance initiatives. Major metropolitan areas such as Beijing, Shanghai, and Guangzhou have become hubs for pharmaceutical production, creating steady demand for advanced chromatographic instrumentation. Environmental monitoring programs further stimulate the need for systems capable of handling complex sample matrices. Domestic manufacturers and international suppliers are investing in service networks and R&D to develop gradient systems with enhanced separation efficiency, precision, and reliability. Pharmaceutical facilities increasingly require automated, high-throughput systems to support drug development, method validation, and regulatory compliance. This combination of industrial expansion, environmental monitoring, and technological advancement makes China the leading market globally, supporting both domestic consumption and international export opportunities.

The market for binary high pressure gradient liquid chromatography systems in India is expanding rapidly, with a CAGR of 6.4% through 2035, driven by increasing pharmaceutical research and development activities. Key centers in Mumbai, Delhi, and Bangalore host pharmaceutical and biotech companies prioritizing method development, quality control, and validation for new drug pipelines. Government initiatives supporting research infrastructure and regulatory compliance promote adoption of high-performance gradient systems. Indian laboratories demand instruments capable of high-precision separation and reproducibility to meet international standards for pharmaceuticals, environmental monitoring, and industrial safety. Collaboration between research institutions, universities, and instrument manufacturers enhances analytical capabilities and supports method development programs. As regulatory scrutiny increases, the need for fully automated, reliable, and efficient gradient systems intensifies. This growth trajectory is reinforced by investment in R&D, local manufacturing capabilities, and integration of sophisticated analytical technologies into pharmaceutical workflows, ensuring India remains a strong emerging market.

The binary HPLC market in Germany is projected to grow at a CAGR of 5.9% through 2035, driven by the country’s strong pharmaceutical industry and analytical technology leadership. German laboratories focus on precision engineering, high reproducibility, and method validation in both pharmaceutical R&D and environmental monitoring. Research institutions and commercial laboratories maintain advanced chromatography systems with sophisticated gradient control, automated sample handling, and high throughput capabilities. Manufacturing hubs produce premium instruments for domestic pharmaceutical companies and international export markets. Continuous innovation in gradient system technology focuses on reliability, accuracy, and compliance with stringent European regulatory standards. German companies lead in method optimization, automation, and instrumentation quality assurance, driving consistent demand for advanced systems capable of complex separation tasks. Integration with laboratory information management systems enhances operational efficiency and data integrity, positioning Germany as a key technology and export hub in the global HPLC market.

The binary high-pressure gradient HPLC system market in Brazil is experiencing steady growth, with a projected CAGR of 5.6% through 2035. This expansion is primarily driven by pharmaceutical quality control programs and stringent environmental monitoring initiatives across major industrial hubs such as São Paulo, Rio de Janeiro, and Brasília. Pharmaceutical laboratories increasingly adopt gradient HPLC systems for drug analysis, method validation, and ensuring regulatory compliance, while environmental agencies require precise instrumentation for accurate contamination assessment and water, soil, and air quality monitoring. Government programs promoting laboratory modernization and technology upgrades facilitate procurement of advanced HPLC systems, meeting analytical demands from drug development to environmental testing. Industrial growth and evolving regulatory requirements further encourage investment in automated, high-throughput gradient systems that enhance reproducibility, operational efficiency, and analytical precision. The market benefits from international suppliers offering technical support, training, and service, which strengthens adoption and ensures long-term utilization of sophisticated chromatographic technologies across pharmaceutical, environmental, and industrial applications.

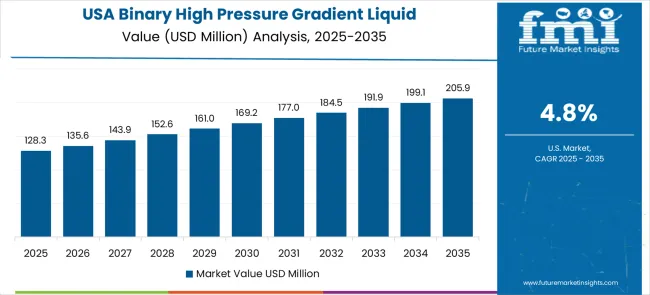

The United States is a mature market for binary high pressure gradient HPLC systems, expanding at a CAGR of 4.8% through 2035. The growth is supported by established pharmaceutical manufacturing, biotechnology development, and advanced analytical laboratory infrastructure. USA laboratories require gradient systems with high precision, reproducibility, and integration with digital laboratory management systems for drug development, quality control, and regulatory compliance. Federal and state regulations enforce strict analytical standards for pharmaceuticals, environmental monitoring, and industrial safety testing. Continuous investment in research and development drives demand for automated, high-throughput HPLC systems capable of handling complex sample types. Collaboration between instrument manufacturers, research institutions, and commercial laboratories ensures the development of innovative methods and reliable equipment. Technology integration initiatives enhance laboratory efficiency, data management, and workflow standardization, maintaining the USA as a leading market in analytical instrumentation for pharmaceutical and environmental applications.

The binary high-pressure gradient HPLC system market in UK is expected to expand at a CAGR of 4.3% through 2035, driven by robust pharmaceutical research initiatives and comprehensive environmental monitoring programs. Advanced analytical laboratories across the UK increasingly adopt high-performance gradient HPLC systems to comply with stringent regulatory requirements for drug development, quality control, and environmental safety. Research institutions and commercial laboratories require instruments capable of delivering high precision, reproducibility, and automated operation to handle complex sample matrices efficiently. Fully automated gradient systems reduce operator variability, improve workflow efficiency, and ensure compliance with both pharmaceutical standards and environmental regulations. Government investment in laboratory modernization and analytical research further supports technology adoption, enabling laboratories to maintain method validation protocols and integrate systems with analytical quality management frameworks. These initiatives ensure consistent data integrity, support regulatory reporting, and strengthen the UK’s position in pharmaceutical innovation and environmental compliance.

The binary high-pressure gradient HPLC system market in Japan is projected to grow at a CAGR of 4.0% through 2035, driven by a strong focus on precision analytical technology, high manufacturing quality standards, and advanced pharmaceutical and environmental research. Laboratories across the country prioritize high-precision instrumentation for pharmaceutical quality control, environmental monitoring, industrial safety, and food safety testing. Research institutions collaborate closely with instrument manufacturers to develop fully automated gradient HPLC systems capable of high-throughput sample processing with minimal operator variability, ensuring consistent and reliable results. Environmental monitoring programs focus on detection of trace contaminants in complex matrices such as groundwater, soil, and industrial effluents, demanding highly reproducible analytical techniques. Advanced automation, precise temperature control, and programmable purge cycles enhance analytical consistency, supporting regulatory compliance and long-term monitoring objectives. Japan’s commitment to technological excellence ensures widespread adoption of sophisticated systems that meet stringent performance and reliability standards.

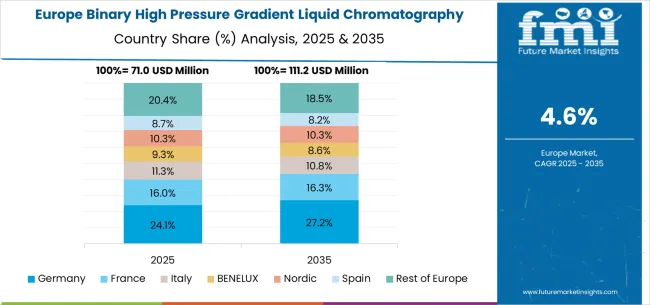

The European binary high pressure gradient liquid chromatography system market demonstrates coordinated development through regional pharmaceutical regulatory harmonization and analytical technology advancement initiatives promoting instrumentation standardization across diverse pharmaceutical and environmental applications. Germany maintains market leadership through precision engineering capabilities and comprehensive pharmaceutical industry presence that supports both domestic analytical infrastructure requirements and export opportunities within European Union markets. The United Kingdom contributes specialized expertise in pharmaceutical research and environmental monitoring that influences regional analytical method development and instrumentation adoption patterns.

France and Italy provide substantial markets for sophisticated analytical instrumentation through pharmaceutical development programs and environmental monitoring initiatives requiring advanced separation capabilities for complex analytical challenges. Nordic countries maintain unique requirements for instrumentation capable of operating effectively in demanding analytical environments while meeting comprehensive regulatory compliance standards. BENELUX region benefits from cross-border pharmaceutical industry coordination that promotes standardized instrumentation adoption and analytical method harmonization across integrated pharmaceutical development operations.

The binary high pressure gradient liquid chromatography system market features moderate concentration with approximately 15 meaningful players competing through technology differentiation, analytical performance capabilities, and comprehensive service support networks. Competition style focus on instrument reliability, gradient precision, and technical service excellence rather than price competition alone. Market structure reflects established analytical instrument manufacturers leveraging chromatography expertise while specialized pump technology companies focus on precision gradient applications requiring superior flow control and mixing capabilities.

Leaders including Shimazu and Agilent maintain dominant positions through comprehensive analytical instrument portfolios, proven system reliability, and established relationships with pharmaceutical and environmental laboratories worldwide. These companies leverage manufacturing scale, research and development capabilities, and global service networks that enable consistent product availability and technical support across diverse analytical applications. Strategic focus continuous technology advancement and system reliability enhancement that addresses evolving pharmaceutical and environmental regulatory requirements.

Challengers including Beijing LabTech Instruments Co., Ltd. and Waters Corporation compete through specialized product development and targeted market focus addressing specific analytical application requirements and regional customer preferences. These companies focus on innovation in pump technology, gradient precision control, and system integration features that differentiate their products from standard chromatography systems while meeting demanding analytical performance requirements.

Specialists including Shanghai Sanotac Scientific Instruments Co., Ltd., TECOTEC Group, Shanghai Wufeng Scientific Instrument Co., Ltd., and emerging players like Acchrom Tech serve focused market segments through specialized product configurations and targeted expertise in pharmaceutical and environmental analytical applications. These companies provide customized solutions for specific analytical requirements while maintaining flexibility in product development and customer service approaches that address unique application needs requiring specialized analytical capabilities.

The binary high pressure gradient liquid chromatography system market represents a specialized analytical instrumentation sector valued at $306.2 million in 2024, projected to reach USD 503.6 million by 2032 with a 5% CAGR. These sophisticated separation systems enable precise analytical measurements across chemical industry ($105.8 million), pharmaceuticals, environmental science, and other laboratory applications. The market encompasses series and parallel pump configurations serving diverse analytical requirements across key regions including China (6.9% market share), India (6.4%), Germany (5.9%), and Brazil (5.4%).

How Governments Could Advance Analytical Science Infrastructure?

Laboratory Modernization Programs: Establish grant programs for upgrading analytical instrumentation in government laboratories, universities, and research institutions, supporting domestic analytical capabilities and scientific research advancement.

Regulatory Compliance Infrastructure: Invest in standardized analytical equipment for regulatory testing laboratories, ensuring consistent pharmaceutical quality control, environmental monitoring, and chemical safety assessments across national laboratory networks.

Scientific Research Funding: Support research and development of advanced chromatography technologies through national science foundations, focusing on improved separation efficiency, reduced solvent consumption, and automated analytical workflows.

Technical Standards Development: Establish national standards for chromatographic analysis methods, instrument qualification, and analytical data integrity that ensure reproducible results across laboratory networks.

Export Promotion for Domestic Manufacturers: Support domestic analytical instrument manufacturers through export credit facilities, international standards certification assistance, and participation in global scientific trade exhibitions.

How Scientific Organizations Could Standardize Analytical Practices?

Method Development and Validation Standards: Create comprehensive guidelines for binary gradient method development, system suitability testing, and analytical method validation that ensure reproducible results across different laboratories.

Instrument Performance Specifications: Establish standardized performance criteria for pump precision, gradient accuracy, baseline stability, and detector sensitivity that enable objective system evaluation and procurement decisions.

Quality Assurance Protocols: Develop systematic approaches to instrument qualification, preventive maintenance, and performance verification that maintain analytical data quality and regulatory compliance.

Training and Competency Programs: Create certification programs for chromatography technicians and analytical chemists that ensure proper system operation, method development, and troubleshooting capabilities.

Inter-laboratory Collaboration: Facilitate method transfer and proficiency testing programs that demonstrate analytical consistency and build confidence in chromatographic results across different laboratory environments.

How Instrument Manufacturers Could Enhance Analytical Capabilities?

Precision Pump Technology: Develop advanced binary gradient pumps with improved flow precision, reduced pulsation, and enhanced solvent mixing capabilities that enable reproducible separation performance.

Intelligent System Integration: Integrate artificial intelligence and machine learning algorithms that optimize gradient programs, predict system maintenance needs, and automatically troubleshoot analytical problems.

Modular Design Architecture: Engineer modular chromatography systems that enable flexible configuration for different applications while facilitating component upgrades and maintenance accessibility.

Environmental Sustainability Features: Develop solvent recycling systems, reduced waste generation technologies, and energy-efficient operation modes that minimize environmental impact of analytical laboratories.

Remote Monitoring and Support: Implement cloud-based monitoring systems that enable remote diagnostics, predictive maintenance alerts, and expert technical support for optimal system performance.

How Laboratory End-Users Could Optimize Analytical Operations?

Method Development Excellence: Implement systematic approaches to binary gradient method development that optimize separation quality, analysis time, and solvent consumption for specific analytical requirements.

Preventive Maintenance Programs: Establish comprehensive maintenance schedules that maximize system uptime, extend component life, and ensure consistent analytical performance through proactive care.

Data Integrity and Compliance: Develop robust data management systems that ensure analytical data integrity, regulatory compliance, and audit trail documentation for pharmaceutical and environmental applications.

Cross-Training and Skill Development: Invest in comprehensive training programs that enable laboratory personnel to operate multiple chromatography systems and troubleshoot analytical challenges effectively.

Analytical Efficiency Optimization: Implement workflow optimization strategies that maximize sample throughput, minimize analytical costs, and improve laboratory productivity through systematic process improvement.

How Financial Partners Could Support Market Development?

Laboratory Equipment Financing: Provide specialized financing solutions for analytical instrument purchases, including lease arrangements that enable regular technology upgrades and maintain analytical competitiveness.

Research and Development Investment: Fund development of next-generation chromatography technologies, including ultra-high pressure systems, green analytical methods, and automated sample preparation integration.

Laboratory Infrastructure Development: Support establishment of analytical service laboratories and contract research organizations that expand access to advanced chromatographic capabilities.

Technology Transfer Financing: Facilitate financing for technology transfer from research institutions to commercial analytical instrument manufacturers, supporting innovation commercialization.

Global Market Expansion Capital: Provide growth capital for analytical instrument manufacturers expanding into emerging markets with developing pharmaceutical, chemical, and environmental testing sectors.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 306.2 million |

| Product Type | Series Pumps, Parallel Pumps, Integrated Systems |

| Application | Chemical Industry, Pharmaceuticals, Environmental Science, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Shimazu, Beijing LabTech Instruments Co., Ltd., Shanghai Sanotac Scientific Instruments Co., Ltd., Agilent, TECOTEC Group, Shanghai Wufeng Scientific Instrument Co., Ltd., Acchrom Tech, Inscinstech, Waters Corporation, Sykam, Wayeal |

| Additional Attributes | Dollar sales by product type and application categories, regional analytical instrumentation demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established instrument manufacturers and specialized pump technology providers, adoption patterns across pharmaceutical and environmental analytical applications, integration with laboratory information management systems and automated analytical workflows, innovations in pump technology and gradient control systems, and development of miniaturized systems with enhanced precision and operational efficiency characteristics for diverse analytical separation requirements. |

The global binary high pressure gradient liquid chromatography system market is estimated to be valued at USD 306.2 million in 2025.

The market size for the binary high pressure gradient liquid chromatography system market is projected to reach USD 503.6 million by 2035.

The binary high pressure gradient liquid chromatography system market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in binary high pressure gradient liquid chromatography system market are series pumps and parallel pumps.

In terms of application, pharmaceuticals segment to command 50.0% share in the binary high pressure gradient liquid chromatography system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Performance Liquid Chromatography-Tandem Mass Spectrometry System Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

High Integrity Pressure Protection System Market

High Pressure Grease Hose Market Size and Share Forecast Outlook 2025 to 2035

High Pressure Grinding Rollers Market Size and Share Forecast Outlook 2025 to 2035

High Pressure Processing (HPP) for Rice and Grain Market Size and Share Forecast Outlook 2025 to 2035

High Pressure Washer Market Size and Share Forecast Outlook 2025 to 2035

High Pressure Seal Market Growth - Innovations, Trends & Forecast 2025 to 2035

High Pressure Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

High Pressure Pumps Market Size, Growth, and Forecast 2025 to 2035

High-Pressure Booster Market Growth – Trends & Forecast 2024-2034

High Pressure Heat Exchanger Market

High Pressure Oil and Gas Separator Market

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Liquid Flavour System Market Insights - Applications & Demand 2025 to 2035

Quartz High-Pressure Sensors Market Size and Share Forecast Outlook 2025 to 2035

High Purity Process Systems for Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Volume Loop Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Nitrogen Purge Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA