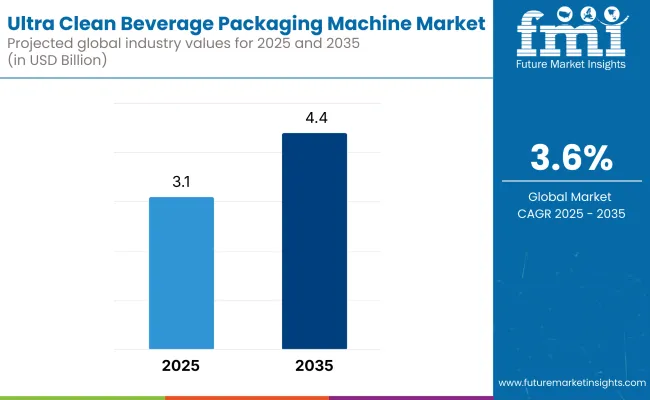

The ultra clean beverage packaging machine market is expected to grow from USD 3.1 billion in 2025 to USD 4.4 billion by 2035, resulting in a total increase of USD 1.3 billion over the forecast decade. This represents a 41.9% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 3.6%. Over ten years, the market grows by a 1.4 multiple.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.1 billion |

| Industry Value (2035F) | USD 4.4 billion |

| CAGR (2025 to 2035) | 3.6% |

In the first five years (2025-2030), the market progresses from USD 3.1 billion to USD 3.7 billion, contributing USD 0.6 billion, or 46.2% of total decade growth. This phase is shaped by increasing adoption in dairy, juice, and plant-based beverage sectors, driven by the need for extended shelf life without chemical preservatives. The market benefits from demand for aseptic and hygiene-intensive filling lines, particularly in Europe and Japan, where regulatory stringency is highest.

In the second half (2030-2035), the market grows from USD 3.7 billion to USD 4.4 billion, adding USD 0.7 billion, or 53.8% of the total growth. This acceleration is supported by smart factory integration, including automated CIP/SIP systems, HEPA-filtered enclosures, and IoT-enabled diagnostics. The rise of RTD functional beverages and probiotic drinks amplifies the need for ultra-clean sealing and contamination-free filling, making this segment central to premium beverage packaging innovation.

From 2020 to 2024, the ultra clean beverage packaging machine market grew from USD 2.6 billion to USD 2.9 billion, driven by hardware-centric adoption across dairy, juice, and functional beverage segments where extended shelf life and aseptic processing are critical. During this period, the competitive landscape was dominated by OEM manufacturers controlling nearly 70% of total revenue, with leaders such as Krones AG, KHS Group, Coesia S.p.A., and SIG focusing on high-speed, ultra-hygienic systems integrated with cleanroom standards and validated sterilization modules.

Competitive differentiation relied on microbiological safety assurance, CIP/SIP automation, and high throughput rates, while data-driven features were bundled as secondary add-ons rather than standalone revenue streams. Service-based models including sterilization audits and process recalibration accounted for less than 10% of the total market value during this time, with most beverage producers opting for capital investment over OPEX-driven models.

Demand for ultra clean beverage packaging machines will expand to USD 4.4 billion in 2035, and the revenue mix will shift as software analytics, condition-based maintenance, and sterile packaging-as-a-service offerings grow to over 40% share. Traditional machine manufacturers face rising competition from integrated solution providers offering remote sanitation monitoring, cleanroom-ready predictive diagnostics, and AI-enabled fill integrity validation.

Major players are pivoting to hybrid models by embedding advanced sterilization mapping, digital twin platforms, and IoT-enabled production traceability. Emerging entrants such as IMA Group, Serac Group, SACMI GROUP, GEA Group, Elopak Group, and BW Packaging are gaining share by specializing in multi-material compatibility, modular aseptic configurations, and sustainability-aligned hygienic packaging solutions.

The increasing demand for extended shelf life, preservative-free beverages, and aseptic processing is driving the growth of the ultra clean beverage packaging machine market. These machines ensure high levels of hygiene and microbial control during filling and sealing, making them ideal for juices, dairy alternatives, low-acid beverages, and functional drinks. Regulatory shifts toward food safety compliance and consumer preferences for minimally processed beverages are further accelerating adoption.

Machines integrated with sterilization modules, HEPA filtration, and cleanroom-compatible filling zones have gained popularity due to their ability to achieve up to log-4 microbial reduction without using harsh chemicals. Their compact footprint, fast changeover capabilities, and compatibility with lightweight bottles and caps also appeal to sustainable packaging initiatives in the beverage industry.

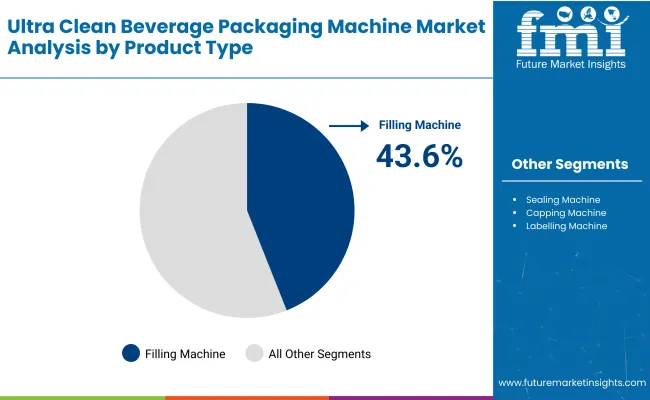

The market is segmented by machine, packaging type, beverage type, capacity, and region. Machine segmentation includes filling machines, sealing machines, capping machines, labelling machines, inspection & quality control machines, and complete packaging lines each supporting different stages of ultra-clean packaging workflows for liquid beverages.

Packaging type covers bottles (PET bottles, glass bottles, HDPE bottles), cans (aluminium, steel), cartons (paper-based aseptic, non-aseptic), pouches (single-layer plastic pouches, multi-layered laminated pouches), and bag-in-box packaging (plastic-based and aluminium-lined), offering sterile and efficient formats for a wide range of beverage categories.

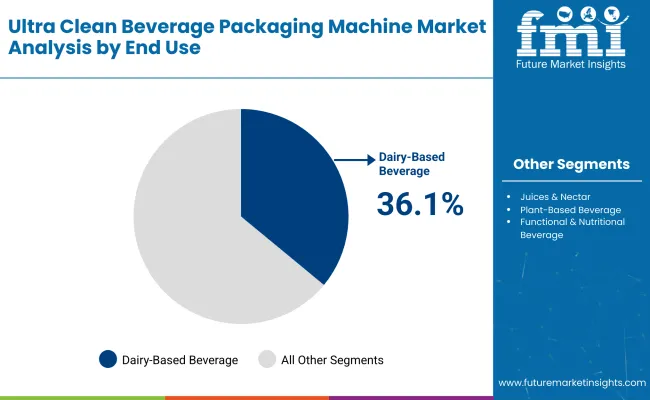

Beverage type includes dairy-based beverages (milk, flavoured milk, drinkable yogurt, lactose-free options), juices & nectars (fresh, pasteurized & aseptic, concentrated), plant-based beverages (almond, soy, oat, coconut, rice milk), functional & nutritional beverages (protein shakes, meal replacement drinks, probiotic & fermented drinks), carbonated soft drinks (flavoured sodas, energy drinks, sports drinks), and bottled water (still, sparkling, flavoured), addressing growing demand for hygienic, preservative-free, and functional drink options.

Capacity segmentation includes up to 5,000 bottles per hour (BPH), 5,000-10,000 BPH, 10,000-20,000 BPH, and above 20,000 BPH, reflecting machine scalability based on production volume and throughput needs. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The filling machines segment is forecast to dominate the market with a 43.6% share in 2025, driven by the increasing demand for high-speed, contamination-free liquid transfer systems. These machines form the core of ultra clean packaging lines as they integrate advanced aseptic technologies, HEPA-filtered environments, and CIP/SIP (Clean-in-Place/Sterilize-in-Place) capabilities, which reduce microbial risks during bottling operations.

The rise of functional beverages, probiotics, and dairy-based drinks with limited shelf life has heightened the need for ultra-hygienic conditions during the filling phase.

Dairy-based beverages are projected to account for a 36.1% share of the market in 2025, as they require sterile packaging processes to ensure product stability, nutritional preservation, and extended shelf life. This category includes milk, flavored milk, yogurt drinks, protein shakes, and other perishable products that are highly susceptible to bacterial contamination and oxidation.

Ultra clean packaging systems cater to these needs by incorporating hermetic sealing, contactless filling, and container sterilization techniques.

Bottles are expected to lead the market by packaging type with a 44.5% share in 2025, owing to their widespread consumer familiarity, reusability, and visual shelf appeal. In ultra clean packaging lines, bottles are preferred for their ability to withstand sterilization processes such as hydrogen peroxide vapor, UV irradiation, and hot air treatment. This makes them ideal for maintaining aseptic conditions during dairy, juice, and nutraceutical beverage packaging.

Bottles also provide greater flexibility for labeling, portion sizing, and on-the-go consumption.

Packaging machines with 10,000-20,000 bottles per hour (BPH) capacity are forecast to hold a 42.5% market share in 2025, making them the preferred choice for mid-to-large scale beverage producers seeking optimal throughput and efficiency. This capacity range offers a balance between cost-efficiency and production flexibility, especially in plants handling multiple SKUs, seasonal volumes, or short-run premium beverages.

With evolving consumer preferences, brands are increasingly launching new beverage variants in diverse bottle formats, requiring packaging systems that offer rapid changeovers and minimal downtime.

Operational complexity and high capital requirements hinder widespread adoption, even as demand rises across dairy, functional beverages, and plant-based drinks for ultra-hygienic, low-contamination packaging systems that extend shelf life without preservatives or cold chain dependence.

Stringent Hygiene Requirements and Shelf-life Optimization Driving Adoption

Ultra clean beverage packaging machines are gaining traction in sectors where product sterility, freshness, and extended shelf stability are critical. Dairy-based beverages, functional drinks with probiotics, and ready-to-drink (RTD) plant-based formulations often require sterile or near-aseptic filling to avoid spoilage. Ultra clean systems offer a cost-effective alternative to full aseptic processing, combining HEPA filtration, sterile zones, and contactless filling to reduce microbial load while preserving product integrity.

These systems are ideal for small to mid-sized manufacturers seeking balance between hygiene compliance and operational efficiency. As clean-label trends accelerate and refrigeration-independent distribution becomes more viable, ultra clean machines provide the required packaging precision without the complexity of full aseptic infrastructure.

Capital Investment, Format Limitations, and Line Integration Challenges

Despite strong market interest, ultra clean beverage packaging machines face adoption barriers due to their high upfront cost and system sophistication. The equipment requires specialized clean-room integration, air filtration systems, and frequent sterilization cycles raising both capital and operational expenses. Additionally, compatibility across varying bottle shapes, caps, and closure systems is often restricted by the clean zone’s configuration.

Integrating these machines into existing filling lines may require major retrofits or infrastructure upgrades. Moreover, training staff for proper sanitation protocols and maintaining microbiological validation records adds further compliance pressure, particularly in export-oriented facilities. These factors slow adoption, especially among small bottlers or companies operating in highly fragmented markets.

Compact Modular Systems and Energy-efficient Cleanroom Technologies Emerging

A major trend in this market is the development of compact, modular ultra clean systems that combine flexible layout design with high-speed functionality. Equipment manufacturers are incorporating servo-driven actuators, CIP/SIP automation, and adaptive cleanroom zoning that minimizes air and energy consumption without compromising sterility. Integrated diagnostics and real-time microbial sensors are being introduced to monitor critical control points, reducing manual intervention and validation cycles.

Additionally, the rise of plant-based and additive-free beverages is pushing packaging innovation toward transparent bottles and lightweight containers that demand delicate, hygienic handling. These trends are transforming ultra clean packaging from a niche compliance solution into a core technology driving beverage innovation, export readiness, and sustainability-aligned operations.

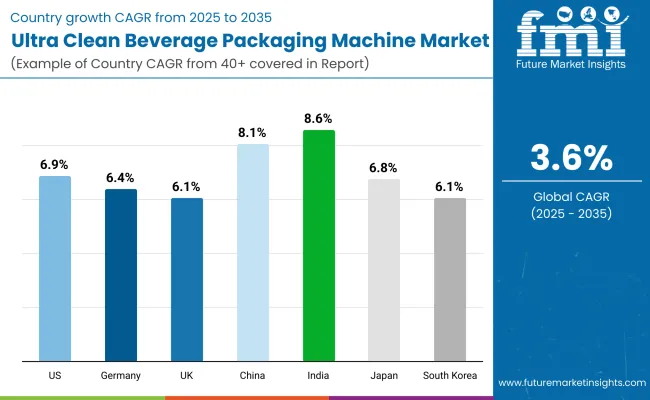

The global ultra clean beverage packaging machine market is expanding steadily, driven by stringent hygiene regulations, the rise in ready-to-drink (RTD) beverages, and extended shelf-life demands. Asia-Pacific is emerging as a lucrative region, with India and China leading growth due to increasing investments in food safety infrastructure and automation. Developed markets like the USA, Germany, and Japan continue to innovate in aseptic filling and high-speed packaging systems, integrating cleanroom technology with robotic modules to meet FDA, EU, and ISO standards.

The USA market is projected to grow at a CAGR of 6.9% from 2025 to 2035. Growth is driven by increasing demand for sterile filling systems in dairy, plant-based beverages, and functional drinks. Equipment manufacturers are introducing fully enclosed, CIP/SIP-compliant machines to meet FDA safety benchmarks. High demand from premium beverage brands is pushing the development of robotic arms and real-time monitoring systems integrated into packaging lines.

Germany’s market is expected to grow at a CAGR of 6.4%, anchored by its advanced beverage manufacturing ecosystem. Demand for hygienic, enclosed packaging lines is rising in response to stricter EU regulations on microbial safety and food contact materials. German engineering firms are developing modular ultra clean systems tailored for juice, probiotic drinks, and non-alcoholic segments.

The UK market is projected to expand at a CAGR of 6.1%, supported by rising premiumization of non-alcoholic beverages and ready-to-drink health drinks. Smaller manufacturers are adopting pre-assembled clean filling units to comply with FSMA and allergen control standards. Startups in functional beverages are driving demand for versatile, compact, and rapid-clean packaging machines.

China is forecast to witness strong growth at a CAGR of 8.1%, driven by government-led food safety initiatives and expansion of the domestic health drink industry. OEMs are localizing ultra clean technologies with HEPA filtration, UV tunnels, and steam sterilization modules. Growth in cold-chain logistics further enables adoption of sterile filling lines across inland beverage manufacturing hubs.

India is the fastest-growing market with a projected CAGR of 8.6%, underpinned by rapid expansion in health-based beverages, dairy, and probiotic drinks. Demand for packaging solutions with low microbial load is increasing due to rising export of ready-to-drink products. Small and medium manufacturers are shifting to closed aseptic systems to meet FSSAI and export standards.

Japan is projected to grow at a CAGR of 6.8%, with beverage manufacturers focusing on ultra clean packaging for nutraceuticals, enzyme drinks, and fermented beverages. Aging population demands sterile, low-acid beverage formats, driving investment in precision filling and HEPA-sealed systems. Innovation in packaging for personalized nutrition and functional wellness drinks supports sustained growth.

South Korea’s market is expected to grow at a CAGR of 6.1%, led by demand in wellness drinks, ginseng-based beverages, and export-grade RTD teas. Ultra clean packaging ensures low bioburden, flavor integrity, and longer shelf stability. Korean manufacturers are combining packaging machines with smart control systems and cleanroom-grade filling lines.

The ultra clean beverage packaging machine market is moderately fragmented, with global packaging system integrators, aseptic line specialists, and modular machine builders competing across dairy, juice, plant-based, and functional beverage applications.

Global leaders such as Krones AG, SIG, and KHS Group hold significant market share, driven by advanced aseptic filling technologies, HEPA-filtered environments, and packaging integrity systems that meet ISO 22000 and EHEDG hygiene standards. Their strategies increasingly emphasize high-speed performance, integrated CIP/SIP automation, and format-flexibility across PET, carton, and pouch platforms.

Established mid-sized players including IMA Group, Serac Group, and Coesia S.p.A. are supporting adoption of modular ultra clean lines featuring servo-driven capping, H2O2-based sterilization, and contactless filling nozzles. These companies are especially active in premium dairy, probiotic drinks, and meal replacement packaging, offering inline testing systems, laminar airflow units, and compatibility with low-acid beverages.

Specialized equipment providers such as SACMI GROUP, GEA Group, Elopak Group, and BW Packaging focus on tailored solutions for regional bottlers and mid-cap producers. Their strengths lie in modular customization, energy-efficient sterilization units, and integration with secondary packaging and robotics systems for tray packing and end-of-line automation.

Key Development of Ultra Clean Beverage Packaging Machine Market

| Item | Value |

|---|---|

| Quantitative Units | USD 3.1 Billion |

| By Machine | Filling Machines, Sealing Machines, Capping Machines, Labelling Machines, Inspection & Quality Control Machines, and Complete Packaging Line |

| By Packaging Type | Bottles (PET Bottles, Glass Bottles, HDPE Bottles), Cans (Aluminium, Steel), Cartons (Paper-Based Aseptic, Non-aseptic), Pouches (Single-layer Plastic Pouches, Multi-Layered Laminated Pouches), and Bag-in-Box Packaging (Plastic-Based Bag-in-Box, Aluminium -Lined Bag-in-Box) |

| By Beverage Type | Dairy-Based Beverages (Milk, Flavoured Milk, Drinkable Yogurt, Lactose-Free Dairy Beverages), Juices & Nectars (Fresh Juices, Pasteurized & Aseptic Juices, Concentrated Juices), Plant-Based Beverages (Almond Milk, Soy Milk, Oat Milk, Coconut Milk, Rice Milk), Functional & Nutritional Beverages (Protein Shakes, Meal Replacement Drinks, Probiotic & Fermented Beverages), Carbonated Soft Drinks (CSDs) (Flavoured Sodas, Energy Drinks, Sports Drinks), and Bottled Water (Still Water, Sparkling Water, Flavoured Water) |

| By Capacity | Up to 5,000 Bottles per Hour (BPH), 5,000-10,000 BPH, 10,000-20,000 BPH, and Above 20,000 BPH |

| Key Companies Profiled | Krones AG, KHS Group, Coesia S.p.A., SIG, IMA Group, Serac Group, SACMI GROUP, GEA Group, Elopak Group, and BW Packaging |

| Additional Attributes | Surge in demand for hygienic filling technologies in sensitive beverages, integration of inline quality inspection for aseptic assurance, use of HEPA filtration and UV sterilization systems in dairy packaging, widespread adoption of PET and multi-layer pouch formats in juice and functional drinks, growing demand for small-batch and lactose-free line configurations, automation in high-speed packaging lines for bottled water and CSDs, increasing use of modular systems for flexible format changes, rapid adoption in emerging markets for probiotic and oat-based beverages, expansion of cleanroom-compatible filling systems, and focus on sustainability via lightweight PET and aseptic carton technology |

The global ultra clean beverage packaging machine market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the ultra clean beverage packaging machine market is projected to reach USD 4.4 billion by 2035.

The ultra clean beverage packaging machine market is expected to grow at a CAGR of 3.6% between 2025 and 2035.

The key packaging types in the ultra clean beverage packaging machine market include bottles, cartons, pouches, and cans used across dairy, juice, and functional beverage industries.

The filling machines segment is expected to account for the highest share of 43.6% in the ultra clean beverage packaging machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ultra-low Temperature Cooling Fan Market Size and Share Forecast Outlook 2025 to 2035

Ultra-low Temperature Air Source Heat Pump Units Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Conductivity Gels Market Size and Share Forecast Outlook 2025 to 2035

Ultra Short Base Line (USBL) Positioning Systems Market Size and Share Forecast Outlook 2025 to 2035

Ultra-Low Temperature Perfluoroelastomer Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Market Size and Share Forecast Outlook 2025 to 2035

Ultra High Bond (UHB) Tape Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Skin Tightening Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultralight Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Ultra High Purity (UHP) Valve Market Size and Share Forecast Outlook 2025 to 2035

Ultraviolet Transilluminator Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Ultra-Fine Ath Market Size and Share Forecast Outlook 2025 to 2035

Ultra High Precision Power Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Ultra-thin Temperature Plate Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic NDT Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ultra Wideband Anchor and Tags Market Size and Share Forecast Outlook 2025 to 2035

Ultra-High Definition (UHD) Panel (4K) Market Size and Share Forecast Outlook 2025 to 2035

Ultrapure Water Market Size and Share Forecast Outlook 2025 to 2035

Ultra High Performance Concrete Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Air Bubble Detectors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA