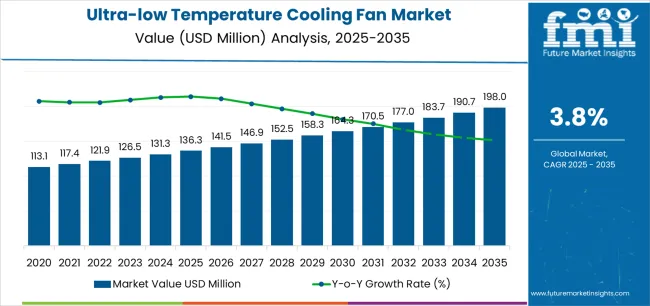

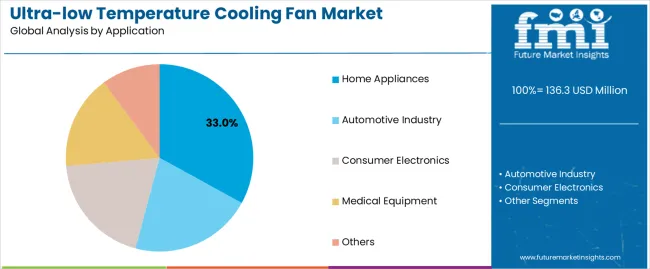

The ultra-low temperature cooling fan market is set to grow from USD 136.3 million in 2025 to USD 198.0 million by 2035, reflecting a 3.8% CAGR. Growth is driven by increasing demand for cooling systems in cold storage, cryogenic processing, and laboratory applications. The -50°C to -60°C range leads the market, accounting for 62% of the market share due to its reliability and suitability for ultra-cold environments. The home appliances segment is the dominant application, capturing 33% of the market.

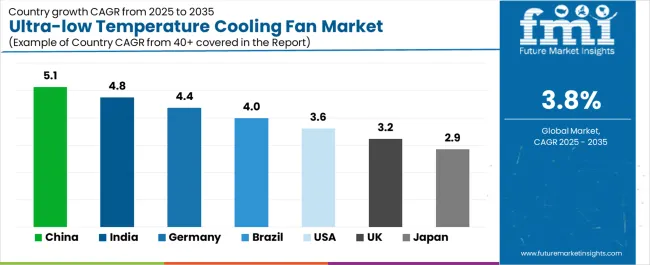

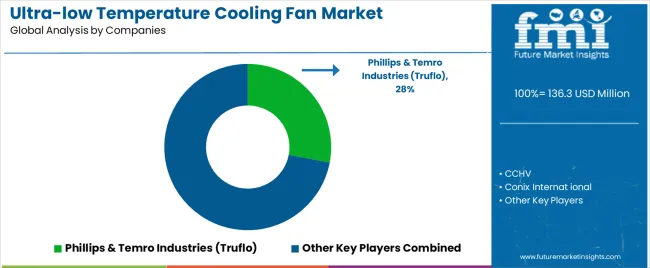

China leads the market with an 8.2% CAGR, followed by India at 7.6% and Germany at 7.0%. The United States and the United Kingdom are expected to see steady growth at 5.8% and 5.2%, respectively, due to strong R&D and modernization efforts in cryogenic and medical applications. Phillips & Temro Industries (Truflo) holds a 28% market share, leading innovation in sub-zero environments, followed by CCHV and Conix International. Key trends include energy-efficient designs, modular cooling systems, and the growing role of smart sensors for real-time monitoring.

The growth rate volatility index for this market is expected to remain low, reflecting stable but gradual expansion across the decade. From 2025 to 2028, moderate volatility will occur due to fluctuations in demand from laboratory refrigeration, cryogenic storage, and semiconductor cooling applications. Short-term variations in research funding and industrial equipment procurement cycles will slightly influence annual growth rates during this early phase.

Between 2029 and 2035, the volatility index is expected to decline as the market achieves a more predictable growth rhythm. Advances in energy-efficient motor systems, coupled with consistent adoption of low-noise, high-reliability fans, will contribute to steadier year-on-year performance. The increasing use of these fans in biomedical storage and electronic testing facilities will create a dependable demand base, minimizing cyclical disruptions. The market demonstrates a low volatility profile, with consistent growth supported by technological reliability, energy optimization, and stable downstream applications in scientific and industrial environments.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 136.3 million |

| Market Forecast Value (2035) | USD 198.0 million |

| Forecast CAGR (2025-2035) | 3.8% |

The ultra-low temperature cooling fan market is growing as industries increasingly demand thermal-management solutions that operate reliably in extreme cold environments, such as cryogenic systems, aerospace equipment and semiconductor-test chambers. Many applications require stable airflow under very low ambient or internal temperatures to maintain component performance and structural integrity. Technological improvements in bearings, materials and motor controls enable fans to function at temperatures far below conventional limits, supporting thermal reliability for precision instrumentation and cold-chain systems. Growth is further driven by expanding sectors like quantum computing, high-vacuum research labs and deep-space instruments, which require compact fans that withstand ultra-low temperature conditions without performance degradation.

Rising adoption of environmentally friendly refrigerants and higher energy-efficiency requirements also push manufacturers to design fans tailored for chilled systems and very-low-temperature cooling loops. Constraints include higher production cost of specialized fans rated for ultra-low temperature operation, limited supplier base for low-temperature-rated components and the relatively niche volume compared to general cooling fans, which may restrain broad-scale adoption in cost-sensitive segments.

The ultra-low temperature cooling fan market is segmented by classification and application. By classification, the market is divided into -50℃ to -60℃ and below -60℃ operating temperature categories. Based on application, it is categorized into home appliances, automotive industry, consumer electronics, medical equipment, and other industrial uses. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The -50℃ to -60℃ segment holds the leading position in the ultra-low temperature cooling fan market, representing approximately 62.0% of the total share in 2025. This category includes cooling fans designed to operate reliably under extreme sub-zero conditions while maintaining consistent airflow, low vibration, and stable bearing performance. These fans are widely utilized in laboratory refrigeration systems, cryogenic storage units, industrial freezers, and specialized cooling modules for temperature-sensitive environments.

The dominance of this segment is driven by its balanced combination of cost efficiency, durability, and adaptability across various applications requiring robust thermal management. Fans in this temperature range offer optimized motor insulation, anti-freeze lubricants, and materials engineered to resist thermal contraction, ensuring extended operational life. The below -60℃ segment, while smaller, is gradually expanding in high-end cryogenic research and defense applications that demand extreme cold endurance and precision cooling under specialized configurations.

Key factors supporting the -50℃ to -60℃ segment include:

The home appliances segment accounts for approximately 33.0% of the ultra-low temperature cooling fan market in 2025. This share reflects the extensive integration of sub-zero cooling fans in domestic refrigeration, deep-freeze systems, and smart cooling appliances designed for consistent performance under varying ambient conditions. The segment’s growth is supported by rising consumer demand for energy-efficient, low-noise, and long-life cooling solutions across residential appliances.

The automotive industry represents the second-largest application area, where these cooling fans are used in battery temperature control units, advanced driver-assistance systems (ADAS), and under-hood thermal management modules for electric and hybrid vehicles. Consumer electronics and medical equipment applications follow, driven by the increasing use of compact cooling systems in high-performance electronic components and laboratory-grade medical devices.

Primary dynamics driving demand from the home appliances segment include:

Demand for specialized cooling in extreme environments, miniaturized high-tech applications, and enhanced thermal-management needs are fuelling growth.

The ultra-low temperature cooling fan market is driven by expanding requirements in telecom base stations, scientific instrumentation, aerospace electronics and cryogenic systems that operate under sub-zero or ultra-low ambient conditions. As device densities increase and heat-flux rises, cooling fans capable of reliable performance at low temperatures become critical. Advances in bearing systems, small-diameter brushless motors and materials rated for cold environments enhance system robustness and open applications in data centres located in cold climates, high-altitude platforms and outdoor cabinets. Supply-chain focus on reliability under thermal stress also supports greater adoption of these specialty cooling solutions.

Higher cost, reliability issues under extreme cold, and niche segmented demand limit scale.

Cooling fans rated for ultra-low temperature use involve premium components such as low-temperature bearings, special lubricants and cold-rated motor windings, which elevate manufacturing cost relative to standard fans. Performance under ultra-low ambient temperatures can degrade due to lubricant thickening or condensation risk, thereby reducing reliability in harsh environments. Also, the addressable market remains relatively narrow, such fans are required primarily in specialised equipment rather than mass consumer devices, restricting economies of scale and slowing cost-ratio improvements.

Modular cold-rated fan solutions, growth in remote/edge-site cooling, and expansion into emerging geographies define market direction.

Manufacturers are increasingly offering modular, plug-and-play ultra-low temperature cooling fans with standardized mounting and electrical interfaces to support rapid deployment in field systems and harsh-environment enclosures. There is strong growth in remote site infrastructure such as telecom towers in cold regions, outdoor 5G cabinets and edge data centres, which drives demand for fans rated for low-temperature starts and sustained operation under −40 °C or lower. Regionally, growth is gaining momentum in regions such as Northern Europe, Russia and North America where outdoor equipment must operate reliably year-round, prompting suppliers to optimise designs for cold-climate performance and integrate predictive-maintenance sensor modules.

The global ultra-low temperature cooling fan market is expanding steadily through 2035, supported by technological advancements in thermal management, growth in semiconductor manufacturing, and increasing demand for precision-controlled refrigeration systems. China leads with an 8.2% CAGR, followed by India at 7.6%, driven by industrial automation and electronic component production. Germany grows at 7.0%, reflecting innovation in cryogenic equipment and engineering design. Brazil records 6.4%, supported by emerging cold storage infrastructure. The United States shows 5.8% growth, emphasizing R&D-led performance innovation, while the United Kingdom (5.2%) and Japan (4.6%) demonstrate steady adoption through precision cooling system modernization and high-quality component manufacturing.

| Country | CAGR (%) |

|---|---|

| China | 5.1 |

| India | 4.8 |

| Germany | 4.4 |

| Brazil | 4.0 |

| USA | 3.6 |

| UK | 3.2 |

| Japan | 2.9 |

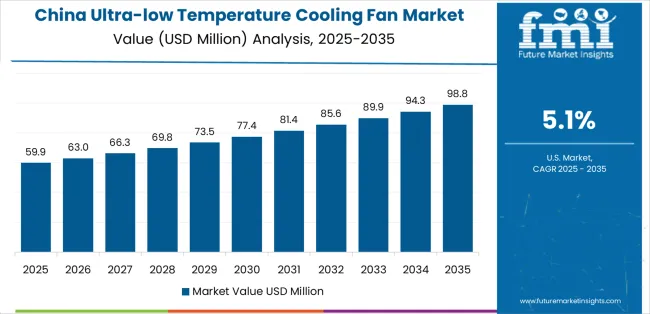

China’s ultra-low temperature cooling fan market grows at 8.2% CAGR, driven by rapid industrial expansion and advancements in refrigeration, cryogenic systems, and semiconductor equipment. The government’s investments in electronic manufacturing zones and biopharmaceutical cold chain networks have accelerated adoption of precision cooling systems. Domestic manufacturers are producing high-performance fans capable of maintaining consistent thermal stability under ultra-low temperature conditions. Technological collaborations between Chinese equipment producers and international cooling system providers are enhancing product design and efficiency. The market benefits from growing applications in medical storage, data centers, and advanced industrial processes.

Key Market Factors:

India’s market grows at 7.6% CAGR, supported by industrial modernization, expansion of healthcare cold chains, and electronic assembly development. The National Electronics Policy and Production Linked Incentive (PLI) schemes are fostering local manufacturing of cooling components. Indian companies are adopting advanced motor control technologies and high-efficiency fan designs for laboratory, pharmaceutical, and industrial applications. The growth of food preservation and logistics sectors is increasing demand for low-temperature air handling systems. Collaborations between domestic manufacturers and international technology suppliers are improving energy performance and reducing production costs.

Market Development Factors:

Germany’s market grows at 7.0% CAGR, supported by strong engineering expertise and emphasis on high-precision cooling solutions. Manufacturers are integrating advanced materials, such as composite fan blades and thermally optimized alloys, to improve performance under cryogenic conditions. The country’s R&D initiatives in renewable energy storage and semiconductor fabrication have increased demand for controlled cooling environments. Regulatory focus on energy efficiency and environmental standards under EU directives promotes innovation in fan design. Collaboration between research institutions and industrial automation firms supports development of low-noise, high-reliability cooling systems.

Key Market Characteristics:

Brazil’s market grows at 6.4% CAGR, supported by growing investments in cold storage infrastructure, food processing, and biotechnology facilities. The adoption of ultra-low temperature systems in pharmaceutical logistics and vaccine storage has accelerated since healthcare modernization programs. Domestic distributors are partnering with global cooling technology providers to introduce reliable, high-performance fans. The government’s incentives for industrial refrigeration and logistics infrastructure development continue to support market growth. Expanding agricultural exports are also stimulating demand for efficient cooling solutions with consistent low-temperature performance.

Market Development Factors:

The United States grows at 5.8% CAGR, supported by advancements in cryogenics, biomedical research, and semiconductor fabrication. The country’s manufacturers are investing in precision-engineered cooling fans with high-speed motor efficiency and reduced noise levels. The development of data centers, laboratory storage systems, and low-temperature testing chambers sustains market growth. Federal funding for energy-efficient cooling technologies and smart automation systems strengthens innovation capacity. Collaboration between equipment producers and research institutions is enabling the creation of next-generation thermal management platforms with superior airflow dynamics and digital control capabilities.

Key Market Factors:

The United Kingdom’s market grows at 5.2% CAGR, driven by the adoption of smart cooling solutions and growth in life sciences research infrastructure. Cooling fan manufacturers are focusing on compact, low-vibration designs optimized for laboratory and cryogenic use. The government’s investments in healthcare and data center development are creating sustained demand for high-precision cooling components. Partnerships with European engineering firms are facilitating innovation in material composition and acoustic performance. The country’s focus on carbon-neutral industrial operations supports deployment of energy-optimized thermal management systems.

Market Development Factors:

Japan’s market grows at 4.6% CAGR, reflecting the country’s commitment to precision engineering and compact cooling technologies. Domestic manufacturers are designing ultra-reliable fans for semiconductor testing, medical refrigeration, and optical equipment. The integration of robotics and IoT-based performance monitoring enhances operational stability. Japan’s industrial policies promoting carbon reduction and manufacturing automation support innovation in advanced thermal systems. Continuous R&D in low-noise fan design, airflow efficiency, and temperature regulation ensures reliability in high-value manufacturing environments. The market benefits from Japan’s sustained export of precision cooling components across Asia-Pacific.

Market Characteristics:

The ultra-low temperature cooling fan market is a niche but technologically demanding segment within the broader thermal management industry. Phillips & Temro Industries (Truflo) holds the leading position with an estimated 28.0% global market share, driven by its extensive engineering expertise in low-temperature air movement systems and proven performance in industrial, energy, and automotive applications. The company’s leadership is reinforced by its proprietary blade design technology, material durability in sub-zero environments, and long-standing OEM partnerships.

CCHV serves as a strong competitor, focusing on customized cooling fan assemblies for cryogenic, refrigeration, and laboratory equipment manufacturers. Its competitiveness is based on precision engineering, energy-efficient motor integration, and consistent reliability under extreme thermal stress. Conix International operates as a smaller but agile participant, targeting research, medical, and defense sectors that require compact, high-tolerance cooling systems for temperature-sensitive components.

Competition in this market is primarily defined by thermal performance stability, noise control, and operational reliability across extreme environments. Product differentiation is achieved through innovations in motor insulation, aerodynamic optimization, and material adaptation for long operating life. Market expansion is driven by the increasing demand for cryogenic systems, deep-freeze logistics, and advanced laboratory equipment, where consistent low-temperature airflow and system efficiency are critical to performance and safety.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Classification | -50℃~-60℃, Below -60℃ |

| Application | Home Appliances, Automotive Industry, Consumer Electronics, Medical Equipment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Phillips & Temro Industries (Truflo), CCHV, Conix International |

| Additional Attributes | Dollar sales by classification and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of ultra-low temperature cooling system manufacturers; advancements in fan technologies for cryogenic and high-efficiency cooling; integration with medical, automotive, and electronics temperature control solutions. |

The global ultra-low temperature cooling fan market is estimated to be valued at USD 136.3 million in 2025.

The market size for the ultra-low temperature cooling fan market is projected to reach USD 198.0 million by 2035.

The ultra-low temperature cooling fan market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in ultra-low temperature cooling fan market are -50℃~-60℃ and below -60℃.

In terms of application, home appliances segment to command 33.0% share in the ultra-low temperature cooling fan market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ultra-low Temperature Air Source Heat Pump Units Market Size and Share Forecast Outlook 2025 to 2035

Ultra-Low Temperature Perfluoroelastomer Market Size and Share Forecast Outlook 2025 to 2035

Ultra-Low Temperature Freezers Market Size and Share Forecast Outlook 2025 to 2035

Temperature Controlled Pharmaceutical Packaging Solutions Market Forecast and Outlook 2025 to 2035

Temperature Monitoring Device Market Size and Share Forecast Outlook 2025 to 2035

Temperature Controlled Vaccine Packaging Market Size and Share Forecast Outlook 2025 to 2035

Temperature and Freshness Sensors Market Size and Share Forecast Outlook 2025 to 2035

Temperature Detection Screen Market Size and Share Forecast Outlook 2025 to 2035

Temperature Loggers Market Size, Share & Forecast 2025 to 2035

Temperature Controlled Pharma Packaging Market Size, Share & Forecast 2025 to 2035

Temperature Controlled Packaging Solution Market - Size, Share, and Forecast Outlook 2025 to 2035

Temperature Transmitter Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Temperature Controlled Packaging Solutions

Temperature Sensors Market Growth - Trends & Forecast 2025 to 2035

Temperature Controlled Pharmaceutical Container Market Analysis, Size, Share & Forecast 2024 to 2034

Temperature Controlled Packaging Boxes Market

Temperature Sensing Foley Catheter Market

Temperature Calibrator Market

5G Temperature-Compensated Crystal Oscillator (TCXO) Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Flexible Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA