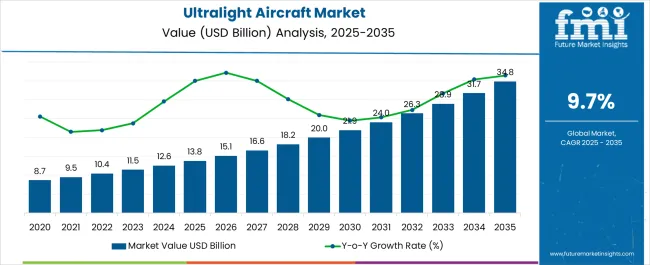

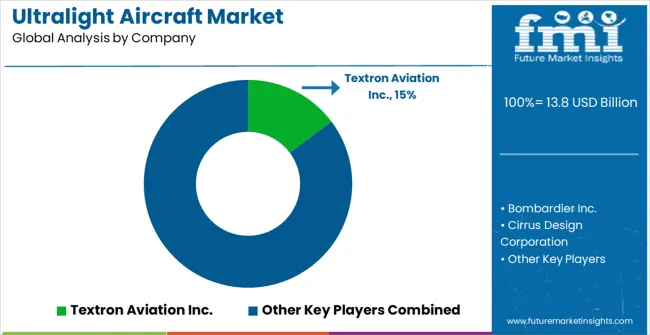

The Ultralight Aircraft Market is estimated to be valued at USD 13.8 billion in 2025 and is projected to reach USD 34.8 billion by 2035, registering a compound annual growth rate (CAGR) of 9.7% over the forecast period.

| Metric | Value |

|---|---|

| Ultralight Aircraft Market Estimated Value in (2025 E) | USD 13.8 billion |

| Ultralight Aircraft Market Forecast Value in (2035 F) | USD 34.8 billion |

| Forecast CAGR (2025 to 2035) | 9.7% |

The Ultralight Aircraft market is witnessing steady growth, driven by the rising demand for efficient, lightweight, and environmentally sustainable aviation solutions. Increasing adoption of electric propulsion systems, advancements in aerodynamics, and the growing interest in recreational and commercial ultralight aviation are fueling market expansion. The integration of electric engines has significantly enhanced operational efficiency, reduced noise levels, and lowered carbon emissions, aligning with global sustainability initiatives.

In addition, regulatory support and safety standards for ultralight aircraft are facilitating broader acceptance across both developed and emerging markets. Technological innovations in lightweight composite materials, battery energy density, and flight control systems are improving performance and range capabilities, further supporting adoption.

The increasing popularity of personal and commercial ultralight aircraft for tourism, training, and short-distance transport is creating new opportunities As the market evolves, continuous research, investment in infrastructure, and advancements in electric propulsion technologies are expected to sustain growth and strengthen the appeal of ultralight aircraft in the coming decade.

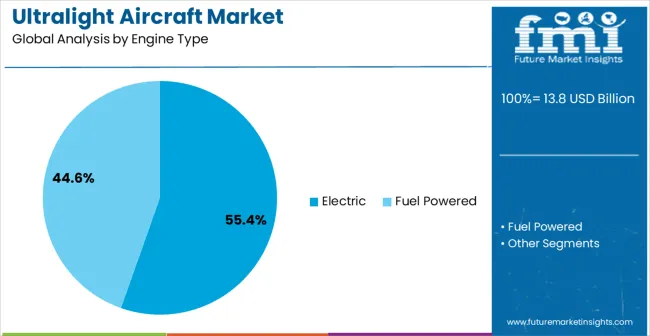

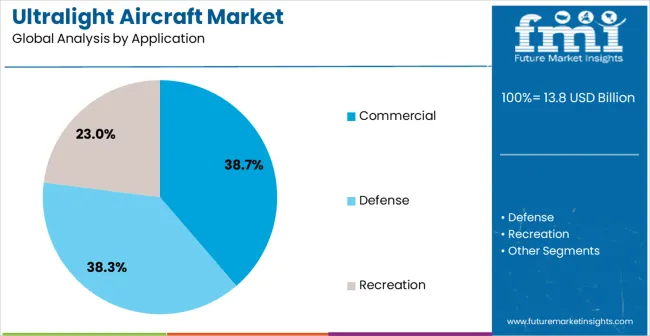

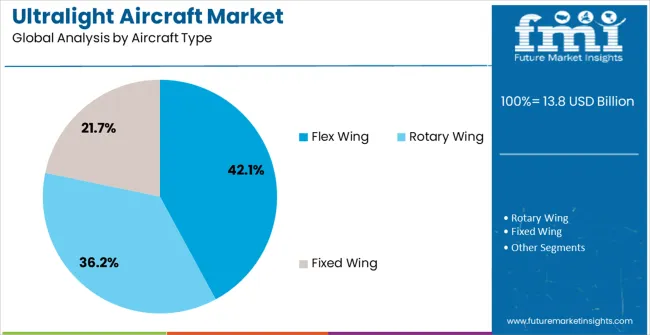

The ultralight aircraft market is segmented by engine type, application, aircraft type, and geographic regions. By engine type, ultralight aircraft market is divided into Electric and Fuel Powered. In terms of application, ultralight aircraft market is classified into Commercial, Defense, and Recreation. Based on aircraft type, ultralight aircraft market is segmented into Flex Wing, Rotary Wing, and Fixed Wing. Regionally, the ultralight aircraft industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The electric engine type segment is projected to hold 55.4% of the market revenue in 2025, establishing it as the leading propulsion system. Growth in this segment is driven by rising demand for environmentally friendly and cost-efficient aircraft solutions. Electric engines offer lower operational costs, reduced maintenance requirements, and enhanced energy efficiency compared to conventional combustion engines.

The ability to integrate high-capacity batteries and lightweight materials has improved flight range, reliability, and performance, making electric engines increasingly suitable for both recreational and commercial applications. Safety, regulatory compliance, and growing awareness of sustainable aviation practices are further strengthening adoption.

Continuous innovation in motor efficiency, battery technology, and flight control systems is enabling scalable deployment in various ultralight aircraft models As the aviation industry continues to focus on sustainability and operational efficiency, electric engines are expected to maintain their leadership position, supported by increasing interest from pilots, aviation clubs, and commercial operators seeking greener, high-performance ultralight solutions.

The commercial application segment is expected to account for 38.7% of the market revenue in 2025, making it the largest application category. Growth in this segment is being driven by the rising adoption of ultralight aircraft for short-distance transportation, aerial surveys, tourism, and training purposes. These aircraft offer operational flexibility, lower acquisition and running costs, and easier regulatory compliance compared to larger aircraft.

The integration of electric engines in commercial ultralight aircraft improves energy efficiency, reduces environmental impact, and enhances safety, aligning with industry trends toward sustainable aviation. Increasing investments by aviation operators, flight schools, and tourism companies in ultralight aircraft fleets are further supporting adoption.

Operational advantages such as shorter takeoff requirements, maneuverability, and reduced maintenance needs are making these aircraft highly attractive for commercial use As demand for efficient and environmentally responsible transportation grows, the commercial application segment is expected to remain a primary driver of revenue, supported by innovations in design, propulsion, and operational management.

The flex wing aircraft type segment is projected to hold 42.1% of the market revenue in 2025, establishing it as the leading aircraft type. Growth in this segment is being driven by the aerodynamic efficiency, maneuverability, and lightweight design characteristics of flex wing ultralight aircraft. These aircraft are particularly favored for recreational flying, training, and commercial aerial applications where operational flexibility and cost efficiency are critical.

The open-frame design allows for improved pilot visibility, ease of maintenance, and adaptability to electric propulsion systems, enhancing overall performance and appeal. Technological advancements in composite materials, control systems, and engine integration have further increased safety, reliability, and flight stability.

Rising interest in personal aviation experiences, tourism-based flying activities, and eco-friendly transport solutions is contributing to market adoption As pilots and operators increasingly prioritize efficiency, operational flexibility, and sustainability, the flex wing segment is expected to maintain its leadership position, supported by ongoing design innovation and the integration of high-performance electric propulsion systems.

Increasing interest in air sports such as aerial acrobatics has greatly put the emphasis on ultralight models of aircraft across the globe. In addition, ultralight aircraft are also finding increasing application in military operations owing to their role in reconnaissance procedures, on the front lines. Increasing emphasis by market players on aircraft regulations and technological advances is anticipated to boost the market during the forecast period.

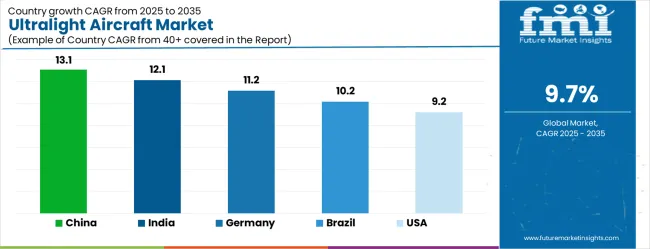

| Country | CAGR |

|---|---|

| China | 13.1% |

| India | 12.1% |

| Germany | 11.2% |

| Brazil | 10.2% |

| USA | 9.2% |

| UK | 8.2% |

| Japan | 7.3% |

The Ultralight Aircraft Market is expected to register a CAGR of 9.7% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 13.1%, followed by India at 12.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 7.3%, yet still underscores a broadly positive trajectory for the global Ultralight Aircraft Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 11.2%. The USA Ultralight Aircraft Market is estimated to be valued at USD 4.9 billion in 2025 and is anticipated to reach a valuation of USD 4.9 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 735.8 million and USD 461.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.8 Billion |

| Engine Type | Electric and Fuel Powered |

| Application | Commercial, Defense, and Recreation |

| Aircraft Type | Flex Wing, Rotary Wing, and Fixed Wing |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Textron Aviation Inc., Bombardier Inc., Cirrus Design Corporation, Piper Aircraft, Inc., Pilatus Aircraft Ltd, Lancair Aerospace, Vulcanair S.p.A., Honda Aircraft Company, LLC, Advanced Tactics Inc, Embraer Group, Evektor Aerotechnik, Air Tractor Inc., Flight Design General Aviation GmbH, Pipistrel D.O.O, and Aviation Partners, Inc. |

The global ultralight aircraft market is estimated to be valued at USD 13.8 billion in 2025.

The market size for the ultralight aircraft market is projected to reach USD 34.8 billion by 2035.

The ultralight aircraft market is expected to grow at a 9.7% CAGR between 2025 and 2035.

The key product types in ultralight aircraft market are electric and fuel powered.

In terms of application, commercial segment to command 38.7% share in the ultralight aircraft market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA