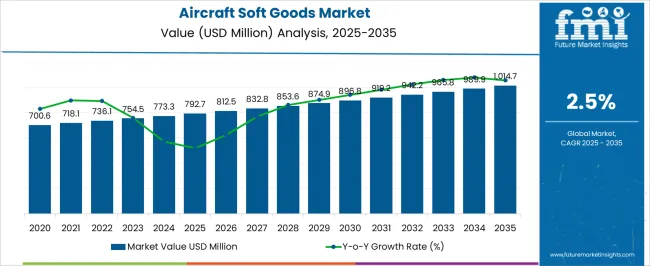

The Aircraft Soft Goods Market is estimated to be valued at USD 792.7 million in 2025 and is projected to reach USD 1014.7 million by 2035, registering a compound annual growth rate (CAGR) of 2.5% over the forecast period. This corresponds to a compound annual growth rate (CAGR) of about 2.5%, indicating a stable but gradual expansion within the aerospace sector. Between 2025 and 2027, the market grows from USD 792.7 million to roughly USD 832.8 million. This period sees steady demand driven by the ongoing production of commercial aircraft and the maintenance, repair, and overhaul (MRO) activities. Aircraft soft goods, which include seat covers, curtains, carpets, and insulation materials, are critical for cabin comfort and safety, supporting continuous replacement cycles.

From 2028 to 2030, the market expands further to USD 896.8 million as airlines focus on fleet upgrades and refurbishment to improve passenger experience and meet regulatory requirements. An increase also influences the growth in air travel demand post-pandemic and the expansion of regional and low-cost carriers, which often require cost-effective soft goods solutions. The aircraft soft goods market experiences consistent growth driven by airline industry recovery, fleet modernization, and ongoing maintenance needs, contributing to its steady progression through 2030.

| Metric | Value |

|---|---|

| Aircraft Soft Goods Market Estimated Value in (2025 E) | USD 792.7 million |

| Aircraft Soft Goods Market Forecast Value in (2035 F) | USD 1014.7 million |

| Forecast CAGR (2025 to 2035) | 2.5% |

The aircraft soft goods market is witnessing stable growth, driven by rising air traffic, cabin interior upgrades, and evolving passenger expectations for comfort and aesthetics. Airlines are prioritizing refurbishment programs to maintain brand consistency and meet increasing competition on cabin experience.

Lightweight, durable, and fire-resistant textile innovations are supporting the replacement cycle of seat covers, curtains, carpets, and wall panels across both new aircraft deliveries and maintenance, repair, and overhaul (MRO) activities. Regulatory standards from aviation safety authorities have pushed manufacturers toward compliant, high-performance materials that do not compromise weight efficiency or design versatility.

Additionally, sustainability initiatives in aviation are propelling demand for recyclable textiles and low-emission production methods. The growing influence of business and regional aviation, along with the integration of antimicrobial and anti-stain finishes, is shaping procurement decisions across both commercial and private jet segments.

The aircraft soft goods market is segmented by aircraft, product, materials, end-user, and geographic regions. By aircraft type, the aircraft soft goods market is divided into Commercial, Regional, Business, and Helicopter. In terms of the product, the aircraft soft goods market is classified into Seat covers, Carpets, Curtains, and Others. Based on materials, the aircraft soft goods market is segmented into Wool/nylon blend fabric, Natural leather, Synthetic leather, and Polyester fabric. The end-user of the aircraft soft goods market is segmented into OEM and Aftermarket. Regionally, the aircraft soft goods industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

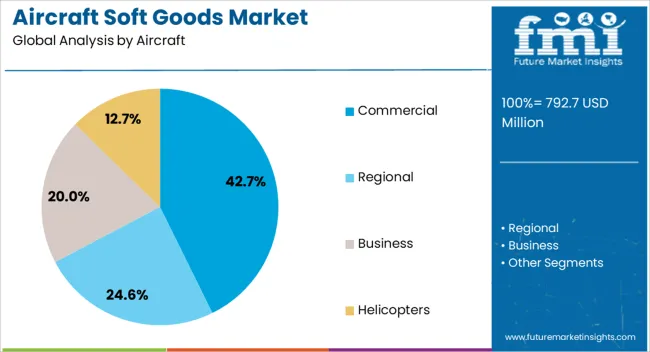

Commercial aircraft are expected to account for 42.7% of the total revenue in the aircraft soft goods market by 2025, making them the leading aircraft type. This segment’s dominance is driven by the scale of commercial fleet operations and the frequency of soft goods refurbishment cycles required to maintain passenger experience standards.

Airlines are increasingly investing in cabin modernization programs that focus on aesthetics, comfort, and brand differentiation, all of which involve the replacement of high-contact textile components. Stringent FAA and EASA compliance requirements have also led to broader adoption of certified fire-retardant fabrics, contributing to elevated demand.

The continuous expansion of low-cost carriers and long-haul routes further reinforces the procurement of high-performance, durable interior materials for commercial fleets.

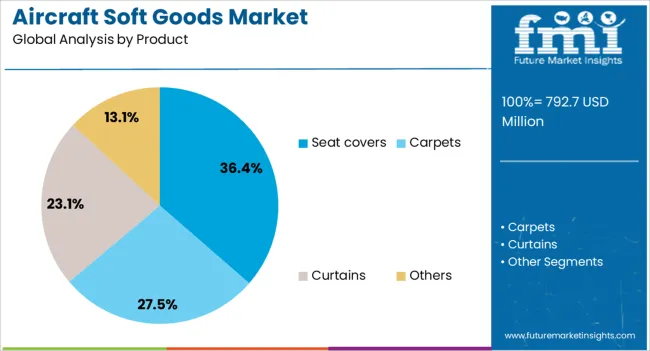

Seat covers are projected to hold 36.4% of the market revenue in 2025, establishing them as the leading product type in the aircraft soft goods market. This segment has maintained its leadership due to the continuous need for cleanliness, branding, and durability across high-frequency passenger contact points.

Seat covers play a vital role in defining cabin identity and passenger comfort while complying with flammability and wear-resistance regulations. Airlines are increasingly favoring customizable, easy-to-maintain fabrics that enhance hygiene and offer longer replacement cycles.

The emphasis on sustainability and waste reduction has further encouraged the adoption of modular seat cover designs that support targeted refurbishment without replacing the entire unit. These factors, combined with rising passenger volumes, are sustaining strong demand within this product category.

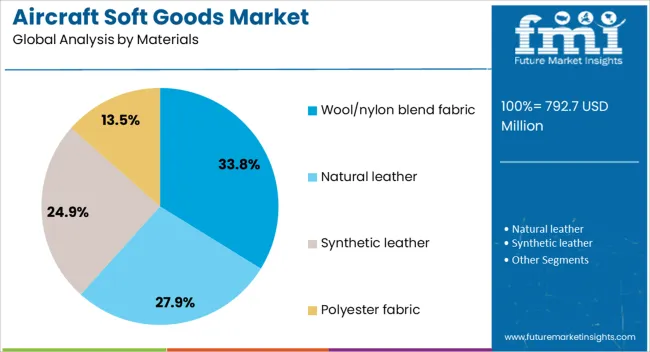

Wool/nylon blend fabrics are expected to contribute 33.8% of total revenue in the aircraft soft goods market by 2025, making them the leading material type. Their popularity stems from their superior durability, abrasion resistance, and compliance with stringent flame-retardant standards essential for aviation interiors.

The blend combines the comfort and insulation of wool with the strength and elasticity of nylon, making it particularly suitable for seat upholstery and carpeting in high-traffic aircraft cabins. Airlines have favored these blends for their ability to retain color vibrancy, resist pilling, and offer thermal regulation.

The materials' long lifecycle and recyclability also align with airline sustainability goals. As cabin design becomes a competitive factor in passenger experience, wool/nylon blends remain a preferred choice for balancing safety, performance, and visual appeal.

The aircraft soft goods market is growing steadily due to rising demand for passenger comfort and stringent safety regulations in commercial and business aviation. Soft goods include textiles, upholstery, carpets, curtains, and insulation materials that contribute to cabin aesthetics and functionality. Increasing airline fleet expansions and refurbishment projects are driving market growth.

Challenges include strict certification requirements, durability under extreme conditions, and weight reduction demands. Innovations in lightweight, fire-resistant, and antimicrobial materials along with sustainable sourcing open new opportunities for manufacturers focused on enhancing cabin experience and regulatory compliance.

Passenger comfort and cabin design play a crucial role in airline differentiation and brand loyalty. Airlines invest in high-quality soft goods to improve the in-flight experience, including ergonomic seating fabrics, soundproof curtains, and comfortable carpeting. The demand for customized interiors that reflect brand identity encourages manufacturers to develop diverse material options with varied textures, colors, and patterns. Business jets and premium cabins are leading adopters of luxury and innovative textiles. Increasing refurbishment cycles of older aircraft to meet modern design standards further boost demand. These trends make soft goods a vital part of overall cabin environment strategies for both commercial and private aviation sectors.

Aircraft soft goods must comply with rigorous aviation industry safety standards, including flammability, smoke toxicity, and smoke density regulations. Materials are subjected to extensive testing and certification processes to ensure passenger safety and operational compliance. Meeting these standards while maintaining aesthetic and comfort qualities presents a challenge for manufacturers. In addition, products must withstand harsh operating environments, including temperature fluctuations, UV exposure, and wear from frequent use. Maintaining consistent quality and traceability throughout supply chains is essential to pass audits and approvals by regulatory authorities. Navigating complex certification processes requires ongoing investment in research and development and strong collaboration with aircraft manufacturers and regulators.

Advancements in material science allow production of soft goods that are lightweight yet durable, contributing to overall aircraft weight reduction and fuel efficiency. New fabric technologies incorporate antimicrobial properties to improve hygiene, especially important in post-pandemic travel. Fire-resistant coatings and treatments enhance safety without compromising texture or appearance. Manufacturers are exploring sustainable and recyclable materials to meet environmental goals and appeal to eco-conscious airlines. Innovations in smart textiles that can regulate temperature or monitor cabin air quality are emerging trends. These developments enhance product functionality, reduce maintenance costs, and support premium cabin experiences, positioning suppliers to meet evolving airline requirements.

Global airline fleet expansions, including narrow-body and wide-body aircraft, create steady demand for new soft goods during initial production. Additionally, aging fleets require refurbishment and retrofitting, offering ongoing business opportunities. Growth in emerging markets with expanding aviation sectors supports increased demand for aircraft interiors. Low-cost carriers upgrading cabin comfort to attract customers also contribute to market growth. Suppliers are forming partnerships with aircraft manufacturers, interior designers, and maintenance organizations to provide integrated solutions. However, supply chain disruptions and raw material cost fluctuations may affect production timelines and pricing. Overall, rising air travel demand and evolving passenger expectations continue to fuel the aircraft soft goods market globally.

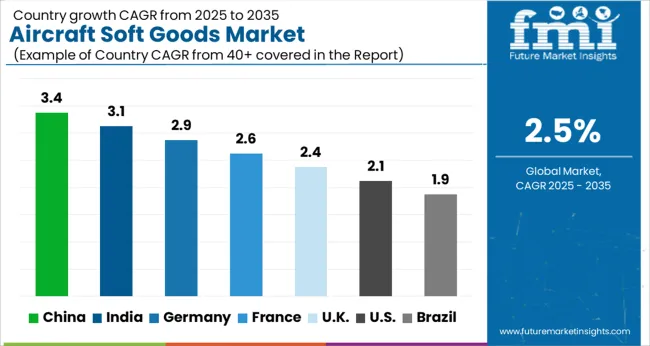

The global aircraft soft goods market is growing steadily at a 2.5% CAGR, driven by increasing demand for lightweight, durable materials in aerospace interiors. China leads with 3.4% growth, supported by expanding aircraft production and modernization programs. India follows at 3.1%, fueled by growing domestic aviation and manufacturing capabilities. Germany records 2.9% growth, reflecting stringent quality standards and technological innovation. The United Kingdom grows at 2.4%, driven by investments in aerospace components and sustainable materials. The United States, a mature market, shows 2.1% growth, shaped by high regulatory standards and ongoing upgrades in aircraft interiors. These countries collectively influence market trends through advancements in material technology, regulatory compliance, and supply chain efficiency. This report includes insights on 40+ countries; the top countries are shown here for reference.

China aircraft soft goods market is growing at a 3.4% CAGR, supported by expanding commercial and regional aircraft production. Rising demand for cabin interior enhancements and passenger comfort drives innovation in lightweight, durable fabrics and materials. Domestic manufacturers are investing in advanced textiles that meet international aviation safety and fire resistance standards. Compared to Western markets, China focuses heavily on cost-effective production and rapid scalability to support its growing airline industry. E-commerce and direct B2B sales channels improve supplier reach. The rise of private jets and business aviation also creates niche demand for luxury soft goods components.

India aircraft soft goods market grows at a 3.1% CAGR, driven by the country’s increasing aircraft fleet and government initiatives to boost aerospace manufacturing. Growing passenger traffic and rising domestic airline networks necessitate upgraded cabin furnishings and ergonomic seating solutions. Compared to China, India’s supply chain is still developing but gaining momentum with rising local textile capabilities and partnerships with global suppliers. Manufacturers emphasize compliance with aviation safety standards and sustainability trends, including recyclable and flame-retardant materials. Training and certification programs improve workforce skills, supporting quality improvements and innovation.

Germany aircraft soft goods market grows at a 2.9% CAGR, reflecting a mature aerospace industry with strong emphasis on quality and regulatory compliance. German manufacturers prioritize materials that combine durability, comfort, and environmental sustainability. Compared to Asian markets, Germany benefits from a well-established supply chain and advanced textile technology. Collaborations with aerospace OEMs ensure products meet strict fire safety and weight reduction requirements. The market also focuses on customization to enhance passenger experience in premium cabins. Research institutions support innovation in smart fabrics and antimicrobial materials.

United Kingdom aircraft soft goods market grows at a 2.4% CAGR, fueled by steady demand for commercial and business aircraft interiors. UK manufacturers emphasize customization and integration of advanced textiles for enhanced passenger comfort and safety. Compared to Germany, the UK market is smaller but rapidly adopting innovation in lightweight and sustainable materials. Growing emphasis on eco-friendly production and recyclability aligns with industry environmental goals. Supplier networks support both domestic production and export to global aerospace hubs. Collaborative projects between manufacturers and universities foster new product development.

aircraft-soft-goods-market-country-value-analysis

United States aircraft soft goods market grows at a 2.1% CAGR, supported by its large aerospace manufacturing base and global airline demand. USA manufacturers focus on high-performance, lightweight fabrics that meet stringent FAA safety standards. Compared to European and Asian markets, the USA industry leverages advanced technology and automation for efficiency and quality control. Demand for premium cabin interiors and retrofitting older fleets drives growth. Strong collaboration with airlines and OEMs enables tailored solutions. Environmental sustainability is a growing priority, with investments in recyclable and low-impact materials.

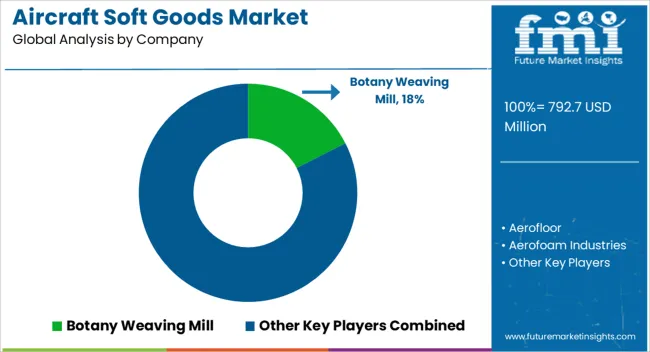

The Aircraft Soft Goods Market encompasses a specialized segment of the aviation industry focused on producing and supplying textile-based materials and components used within aircraft interiors. Key players in this market include Botany Weaving Mill, Aerofloor, Aerofoam Industries, Aircraft Interior Products, DESSO Aviation, E-Leather, and Fellfab Limited. These companies provide a range of products such as seat covers, carpets, upholstery, headliners, curtains, insulation materials, and foam components, all designed to meet the stringent safety, durability, and comfort standards required in commercial and private aircraft.

The market is driven by increasing airline fleet expansions, rising passenger expectations for cabin comfort, and regulatory mandates regarding fire resistance and lightweight materials to improve fuel efficiency. Innovations in materials, including lightweight composites, flame-retardant fabrics, antimicrobial coatings, and eco-friendly options like recycled textiles, are shaping product offerings. Companies such as Botany Weaving Mill focus on high-quality woven fabrics, while Aerofoam Industries specializes in engineered foam solutions for seating and cushioning.

DESSO Aviation is notable for its sustainable carpet solutions tailored to aircraft interiors, and E-Leather offers leather alternatives designed to balance luxury with durability and ease of maintenance. Fellfab Limited is recognized for manufacturing technical textiles used in upholstery and cabin furnishings. The Aircraft Soft Goods Market is also influenced by trends towards customization and modular interior designs, allowing airlines to differentiate their cabin aesthetics and enhance passenger experience.

Furthermore, manufacturers must comply with stringent aviation standards like FAR 25 and EASA CS-25 for flammability, smoke toxicity, and smoke density. This market is expected to grow steadily as airlines invest in fleet modernization and retrofit projects to improve comfort, safety, and sustainability, driving demand for innovative soft goods that blend performance with design.

Manufacturers are focusing on improving the comfort of seating cushions, headrests, blankets, carpets, and curtains. Innovations include the use of memory foam and ergonomic designs to enhance the overall flight experience. For instance, Zodiac Aerospace provides a variety of aircraft interior textiles, including soft goods designed for durability and comfort.

| Item | Value |

|---|---|

| Quantitative Units | USD 792.7 Million |

| Aircraft | Commercial, Regional, Business, and Helicopters |

| Product | Seat covers, Carpets, Curtains, and Others |

| Materials | Wool/nylon blend fabric, Natural leather, Synthetic leather, and Polyester fabric |

| End-User | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Botany Weaving Mill, Aerofloor, Aerofoam Industries, Aircraft Interior Products, DESSO Aviation, E-Leather, and Fellfab Limited |

| Additional Attributes | Dollar sales vary by product, including seat covers, carpets, curtains, foam pads, and baggage covers; by material, such as nylon, polyester, leather, vinyl, and cotton; by end-use, spanning commercial aviation, business jets, and military aircraft; and by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising air travel demand, luxury cabin upgrades, and sustainability trends. |

The global aircraft soft goods market is estimated to be valued at USD 792.7 million in 2025.

The market size for the aircraft soft goods market is projected to reach USD 1,014.7 million by 2035.

The aircraft soft goods market is expected to grow at a 2.5% CAGR between 2025 and 2035.

The key product types in aircraft soft goods market are commercial, regional, business and helicopters.

In terms of product, seat covers segment to command 36.4% share in the aircraft soft goods market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Micro Turbine Engines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft De-icing Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Window Frame Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA