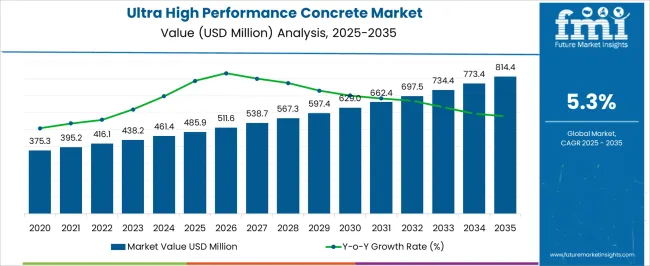

The ultra high performance concrete market is estimated to be valued at USD 485.9 million in 2025 and is projected to reach USD 814.4 million by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

The ultra high performance concrete market, valued at USD 485.9 million in 2025 and projected to reach USD 814.4 million by 2035 with a CAGR of 5.3%, reflects a value chain that integrates raw material procurement, formulation, production, application, and lifecycle management. The cost structure is shaped largely by high-quality inputs including fine powders, silica fume, quartz flour, superplasticizers, and steel or polymeric fibers. These specialized constituents contribute significantly to material expenses compared to conventional concrete, raising the upfront investment for manufacturers and contractors.

Production costs also involve precision mixing technology, curing processes, and quality control systems that ensure superior strength, durability, and resistance properties. Equipment-intensive processing elevates capital expenditure, though long-term performance reduces lifecycle costs for end users. Within the value chain, material suppliers, admixture developers, and fiber producers play a foundational role, while concrete manufacturers, precast fabricators, and contractors handle deployment.

Engineering firms and infrastructure developers drive demand, with service providers adding value through testing, certifications, and maintenance solutions. Service-driven revenues such as design consultation and durability assessments are gaining importance as UHPC adoption expands across bridges, façades, and defense applications. The value chain emphasizes a balance between higher initial costs and the extended service life benefits, supporting sustained growth across global construction markets.

| Metric | Value |

|---|---|

| Ultra High Performance Concrete Market Estimated Value in (2025 E) | USD 485.9 million |

| Ultra High Performance Concrete Market Forecast Value in (2035 F) | USD 814.4 million |

| Forecast CAGR (2025 to 2035) | 5.3% |

The ultra-high performance concrete market is positioned as an advanced category within the global construction materials industry, defined by its superior strength, durability, and design flexibility. Within the overall cement and concrete sector, it represents about 2.7%, reflecting its niche adoption in demanding projects. In the advanced construction materials industry, its share is estimated at 3.4%, driven by use in infrastructure requiring longevity and reduced maintenance. Across the precast concrete solutions sector, UHPC accounts for 2.2%, supporting complex structural elements with reduced weight.

In the architectural and specialty building materials market, it secures 3.0%, where aesthetics and performance are valued. Within the transportation infrastructure materials category, it holds about 4.1%, emphasizing its growing role in bridges, tunnels, and highway projects where resilience and reduced lifecycle costs are critical. Recent industry trends in the UHPC market have highlighted material innovation, performance optimization, and sustainability-focused solutions. Groundbreaking strategies include the use of fiber reinforcement technologies, nanomaterials, and admixture enhancements to improve compressive strength and crack resistance.

Precast UHPC components are being increasingly adopted in bridge decks, façade panels, and structural retrofits due to their durability and design efficiency. Key players are investing in proprietary mix designs, automated casting processes, and collaborations with infrastructure developers to expand applications. Strategic initiatives include the integration of UHPC with 3D printing for complex structures and the development of eco-friendly formulations using industrial by-products. These advancements are positioning UHPC as a critical material for next-generation infrastructure and high-performance construction projects.

The ultra high performance concrete (UHPC) market is expanding steadily as the construction industry prioritizes materials that offer superior strength, durability, and long-term performance. With increasing demand for sustainable and resilient infrastructure, UHPC has emerged as a preferred solution in projects where longevity and structural integrity are critical.

The material's ability to withstand extreme environmental conditions, reduce maintenance costs, and extend service life is driving its adoption in both developed and developing regions. Governments and private developers are increasingly incorporating UHPC in infrastructure projects to meet modern design and safety standards.

Additionally, the push for carbon footprint reduction in construction is accelerating interest in UHPC due to its potential for thinner cross-sections and longer lifecycle benefits. As technological advancements make the material more accessible and cost-competitive, the market is expected to register consistent growth supported by rising investments in public works, commercial developments, and high-performance architectural applications

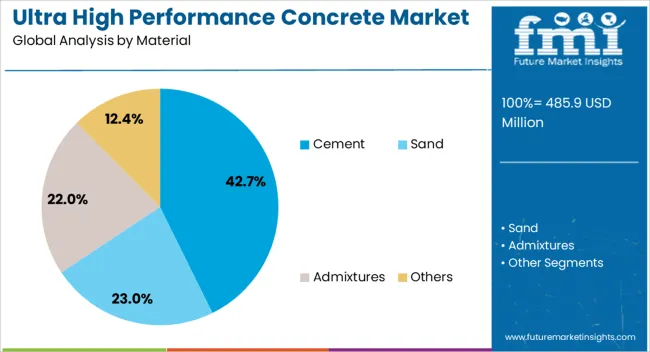

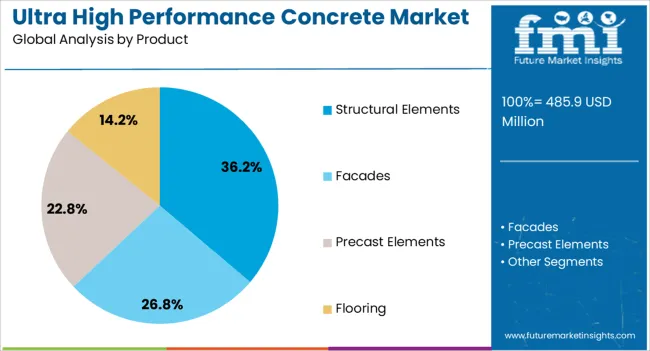

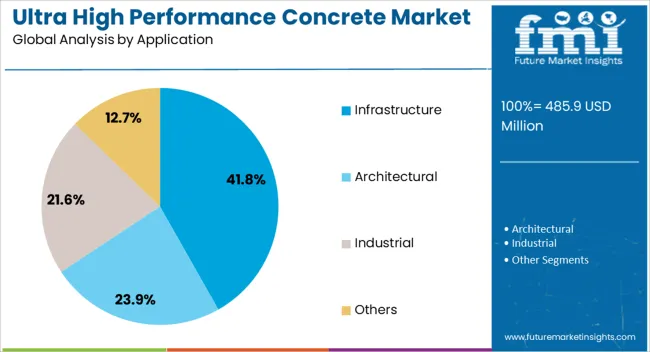

The ultra high performance concrete market is segmented by material, product, application, end-use, and geographic regions. By material, ultra high performance concrete market is divided into cement, sand, admixtures, and others. In terms of product, ultra high performance concrete market is classified into structural elements, facades, precast elements, and flooring. Based on application, ultra high performance concrete market is segmented into infrastructure, architectural, industrial, and others. By end-use, ultra high performance concrete market is segmented into construction industry, architectural industry, infrastructure development, and others. Regionally, the ultra high performance concrete industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cement segment holds the largest share within the material category at 42.7%, reinforcing its foundational role in UHPC formulation due to its binding strength and compatibility with advanced admixtures. High cement content is essential to achieve the ultra-dense matrix that characterizes UHPC, enabling exceptional compressive strength and reduced permeability.

The segment's dominance is supported by innovations in binder chemistry that enhance durability while lowering the water-to-cement ratio. Cement producers are also responding to demand by developing specialty products tailored for UHPC mixes, including low-carbon and blended cements.

Market growth is further supported by increasing awareness of performance-based design, where cement-rich UHPC is favored for applications requiring extreme load-bearing capacity and minimal shrinkage. With infrastructure projects prioritizing materials that ensure structural longevity, the cement segment is expected to maintain its leadership within the UHPC value chain

The structural elements segment commands a 36.2% share of the UHPC product category, driven by the material's widespread use in high-strength applications such as beams, columns, panels, and bridge components. Its superior mechanical properties allow for lighter and thinner structures without compromising performance, making it ideal for both retrofit and new construction projects.

This segment has grown due to the increasing use of precast UHPC elements, which offer speed, uniformity, and reduced labor requirements on-site. Structural components made with UHPC demonstrate enhanced durability and resistance to corrosion, fatigue, and impact, leading to lower lifecycle costs.

Continued demand from transportation and commercial construction sectors supports the segment’s expansion, particularly in regions focused on infrastructure modernization. With evolving design codes now incorporating UHPC provisions, adoption of structural elements made from this material is expected to accelerate in future project specifications

The infrastructure segment leads the application category with a 41.8% market share, reflecting the growing reliance on UHPC for constructing durable and long-lasting public assets such as bridges, tunnels, and highway components. The segment benefits from UHPC’s unique capabilities, including high compressive strength, resistance to freeze-thaw cycles, and minimal permeability, which are critical for infrastructure exposed to harsh environmental conditions.

Governments and municipalities are increasingly specifying UHPC in long-span bridges, seismic retrofits, and rehabilitation of aging transport systems to extend service life and reduce maintenance frequency. Additionally, public funding initiatives focused on sustainable infrastructure development are accelerating UHPC adoption across key geographies.

As infrastructure resilience and cost efficiency become top priorities, the segment is expected to maintain its dominant position within the market, with growing opportunities for both precast and cast-in-place UHPC applications

The market has expanded as advanced construction materials gain traction for critical infrastructure, defense structures, and high-rise buildings. Characterized by superior compressive strength, high durability, low permeability, and extended service life, ultra-high performance concrete is increasingly used in bridges, precast elements, façade panels, and architectural applications. Its ability to withstand extreme environmental conditions and reduce maintenance requirements has made it a preferred choice for both public and private infrastructure projects. Growing focus on resilient construction, longer building lifecycles, and sustainable material performance has driven demand.

Ultra high performance concrete is being favored for its exceptional mechanical and durability properties. It offers compressive strength exceeding 150 MPa, resistance to chloride penetration, freeze-thaw cycles, and chemical attacks. These attributes significantly extend the service life of critical infrastructure components such as bridges, tunnels, and marine structures. The reduced maintenance and longer lifecycle result in lower long-term costs compared to conventional concrete. Its high tensile strength, often enhanced by steel or synthetic fibers, allows for reduced cross-sectional dimensions, making structures lighter and more efficient. As infrastructure agencies and developers prioritize longevity and resilience, ultra-high performance concrete has emerged as a compelling solution for both new construction and retrofitting projects.

Government-backed infrastructure renewal projects have acted as a strong driver for ultra-high performance concrete adoption. Aging transportation networks, bridges, and water systems in regions such as North America and Europe have required durable material solutions with lower lifecycle costs. Investments in resilient construction materials align with public safety and sustainability priorities, making ultra-high performance concrete a key material of choice. Large-scale infrastructure programs in Asia Pacific, supported by rapid urban expansion and economic development, have further accelerated adoption. The material’s ability to reduce repair frequency and extend structural lifespans aligns with public sector budgets and long-term infrastructure strategies, ensuring growing demand globally.

Advancements in admixtures, nano-silica, and fiber reinforcement have enhanced the performance and versatility of ultra-high performance concrete. Modern formulations enable improved workability, higher ductility, and faster setting times, making them suitable for both precast and cast-in-place applications. Innovations in mixing technology and curing methods have also reduced production costs, improving scalability. Research institutions and industry players are developing eco-efficient blends with reduced carbon footprints, aligning with evolving green construction standards. These advancements are broadening the scope of ultra-high performance concrete applications across architectural designs, defense structures, and prefabricated modular construction, driving wider adoption in both developed and emerging economies.

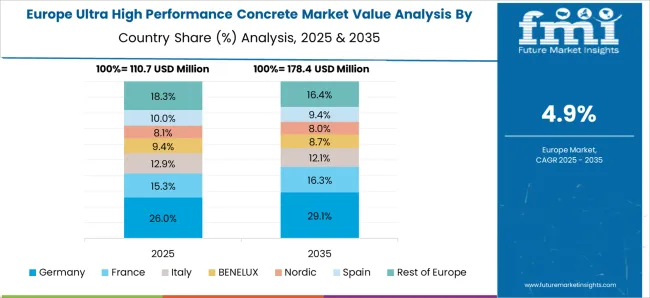

Asia Pacific leads the market due to large-scale infrastructure projects and strong government investments in resilient construction. Europe emphasizes sustainable building practices and infrastructure rehabilitation using high-performance materials. North America has witnessed adoption driven by modernization of transportation and defense-related structures. Key companies focus on product innovation, strategic partnerships, and collaborations with contractors to strengthen market positioning. Competitive strategies include the development of cost-effective mixes, expanded distribution networks, and integration into precast solutions. Regional regulations, climate resilience goals, and construction industry modernization trends continue to shape the competitive landscape, ensuring steady growth for ultra-high performance concrete worldwide.

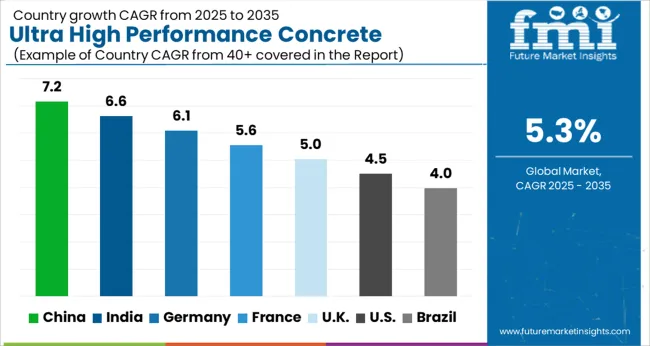

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The market is forecasted to expand at a CAGR of 5.3% from 2025 to 2035. India records 6.6%, driven by infrastructure upgrades and rising use of advanced construction materials in urban projects. China remains at the forefront with 7.2%, benefiting from large scale adoption in bridges, skyscrapers, and transportation networks. Germany holds 6.1%, supported by engineering precision and emphasis on sustainable building techniques. The UK at 5.0% steadily incorporating UHPC in modernization projects, while the USA at 4.5% reflects demand for resilient materials in public infrastructure. These trends underline the crucial role of UHPC in shaping stronger, longer-lasting, and innovative construction solutions globally. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is recording a CAGR of 7.2% in the market, propelled by large-scale infrastructure projects and adoption in bridge and tunnel construction. The focus on durability, load-bearing capacity, and resistance to extreme conditions supports wider use. Government investments in transportation and urban redevelopment projects are encouraging UHPC integration for longer service life of structures. Chinese firms, along with international suppliers, are concentrating on high-strength precast elements and advanced admixtures to meet growing construction needs. The competitive edge lies in reducing costs while ensuring quality through local production.

India is witnessing a CAGR of 6.6% in the market, driven by demand for durable infrastructure in highways, metro projects, and commercial structures. Government programs focused on transport corridors and smart city initiatives are creating a strong base for UHPC adoption. Builders prefer UHPC for its superior compressive strength, crack resistance, and low permeability, making it ideal for long-term construction. Indian firms are collaborating with global players to enhance local manufacturing capacity and optimize formulations suited to climatic conditions. The growth trend is aligned with increasing investments in advanced construction technologies.

Germany is advancing at a CAGR of 6.1% in the UHPC market, supported by retrofitting of aging infrastructure and development of sustainable commercial projects. The need for high durability and energy efficiency in construction is pushing UHPC adoption in both public and private sectors. German engineers emphasize integration of UHPC in modular construction, precast elements, and energy-efficient buildings. Research institutions are actively engaged in developing optimized formulations that meet environmental standards. Collaboration between local firms and global suppliers enhances innovation, ensuring compliance with stringent European quality benchmarks.

The United Kingdom is projected to expand at a CAGR of 5.0% in the market, with demand arising from modernization of bridges, public infrastructure, and commercial real estate projects. Builders prioritize UHPC for its long life cycle benefits, reduced maintenance costs, and enhanced structural resilience. Retrofit projects in metropolitan areas are particularly boosting adoption, as UHPC enables improved performance in existing structures. Partnerships between UK construction firms and international UHPC suppliers have accelerated market penetration, especially in specialized applications like offshore platforms and transport networks.

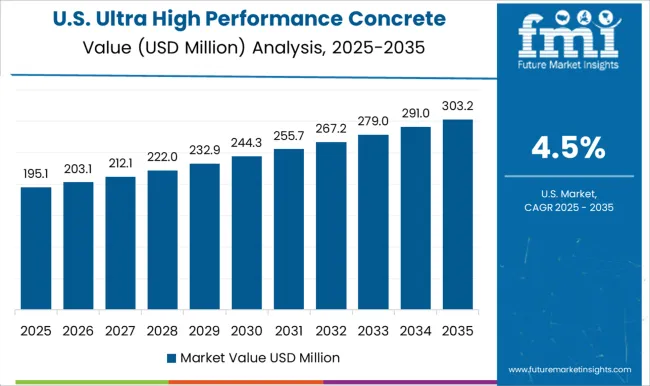

The United States market for UHPC is expected to rise at a CAGR of 4.5%, fueled by bridge rehabilitation programs and investments in long-lasting public infrastructure. Demand is also growing in high-rise commercial projects where UHPC offers greater load-bearing performance and durability. Federal and state-level initiatives supporting infrastructure modernization are encouraging adoption of UHPC across regions. Local construction firms and global material suppliers are investing in R&D to enhance scalability and cost-effectiveness. The emphasis is placed on sustainable, high-strength materials to ensure long-term performance in critical infrastructure.

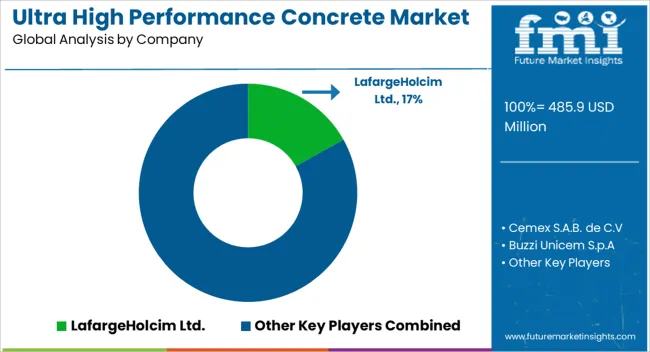

The UHPC market features a concentrated mix of global cement leaders, chemical companies, and specialized material innovators. LafargeHolcim Ltd., Cemex S.A.B. de C.V, Buzzi Unicem, and CRH’s Tarmac lead with extensive cement and construction materials portfolios, leveraging their global distribution networks and strong ties with infrastructure projects. Sika AG, GCP Applied Technologies, and Sobute New Materials strengthen competitiveness by focusing on admixtures and chemical formulations that enhance durability, strength, and sustainability in UHPC applications.

Specialized firms such as Ductal (Lafarge Group), TAKTL LLC, Rampf Group, and EPC Engineering & Technologies emphasize product innovation, architectural versatility, and design-driven concrete solutions, particularly for precast and façade elements. ACCIONA S.A. integrates UHPC within large-scale infrastructure and transportation projects, demonstrating its role as both a producer and end-user. Regional players like CEMEX USA and CEMEX Mexico expand their reach through localized manufacturing and tailored offerings.

Competition in this market is influenced by infrastructure modernization, urban megaprojects, and growing adoption in defense, marine, and architectural applications. Companies focus heavily on R&D collaborations, strategic partnerships, and sustainable formulations to reduce carbon impact. With demand rising for longer-lasting, high-strength construction materials, UHPC providers are aligning with global infrastructure and green building initiatives, creating a landscape where material science expertise and project execution capabilities define competitive advantage.

| Items | Values |

|---|---|

| Quantitative Units | USD 485.9 million |

| Material | Cement, Sand, Admixtures, and Others |

| Product | Structural Elements, Facades, Precast Elements, and Flooring |

| Application | Infrastructure, Architectural, Industrial, and Others |

| End-use | Construction Industry, Architectural Industry, Infrastructure Development, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | LafargeHolcim Ltd., Cemex S.A.B. de C.V, Buzzi Unicem S.p.A, CEMEX USA, Sika AG, Ductal (Lafarge Group), EPC Engineering & Technologies GmbH, GCP Applied Technologies, Rampf Group, Sobute New Materials, TAKTL LLC, ACCIONA S.A., CEMEX Mexico, Tarmac (CRH plc), and RAMPF Holding GmbH & Co. KG |

| Additional Attributes | Dollar sales by concrete type and application, demand dynamics across infrastructure, commercial, and residential construction sectors, regional trends in high-strength material adoption, innovation in fiber reinforcement, durability, and mix design, environmental impact of cement production and lifecycle emissions, and emerging use cases in bridges, precast elements, and architectural structures. |

The global ultra high performance concrete market is estimated to be valued at USD 485.9 million in 2025.

The market size for the ultra high performance concrete market is projected to reach USD 814.4 million by 2035.

The ultra high performance concrete market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in ultra high performance concrete market are cement, sand, admixtures and others.

In terms of product, structural elements segment to command 36.2% share in the ultra high performance concrete market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ultra-low Temperature Air Source Heat Pump Units Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Conductivity Gels Market Size and Share Forecast Outlook 2025 to 2035

Ultra Short Base Line (USBL) Positioning Systems Market Size and Share Forecast Outlook 2025 to 2035

Ultra-Low Temperature Perfluoroelastomer Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Skin Tightening Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultralight Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Jewelry Cleaning Machine Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Ultraviolet Transilluminator Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Ultra-Fine Ath Market Size and Share Forecast Outlook 2025 to 2035

Ultra-thin Temperature Plate Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic NDT Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ultra Wideband Anchor and Tags Market Size and Share Forecast Outlook 2025 to 2035

Ultrapure Water Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Air Bubble Detectors Market Size and Share Forecast Outlook 2025 to 2035

Ultracapacitors Market Size and Share Forecast Outlook 2025 to 2035

Ultra-Low Temperature Freezers Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Pouch Sealers Market Analysis Size and Share Forecast Outlook 2025 to 2035

Ultrasound Biometry Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA