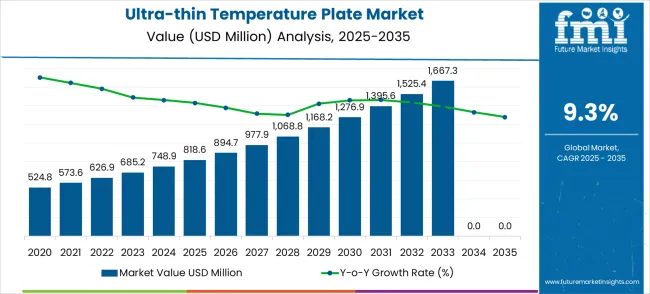

The ultra-thin temperature plate market is valued at USD 818.6 million in 2025 and is forecast to reach USD 1,991.8 million by 2035, registering a CAGR of 9.3%. This growth reflects increasing adoption across industries such as electronics, aerospace, healthcare, and precision manufacturing, where compact thermal management solutions are essential. The CAGR of 9.3% signals a strong expansion driven by advancements in material science, rising demand for high-efficiency thermal plates, and integration in next-generation devices. Over the decade, the market size will more than double, demonstrating robust long-term growth potential fueled by innovation and growing regional penetration.

A comparative year-by-year analysis reveals notable differences in growth rates across the forecast period. The first three years (2025–2027) show a steady upward movement from USD 818.6 million to USD 977.9 million, with YoY growth rates between 9.3% and 9.4%. This period marks a strong initial growth phase driven by early adoption in electronics and semiconductor industries. The highest YoY increase in absolute value occurs between 2034 and 2035, with an increment of USD 169.4 million, reflecting the cumulative effect of long-term demand expansion and technological advances in ultra-thin temperature plate manufacturing.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 818.6 million |

| Market Forecast Value (2035) | USD 1,991.8 million |

| Forecast CAGR (2025–2035) | 9.3% |

Examining best versus worst performance years, 2025 marks the lowest starting point, with the smallest base value, while 2035 represents the peak of the forecast, driven by a decade of compounding growth. The years 2026–2028 exhibit moderate but consistent growth, while the later years, particularly 2032–2035, reflect accelerated growth due to expanded applications in high-tech sectors such as wearable devices, electric vehicles, and aerospace systems. This indicates an inflection point where demand broadens across both mature and emerging industry segments.

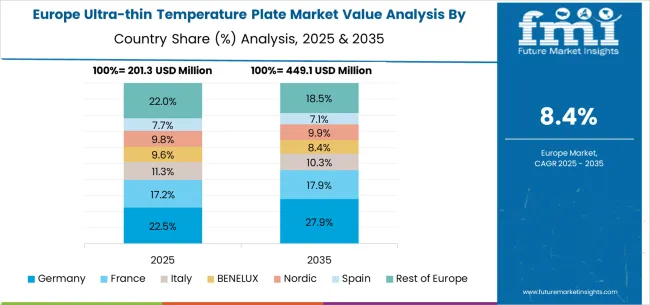

Regional comparisons reveal that Asia-Pacific is likely to emerge as the fastest-growing market due to large-scale electronics manufacturing, cost advantages, and rising investments in R&D. North America and Europe will show stable growth, driven by demand for advanced thermal solutions in aerospace and healthcare equipment. Scenario analysis suggests that in an optimistic case, market growth could exceed USD 2.1 billion by 2035, driven by accelerated adoption and innovation, while a conservative scenario might place the market around USD 1.85 billion, reflecting slower adoption rates. The market demonstrates a strong upward comparative growth trajectory, with peak performance in the final forecast years.

Market expansion is being supported by the rapid advancement of mobile processor technologies across consumer electronics and the corresponding need for efficient thermal management solutions in increasingly compact device designs. Modern electronic devices require sophisticated cooling technologies that can dissipate heat effectively while maintaining ultra-thin profiles and lightweight characteristics. The superior heat transfer efficiency and space optimization capabilities of ultra-thin temperature plates make them essential components in high-performance mobile devices where thermal management directly impacts processing speed, battery life, and user experience.

The growing focus on device performance optimization and user experience enhancement is driving demand for advanced thermal management technologies from certified manufacturers with proven track records of reliability and thermal efficiency. Device manufacturers are increasingly investing in ultra-thin temperature plate systems that offer superior heat dissipation capabilities while enabling compact device designs and extended battery life. Performance requirements and consumer expectations are establishing benchmarks that favor advanced thermal management solutions with intelligent heat distribution and energy efficiency characteristics.

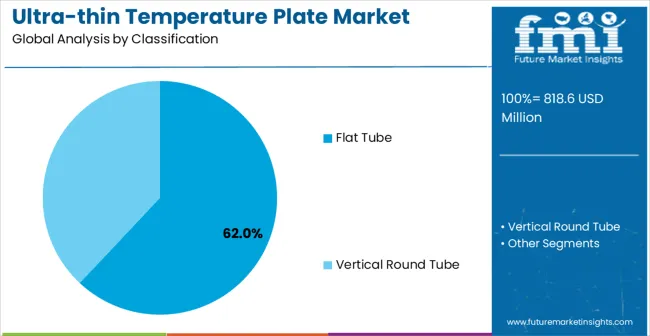

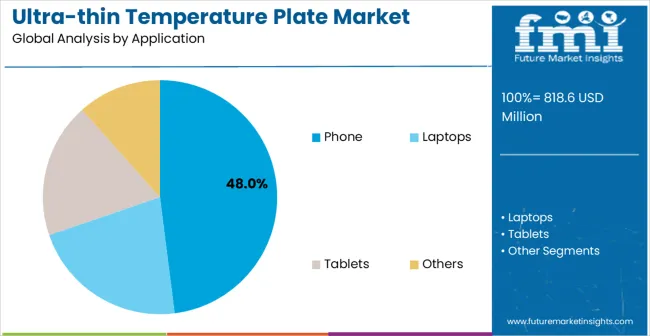

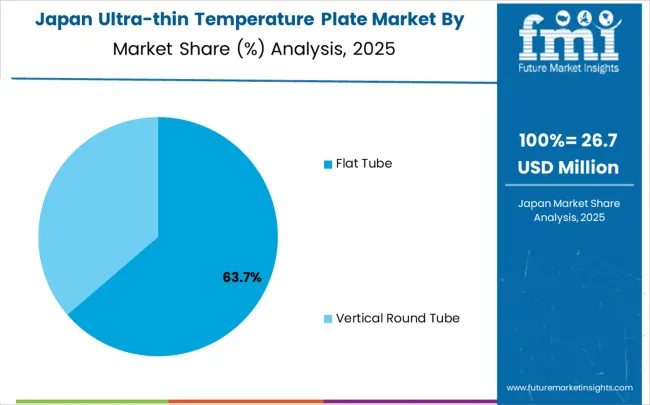

The market is segmented by plate type, application, and region. By plate type, the market is divided into flat tube and vertical round tube configurations. Based on application, the market is categorized into phone, laptops, tablets, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Flat Tube configurations are projected to account for 62% of the ultra-thin temperature plate market in 2025. This leading share is supported by the excellent heat transfer efficiency, design flexibility, and manufacturing scalability that flat tube systems offer for diverse consumer electronics applications. Flat tube temperature plates provide optimal thermal conductivity while maintaining minimal thickness profiles, making them the preferred choice for smartphones, tablets, ultra-thin laptops, and wearable devices. The segment benefits from technological advancements that have improved heat pipe performance, reduced manufacturing costs, and enhanced integration capabilities.

Modern flat tube temperature plates incorporate advanced micro-channel designs, optimized working fluid formulations, and sophisticated manufacturing processes that deliver exceptional thermal performance while minimizing space requirements and weight considerations. These innovations have significantly improved heat dissipation efficiency while maintaining compatibility with compact device architectures and reducing total system thickness through optimized thermal interface design. The smartphone sector particularly drives demand for flat tube solutions, as this industry requires reliable thermal management systems that can support high-performance processors while maintaining sleek device profiles.

Phone applications are expected to represent 48% of ultra-thin temperature plate demand in 2025. This dominant share reflects the critical role of thermal management in modern smartphone performance and the need for efficient cooling solutions capable of supporting increasingly powerful mobile processors in compact form factors. Smartphone manufacturers require advanced and reliable thermal management systems for flagship devices, gaming phones, and 5G-enabled smartphones with high processing demands. The segment benefits from ongoing smartphone innovation cycles and increasing consumer expectations for device performance, battery life, and thermal comfort during extended use.

Phone applications demand exceptional thermal management performance to ensure adequate heat dissipation for advanced system-on-chip designs, high-resolution displays, and power-intensive applications including gaming, video processing, and artificial intelligence functions. These applications require temperature plates capable of handling variable thermal loads, maintaining consistent device temperatures, and providing reliable performance across diverse usage patterns and environmental conditions. The growing focus on smartphone photography, video recording, and mobile gaming, particularly in flagship and premium device categories, drives consistent demand for advanced thermal management solutions.

The ultra-thin temperature plate market is advancing rapidly due to increasing mobile device performance requirements and growing recognition of thermal management importance in maintaining device reliability and user satisfaction. The market faces challenges including manufacturing complexity for ultra-thin profiles, need for customized solutions across different device architectures, and varying thermal requirements across different application segments. Standardization efforts and certification programs continue to influence thermal management quality and market development patterns.

The growing deployment of advanced materials including graphene, carbon nanotubes, and specialized thermal interface materials is enabling superior heat transfer capabilities and ultra-thin profile optimization in temperature plate designs. Advanced material technologies and nanotechnology applications provide enhanced thermal conductivity while enabling reduced thickness and weight characteristics compared to traditional thermal management solutions. These technologies are particularly valuable for premium device manufacturers that require exceptional thermal performance in extremely compact form factors.

Modern temperature plate manufacturers are incorporating intelligent thermal management systems and adaptive cooling technologies that optimize heat dissipation based on real-time device usage patterns and thermal load requirements. Integration of phase-change materials and variable thermal conductivity systems enables dynamic thermal management and significant efficiency improvements compared to traditional static thermal solutions. Advanced sensor integration and thermal modeling also support development of more responsive and efficient cooling solutions for demanding mobile device applications.

| Country | CAGR (2025–2035) |

|---|---|

| China | 12.6% |

| India | 11.6% |

| Germany | 10.7% |

| Brazil | 9.8% |

| United States | 8.8% |

| United Kingdom | 7.9% |

| Japan | 7.0% |

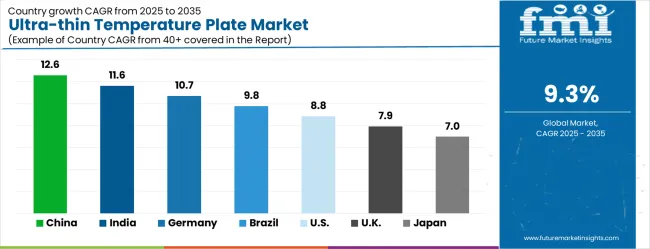

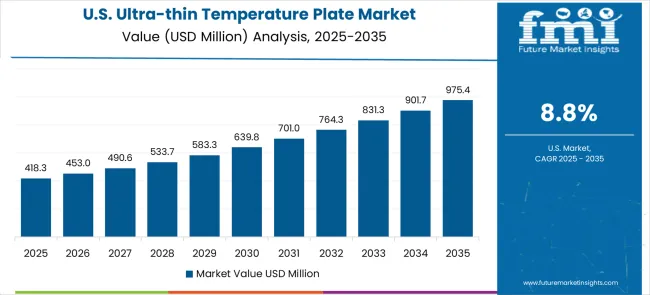

The market is growing rapidly, with China leading at a 12.6% CAGR through 2035, driven by massive consumer electronics manufacturing sector expansion, government support for advanced technology development, and growing domestic demand for high-performance mobile devices. India follows at 11.6%, supported by rapid smartphone adoption across diverse population segments and increasing investments in electronics manufacturing supporting local device production. Germany records strong growth at 10.7%, focusing precision engineering applications, automotive electronics, and advanced manufacturing technologies requiring sophisticated thermal management. Brazil grows steadily at 9.8%, integrating advanced thermal solutions into expanding electronics manufacturing and growing consumer device market. The United States shows robust growth at 8.8%, focusing on premium device segments and innovative thermal management technologies. The United Kingdom maintains solid expansion at 7.9%, supported by technology sector growth and advanced electronics applications. Japan demonstrates steady growth at 7.0%, focusing technological innovation and manufacturing excellence.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China is expected to achieve a CAGR of 12.6% between 2025 and 2035, supported by rapid advancements in electronics manufacturing, automotive systems, and high-precision industrial equipment. Ultra-thin temperature plates are increasingly used for efficient thermal management in compact devices such as smartphones, EV battery systems, and high-speed computing units. The demand is driven by growth in electric vehicles and next-generation communications infrastructure. Chinese manufacturers are heavily investing in advanced materials and manufacturing processes to improve performance while reducing thickness. Government-backed manufacturing programs and rising export volumes support market growth. Combined with increasing consumer and industrial demand for high-efficiency thermal solutions, China is poised to be a leading market for ultra-thin temperature plate adoption.

India is projected to grow at a CAGR of 11.6% from 2025 to 2035, driven by expanding electronics manufacturing, renewable energy, and automotive sectors. Ultra-thin temperature plates are increasingly adopted for heat dissipation in compact, high-performance electronics, EV battery modules, and industrial automation equipment. The growth of mobile device manufacturing and renewable energy storage systems is also boosting demand. Local manufacturers focus on cost-efficient production without compromising quality, while innovations in materials enhance plate performance. Government incentives for electronics manufacturing and Make in India initiatives support adoption. Rising export activity and growing domestic manufacturing capability make India a key emerging market for ultra-thin temperature plates in Asia.

Germany is anticipated to record a CAGR of 10.7% between 2025 and 2035, driven by robust automotive electronics manufacturing and high-precision engineering industries. Ultra-thin temperature plates play a crucial role in maintaining thermal efficiency in industrial machinery, EV electronics, and high-speed computing systems. German manufacturers leverage advanced production processes and materials to develop high-performance plates with superior durability and heat dissipation capabilities. Research and development are focused on enhancing conductivity and mechanical strength. Exports of precision thermal management solutions further strengthen Germany’s market position. Strict European quality regulations continue to drive demand for highly reliable and innovative ultra-thin temperature plates in Germany.

Brazil is projected to grow at a CAGR of 9.8% during 2025–2035, driven by increasing demand in automotive electronics, renewable energy, and industrial automation. Ultra-thin temperature plates are gaining adoption for their ability to deliver efficient heat dissipation in compact device designs. Growth in EV production and renewable energy generation systems is fueling demand. Local manufacturers are improving production techniques to enhance quality while maintaining cost efficiency. International collaborations and technology transfers are strengthening manufacturing capabilities. Brazil’s focus on quality assurance for exports supports the rising adoption of thermal management solutions. These factors together position Brazil as a steady growth market for ultra-thin temperature plates over the coming decade.

The United States is forecasted to grow at a CAGR of 8.8% between 2025 and 2035, supported by demand in consumer electronics, EV manufacturing, aerospace, and industrial applications. Ultra-thin temperature plates are critical for managing heat in compact and high-performance systems such as aerospace electronics, EV battery modules, and server cooling solutions. USA manufacturers are investing in cutting-edge materials and automated manufacturing to increase efficiency and product quality. Government programs promoting advanced manufacturing and high-tech innovation further drive adoption. Rising demand for portable electronics and EVs is expected to sustain market growth. The United States is set to remain one of the largest markets for ultra-thin temperature plates globally.

The United Kingdom is projected to grow at a CAGR of 7.9% from 2025 to 2035, driven by growth in high-speed computing, telecommunications, and automotive electronics sectors. Ultra-thin temperature plates are widely adopted to improve thermal efficiency in compact devices without increasing system size. Demand is boosted by the expansion of EV production and data center infrastructure. UK manufacturers are prioritizing development of lightweight, high-performance plates that meet rigorous quality and safety standards. Collaborations with research institutions support innovations in material composition and manufacturing methods. Rising demand for precision thermal management solutions makes the United Kingdom a steadily growing market for ultra-thin temperature plates.

Japan is expected to grow at a CAGR of 7.0% between 2025 and 2035, supported by advanced electronics manufacturing, automotive systems, and industrial equipment sectors. Ultra-thin temperature plates are increasingly used for high-performance compact devices requiring precise thermal control, including robotics, EV electronics, and high-speed computing. Japanese manufacturers are investing heavily in precision engineering and material science to enhance plate performance while maintaining structural integrity. Rising exports of electronics and increasing demand for miniaturized devices drive adoption. Government policies supporting manufacturing innovation further enhance growth prospects. Japan is positioned to remain a significant market for ultra-thin temperature plate solutions through continuous technological advancement.

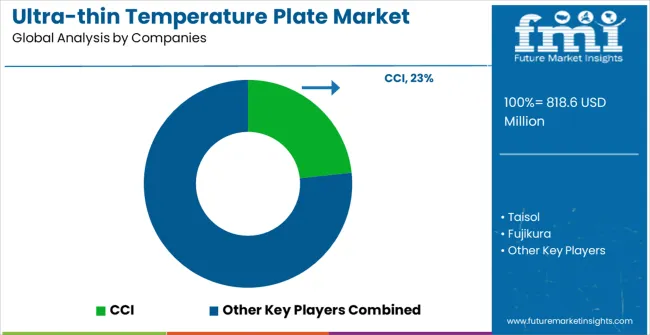

The market is defined by competition among established thermal management companies, specialized cooling solution providers, and emerging advanced materials firms. Companies are investing in advanced thermal technologies, material science innovation, standardized manufacturing processes, and technical support capabilities to deliver reliable, efficient, and scalable thermal management solutions. Strategic partnerships, technological advancement, and geographic expansion are central to strengthening product portfolios and market presence.

CCI, operating globally, offers comprehensive thermal management solutions with focus on ultra-thin profiles, performance optimization, and technical support services. Taisol, Asia-based, provides advanced cooling systems with focus on consumer electronics applications and cost-effective manufacturing. Fujikura, Japan-based, delivers specialized thermal solutions with focus on advanced materials and precision engineering. Delta Electronics offers comprehensive thermal management technologies with standardized procedures and global manufacturing capabilities.

Jones Tech provides industrial thermal systems with focus on customized solutions and performance optimization. Wakefield Thermal delivers specialized thermal interface materials with focus on high-performance applications. Specialcoolest Technology offers comprehensive cooling solutions for demanding electronics environments. Aavid provides advanced thermal management systems with innovative heat dissipation technologies.

Auras, VCT Tech, Blue Ocean, Forcecon Tech, Tianmai, and GrAndvance Technology offer specialized thermal management expertise, regional manufacturing capabilities, and technical support across global and regional networks.

The ultra-thin temperature plate market underpins consumer electronics advancement, mobile device performance optimization, thermal management innovation, and user experience enhancement. With miniaturization demands, stricter thermal requirements, and demand for high-performance mobile computing, the sector must balance cost competitiveness, manufacturing scalability, and performance reliability. Coordinated contributions from governments, industry bodies, technology providers, device manufacturers, and investors will accelerate the transition toward advanced, efficient, and highly integrated thermal management systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 818.6 million |

| Plate Type | Flat Tube, Vertical Round Tube |

| Application | Phone, Laptops, Tablets, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | CCI, Taisol, Fujikura, Delta Electronics, Jones Tech, Wakefield Thermal, Specialcoolest Technology, Aavid, Auras, VCT Tech, Blue Ocean, Forcecon Tech, Tianmai, GrAndvance Technology |

| Additional Attributes | Dollar sales by plate type and application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established thermal management providers and emerging technology specialists, deployment preferences for flat tube versus vertical round tube configurations, integration with consumer electronics design and manufacturing processes, innovations in thermal interface materials and micro heat pipe technologies for enhanced performance and miniaturization, and adoption of advanced materials and nanotechnology solutions with optimized thermal conductivity and ultra-thin profiles for improved device performance and user experience. |

The global ultra-thin temperature plate market is estimated to be valued at USD 818.6 million in 2025.

The market size for the ultra-thin temperature plate market is projected to reach USD 1,991.8 million by 2035.

The ultra-thin temperature plate market is expected to grow at a 9.3% CAGR between 2025 and 2035.

The key product types in ultra-thin temperature plate market are flat tube and vertical round tube.

In terms of application, phone segment to command 48.0% share in the ultra-thin temperature plate market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA