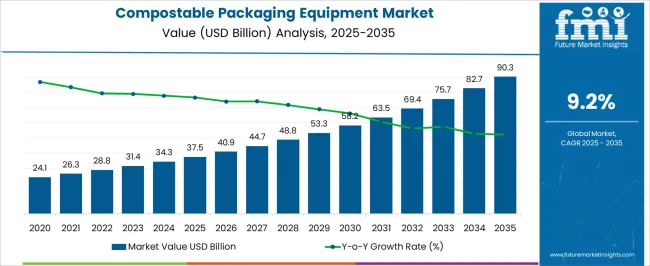

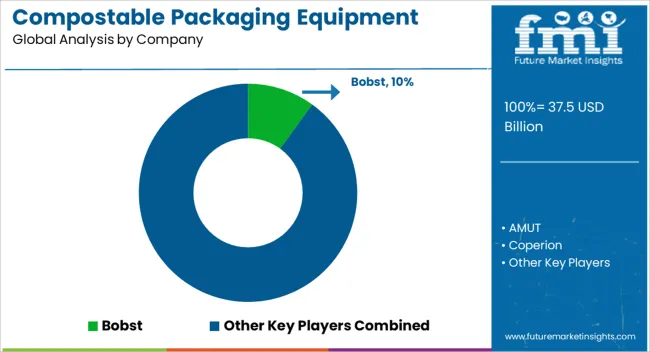

The compostable packaging equipment market is projected to grow from USD 37.5 billion in 2025 to USD 90.3 billion by 2035, registering a CAGR of 9.2%. From 2021 to 2025, the market shows steady value accumulation, rising from USD 24.1 billion in 2021 to USD 37.5 billion in 2025. This initial growth phase reflects increasing adoption of compostable packaging solutions across food, beverage, and consumer goods industries, driven by regulatory pressures and growing consumer preference for environmentally responsive alternatives. Between 2025 and 2030, the market sees accelerated growth, climbing from USD 37.5 billion to USD 58.2 billion.

This period marks a significant contribution to overall market expansion, as manufacturers increasingly invest in advanced equipment that improves efficiency, speed, and precision in producing compostable packaging materials. The adoption of automated production lines and multi-material compatibility further boosts market value, ensuring a higher contribution index during this phase. From 2030 to 2035, the market continues its upward trajectory, reaching USD 90.3 billion by 2035. Growth contribution during this period is driven by broader industrial adoption, expansion into emerging economies, and rising output from key players implementing technologically advanced machinery.

The market’s growth contribution index reflects the increasing weight of equipment demand in the overall packaging sector, with investments in high-capacity, flexible, and integrated production systems enhancing both productivity and adoption of compostable packaging solutions across multiple industries.

| Metric | Value |

|---|---|

| Compostable Packaging Equipment Market Estimated Value in (2025 E) | USD 37.5 billion |

| Compostable Packaging Equipment Market Forecast Value in (2035 F) | USD 90.3 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

The compostable packaging equipment market is supported by several parent markets that shape its demand and application across different industries. The packaging machinery market plays the most critical role, with compostable packaging equipment accounting for nearly 15-18% of this segment. Businesses investing in automated packaging systems are increasingly deploying machinery capable of processing compostable materials, driven by the need for versatile and efficient solutions. The food and beverage packaging market contributes around 12-15% of the compostable packaging equipment market, as the sector requires packaging that maintains freshness while offering environmentally friendly disposal options. Ready-to-eat meals, snacks, beverages, and frozen products are among the categories where this demand is particularly strong.

The consumer goods packaging market represents approximately 8-10% of the share. Personal care, household goods, and other fast-moving consumer products are gradually transitioning toward compostable packaging, increasing investments in equipment that can meet these requirements. The pharmaceutical packaging market accounts for about 6-8%, as compostable packaging is gaining relevance in secondary and tertiary packaging for medicines, supplements, and disposable healthcare products. Growing regulatory emphasis on reducing environmental impact in healthcare packaging is fueling this trend. The retail and e-commerce packaging market holds roughly 7-9% of the compostable packaging equipment market.

The Compostable Packaging Equipment market is experiencing accelerated expansion, driven by the increasing global emphasis on sustainability and circular economy initiatives. Growing regulatory mandates on reducing single-use plastics, coupled with heightened consumer awareness about environmental impact, have significantly boosted the adoption of compostable packaging solutions. Technological advancements in manufacturing equipment are enabling higher production efficiency, improved material compatibility, and lower operational costs, making compostable packaging a viable alternative for a wide range of industries.

The ability of modern equipment to handle diverse biodegradable materials while maintaining product integrity is further enhancing market adoption. In addition, brand owners are investing in sustainable packaging strategies to align with corporate environmental goals, creating a strong demand for advanced compostable packaging machinery.

The integration of automation, real-time monitoring, and energy-efficient systems is expected to further improve throughput and reduce waste, ensuring continued market growth As consumer preferences and industry regulations evolve, the market is anticipated to witness strong adoption across both developed and emerging economies.

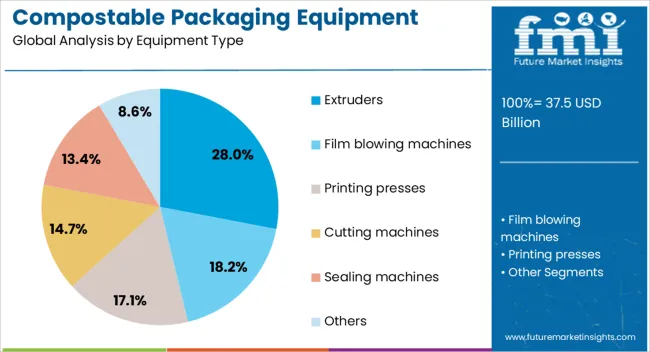

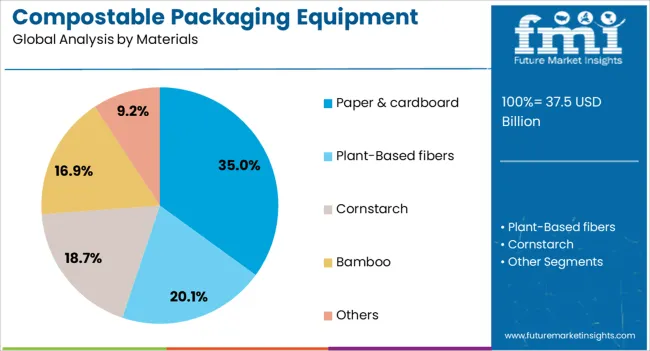

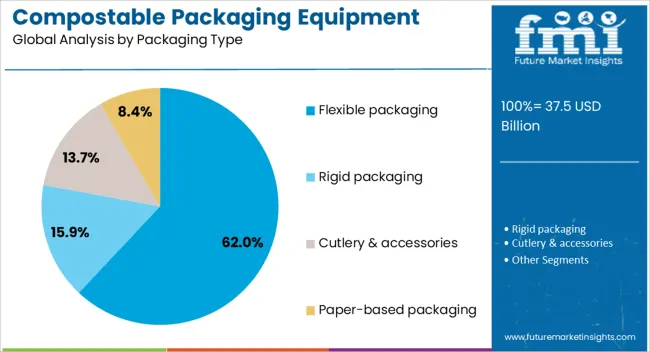

The compostable packaging equipment market is segmented by equipment type, materials, packaging type, automation grade, power source, end use, distribution channel, and geographic regions. By equipment type, compostable packaging equipment market is divided into Extruders, Film blowing machines, Printing presses, Cutting machines, Sealing machines, and Others. In terms of materials, compostable packaging equipment market is classified into Paper & cardboard, Plant-Based fibers, Cornstarch, Bamboo, and Others. Based on packaging type, compostable packaging equipment market is segmented into Flexible packaging, Rigid packaging, Cutlery & accessories, and Paper-based packaging. By automation grade, compostable packaging equipment market is segmented into Automatic, Semi-automatic, and Manual. By power source, compostable packaging equipment market is segmented into Electric-powered equipment, Gas-powered equipment, Diesel, and Hybrid. By end use, compostable packaging equipment market is segmented into Food & beverage packaging, Retail & consumer goods, Healthcare & personal care, E-commerce & shipping, Agriculture & horticulture, and Others. By distribution channel, compostable packaging equipment market is segmented into Direct and Indirect. Regionally, the compostable packaging equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The extruders segment is projected to account for 28% of the Compostable Packaging Equipment market revenue share in 2025, making it the leading equipment type. Growth in this segment has been supported by its ability to efficiently process biodegradable polymers into films, sheets, and other packaging forms with high precision and consistency.

The flexibility of extruder systems to adapt to varying material formulations without significant downtime has improved production efficiency. Additionally, technological upgrades in extruder machinery have enabled better control over material properties, ensuring uniform thickness and enhanced barrier performance in compostable packaging products.

Demand has also been driven by the ability to integrate extruders into automated production lines, reducing labor costs and improving scalability With increasing investment in sustainable packaging production facilities, extruders have been widely preferred for their reliability, adaptability, and cost-effectiveness, reinforcing their dominant position in the market.

The paper and cardboard segment is expected to hold 35% of the Compostable Packaging Equipment market revenue share in 2025, establishing itself as the leading material category. The segment’s prominence has been attributed to the material’s biodegradability, recyclability, and widespread consumer acceptance.

Advancements in coating technologies and material processing have enhanced the durability and moisture resistance of paper and cardboard packaging, expanding its applications across multiple industries. Growing demand from food and beverage, personal care, and e-commerce sectors has further strengthened its market position.

Equipment designed for paper and cardboard processing has evolved to deliver high-speed, precision cutting, and shaping capabilities, meeting the increasing volume requirements of large-scale production The segment is also benefiting from favorable regulations promoting fiber-based materials over plastic-based alternatives, further supporting its sustained growth in the compostable packaging domain.

The flexible packaging segment is anticipated to capture 62% of the Compostable Packaging Equipment market revenue share in 2025, making it the dominant packaging type. Its market leadership has been driven by its lightweight nature, reduced material usage, and versatility in design and application. Flexible compostable packaging offers significant advantages in storage and transportation efficiency, reducing overall logistics costs for manufacturers and distributors.

The adaptability of flexible packaging to various shapes, sizes, and barrier requirements has made it highly suitable for a broad spectrum of products, including perishable goods. Advances in compostable films and laminates have improved product shelf life and printing quality, enhancing brand visibility.

Equipment innovations enabling high-speed pouching, sealing, and printing have also contributed to the segment’s growth With increasing consumer demand for convenient, eco-friendly packaging solutions, flexible packaging continues to lead the market, backed by both functional benefits and environmental advantages.

The compostable packaging equipment sector is expanding steadily as industries seek alternatives to conventional plastic packaging. Growth is supported by strong demand from food and beverage, healthcare, and personal care segments where packaging performance, safety, and compliance are crucial. Manufacturers are investing in advanced machinery such as film extrusion systems, thermoforming lines, and form fill seal units optimized for compostable substrates. The acceleration of e commerce has also increased the need for packaging that is both protective and compatible with modern waste management frameworks. Technological strides including servo driven systems, automated handling, and modular equipment designs are helping producers improve output speed and material efficiency.

The cost of specialized machinery remains a significant barrier for smaller manufacturers who may struggle to justify the capital outlay. Feedstock volatility for compostable materials such as PLA, PHA, and starch blends creates added complexity, as inconsistent raw material availability impacts both production and profitability. Integration of compostable packaging machinery into existing production systems can also be resource intensive, requiring reconfiguration, operator training, and maintenance specialization. Moreover, compliance with diverse regional regulations on compostability, labeling, and material performance adds to operational burdens, demanding frequent adaptations to meet certification requirements. Skilled labor shortages, particularly in technical roles like equipment calibration and repair, further tighten production capacity. Together, these factors create operational hurdles that can delay adoption and limit market accessibility, highlighting the need for strategic investments and stronger technical support frameworks.

Regulatory pressure is a major driver, with restrictions on single use plastics compelling industries to transition toward compostable packaging formats. This shift is reinforced by consumer demand for packaging that offers better end of life outcomes, particularly in food, beverage, and e commerce applications. Technological improvements in machinery design are also fueling adoption, as modern systems provide higher accuracy, speed, and flexibility for handling compostable films and trays. Automation and robotics are playing a vital role in ensuring consistent product quality, reducing labor dependency, and improving throughput. The growth of ready to eat and convenience foods, combined with rising demand in personal care and medical sectors, is further strengthening the outlook for compostable packaging equipment. These drivers collectively create a favorable environment for manufacturers to expand operations and invest in next generation packaging technologies.

Equipment capable of producing customized packaging formats such as stand up pouches, thermoformed trays, and multilayer compostable films is gaining traction as brands seek to differentiate their products. The expansion of e commerce is creating opportunities for protective packaging designs that balance durability with compostability. Emerging markets in Asia Pacific and Latin America present strong potential, as rising incomes and rapid industrialization accelerate demand for packaged goods. Manufacturers who offer localized sales networks and modular equipment models will be well positioned to capture this demand. Digitalization also presents opportunities, with IoT enabled systems supporting real time monitoring and predictive maintenance for better efficiency. Companies investing in R and D for advanced substrates and machinery compatibility can further expand their reach, unlocking new possibilities across foodservice, retail, and healthcare packaging applications.

The compostable packaging equipment market is evolving rapidly under the influence of technology. Industry 4.0 practices such as IoT integration, data analytics, and predictive maintenance are being applied to optimize machinery performance and reduce downtime. Digital printing and smart labeling are enhancing personalization and traceability, enabling brands to provide interactive and informative packaging experiences. Robotics and collaborative automation are improving material handling, reducing changeover times, and lowering reliance on manual operations. As compostable materials expand in variety, equipment designs are adapting to handle new substrates with greater precision and reduced waste. Modular equipment that can scale with production needs is gaining preference, allowing manufacturers flexibility in operations. The adoption of fully automated lines that self adjust based on run length and material characteristics is also increasing. These innovations point toward a future where compostable packaging equipment delivers higher efficiency, adaptability, and product diversity.

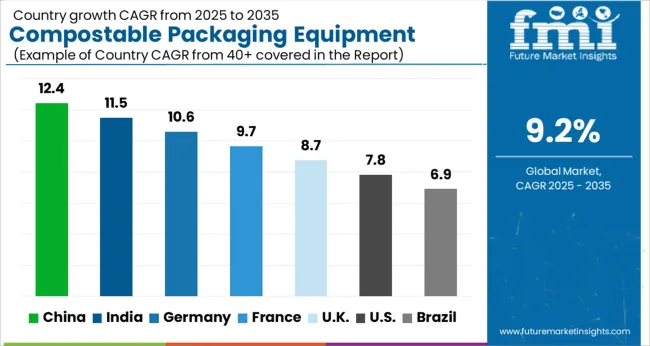

| Countries | CAGR |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| France | 9.7% |

| UK | 8.7% |

| USA | 7.8% |

| Brazil | 6.9% |

The global compostable packaging equipment market is expected to grow at a CAGR of 9.2% from 2025 to 2035. China leads with a growth rate of 12.4%, followed by India at 11.5%, and France at 9.7%. The United Kingdom and the United States record growth rates of 8.7% and 7.8%, respectively. Market growth is driven by strong demand in food, beverage, personal care, and retail sectors, alongside regulatory measures encouraging alternatives to conventional packaging. Investments in advanced machinery, automation, and international partnerships are expected to shape the market’s trajectory across these leading regions. The analysis includes over 40+ countries, with the leading markets detailed below.

China is projected to dominate the compostable packaging equipment market with a CAGR of 12.4% between 2025 and 2035. The rapid expansion of consumer goods, food service, and e-commerce industries is creating strong demand for compostable packaging and the machinery required for its production. With large-scale manufacturing capacity, China is advancing investments in automated and high-speed machinery to address the rising need for innovative packaging solutions. Government initiatives encouraging the use of eco-friendly materials in packaging also play a critical role in shaping demand. The country’s export-oriented industries further fuel the adoption of compostable packaging equipment, with global clients demanding high-quality, eco-compliant packaging formats.

India is forecast to grow at a CAGR of 11.5% in the compostable packaging equipment market from 2025 to 2035. The demand is driven by expanding food service, retail, and consumer goods industries, alongside rising awareness about alternatives to traditional packaging. India’s strong manufacturing ecosystem and investments in advanced packaging technology are fostering market expansion. With government policies supporting greener packaging options, local manufacturers are increasingly adopting equipment designed for compostable materials. Small and medium-scale enterprises are emerging as important adopters, with equipment suppliers providing cost-efficient machinery to address their requirements

France is expected to expand at a CAGR of 9.7% in the compostable packaging equipment market from 2025 to 2035. The demand is supported by strong regulations on packaging materials and the country’s focus on reducing dependency on conventional plastics. The growing popularity of compostable packaging in food, beverage, and personal care industries continues to support the equipment market. With retailers and consumer brands increasingly investing in compostable formats, the need for advanced machinery capable of producing efficient and scalable solutions is expected to increase. The expansion of packaging R&D centers across Europe further strengthens France’s role in driving technological advancement in this market.

The United Kingdom is projected to grow at a CAGR of 8.7% between 2025 and 2035 in the compostable packaging equipment market. The demand is shaped by retail modernization, growing foodservice industries, and government-led initiatives encouraging the adoption of alternative packaging formats. The UK is witnessing rising investment in packaging automation, with companies adopting machinery that ensures speed, consistency, and efficiency in compostable material production. Local manufacturers are also collaborating with international players to enhance technology adoption, enabling advanced packaging machinery to cater to both domestic and export needs.

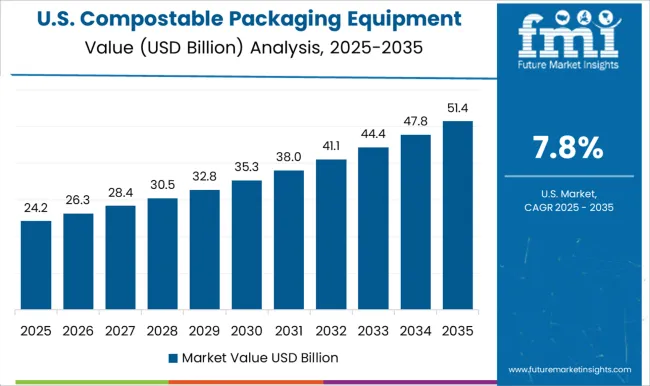

The USA market for compostable packaging equipment is anticipated to grow at a CAGR of 7.8% from 2025 to 2035. The expansion is supported by the strong demand for compostable packaging in food, beverage, and personal care sectors, coupled with increasing regulations on packaging waste. The USA is witnessing significant investment in next-generation packaging machinery that focuses on automation, high efficiency, and adaptability to various compostable materialsStrategic partnerships between USA packaging companies and global machinery providers are enhancing the market’s competitiveness, creating opportunities for advanced equipment integration.

In the compostable packaging equipment market, competition is centered on how effectively machinery can adapt to bio-based materials while ensuring high productivity and consistency. Bobst competes with advanced printing, coating, and lamination systems that are designed to run compostable substrates without compromising on speed or print clarity. AMUT offers extrusion and thermoforming equipment tailored to biodegradable polymers, allowing manufacturers to produce flexible films, trays, and containers suitable for food and consumer goods. Coperion focuses on compounding and extrusion systems that blend PLA, starch-based resins, and other bio-polymers with precision, providing converters with reliable material consistency and scalability. Windmöller & Hölscher positions its machinery in blown film and converting applications, where compostable resins are processed at industrial scale to meet growing demand in flexible packaging. Other OEMs compete in specialized segments, delivering solutions for niche products where compostable adoption is expanding rapidly. Strategies adopted by these companies emphasize portfolio diversification, pilot testing, and partnerships with resin developers to ensure machine compatibility with new-generation materials. Bobst highlights optimization of converting lines for bio-substrates, while AMUT focuses on extrusion systems capable of balancing throughput with film quality. Coperion strengthens its compounding technology for improved filler handling and durability of compostable blends. Windmöller & Hölscher emphasizes reliable, high-output film lines that can transition from trial runs to mass production. Product brochures highlight these approaches. Bobst presents laminators and presses suited for compostable packaging. AMUT details extrusion and thermoforming solutions for bio-resins. Coperion showcases twin-screw extruders for compostable blends, while Windmöller & Hölscher highlights blown film lines engineered for certified compostable materials.

| Item | Value |

|---|---|

| Quantitative Units | USD 37.5 Billion |

| Equipment Type | Extruders, Film blowing machines, Printing presses, Cutting machines, Sealing machines, and Others |

| Materials | Paper & cardboard, Plant-Based fibers, Cornstarch, Bamboo, and Others |

| Packaging Type | Flexible packaging, Rigid packaging, Cutlery & accessories, and Paper-based packaging |

| Automation Grade | Automatic, Semi-automatic, and Manual |

| Power Source | Electric-powered equipment, Gas-powered equipment, Diesel, and Hybrid |

| End Use | Food & beverage packaging, Retail & consumer goods, Healthcare & personal care, E-commerce & shipping, Agriculture & horticulture, and Others |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bobst, AMUT, Coperion, Windmöller & Hölscher, and Other OEMs |

| Additional Attributes | Dollar sales by equipment type (extruders, converters, bag-making, pouch-making), material compatibility (PLA, PBAT, starch blends), and automation level (manual, semi-automated, fully automated). Demand dynamics are driven by the rise in eco-conscious packaging adoption, regulatory mandates on compostable packaging, and increasing industrial and foodservice applications. Regional trends highlight growth in Europe, North America, and Asia-Pacific due to environmental regulations and expanding biodegradable packaging initiatives. |

The global compostable packaging equipment market is estimated to be valued at USD 37.5 billion in 2025.

The market size for the compostable packaging equipment market is projected to reach USD 90.3 billion by 2035.

The compostable packaging equipment market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in compostable packaging equipment market are extruders, film blowing machines, printing presses, cutting machines, sealing machines and others.

In terms of materials, paper & cardboard segment to command 35.0% share in the compostable packaging equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compostable Pouch Market Size and Share Forecast Outlook 2025 to 2035

Compostable Adhesives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Compostable Tableware Market Size and Share Forecast Outlook 2025 to 2035

Compostable Straws Market Growth - Demand & Forecast 2025 to 2035

Compostable Food Trays Market Size and Share Forecast Outlook 2025 to 2035

Compostable Toothbrush Market Growth & Forecast 2025 to 2035

Market Positioning & Share in the Compostable Food Trays Industry

Leading Providers & Market Share in the Compostable Toothbrush Industry

Global Compostable & Biodegradable Refuse Bags Market Insights – Trends, Demand & Growth 2025–2035

Market Share Distribution Among Compostable Refuse Bag Manufacturers

Compostable Mailer Market Growth & Trends Forecast 2024-2034

Compostable Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Compostable Packaging Companies

Compostable Plastic Packaging Material Market from 2025 to 2035

Compostable Foodservice Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Compostable Foodservice Packaging Providers

UK Compostable Toothbrush Market Report – Key Trends & Growth Forecast 2025-2035

India Compostable Toothbrush Market Report – Key Trends & Growth Forecast 2025-2035

France Compostable Toothbrush Market Report – Key Trends & Growth Forecast 2025-2035

Hinged Lid Compostable Container Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA