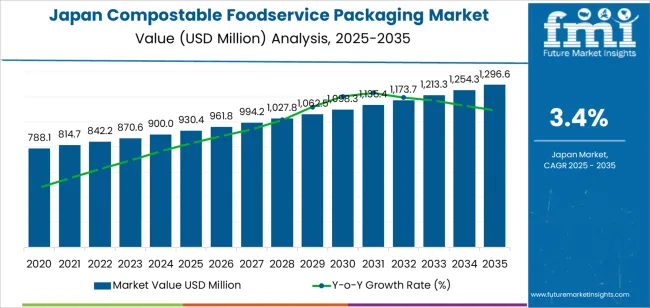

The demand for compostable foodservice packaging in Japan is expected to grow from USD 930.4 million in 2025 to USD 1,296.6 million by 2035, reflecting a CAGR of 3.4%. Compostable packaging, including biodegradable containers, compostable cutlery, and eco-friendly food wrappers, is gaining traction in Japan amid increasing environmental awareness and the government’s focus on reducing plastic waste. The shift towards sustainable packaging solutions is driven by consumer preference for eco-friendly alternatives and stricter regulations on single-use plastics. As restaurants, cafes, and foodservice providers adopt green practices to meet consumer demand for sustainable packaging, the market for compostable foodservice packaging is expected to grow steadily.

Technological advancements in bioplastics and compostable materials are also supporting the growth of the market. With innovations in packaging technologies that provide durability, heat resistance, and functional design, compostable packaging is becoming increasingly viable for use across a wide range of foodservice applications. Japan’s strict environmental policies and the push towards a circular economy will drive the adoption of compostable packaging solutions, making it a key segment in the overall sustainable packaging market.

The growth momentum analysis for compostable foodservice packaging in Japan shows consistent, steady expansion across the forecast period, with accelerating growth in the early years followed by sustained demand as the market matures.

From 2025 to 2030, the market will grow from USD 930.4 million to USD 1,098.3 million, contributing an increase of USD 167.9 million in value. This phase will witness strong momentum, driven by the rising demand for sustainable food packaging in response to both consumer preferences and regulatory pressures. The momentum in this phase will be further accelerated by Japan’s stringent regulations regarding plastic waste reduction and eco-friendly packaging standards. Increased awareness of environmental impact and the growing trend of green consumerism will lead to wider adoption of compostable packaging across the foodservice industry.

From 2030 to 2035, the market will grow from USD 1,098.3 million to USD 1,296.6 million, adding USD 198.3 million in value. This phase will see stable growth momentum, as the market matures with wider industry adoption of compostable packaging solutions. Although the growth rate will decelerate slightly as the market becomes more saturated, the demand will remain strong due to continued regulatory support for sustainable packaging, technological advancements, and the increasing consumer shift towards eco-conscious dining experiences. The second half of the forecast period will see steady adoption across restaurants, cafes, and other foodservice establishments, contributing to ongoing growth despite a more mature market.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 930.4 million |

| Industry Forecast Value (2035) | USD 1,296.6 million |

| Industry Forecast CAGR (2025-2035) | 3.4% |

Demand for compostable foodservice packaging in Japan is growing as foodservice operators respond to increasing sustainability expectations and regulatory pressures to reduce plastic waste. The broader foodservice packaging market in Japan is projected to grow at a compound annual growth rate (CAGR) of about 6.5 % from 2025 to 2033. In this context, compostable packaging formats are gaining traction as brands and operators shift away from conventional plastics toward materials that can be composted or otherwise responsibly managed. The drive towards takeaway, delivery and convenience food solutions also elevates the need for lightweight, single use packaging that aligns with eco friendly credentials.

Another key factor is government policy and consumer preference in Japan. Policies aimed at reducing single use plastics and promoting circular economy principles reinforce the case for compostable materials in foodservice applications. Japanese consumers display increasing interest in sustainable packaging solutions and expect food operators to meet higher environmental standards. Innovations in material science such as paper based, bagasse or bamboo compostable formats and enhanced certification frameworks support wider uptake.

However, barriers such as higher cost of compostable substrates relative to traditional plastics, limited industrial composting infrastructure, and the need to ensure functional performance in foodservice environments remain. Overall, the convergence of regulatory momentum, consumer awareness and foodservice packaging demand suggests that the market for compostable foodservice packaging in Japan will continue to expand.

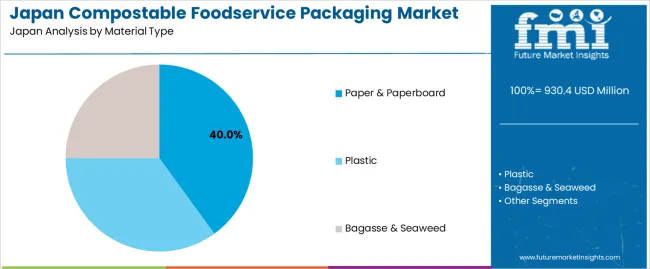

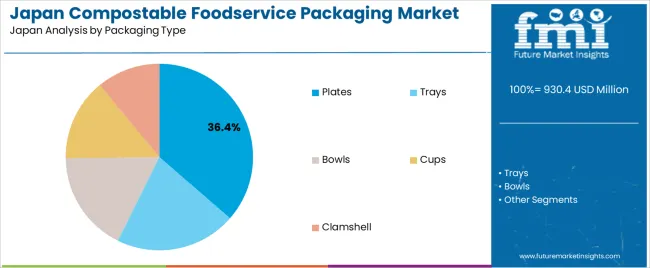

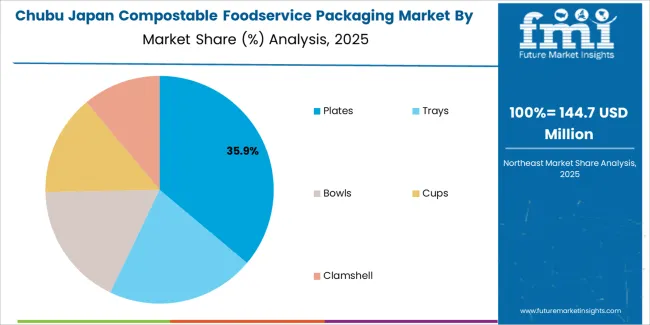

The demand for compostable foodservice packaging in Japan is primarily driven by material type and packaging type. The leading material type is paper & paperboard, capturing 40% of the market share, while plates are the dominant packaging type, accounting for 36.4% of the demand. With the growing focus on sustainability and environmental responsibility, compostable foodservice packaging is increasingly preferred by businesses and consumers alike. The shift towards eco-friendly alternatives in the foodservice industry is being driven by both consumer demand and regulatory pressures to reduce plastic waste.

Paper & paperboard dominate the compostable foodservice packaging market in Japan, holding 40% of the demand. Paper-based products are highly preferred due to their biodegradability, renewable nature, and ability to break down naturally without causing long-term environmental harm. Paper and paperboard materials are widely used in packaging for a variety of foodservice applications, offering a sustainable alternative to traditional plastic containers and utensils.

The demand for paper & paperboard packaging is driven by the increasing awareness of environmental issues, such as plastic pollution, and the growing emphasis on reducing waste in foodservice operations. Consumers and businesses alike are seeking more sustainable solutions, and paper & paperboard products are ideal for disposable packaging in restaurants, cafes, and fast-food chains. Additionally, the ability to print branding and product information directly on paper-based packaging makes it an attractive option for companies looking to align with eco-conscious consumer values. As sustainability becomes a higher priority, the use of paper & paperboard in foodservice packaging is expected to continue growing in Japan.

Plates are the leading packaging type in the compostable foodservice packaging market in Japan, accounting for 36.4% of the demand. Compostable plates are commonly used in both fast-casual and fine dining settings, especially for takeout, catering, and events where sustainability is a key focus. These plates are often made from paper, bagasse, or other biodegradable materials, offering a sustainable alternative to traditional plastic or foam plates.

The demand for compostable plates is driven by the increasing consumer preference for environmentally friendly and single-use items that do not contribute to long-lasting waste. As Japan moves toward reducing its environmental footprint, the adoption of compostable plates in foodservice establishments is expected to grow. Furthermore, government regulations and policies aimed at reducing plastic waste and promoting sustainability are likely to further drive the use of compostable plates. With the continued focus on eco-friendly alternatives in the foodservice industry, plates will remain a dominant product in the compostable packaging sector.

Demand for compostable foodservice packaging in Japan is driven by a rising focus on environmental sustainability in the food service and takeaway sectors, where operators seek alternatives to conventional plastics. Fast food chains and food delivery platforms are increasingly adopting compostable materials to align with regulatory pressures and consumer expectations. At the same time, higher material and processing costs, as well as limited industrial composting infrastructure, moderate the pace of adoption. These factors combine to shape the evolving demand environment for compostable packaging in Japan.

Several drivers support growth. First, Japan’s food service industry particularly takeaway and delivery segments is expanding and requires packaging that supports convenience and hygiene while managing waste. Second, regulatory initiatives and industry commitments aimed at reducing single use plastics and improving waste diversion are prompting adoption of compostable options. Third, Japanese consumers increasingly value eco friendly packaging and associate high quality or premium food experiences with sustainable materials. Fourth, major food service operators in Japan are switching to materials like bagasse and molded fiber, reinforcing supplier momentum and supply chain readiness.

Despite significant growth potential, restraints remain. The higher cost of compostable packaging compared with conventional plastics can limit uptake among cost sensitive operators. Industrial composting facilities and collection systems in many Japanese municipalities are still underdeveloped, reducing the end of life value proposition of compostable materials. Some food service outlets may lack infrastructure or processes to segregate compostable waste effectively. Additionally, performance concerns (such as durability, moisture resistance and heat retention) of early generation compostable options may deter adoption in demanding food service applications.

Key trends include the increasing use of fiber based materials (such as bagasse, bamboo pulp and molded fiber) for hot food containers and clamshells, which better match sustainability credentials and functional requirements. Food service chains are integrating branding of sustainable packaging into customer messaging and menu design, using compostable packaging as part of their environmental strategy. Suppliers are developing enhanced compostable coatings and formulations that improve moisture, grease and heat resistance to broaden application scope. Finally, the expansion of food delivery and ghost kitchen operations in Japan is accelerating demand for packaging specifically tailored to take out and delivery with a sustainability narrative.

The demand for compostable foodservice packaging in Japan is growing as the country continues to prioritize environmental sustainability and waste reduction. Compostable packaging offers a solution to the environmental concerns associated with plastic waste, particularly in the foodservice industry, where single-use packaging is prevalent. Japan’s strong emphasis on waste management, combined with consumer and regulatory pressure for eco-friendly alternatives, is driving the adoption of compostable foodservice packaging.

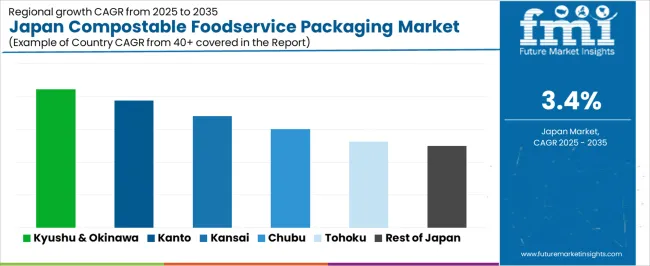

Additionally, the increasing number of foodservice businesses adopting sustainable practices and the rising awareness among consumers about the environmental impact of packaging are contributing to the market's growth. Regional demand is influenced by factors such as local environmental regulations, industrial activity, and consumer awareness of sustainable packaging solutions. Below is an analysis of the demand for compostable foodservice packaging across different regions in Japan.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 4.2% |

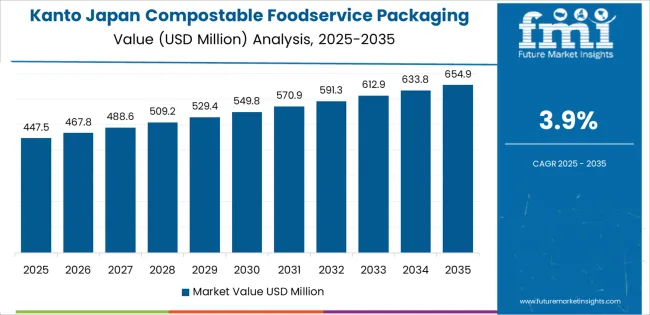

| Kanto | 3.9% |

| Kinki | 3.4% |

| Chubu | 3% |

| Tohoku | 2.6% |

| Rest of Japan | 2.5% |

Kyushu & Okinawa leads the demand for compostable foodservice packaging in Japan with a CAGR of 4.2%. This can be attributed to the region’s growing emphasis on sustainability and eco-friendly practices, particularly in tourist-heavy areas like Okinawa. The island’s strong reliance on tourism and its focus on preserving natural beauty make it a hotspot for environmental initiatives, including the adoption of compostable packaging solutions in the foodservice sector.

Kyushu & Okinawa’s proactive approach to waste reduction and local regulations promoting sustainable packaging further support the region’s high demand for compostable foodservice packaging. As consumers in the region become increasingly environmentally conscious and businesses strive to meet sustainability goals, the adoption of compostable packaging continues to rise, driving the market’s growth.

Kanto shows strong demand for compostable foodservice packaging with a CAGR of 3.9%. Kanto, home to Tokyo and its surrounding areas, is a major center of both foodservice activity and sustainability initiatives. As the capital region, Tokyo has a high concentration of restaurants, cafes, and foodservice providers who are increasingly adopting compostable packaging solutions to meet growing consumer demand for eco-friendly practices.

The region’s strict waste management regulations and the rising pressure on businesses to adopt green solutions are key drivers behind this trend. Additionally, as Kanto’s population grows more conscious of environmental impacts, businesses are being compelled to switch to sustainable packaging options. The combination of environmental awareness, local regulations, and the high concentration of foodservice businesses in Kanto contributes to the region's robust demand for compostable foodservice packaging.

Kinki, with a CAGR of 3.4%, shows steady demand for compostable foodservice packaging. The region includes Osaka and Kyoto, two of Japan’s major metropolitan areas with a strong foodservice sector. The demand for compostable packaging in Kinki is driven by the region’s growing focus on sustainability in the food and hospitality industries. Osaka’s role as a key business hub, combined with Kyoto’s historical significance as a tourist destination, further fuels the adoption of sustainable packaging practices.

While growth in Kinki is slower than in Kyushu & Okinawa and Kanto, the steady demand is supported by increasing awareness of environmental issues, government incentives for sustainable practices, and consumer preferences for eco-friendly alternatives. As more businesses in Kinki adopt compostable solutions to align with local sustainability goals, the demand for compostable foodservice packaging continues to grow.

Chubu shows moderate growth in the demand for compostable foodservice packaging with a CAGR of 3.0%. The region, which includes Nagoya and surrounding areas, has a strong manufacturing base, with foodservice packaging companies beginning to shift towards more sustainable solutions in response to increasing consumer awareness and regulatory pressures. Chubu’s industrial focus on automotive and technology sectors is now complemented by rising attention to sustainable practices in foodservice and packaging.

Although growth in Chubu is slower compared to other regions like Kyushu & Okinawa and Kanto, the demand for compostable foodservice packaging is steadily increasing as local businesses adopt greener alternatives. The region’s evolving awareness of environmental issues and the growing demand for sustainable products contribute to the market's moderate growth.

Tohoku, with a CAGR of 2.6%, and the Rest of Japan, with a CAGR of 2.5%, show slower growth in the demand for compostable foodservice packaging. These regions are less urbanized and have fewer foodservice providers that are as heavily influenced by sustainability trends compared to larger metropolitan areas. Although there is some demand for eco-friendly packaging, it is more limited due to less emphasis on sustainability in rural areas.

However, as awareness of environmental issues increases in these regions and as local governments and businesses begin to adopt more sustainable practices, the demand for compostable packaging will likely see gradual growth. While the growth rate is slower than in other regions, Tohoku and the Rest of Japan are expected to catch up over time, as sustainability becomes an increasingly important factor in the foodservice industry.

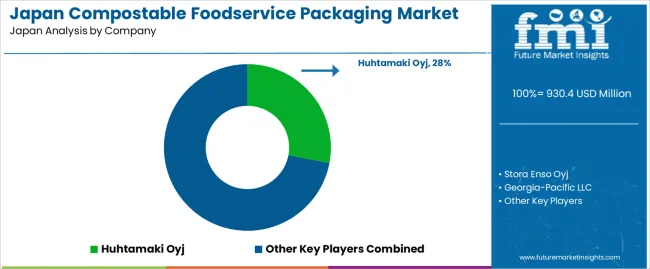

The demand for compostable foodservice packaging in Japan is growing as consumers and businesses increasingly prioritize sustainability and environmental responsibility. Companies like Huhtamaki Oyj (holding approximately 28% market share), Stora Enso Oyj, Georgia-Pacific LLC, WestRock Company, and Mondi Group are key players in this market. The shift toward compostable and biodegradable materials is driven by Japan’s strong environmental regulations, consumer demand for eco-friendly packaging, and a rising awareness of the environmental impact of single-use plastics.

Competition in the compostable foodservice packaging industry is focused on product performance, material innovation, and sustainability credentials. Companies are investing in developing packaging solutions that are not only compostable but also durable, functional, and capable of maintaining the quality of food items. Additionally, there is increasing demand for packaging that can be easily processed through existing composting infrastructure, ensuring a true circular economy.

Another competitive factor is the ability to provide custom packaging solutions for different types of foodservice operations, including quick-service restaurants, catering, and takeout businesses. Marketing materials typically emphasize features such as compostability certifications, material sourcing (e.g., renewable resources), and compliance with Japanese and international environmental standards. By aligning their products with the growing demand for sustainable, eco-friendly packaging solutions, these companies aim to strengthen their position in Japan’s compostable foodservice packaging market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Material Type | Paper & Paperboard, Plastic, Bagasse & Seaweed |

| Packaging Type | Plates, Trays, Bowls, Cups, Clamshell |

| End Use | Chain Restaurants, Non-Chain Restaurants, Chain Cafe, Non-Chain Cafe, Delivery Catering |

| Key Companies Profiled | Huhtamaki Oyj, Stora Enso Oyj, Georgia-Pacific LLC, WestRock Company, Mondi Group |

| Additional Attributes | The market analysis includes dollar sales by material type, packaging type, and end-use categories. It also covers regional demand trends in Japan, particularly driven by the growing need for sustainable and compostable foodservice packaging. The competitive landscape highlights key players in the compostable packaging industry, focusing on innovations in biodegradable and eco-friendly packaging materials. Trends in the increasing adoption of compostable packaging in restaurants, cafes, and delivery catering services are explored, along with advancements in material technologies and regulatory influences promoting sustainable practices. |

The global demand for compostable foodservice packaging in Japan is estimated to be valued at USD 930.4 million in 2025.

The demand for compostable foodservice packaging in Japan is projected to reach USD 1,296.6 million by 2035.

The demand for compostable foodservice packaging in Japan is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types for compostable foodservice packaging in Japan are paper & paperboard, plastic and bagasse & seaweed.

In terms of packaging type, plates segment is expected to command 36.4% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA