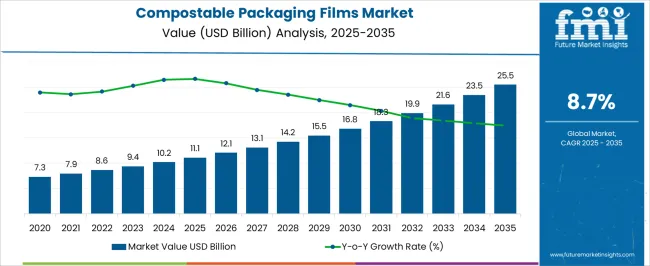

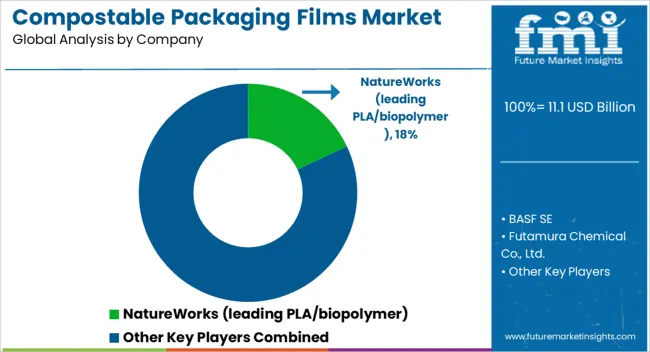

The compostable packaging films market is estimated to be valued at USD 11.1 billion in 2025 and is projected to reach USD 25.5 billion by 2035, registering a compound annual growth rate (CAGR) of 8.7% over the forecast period.

During the early adoption phase (2020–2024), growth was modest, with limited deployment in niche packaging applications. Manufacturers focused on demonstrating product performance, compatibility with existing packaging machinery, and consumer acceptance. By 2025, as the market reaches USD 11.1 billion, the scaling phase begins, characterized by broader adoption across food, beverage, and consumer goods segments, increasing production capacities, and expanded distribution networks supporting higher market penetration.

Between 2025 and 2030, the market expands from USD 11.1 billion to approximately USD 15–16.8 billion. Adoption spreads across regional markets, driven by increasing product availability and operational efficiencies. The consolidation phase from 2030 to 2035 sees the market reaching USD 25.5 billion, with growth stabilizing. By this stage, compostable packaging films are widely used across multiple industries, supply chains are mature, and production processes are optimized. The market transitions from steady expansion to a well-established segment, supported by predictable demand, standardized production, and integration into mainstream packaging operations.

| Metric | Value |

|---|---|

| Compostable Packaging Films Market Estimated Value in (2025 E) | USD 11.1 billion |

| Compostable Packaging Films Market Forecast Value in (2035 F) | USD 25.5 billion |

| Forecast CAGR (2025 to 2035) | 8.7% |

The compostable packaging films market, growing from USD 11.1 billion in 2025 to USD 25.5 billion by 2035 at a CAGR of 8.7%, exhibits key breakpoints marking shifts in adoption and market dynamics. The first significant breakpoint occurs around 2025, when the market reaches USD 11.1 billion. At this stage, adoption moves from limited niche use to broader commercial deployment across food, beverage, and consumer goods segments. Increased production capacity, successful pilot implementations, and growing acceptance among manufacturers and retailers build confidence. This phase represents the scaling period, characterized by expanding adoption, enhanced distribution networks, and investments in supply chains to meet increasing demand.

A second critical breakpoint emerges between 2030 and 2032, as the market approaches USD 19–21 billion. By this stage, compostable packaging films are widely adopted, and the market begins shifting from rapid growth to consolidation. Major suppliers strengthen their positions, supply chains stabilize, and production processes become standardized. By 2035, reaching USD 25.5 billion, the market reflects full consolidation, with compostable films established as a mainstream packaging solution. Mature production capabilities, optimized logistics, and predictable demand patterns ensure long-term stability and position the market as a well-established segment within the global packaging industry.

The market is experiencing accelerated growth as sustainability becomes a central priority for industries and consumers. Increasing regulatory mandates targeting single-use plastics and a shift toward eco-friendly packaging solutions are creating a favorable environment for adoption. Technological advancements in biodegradable polymers have enhanced the performance characteristics of compostable films, making them suitable for a broader range of applications without compromising durability or product safety.

Rising consumer preference for environmentally responsible packaging, coupled with heightened brand commitments to sustainability, is driving market penetration. Food safety compliance, extended shelf life, and compatibility with existing packaging machinery are adding to the appeal of these films across various sectors.

The market outlook remains positive, supported by continuous innovation in material science, strategic collaborations between packaging manufacturers and end-users, and the expansion of composting infrastructure As global awareness about environmental impact grows, compostable packaging films are positioned to capture a significant share of the packaging industry in the years ahead.

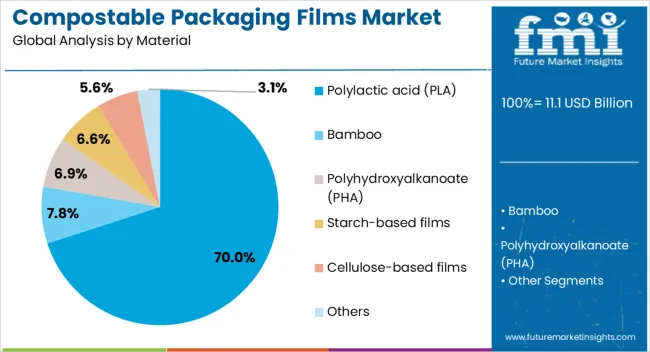

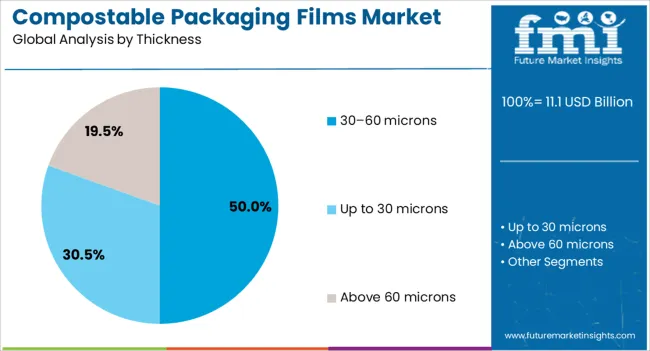

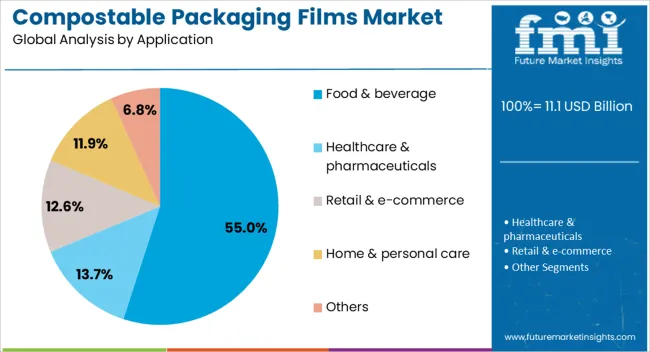

The compostable packaging films market is segmented by material, thickness, application, and geographic regions. By material, compostable packaging films market is divided into polylactic acid (PLA), bamboo, polyhydroxyalkanoate (PHA), starch-based films, cellulose-based films, and others. In terms of thickness, compostable packaging films market is classified into 30–60 microns, up to 30 microns, and above 60 microns. Based on application, compostable packaging films market is segmented into food & beverage, healthcare & pharmaceuticals, retail & e-commerce, home & personal care, and others. Regionally, the compostable packaging films industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polylactic acid (PLA) material segment is projected to account for 70% of the Compostable Packaging Films market revenue share in 2025, making it the dominant material category. This growth has been driven by the bio-based origin of PLA, which is derived from renewable resources such as corn starch and sugarcane, ensuring a lower carbon footprint compared to petroleum-based plastics. PLA offers excellent transparency, printability, and mechanical strength, making it well-suited for diverse packaging needs. Its compatibility with industrial composting processes and ability to meet stringent regulatory standards for biodegradability have strengthened its adoption among environmentally conscious brands. The material’s cost-effectiveness, improving supply chain availability, and adaptability to various film manufacturing processes have further bolstered its market position As manufacturers continue to innovate in PLA formulation to enhance heat resistance and moisture barrier properties, its share is expected to remain strong, reflecting its role as a preferred choice for sustainable packaging solutions.

The 30–60 microns thickness segment is anticipated to hold 50% of the Compostable Packaging Films market revenue share in 2025, emerging as the leading thickness range. This dominance has been supported by the optimal balance it offers between durability, flexibility, and cost efficiency. Films in this range provide adequate mechanical strength to protect products during storage and transportation while maintaining compostability standards. Their versatility enables usage in multiple packaging formats, including pouches, wraps, and bags, which cater to diverse industry needs. The thickness range also allows for effective printing and branding, which is increasingly important for consumer-facing products. Cost savings in raw material usage compared to thicker alternatives, along with compatibility with high-speed packaging machinery, have contributed to its widespread adoption Additionally, the ability to meet performance requirements across food, beverage, and non-food sectors while aligning with sustainability goals ensures the continued preference for this segment.

The food and beverage application segment is expected to capture 55% of the Compostable Packaging Films market revenue share in 2025, positioning it as the leading application category. This growth has been reinforced by the increasing demand for sustainable packaging in sectors where freshness, safety, and shelf life are paramount. Compostable films have been adopted widely for packaging fresh produce, snacks, ready-to-eat meals, and beverages, owing to their ability to provide a protective barrier against moisture and oxygen while being environmentally responsible. Regulatory pressure to reduce plastic waste in food packaging has accelerated the shift toward compostable solutions in this sector. Furthermore, rising consumer awareness about eco-friendly packaging and its environmental benefits has influenced purchasing decisions, prompting brands to incorporate compostable films into their product lines The adaptability of these films to various packaging technologies and their ability to maintain product integrity have further solidified their role in the food and beverage industry.

The compostable packaging films market is growing as demand rises for sustainable alternatives to conventional plastic packaging. Increasing consumer awareness of environmental issues, coupled with stricter regulations on single-use plastics, is driving adoption across food, beverage, and consumer goods industries. Compostable films offer benefits such as biodegradability, reduced carbon footprint, and compatibility with organic waste management systems. Technological advancements in material formulations, barrier properties, and production processes are further supporting market expansion. Companies providing innovative, certified, and high-performance compostable films are well-positioned to capitalize on the shift toward sustainable packaging solutions across retail, e-commerce, and foodservice sectors.

Compostable packaging films face challenges related to material performance, cost, and regulatory compliance. Achieving mechanical strength, flexibility, and barrier properties comparable to conventional plastics is complex and requires advanced formulations. Production costs are often higher than traditional packaging, affecting adoption in price-sensitive markets. Additionally, regulatory requirements and certifications for compostability differ across regions, creating challenges for manufacturers seeking global market penetration. End-of-life management also requires compatible waste processing infrastructure, which may not be widely available. Manufacturers must focus on R&D, standardized testing, and education of stakeholders to ensure that compostable films meet performance expectations while complying with environmental standards and supporting consumer confidence in sustainability claims.

The compostable packaging films market is trending toward innovative biodegradable materials and multi-layer films with improved performance. Films made from polylactic acid, starch blends, and other bio-based polymers are gaining prominence due to their environmental benefits and functional properties. Multi-layer films are being developed to provide enhanced moisture, oxygen, and grease barriers while remaining fully compostable. Research into coatings, additives, and process optimization is enabling better durability, printability, and shelf-life for packaged products. Collaboration between material scientists, packaging manufacturers, and brand owners is accelerating innovation. Consumer demand for eco-friendly packaging and rising adoption of zero-waste and circular economy principles are pushing manufacturers to develop films that balance environmental sustainability with operational performance.

The compostable packaging films market offers substantial opportunities in food packaging, retail, and e-commerce sectors. The growing demand for ready-to-eat meals, fresh produce, and takeaway food drives the need for flexible, safe, and sustainable films. Retailers and online marketplaces are increasingly prioritizing eco-friendly packaging to meet consumer expectations and corporate sustainability goals. Adoption of compostable films in secondary and protective packaging further supports brand initiatives in reducing plastic waste. Partnerships with waste management and composting facilities can enhance the value proposition by ensuring proper end-of-life disposal. Expansion into emerging markets, where regulatory pressure and consumer awareness are rising, presents additional growth potential for manufacturers that can deliver high-quality, certified, and cost-effective compostable films.

Market growth for compostable packaging films is restrained by higher production costs, limited composting infrastructure, and certain performance limitations. Bio-based materials and specialized processing increase manufacturing expenses compared to conventional plastics, which can discourage adoption in cost-sensitive sectors. Lack of widespread industrial composting facilities restricts proper disposal, reducing the environmental benefit of compostable films. Additionally, some films may have lower barrier properties, heat resistance, or durability compared to traditional plastics, limiting their use in certain applications. Consumer misunderstanding about compostable labeling and end-of-life handling can also reduce confidence. Until cost-effective solutions, infrastructure expansion, and performance improvements are achieved, adoption may remain concentrated in premium and sustainability-driven segments.

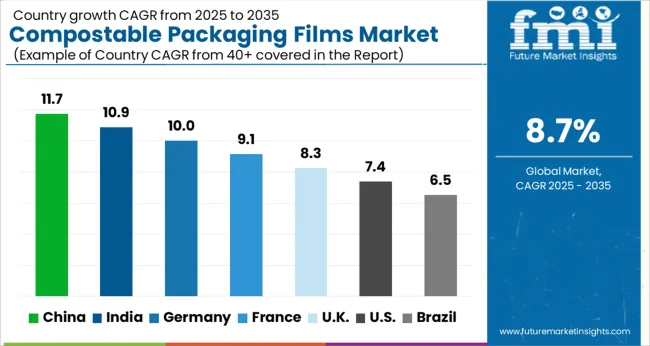

| Country | CAGR |

|---|---|

| China | 11.7% |

| India | 10.9% |

| Germany | 10.0% |

| France | 9.1% |

| UK | 8.3% |

| USA | 7.4% |

| Brazil | 6.5% |

The global compostable packaging films market is projected to grow at a CAGR of 8.7% through 2035, supported by increasing demand across food, beverage, and consumer goods packaging applications. Among BRICS nations, China has been recorded with 11.7% growth, driven by large-scale production and deployment in retail and industrial packaging, while India has been observed at 10.9%, supported by rising utilization in food and beverage packaging solutions. In the OECD region, Germany has been measured at 10.0%, where production and adoption for industrial and consumer packaging applications have been steadily maintained. The United Kingdom has been noted at 8.3%, reflecting consistent use in food and beverage packaging, while the USA has been recorded at 7.4%, with production and utilization across consumer goods, food, and industrial packaging sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The compostable packaging films market in China is growing at a CAGR of 8.7%, driven by increasing demand from the food, beverage, and e-commerce sectors. Manufacturers are focusing on biodegradable and compostable polymers that meet sustainability standards while offering strong barrier properties and durability. Government regulations targeting single-use plastics and promoting eco-friendly materials are accelerating adoption. R&D efforts aim to improve mechanical performance, cost efficiency, and industrial scale production. Pilot projects in retail chains, food delivery services, and packaging firms are validating operational feasibility. Collaborations between universities, research institutes, and manufacturers are advancing innovative materials and production technologies. Consumer awareness regarding environmental impact and waste reduction is further boosting market demand.

Compostable packaging films market in India is expanding at a CAGR of 8.7%, fueled by growing environmental awareness and government initiatives restricting single-use plastics. Compostable films are increasingly adopted in food packaging, beverages, and personal care products. Manufacturers are investing in bio-based materials, flexible production methods, and cost-effective solutions. Pilot projects in retail, restaurants, and online delivery demonstrate feasibility and customer acceptance. Government programs supporting circular economy practices and sustainable packaging solutions are accelerating adoption. Collaborations between research institutions, universities, and packaging companies are enhancing material performance, mechanical strength, and biodegradability. Rising consumer preference for sustainable packaging, coupled with stricter regulations, is driving steady growth in India’s market.

Compostable packaging films market in Germany is recording a CAGR of 10.0%, supported by strict environmental regulations and high consumer awareness. The market is driven by demand in food packaging, personal care, and e-commerce sectors. Manufacturers are focusing on bio-based polymers, improved barrier properties, and industrial compostable certifications. Pilot programs with retail chains and e-commerce companies are demonstrating operational benefits and eco-friendliness. Government incentives for sustainable packaging, recycling, and circular economy practices are promoting adoption. Research institutions and industrial collaborations are advancing material innovation, process optimization, and cost-effective production techniques. Consumers’ increasing preference for environmentally responsible packaging is further boosting market growth.

The United Kingdom is experiencing a CAGR of 8.3% in the compostable packaging films market, driven by sustainability initiatives, consumer preference for eco-friendly packaging, and regulatory policies. Compostable films are used for food, beverages, personal care products, and e-commerce packaging. Manufacturers are investing in biodegradable polymers, mechanical durability, and industrial-scale production. Government programs targeting single-use plastic reduction and promoting sustainable packaging solutions are accelerating adoption. Pilot projects in retail and food service sectors demonstrate feasibility and operational benefits. Academic and industry collaborations are advancing material performance, film strength, and cost efficiency. Growing consumer awareness and environmental responsibility are expected to continue driving market growth in the UK.

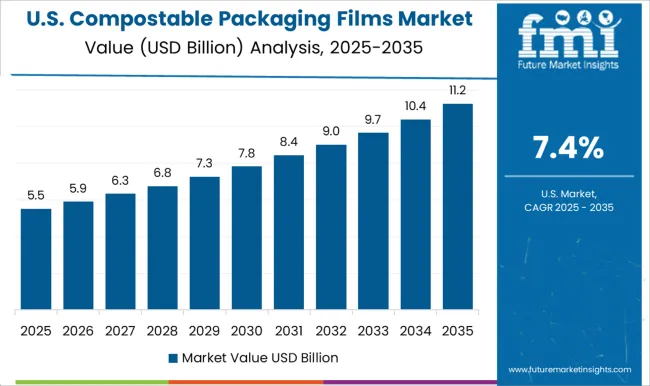

The United States compostable packaging films market is growing at a CAGR of 7.4%, supported by consumer demand for eco-friendly packaging, corporate sustainability programs, and regulatory initiatives. Compostable films are used in food, beverage, personal care, and e-commerce packaging. Manufacturers are focusing on bio-based polymers, industrial compostable certifications, and improved barrier and mechanical properties. Pilot programs in retail, restaurants, and e-commerce platforms are demonstrating operational feasibility and consumer acceptance. Collaborations between research institutes, universities, and packaging firms are advancing innovation, production efficiency, and material performance. Rising consumer awareness and regulatory support for reducing single-use plastics continue to drive steady adoption across multiple sectors in the USA

The secondary smelting and alloying of aluminium market plays a crucial role in the global aluminium value chain, focusing on recycling scrap aluminium and producing high-quality alloys for automotive, aerospace, construction, and packaging industries. Secondary aluminium production offers significant energy savings and environmental benefits compared to primary aluminium, making it increasingly important amid sustainability and circular economy initiatives. Novelis Inc. is a leading player in this market, providing advanced recycling and alloying solutions to produce lightweight, high-performance aluminium sheets and extrusions. Real Alloy specializes in secondary smelting and alloying services, delivering customized aluminium alloys to meet specific customer requirements across automotive and industrial sectors.

Kaiser Aluminum focuses on high-strength, precision-engineered aluminium products through its secondary smelting operations, serving aerospace, defense, and specialty applications. Constellium offers innovative alloying solutions and recycled aluminium products for packaging, automotive, and industrial markets. Norsk Hydro ASA emphasizes sustainable production and efficient secondary smelting technologies to optimize alloy quality and reduce carbon footprint. Hindalco Industries leverages its global aluminium recycling network to supply secondary alloys for diverse industrial applications. In addition to these global leaders, numerous regional players contribute significantly by providing localized smelting and alloying services, supporting regional demand while enhancing sustainability in the aluminium supply chain.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.1 billion |

| Material | Polylactic acid (PLA), Bamboo, Polyhydroxyalkanoate (PHA), Starch-based films, Cellulose-based films, and Others |

| Thickness | 30–60 microns, Up to 30 microns, and Above 60 microns |

| Application | Food & beverage, Healthcare & pharmaceuticals, Retail & e-commerce, Home & personal care, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | NatureWorks (leading PLA/biopolymer), BASF SE, Futamura Chemical Co., Ltd., TotalEnergies Corbion, Mitsubishi Chemical Corporation, and Novamont / Other regional players |

| Additional Attributes | Dollar sales in the Compostable Packaging Films Market vary by type including polylactic acid (PLA), polyhydroxyalkanoates (PHA), and starch-based films, application across food & beverages, personal care, and e-commerce packaging, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for sustainable packaging, regulatory support for biodegradable materials, and increasing consumer preference for eco-friendly products. |

The global compostable packaging films market is estimated to be valued at USD 11.1 billion in 2025.

The market size for the compostable packaging films market is projected to reach USD 25.5 billion by 2035.

The compostable packaging films market is expected to grow at a 8.7% CAGR between 2025 and 2035.

The key product types in compostable packaging films market are polylactic acid (pla), bamboo, polyhydroxyalkanoate (pha), starch-based films, cellulose-based films and others.

In terms of thickness, 30–60 microns segment to command 50.0% share in the compostable packaging films market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compostable Adhesives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Compostable Tableware Market Size and Share Forecast Outlook 2025 to 2035

Compostable Straws Market Growth - Demand & Forecast 2025 to 2035

Compostable Food Trays Market Size and Share Forecast Outlook 2025 to 2035

Compostable Toothbrush Market Growth & Forecast 2025 to 2035

Market Positioning & Share in the Compostable Food Trays Industry

Leading Providers & Market Share in the Compostable Toothbrush Industry

Global Compostable & Biodegradable Refuse Bags Market Insights – Trends, Demand & Growth 2025–2035

Market Share Distribution Among Compostable Refuse Bag Manufacturers

Compostable Mailer Market Growth & Trends Forecast 2024-2034

Compostable Pouch Market Insights – Growth & Forecast 2024-2034

Compostable Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Compostable Packaging Companies

Compostable Plastic Packaging Material Market from 2025 to 2035

Compostable Foodservice Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Compostable Foodservice Packaging Providers

UK Compostable Toothbrush Market Report – Key Trends & Growth Forecast 2025-2035

India Compostable Toothbrush Market Report – Key Trends & Growth Forecast 2025-2035

France Compostable Toothbrush Market Report – Key Trends & Growth Forecast 2025-2035

Hinged Lid Compostable Container Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA