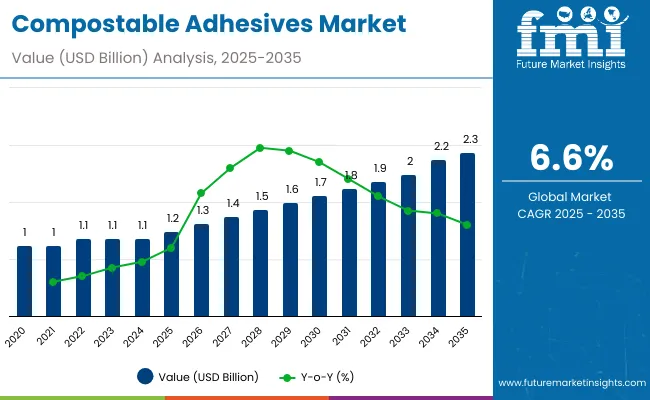

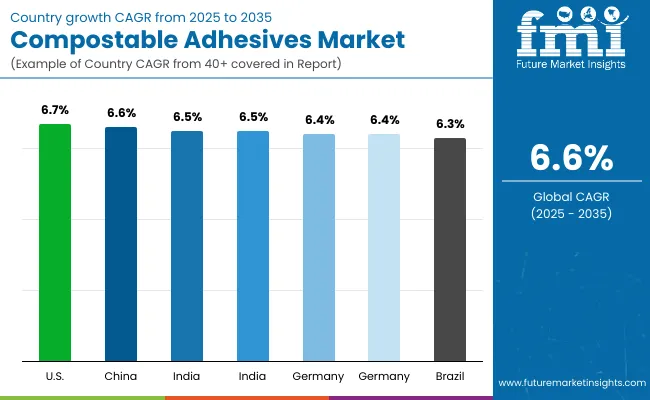

The compostable adhesives market is set to increase from USD 1.2 billion in 2025 to USD 2.3 billion by 2035, advancing at a CAGR of 6.6%. Growth reflects demand for bio-based materials, sustainability regulations, and expansion across packaging, healthcare, and consumer goods. Market value will nearly double, cementing compostable adhesives as a key component of eco-friendly packaging ecosystems.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.2 billion |

| Industry Value (2035F) | USD 2.3 billion |

| CAGR (2025 to 2035) | 6.6% |

Between 2025 and 2030, the market will add USD 0.4 billion, supported by packaging conversions, especially flexible formats in food and beverages. From 2030 to 2035, growth of USD 0.7 billion will be driven by pharmaceuticals, healthcare, and industrial packaging. PLA-based resins, water-based formulations, and automation-ready adhesive systems will shape competitive strategies and meet regulatory and consumer requirements worldwide.

From 2020 to 2024, compostable adhesives evolved from niche applications to mainstream packaging solutions. PLA and starch-based formulations gained traction in food and beverage packaging, supported by regulations banning single-use plastics. Brands emphasized recyclability and biodegradability, integrating adhesives into flexible and rigid packaging systems. Consumer awareness of sustainability and demand for clean-label packaging further accelerated adoption.

By 2035, the market will reach USD 2.3 billion at 6.6% CAGR. PLA and water-based adhesives will dominate, supported by regulatory compliance and performance advances. Growth will be underpinned by demand in food, healthcare, cosmetics, and industrial packaging. Asia-Pacific will be the fastest-growing region, while Europe and North America prioritize compliance with stringent regulations. Compostable adhesives will be central to achieving circular packaging economies.

The compostable adhesives market is expanding as industries replace petrochemical-based adhesives with biodegradable alternatives. Global regulations banning plastics and requiring recyclable packaging reinforce adoption. Food and beverage companies adopt compostable adhesives for flexible packaging, while healthcare and cosmetics sectors shift toward bio-based materials for hygiene and personal care products.

Consumer preference for eco-friendly solutions and traceable packaging drives market expansion. Technological innovations improve bonding strength, heat resistance, and moisture protection, extending applications into demanding sectors. Strategic investments in automation-ready manufacturing and supply chain integration ensure scalability. With regulations, consumer pressure, and innovation aligning, compostable adhesives are positioned as the preferred choice across multiple industries.

The compostable adhesives market is segmented by resin type, adhesive type, application, end-use industry, and region. Resin types include PLA, PHA, starch-based, cellulose-based, and soy protein-based adhesives. Adhesive types cover water-based, hot-melt, and pressure-sensitive adhesives. Applications span flexible packaging, labels and tapes, rigid packaging, paper and cardboard packaging, and hygiene products. End-uses include food and beverages, pharmaceuticals and healthcare, cosmetics and personal care, household cleaning, and industrial packaging. Regional markets include North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

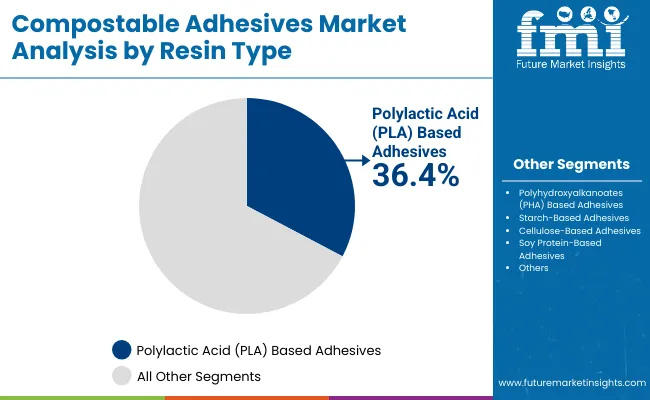

PLA-based adhesives will represent 36.4% share in 2025, favored for recyclability, biodegradability, and performance compatibility with paper, board, and film substrates. Their use in food and beverage packaging, labels, and retail-ready applications positions PLA as the most widely adopted resin. Strong alignment with global sustainability mandates ensures continued preference by brands.

Growth will be supported by advancements in blending PLA with starch and cellulose for enhanced bonding strength. Improved barrier properties and resistance to moisture and heat will extend applications to chilled and healthcare packaging. With global capacity expansions underway, PLA-based adhesives will remain the leading resin type through 2035.

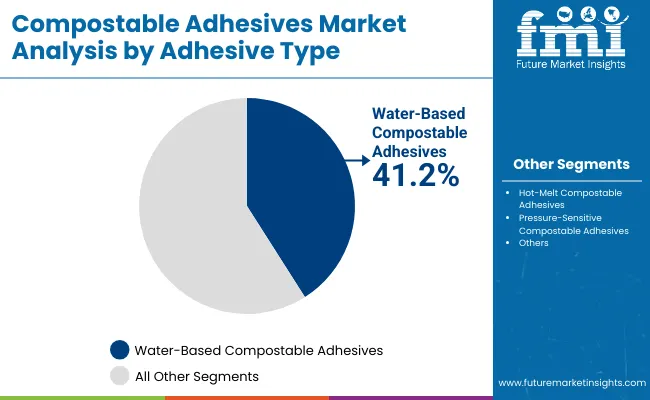

Water-based compostable adhesives will account for 41.2% share in 2025. Their ease of processing, low VOC emissions, and strong adhesion across paper and flexible substrates make them highly versatile. Brands in food and beverage packaging increasingly specify water-based adhesives for compliance with environmental standards and consumer health concerns.

Advances in bio-based formulations are improving bonding in rigid packaging and hygiene products. Performance enhancements in wash-off and moisture-resistant properties ensure broader adoption. As automation-ready water-based systems align with recyclability and compostability goals, they will remain dominant across applications and industries through 2035.

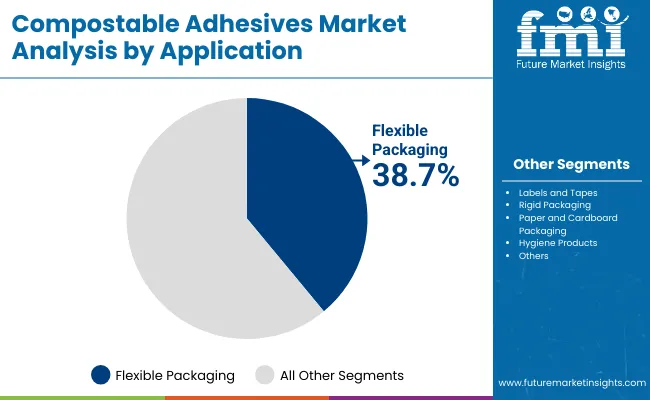

Flexible packaging will command 38.7% share in 2025, driven by rising consumption of packaged foods, beverages, and snacks. Compostable adhesives provide reliable sealing, heat resistance, and biodegradability, making them ideal substitutes for petrochemical adhesives in pouches, wraps, and sachets. Brand focus on light weighting and curbside recyclability reinforces growth.

Future adoption will be supported by smart packaging and functional coatings integration. Compostable adhesives that enable barrier protection against oxygen and moisture will expand applications to frozen foods and pharmaceuticals. As e-commerce and consumer convenience drive packaging evolution, flexible packaging will remain the anchor application.

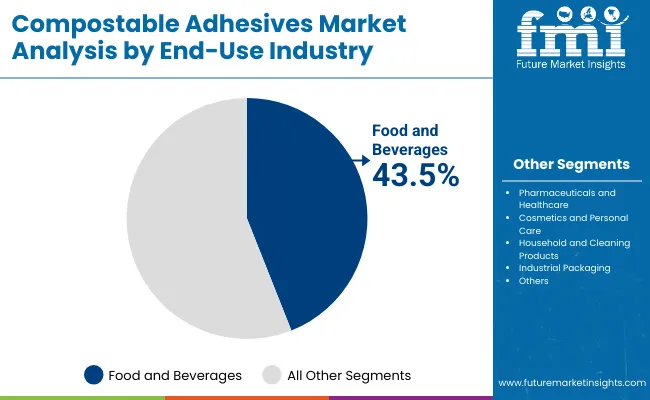

Food and beverages will hold 43.5% share in 2025, the largest end-use industry for compostable adhesives. Rising packaged food consumption and plastic reduction targets support strong adoption in cartons, pouches, trays, and beverage packaging. Clean-label, recyclable adhesives also meet consumer expectations for safe, sustainable packaging.

Further growth will come from expansion into meal kits, ready-to-drink beverages, and delivery packaging. PLA and water-based adhesives enhance shelf life and protection while ensuring compostability. As retailers and foodservice chains commit to sustainable packaging goals, food and beverages will remain the leading driver of demand through 2035.

Compostable adhesives demand is driven by plastic bans, rising adoption in food and beverages, and increasing consumer preference for sustainable packaging. Water-based and PLA adhesives provide performance with recyclability. Retailers and FMCGs prioritize compostability to align with ESG commitments, while technological advances expand applications into rigid and hygiene packaging. High production costs compared to conventional adhesives, limitations in humidity and temperature resistance, and lack of global standards for compostability certification restrain adoption. Small and mid-sized converters face barriers to scaling bio-based adhesive usage, especially in cost-sensitive markets where plastics remain cheaper.

Opportunities lie in healthcare, cosmetics, and industrial packaging, where compostable adhesives enhance product safety and branding. Development of multifunctional adhesives with barrier and antimicrobial properties strengthens their role in premium applications. Partnerships with packaging OEMs and automation suppliers expand potential for large-scale integration across global supply chains.

Trends include hybrid adhesive systems combining PLA and starch, PFAS-free barrier coatings, and improved heat/moisture performance. Digital print compatibility and automation integration are reshaping production efficiency. Growing adoption of bio-based adhesives in hygiene and personal care reflects consumer demand for safe, eco-friendly products.

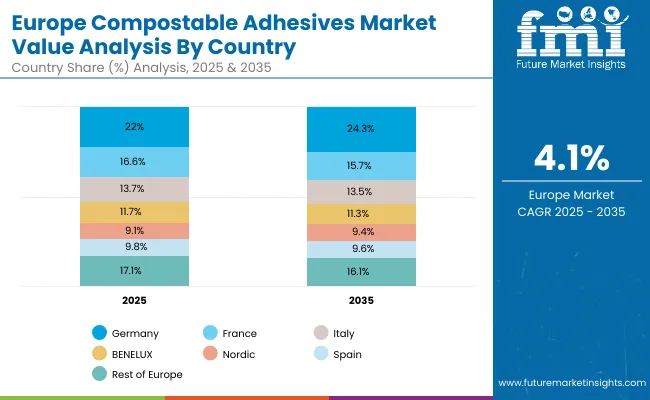

The compostable adhesives market is expanding globally, with Asia-Pacific leading volume growth due to strong packaging demand in China, India, and Japan. Europe enforces stringent sustainability laws, while North America emphasizes recyclability and low-VOC performance. Emerging markets in Latin America and the Middle East adopt compostable adhesives through agriculture and food exports, supported by international trade alignment and regulatory compliance.

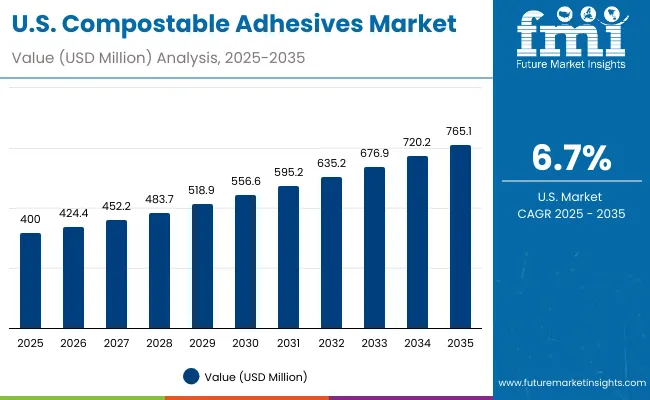

The USA market is projected to grow at a 6.7% CAGR, driven by robust demand from foodservice operations and packaging conversions across consumer goods. PLA and water-based adhesives are witnessing accelerated adoption in cartons, labels, and flexible pouches, ensuring compliance with FDA regulations. Rising consumer preference for eco-friendly solutions has reinforced industry adoption, while the surge in e-commerce demand has broadened applications in secondary packaging, enhancing efficiency and sustainability across retail and logistics channels.

Germany’s adhesive market is expected to expand at a 6.4% CAGR, with growth supported by strict national packaging laws and established recycling infrastructure. Adoption remains strong across food, beverage, and hygiene sectors, where sustainable compliance is critical. Industrial packaging applications are also seeing significant progress, as compostable adhesives align with EU-wide environmental goals. Growing emphasis on closed-loop systems further enhances adoption, positioning Germany as a leading hub in the transition to sustainable packaging within the European Union.

The UK is forecasted to grow at 6.5% CAGR, propelled by Extended Producer Responsibility (EPR) frameworks and the Plastic Packaging Tax. Grocers and e-commerce companies are increasingly shifting toward compostable adhesives for sustainable pouch and carton formats, addressing growing consumer demand. Healthcare applications are also expanding, particularly in medical packaging trials where coated adhesives ensure sterile and secure formats. The combination of regulatory pressure and sector diversification is accelerating usage across industries.

China’s adhesive market is projected to expand at 6.6% CAGR, supported by high demand in packaged food, electronics, and export packaging. Large-scale manufacturing capabilities ensure affordability, making compostable solutions accessible for mass adoption. Compliance with export requirements in the EU and USA is fueling PLA adoption, reinforcing China’s positioning in the global trade landscape. The growing role of electronics and technology packaging is also driving adhesives usage in sustainable and high-performance packaging designs.

India will expand at 6.5% CAGR, with growth supported by retail modernization, agricultural packaging, and the rapid rise of quick-commerce channels. Nationwide plastic bans have accelerated the use of compostable adhesives across food, beverage, and cosmetic packaging. Export-driven demand is also strengthening, particularly in compliance-focused categories. Rising adoption in agriculture-based packaging solutions is further boosting demand, as sustainable formats become integral to supply chains under stricter government enforcement.

Japan is expected to lead regional growth with a 7.3% CAGR, supported by strong demand in premium food, healthcare, and cosmetics packaging. Advanced recycling infrastructure complements adoption by ensuring proper recovery of compostable materials. Water-based adhesives are gaining traction in hygiene applications, driven by consumer preference for safe and eco-friendly formats. The country’s focus on quality packaging and sustainable solutions is positioning it as a trendsetter in Asia’s premium segment.

South Korea’s market is projected to expand at a 7.2% CAGR, driven by robust growth in e-commerce packaging, personal care products, and electronics exports. Adhesives are increasingly being used to strengthen recyclable packaging formats, enabling compliance with both local regulations and international trade standards. Retailers and manufacturers are placing greater emphasis on eco-friendly adoption, aligning with the country’s sustainable growth objectives. The role of cosmetics and electronics industries continues to make South Korea a key innovator in packaging adoption.

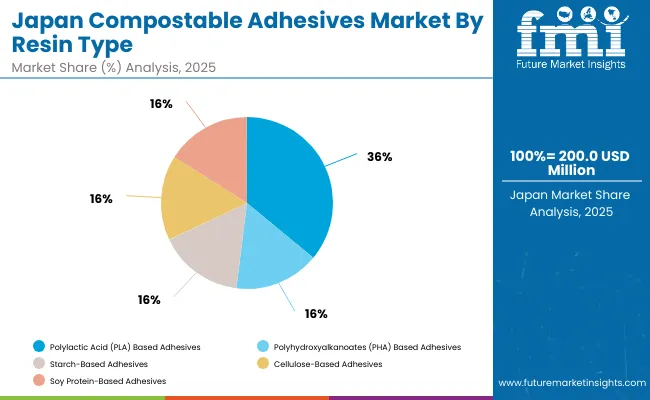

Japan’s compostable adhesives market, valued at USD 200 million in 2025, is dominated by polylactic acid (PLA)-based adhesives, holding 36.1% share due to wide use in packaging and paper applications. Polyhydroxyalkanoates (PHA)-based adhesives account for 19.3%, gaining traction with biodegradable product innovations. Starch-based adhesives, at 17.8%, maintain steady growth across consumer packaging. Cellulose-based adhesives capture 17.3%, supported by natural fiber adoption in eco-materials. Soy protein-based adhesives, though smallest at 9.4%, show potential for niche applications. Collectively, this segmentation highlights Japan’s pivot toward bio-based resins, propelled by regulatory mandates and consumer demand for sustainable packaging alternatives in the adhesives sector.

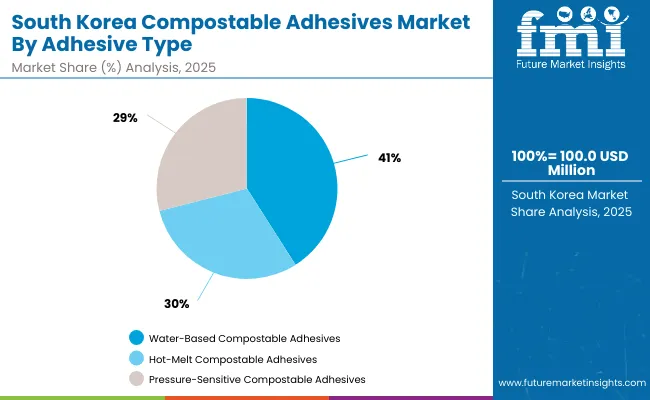

South Korea’s compostable adhesives market, valued at USD 100 million in 2025, is led by water-based compostable adhesives, holding 42.5% share due to their non-toxic, eco-friendly, and cost-efficient application in packaging and labeling. Hot-melt compostable adhesives, at 18.1%, cater to fast production lines requiring strong bonding. Pressure-sensitive compostable adhesives hold 16%, enabling easy-use labeling in food, retail, and healthcare applications. This distribution underscores South Korea’s strategic emphasis on water-based formats, aligning with global sustainability regulations and offering manufacturers scalable solutions. Rising adoption across FMCG and e-commerce packaging further accelerates demand, supporting eco-conscious industry transformation and consumer-oriented innovation growth.

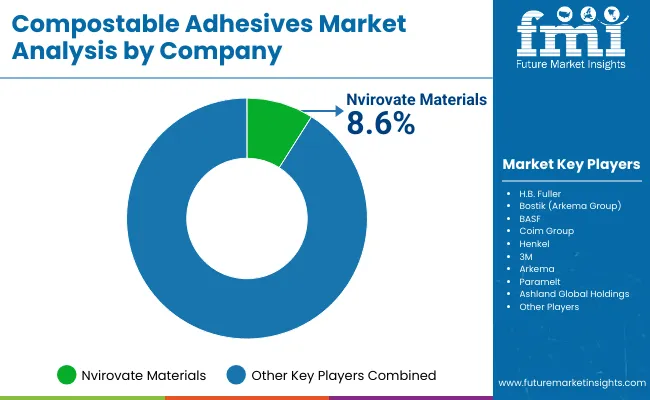

The compostable adhesives market is moderately fragmented with leaders including H.B. Fuller Company, Henkel AG & Co. KGaA, Arkema S.A. (Bostik), BASF SE, and Ashland Global Holdings Inc. These companies invest in R&D for bio-based resin integration, PFAS-free coatings, and automation compatibility. Partnerships with FMCGs and packaging OEMs ensure large-scale adoption across food, healthcare, and cosmetics.

Emerging players such as Nvirovate Materials, Paramelt B.V., Coim Group, and 3M Company compete by offering specialized bio-resin adhesives and regional supply flexibility. Competition is shaped by sustainability credentials, certifications, and traceability features. With rising global regulations and consumer demand, players increasingly focus on innovation, scalability, and multi-region production strategies to secure market share.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| By Resin Type | PLA, PHA, Starch-Based, Cellulose-Based, Soy Protein-Based |

| By Adhesive Type | Water-Based, Hot-Melt, Pressure-Sensitive |

| By Application | Flexible Packaging, Labels and Tapes, Rigid Packaging, Paper & Cardboard Packaging, Hygiene Products |

| By End-Use Industry | Food & Beverages, Pharmaceuticals & Healthcare, Cosmetics & Personal Care, Household & Cleaning, Industrial Packaging |

| Key Companies Profiled | Nvirovate Materials, H.B. Fuller Company, Bostik (Arkema S.A.), BASF SE, Coim Group, Henkel AG & Co. KGaA, 3M Company, Arkema S.A., Paramelt B.V., Ashland Global Holdings Inc. |

| Additional Attributes | Growth supported by sustainability mandates, consumer demand, and resin innovation. |

The market will be valued at USD 1.2 billion in 2025.

The market will reach USD 2.3 billion by 2035.

The market will grow at a CAGR of 6.6% during 2025-2035.

Water-based compostable adhesives will dominate with a 41.2% share in 2025.

Key companies include Nvirovate Materials, H.B. Fuller Company, Bostik (Arkema S.A.), BASF SE, Coim Group, Henkel AG & Co. KGaA, 3M Company, Arkema S.A., Paramelt B.V., and Ashland Global Holdings Inc.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compostable Foodservice Packaging Market Size and Share Forecast Outlook 2025 to 2035

Compostable Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Compostable Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Compostable Tableware Market Size and Share Forecast Outlook 2025 to 2035

Compostable Straws Market Growth - Demand & Forecast 2025 to 2035

Compostable Food Trays Market Size and Share Forecast Outlook 2025 to 2035

Compostable Plastic Packaging Material Market from 2025 to 2035

Compostable Toothbrush Market Growth & Forecast 2025 to 2035

Market Positioning & Share in the Compostable Food Trays Industry

Market Share Insights of Compostable Foodservice Packaging Providers

Leading Providers & Market Share in the Compostable Toothbrush Industry

Global Compostable & Biodegradable Refuse Bags Market Insights – Trends, Demand & Growth 2025–2035

Competitive Overview of Compostable Packaging Companies

Market Share Distribution Among Compostable Refuse Bag Manufacturers

Compostable Mailer Market Growth & Trends Forecast 2024-2034

Compostable Pouch Market Insights – Growth & Forecast 2024-2034

UK Compostable Toothbrush Market Report – Key Trends & Growth Forecast 2025-2035

India Compostable Toothbrush Market Report – Key Trends & Growth Forecast 2025-2035

France Compostable Toothbrush Market Report – Key Trends & Growth Forecast 2025-2035

Hinged Lid Compostable Container Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA