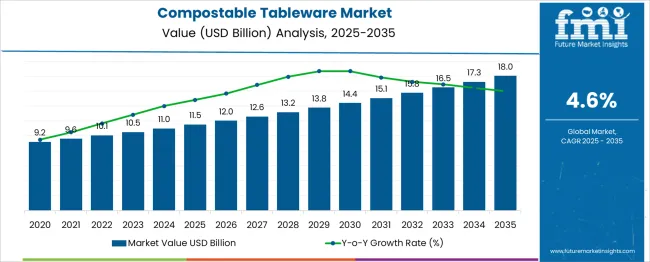

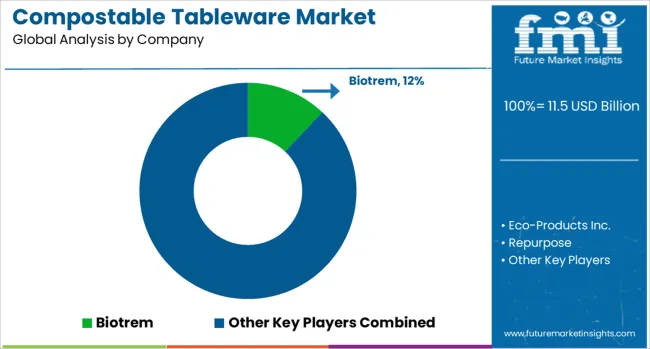

The Compostable Tableware Market is estimated to be valued at USD 11.5 billion in 2025 and is projected to reach USD 18.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period. Growth momentum is expected to maintain steady acceleration throughout the forecast period, supported primarily by increasing demand in foodservice sectors seeking alternatives to conventional single-use plastics. Early years between 2025 and 2028 are anticipated to see moderate value gains driven by regulatory pressures on plastic use and growing adoption in cafes and casual dining venues. Between 2029 and 2035, momentum is projected to strengthen as product innovation expands to include durable, heat-resistant options and bulk packaging solutions for large-scale catering. Increased consumer awareness and evolving municipal waste management policies aimed at organic waste diversion are likely to reinforce demand. This phase is also expected to witness greater penetration in emerging economies due to growing hospitality infrastructure and increasing availability of cost-competitive alternatives. The consistent growth momentum over the decade is forecasted to be supported by expanding product portfolios, improved supply chain integration, and evolving sustainability mandates targeting single-use product categories.

| Metric | Value |

|---|---|

| Compostable Tableware Market Estimated Value in (2025 E) | USD 11.5 billion |

| Compostable Tableware Market Forecast Value in (2035 F) | USD 18.0 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The compostable tableware market holds a significant share across several parent segments. It constitutes approximately 10–12 % of the broader biodegradable tableware market, reflecting its focus on products that decompose naturally without leaving harmful residues. Within the foodservice disposables market, it represents around 20–25 %, driven by increasing demand for sustainable alternatives in restaurants, catering, and events. In the single-use packaging market, its share is about 15–18 %, as businesses seek eco-friendly options to replace traditional plastic packaging.

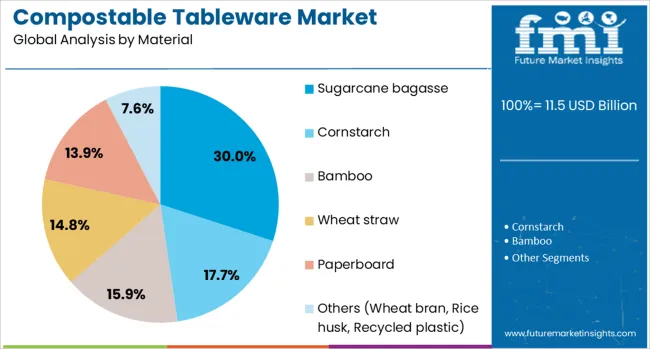

The retail eco-product market sees a contribution of 5–7 %, with consumers opting for compostable products in daily use. In the waste management and composting services market, its presence is under 5 %, as these products facilitate organic waste processing and reduce landfill contributions. Recent developments in the compostable tableware market emphasize the adoption of materials such as sugarcane bagasse, bamboo, and palm leaves, which offer durability and environmental benefits. Manufacturers are focusing on enhancing the strength and water resistance of compostable products to meet the demands of various foodservice applications. Innovations include the introduction of microwave-safe and freezer-friendly compostable tableware, expanding their usability in diverse settings.

Additionally, companies are investing in biodegradable coatings to improve the performance of compostable products without compromising their eco-friendly attributes. The market is also witnessing a shift towards local sourcing and production to reduce carbon footprints and support regional economies. These trends reflect a broader commitment to sustainability and the growing preference for environmentally responsible alternatives in the foodservice industry.

Increasing restrictions on single-use plastics, coupled with rising consumer awareness of environmental issues, have shifted preferences toward biodegradable and eco-conscious alternatives. The industry is being further driven by foodservice providers and hospitality brands seeking to reduce their environmental impact and meet evolving regulatory standards.

As circular economy initiatives take hold globally, compostable tableware solutions are being integrated across institutional catering, events, and quick-service restaurants. The ability to align with both functional performance and eco-compliance has made compostable products an attractive option.

Advancements in plant-based materials and scalable manufacturing techniques are supporting broader adoption, while favorable government policies are catalyzing local production ecosystems. The future outlook remains positive as innovation in bioplastics and composting infrastructure continues to enhance the usability, durability, and appeal of compostable tableware in both developed and emerging markets..

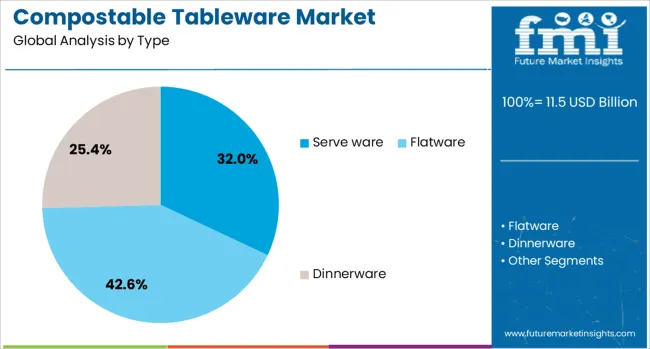

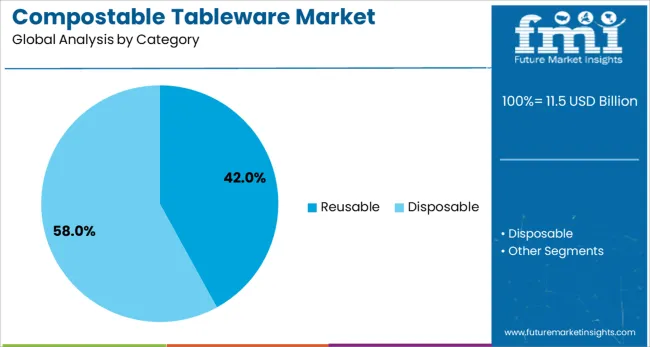

The compostable tableware market is segmented by type, category, material, end use, distribution channel, and geographic regions. The compostable tableware market is divided into serving ware, Flatware, Dinnerware, Glassware, and Others (Straws, Toothpicks, Napkins, etc.). In terms of the category, the compostable tableware market is classified into Reusable and Disposable. The compostable tableware market is segmented into Sugarcane bagasse, Cornstarch, Bamboo, Wheat straw, Paperboard, and Others (Wheat bran, Rice husk, recycled plastic). The end use of the compostable tableware market is segmented into Household, Restaurants, Cafés, Fast food chains, Parties, Festivals, and Others (Corporate Events, etc.). The distribution channel of the compostable tableware market is segmented into Online and Offline. Regionally, the compostable tableware industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The serve ware segment is expected to contribute 32% of the Compostable Tableware market revenue in 2025, making it the leading product type. The growth of this segment has been largely driven by its critical role in large-scale dining and catering applications where single-use convenience must align with eco-friendly disposal. Serve ware items such as plates, bowls, and trays have been widely adopted across foodservice and hospitality environments where visual presentation, rigidity, and thermal resistance are essential.

Their compostable nature has offered an environmentally responsible alternative to traditional plastics, aligning with global bans and consumer expectations. Manufacturers have increasingly focused on enhancing the durability and functional performance of serve ware items to meet industry-grade standards.

The segment’s leadership is further supported by strong demand from quick-service chains and institutional kitchens where disposable yet sustainable solutions are prioritized. The ability to customize serve ware designs while maintaining compostability has also contributed to its wide market penetration and continued dominance..

The reusable category is projected to hold 42% of the Compostable Tableware market share in 2025, emerging as the dominant usage format. Its growing popularity has been reinforced by rising demand for longer-lifecycle alternatives that minimize both cost and waste. Reusable compostable products have been favored in semi-permanent environments such as office canteens, schools, and event venues, where repeated use offers sustainability without sacrificing performance.

The shift toward reusability within compostable offerings reflects a deeper commitment among end users to adopt zero-waste practices while still complying with health and safety norms. Enhanced material engineering has enabled the production of sturdy, aesthetically appealing tableware that withstands multiple wash cycles before composting.

This dual benefit of usability and biodegradability has made the reusable category appealing to institutional buyers and environmentally conscious consumers alike. Supportive regulations and purchasing incentives provided by municipal and corporate sustainability programs are further elevating the prominence of this segment across regions..

The sugarcane bagasse segment is anticipated to account for 30% of the Compostable Tableware market revenue share in 2025, making it the leading material type. This leadership has been driven by the widespread availability and cost-effectiveness of sugarcane waste as a raw material, particularly in regions with established sugar production. Bagasse-based tableware has gained strong acceptance due to its compostability, strength, and natural resistance to oil and heat, making it suitable for both hot and cold food applications.

Its fibrous structure enables the molding of lightweight, durable items that decompose efficiently in commercial and home composting environments. Manufacturers have increasingly adopted bagasse for its scalability and minimal environmental footprint, allowing for sustainable mass production without compromising product quality.

In addition, government policies encouraging the utilization of agricultural waste have supported the growth of bagasse-based manufacturing. The segment continues to benefit from its compatibility with clean-label branding and the growing shift toward plant-based packaging across foodservice industries..

Adoption of alternatives made from natural fibers like bagasse, bamboo, and cornstarch has risen across the foodservice and hospitality sectors. Government regulations limiting single-use plastics have accelerated demand. Product innovations enhancing durability and functionality have enabled broader application. Growth in emerging economies, driven by rising disposable incomes and increased awareness, is further increasing market penetration, especially in urbanized regions seeking eco-friendly dining solutions.

Growing consumer preference for eco-conscious products has pushed businesses to integrate compostable tableware into their offerings. Foodservice companies have transitioned to biodegradable alternatives to comply with new environmental laws and meet shifting customer expectations. Regions implementing bans on plastic disposables have reported adoption rates exceeding 45% in commercial dining segments. Public and private initiatives encouraging waste segregation and composting infrastructure have facilitated market development. The synergy between consumer demand and regulatory frameworks has driven investments in sustainable product lines, creating a consistent rise in compostable tableware usage globally.

Material innovations have enabled the creation of compostable tableware with improved resistance to moisture, heat, and mechanical stress. Products made from bagasse, PLA, and bamboo fibers exhibit enhanced durability comparable to conventional plastics. This has enabled wider use in catering, fast food, and retail food packaging. Developments in additive technology have extended product shelf life and usability with hot or oily foods, increasing customer satisfaction. Enhanced compostability certifications have also boosted buyer confidence. These technical advancements have supported market expansion by addressing previous functional limitations associated with compostable materials.

While compostable tableware is often priced higher than plastic alternatives, ongoing improvements in manufacturing efficiency have narrowed the cost gap. Scaling of production and raw material sourcing from agricultural waste have reduced expenses by up to 15%. Bulk procurement by large foodservice chains has further lowered costs. However, smaller vendors face challenges due to initial investment in new product lines and limited economies of scale. Economic incentives and subsidies in some regions have promoted adoption, but price sensitivity remains a restraint in price-competitive markets. Continuous R&D investments are anticipated to drive further cost optimization.

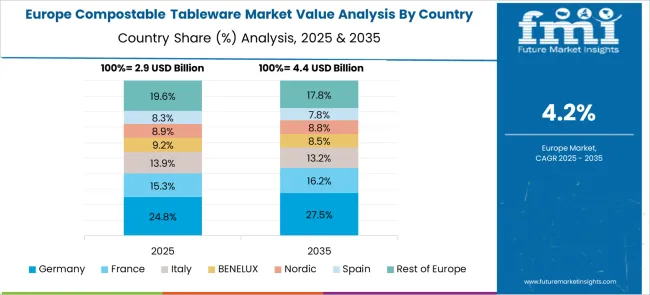

Adoption of compostable tableware varies widely by region, influenced by regulatory stringency, infrastructure maturity, and consumer awareness. Europe and North America lead in market penetration, supported by strict bans on single-use plastics and widespread composting facilities. Asia-Pacific markets are growing rapidly due to expanding urban foodservice sectors and increasing environmental education, although adoption is uneven due to infrastructure gaps. Latin America and Africa are witnessing a gradual uptake, driven by international partnerships and government initiatives. Regional distribution networks and supply chain developments have facilitated increased product accessibility in emerging markets.

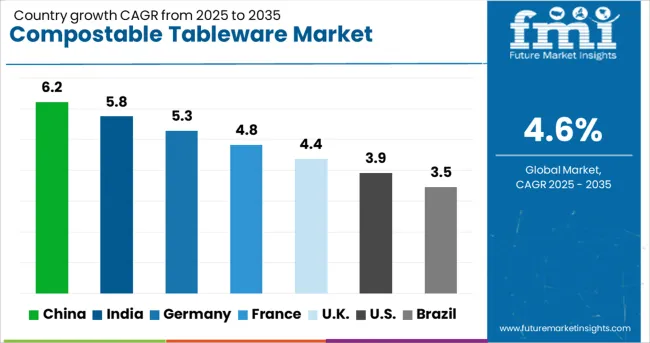

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

Global demand for compostable tableware is projected to grow at a CAGR of 4.6% from 2025 to 2035. Among the five benchmark markets profiled out of 40+ analyzed, China leads with a CAGR of 6.2%, followed by India at 5.8%, Germany at 5.3%, the United Kingdom at 4.4%, and the United States at 3.9%. These figures represent a +35% premium for China, with India and Germany above baseline by +26% and +15% respectively. The UK shows a moderate decline at –5%, while the US is –15% below baseline. Growth in China and India is driven by expanding institutional adoption in hospitality and foodservice sectors. Slower rates in the US and UK are linked to regulatory challenges and alternative product preferences. The report covers detailed analysis of 40+ countries, with the top five shared as reference.

China is forecast to expand at a CAGR of 6.2% in the compostable tableware market between 2025 and 2035. The growth is supported by widespread adoption among food delivery chains and large-scale catering providers, particularly in Tier 2 and Tier 3 cities. Innovations in bagasse and bamboo-based products have been widely accepted, offering alternatives to plastic disposables. Key players such as Greenmate and Biopac have intensified product development focusing on water-resistant coatings and increased heat tolerance. Regional governments have incentivized the use of compostable items in public institutions, strengthening market penetration. Export demand for biodegradable cutlery has also risen, positioning China as a leading supplier.

India is projected to grow at a CAGR of 5.8% in the compostable tableware market through 2035. Adoption has accelerated in institutional catering and mid-tier restaurant segments, with growing awareness of biodegradable alternatives. Local manufacturers like Ecoware and Bambu Nature have introduced cost-efficient products leveraging agricultural waste such as wheat straw and bagasse. Regional consumption patterns reflect rising preference in urban centers such as Delhi, Mumbai, and Bangalore. Supply chain enhancements have reduced costs, facilitating wider availability in retail outlets and online channels. Public-private collaborations have promoted compostable tableware usage during public events and festivals.

Germany is expected to grow at a CAGR of 5.3% in the compostable tableware market from 2025 to 2035. Demand is driven by institutional buyers in corporate cafeterias and eco-conscious event management firms. Strict regulations limiting single-use plastics have encouraged the substitution with compostable products, primarily made from renewable fibers and PLA-based materials. Key market players such as Vegware and Bio-Lutions have launched innovative lines focusing on product certification and compostability standards. Retail expansion through organic supermarkets and specialized eco-stores supports consistent demand growth. Circular economy initiatives continue to influence procurement practices.

The United Kingdom is forecast to grow at a CAGR of 4.4% in the compostable tableware market through 2035. Market drivers include eco-friendly foodservice providers and regulatory pressures on plastic reduction. Product adoption is concentrated among fast-casual dining outlets and festival organizers. British companies such as Biopak and Vegware focus on innovation in fiber blends and compostability claims. The gradual phase-out of conventional plastic tableware under government initiatives supports expansion, though market penetration is constrained by cost sensitivity and competition from reusable alternatives. Awareness campaigns and partnerships with local authorities are ongoing to support growth.

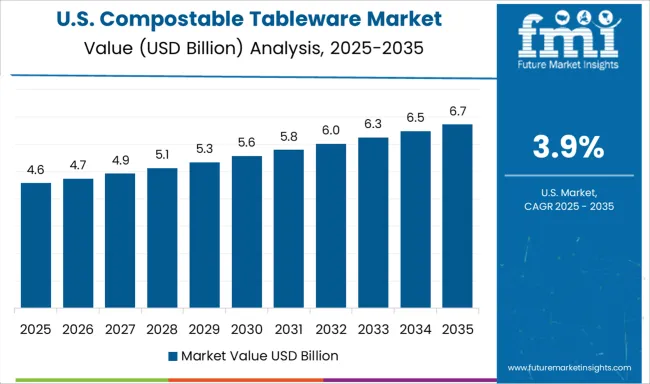

The United States is anticipated to grow at a CAGR of 3.9% in the compostable tableware market between 2025 and 2035. Growth remains moderate due to market fragmentation and availability of alternative disposable options. Institutional adoption is prominent in university campuses and health care facilities. Leading manufacturers such as Eco-Products and World Centric emphasize renewable material sourcing and enhanced biodegradability certifications. State-level regulations differ widely, impacting overall market pace. Consumer preference for reusable solutions and price competition have restrained rapid expansion. Nonetheless, commercial sectors increasingly adopt compostable tableware in response to sustainability-driven procurement policies.

Biotrem specializes in wheat bran-based disposable tableware, offering products that are biodegradable and suited for foodservice businesses aiming to reduce waste. Its focus on lightweight and sturdy designs supports adoption in quick-service restaurants and catering. Eco-Products Inc. has expanded its compostable product portfolio by introducing molded fiber plates and cutlery designed for large-scale events and institutional cafeterias.

The company’s strategy includes partnering with waste management firms to facilitate industrial composting programs across North America. Repurpose targets both retail and foodservice sectors by offering a wide range of compostable plates, bowls, and cups made from renewable plant fibers. The company’s investments in supply chain efficiency have improved product availability in key urban markets. World Centric focuses on providing tableware with certification from recognized compostability standards, ensuring compatibility with commercial composting facilities.

Verterra Ltd. has developed bagasse-based products aimed at reducing plastic usage in catering and takeaway services. GreenGood USA and Huhtamaki Group have enhanced their product lines through innovations in fiber molding technology and expanded distribution channels across Europe and the US. Their efforts emphasize product durability and broad application in both casual dining and outdoor events.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.5 Billion |

| Type | Serve ware, Flatware, Dinnerware, Glassware, and Others (Straws, Toothpicks, Napkins, Etc.) |

| Category | Reusable and Disposable |

| Material | Sugarcane bagasse, Cornstarch, Bamboo, Wheat straw, Paperboard, and Others (Wheat bran, Rice husk, Recycled plastic) |

| End Use | Household, Restaurants, Cafés, Fast food chains, Parties, Festivals, and Others (Corporate Events, Etc.) |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Biotrem, Eco-Products Inc., Repurpose, World Centric, Verterra Ltd., GreenGood USA, and Huhtamaki Group |

The global compostable tableware market is estimated to be valued at USD 11.5 billion in 2025.

The market size for the compostable tableware market is projected to reach USD 18.0 billion by 2035.

The compostable tableware market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in compostable tableware market are serve ware, _serving platters, _serving bowls, _serving utensils, _chafing dishes, _others (serving trays, etc.), flatware, _cutlery sets, _others (napkin holders, cutlery holders, etc.), dinnerware, _plates, _bowls, _platter sets, _serving sets, glassware, _drinking glasses, _mugs, _specialty glasses and others (straws, toothpicks, napkins, etc.).

In terms of category, reusable segment to command 42.0% share in the compostable tableware market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compostable Pouch Market Size and Share Forecast Outlook 2025 to 2035

Compostable Foodservice Packaging Market Size and Share Forecast Outlook 2025 to 2035

Compostable Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Compostable Adhesives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Compostable Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Compostable Straws Market Growth - Demand & Forecast 2025 to 2035

Compostable Food Trays Market Size and Share Forecast Outlook 2025 to 2035

Compostable Plastic Packaging Material Market from 2025 to 2035

Compostable Toothbrush Market Growth & Forecast 2025 to 2035

Market Positioning & Share in the Compostable Food Trays Industry

Market Share Insights of Compostable Foodservice Packaging Providers

Leading Providers & Market Share in the Compostable Toothbrush Industry

Global Compostable & Biodegradable Refuse Bags Market Insights – Trends, Demand & Growth 2025–2035

Competitive Overview of Compostable Packaging Companies

Market Share Distribution Among Compostable Refuse Bag Manufacturers

Compostable Mailer Market Growth & Trends Forecast 2024-2034

UK Compostable Toothbrush Market Report – Key Trends & Growth Forecast 2025-2035

India Compostable Toothbrush Market Report – Key Trends & Growth Forecast 2025-2035

France Compostable Toothbrush Market Report – Key Trends & Growth Forecast 2025-2035

Demand for Compostable Foodservice Packaging in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA