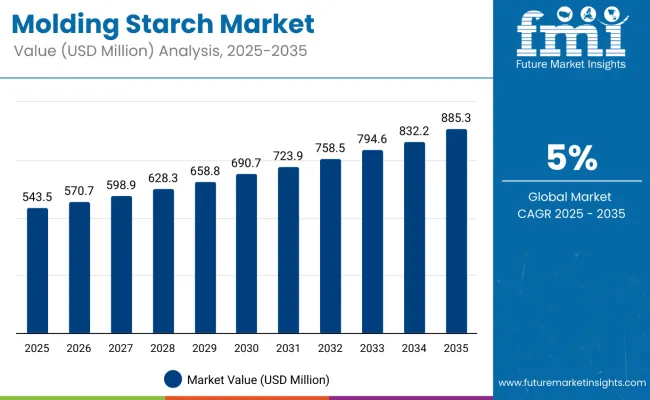

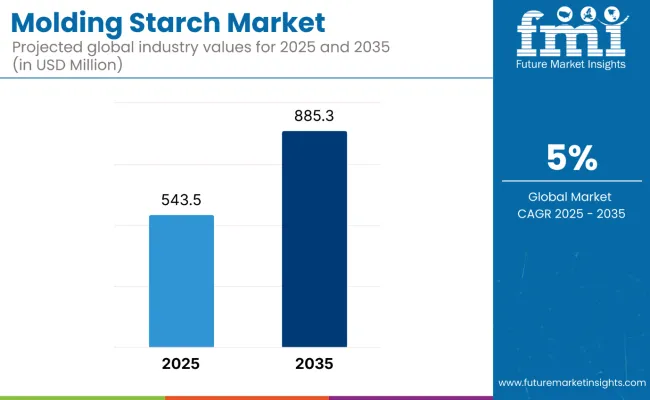

The molding starch market is estimated to be valued at USD 543.5 million in 2025 and is projected to reach USD 885.3 million by 2035, registering a CAGR of 5.0% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 341.8 million over the forecast period.

By 2030, the market is likely to reach USD 693.5 million, accounting for USD 150.0 million in incremental value over the first half of the period. The remaining USD 191.8 million is expected during the second half, suggesting a moderately accelerated growth pattern. Product innovation around modified starches and enhanced functional properties is gaining traction because molding starch offers favorable moisture absorption, mold release, and biodegradability improvement.

Companies such as Cargill Incorporated and Archer Daniels Midland (ADM) are advancing their competitive positions through investment in starch modification technologies and scalable production systems. Innovation-led procurement models are supporting expansion into confectionery manufacturing, food processing applications, and sustainable packaging solutions. Market performance will remain anchored in food safety compliance, quality standards, and sustainable sourcing benchmarks.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 543.5 million |

| Forecast Value in (2035F) | USD 885.3 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

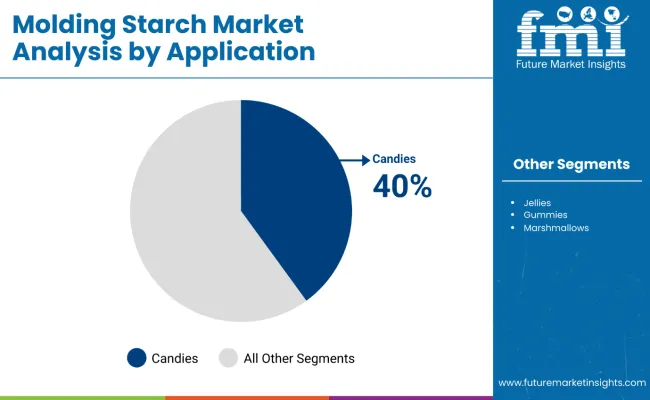

The market holds 18% of the confectionery starch applications market, driven by its essential role in candy manufacturing, mold release properties, and moisture control capabilities. It accounts for around 45% of the molding processing agents market, supported by its function in facilitating efficient molding processes and biodegradable manufacturing solutions. The market contributes nearly 23% to the mold release agents market, particularly for confectionery molding, food-grade applications, and sustainable production processes. It holds close to 2.4% of the broader food starch market, where molding starch serves specialized texture enhancement and processing aid functions. The share in the confectionery ingredients market reaches about 40% through the candies segment, reflecting its preference among manufacturers seeking natural molding solutions for shape formation and quality enhancement applications.

The market is undergoing structural change driven by rising demand for natural and sustainable ingredients across confectionery, food processing, and packaging sectors. Advanced processing methods using modified starch technologies and enzymatic treatments have enhanced functional properties, biodegradability, and processing efficiency, making molding starch a viable alternative to synthetic molding agents and chemical release compounds. Manufacturers are introducing standardized grades and specialized formulations tailored for confectionery production, food processing applications, and sustainable packaging use, expanding their role beyond traditional industrial molding applications.

Molding starch's proven biodegradability, moisture absorption properties, and mold release capabilities make it an attractive alternative to synthetic molding agents in confectionery, food processing, and sustainable packaging applications. The natural origin and food-safe characteristics of molding starch align with increasing regulatory requirements and consumer preferences for environmentally friendly production methods.

Growing awareness of sustainable manufacturing practices is further propelling adoption, especially in confectionery production systems and eco-friendly packaging solutions. Consumer demand for clean-label products and sustainable manufacturing, along with innovations in starch modification and processing technology, are also enhancing product functionality and application versatility. Advanced enzymatic treatments and modified starch formulations have improved heat stability, moisture control, and processing efficiency, expanding use cases beyond traditional applications.

As the global food processing and confectionery industries continue to prioritize natural ingredients and sustainable production systems, the market outlook remains favorable. With manufacturers and consumers prioritizing environmental sustainability, food safety, and natural origin, molding starch is well-positioned to expand across various confectionery manufacturing, food processing, and sustainable packaging applications.

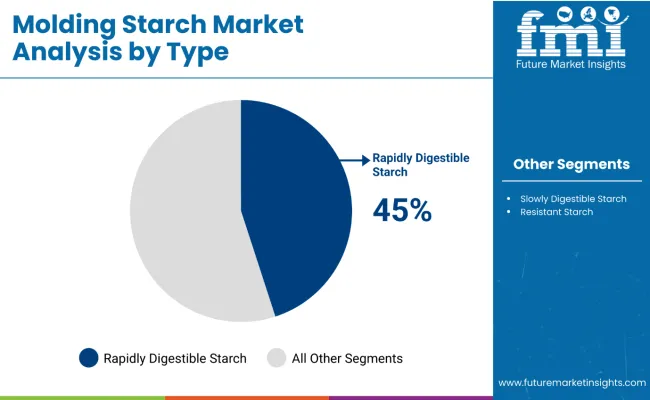

The market is segmented by type, application, and region. By type, the market is divided intorapidly digestible starch, slowly digestible starch, and resistant starch. Based on application, the market is categorized into candies, jellies, gummies, marshmallows, and others (puddings, desserts, and bakery fillings). Regionally, the market is classified into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The rapidly digestible starch (RDS) segment stands out as the most lucrative portion of the molding starch market, capturing 45% of total revenues in 2025. This dominance is underpinned by RDS’s unique ability to undergo swift enzymatic hydrolysis, delivering precise moisture control and rapid texturizationcritical attributes for high-speed confectionery molding operations. Manufacturers in North America and Europe, which together account for over 60% of global confectionery output, favor RDS for its consistent performance in automated molding lines, where cycle times and dimensional accuracy directly impact throughput and product quality.

Technological advancements in RDS production, such as ultra-fine milling and controlled amylopectinamylose ratioshave further enhanced its thermal stability and mold-release properties, reducing production downtime and waste. Additionally, the clean-label trend has bolstered RDS’s appeal, as it naturally aligns with consumer demand for minimally processed ingredients. With its operational efficiencies, sustainability credentials, and alignment with premium brand requirements, RDS is projected to maintain robust growth through 2035.

The candies segment emerges as the most lucrative application in the molding starch market, commanding 40% of total share in 2025. This leadership is attributable to candies’ stringent requirements for intricate shapes, high-definition surface finishes, and consistent moisture profilescriteria that molding starch uniquely fulfills through its superior mold-release properties and moisture-wicking capabilities. Modern candy manufacturers, particularly in North America and Europe, have shifted toward automated molding lines where rapid demolding and minimal product adhesion are critical for maintaining throughput and reducing cycle times.

Advances in starch formulation, such as modified amylopectin content and tailored particle size distributions, have further elevated performance, enabling ultra-thin candy coatings and intricate confectionery pieces without compromising texture or shelf stability. Additionally, rising consumer demand for premium and novelty candiesdriven by social media trends and seasonal product launcheshas intensified the need for reliable molding agents that can deliver complex geometries at scale. With global candy sales projected to exceed USD 275 billion by 2030, continued innovation in molding starch is poised to sustain the segment’s robust growth and market dominance.

In 2024, global molding starch consumption increased by 14% year-on-year, with Europe holding a 42% share due to its established confectionery base. Applications include jelly candy molding, gummy casting, and nutraceutical gummies, where starch is used as a dusting and molding medium. Manufacturers are offering modified starch blends that deliver improved moisture control, faster demolding, and consistent surface texture. Growing demand for natural, plant-based excipients supports starch adoption, especially in clean-label confectionery and fortified gummy formulations. With consumer preference for non-synthetic ingredients, molding starch is being increasingly positioned as a versatile, functional processing aid across premium confectionery and pharmaceutical formats.

Health-Conscious and Functional Confectionery Trends Drive Molding Starch Adoption

Confectionery and nutraceutical producers are selecting molding starch to enhance production efficiency, achieve smooth product finishes, and maintain integrity during demolding cycles. Modified starch blends provide consistent moisture absorption, reducing drying times by up to 20% compared to traditional starch bases. In fortified gummies, starch ensures uniform shape retention and prevents stickiness, making it an ideal medium for functional formats with vitamins, minerals, or botanicals.

Adoption in the nutraceutical sector rose 28% in 2024, with starch-based molding enabling large-scale production of functional gummies and jellies. Natural corn and potato starches are increasingly chosen for clean-label positioning, supporting industry transition away from synthetic molding agents. This operational and marketing advantage explains the 35% adoption growth of molding starch in European and North American nutraceutical production facilities last year.

Supply Chain Volatility, Specialized Handling, and Processing Constraints Restrict Expansion

Challenges remain due to fluctuations in raw starch pricing, specialized equipment requirements, and contamination risks. Starch procurement costs vary between USD 450 and USD 620 per metric ton depending on crop yields and export conditions, impacting molding starch pricing and increasing volatility in supply contracts. Processing requires dedicated molding rooms with starch conditioning systems, adding 5 to 7 weeks to facility set-up cycles.

Frequent starch recycling in molding operations adds complexity, requiring dust management, sifting, and microbial control measures, which increase operational costs by 18-22% compared to gelatin or alternative molding media. Limited global suppliers capable of providing high-performance molding starch blends restrict availability, slowing scalability for confectionery players in emerging markets. These cost and infrastructure challenges temper adoption rates despite rising interest in starch as a natural processing excipient.

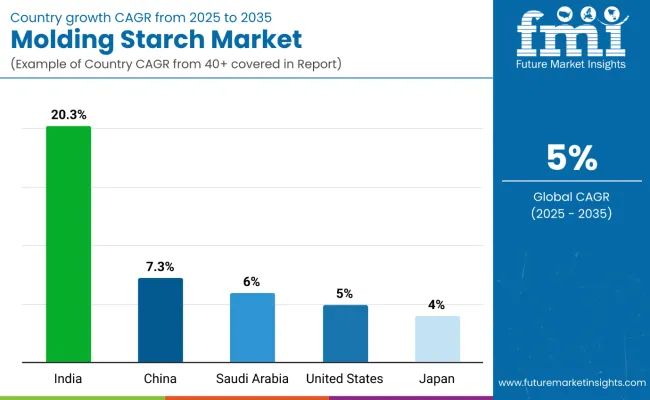

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 20.3% |

| China | 7.3% |

| Saudi Arabia | 6.0% |

| United States | 5.0% |

| Japan | 4.0% |

The market exhibits pronounced regional growth disparities, led by India’s exceptional 20.3% CAGR driven by rapid urbanization, surging confectionery consumption, and substantial government support for food-processing infrastructure. China follows at 7.3%, capitalizing on its massive confectionery production base, modernization of starch facilities, and strategic development of agro-processing clusters. Saudi Arabia records a 6.0% CAGR, underpinned by economic diversification initiatives, expansion of integrated starch modification plants, and incentives for sustainable food manufacturing.

The United States’ mature market grows at 5.0%, sustained by technological upgrades in enzymatic modification, clean-label regulations, and the co-production of starch derivatives in biorefinery models. Japan demonstrates the most modest increase at 4.0%, reflecting its established confectionery culture, emphasis on ultra-pure starch grades, and precision-driven production processes.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

Revenue from molding starch in India is growing rapidly, reflecting a 20.3% CAGR supported by capacity build-outs to satisfy surging demand from its flourishing confectionery sector and rising processed-food consumption. Installed production volumes are projected to increase from 250 kilotons in 2025 to 410 kilotons by 2035. This expansion is underpinned by significant investments in greenfield starch modification plants and modernization of existing facilities.

Government subsidies for food-processing infrastructure and strategic public-private partnerships have accelerated construction of ultra-fine milling lines and moisture-control units. Leading starch producers are establishing localized supply chains to minimize feedstock transit times and ensure consistent quality.

Demand for molding starch in China is projected with a 7.3% CAGR, driven by the country’s status as the world’s largest confectionery producer. Food-grade starch facilities are undergoing rapid modernization with investments in high-efficiency dryers, extrusion systems, and enzymatic modification units. Provincial governments are incentivizing the development of agro-processing clusters, integrating corn wet-milling with starch refining operations.

Domestic and multinational suppliers are collaborating with leading OEMs to co-develop specialized starch grades tailored for automated molding lines. Controlled particle-size distributions and advanced purification techniques enhance product consistency for intricate candy shapes. Expansion of cold-chain logistics and port infrastructure supports both domestic consumption and export capabilities. Growing consumer interest in premium and artisanal candy varieties sustains demand for high-performance molding starch solutions, reinforcing China’s pivotal role in global supply.

Sales of molding starch in Saudi Arabia are undergoing structural transformation, projected to grow at a 6.0% CAGR between 2025 and 2035. Economic diversification initiatives have prompted the establishment of integrated starch modification and drying facilities in key industrial zones. Investments by both local conglomerates and international players focus on advanced starch processing technologies, including ultra-fine milling and moisture-controlled blending systems. Rapidly digestible starch dominates the portfolio, capturing 45.0% of capacity, while Candy applications drive plant design specifications. Government incentives for food-processing investments and sustainable manufacturing practices have accelerated plant commissioning.

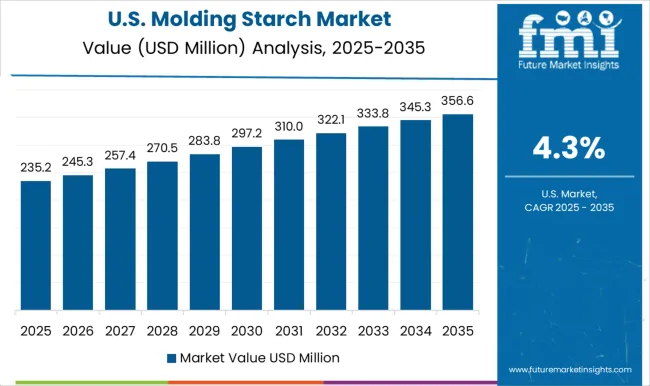

Revenue from molding starch in USA is projected to expand and reflecting a 5.0% CAGR. Investment priorities include upgrading corn-based starch plants with state-of-the-art enzymatic modification units and ultra-fine grinding mills to produce high-performance grades such as rapidly digestible starch (45.0% share). Leading manufacturers are integrating biorefinery concepts to co-produce starch derivatives and biofuels, optimizing resource utilization and sustainability.

Clean-label regulations and consumer preference for non-GMO and organic ingredients drive the development of specialized molding starch formulations. Automated molding lines in confectionery plants benefit from improved mold-release and moisture-control properties, reducing cycle times and waste. Strategic R&D collaborations with major candy OEMs tailor products to seasonal and functional candy trends.

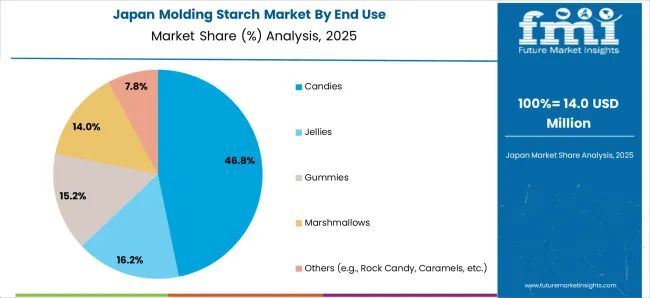

Revenue from molding starch in Japan is expected to grow at a 4.0% CAGR, driven by the country’s established confectionery culture and consistent demand for premium textures. Production facilities focus on ultra-purification, membrane filtration, and precise particle-size control to meet exacting quality standards. Rapidly Digestible Starch leads with 45.0% of capacity, serving the high-definition candy and confectionery segments that require intricate shapes and smooth surfaces.

Collaboration between starch suppliers and leading confectionery brands on co-development of customized grades enhances market responsiveness. Government support for sustainable food processing and R&D funding for enzyme-assisted starch modification further fuel capacity additions. Seasonal confectionery launches and functional food innovations drive steady demand for molding starch.

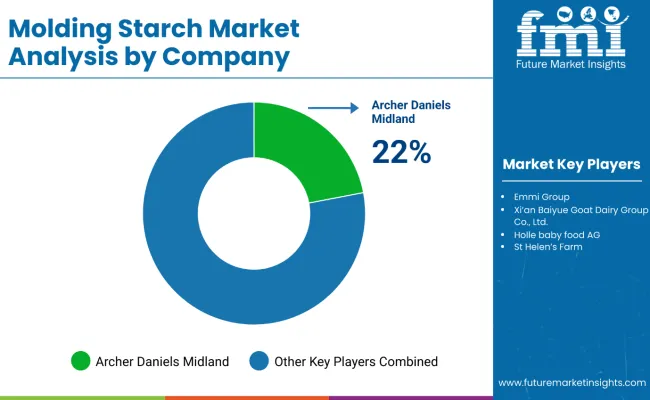

The market is moderately consolidated, dominated by a handful of global ingredient suppliers with advanced starch modification and production capabilities. Archer Daniels Midland (ADM) and Cargill Incorporated lead the market for high-performance starch grades, supplying Rapidly Digestible Starch with superior moisture-control and mold-release properties for high-speed confectionery molding. Their strength lies in proprietary enzyme-assisted modification processes and large-scale wet-milling facilities that ensure consistent grade quality and regulatory compliance.

Ingredion Incorporated differentiates through its portfolio of customized starch blends and clean-label formulations, offering specialized particle-size distributions and tailored amylopectin: amylose ratios for niche confectionery and bakery applications. Tate & Lyle PLC focuses on sustainable sourcing and energy-efficient drying technologies, targeting premium candy and food packaging applications with low-residue, biodegradable starch grades.

Regional players such as Roquette SA and Grain Processing Corporation emphasize localized production and supply-chain agility, ensuring minimal feedstock transit times and rapid technical support for domestic confectionery manufacturers. Meanwhile, specialty starch producers are investing in continuous-flow processing and membrane-filtration systems to enhance thermal stability and reduce production waste.

Entry barriers remain high, driven by capital-intensive plant investments, strict food-safety regulations, and the need for deep technical expertise in starch chemistry. Competitive advantage increasingly depends on scale of modification capacity, proprietary enzyme technologies, and the ability to deliver clean-label, biodegradable molding solutions at consistent quality and global logistics standards.

Key Developments in the Molding Starch Market

In April 2024, Roquette unveiled a flexible addition to its LYCAGEL® hydroxypropyl pea starch range at Vitafoods Europe, highlighting innovations for vegetarian and vegan softgel supplements. In collaboration with Qualicaps, the company showcased its expanded portfolio, offering insights on efficiency, quality, sustainability, and tailored support for nutraceutical formulation challenges.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 543.5 Million |

| Type | Rapidly Digestible Starch, Slowly Digestible Starch, Resistant Starch |

| Application | Candies, Jellies, Gummies, Marshmallows, and Others (puddings, desserts, and bakery fillings) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa, Australia and 40+ countries |

| Key Companies Profiled | Archer Daniels Midland (ADM), Cargill Incorporated, Ingredion Incorporated, Tate & Lyle PLC, Roquette SA |

| Additional Attributes | Dollar sales by type and application sector; growing usage in high-speed confectionery molding ; stable demand in eco-friendly packaging; innovations in enzyme-assisted starch modification and ultra-fine milling enhance functionality, purity, and regulatory compliance |

The global molding starch market is estimated to be valued at USD 543.5 million in 2025.

The market size for the molding starch market is projected to reach USD 885.3 million by 2035.

The molding starch market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in molding starch market are candies, jellies, gummies, marshmallows and others (e.g., rock candy, caramels, etc.).

In terms of , segment to command 0.0% share in the molding starch market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bulk Molding Compounds Market Size and Share Forecast Outlook 2025 to 2035

Pulp Molding Tooling Market Size and Share Forecast Outlook 2025 to 2035

Pulp Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Blow Molding Resin Market Growth – Trends & Forecast 2024-2034

Rubber Molding Market Forecast Outlook 2025 to 2035

Lipstick Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Injection Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Injection Molding Machines Industry Analysis in India Size, Share & Forecast 2025 to 2035

Injection Molding Polyamide 6 Market Growth – Trends & Forecast 2024-2034

Injection Molding Containers Market

Rotational Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Auto Glass Moldings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of Rotational Molding Machine Market Share

Stretch Blow Molding Machines Market Segmentation based on Technology Type, Orientation Type, End Use, and Region: A Forecast for 2025 and 2035

Market Share Insights of Leading Stretch Blow Molding Machines Providers

Particle Foam Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Injection Blow Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Metal Injection Molding (MIM) Parts Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA